Market Overview

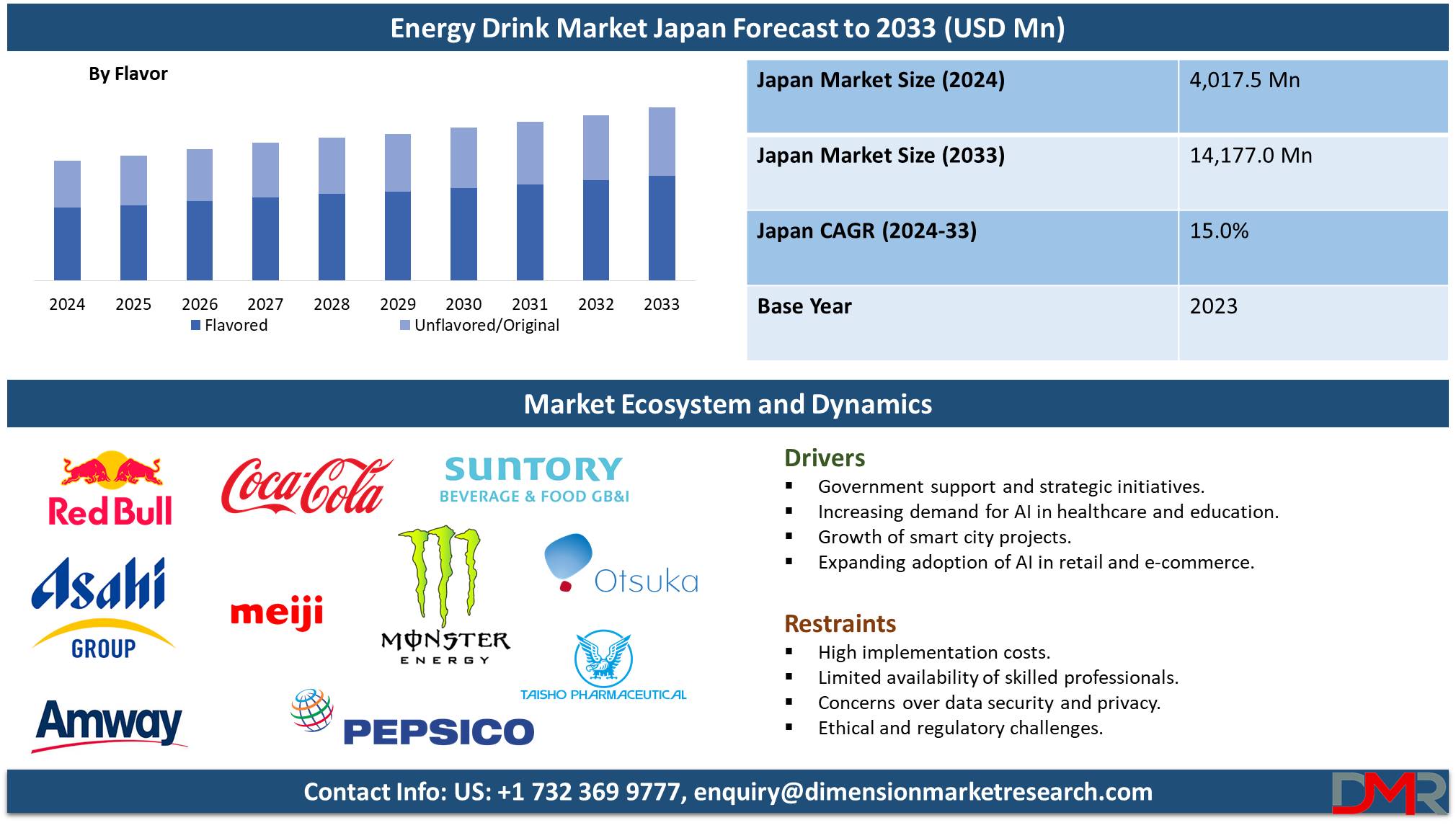

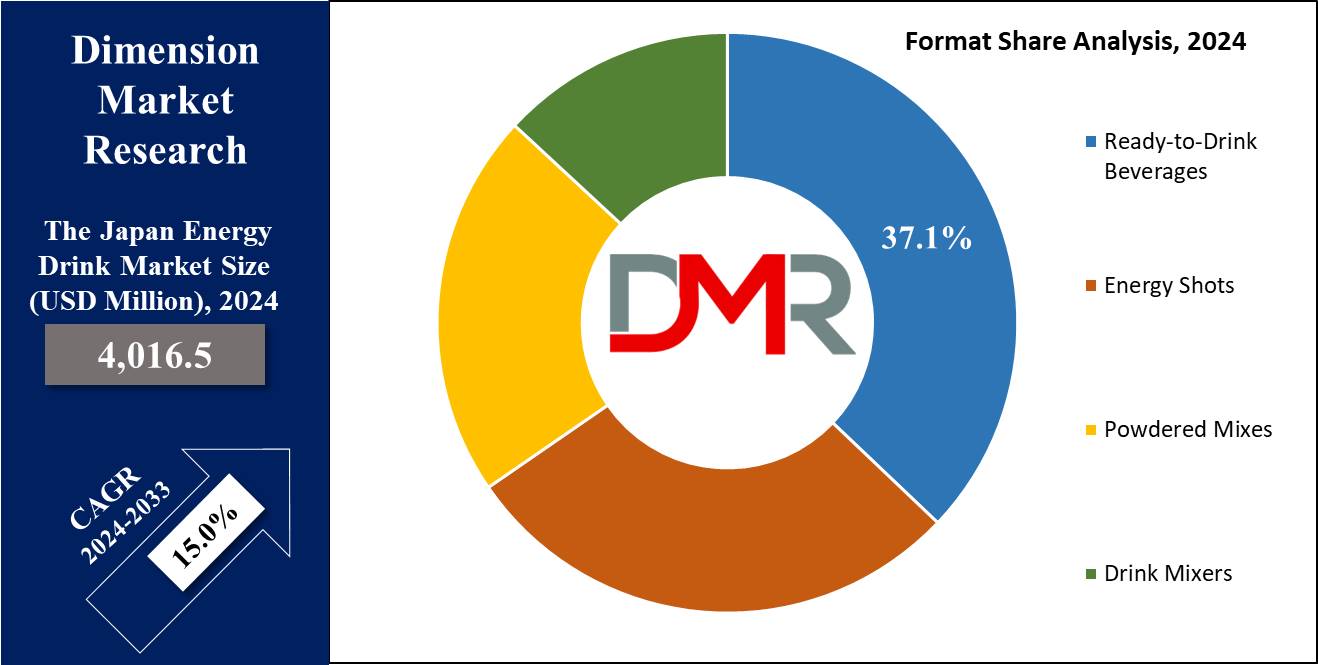

The Japan Energy Drink Market size is expected to reach a value of USD 4,016.5 million in 2024, and it is further anticipated to reach a market value of USD 14,177.0 million by 2033 at a CAGR of 15.0%.

The energy drink market in Japan is growing vigorously, as the consumer's lifestyle, health awareness, and demand for functional beverages have been developing. Energy drinks provide immediate energy and concentration and therefore are targeted mainly towards the younger generation, fitness enthusiasts, and busy professionals in Japan.

The market comprises various types of products, such as ready-to-drink cans, powdered mixes, and functional shots, primarily filled with caffeine, vitamins, amino acids, and other energizing ingredients. This growth is in line with an increasing preference for functional beverages and an expanding fitness culture. Besides, innovations in product formulations, such as sugar-free and natural ingredient-based drinks, further fuel consumer interest.

One of the major trends is that people increasingly prefer low-calorie and natural energy drinks. Japanese health-conscious consumers are increasingly opting for products with less sugar, artificial flavorings, and plant-based sources of caffeine, such as matcha or guarana. Companies like Red Bull, Monster, and domestic players like Suntory have launched various product variants in this regard.

Second, customization in packaging and eco-friendly processes might be a trend that could emerge. Today, a raft of manufacturers increasingly employs recyclable materials, making designs appealingly good-looking in their attempts to target young consumers. Besides that, online sales channels or subscription services have been attracting more customers, which reveals shopping habits typical of tech-savvy Japanese citizens.

