Indoor farming is cultivating crops within enclosed environments, such as buildings or greenhouses, utilizing controlled conditions to optimize plant growth. This method employs technologies like hydroponics, aeroponics, and aquaponics, eliminating the need for soil by using nutrient-rich solutions. Artificial lighting, climate control systems, and automation are integral, allowing year-round production regardless of external weather conditions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Indoor farming enhances resource efficiency by reducing water usage and minimizing pesticide application. It's particularly beneficial in urban areas or regions with limited arable land, addressing food security concerns and enabling the local production of fresh, high-quality produce.

Japan's indoor farming market is rapidly expanding, fueled by urbanization, limited arable land, and a growing focus on sustainable agriculture. The industry includes various farming methods such as greenhouses, vertical farms, container farms, and deep water culture systems. Greenhouses dominate due to their cost-efficiency, while vertical farms are becoming increasingly popular in urban settings for their ability to maximize space.

Technological advancements such as AI monitoring, LED lighting, and automated irrigation—are improving yields, reducing labor costs, and enhancing overall efficiency. Government support through policies and subsidies is also encouraging the adoption of these innovative farming techniques, especially in densely populated cities.

The Japan Indoor Farming Market is mainly driven by the demand for fresh, pesticide-free fruits, vegetables, and herbs, although flowers and ornamental plants also contribute to the sector. As Japan continues to address food security and environmental concerns, indoor farming is emerging as a vital solution, combining technology and agriculture to create a more resilient and sustainable food system.

