ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is witnessing a significant trend toward tech-enabled services and automation. Digital check-ins, AI-powered concierge services, and multilingual mobile applications are being rapidly adopted to enhance guest experiences while addressing the country’s ongoing labor shortages. Sustainability is also becoming central, with many establishments integrating green practices such as energy-efficient designs, waste reduction programs, and eco-certifications to attract environmentally conscious travelers.

Despite positive momentum, the industry faces structural restraints. A shrinking domestic population and aging workforce challenge long-term staffing and service consistency, especially in rural areas where tourism infrastructure remains underdeveloped. Additionally, the high cost of maintaining traditional hospitality establishments such as ryokans limits scalability and modernization efforts, potentially hindering competitiveness against newer, international hotel chains.

Nonetheless, the Japanese hospitality market presents substantial opportunities. The Osaka World Expo 2025 and the growing interest in rural tourism and cultural immersion offer new growth avenues. There is also a rising demand for wellness tourism and themed accommodations, including anime and gaming-based stays, which are attracting younger global audiences. Moreover, strategic government incentives and partnerships with global OTAs are expanding Japan’s global hospitality footprint.

The Japanese hospitality industry is projected to grow at a steady rate, supported by rising international arrivals, a shift toward experiential travel, and ongoing digital transformation initiatives. The industry’s long-term growth prospects remain positive as it adapts to changing travel preferences and global tourism dynamics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Japan Hospitality Industry Market: Key Takeaways