A unique opportunity lies in the increasing demand for functional beverages from aging populations. Japan's aging society, combined with health-conscious seniors, opens up a niche for energy drinks offering benefits like mental alertness, improved metabolism, and enhanced endurance. The other key opportunities include an increase in the penetration of e-commerce platforms.

Driven by digital channels, retail growth can be supported through data analytics and targeted marketing for brands to reach out to specific consumer segments. Also, interest in esports and gaming has increased, thus creating more demand for energy drinks, which guarantee sustained focus and energy over several hours.

Yet, several challenges also confront the Japanese energy drink market. Regulation around caffeine content and labeling may inhibit product innovation and new market entrants. Japanese authorities have focused on consumer safety; the display of the level of caffeine in each can/bottle, along with the need to adhere to strict marketing guidelines, will have manufacturers comply. Furthermore, high prices for premium energy drinks could further hamper demand among price-sensitive consumers. There is also intense competition from other domestic markets, such as energy drinks based on tea, or traditional Japanese beverages of green tea, perceived to be healthier.

By the year 2022, Japanese functional beverages had an overall market share of energy beverages of about 15%. RTD accounted for the top-selling formats due to an estimated 60% of energy drinkers being aged between 18 to 34, predominantly males which exhibit gender dependence. However, women are slowly being converted into engaging in the consumption of energy drinks, especially during late years when low-calorie sugar-free drinks are involved because of a change in gender tastes or orientation preferences. With an average annual per capita consumption of 2.5 liters, it is relatively lower compared to Western markets and thus presents a high growth potential. Urban areas like Tokyo and Osaka dominate consumption because of their fast lifestyles, while rural areas are still lagging in the adoption of energy drinks.

Strong prospects in consumer growth and brand diversification have been pointing towards reasonable development in the energy drink market of Japan. Other innovative aspects also are expected to increase in demand in smaller groups of people: organic and vegan-friendly formulas of the energy drink. Strategic partnerships also influence increased consumption by energy drink firms with gyms, leading outdoor/sports events, and leading Gaming events.

Furthermore, government advocacy for lifestyles and wellness products is considered to converge with market growth, which enables manufacturers to position their products according to the priorities of consumers' health. Conclusion Though the energy drink market in Japan holds immense promise, overcoming regulatory challenges and overcoming traditional beverages will be the key to long-term success. Innovation, affordability, and consumer-oriented marketing strategies are the differentiators that will enable the brands to emerge as leaders in this dynamic market.

Key Takeaways

- Market Size: The Japan Energy Drink Market size is estimated to have a value of USD 4,016.5 million in 2024 and is expected to reach USD 14,177.0 million by the end of 2033.

- By Type Segment Analysis: Non-alcoholic drinks are projected to dominate this segment with the highest market share in 2024.

- By Format Segment Analysis: Ready-to-Drink Beverages are anticipated to dominate this segment with 37.1% of the market share in 2024.

- Key Players: Some of the major key players in the Japan Energy Drink Market are Red Bull GmbH, Monster Beverage Corporation, Suntory Beverage & Food Limited, Coca-Cola Japan Co. Ltd., PepsiCo Inc., Asahi Group Holdings, Ltd., and many others.

- Market Growth Rate: The market is growing at a CAGR of 15.0 percent over the forecasted period.

Use Cases

- Athletic Performance Enhancement: Energy drinks provide immediate energy for athletes, sustain endurance during training, and recover by replenishing electrolytes for improved physical performance and sustained activity levels.

- Late-night productivity: Energy drinks are used by students and professionals to keep them awake, enhance their concentration, and be productive for late-night study or work sessions that help them meet deadlines and maintain sharp mental focus.

- Travel and Jet Lag Relief: The energy drinks combat jet lag's fatigue and give them energy and alertness during a very long plane ride, which helps the consumer adapt to the different time zones without sleep.

- Gaming and Esports Stamina: Energy drinks are consumed by gamers to increase focus, quicken reactions, and prolong energy throughout extended sessions of gaming or esports. Thus, competitive performance is ensured, with extended effectiveness in gameplay.

