Market Overview

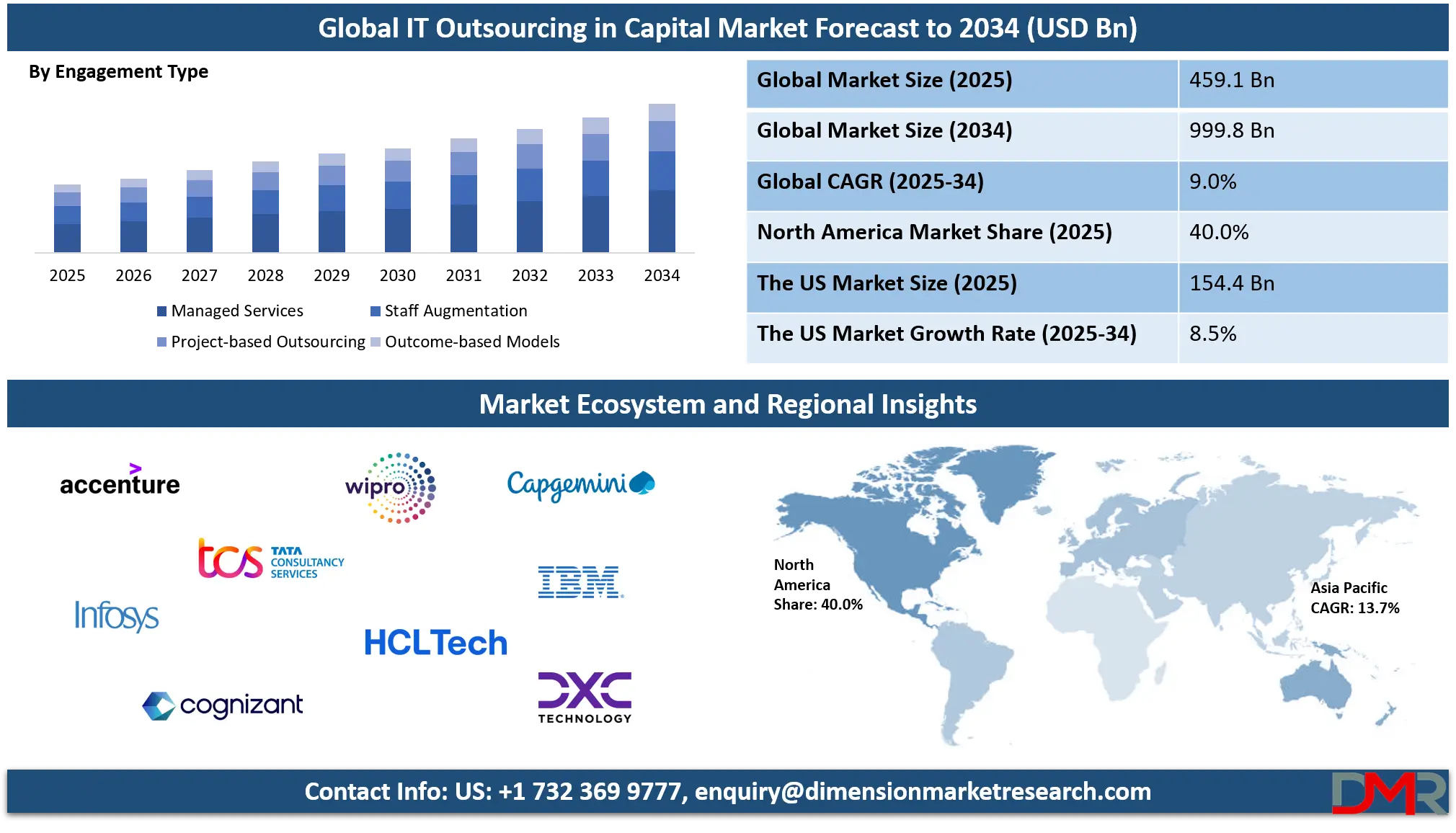

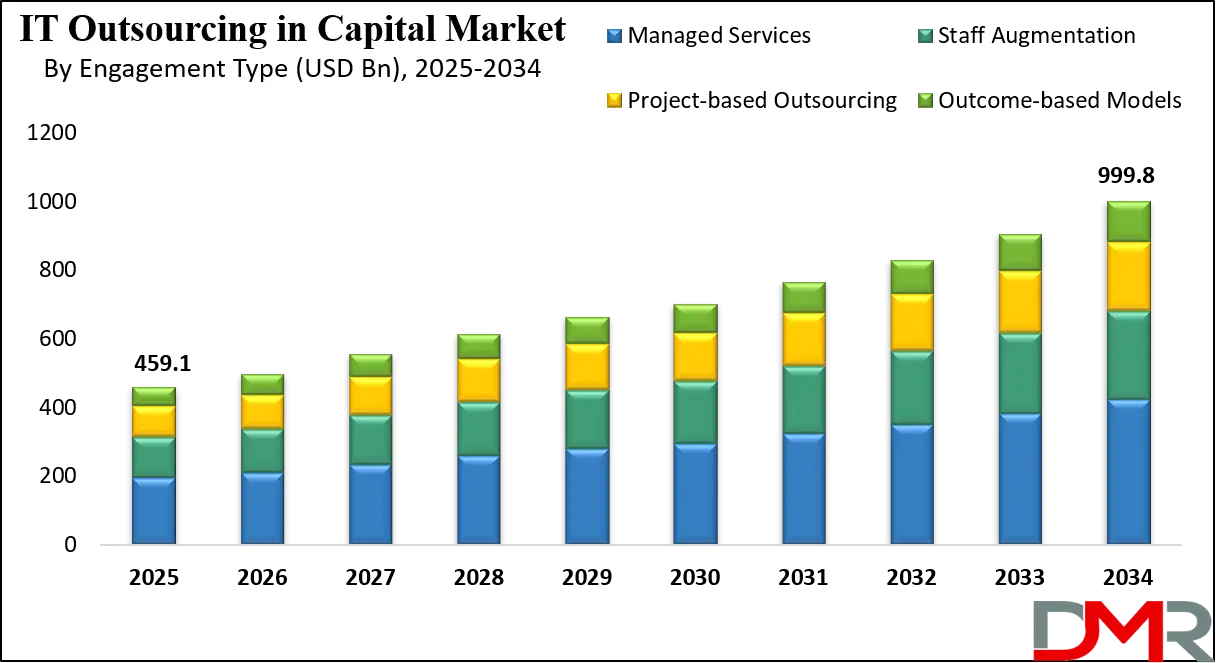

The Global IT Outsourcing in Capital Market size is estimated to be valued at USD 459.1 billion in 2025 and is further anticipated to reach USD 999.8 billion by 2034 at a CAGR of 9.0%.

IT outsourcing in capital refers to the practice where financial institutions such as banks, asset managers, brokerages, and exchanges delegate their technology-driven processes, infrastructure management, and specialized IT functions to third-party providers. This approach enables capital market participants to focus on their core financial activities such as trading, investment strategy, and client servicing while leveraging external expertise to manage complex IT systems, reduce operational costs, enhance scalability, and meet regulatory requirements efficiently. It often includes areas like application development, risk management platforms, cybersecurity, data analytics, and cloud integration, ensuring that firms remain competitive in a technology-driven trading environment.

The global IT outsourcing in capital markets industry represents a highly dynamic sector that aligns the financial ecosystem with advanced digital transformation initiatives. It involves large-scale collaborations between financial enterprises