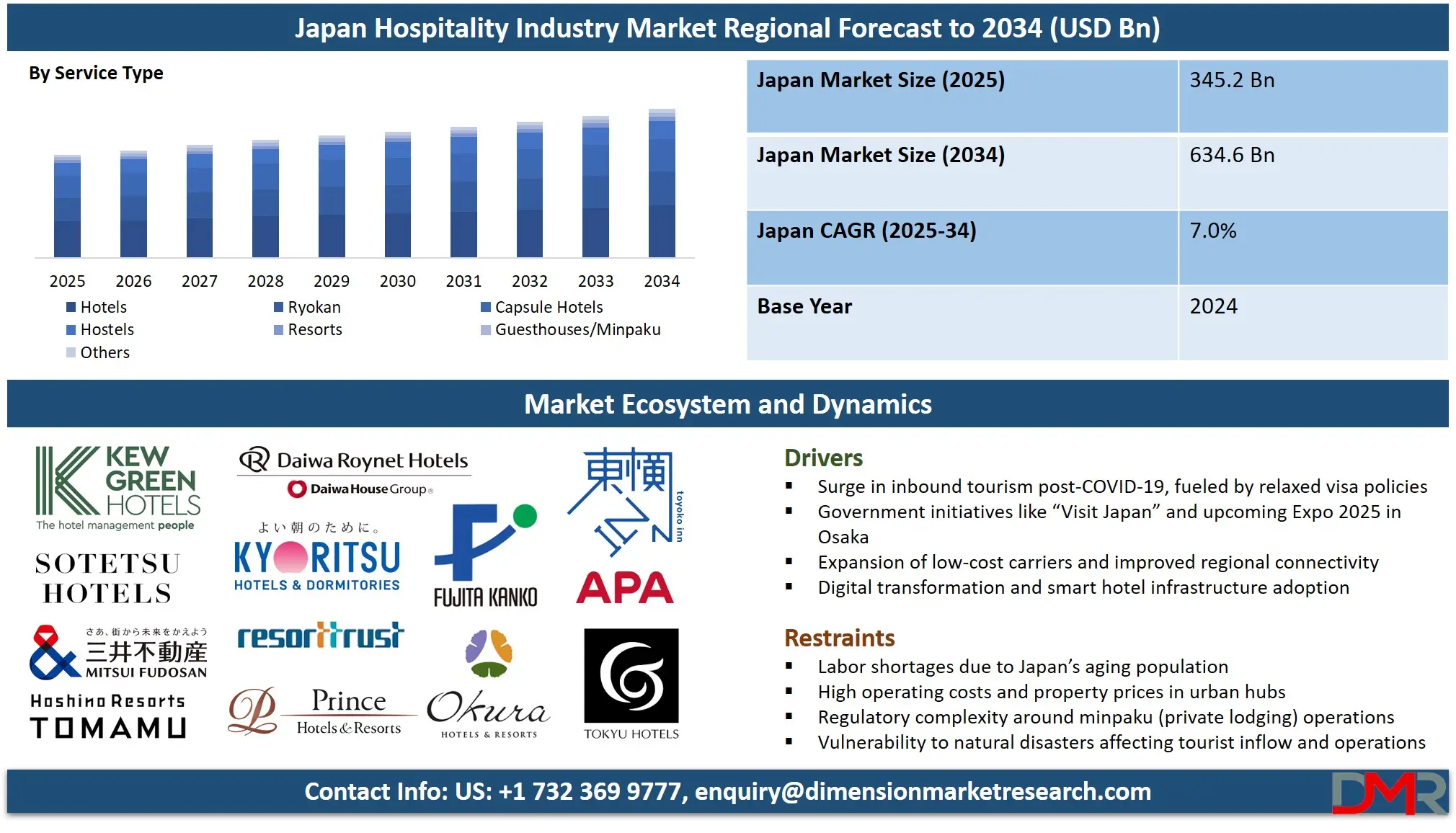

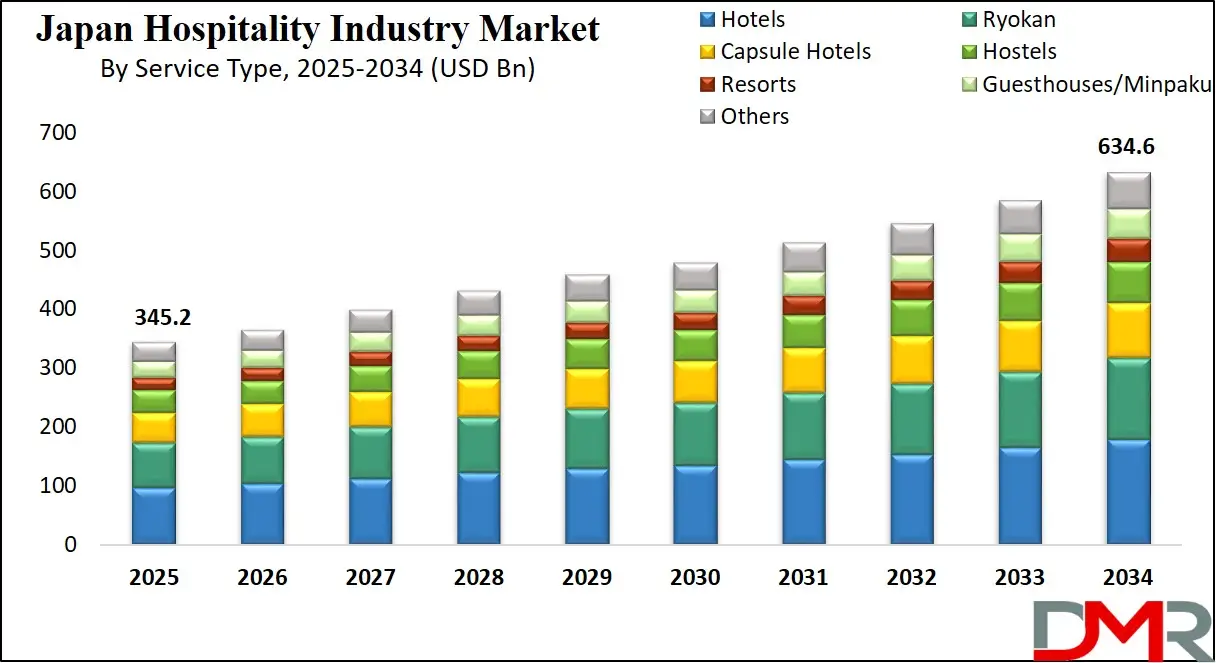

- Market Size Insights: The Japan Hospitality Industry Market size is estimated to have a value of USD 345.2 billion in 2025 and is expected to reach USD 634.6 billion by the end of 2034.

- By Type of Establishment Segment Insights: Hotels are projected to dominate Japan's hospitality industry with the highest market share by the end of 2025.