Market Dynamic

Trends

Premiumization of Energy Drinks

The premium segment keeps on gaining huge traction within the energy drink market of Japan. These energy drinks highlight high-quality natural ingredients such as green tea extract, matcha, and ginseng targeted toward health-conscious consumers. Increased nutrition profiles, innovative and green packaging, and ethical sourcing further drive the trend.

Premium energy beverages serve a more sophisticated market that values, along with functionality, both the aesthetic and ethical aspects of consumption. This trend denotes the preference of the global market and is responsible for the growth of energy drinks in Japan during the forecast period.

Functional Beverages Gaining Momentum

Energy functional drinks become popular, including more and more not only properties that make energy but a bottom-up approach to various benefits linked to health, such as stress relief or the state of immunity and cognitive approaches. This novelty caters to a wide-ranging consumption-need-from relieving states of fatigue, therefore a refreshing drink, or making way to mental clarity kind of energy contains certain special ingredients.

Having the latest inclusion of adaptogenic with vitamins and probiotic combinations reformed consumer expectations through growing demands for multifunctionality of beverages. It thus places functional energy drinks as the commanding segment within the industry and reflects increasing orientation for health in Japanese consumer choices, thus setting a certain standard for world market trends.

Growth Drivers

Rising Health Awareness

Health-conscious Japanese consumers are looking for beverages beyond energy provision with some additional nutritional value. Energy drinks containing vitamins, amino acids, natural caffeine, and plant-based ingredients see higher demand. Growing awareness about the health effects of using artificial ingredients and sugar forces manufacturers to develop cleaner, healthier formulations. This not only drives sales but changes how key players in the product development strategy approach the Japan Energy Drink Market.

Expanding Urbanization and Busy Lifestyles

The highly urbanized society and fast lifestyles of Japan are additional contributors to the demand for energy drinks. The ready-to-drink formats are befitting the lifestyles of busy professionals, students, and commuters. Such drinks present a readily available method to sustain energy and productivity throughout the day. The growing penetration of vending machines and convenience stores across urban areas further helps facilitate accessibility, thereby driving growth.

Growth Opportunities

Expansion in Untapped Demographics

Although the Japanese energy drink market has reached maturity for working adults and people in the field of fitness, there are other untapped segments consisting of younger consumers and aging generations. Targeted products will include fun, taste, and a reasonable amount of caffeine as a base in a product aimed at youngsters; similarly, for elderly people, it should project health-related benefits, such as bones, digestive issues, or cardiac problems, which provide wide scope for market shares. It has to be supplemented by appropriate age-related campaigns and formulations for significantly enhanced market coverage.

Integration of Sustainable Practices

Japanese consumers are increasingly showing a preference for the environment. Energy drink makers adopting sustainable production processes, eco-friendly packaging, and minimizing carbon footprints go in line with consumer values and government regulations. Recyclable cans, plant-based packaging materials, and

renewable energy sources in production attract not only environment-conscious customers but also make a mark in the competitive market. Such practices ensure better brand loyalty and contribute to market sustainability in the long run.

Restraints

Regulatory Challenges

The Japanese energy drink market is very much bound to strict policies regarding caffeine-sugar content and labeling issues. These policies are important in protecting general health but have negative implications for manufacturers in considerations of compliance and innovation. These raise the production cost due to reformulations to meet such guidelines, further limiting the types that can be developed and reducing the time to market for new products. Balancing regulatory compliance while meeting consumer demand for highly potent and flavorful energy drinks remains arguably the biggest challenge facing market participants.

Competition from Alternatives

Energy drinks fight increasing competition from other forms of beverages, such as sports drinks, herbal teas, and functional waters. By their positioning as healthier, or at least more 'natural,' these alternatives are gaining popularity in Japan, emphasizing health and tradition in beverages; sports drinks, for example, hydrate the body and replenish fluid electrolytes without the caffeine provided by energy drinks, since the products are positioned above rest and wellness. This tough competition demands new marketing combinations and differentiation of the product based on their category to keep brands competitive in the market.

Research Scope and Analysis

By Type

With all their varieties, functional energy drinks are by now the cornerstone of Japan's energy drink market. Of course, the functionality in functionality extends beyond just the swift sense of energy. Minerals, vitamins, amino acids, and sources of natural caffeine will surely help to reach those highly sought-after health-conscious customers and drive business growth, Where the growth in the energy drink market is strongly connected to an increase in the desire for multifunctional drinks.