and technology service providers to modernize legacy infrastructure, integrate artificial intelligence, and deploy data-driven platforms that enable faster trade execution and compliance management. The market is driven by rising transaction volumes, the increasing demand for secure digital trading systems, and the pressure to comply with complex cross-border financial regulations.

Additionally, the market reflects a shift toward cloud-native solutions, advanced data platforms, and specialized managed services designed to optimize end-to-end trading and post-trade operations. With institutions facing heightened cybersecurity threats and the need to maintain real-time processing capabilities, outsourcing providers deliver critical value through scalable, resilient, and innovative technology services. Regional growth is strong in North America and Europe due to regulatory stringency and high adoption rates, while Asia-Pacific emerges as a growth hub owing to rapid digitalization of financial institutions and the increasing role of fintech partnerships.

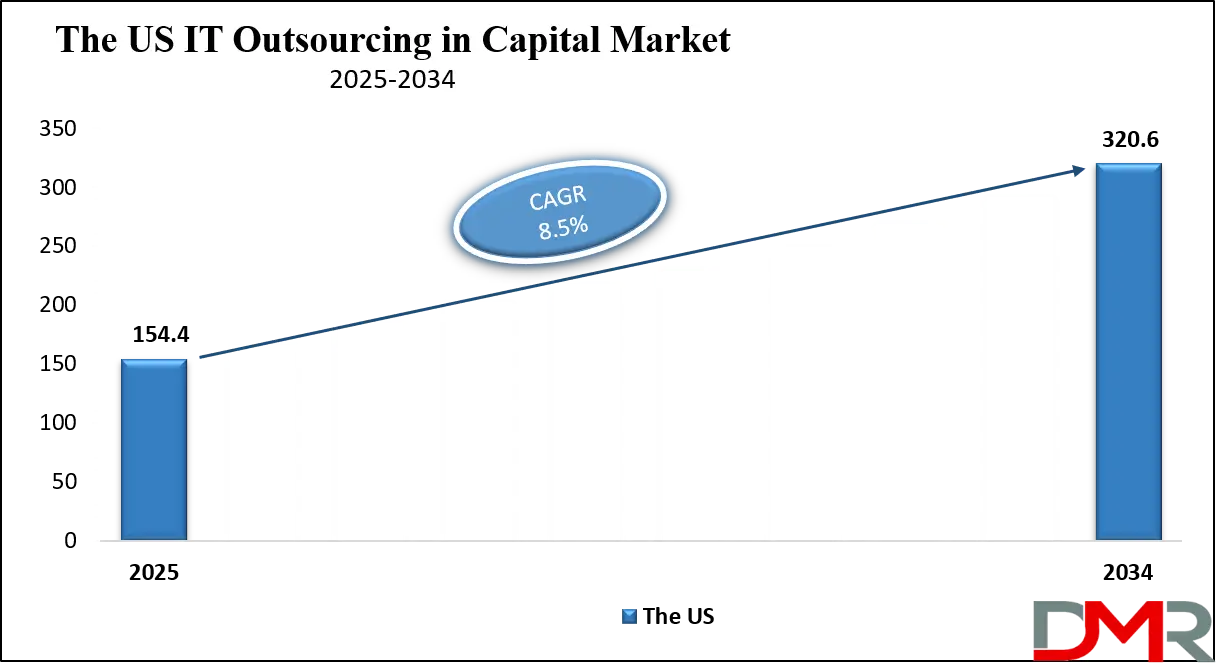

The US IT Outsourcing in Capital Market

The US IT outsourcing in capital Market is projected to be valued at USD 154.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 320.6 billion in 2034 at a CAGR of 8.5%.