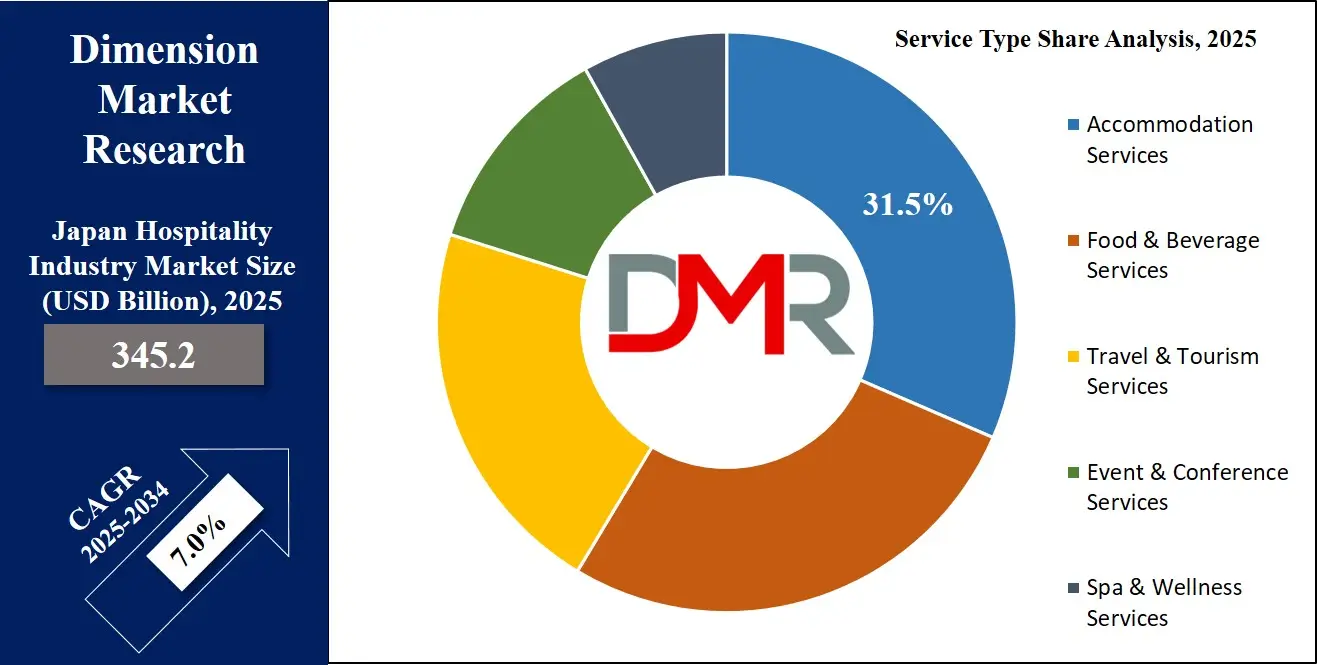

- By Service Type Segment Insights: Accommodation services are expected to dominate the service type segment of the Japan hospitality industry as it contains major portion of revene in 2025.

- Key Players Insights: Some of the major key players in the Japan Hospitality Industry Market are APA Group, Hoshino Resorts, Prince Hotels, Hotel Okura, Fujita Kanko, Mitsui Fudosan Hotel Management, Tokyu Hotels, JR-East Hotels, and many others.

- Market Growth Rate Insights: The market is growing at a CAGR of 7.0 percent over the forecasted period of 2025.

Japan Hospitality Industry Market: Use Cases

- Smart Capsule Hotels: Japan’s capsule hotels are integrating IoT-enabled pods with personalized settings such as lighting, temperature, and entertainment. These tech-forward accommodations target solo travelers and digital nomads looking for affordable, contactless, and efficient lodging in urban centers like Tokyo and Osaka.

- Ryokan Revitalization Projects: Local governments collaborate with private investors to modernize aging ryokans while preserving their cultural value. By updating amenities and incorporating bilingual services, these traditional inns now appeal to both international tourists and domestic luxury seekers seeking authentic yet comfortable experiences.

- AI Concierge in Chain Hotels: Major hotel chains like APA and Henn na Hotel use AI-powered robots and kiosks for check-in, check-out, and guest queries. This reduces dependency on human staff, addresses labor shortages, and ensures consistent, multilingual guest services across high-traffic hospitality hubs.

- Wellness-Focused Resorts: Hospitality operators in Hokkaido and Okinawa are developing spa and wellness resorts that blend hot spring therapies with nutrition and mindfulness programs. These facilities cater to a rising global interest in holistic health tourism and attract long-stay international visitors seeking rejuvenation.

- Cultural Immersion Guesthouses: Minpaku-style accommodations are expanding in Kyoto and Nara, offering travelers a chance to participate in tea ceremonies, calligraphy workshops, and local farm stays. These guesthouses cater to experiential travelers looking for deeper cultural engagement beyond standard tourism packages.

Japan Hospitality Industry Market: Stats & Facts

Japan National Tourism Organization (JNTO)

- Record Tourism in 2024: Japan achieved an all-time high of 36.87 million international tourists in 2024. This figure surpassed the previous peak of 31.9 million in 2019, indicating a full recovery and accelerated growth in the post-pandemic tourism rebound.

- Surge in March 2025: In March 2025, Japan welcomed a record-breaking 3.5 million foreign visitors in a single month. This surge was driven by increased travel demand from Asia and promotional campaigns around the cherry blossom season.

- First Quarter 2025 Milestone: From January to March 2025, Japan received 10.54 million international arrivals, reaching this milestone faster than any previous year. It reflects strong tourism momentum heading into the peak spring season.