Japan Indoor Farming Market: Key Takeaways

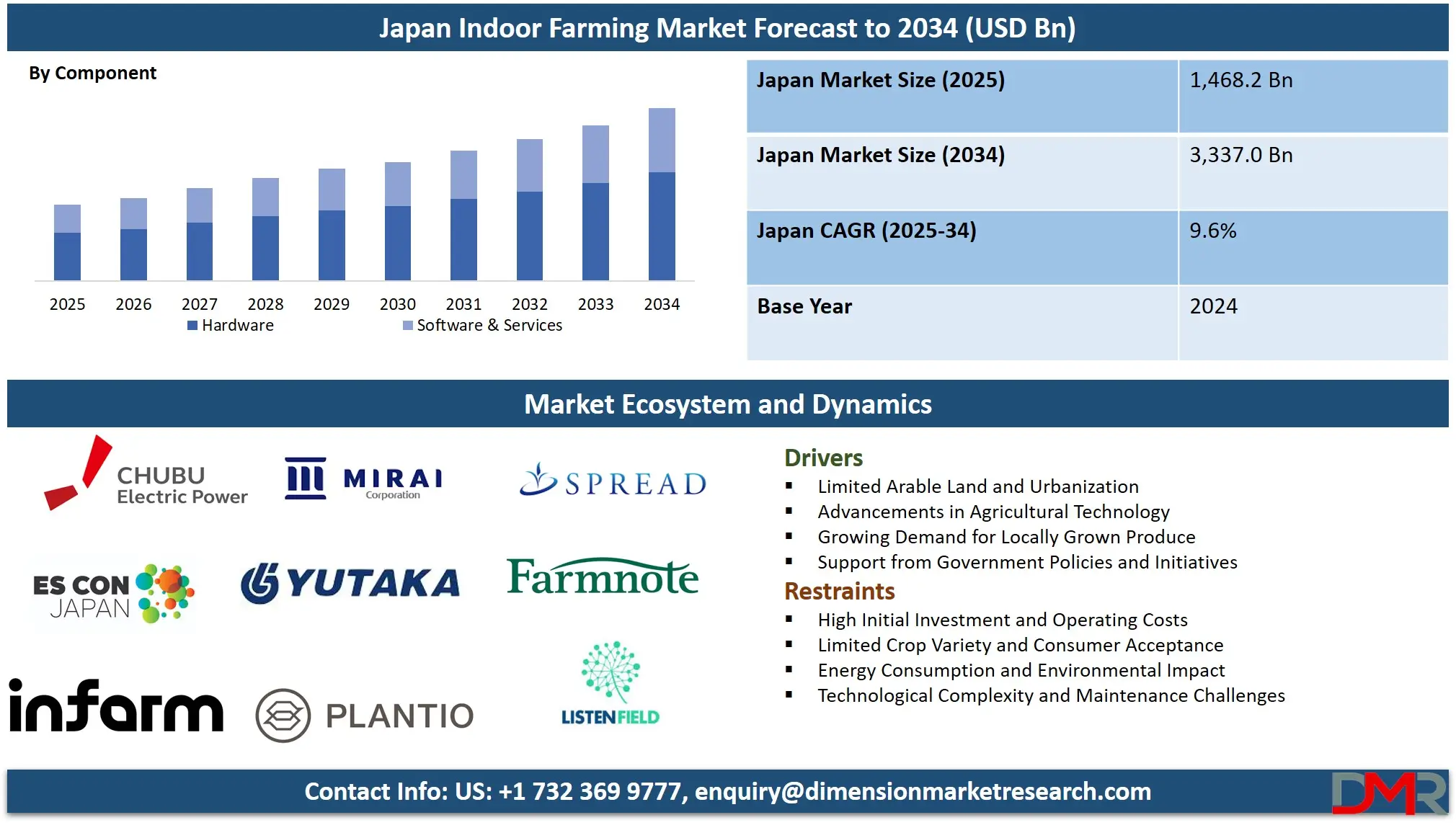

- Market Overview: The Japan Indoor Farming Market is projected to reach a valuation of USD 1,468.2 million in 2025 and is forecasted to grow to USD 3,337.0 million by 2034, reflecting a compound annual growth rate (CAGR) of 9.6% during the period from 2025 to 2034.

- Growing System Analysis: Hydroponics is expected to dominate the growing systems segment, capturing approximately 60.3% of Japan’s indoor farming market by 2025, driven by its efficient use of space and water, which are critical factors in Japan's land-limited environment.

- Facility Type Analysis: Indoor vertical farming is set to lead the facility type segment, projected to secure a market share of 45.2% by the end of 2025.

- Component Analysis: Hardware components are predicted to hold the largest share, contributing about 72.4% of the Japan indoor farming market revenue by 2025, owing to their essential role in maintaining controlled growth environments.