The United States IT outsourcing in capital markets represents one of the most mature and technology-intensive segments within the global outsourcing landscape. Large investment banks, asset managers, hedge funds, and broker-dealers in the US increasingly rely on external service providers to manage complex trading platforms, order management systems, and post-trade settlement operations. The market is strongly influenced by the scale of financial transactions taking place on Wall Street and other major exchanges, creating demand for advanced application development, infrastructure modernization, and cloud-native solutions.

Outsourcing partners provide expertise in areas such as quantitative analytics, risk management platforms, cybersecurity frameworks, and compliance technology, allowing US capital market firms to maintain operational efficiency while focusing on core investment and trading strategies.

The growth of IT outsourcing in US capital markets is further accelerated by stringent financial regulations, rising costs of in-house IT operations, and the shift toward digital-first trading ecosystems. Regulatory reporting requirements from agencies such as the SEC, combined with increasing cybersecurity threats and the demand for high-frequency trading infrastructure, drive institutions to collaborate with global technology providers.

The US market also leads in the adoption of emerging technologies, including artificial intelligence, blockchain for settlement, and predictive analytics for portfolio management, enhancing decision-making and risk control. With financial institutions under pressure to deliver speed, resilience, and innovation, outsourcing has become an essential strategy for achieving scalability, reducing IT expenditures, and gaining access to specialized expertise.

Europe IT Outsourcing in Capital Market

The Europe IT outsourcing market in capital markets is estimated to reach USD 137.1 billion in 2025, reflecting the increasing reliance of financial institutions on external technology service providers. Investment banks, asset managers, brokerages, and exchanges across Europe are increasingly outsourcing critical IT functions such as application development, infrastructure management, risk analytics, and compliance reporting.

The need to modernize legacy systems, integrate advanced technologies like artificial intelligence and cloud platforms, and maintain high operational efficiency is driving the adoption of IT outsourcing across the region. Financial firms benefit from reduced costs, access to specialized talent, and enhanced scalability, enabling them to remain competitive in a fast-evolving financial ecosystem.

The European market is also witnessing significant growth due to regulatory pressures and digital transformation initiatives across the financial sector. Institutions are turning to outsourcing providers to manage complex compliance requirements, real-time trading systems, and post-trade operations while ensuring data security and operational resilience. The market’s projected CAGR of 8.0% indicates a robust expansion trajectory, supported by increased investments in cloud-native solutions, cybersecurity frameworks, and data analytics platforms. As financial institutions continue to prioritize agility, innovation, and cost optimization, Europe is positioned to remain a key region in the global IT outsourcing in capital markets landscape.

Japan IT Outsourcing in Capital Market

The Japan IT outsourcing market in capital markets is estimated to reach USD 17.3 billion in 2025, reflecting the increasing adoption of outsourced technology services by financial institutions. Investment banks, asset managers, brokerages, and exchanges in Japan are increasingly relying on external providers to manage application development, cloud infrastructure, risk analytics, and compliance reporting.

The demand is driven by the need to modernize trading platforms, implement low-latency systems, and leverage AI-powered analytics, enabling firms to optimize operational efficiency, reduce costs, and maintain competitiveness in a dynamic financial environment. Outsourcing partners provide the specialized expertise and scalability required to support these complex operations.

The market is projected to grow at a CAGR of 10.0%, driven by continued digital transformation and investment in fintech innovation. Japanese financial institutions are adopting cloud-native platforms, automated compliance solutions, and advanced data analytics to meet regulatory requirements and improve decision-making. This steady growth highlights Japan’s increasing reliance on external IT services to support the modernization of its capital markets infrastructure. The trend positions outsourcing as a critical strategy for scalability, operational resilience, and technological advancement in the country’s financial sector.

Global IT Outsourcing in Capital Market: Key Takeaways

- Market Value: The global IT outsourcing in the capital market size is expected to reach a value of USD 999.8 billion by 2034 from a base value of USD 459.1 billion in 2025 at a CAGR of 9.0%.