- Tourist Spending in Q1 2025: International visitors spent 2.27 trillion yen (approximately $16 billion USD) during the first quarter of 2025, representing a 28.4% year-on-year increase. Spending was especially strong in Tokyo, Kyoto, and Osaka.

- Record-Breaking Annual Spending in 2024: Tourists in Japan spent a total of 8.1 trillion yen throughout 2024. This marked a 53% increase over 2023 figures and highlighted the rising economic contribution of inbound tourism.

Ministry of Land, Infrastructure, Transport and Tourism (MLIT)

- Total Lodging Facilities: As of 2023, Japan hosted over 85,000 accommodation facilities, including hotels, ryokan (traditional inns), guesthouses, and hostels. These properties catered to a wide range of budget preferences and tourist experiences.

- Capsule Hotels Popularity: Capsule hotels, a uniquely Japanese concept providing compact, efficient lodging, continue to be a cost-effective and quirky choice, especially among solo travelers and business visitors.

Statistics Bureau of Japan

- Domestic Tourism Growth: Japan recorded 499.72 million overnight stays by domestic tourists in 2023, up significantly from 313.47 million in 2021, indicating a robust domestic travel recovery post-COVID-19.

- 2024 First Half Overnight Stays: In the first half of 2024, a total of 304.7 million overnight guests (domestic and foreign) were reported, showing a 7.5% growth compared to the same period in the previous year.

World Travel & Tourism Council (WTTC)

- Economic Contribution of Tourism: In 2024, Japan’s travel and tourism sector was projected to contribute nearly 44.6 trillion yen to the national economy. This is a 5.7% increase over the pre-pandemic peak in 2019 and underscores the sector’s vitality.

- Job Creation Surge: The tourism industry in Japan was expected to support more than 6 million jobs in 2024, representing a 10% year-over-year increase and emphasizing the sector's role in national employment.

- Visitor Spending Breakdown: In 2024, international tourists were projected to spend 6.3 trillion yen, while domestic travelers were expected to contribute nearly 24.9 trillion yen to the tourism economy.

OECD Tourism Trends and Policies

- 2019 Baseline for Arrivals: Before the pandemic, Japan welcomed 31.88 million international tourists in 2019. This figure is often used as a baseline for assessing post-pandemic recovery.

- Domestic Travel in 2019: The year 2019 also saw 587.1 million domestic trips, a testament to the strength of Japan’s internal tourism market, which helped cushion the blow during the pandemic.

Hotel Market and Performance

- Tokyo Hotel Metrics (H1 2024): In the first half of 2024, Tokyo hotels saw an average occupancy rate of nearly 78%, with an Average Daily Rate (ADR) of $188 and a Revenue Per Available Room (RevPAR) of $148. These metrics indicated a healthy rebound in the capital’s hospitality industry.

- Osaka Hotel Metrics (H1 2024): Osaka's hotel market also thrived, with a 79% occupancy rate, an ADR of $121, and a RevPAR close to $96, reflecting strong domestic and international demand.

- Hotel Labor Shortage: Approximately 80% of accommodation providers in Japan have reported difficulties in operating at full capacity due to labor shortages, an issue exacerbated by aging demographics and post-pandemic workforce exits.

Japan Hospitality Industry Market: Market Dynamics

Driving Factors in the Japanese Hospitality Industry Market

Government-Backed Tourism Promotion and Infrastructure Investment

Japan's hospitality industry is being significantly bolstered by aggressive government-led efforts to revitalize and expand the tourism sector. Through initiatives like the “Visit Japan Campaign” and national tourism strategies targeting 60 million international visitors by 2030, the government is investing heavily in enhancing the travel ecosystem.

This includes expanding airport capacities, improving signage and multilingual support, and upgrading rural and regional tourism infrastructure to spread the benefits of tourism beyond urban centers. Financial incentives are provided to hospitality businesses that adopt international standards or promote local culture and sustainability. Japan has also eased visa regulations for many countries and added direct international flight routes, especially from Southeast Asia and Europe.

Inbound tourist-friendly policies such as duty-free shopping, accessible transportation, and cultural exchange programs are further driving visitor inflows. These government interventions not only boost arrival numbers but also increase the average spend per tourist. Local hospitality businesses are gaining from increased demand across accommodation, dining, wellness, and events. As Japan continues to align policy, infrastructure, and international branding, the role of strategic public-sector engagement remains a key growth pillar for the hospitality industry, fostering global competitiveness and service excellence.

Strong Domestic Tourism and Regional Revitalization Policies

Domestic tourism continues to play a critical role in supporting Japan’s hospitality sector, particularly as part of the national strategy to revitalize regional economies. Programs like “Go To Travel” and its subsequent iterations have incentivized millions of Japanese residents to travel within the country by offering substantial discounts on lodging, transportation, and local experiences. This initiative proved particularly impactful during periods of limited international travel, helping hospitality businesses stay afloat and stimulating regional markets. Furthermore, the Japanese government has promoted

cultural tourism in underdeveloped areas through the “Japan Heritage” framework, which highlights lesser-known but historically and culturally significant destinations.

This has spurred the growth of local guesthouses, ryokans, and experiential tourism providers. Regional authorities have also partnered with private sector entities to develop destination branding, local food trails, and craft-based experiences that appeal to domestic travelers seeking authenticity and connection with their heritage. The robustness of domestic travel behavior, even during economic downturns, provides a reliable revenue stream and a test bed for new service offerings. As rural depopulation continues, leveraging domestic tourism for regional revitalization ensures a sustainable and equitable growth model for the broader hospitality industry.

Restraints in the Japanese Hospitality Industry Market

Acute Labor Shortages and Workforce Aging

A major restraint on the growth of Japan’s hospitality industry is the severe labor shortage, compounded by the nation’s aging demographic. With over 28% of Japan’s population aged 65 or older and a declining birthrate, the hospitality sector is facing difficulties in recruiting and retaining young, skilled workers. Many hotels, restaurants, and tour operators are struggling to meet demand due to staff shortages, leading to reduced operating hours, compromised service quality, or caps on occupancy. The problem is especially acute in rural regions where young people migrate to cities for better opportunities. Although foreign workers under specified skill visas are being recruited, language barriers, cultural gaps, and policy constraints often hinder integration.

The labor crisis not only affects day-to-day operations but also limits expansion plans, particularly for smaller and independent establishments that cannot afford automation or technology investments. Long-term structural reforms in immigration policy, vocational training, and workforce mobility are needed, but progress remains slow. Unless these challenges are addressed, Japan’s hospitality industry risks losing competitiveness, especially against neighboring countries that are more agile in scaling their tourism workforce.

Overtourism and Infrastructure Pressure in Popular Destinations

While increased international arrivals have boosted Japan’s hospitality sector, overtourism in certain hotspots poses a serious restraint on sustainable growth. Cities like Kyoto, Nara, and Mount Fuji are experiencing infrastructure strain, environmental degradation, and community pushback due to excessive tourist numbers. Narrow streets, limited public transportation, and residential disturbances are common complaints from locals, prompting authorities to introduce crowd-control measures such as admission fees, timed entry, and traffic regulation zones. Hospitality establishments in these areas face operational hurdles, ranging from waste management to noise complaints, and reputational risks associated with being seen as contributors to the problem.

Additionally, the concentration of tourism in specific locales leads to uneven economic benefits and neglect of potential in under-visited areas. Without effective dispersal strategies, such as better promotion of lesser-known destinations or regulatory frameworks that balance growth with community wellbeing, the hospitality industry in these hotspots could experience declining tourist satisfaction and reduced repeat visits. Ensuring equitable tourism distribution and preserving cultural integrity are now crucial to the long-term resilience of Japan’s hospitality market.

Opportunities in the Japanese Hospitality Industry Market

Expansion in Rural and Secondary City Hospitality Infrastructure

One of the most promising opportunities for Japan’s hospitality industry lies in expanding beyond major urban hubs into rural areas and secondary cities. Destinations like Kanazawa, Takayama, Beppu, and Yakushima are witnessing increasing interest from both domestic and international travelers seeking authentic, less crowded, and culturally rich experiences. However, many of these regions lack sufficient accommodation infrastructure to cater to the rising demand. This gap presents a clear opportunity for investors and hospitality brands to establish boutique hotels, eco-resorts, and traditional ryokan that reflect local heritage while offering modern comforts.

With land costs lower than in metropolitan areas, development in these regions also promises better ROI and market differentiation. The government actively supports such expansion through grants, tax incentives, and infrastructure improvements like better rail connectivity and multilingual signage. Additionally, these areas are ideal for integrating sustainable practices and community-based tourism models, offering long-term resilience and visitor appeal. As travelers increasingly seek immersive, localized experiences, hospitality businesses that expand into and invest in Japan’s countryside will tap into a high-growth segment poised to redefine the national tourism narrative in a post-urban saturation era.

Leveraging Cultural Capital for Experiential Hospitality

Japan’s rich cultural heritage, ranging from tea ceremonies and samurai history to contemporary art and anime, offers vast opportunities for experiential hospitality. Today’s global travelers prioritize experiences over amenities, and Japan is uniquely positioned to cater to this trend. Hotels and resorts can incorporate cultural immersion programs like calligraphy classes, kimono-wearing sessions, or martial arts workshops, turning stays into storytelling experiences. Traditional ryokan and temple stays (shukubo) can further enhance guest engagement with Japan’s spiritual and historical context. Even urban hotels are redesigning spaces to reflect regional themes, integrating tatami rooms, seasonal kaiseki dining, and architecture inspired by Japanese aesthetics.