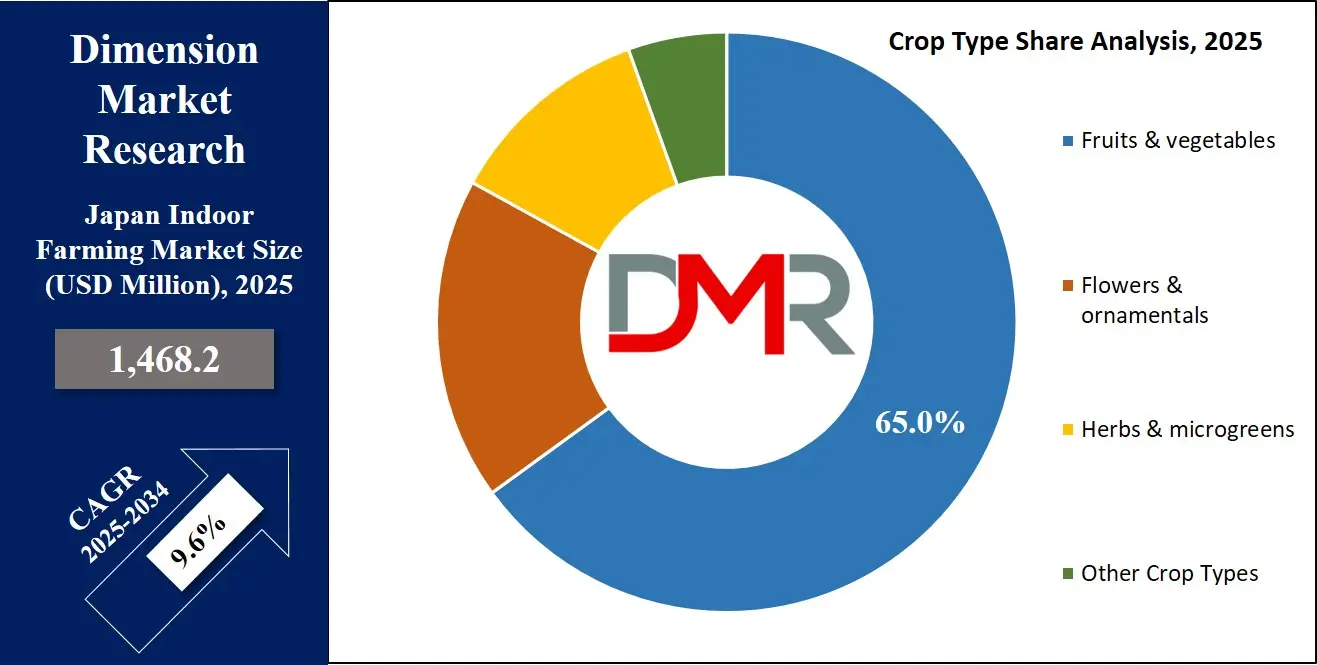

- Crop Type Analysis: Fruits and vegetables are anticipated to dominate the crop type segment, accounting for around 65.3% of market revenue by 2025, fueled by strong consumer demand and the scarcity of arable land.

Japan Indoor Farming Market: Use Cases

- Urban Agriculture: Indoor farming allows fresh produce to be grown in urban areas where traditional farmland is scarce, helping reduce transportation costs and carbon emissions.

- Year-Round Crop Production: Controlled environments in indoor farms enable consistent crop production throughout the year, regardless of external weather conditions or seasons.

- Space-Saving Solutions: Vertical farming techniques used indoors make efficient use of space, making it possible to grow more food in smaller areas, ideal for densely populated regions.

- Reduced Water Usage: Indoor farming systems like hydroponics and aeroponics use significantly less water compared to traditional farming, making them a sustainable option in water-scarce regions.

Japan Indoor Farming Market: Market Dynamics

Driving Factors in the Japan Indoor Farming Market

Limited Arable Land and Urbanization

Japan's mountainous geography leaves limited space for traditional agriculture. With over 90% of its population living in urban areas, indoor farming offers a solution to maximize food production within cities.

Controlled environment agriculture (CEA) allows for year-round cultivation, making it ideal for land-scarce urban regions. As the population ages and rural farming declines, indoor farming helps bridge the production gap while reducing transportation needs and environmental impact. Government support and technological innovation further encourage investment in vertical and indoor farming operations to meet local demand with minimal space usage.

Advancements in Agricultural Technology

Japan's leadership in robotics, automation, and sensor technology is fueling rapid progress in indoor farming systems. Innovations such as LED lighting, climate control systems, hydroponics, and AI-driven crop management have enhanced productivity and reduced labor dependence. These technologies optimize resource use and enable precise monitoring, making indoor farming highly efficient and scalable. Automation also addresses labor shortages, especially as Japan faces a shrinking workforce. With continued R&D investments from both private and public sectors, technology remains a central driver in expanding and commercializing indoor farming practices across the country.

Restraints in the Japan Indoor Farming Market

High Initial Investment and Operating Costs

Despite its benefits, indoor farming requires significant capital for setup, such as LED systems, climate controls, and hydroponic infrastructure. These initial costs deter smaller farmers and startups from entering the market. Additionally, the ongoing energy and maintenance expenses can be substantial, particularly in regions where electricity costs are high. While long-term savings on water and pesticides are notable, the upfront financial barrier remains a critical restraint. Financial risk is heightened in the absence of guaranteed market access or subsidies, making indoor farming less attractive for widespread adoption.