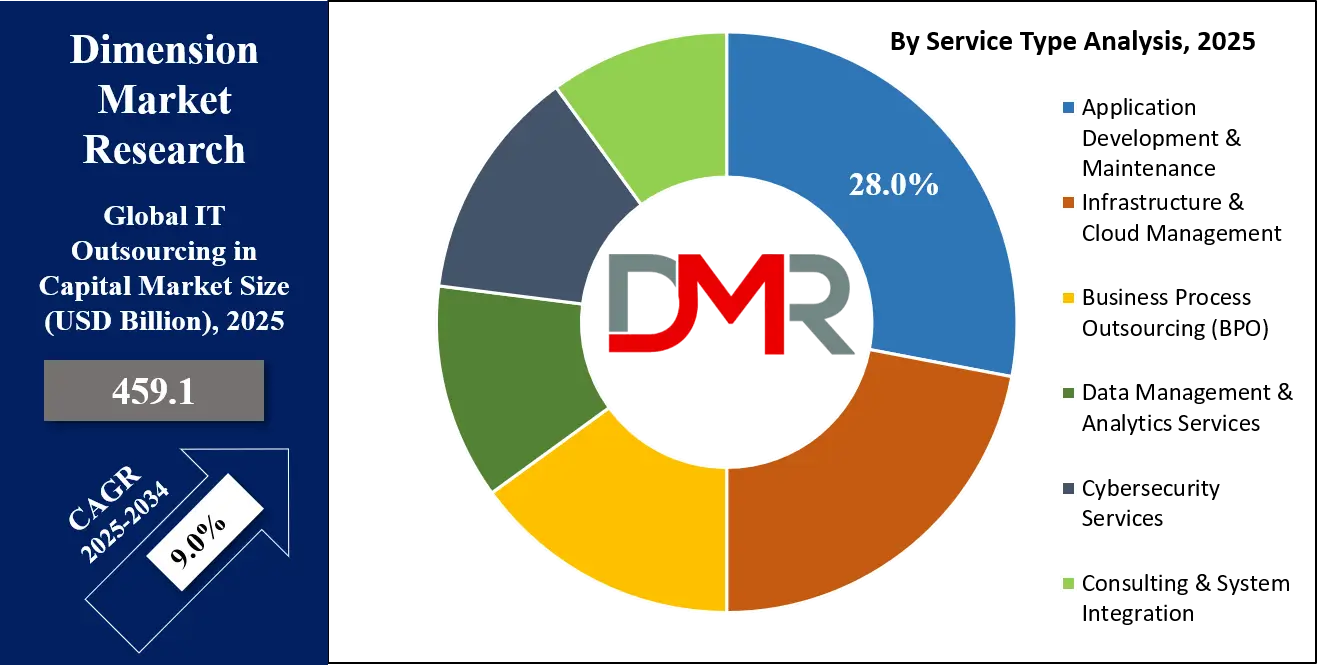

- By Service Type Segment Analysis: Application Development & Maintenance is anticipated to dominate the service type segment, capturing 28.0% of the total market share in 2025.

- By Delivery Model Segment Analysis: Offshore models are expected to maintain their dominance in the delivery model segment, capturing 46.0% of the total market share in 2025.

- By Deployment Model Segment Analysis: Cloud will dominate the deployment model segment, capturing 46.0% of the market share in 2025.

- By Engagement Type Segment Analysis: Managed Services will account for the maximum share in the engagement type segment, capturing 42.0% of the total market value.

- By Business Function Segment Analysis: Trading & Order Management Systems will dominate the business function segment, capturing 24.0% of the market share in 2025.

- By Technology Segment Analysis: Legacy & Middleware Systems will dominate the technology segment, capturing 26.0% of the market share in 2025.

- By End-User Segment Analysis: Investment Banks will account for the maximum share in the end-user segment, capturing 32.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global IT outsourcing in capital market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global IT outsourcing in capital market include Accenture, Tata Consultancy Services (TCS), Infosys, Cognizant, Wipro, HCLTech, Capgemini, IBM, DXC Technology, Atos, Tech Mahindra, Genpact, CGI Inc., LTI Mindtree, NTT DATA, Fujitsu, EPAM Systems, Virtusa, Mphasis, and Others.

Global IT Outsourcing in Capital Market: Use Cases

- Modernization of Trading Platforms: Global financial institutions outsource IT services to upgrade legacy trading systems into cloud-native, low-latency platforms. Service providers deliver expertise in algorithmic trading, electronic order management, and connectivity with global exchanges, enabling faster execution and reduced operational downtime. Outsourcing also helps integrate APIs, data feeds, and real-time analytics to enhance decision-making and improve overall trading efficiency.

- Regulatory Compliance and Risk Management: Capital market firms face constant regulatory scrutiny from agencies such as the SEC, ESMA, and Basel committees. Outsourcing partners provide advanced compliance technology, automated reporting tools, and risk analytics platforms to manage evolving regulations. This ensures timely reporting, reduced compliance costs, and accurate risk assessment while allowing institutions to focus on strategic financial operations.

- Post-trade Processing and Settlement Operations: Post-trade functions such as clearing, reconciliation, and settlement require high accuracy and speed. IT outsourcing partners streamline these processes through automation, blockchain integration, and cloud-based data management. By outsourcing post-trade services, financial firms minimize errors, reduce transaction costs, and achieve scalability in handling rising global trading volumes.

- Cybersecurity and Data Protection: With the rise of cyber threats targeting financial institutions, outsourcing firms provide advanced security frameworks, identity management, and real-time monitoring solutions. Capital market participants rely on IT partners to safeguard sensitive trading data, protect against fraud, and ensure business continuity. This use case enhances resilience, builds investor confidence, and maintains compliance with strict data protection regulations.

Impact of Artificial Intelligence on the global IT Outsourcing in the Capital market

Artificial intelligence is transforming the global IT outsourcing in capital markets by automating complex financial operations, enhancing data-driven decision-making, and enabling predictive capabilities. Outsourcing providers are increasingly integrating AI into trading platforms, compliance technology, and post-trade systems to deliver faster execution and higher accuracy. Natural language processing is being used to process regulatory documents and client communications, while machine learning models power fraud detection, risk assessment, and algorithmic trading strategies. This allows capital market firms to reduce manual workloads, lower costs, and achieve greater efficiency in critical IT functions.

In addition, AI-driven outsourcing solutions are reshaping client experiences and operational resilience across the financial ecosystem. Outsourcing partners are offering cognitive analytics platforms, robotic process automation, and intelligent bots that improve settlement cycles, enhance cybersecurity, and provide real-time insights for portfolio management. The adoption of AI within outsourcing agreements also supports compliance with evolving regulations and ensures scalability for institutions managing rising transaction volumes. As a result, AI is becoming a central enabler of innovation, agility, and competitive advantage in the global IT outsourcing in capital markets.

Global IT Outsourcing in Capital Market: Stats & Facts

United States – SEC, Federal Reserve, Treasury, OCC, USITC

- 2025 – OCC: The Office of the Comptroller of the Currency issued regulations governing the safe and sound operations of national banks and federal savings associations, including guidance on cybersecurity practices.