Functional types of energy drinks attract gym users who want better solutions to improve performance and recovery, which corresponds to general health trends. In relation to aging Japanese demographics, another underlying trend in the segment is beverages containing ingredients that contribute to vitality and well-being in general. It was identified from market research that during the forecast period, the functional energy drinks category held the largest share because they had successfully managed to combine health benefits along with their energy-boosting properties.

Their popularity has been bolstered by strategic marketing campaigns emphasizing these dual benefits, reinforcing consumer trust and preference. Global energy drink market players, including Red Bull GmbH and other companies in the energy drink industry, have introduced innovative functional drink variants to cater to this growing demand. The size of the market continues to increase, and with the growing health and functionality trend, the energy functional drink market is likely to grow phenomenally.

By Format

Ready-to-drink is the leading format in the Japanese energy drink market, thanks to its unrivaled convenience and appeal that has grown among busy, urban consumers. RTD beverages require no preparation, thus making them ideal for Japan's fast-paced lifestyles in which consumers seek quick solutions for energy. According to various market research, RTD energy drinks address a wide demographic that ranges from commuters who need a mid-day energy boost to athletes looking for performance enhancers on the go.

This segment holds a significant market share due to the growing demand for portable and instantly consumable

energy drinks. Other reasons for their dominance include the wide variety available in the RTD format, from canned energy drinks to bottles with resealable caps, to cater to different consumer preferences. This is perpetuated by creative marketing campaigns by major energy drink companies such as Red Bull GmbH, based on the convenience of use and highly energetic performance.

Besides, the RTD format has also met modern development in market trends toward convenience and portability, which is very critical for growth in the forecast period. RTD products are usually fortified with functional benefits, combining health and energy, thus increasing their popularity. The RTD segment dominated the energy drink market size owing to its ability to adapt to lifestyle changes and thus contributed significantly to the overall growth of the energy drink industry both in Japan and the global market.

By Flavor

Flavored energy drinks act as driving forces within the energy drink market of Japan, coming with a host of flavor varieties to attract people with varying tastes. With these beverages, the functional benefits become blended with enjoyable flavors. As part of market analyses, the flavored segment seems to take the lead simply because of its ability to cater to evolving consumer trends. These demographics, particularly the younger generations, like unique and exotic flavors, such as yuzu, matcha, and tropical fruit combinations that are relevant to Japan's current taste trends in popular culture. Energy drinks were very popular in this category, providing avenues for market growth due to flavor innovation.

Additionally, flavored energy drinks disguise the aftertaste of regular caffeinated drinks, thus attracting first-time consumers who repeat the consumption rate. Companies operating in the energy drink market strategize with a wide variety of flavors to establish their leading positions. The growth in the segment is also underpinning the demand for more natural and low-sugar products by health-conscious consumers, boosting the growth rate.

With this, limited and seasonal flavors are also very common strategies among manufacturers to keep consumers interested in their offerings and, hence, increase the demand for energy drinks. The Japan energy drink report highlights that the flavored segment will continue to see growth supported by the fact that they can be adapted to evolving tastes and health trends within the forecast period.

By Nature

Dominance in the Japanese energy drink market is for conventional energy drinks since they hold a better brand reputation among consumers, with availability and easy affordability. Thus, to cater to consumer demand, these products keep their consistent taste and performance. Various market research underlines conventional energy drinks that hold a majority share size for their energy drinks product due to a broad category appeal to target consumers.

But because a natural energy drink is mostly a niche product, as compared to the conventional items, the latter are renowned for their dependability associated with availed energy thereby making most consumers, irrespective of demographics, prefer these products above those currently recommended.

The market growth registered with energy drinks is relative to conventions that are very affordable, especially when positioned as means or solutions that answer the pocket calls of thrift-conscious consumers easily for whatever energy levels they require and need. The added accessibility, along with some companies, like Red Bull GmbH, pursuing aggressive marketing strategies, has maintained the latter's stronghold.