Limited Crop Variety and Consumer Acceptance

Indoor farms are currently best suited for leafy greens, herbs, and a limited selection of vegetables. Staple crops like rice, wheat, and fruit trees are not yet viable in indoor systems at scale. This restricts the market's ability to address the full spectrum of dietary needs. Furthermore, Japanese consumers value food quality, freshness, and tradition, and may be hesitant to fully embrace produce grown in artificial environments. This skepticism, coupled with high prices for indoor-grown crops, creates a barrier to market penetration, particularly in rural or conservative segments.

Opportunities in the Japan Indoor Farming Market

Integration with Smart Cities and Urban Infrastructure

Indoor farming can become a cornerstone of smart city planning in Japan. By integrating vertical farms into residential and commercial buildings, parking structures, and rooftops, municipalities can create hyper-local food systems. This reduces the carbon footprint of food transport and enhances food security in densely populated areas. Government initiatives promoting sustainability and digital infrastructure further support these integrations. Urban farming initiatives can also turn unused spaces into productive green zones, contributing to climate resilience, employment, and local economic revitalization.

Export Potential and Premium Produce Demand

Japan’s reputation for quality produce can be leveraged through indoor farming to target premium export markets. High-end leafy greens, herbs, and specialty crops grown in controlled environments offer consistent quality, safety, and traceability attributes valued globally. Markets in Singapore, Hong Kong, and parts of the Middle East show strong demand for safe, high-quality produce with a reliable supply chain. With the right branding and logistics, Japanese indoor farms can position themselves as exporters of luxury, pesticide-free vegetables, capitalizing on growing global trends toward clean, sustainable food sources.

Trends in the Japan Indoor Farming Market

Rise of Tech-Driven Agribusiness Startups

There is a surge in agri-tech startups in Japan focused on indoor farming solutions. These companies blend IoT, robotics, and AI to automate tasks, monitor crop health, and improve yield prediction. Many receive funding from venture capitalists and corporate investors seeking sustainability-focused ventures. The growth of these startups reflects a broader trend of digital transformation in agriculture and increasing public interest in food innovation. Collaborations between tech companies and agricultural producers are accelerating product development and commercialization, bringing new energy into Japan’s indoor farming ecosystem.

Increasing Consumer Demand for Pesticide-Free Produce

Japanese consumers are increasingly health-conscious and concerned about food safety, driving demand for pesticide-free, locally-grown produce. Indoor farms cater directly to this trend by offering clean crops grown in sterile, controlled environments. Retailers are responding by creating dedicated sections for such produce and highlighting freshness and safety in marketing. This trend is especially strong among younger, urban populations and families with children. As food traceability and sustainability become key purchasing factors, indoor farming aligns well with evolving consumer preferences and is gaining traction in both retail and direct-to-consumer channels.

Japan Indoor Farming Market: Research Scope and Analysis

By Growing System Analysis

Hydroponics is expected to account for around 60.3% of Japan's indoor farming market by the end of 2025 due to its efficient space and water usage, which are vital considerations in Japan's land-scarce environment. Year-round cultivation with precise nutrient delivery makes hydroponics ideal for urban environments and unstable weather conditions. Higher crop yields and reduced need for pesticides make hydroponics suitable for supporting food safety and sustainability goals. Advancements in LED lighting technology combined with government investments further drive adoption across greenhouses and vertical farms alike.

Soil-based indoor farming holds an estimated market share in Japan, estimated to be second. Its success can be attributed to lower setup costs, familiarity among traditional farmers, and compatibility with organic cultivation. Many small-scale growers transitioning to indoor methods often opt for soil due to existing knowledge or cultural preferences.

These systems can also be found widely used in semi-urban or suburban areas with more space available. Furthermore, certain crops such as root vegetables and herbs do best when grown using soil environments; these systems maintain a strong presence due to simplicity, affordability, and consumer demand for naturally grown produce grown using soil methods despite technological limitations that Hydroponic systems offer.