- 2025 – USITC: The U.S. International Trade Commission released a report focusing on trade in professional services, including accounting, management consulting, and IT-related services.

- 2024 – Federal Reserve: The Cybersecurity and Critical Infrastructure Subcommittee focused on risk management, threat intelligence, and collaboration in financial institutions.

- 2024 – Treasury Department: The Treasury issued guidance on managing risks from third-party cloud providers and outsourcing arrangements in the financial sector.

- 2023 – SEC: Emphasized the importance of strong capital markets in promoting economic resilience and investor protection.

India – Ministry of Electronics & IT, NASSCOM

- 2025 – Ministry of Electronics & IT: IT exports from India included extensive use of external technology services in banking and financial sectors.

- 2025 – Ministry of Electronics & IT: Indian institutions increasingly relied on third-party IT services for AI and analytics solutions.

- 2024 – NASSCOM: Over 17,000 IT and BPM firms in India were actively engaged in outsourcing and software services.

- 2024 – NASSCOM: Companies outsourced IT infrastructure and process management tasks for operational efficiency.

- 2023 – NASSCOM: BPM, ER&D, and software product services accounted for a significant portion of outsourced IT activities.

Singapore – Monetary Authority of Singapore, SGX, Ministry of Trade & Industry

- 2025 – Singapore Statistics (SSIC): SSIC updated to align with UN ISIC Rev. 5 for standardized industrial classification, including IT outsourcing activities.

- 2024 – SGX: The Singapore Stock Exchange reported reduced listing activity, affecting technology and financial service operations.

- 2024 – Ministry of Trade & Industry: New investment screening mechanism designated critical entities, including IT service providers.

- 2024 – MAS: Guidelines were issued for financial institutions to manage risks from third-party and outsourcing arrangements.

- 2023 – MAS: Provided expectations for financial institutions engaging in outsourcing arrangements.

Hong Kong – HKMA, Hong Kong Institute for Monetary & Financial Research

- 2025 – HKMA: Strategic initiatives were implemented to enhance market microstructure and IT systems in the stock exchange.

- 2025 – HK Institute for Monetary & Financial Research: Published a report on AI adoption and IT outsourcing in financial institutions.

- 2025 – HK Government: Allocated funds to support IT infrastructure and technology initiatives in finance.

- 2024 – HKMA: Issued guidelines on risk management considerations for distributed ledger technology in financial services.

- 2023 – HKMA: Reported on AI infrastructure adoption and IT outsourcing usage in banking and finance.

Australia – Infrastructure Australia, Cyber.gov.au, Productivity Commission, AFIA

- 2025 – AFIA: Reported on AI adoption, productivity gains, and challenges in IT outsourcing within the finance industry.

- 2025 – Productivity Commission: Received inputs on improving productivity using digital technologies and third-party IT services.

- 2024 – Cyber.gov.au: Highlighted threats from cybercriminals and state actors targeting Australian networks, including outsourced IT systems.

- 2024 – Jobs and Skills Australia: Projected employment growth for digital workers requiring outsourced IT services in finance and banking.

- 2023–2024 – Infrastructure Australia: The Major Public Infrastructure Pipeline included outsourced IT projects supporting public infrastructure and financial services.

Global IT Outsourcing in Capital Market: Market Dynamics

Global IT Outsourcing in Capital Market: Driving Factors

Rising Digital Transformation in Capital Markets

Financial institutions are accelerating digital initiatives to modernize legacy infrastructure, enhance trading efficiency, and improve client services. The adoption of cloud computing, data platforms, and automated post-trade solutions is driving demand for specialized outsourcing services. IT outsourcing enables capital market firms to scale operations quickly, integrate fintech solutions, and remain competitive in an increasingly digital-first financial ecosystem.

Increasing Regulatory Compliance Pressure

Capital market firms face complex compliance requirements from global regulators such as the SEC, ESMA, and Basel authorities. Meeting these demands in-house is resource-intensive and costly. Outsourcing providers offer advanced regulatory reporting, compliance technology, and automated monitoring platforms, allowing institutions to maintain transparency and avoid penalties while optimizing operational resources.

Global IT Outsourcing in Capital Market: Restraints

Data Security and Cybersecurity Concerns

Capital markets deal with highly sensitive financial and client data, making cybersecurity a top concern. Outsourcing critical IT functions to third-party vendors raises risks related to data breaches, fraud, and regulatory non-compliance. These security challenges often slow down outsourcing decisions and limit the extent of offshoring in sensitive functions such as trading and risk management.

Rising Cost of Skilled IT Talent

Although outsourcing reduces operational expenses, the global shortage of highly skilled IT professionals in areas like AI, blockchain, and high-frequency trading infrastructure has increased vendor pricing. This inflates outsourcing contracts and reduces the cost advantage for capital market firms, especially in regions with high labor demand such as North America and Europe.

Global IT Outsourcing in Capital Market: Opportunities

Integration of Emerging Technologies

Outsourcing providers are introducing cutting-edge solutions such as artificial intelligence, blockchain, and robotic process automation for capital markets. These technologies optimize settlement cycles, improve fraud detection, and enhance decision-making for portfolio managers. This creates new opportunities for vendors to offer differentiated services and for capital market firms to access innovation without heavy upfront investments.

Expansion in Asia-Pacific Financial Hubs

The rapid digitalization of exchanges, brokerages, and asset managers in the Asia-Pacific region is creating a strong demand for outsourcing. Countries like India, Singapore, and Hong Kong are emerging as key hubs due to their skilled IT workforce and cost advantages. This regional growth presents significant opportunities for global outsourcing providers to expand service portfolios and capture new client bases.