The conventional segment also benefits from the strong Japanese distribution networks to literally reach every supermarket, the convenience store, and even sell on vending machines all across the country. That gives consumers that extra impulse to purchase. Even with growth showing of naturals as alternatives, still, conventional energy drinks still see the largest share in this, which can adapt more quickly to mass-market requirements and easily sustain its popular image in this forecasted period.

By Packaging

The most dominating format in the energy drink market in Japan would be cans because of the fact that these are convenient, durable, and can easily be marketed on green platforms. The cans are also light and portable, suit the active lifestyles of mankind, hence allowing one the leisure of enjoying energy drinks at any time and place whatsoever. Market trends indicate clearly that in the segment of packaging as far as energy drinks are concerned, cans are by and large dominating due basically to the fact that packaging helps protect the quality.

Aluminum cans protect beverages from light and oxygen, which is extremely important for preserving flavor and carbonation-the energetic and refreshing imagery that energy drinks sell. Additionally, Japan's sophisticated recycling infrastructure enhances ecological acceptability; this fits into consumer trends to show a preference for greener packaging. Energy drink firms use this to their full advantage through the publicization of product recyclability as a way to command market share among environmentally sensitive consumers.

Apart from that, aggressive branding with fancy designs on the can further makes them attractive enough for consumers. The makers also use this packaging format as an opportunity to gain adequate representation in retail displays that give further impetus to notice, leading to higher sale potentialities of such products. As long-term forecasts remain bright for growth in the energy drink sector, the demand for energy drinks in cans is seen to go up, supported by factors related to practicality and environmental acceptability. Consequently, this makes the aforementioned points an important driver behind Japan's energy drink market size.

By Distribution Channel

Convenience stores dominate the market share in the Japanese energy drink market because of their wide coverage and accessibility to consumers. These stores also sell energy drinks as quick, on-the-go solutions, targeting Japan's urbanized and fast-paced lifestyle. Energy drinks are placed near the checkouts or refrigerated sections to increase impulse buys. Convenience stores are an important distribution channel because of their closeness to transportation hubs and business districts, hence ensuring regular flows of consumers.

Promotional campaigns and loyalty programs being done by the stores themselves contribute to further driving demand for energy drinks. The extended hours of operations-often 24/7 meet the consumer needs for energy boosts both late at night and during early commutes.

Additionally, the convenience stores also work with the energy drink manufacturers on special product variants, increasing the demand for them. This, in turn, solidifies the position of the convenience store segment in the energy drink market size and is expected to boost market growth during the forecast period. The strategic locations and the rise in the consumption of energy drinks make convenience stores the preferred channel for buying energy drinks, thus providing the segment with a solid footing in the Japanese energy drink market.

The Japan Energy Drink Market Report is segmented on the basis of the following

By Type

- Non-Alcoholic Energy Drinks

- Caffeinated Drinks

- Decaffeinated or Low-Caffeine Drinks

- Functional Energy Drink

- Herbal-based Drinks

- Vitamin-fortified Drinks

- Electrolyte-enhanced Drinks

- Adaptogen-infused Drinks

By Format

- Ready-to-Drink Beverages

- Energy Shots

- Powdered Mixes

- Drink Mixers

By Flavor

- Unflavored/Original

- Flavored

- Citrus

- Berry

- Tropical

- Exotic/Traditional Japanese Flavors

- Custom/Innovative Flavors

By Nature

- Conventional

- Organic

- Clean Label

By Packaging

- Cans

- Bottles

- Pouches/Sachets

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores/Grocery Stores

- Online Retail Stores

- Other Distribution Channels

Competitive Landscape

The energy drink market of Japan is very competitive in nature, where a few players are competing against each other through innovation, branding, and strategic partnerships. A few leading companies such as Red Bull GmbH, and Monster Energy Company, and local brands including Suntory are dominating the market due to their established presence and wide range of product portfolios.

Red Bull GmbH is still in the lead through its well-known brand and promotion linked to extreme sports. Due to effective marketing, including sponsorships and focused campaigns, the company has managed to retain its popularity among younger audiences and individuals engaged in sports. Where another leading player, Monster Energy, has been differentiated by its bold branding and innovation of flavors, the firm continuously introduces limited-edition products or collaborations that embed themselves into the youth culture of Japan.