By Facility Type Analysis

Indoor vertical farms are anticipated to dominate Japan indoor farming market with an estimated market share of 45.2% by the end of 2025. This trend can be explained by Japan's limited arable land availability and dense urban population density making space-saving solutions highly valuable. Vertical farms employ layers and high-tech hydroponic or aeroponic systems to maximize yield per square meter, taking full advantage of Japan's advanced technological infrastructure - automation, AI, IoT are seamlessly integrated to reduce labor costs while increasing productivity and decreasing year-round production in controlled environments - an especially crucial feature in an area prone to natural disasters such as Japan. Furthermore, government support for food security and sustainable agriculture further facilitates adoption.

Glass or poly greenhouses account for an estimated 30.3% share in Japan's indoor farming market, accounting for mid-scale crop production using natural sunlight and controlled climate conditions, at an economical cost. They're popular choices in rural and peri-urban locations with limited space, as their operation costs are typically less expensive compared to vertical farms; their adaptation makes them compatible with eco-friendly technologies; government incentives also support greenhouse adoption, boosting the overall market growth significantly.

By Component Analysis

Hardware is likely to lead the Japan indoor farming market with an anticipated revenue share of 72.4% by 2025 due to its vital role in creating controlled environments conducive to optimal plant growth. Components such as climate control systems, lighting systems, and irrigation systems are indispensable tools in indoor agriculture for managing temperature, humidity, water distribution, and light cycles, which is one of the key aspects to consider in indoor cultivation environments.

Japan's limited arable land and advanced infrastructure contribute to the demand for advanced hardware that supports vertical farming and plant factories. Furthermore, China's focus on energy-saving automation solutions and investments in sensors and system controls that facilitate precise farming has resulted in substantial investments for these sensors and controls, which ensure year-round crop production with higher yields - an integral element in indoor farming systems.

Software & services represent a key segment in Japan's indoor farming market, supporting the efficient operation of hardware systems. Software solutions offer real-time data analytics, predictive maintenance, and automated controls for lighting, irrigation, and climate systems to enhance crop quality and yield.

Cloud-based platforms enable remote monitoring and management, making them particularly advantageous in Japan's rapidly aging agricultural workforce. Services, including installation, technical support, and farm management consulting, supplement hardware infrastructure to ensure smooth integration and performance optimization. This segment's growth is propelled by digitalization trends as demand rises for intelligent indoor farming systems that offer scale.

By Crop Type Analysis

Fruit and vegetable production is projected to lead Japan indoor farming market with 65.3% revenue share by the end of 2025 due to high consumer demand and limited arable land available for farming operations. Urbanization and population density have led to decreased farmland, prompting indoor farming systems as an effective method for food security. Leafy greens such as lettuce, kale, and spinach have short growth cycles, which make them suitable for vertical farms.

Consumer preferences for nutritious diets and pesticide-free produce also contribute to its expansion. Technological advances such as hydroponics and LED lighting have made indoor cultivation of fruits like tomatoes and strawberries much more viable and cost-efficient, thus encouraging further investment and expansion.

Herbs and microgreens have quickly emerged as one of the top products within Japan's indoor farming market due to their high market value, fast growth rate, small space requirements, and fast harvest cycles. Crops like basil, tarragon, and wheatgrass are popular with health-conscious consumers and restaurants, with short harvest cycles offering year-round production opportunities that appeal to growers aiming for quick turnover and profitability. Furthermore, Japanese cuisine places great value on fresh herbs, which increases consistent demand, which is something indoor farming provides by creating controlled environments without contamination. It benefits delicate crops while the markets expand exponentially.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan Indoor Farming Market Report is segmented on the basis of the following:

By Growing System

- Hydroponics

- Aquaponics

- Aeroponics

- Soil-based

- Hybrid

By Facility Type

- Indoor vertical farms

- Glass or poly greenhouses

- Container farms

- Indoor DWC systems

By Component

- Hardware

- Climate Control Systems

- Lighting Systems

- Communication Systems

- Sensors

- System Controls

- Irrigation Systems

- Other hardware

- Software & Services

By Crop Type

- Fruits & vegetables

- Leafy greens

- Lettuce

- Kale

- Spinach

- Other leafy greens

- Tomatoes

- Strawberries

- Eggplants

- Other fruits & vegetables

- Herbs & microgreens

- Basil

- Herbs

- Tarragon

- Wheatgrass

- Flowers & ornamentals

- Perennials

- Annuals

- Ornamentals

- Other Crop Types

Competitive Landscape

The indoor farming market in Japan is characterized by a competitive landscape driven by technological innovation, urbanization, and a growing demand for sustainable agriculture. Key players in the market include Spread Co., Ltd., Mirai Co., Ltd., and Panasonic Corporation, which leverage advanced technologies such as vertical farming, hydroponics, and AI-driven systems to enhance productivity and resource efficiency. These companies focus on leafy greens and herbs, which are well-suited to controlled-environment agriculture.

Startups and research institutions also contribute to the market's dynamism by developing compact farming units and automated cultivation systems, catering to urban consumers and commercial clients. Foreign companies are increasingly entering the Japanese market through partnerships or technology licensing, adding to the competition.

Government support for smart agriculture and food security, along with consumer preference for pesticide-free and locally grown produce, fuels the industry's growth. However, high initial investment costs and energy consumption remain key challenges. Companies differentiate themselves by optimizing energy efficiency, crop yield, and system scalability. As the market matures, innovation in lighting, nutrient delivery, and data analytics will play a crucial role in maintaining a competitive edge. The focus is increasingly on achieving profitability while addressing sustainability and food self-sufficiency goals.

Some of the prominent players in the Japan Indoor Farming Market are:

- Mirai

- Spread Co. Ltd.

- Chubu Electric Power Co. Inc

- ES-CON Japan Ltd

- Infarm

- Daio Wasabi Farm

- ES-CON Japan Ltd.

- Ichigo Inc.

- NTT Agri Innovation

- Farmnote

- T-LIO

- SaaS (PLANET) Agricultural Corporation

- Yutaka

- Microbial Discovery Research Group (MDR)

- Mirai Genomics

- PLANTIO

- ListenField

- Agrist Inc.

- Zen-Noh

- Earth Embassy

- Mebiol Inc.

- Other Key Players

Recent Developments

- In March 2025, 80 Acres Farms revealed in March 2025 that it had secured $115 million in funding, finalized in 2024, from backers like General Atlantic, Siemens Financial Services, and Barclays Climate Ventures—bringing its total funding to over $370 million. The Ohio-based vertical farming company also acquired Israeli biotech firm Plantae Bioscience, known for its advanced plant breeding technologies developed with the Weizmann Institute. This dual move aims to accelerate the company's retail footprint and strengthen its ability to deliver climate-resilient, nutrient-rich, and flavorful crops to meet growing demand for stable, weather-independent food supply chains.

- In March 2025, Square Roots announced its expansion into Japan through its subsidiary, Square Roots Japan, partnering with investor Green Prosperity. The initiative brings its modular container farming system to Japanese cities, focusing on specialty crops such as mizuna, shiso, and unique wasabi microgreens. These systems, placed in compact urban spaces near Tokyo, combine traditional farming knowledge with cloud-based hydroponics to produce high-value greens. The venture, led by Yasaki Mai and Kotaro Shiba, emphasizes intellectual property licensing and hybrid cultivation strategies rather than heavy infrastructure investment. Meanwhile, broader interest in indoor farming grew, as indicated by a rise in the Indoor Ag Buzz Index driven by multiple new farm and partnership announcements.

- In October 2024, the Japan Plant Factory Association (JPFA) will host an intensive in-person training on Plant Factories with Artificial Lighting (PFALs) from October 7–9, 2024, at Chiba University’s Kashiwanoha Campus. This hands-on course will spotlight the latest innovations in PFALs and Japanese agri-tech. Participants can access a set of pre-course learning materials, including ten foundational lectures covering PFAL theory, cultivation practices, operational management, and business strategies for success in the sector.