Partnerships with local artisans, chefs, and cultural institutions can help hospitality brands co-create curated itineraries or in-house programs that bring Japanese traditions to life. Moreover, aligning hospitality offerings with Japan’s internationally renowned pop culture, from themed accommodations and

manga cafés to cosplay events, broadens appeal to younger and more diverse traveler segments. As tourism becomes increasingly experience-driven, leveraging Japan’s unique and varied cultural identity represents an untapped growth frontier that can increase length of stay, guest loyalty, and per-visit spend.

Trends in the Japanese Hospitality Industry Market

Technological Integration and Smart Hospitality Experiences

Japan’s hospitality sector is rapidly adopting cutting-edge technologies, aligning with the country’s reputation for innovation. Hotels and accommodation providers are increasingly leveraging AI, robotics, and IoT to create seamless and personalized guest experiences. Robot concierges, contactless check-ins, voice-controlled room settings, and real-time service requests are being deployed to enhance operational efficiency and guest satisfaction.

Smart keys, digital payment integration, and facial recognition are becoming commonplace in upscale hotels. Additionally, data analytics and CRM tools are allowing hotels to understand guest preferences in-depth and tailor marketing and service offerings. Technology is also aiding in addressing the persistent labor shortage in the industry by automating repetitive tasks.

These changes reflect a broader digital transformation sweeping across Japan’s service sector, further accelerated by post-pandemic hygiene demands and customer expectations for safety and convenience. The trend is not limited to large chains; even traditional ryokans are blending tech with heritage to appeal to tech-savvy travelers. As Japan prepares for continued tourism growth, the convergence of digital innovation and hospitality is not only a trend but a necessity for maintaining competitiveness and sustainability in the market.

Rise of Sustainable and Wellness-Oriented Tourism

The Japanese hospitality industry is seeing a surge in demand for sustainability-focused and wellness-based experiences, driven by shifting consumer values post-COVID and Japan’s long-term environmental goals. Eco-conscious tourists are seeking accommodations that use renewable energy, minimize waste, and emphasize responsible resource use. Hotels are responding with initiatives like zero-plastic policies, energy-efficient infrastructure, and eco-certifications. The Japanese government is also incentivizing green tourism practices through subsidies and promotional programs, especially in rural revitalization zones. Meanwhile, wellness tourism is expanding as travelers increasingly prioritize mental and physical well-being.

Traditional Japanese practices like onsen (hot spring bathing), forest bathing (shinrin-yoku), and organic farm stays are attracting both international and domestic wellness seekers. Resorts and spas are designing packages that combine mindfulness, cultural immersion, and healthy dining. The intersection of health, nature, and local culture is redefining hospitality offerings and creating new premium segments. This trend aligns with Japan’s cultural ethos of harmony with nature and attention to detail. As international tourists continue to seek meaningful, restorative travel experiences, hospitality businesses that align their services with sustainable and wellness-driven values will be positioned to gain a competitive advantage and customer loyalty.

Japan Hospitality Industry Market: Research Scope and Analysis

By Type of Establishment Analysis

Hotels are projected to dominate Japan's hospitality industry due to their extensive infrastructure, diverse service offerings, and alignment with global and domestic traveler expectations. As Japan continues to experience a tourism boom, particularly post-pandemic, the demand for standardized, convenient, and multi-tier lodging options has skyrocketed. Hotels provide varied accommodations ranging from economy to luxury segments, appealing to a wide range of travelers, including solo tourists, families, and business visitors.

Urban hubs such as Tokyo, Osaka, and Kyoto have a dense concentration of hotels, catering to international tourists with multilingual services, proximity to public transport, and access to major attractions. Moreover, international and domestic hotel chains offer loyalty programs and consistent service quality, which enhance customer retention and trust. Unlike more specialized or traditional options like ryokan or capsule hotels, modern hotels offer flexible check-in times, amenities such as fitness centers and conference rooms, and digitalized services, making them ideal for both leisure and business travelers.

Hotels also meet international safety and accessibility standards, making them a preferred choice for tour operators and corporate clients. With support from government-backed tourism strategies and investment in hotel development, especially around transit hubs and Olympic legacy areas, hotels are not only the most accessible but also the most scalable form of accommodation. Their operational versatility, integration with travel platforms, and ability to cater to both inbound and domestic tourism continue to cement their dominance in Japan's hospitality ecosystem.