Local brands, like Suntory, play off their strength in understanding regional tastes and preferences by offering flavors like yuzu and matcha that are targeted at Japanese consumers. These companies are also focusing on functionality-additional health-oriented ingredients to meet the increasing demand for functional energy drinks. Other smaller and niche players have entered the market, introducing organic and natural energy drinks into the mix.

These companies attract health-conscious consumers, which opens up new prospects for the market to grow. In Japan, the energy drink market is continuously changing, so strategic investments in product innovation, distribution, and consumer engagement are very crucial for the players to strengthen their foothold in this dynamic industry.

Some of the prominent players in the Japan Energy Drink Market are

- Red Bull GmbH

- Monster Beverage Corporation

- Suntory Beverage & Food Limited

- Coca-Cola Japan Co., Ltd.

- PepsiCo, Inc.

- Asahi Group Holdings, Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Taisho Pharmaceutical Co., Ltd.

- Amway Japan G.K.

- Daiso Pharmaceutical Co., Ltd.

- Meiji Holdings Co., Ltd.

- Kirin Holdings Company, Limited

- Aiya Matcha Company

- Other Key Players

Recent Developments

- October 2024: Red Bull GmbH launched a limited-edition yuzu-flavored energy drink tailored specifically for the Japanese market. This product introduction capitalized on the local preference for citrus-based flavors, aligning with Japan’s seasonal trends and cultural affinity for unique and refreshing beverages.

- July 2024: Monster Energy Company unveiled its "Ultra Series" of zero-sugar energy drinks, targeting Japan’s growing segment of health-conscious consumers. This launch diversified Monster Energy’s product portfolio, emphasizing guilt-free energy boosts with bold flavors.

- March 2024: Suntory Holdings Limited partnered with FamilyMart, a leading convenience store chain in Japan, to release exclusive energy drink flavors. The collaboration focused on leveraging FamilyMart’s extensive network of stores, ensuring product availability, and engaging consumers through in-store promotions, limited-time discounts, and loyalty programs.

- November 2023: The Japan Beverage Association reported a significant 12% surge in energy drink consumption in Japan, reflecting rising consumer interest in functional and quick energy solutions. This announcement highlighted market growth, influencing energy drink companies to expand their product offerings and innovate with new formulations.

- June 2023: Genki Energy, a niche player in the energy drink market, introduced an organic matcha-based energy drink. This product appealed to the health-conscious segment, blending traditional Japanese ingredients with modern energy drink functionality, and marked a shift toward natural and sustainable beverage solutions.

- January 2023: Coca-Cola Japan debuted its "Coke Energy Boost" line, focusing on millennial and young professional demographics. The launch highlighted Coca-Cola's effort to diversify beyond traditional soft drinks, featuring vibrant branding and a marketing strategy centered on office-goers and urban consumers.

- August 2022: DyDo Drinco, Inc., a prominent vending machine operator, broadened its energy drink offerings. The company emphasized functional benefits such as hydration and enhanced stamina, while also focusing on innovative and convenient packaging designs that catered to Japan’s on-the-go lifestyle.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4,106.5 Mn |

| Forecast Value (2033) |

USD 14,177.0 Mn |

| CAGR (2024-2033) |

15.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Non-Alcoholic Energy Drinks, and Functional Energy Drink), By Format (Ready-to-Drink Beverages, Energy Shots, Powdered Mixes, and Drink Mixers), By Flavor (Unflavored/Original, Flavored), By Nature (Conventional, Organic, Clean Label), By Packaging (Cans, Bottles, Pouches/Sachets, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores/Grocery Stores, Online Retail Stores, and Other Distribution Channels) |

| Regional Coverage |

Japan |

| Prominent Players |

Red Bull GmbH, Monster Beverage Corporation, Suntory Beverage & Food Limited, Coca-Cola Japan Co. Ltd., Pepsi Co Inc., Asahi Group Holdings, Ltd., Otsuka Pharmaceutical Co. Ltd., Taisho Pharmaceutical Co. Ltd., Amway Japan G.K., Daiso Pharmaceutical Co. Ltd., Meiji Holdings Co. Ltd., Kirin Holdings Company Limited, Aiya Matcha Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |