Market Overview

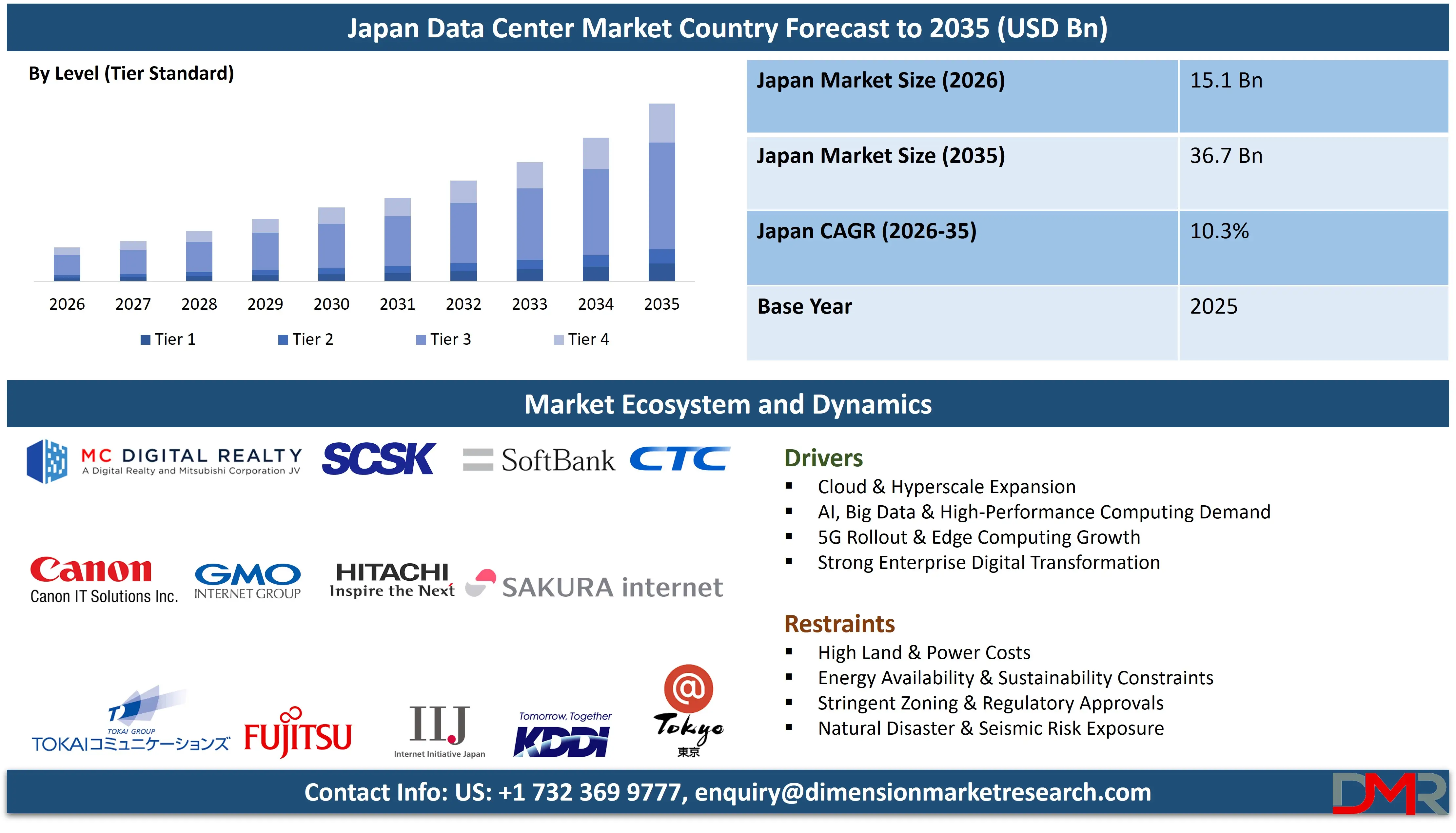

The Japan Data Center Market is projected to reach USD 15.1 billion in 2026 and is expected to grow at a CAGR of 10.3% from 2026 to 2035, attaining a value of USD 36.7 billion by 2035. This sustained growth trajectory is anchored in Japan's strategic national imperatives to fortify its digital infrastructure. The confluence of a rapidly aging population, accelerated enterprise digital transformation post-pandemic, and the government's ambitious "Society 5.0" and "Digital Garden City Nation" initiatives are creating unprecedented demand for robust, scalable, and intelligent data center capacity.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Japan's unique geographical and regulatory landscape presents both challenges and catalysts for market evolution. As a seismically active nation with high population density in urban corridors and stringent data localization guidelines, there is a critical push toward building resilient, energy-efficient, and domestically housed digital infrastructure. The market is rapidly evolving beyond traditional enterprise server rooms to sophisticated hyperscale campuses, distributed edge nodes, and green data centers powered by renewable energy. This shift is essential to support burgeoning technologies such as generative AI, autonomous vehicles, smart factories, and nationwide telemedicine networks, all of which require ultra-low latency, massive computational power, and guaranteed data sovereignty.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The competitive landscape is intensifying with global cloud titans and colocation specialists making landmark investments, while domestic telecom giants and new entrants innovate in sustainability and edge delivery. Despite facing headwinds like skilled labor shortages, complex power procurement, and high metropolitan real estate costs, Japan's data center market is positioned as a cornerstone of Asia-Pacific's digital economy, driven by technological inevitability and strategic national policy.