Global IT Outsourcing in Capital Market: Trends

Growing Adoption of Cloud-native Outsourcing Models

Capital market institutions are increasingly migrating to cloud platforms for trading systems, risk analytics, and client-facing services. Outsourcing firms are delivering cloud-native solutions that enhance scalability, reduce infrastructure costs, and ensure compliance with evolving regulations. This trend is reshaping the outsourcing landscape with hybrid and multi-cloud strategies becoming the norm.

Shift Toward Outcome-based Outsourcing Contracts

Traditional time-and-materials contracts are being replaced by outcome-driven agreements, where vendors are accountable for performance metrics such as reduced downtime, faster settlement, or improved compliance reporting. This trend emphasizes value creation, efficiency, and innovation, aligning outsourcing services more closely with business goals in the capital markets sector.

Global IT Outsourcing in Capital Market: Research Scope and Analysis

By Service Type Analysis

Application development and maintenance is expected to hold the leading position in the service type segment, accounting for 28.0% of the total market share in 2025. The dominance of this segment is driven by the continuous need for upgrading trading platforms, order management systems, and portfolio applications across global capital markets. Financial institutions depend heavily on robust applications to handle high-frequency trading, compliance reporting, and risk analytics, which requires ongoing enhancements and support. Outsourcing in this area ensures faster development cycles, reduced downtime, and access to specialized expertise, enabling institutions to adapt quickly to evolving regulatory requirements and market dynamics.

Infrastructure and cloud management is also emerging as a critical outsourcing segment in capital markets. As financial firms increasingly shift toward hybrid and cloud-native ecosystems, outsourcing providers deliver essential services such as server management, network optimization, and cloud migration.

These services enhance scalability, improve disaster recovery, and lower infrastructure costs while ensuring that sensitive trading data remains secure. The rising adoption of cloud-based trading systems, risk management platforms, and compliance technology highlights the importance of this segment, positioning it as a major growth driver for IT outsourcing in the capital markets industry.

By Delivery Model Analysis

Offshore delivery models are projected to maintain their dominance in the delivery model segment, accounting for 46.0% of the total market share in 2025. This dominance is attributed to the cost efficiency, scalability, and availability of a highly skilled workforce in countries such as India, the Philippines, and Eastern European regions. Capital market firms rely on offshore outsourcing to manage large-scale application development, post-trade operations, and compliance reporting, which require continuous support and rapid turnaround times. The offshore approach also allows institutions to leverage time zone advantages, ensuring round-the-clock operations and faster execution of technology-driven services in trading and risk management environments.

Nearshore delivery models are also playing an increasingly important role in IT outsourcing within capital markets. By collaborating with providers in geographically closer regions, financial institutions benefit from better cultural alignment, shared time zones, and smoother communication, which are critical for complex, real-time trading and regulatory projects.

Nearshore outsourcing offers a balance between cost savings and operational control, making it a preferred choice for functions that demand close collaboration, such as risk management platforms, analytics, and client servicing solutions. This approach helps reduce project delays and enhances agility in responding to evolving regulatory and market requirements.

By Deployment Model Analysis

Cloud deployment is set to dominate the deployment model segment, capturing 46.0% of the market share in 2025. The rising preference for cloud solutions in capital markets is driven by the need for flexibility, cost optimization, and faster innovation cycles. Financial institutions are increasingly migrating their trading platforms, risk management systems, and compliance reporting tools to cloud environments to handle increasing transaction volumes and real-time analytics requirements.

Cloud outsourcing providers offer scalability, seamless integration with fintech applications, and advanced security frameworks, enabling capital market firms to achieve operational efficiency while maintaining regulatory compliance. The ability to support hybrid and multi-cloud strategies further reinforces the cloud’s position as the preferred deployment model across the industry.

On-premises deployment continues to hold relevance in the IT outsourcing landscape of capital markets, particularly for institutions handling highly sensitive data and mission-critical trading operations. Many firms retain core systems within their in-house data centers or co-located facilities to ensure full control, security, and compliance with stringent regulatory requirements.

While less flexible compared to cloud models, on-premises deployment is often favored for low-latency trading environments, proprietary risk models, and applications where data sovereignty is a concern. Outsourcing providers support these infrastructures through managed services, maintenance, and modernization, ensuring they remain resilient, secure, and aligned with evolving technological standards.

By Engagement Type Analysis

Managed services are anticipated to lead the engagement type segment, capturing 42.0% of the total market value in 2025. This dominance is supported by the increasing need among capital market institutions to outsource end-to-end IT functions, including application management, infrastructure monitoring, and regulatory compliance systems.

Managed services allow financial firms to establish long-term partnerships with outsourcing providers, ensuring consistent performance, predictable costs, and proactive risk management. With the rising complexity of trading environments and the demand for 24/7 system availability, managed services deliver scalability and resilience while allowing firms to focus on their core financial operations.

Staff augmentation is also a key component of IT outsourcing in capital markets, providing flexibility for institutions that require specialized talent on a project basis. This model allows firms to fill skill gaps in areas such as cloud migration, cybersecurity, or quantitative development without bearing the cost of full-time hires. It is particularly beneficial for time-sensitive projects and regulatory initiatives where access to domain expertise is critical. By leveraging staff augmentation, financial institutions can scale their workforce dynamically, accelerate project execution, and maintain control over workflows while still benefiting from external expertise.

By Business Function Analysis

Trading and order management systems are projected to dominate the business function segment, capturing 24.0% of the market share in 2025. The dominance of this segment stems from the critical role these systems play in ensuring seamless trade execution, market connectivity, and regulatory compliance. Financial institutions outsource the development and maintenance of these platforms to achieve faster transaction processing, enhanced scalability, and integration with global exchanges.

Outsourcing providers deliver advanced capabilities such as algorithmic trading, electronic order routing, and real-time analytics, which are vital for maintaining competitiveness in a fast-paced capital market environment. The increasing demand for low-latency infrastructure and cloud-based trading solutions further strengthens the reliance on outsourced trading and order management systems.

Risk management systems represent another essential outsourcing area within the capital markets sector. With the increasing complexity of financial products and heightened regulatory scrutiny, institutions depend on sophisticated risk platforms to monitor market, credit, and operational risks in real time. Outsourcing providers supply advanced analytics, predictive modeling, and AI-driven risk assessment tools that help firms identify vulnerabilities and ensure compliance with global regulatory frameworks.

These systems also support stress testing and scenario analysis, enabling institutions to make informed decisions while safeguarding portfolios against market volatility. As risk management becomes more data-driven, outsourcing is enabling capital market firms to access cutting-edge solutions without incurring heavy in-house investment costs.

By Technology Analysis

Legacy and middleware systems are expected to dominate the technology segment, capturing 26.0% of the market share in 2025. Despite the rapid adoption of modern technologies, a significant portion of capital market infrastructure still relies on mainframes, middleware, and legacy applications that power trading, settlement, and risk management operations. Outsourcing providers play a crucial role in maintaining, modernizing, and integrating these systems with new platforms while ensuring minimal disruption to mission-critical processes. The continued reliance on legacy technology is driven by the complexity and cost of migrating large-scale financial systems, as well as the need for stability, reliability, and compliance in core capital market operations.

Cloud-native solutions are also gaining significant traction within the capital markets outsourcing space. Financial institutions are increasingly adopting containerized applications, microservices architectures, and hybrid cloud strategies to improve scalability, agility, and cost efficiency. Outsourcing partners support this transition by designing, deploying, and managing cloud-native platforms that can handle high trading volumes, real-time risk analytics, and compliance reporting.

These solutions allow firms to respond faster to market changes, reduce infrastructure overheads, and accelerate the rollout of innovative digital services. As capital markets embrace digital transformation, cloud-native outsourcing is emerging as a critical driver of operational flexibility and future-ready infrastructure.

By End-User Analysis

Investment banks are projected to account for the maximum share in the end-user segment, capturing 32.0% of the market share in 2025. Their dominance is attributed to the vast scale of operations they manage, ranging from global trading activities to large-scale risk management and regulatory compliance. These institutions require highly complex IT infrastructures to support low-latency trading, post-trade settlement, and cross-border compliance, which makes outsourcing a strategic necessity. By relying on external service providers, investment banks gain access to advanced technologies such as AI-driven analytics, cloud-native trading systems, and automated reporting tools that enhance efficiency, reduce operational risks, and improve cost structures while ensuring uninterrupted global operations.

Asset managers and hedge funds also represent a vital segment of IT outsourcing in capital markets. These firms depend on sophisticated portfolio management platforms, predictive analytics, and data-driven risk models to make high-value investment decisions. Outsourcing partners provide critical services such as cloud-based portfolio systems, AI-powered research tools, and cybersecurity frameworks to secure sensitive investor data and optimize trading strategies.

Hedge funds, in particular, require advanced outsourcing solutions for algorithmic trading, compliance reporting, and data management to stay ahead in competitive markets. The increasing reliance on outsourcing allows asset managers and hedge funds to focus on generating returns while leveraging scalable, cost-efficient, and innovative IT infrastructure managed by specialized providers.

The IT Outsourcing in Capital Market Report is segmented on the basis of the following:

By Service Type

- Application Development & Maintenance

- Infrastructure & Cloud Management

- Business Process Outsourcing (BPO)

- Data Management & Analytics Services

- Cybersecurity Services

- Consulting & System Integration

By Delivery Model

- Offshore

- Nearshore

- Onshore

- Hybrid

By Deployment Model

By Engagement Type

- Managed Services

- Staff Augmentation

- Project-based Outsourcing

- Outcome-based Models

By Business Function

- Trading & Order Management Systems

- Risk Management Systems

- Post-trade & Settlement Operations

- Regulatory Compliance & Reporting

- Portfolio & Wealth Management Platforms

- Market Data & Client Services

By Technology

- Legacy & Middleware Systems

- Cloud-native Solutions

- Data Platforms & Big Data Analytics

- Low-latency & High-performance Infrastructure

- Emerging Technologies (Blockchain, AI, DLT)

By End-User

- Investment Banks

- Asset Managers & Hedge Funds

- Exchanges & Market Infrastructure Providers

- Broker-Dealers

- Custodians & Clearing Houses

- Wealth Management Firms

Global IT Outsourcing in Capital Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global IT outsourcing in capital markets landscape, capturing 40.0% of the total market revenue in 2025. The region’s dominance is driven by the presence of major financial hubs such as New York and Chicago, where investment banks, brokerages, and asset management firms operate at a large scale. High adoption of advanced technologies, stringent regulatory compliance requirements, and the need for low-latency trading infrastructure are key factors fueling outsourcing demand.

Financial institutions in North America increasingly rely on external IT service providers for application development, cloud management, cybersecurity, and data analytics, enabling them to optimize costs, enhance operational efficiency, and maintain competitive advantage in a rapidly evolving capital markets environment.

Region with significant growth

The Asia-Pacific region is emerging as the fastest-increasing market for IT outsourcing in capital markets, driven by rapid digitalization of financial institutions, expanding stock exchanges, and increasing adoption of cloud and data analytics solutions. Countries such as India, Singapore, Hong Kong, and China are becoming key outsourcing hubs due to their skilled IT workforce, cost advantages, and supportive regulatory frameworks.

The rising demand for algorithmic trading, portfolio management platforms, and risk management systems in the region is encouraging capital market firms to collaborate with specialized IT service providers. This growth trajectory positions Asia-Pacific as a strategic market for both global financial institutions and outsourcing vendors seeking scalability and innovation.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global IT Outsourcing in Capital Market: Competitive Landscape

The global IT outsourcing in capital markets market is highly competitive, with a mix of multinational technology service providers, consulting firms, and specialized financial IT vendors vying for market share. Leading companies such as Accenture, Tata Consultancy Services, Infosys, Cognizant, Wipro, HCLTech, Capgemini, and IBM dominate through comprehensive service offerings that include application development, cloud management, cybersecurity, and data analytics tailored for trading, risk management, and regulatory compliance.

Market players compete on the basis of technological expertise, global delivery capabilities, cost efficiency, and innovation in emerging technologies such as artificial intelligence, blockchain, and cloud-native platforms. Strategic partnerships, mergers and acquisitions, and investment in next-generation financial technologies further intensify competition and drive continuous improvement across the industry.

Some of the prominent players in the global IT Outsourcing in the Capital market are:

- Accenture

- Tata Consultancy Services (TCS)

- Infosys

- Cognizant

- Wipro

- HCLTech

- Capgemini

- IBM

- DXC Technology

- Atos

- Tech Mahindra

- Genpact

- CGI Inc.

- LTI Mindtree

- NTT DATA

- Fujitsu

- EPAM Systems

- Virtusa

- Mphasis

- Sopra Steria

- Other Key Players

Global IT Outsourcing in Capital Market: Recent Developments

- August 2025: Accenture announced plans to acquire Australian cybersecurity firm CyberCX in its largest-ever cybersecurity deal, valued at over AUSD 1 billion ($650 million). This acquisition aims to strengthen Accenture’s cybersecurity capabilities in the Asia Pacific region.

- May 2025: Infosys completed the sale of a 2% stake in its Japan-based joint venture, HIPUS, to Mitsubishi Heavy Industries. This transaction reinforces the strategic partnership between the two companies and enhances HIPUS's growth opportunities in providing end-to-end procurement solutions tailored to Japanese corporations.

- May 2025: Infosys co-founder Nandan Nilekani committed a second multi-year grant to AI4Bharat, an open-source initiative at IIT Madras, increasing his total commitment to Rs 70 crore. AI4Bharat focuses on developing foundational AI models tailored for Indian languages, aiming to bridge the language divide in technology access.

- March 2025: Infosys announced an expansion of its strategic collaboration with Citizens to propel AI-led transformation. This partnership leverages Infosys' expertise in AI, cloud, and automation to develop cloud-native domain platforms and achieve data center exit, enhancing operational resilience and stability.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 459.1 Bn |

| Forecast Value (2034) |

USD 999.8 Bn |

| CAGR (2025–2034) |

9.0% |

| The US Market Size (2025) |

USD 154.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Application Development & Maintenance, Infrastructure & Cloud Management, Business Process Outsourcing, Data Management & Analytics Services, Cybersecurity Services, Consulting & System Integration), By Delivery Model (Offshore, Nearshore, Onshore, Hybrid), By Deployment Model (Cloud, On-premises, Hybrid), By Engagement Type (Managed Services, Staff Augmentation, Project-based Outsourcing, Outcome-based Models), By Business Function (Trading & Order Management Systems, Risk Management Systems, Post-trade & Settlement Operations, Regulatory Compliance & Reporting, Portfolio & Wealth Management Platforms, Market Data & Client Services), By Technology (Legacy & Middleware Systems, Cloud-native Solutions, Data Platforms & Big Data Analytics, Low-latency & High-performance Infrastructure, Emerging Technologies), and By End-User (Investment Banks, Asset Managers & Hedge Funds, Exchanges & Market Infrastructure Providers, Broker-Dealers, Custodians & Clearing Houses, Wealth Management Firms) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

include Accenture, Tata Consultancy Services (TCS), Infosys, Cognizant, Wipro, HCLTech, Capgemini, IBM, DXC Technology, Atos, Tech Mahindra, Genpact, CGI Inc., LTI Mindtree, NTT DATA, Fujitsu, EPAM Systems, Virtusa, Mphasis, and Others.

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global IT outsourcing in capital market size is estimated to have a value of USD 459.1 billion in 2025 and is expected to reach USD 999.8 billion by the end of 2034.

The US IT outsourcing in capital market is projected to be valued at USD 154.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 320.6 billion in 2034 at a CAGR of 8.5%.

North America is expected to have the largest market share in the global IT outsourcing in capital market, with a share of about 40.0% in 2025.

Some of the major key players in the global IT outsourcing in capital market are Accenture, Tata Consultancy Services (TCS), Infosys, Cognizant, Wipro, HCLTech, Capgemini, IBM, DXC Technology, Atos, Tech Mahindra, Genpact, CGI Inc., LTI Mindtree, NTT DATA, Fujitsu, EPAM Systems, Virtusa, Mphasis, and Others.

The market is increasing at a CAGR of 9.0 percent over the forecasted period.