By Service Type Analysis

Accommodation services are expected to dominate the service type segment of the Japanese hospitality industry due to their foundational role in fulfilling the core purpose of tourism and business travel, providing a place to stay. Whether in the form of hotels, ryokan, hostels, or guesthouses, lodging remains the first and most critical consideration for any traveler, representing the largest portion of consumer spending in the hospitality value chain. Japan’s robust accommodation ecosystem is designed to meet the needs of diverse travelers, from backpackers to luxury tourists.

The demand is sustained year-round through a blend of international tourism, strong domestic travel culture, and a steady influx of business travelers. Accommodation services also benefit from long stays during festivals, corporate events, or seasonal tourism in destinations like Hokkaido (for winter sports) and Okinawa (for beach holidays). Unlike other hospitality services, accommodation generates predictable and recurring revenue streams through daily occupancy rates and seasonal bookings.

Innovations in room technology, automated check-ins, and customized guest experiences are further enhancing their appeal. Moreover, accommodation providers often bundle or upsell ancillary services such as dining, spa treatments, or guided tours, increasing their revenue potential and role within the value chain. With Japan’s tourism policies focusing on regional revitalization and international marketing, accommodation services are expanding across both urban and rural landscapes, reinforcing their dominance. Their indispensable nature, broad utility, and scalability make accommodation services the backbone of Japan's hospitality offerings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Ownership Type Analysis

Chain-affiliated establishments are projected to dominate Japan’s hospitality market due to their strong brand equity, operational consistency, and ability to leverage economies of scale. Major hotel chains, both domestic (e.g., APA, Tokyu Stay) and international (e.g., Marriott, Hilton, Accor), have built extensive networks across Japan, ensuring consistent service standards that resonate with both international and domestic travelers. Chain-affiliated properties benefit from centralized marketing, brand loyalty programs, and standardized operating procedures, which enhance customer retention and business efficiency.

They also possess greater access to capital, allowing rapid expansion and technological upgrades such as mobile check-ins, AI-based customer service, and smart room controls. Their adaptability to regional preferences, while maintaining core brand values, enables them to localize services without compromising identity. Additionally, they often form partnerships with airlines, tour operators, and event organizers, capturing a larger share of business travel and group bookings.

These establishments are also better equipped to comply with government regulations and environmental guidelines, which is crucial in Japan’s highly structured business environment. During crises such as the COVID-19 pandemic, chain hotels could more effectively implement safety protocols and communicate updates through established corporate channels, gaining consumer trust.

Furthermore, chains offer operational support to franchisees or local partners, enabling rapid penetration into rural or developing tourism regions as part of Japan’s regional revitalization policies. This combination of scalability, trust, and infrastructure makes chain-affiliated establishments the dominant force in the ownership segment of the hospitality industry.

By Booking Channel Analysis

Direct booking is anticipated to lead among booking channels in Japan’s hospitality industry due to its strategic advantages for both customers and service providers. With Japan’s high digital penetration and tech-savvy consumer base, direct booking through hotel websites or mobile apps has grown substantially. Travelers benefit from best-rate guarantees, exclusive deals, flexible cancellation policies, and loyalty points that third-party platforms often cannot match. For hoteliers, direct booking maximizes profit margins by avoiding commission fees from Online Travel Agencies (OTAs), which can range between 15% to 25%.

It also provides greater control over customer data, enabling personalized marketing, post-stay engagement, and improved CRM initiatives. Japanese hospitality operators have invested in sophisticated booking engines, multilingual websites, and AI chatbots to enhance the direct booking experience for both domestic and international guests.

Mobile-first interfaces and integration with payment gateways such as PayPal, Apple Pay, and global credit cards further ease the transaction process. Direct booking also plays a crucial role in managing inventory, offering real-time availability, and dynamic pricing strategies tailored to consumer behavior and demand forecasts.

In addition, chain-affiliated hotels leverage their loyalty programs to incentivize return visits and direct interactions, creating a closed-loop marketing ecosystem. Government and regional tourism campaigns also encourage direct engagement through local platforms to promote authentic experiences and community-based stays. This growing ecosystem of trust, control, and profitability underpins the dominance of direct booking within Japan’s hospitality market, empowering operators while delivering enhanced value to consumers.