Japan Data Center Market: Key Takeaways

- Strong National Market Growth Outlook: The Japan Data Center Market is expected to be valued at USD 15.1 billion in 2026 and is projected to reach USD 36.7 billion by 2035, showcasing sustained expansion supported by digital economy mandates and hyperscale investment.

- Steady CAGR Driven by Digital Infrastructure Modernization: The market is expected to grow at a CAGR of 10.3% from 2026 to 2035, fueled by cloud migration, AI workload deployment, and upgrades to energy-efficient and resilient infrastructure.

- Hyperscale and Cloud Data Centers Lead Growth: Hyperscale facilities developed by global cloud providers (AWS, Google, Microsoft) and domestic players (SoftBank, NTT) represent the largest segment, driven by massive demand for scalable compute and storage resources.

- Rapid Advancement in Cooling and Power Technologies: Innovations including liquid cooling, lithium-ion battery UPS, hydrogen fuel cell backup, and AI-based infrastructure management are significantly improving PUE (Power Usage Effectiveness) and operational resilience.

- Growing Regulatory Emphasis on Green Data Centers: Rising regulatory and corporate pressure to achieve carbon neutrality is driving sustained investment in renewable energy procurement, waste heat recycling, and energy-efficient design.

Japan Data Center Market: Use Cases

- Hyperscale Cloud Infrastructure: Hyperscale cloud infrastructure supports Japanese enterprises and global hyperscalers by enabling scalable compute, storage, and AI workloads, ensuring low latency, data sovereignty compliance, disaster resilience, and high availability across Tokyo and Osaka regions nationwide.

- Edge Computing & 5G Enablement: Edge data centers power 5G applications such as autonomous mobility, smart factories, and real-time analytics by processing data locally, reducing latency, improving reliability, and supporting Japan’s advanced manufacturing, robotics, and IoT ecosystems nationwide deployments.

- BFSI & Financial Systems: Highly secure data centers enable Japanese banks, insurers, and fintech firms to run mission-critical systems, meet strict regulatory requirements, ensure data privacy, support digital payments, trading platforms, and business continuity during natural disasters events.

- Healthcare & Life Sciences: Data centers support Japan’s healthcare digitization by hosting electronic medical records, medical imaging, and AI diagnostics, enabling secure data sharing, telemedicine, regulatory compliance, and resilient operations for hospitals, research institutes, and public health agencies.

- Media, Gaming & Digital Content: High-density data centers underpin Japan’s gaming, streaming, and media industries by delivering ultra-low latency, high bandwidth, content caching, and scalable distribution, supporting esports, live events, and immersive digital experiences nationwide across major urban markets.

Japan Data Center Market: Stats & Facts

Ministry of Internal Affairs and Communications (MIC), Government of Japan

- Japan’s data center services market size (2023) was approximately USD 17,650 million.

- The market is projected to reach USD 32,800 million by 2028.

- The data center market is expected to grow by ~86 % between 2023 and 2028.

- Cloud service expansion is identified as the primary driver of domestic data center demand.

- Data centers are classified as critical digital infrastructure in Japan’s ICT White Paper.

Japan Data Center Council / Government-Referenced Energy Studies

- Japan’s data center electricity consumption (2024) was approximately 19 TWh.

- Electricity consumption is projected to rise to 57–66 TWh by 2034.

- This represents a 3× increase in data center power demand over 10 years.

- Peak data center power demand is projected at 6.6–7.7 GW by 2034.

- Data centers could account for ~4 % of Japan’s national peak electricity demand.

International Energy Agency (IEA)

- Japan accounts for approximately 3–4 % of global data center electricity demand.

- Japan and South Korea together represent ~5 % of global data center power use.

- Global data center electricity demand is projected to double by 2030, affecting Japan’s grid planning.

- AI workloads are identified as a major contributor to rising data center energy demand.

Ministry of Economy, Trade and Industry (METI), Japan

- Japan has allocated approximately USD 1,350 million in subsidies for clean-energy-intensive industries, including data centers.

- Subsidies may cover up to 50 % of eligible capital investment costs.

- Energy-efficient and low-carbon data centers are prioritized in industrial policy.

- Data centers are included in Japan’s strategic electricity demand planning.

Japan External Trade Organization (JETRO)

- Japan’s ICT sector (including data centers) contributes ~10 % of national GDP.

- Japan is the second-largest data center market in Asia by infrastructure scale.

- Japan ranks among the top three global data center destinations for reliability and connectivity.

- National fiber-optic coverage exceeds 99 % of households, supporting data center operations.

Digital Agency of Japan (Government of Japan)

- Government cloud migration programs are significantly increasing domestic data center demand.

- Public-sector IT modernization is a long-term structural driver for new data center capacity.

- Data centers are formally designated as core infrastructure for Japan’s digital transformation strategy.

Japan Data Center Market: Market Dynamic

Driving Factors in the Japan Data Center Market

Government-Led Digitalization and Data Residency Policies

The establishment of Japan's Digital Agency in 2021 has been a pivotal force, accelerating the migration of government workloads to the cloud under the "Cloud-by-Default" principle. Complementary regulations in the financial (FSA) and healthcare sectors strongly encourage or mandate the domestic storage and processing of sensitive data. This regulatory push creates a non-negotiable demand floor for local data center capacity, benefiting both colocation providers and cloud regions built in-country.

Explosion of AI, IoT, and 5G Workloads

Japan's corporate sector is aggressively investing in generative AI, industrial IoT for manufacturing (Industry 4.0), and smart city applications. These technologies generate vast, latency-sensitive datasets that cannot be efficiently processed in centralized clouds alone. This necessitates a three-tier infrastructure model: hyperscale cores for model training, regional colocation for core business processing, and a proliferating network of edge data centers for real-time analytics, fueling demand across all data center types.

Restraints in the Japan Data Center Market

Acute Skilled Workforce Shortage and High OPEX

Japan faces a critical deficit of data center-specific engineers, including experts in mechanical/electrical systems for high-density environments, cloud architecture, and cybersecurity for critical infrastructure. This talent gap increases operational risks and costs. Furthermore, Japan's high commercial electricity rates and the complexity of securing redundant, high-voltage power feeds in dense urban areas significantly inflate operational expenditures (OPEX), challenging profitability.

Seismic Design Complexity and Urban Land Scarcity

Constructing a data center to withstand major earthquakes requires specialized engineering, foundation work, and rack-level stabilization, adding 15-25% to baseline construction costs. Simultaneously, securing large, contiguous parcels of land with adequate power access in the Tokyo and Osaka metropolitan areas is exceedingly difficult and expensive, pushing new development to suburban zones and increasing reliance on vertical data center designs.

Opportunities in the Japan Data Center Market

ProLiferation of Edge and Micro Data Centers for Latency-Critical Use Cases

The rollout of 5G Standalone (SA) networks and the adoption of technologies like autonomous guided vehicles (AGVs) in logistics, real-time robotic control in factories, and cloud gaming create a massive opportunity for edge computing. This drives demand for micro data centers deployed at factory floors, telecom base stations, and commercial buildings, as well as larger regional edge facilities in prefectural capitals.

Leadership in Sustainable and Disaster-Resilient Design

Japan's unique challenges position it as a potential global exporter of expertise in building ultra-resilient and energy-efficient data centers. There is a significant opportunity for providers who can offer certified green data centers with proven seismic resilience, leveraging technologies like fuel cells, advanced battery storage, and liquid cooling. These facilities command a premium from enterprises with stringent ESG and business continuity goals.

Trends in the Japan Data Center Market

Accelerated Adoption of Liquid Cooling Technologies

With AI server racks routinely demanding 40-100kW of power, traditional air cooling is becoming ineffective and prohibitively expensive. Japanese data center operators are rapidly deploying direct-to-chip (D2C) and single-phase immersion cooling solutions. This trend is moving from pilot projects to mainstream adoption, especially in new high-performance computing (HPC) and AI clusters within hyperscale and large colocation facilities.

Rise of the "Data Center as a Platform" and Managed Services

Enterprises are increasingly looking for more than mere space and power. They seek a "platform" that offers seamless interconnection to multiple cloud providers, bundled managed services (security, monitoring, compliance), and advanced data analytics on their infrastructure usage. This trend is pushing colocation and managed service providers to develop sophisticated digital portals, robust ecosystem partnerships, and AI-powered value-added services.

Japan Data Center Market: Research Scope and Analysis

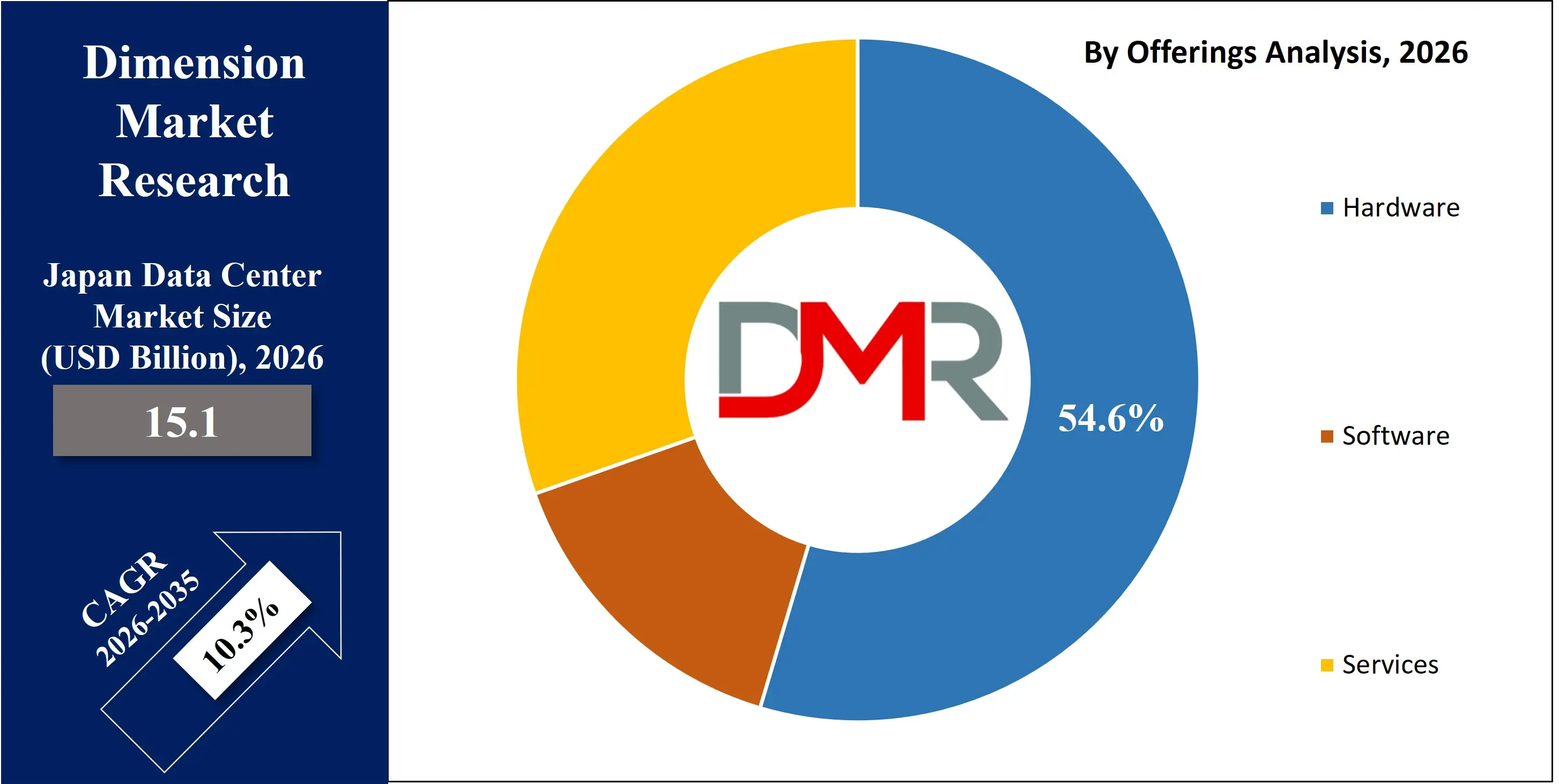

By Offerings Analysis

The Hardware segment constitutes the foundational and largest share of Japan's data center market, propelled by continuous capital expenditure cycles. As enterprises and hyperscalers build and retrofit facilities for AI and high-performance computing, the demand for physical infrastructure remains paramount. Cooling Modules are witnessing explosive growth, particularly Liquid Cooling solutions (direct-to-chip and immersion), driven by the heat dissipation challenges of AI server racks. Power Modules follow closely, with significant investment in modular UPS systems, lithium-ion battery backup for enhanced runtime and footprint efficiency, and dynamic grid-interactive systems that support Japan’s stressed power infrastructure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Within IT Modules, the shift is toward specialized infrastructure: AI-optimized servers from NVIDIA and AMD, all-flash storage arrays for low-latency data access, and high-speed networking gear like 400GbE/800GbE switches to manage soaring intra-facility data traffic. This persistent hardware refresh cycle, combined with Japan’s need for seismic and disaster-resilient designs, ensures its market leadership.

The Software segment is the critical intelligence layer fueling market innovation and operational efficiency. Growth is surging as data center operations become software-defined. Automation & Orchestration Software is essential for managing sprawling hybrid and multi-cloud environments, enabling policy-based workload placement. Analytics & Optimization Software, powered by AI and machine learning, provides predictive insights into capacity planning, thermal management, and energy consumption, directly improving Power Usage Effectiveness (PUE).

Security Software is non-negotiable, evolving to offer Zero-Trust Network Access (ZTNA) frameworks and advanced behavioral threat detection to protect critical infrastructure from sophisticated cyber-physical attacks. Virtualization Software continues to be a core expenditure, maximizing hardware utilization, while Backup & Disaster Recovery Software is vital for business continuity in a disaster-prone nation.

By Deployment Model Analysis

The Hybrid deployment model is the dominant and most strategic architecture for the vast majority of Japanese enterprises. This approach perfectly aligns with the nation's business culture, which balances innovation with prudent risk management. It allows organizations to maintain sovereign control over sensitive, regulated, or legacy workloads in on-premise or domestic colocation facilities critical for sectors like BFSI and government while strategically leveraging the agility, scalability, and advanced services of public clouds (like AWS, Azure, and Google Cloud) for development, analytics, and customer-facing applications. This model facilitates a "cloud-smart" strategy, optimizing cost and performance by placing each workload in its ideal environment. The hybrid model's growth is further fueled by the proliferation of interconnection services in colocation hubs, which provide secure, high-performance, and low-latency links between private infrastructure and multiple public clouds, effectively making the hybrid model operational and efficient.

Cloud-Based deployment is the fastest-growing model, experiencing rapid adoption across the business spectrum. Digital Native Businesses (DNBs), startups, and a swelling cohort of Small & Medium Enterprises (SMEs) are embracing a cloud-first, and often cloud-only, approach. This is accelerated by Japanese government digitalization subsidies, the compelling economics of OpEx-based IT, and the ease of accessing enterprise-grade capabilities without upfront capital. Even within cloud adoption, a multi-cloud strategy is becoming standard practice to avoid vendor lock-in, leverage best-in-class services, and optimize costs. This strategic diversification, however, increases complexity, which in turn drives demand for cloud-adjacent colocation and cloud management platforms that can orchestrate across different providers, demonstrating how cloud growth symbiotically feeds other segments of the data center market.

By Data Center Type Analysis

Hyperscale Data Centers are the undisputed growth engine and scale leaders of the Japanese market. These are massive, purpose-built facilities (typically 50MW and above) constructed by or for global Cloud Service Providers (CSPs) like AWS, Microsoft Azure, and Google Cloud. Japan's strategic importance in the Asia-Pacific region makes it a key battleground for CSP expansion, leading to continuous, multi-billion-dollar investments in new regions and availability zones. These campuses set the benchmark for scale, energy efficiency (often pioneering liquid cooling), and automation. Their primary function is to host the public cloud infrastructure that powers the digital economy, and their expansion directly dictates the pace of overall market growth, pulling along the supply chain for power, cooling, and construction.

Colocation Data Centers remain the essential backbone for enterprise IT infrastructure, serving a diverse clientele. Within this segment, Wholesale Colocation is growing faster than retail. Here, large enterprises, technology firms, and even CSPs lease entire data halls or buildings ("turnkey shells") to deploy their own IT gear. This offers greater control and customization than public cloud, without the capital outlay and complexity of building from scratch. Retail Colocation, where customers rent individual racks or cages, continues to thrive by serving SMEs, providing interconnection hubs, and acting as a launchpad for hybrid cloud strategies. Colocation facilities are evolving into sophisticated interconnection ecosystems, crucial for enabling the hybrid and multi-cloud models that dominate corporate Japan.

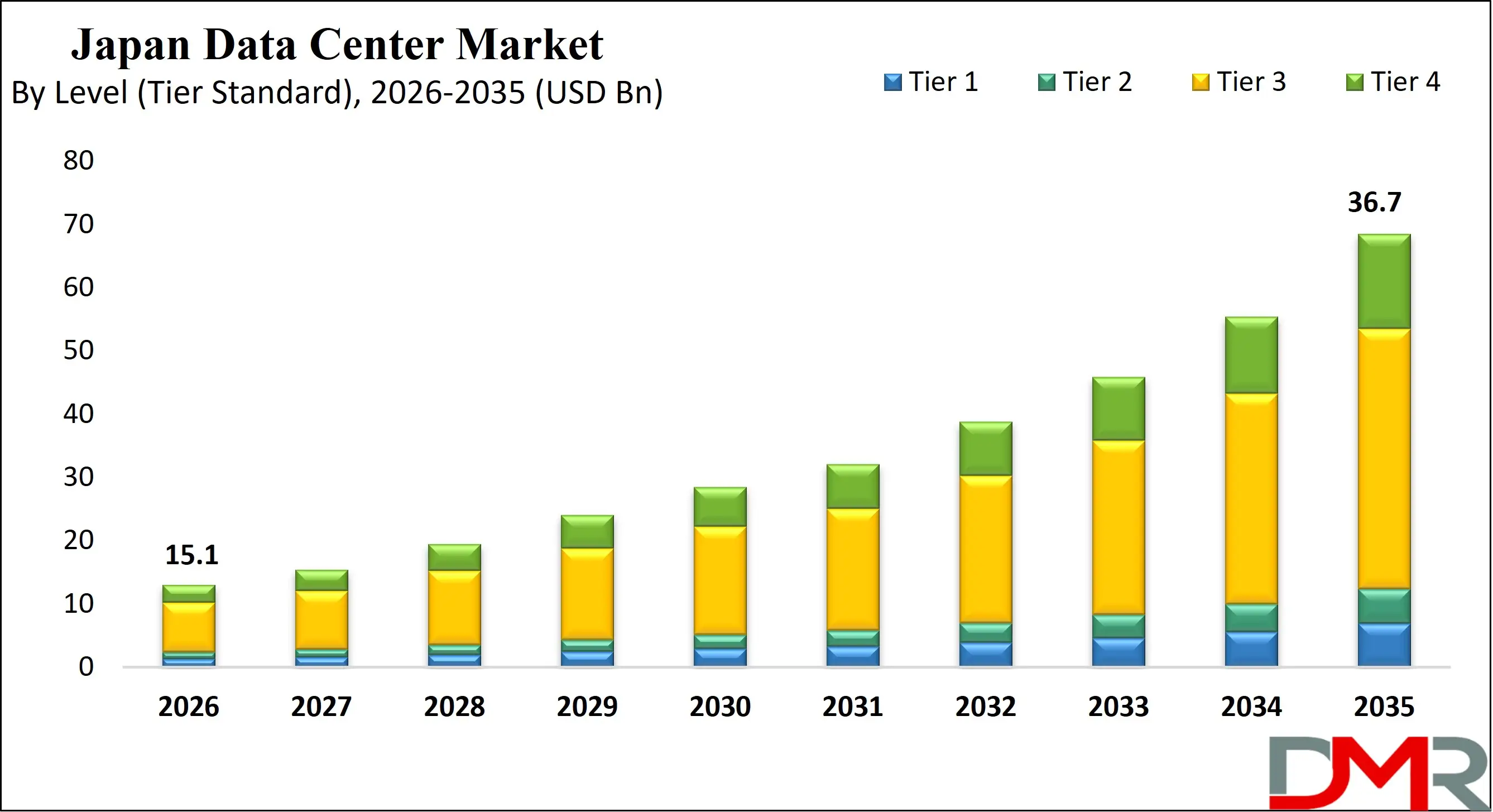

By Level (Tier Standard) Analysis

Tier 3 data centers command the largest market share in Japan, representing the optimal balance between high availability and cost for the broad commercial market. Offering "concurrent maintainability," Tier 3 facilities allow any component to be serviced or replaced without taking the IT load offline, delivering 99.982% uptime. This level of resilience satisfies the requirements of the vast majority of enterprise applications, most retail colocation customers, and many cloud-adjacent deployments. Its prevalence is due to its suitability for mission-critical business operations without incurring the significant premium associated with the fully fault-tolerant design of Tier 4. As Japanese enterprises continue to migrate from outdated on-premise facilities, Tier 3 colocation is the primary destination, fueling this segment's dominance.

Tier 4 facilities, while representing a smaller portion of the market by count, are experiencing growing demand and hold strategic importance. This design offers "fault tolerance," meaning the infrastructure has redundant capacity components and multiple independent distribution paths, allowing the facility to sustain at least one unforeseen failure without impacting IT operations (99.995% uptime). This premium capability is considered essential insurance for absolutely mission-critical workloads. Demand is strongest from the BFSI sector for core banking and high-frequency trading systems, from hyperscale cloud providers for their most critical availability zones, and for government disaster recovery (DR) and national security sites. In a country prone to natural disasters, the value proposition of Tier 4's extreme resilience is particularly compelling for these segments.

By Enterprise Size Analysis

Large Enterprises are the dominant consumers in terms of revenue and capacity consumption within Japan's data center market. Their massive digital transformation initiatives modernizing legacy ERP systems, deploying enterprise-wide AI and analytics platforms, and shifting to hybrid cloud architectures require substantial, reliable, and often customized infrastructure. These firms drive demand for wholesale colocation space, where they can deploy their own hardware at scale, and for complex managed and professional services to design, integrate, and operate these environments. Their contracts are high-value and long-term, making them the cornerstone clients for major colocation providers and system integrators. The scale of their IT projects directly influences the design of new data center facilities, pushing requirements for higher power densities and advanced connectivity.

Small & Medium Enterprises (SMEs) represent the highest-growth segment, undergoing a rapid and fundamental shift in their IT strategy. Historically reliant on limited, often outdated on-premise servers, SMEs are now aggressively embracing cloud-based services and retail colocation at an unprecedented rate. This shift is driven by the need to gain competitive capabilities (like e-commerce platforms, data analytics, and robust cybersecurity), support hybrid work models, and achieve operational agility without large capital expenditures. A key accelerator is active government support; Japanese ministries offer subsidies, tax incentives, and consulting programs specifically designed to spur SME digitalization. For data center providers, this translates into a vast, expanding market of customers seeking scalable, pay-as-you-go infrastructure and managed IT services, fueling innovation in packaged, SME-friendly service offerings.

By End User Analysis

Cloud Service Providers (CSPs) are the most influential and capital-intensive end-user segment. Their expansion blueprints directly dictate the timing, location, scale, and technological specifications of hyperscale data center construction in Japan. As they compete for dominance in the Asia-Pacific market, CSPs like AWS, Microsoft, and Google are in a continuous cycle of establishing new cloud regions and expanding existing ones. They act as both builders (developing their own facilities) and anchor tenants (leasing massive wholesale colocation capacity), making them the primary engine of growth for the entire market's supply side, from construction firms to hardware vendors.

Technology Providers, including global IT hardware vendors (e.g., Cisco, HPE), software giants, and content/gaming companies (e.g., Sony, Nintendo), constitute another major consumer bloc. They require high-performance, globally interconnected data center space not only to run their internal operations and SaaS platforms but also for research and development, particularly in AI and graphics rendering. Their needs drive demand for high-density power, advanced cooling, and robust, low-latency network connectivity within colocation facilities.

The BFSI (Banking, Financial Services, and Insurance) sector is a premium, high-stakes end-user. Driven by extreme sensitivity to latency (microseconds matter in trading), stringent regulatory compliance (FSA guidelines), and paramount security needs, financial institutions demand Tier 3+ or Tier 4 colocation in core districts like Tokyo's Otemachi. They rely on dense interconnection ecosystems within these facilities for direct market data feeds and secure partner connectivity, making them a foundational clientele for carrier-neutral colocation providers.

The Japan Data Center Market Report is segmented on the basis of the following

By Offerings

- Hardware

- IT Modules

- Servers

- Storage Systems

- Networking Equipment

- Power Modules

- UPS Systems

- Power Distribution Units

- Backup Power Systems

- Cooling Modules

- Air-Based Cooling

- Liquid Cooling

- Precision Cooling Systems

- Software

- Monitoring & Management Tools

- Automation & Orchestration Software

- Backup & Disaster Recovery Software

- Security Software

- Virtualization Software

- Analytics & Optimization Software

- Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

- Managed Data Center Services

By Deployment Model

- On-Premise

- Hybrid

- Cloud-Based

By Data Center Type

- Enterprise Data Center

- Colocation Data Center

- Retail Colocation

- Wholesale Colocation

- Cloud Data Center

- Hyperscale Data Center

- Edge Data Center

- Micro Data Center

By Level (Tier Standard)

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- Cloud Service Providers

- Technology Providers

- Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Entertainment & Media

- Energy & Utilities

Impact of Artificial Intelligence in the Japan Data Center Market

- AI-Optimized Physical Infrastructure Management: Beyond predictive maintenance, AI is being used for real-time "self-healing" infrastructure. AI systems can automatically reroute power, adjust cooling setpoints in response to a chiller fault, or rebalance workloads preemptively based on thermal maps, dramatically improving uptime and efficiency without human intervention.

- Intelligent Cybersecurity Mesh for Infrastructure: AI-powered security platforms create a dynamic, adaptive defense layer. They analyze behavioral patterns across IT networks, physical access logs, and building management systems to detect sophisticated, multi-vector attacks (e.g., a cyber-physical attack aiming to disrupt cooling), enabling real-time threat neutralization.

- Generative AI for Design, Compliance, and Operations: Generative AI tools are being used to create and iterate data center design blueprints, optimizing for PUE, cost, and seismic resilience. They also automate the generation of compliance reports for regulations and translate operational manuals and alerts across languages for Japan's international workforce.

- Sophisticated Workload and Carbon Intelligence: AI schedulers analyze real-time electricity carbon intensity (from the grid and on-site generation), electricity pricing, and computational priorities to decide when and where to run batch workloads (like AI training or rendering). This can shift non-urgent compute to times of high renewable output, minimizing carbon footprint and cost.

- Enhanced Customer Experience and Capacity Planning: Colocation and managed service providers use AI to analyze customer usage patterns and predict future capacity needs with high accuracy. They can offer proactive "right-sizing" recommendations and automated provisioning through customer portals, transforming the procurement experience.

Japan Data Center Market: Competitive Landscape

The competitive landscape of the Japan data center market is shaped by a mix of large domestic incumbents, global hyperscalers, and carrier-neutral colocation specialists, all vying to meet rapidly growing demand driven by cloud computing, AI, 5G, and edge services. Domestic infrastructure providers notably NTT, KDDI, SoftBank/IDC Frontier, Fujitsu, and NEC leverage deep telecom roots, expansive land banks, and established utility partnerships to secure long-term contracts and expand geographic footprints across major hubs such as Tokyo, Osaka, and emerging regional sites. These players differentiate on service reliability, energy efficiency, interconnection density, and compliance support, often integrating advanced cooling systems and renewable energy to address sustainability goals and stringent local regulations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global operators like Equinix, Digital Realty, and AWS add competitive pressure by offering carrier-neutral ecosystems, extensive inter-site connectivity, and large-scale wholesale capacity. Hyperscale cloud builders frequently pre-lease capacity years in advance or develop proprietary campuses, forcing traditional colocation providers to sharpen their value propositions around hybrid cloud and edge solutions.

Competition is moderately concentrated, with the top operators holding around 60–65% of installed capacity, but it remains dynamic due to strategic partnerships between real-estate investors and specialist operators, plus new entrants targeting niche segments like AI-optimized data centers and micro-edge deployments. Emphasis on green infrastructure, energy diversification, and regulatory fluency has become a pivotal differentiator in capturing market share as the sector continues substantial growth through the late 2020s.

Some of the prominent players in the Japan Data Center Market are

- NTT Global Data Centers

- KDDI Corporation

- Fujitsu Limited

- NEC Corporation

- Hitachi Systems

- SCSK Corporation

- Itochu Techno-Solutions (CTC)

- Sakura Internet

- Internet Initiative Japan (IIJ)

- Tokai Communications

- MC Digital Realty (Mitsubishi Corporation)

- Telehouse Japan (KDDI)

- GMO Internet Group

- SOFTBANK Corp.

- IDC Frontier

- Canon IT Solutions

- AT TOKYO

- Colt Data Centre Services

- Equinix Japan

- Other Key Players

Recent Developments in the Japan Data Center Market

- November 2026: NTT announces new hyperscale campus in Osaka with focus on AI. NTT unveiled plans for a 60MW hyperscale data center campus in Osaka, designed specifically for high-density AI workloads. The campus will feature integrated direct-to-chip liquid cooling from the outset and has secured a long-term power purchase agreement (PPA) for solar and wind energy, targeting a PUE of under 1.15.

- October 2026: Equinix launches $1 billion expansion plan for Japan. Equinix committed a major investment to expand its TY12 (Tokyo) and OS2 (Osaka) International Business Exchange data centers, and announced the pursuit of a new site in the Kanto region. The expansion emphasizes increased interconnection capacity and AI-optimized power zones within its facilities.

- September 2026: Google opens its second cloud region in Tokyo (asia-northeast2). Google Cloud launched its second cloud region in Tokyo to provide enhanced redundancy, lower latency for domestic customers, and increased capacity for AI and data analytics services. The region is designed to be one of Google's most energy-efficient in Asia.

- August 2026: Strategic partnership between KDDI and Mitsubishi Heavy Industries on hydrogen power. KDDI and MHI launched a comprehensive pilot at a KDDI data center, testing a combined system of green hydrogen production, storage, and fuel cell-based backup power. The initiative aims to create a blueprint for 24/7 carbon-free power resilience.

- July 2026: Digital Realty secures key land parcel in Inzai for strategic development. Digital Realty finalized the acquisition of a large, powered land site in Inzai, Chiba Prefecture a major data center corridor. The company plans to develop a multi-phase, carrier-neutral data center campus targeting hyperscale and large enterprise customers seeking scalable space in the Greater Tokyo area.

- June 2026: METI formalizes "Green Data Center Certification" program. Japan's Ministry of Economy, Trade and Industry (METI) officially launched a certification program that rates data centers on energy efficiency (PUE, WUE), use of renewable energy, and overall sustainability practices. The certification is expected to become a key differentiator in procurement decisions by major enterprises and government agencies.

Report Details

| Report Characteristics |

| Market Size (2026) |

USD 15.1 Bn |

| Forecast Value (2035) |

USD 36.7 Bn |

| CAGR (2026-2035) |

10.3% |

| Historical Data |

2020 – 2025 |

| Forecast Data |

2027 – 2035 |

| Base Year |

2025 |

| Estimate Year |

2026 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offerings (Hardware, Software, and Services) By Deployment Model (On-Premise, Hybrid, and Cloud-Based) By Data Center Type (Enterprise Data Centers, Colocation Data Centers, Cloud Data Centers, Hyperscale Data Centers, Edge Data Centers, and Micro Data Centers), By Level (Tier 1, Tier 2, Tier 3, and Tier 4), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), and By End User (Cloud Service Providers, Technology Providers, Telecom, BFSI, Healthcare, Retail & E-commerce, Entertainment & Media, and Energy & Utilities) |

| Regional Coverage |

Japan |

| Prominent Players |

NTT Global Data Centers, KDDI Corporation, Fujitsu Limited, NEC Corporation, Hitachi Systems, SCSK Corporation, Itochu Techno-Solutions (CTC), Sakura Internet, Internet Initiative Japan (IIJ), Tokai Communications, MC Digital Realty (Mitsubishi Corporation), Telehouse Japan (KDDI), GMO Internet Group, SoftBank Corp., IDC Frontier, Canon IT Solutions, AT TOKYO, Colt Data Centre Services, and Equinix Japan., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Japan Data Center Market?

▾ The Japan Data Center Market size is estimated to have a value of USD 15.1 billion in 2026 and is expected to reach USD 36.7 billion by the end of 2035, reflecting a period of sustained, high-value growth.

What is the growth rate in the Japan Data Center Market?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 10.3 percent over the forecasted period from 2026 to 2035.

Which data center type is leading the market in Japan?

▾ Hyperscale Data Centers are the dominant and fastest-growing type. This is directly driven by massive, continuous investments from global cloud service providers (AWS, Google, Microsoft) establishing and expanding their cloud regions to capture Japan's digital economy.

Who are the key players in the Japan Data Center Market?

▾ The market features a mix of global giants and domestic leaders. Key players include domestic telecom-based providers NTT Communications and KDDI, global colocation specialists Equinix and Digital Realty, the hyperscale cloud builders Amazon Web Services (AWS), Microsoft, and Google, and diversified industrial conglomerates like SoftBank and Mitsubishi.