The Japan Hospitality Industry Market Report is segmented on the basis of the following:

By Type of Establishment

- Hotels

- Ryokan

- Capsule Hotels

- Hostels

- Resorts

- Guesthouses/Minpaku

- Other

By Service Type

- Accommodation Services

- Food & Beverage Services

- Restaurants

- Cafés

- Izakaya (Japanese-style pubs)

- Fast Food Chains

- Travel & Tourism Services

- Tour Packages

- Travel Agencies

- Guides & Interpretation Services

- Event & Conference Services

- Banquet Halls

- MICE (Meetings, Incentives, Conferences, Exhibitions)

- Spa & Wellness Services

By Ownership Type

- Chain-affiliated Establishments

- Independent Establishments

- Franchise Operations

- Government-owned Hospitality Facilities

By Booking Channel

- Direct Booking

- Online Travel Agencies (OTAs)

- Travel Agents / Intermediaries

- Corporate Bookings

- Government / Institutional Bookings

Japan Hospitality Industry Market: Competitive Landscape

Japan’s hospitality industry features a dynamic and competitive landscape shaped by a mix of domestic powerhouses, international hotel chains, and niche boutique operators. Leading Japanese brands such as APA Hotels, Tokyu Hotels, and Hotel Okura maintain a strong presence nationwide, offering a blend of traditional hospitality and modern amenities tailored to domestic preferences. These companies have capitalized on brand loyalty, strategic locations, and value pricing to retain a significant share of the market.

International hotel groups like Marriott International, Hilton, and InterContinental Hotels Group (IHG ANA Hotels) have rapidly expanded in urban centers such as Tokyo, Osaka, and Kyoto, targeting high-spending international tourists and business travelers. Their global standards, loyalty programs, and extensive marketing give them an edge in attracting foreign clientele.

Meanwhile, niche players, including ryokans, capsule hotels, and wellness resorts, are competing by offering culturally immersive and personalized experiences. Technological innovation, such as AI-enabled services and contactless check-ins, has become a key differentiator, especially among urban mid-tier and upscale operators.

Franchise and chain-affiliated models dominate in urban areas, while independent guesthouses thrive in rural tourism corridors. As Japan prepares for future events like Expo 2025 in Osaka, strategic partnerships, digital transformation, and service diversification are expected to further intensify competitive dynamics.

Some of the prominent players in the Japan Hospitality Industry Market are:

- APA Group

- Hoshino Resorts

- Prince Hotels, Inc.

- Hotel Okura Co., Ltd.

- Fujita Kanko Inc.

- Mitsui Fudosan Hotel Management

- Tokyu Hotels

- JR-East Hotels (Nippon Hotel Co., Ltd.)

- Resorttrust, Inc.

- Kyoritsu Maintenance Co., Ltd.

- Toyoko Inn Co., Ltd.

- Daiwa House Group (Daiwa Roynet Hotels)

- Ishin Hotels Group

- Richmond Hotels (Royal Holdings Co., Ltd.)

- Sotetsu Hotels

- Dormy Inn (Kyoritsu Maintenance)

- Green Hotels Management Co., Ltd.

- Hotel Monterey Group

- InterContinental Hotels Group Japan (IHG ANA Hotels)

- Marriott International Japan

- Other Key Players

Recent Developments in Japan Hospitality Industry Market

- February 2025: ORIX JREIT completed the acquisition of the 428-key Hotel Universal Port Vita for JPY35 billion. This strategic move aims to capitalize on the anticipated tourism surge in the region and enhance synergy with the adjacent Hotel Universal Port.

- December 2024: Blackstone Inc. announced the acquisition of Tokyo Garden Terrace Kioicho, a mixed-use complex in Tokyo, for USD2.6 billion. The complex includes the 250-key The Prince Gallery Tokyo Kioicho, a Luxury Collection Hotel.

- November 2024: Ichigo Hotel REIT acquired two properties in Fukuoka: the 103-key The OneFive Marine Fukuoka for JPY2.6 billion and the 160-key Nest Hotel Hakata Ekimae for JPY6.5 billion. Additionally, it sold the 302-key Nest Hotel Osaka Shinsaibashi in Osaka for JPY7.75 billion, generating a gain of JPY290 million.

- October 2024: Colliers International Japan announced the establishment of its Hotels & Hospitality Services division, appointing Kei Sumiyoshi as Senior Director & Head. This move aims to accelerate Colliers' expansion into Japan's hotels and hospitality sector.

- September 2024: Singapore-based GIC sold the 1,052-key Hilton Fukuoka Sea Hawk Hotel to Japan-based Mizuho Leasing Company. The hotel is part of a 169,157 sqm entertainment complex adjacent to the Mizuho PayPay Dome.

- August 2024: Star Asia Investment Corporation acquired three hotels in Tokyo and one in Osaka, totaling JPY34.7 billion. The properties include Koko Hotel Tsukiji Ginza, Koko Hotel Residence Asakusa Tawaramachi, Koko Hotel Residence Asakusa Kappabashi, and Koko Hotel Osaka Shinsaibashi.

- June 2024: Kasumigaseki Capital Co., Ltd. announced the acquisition of a business hotel in Fukuoka City and a development site in Ise City for future hotel development under their FAV HOTEL brand.