Market Overview

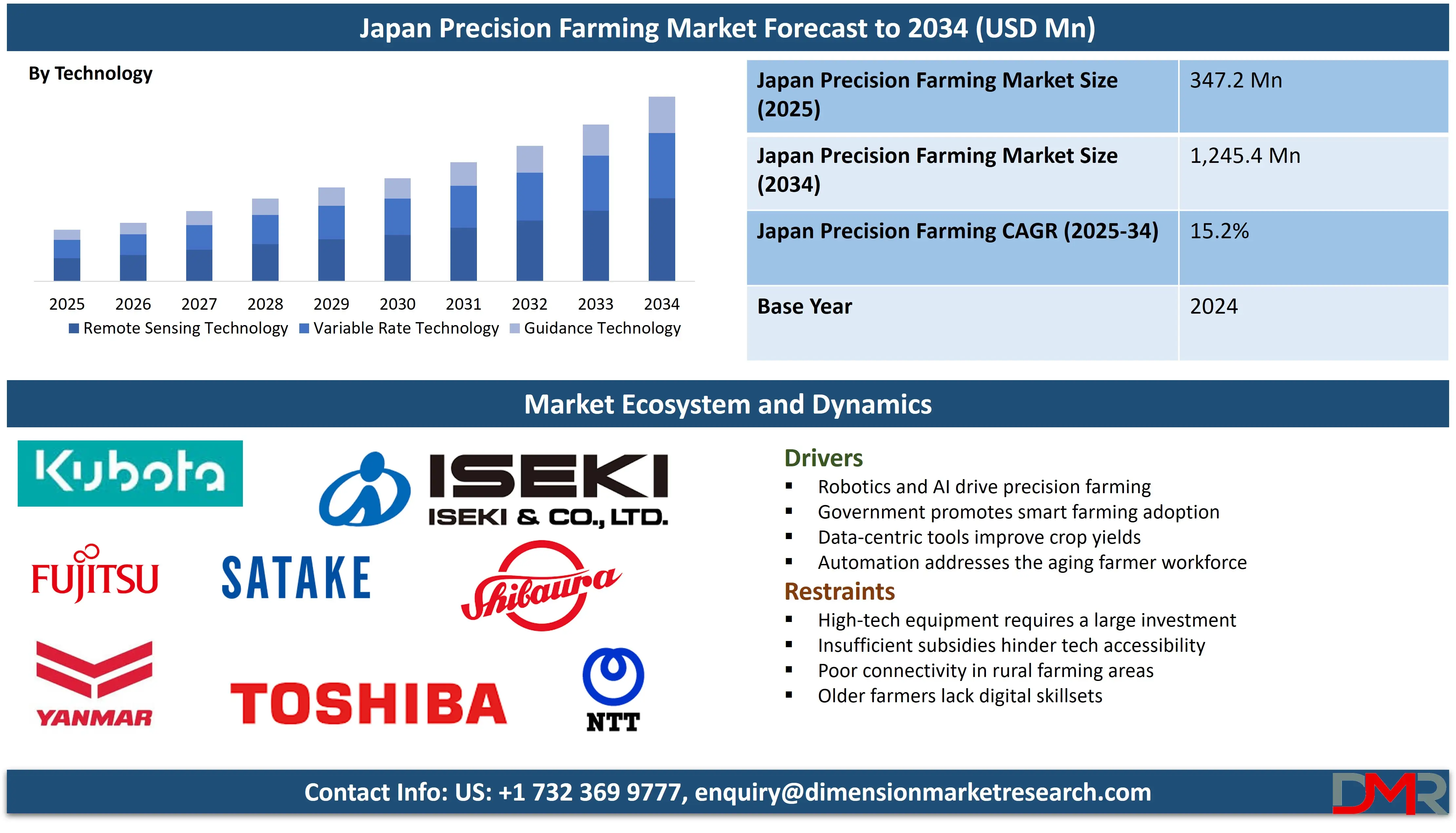

The Japan Precision Farming Market is predicted to be valued at

USD 347.2 million in 2025 and is expected to grow to

USD 1,245.4 million by 2034, registering a compound annual growth rate

(CAGR) of 15.2% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Precision farming, also known as precision agriculture, is a modern farming approach that uses technology to optimize crop yields and resource use. It involves collecting real-time data using GPS, sensors, drones, and satellite imagery to monitor field conditions, soil health, and crop performance. This data-driven method allows farmers to apply water, fertilizers, and pesticides more accurately and efficiently, reducing waste and environmental impact. By targeting specific areas of a field rather than treating it uniformly, precision farming increases productivity, lowers costs, and supports sustainable agriculture.

The Japan Precision Farming market is seeing strong growth, primarily due to the country’s shrinking farming population and the increasing need to improve food self-sufficiency. As the number of farmers continues to decline and younger generations show less interest in agriculture, much of the country's farmland is being abandoned. This labor shortage has fueled the rise of advanced farming technologies that reduce the need for manual labor while enhancing agricultural output.

Japan’s technological prowess provides a solid foundation for the expansion of precision agriculture. The growing demand for more efficient and sustainable farming practices has led to the widespread use of cutting-edge solutions such as variable rate technology, soil and nutrient mapping, AI-driven

crop monitoring, and robotics. Industry leaders like Kubota and Yanmar are introducing GPS-enabled smart machinery, while companies like Fujitsu are using AI and satellite technology to optimize crop management.

There are numerous growth opportunities in Japan’s precision farming sector, particularly in fields such as AI-powered analytics, blockchain for supply chain transparency, and automated vertical farming. For example, TEPCO’s blockchain system enhances traceability, and Spread Co.’s automated vertical farming reduces labor costs and boosts productivity. Additionally, the government plays a crucial role, with support from research institutions and agencies like the Ministry of Agriculture, Forestry, and Fisheries, driving continued innovation.

Japan precision farming market shows great promise. Ongoing developments in agri-robotics, remote sensing, and data-driven agriculture will continue to optimize farming operations and increase crop yields. With a growing focus on food security, sustainability, and technology, Japan is poised to lead the way in precision agriculture, offering a model for other advanced economies facing similar agricultural challenges.

Precision Farming Market: Key Takeaways

- Market Overview: The Japan precision farming market is projected to reach a value of USD 347.2 million in 2025 and is forecasted to grow significantly, hitting USD 1,245.4 million by 2034. This growth reflects a strong compound annual growth rate (CAGR) of 15.2% during the 2025–2034 period.

- By Offering: Hardware is expected to dominate the Japan precision farming market in 2025, capturing a 70.2% revenue share. This is largely driven by its crucial role in mitigating labor shortages and enhancing agricultural productivity.

- By Technology: Remote sensing is set to take the lead in terms of technology, anticipated to account for 58.3% of market revenue by the end of 2025. This is supported by Japan’s robust technological infrastructure and expertise.

- By Application: Yield monitoring is forecasted to be the leading application within the precision farming sector in Japan, contributing a 49.4% revenue share by the close of 2025.

- Key Players: Prominent companies operating in the Japan precision farming market include Kubota Corporation, Yanmar Co. Ltd., Iseki & Co. Ltd., among others.

Precision Farming Market: Use Cases

- Variable rate technology (VRT) allows farmers to apply fertilizers, pesticides, and water at different rates across a field, optimizing input use and reducing waste.

- Remote sensing using drones or satellites helps monitor crop health, detect pest infestations early, and assess plant growth across large areas with minimal physical effort.

- Soil mapping and analysis enables farmers to understand the nutrient composition and moisture levels of different zones in a field, allowing for more informed planting and treatment decisions.

- Automated machinery and GPS-guided equipment improve planting accuracy and harvesting efficiency, reducing labor costs and enhancing overall productivity.

Precision Farming Market: Stats & Facts

- Aging Farmer Population: As of 2020, the average age of Japanese farmers was over 67 years. Nearly 70% of core farmers are above 65, creating a labor crisis as younger generations avoid agriculture due to physical demands and low profitability. (Source: Ministry of Agriculture, Forestry and Fisheries (MAFF), 2020)

- Decline in Number of Farms: Between 2000 and 2020, the number of commercial farms in Japan decreased from 2.3 million to under 1.2 million, halving in two decades. This decline reflects aging farmers retiring and the consolidation of farmland by corporate and professional farmers (Source: 2020 Agriculture and Forestry Census, MAFF)

- Farmland Abandonment: Japan has over 420,000 hectares of abandoned farmland as of 2020, caused by depopulation and aging in rural areas. This accounts for more than 10% of all cultivable land and poses challenges for food security and rural development. (Source: MAFF Farmland Use Survey, 2020)

- Farmland Consolidation Goals: To boost efficiency, the Japanese government aims to increase the share of farmland managed by professional farmers from 56% in 2015 to 80% by 2023. This policy is part of a strategy to strengthen agricultural productivity.(Source: MAFF Policy Goals, 2015–2023 Strategy)

- Self-Sufficiency Rate: Japan's food self-sufficiency rate on a calorie basis was 38% in 2022, one of the lowest among developed nations. Heavy reliance on food imports exposes the country to global supply disruptions and price volatility. (Source: MAFF Annual Food Supply and Demand Report, 2022)

- Adoption of Robotic Precision Technologies in Japan: According to the International Society of Precision Agriculture (ISPA), Japan is using precision technology through robotic equipment, such as rice transplanting robots, autonomous lawnmowers for yard work, unmanned tractors, autonomous agricultural spraying, and automated harvesting of fruit trees.

Japan Precision Farming Market: Market Dynamics

Driving Factors in the Precision Farming Market

Technological Advancements in Agriculture

Japan's expertise in robotics, artificial intelligence, and the Internet of Things is playing a vital role in advancing precision farming across the country. Cutting-edge developments, including self-operating tractors, irrigation systems driven by sensors, and drone-based crop surveillance, are boosting agricultural efficiency while lowering operational expenses. The Japanese government is actively promoting smart farming through various initiatives, further encouraging the adoption of these technologies.

Companies in Japan are at the forefront of integrating remote sensing and machine learning into agriculture, transforming traditional practices into highly data-centric operations. These innovations help address critical challenges such as the shortage of labor and the aging farmer demographic by reducing the need for manual effort and improving crop yield accuracy through precise farm management.

Aging Farmer Population and Labor Shortage

Japan is experiencing a demographic shift, with a significant portion of its farming population now aged 65 and older. This growing imbalance has created an urgent need for digital and automated solutions to maintain agricultural productivity. Precision farming meets this need by offering intelligent, automated systems that reduce physical workload and can be operated by fewer individuals.

Tools such as GPS-enabled machinery, smart irrigation systems, and AI-based crop monitoring are effectively narrowing the labor gap. As a result, this demographic pressure is accelerating the adoption of smart farming practices, which are seen as essential for sustaining food production and ensuring long-term food security in Japan.

Restraints in the Precision Farming Market

High Initial Investment Costs

Implementing precision farming solutions often involves substantial financial investment, as it includes acquiring high-tech equipment such as advanced machinery, drones, sensor networks, and software systems. This level of expenditure can be overwhelming for small to medium-sized farms, which form a large portion of Japan’s agricultural landscape. In addition to the initial purchase costs, these technologies require ongoing expenses for maintenance and software updates, further adding to the financial strain.

Although government subsidies are available to support adoption, they are frequently insufficient to make the technology truly accessible. This financial obstacle particularly affects older farmers, who are typically more risk-averse and less inclined to adopt new, complex tools, ultimately slowing down the broader adoption of precision agriculture in the country.

Limited Digital Infrastructure in Rural Areas

While Japan is recognized for its technological leadership, many agricultural regions still suffer from an underdeveloped digital infrastructure. Limited access to stable internet connections and cloud-based platforms hampers the effective use of precision farming technologies. These solutions often depend on real-time data flow, satellite mapping, and remote monitoring systems to function optimally, capabilities that are significantly impaired by poor connectivity.

Additionally, digital literacy remains a challenge, especially among older farmers who may not be comfortable navigating sophisticated software or using high-tech devices. The lack of proper infrastructure and training in these areas presents a major barrier to the widespread integration of smart farming techniques, creating disparities in adoption across different regions of the country.

Opportunities in the Precision Farming Market

Government Support and Subsidies for Smart Agriculture

The Japanese government is actively advancing the adoption of smart agriculture by implementing a range of policies and support mechanisms. Through initiatives led by the Ministry of Agriculture, Forestry, and Fisheries (MAFF), financial assistance and subsidies are made available to farmers embracing precision farming technologies. These efforts are part of a broader strategy to modernize the agricultural sector and enhance the nation’s food self-sufficiency.

By fostering a favorable policy environment, the government is also encouraging innovation from technology providers and service companies. Additionally, collaborative efforts such as public-private partnerships and pilot projects are being launched to develop solutions tailored to Japan’s specific agricultural challenges. These supportive measures are anticipated to significantly accelerate the adoption and scalability of precision farming across the country.

Growing Demand for Sustainable and Organic Produce

Japanese consumers are becoming increasingly focused on sustainability, food safety, and health, driving a surge in demand for organic and environmentally friendly agricultural products. Precision farming aligns well with these values, as it enables farmers to apply resources like water, fertilizers, and pesticides with great accuracy, thereby minimizing waste and reducing environmental impact.

This shift in consumer preferences presents an opportunity for precision agriculture companies to develop and promote eco-conscious solutions that boost productivity while maintaining soil and crop health. Firms that prioritize sustainability in their technological offerings are well-positioned to gain traction in the market and build strong relationships with both producers and environmentally aware consumers.

Trends in the Precision Farming Market

Integration of AI and Big Data in Farm Decision-Making

Artificial intelligence and big data are increasingly becoming central components of precision farming practices in Japan. Modern agricultural technologies can now gather extensive data related to climate conditions, soil composition, and crop development. This information is then processed and analyzed to enhance the timing and accuracy of planting, resource allocation, and harvesting strategies.

AI-driven systems offer predictive insights that support smarter decision-making, helping farmers manage risks and improve productivity. Given Japan’s advanced technological infrastructure, this evolution is reshaping traditional farming into a highly data-oriented industry. Moreover, as these digital tools become more cost-effective and user-friendly, their adoption is expanding across farms of varying sizes.

Rise of Agricultural Drones and Remote Sensing

There is a notable increase in the use of drones and satellite-based remote sensing within Japan's agricultural sector. Drones are being employed for tasks such as aerial surveillance, crop health assessment, and precision pesticide application, significantly boosting efficiency with reduced manual effort. Remote sensing allows for detailed monitoring of field conditions, enabling early detection of challenges like pest outbreaks or nutrient imbalances.

These capabilities empower farmers to take timely, targeted actions that enhance yields and conserve inputs. The continued development of Japan’s drone industry, along with greater availability of related services, is further fueling the adoption of these advanced aerial technologies in modern farming practices.

Precision Farming Market: Research Scope and Analysis

By Offering Analysis

Hardware is expected to lead the precision farming market in Japan by 2025 with a revenue share of 70.2 percent due to its essential role in addressing the country's labor shortages and increasing demand for agricultural efficiency. Japan’s farming sector faces challenges such as an aging population and limited farmland, making advanced tools like autonomous tractors, drones, and field sensors crucial.

These technologies allow farmers to monitor soil and crop conditions in real time and make accurate decisions. Local manufacturers are innovating with smart machines that use GPS and artificial intelligence to automate operations. This shift toward high-tech farming not only helps maintain productivity with fewer workers but also ensures consistency and quality in output, securing hardware’s dominant position in the market.

Software represents the second most prominent segment in Japan’s precision farming market due to its role in processing and analyzing agricultural data. Farmers are turning to web-based platforms and artificial intelligence applications to interpret information collected from the field. These solutions assist in planning crop cycles, predicting yields, managing inventories, and responding to changing weather conditions.

The shift toward cloud computing supports real-time decision-making and reduces the need for costly infrastructure. Government initiatives promoting smart farming and growing collaborations between agriculture and technology providers are accelerating adoption. As more farms adopt digital strategies to enhance sustainability and productivity, software is becoming a vital component that supports and complements hardware in Japan’s evolving agricultural landscape.

By Technology Analysis

The Japan precision farming sector is likely to be dominated by remote sensing technology, expected to achieve a 58.3% revenue share in 2025 because Japan excels in technology development and implements government programs for agricultural modernization. Japanese farming faces two critical challenges, including an aging workforce along with employee scarcity, yet remote satellite and drone monitoring systems enable efficient field observation and resource management.

Remote sensing technology enables the integration of efficiency improvements with Japan's need for environmentally responsible farming practices through simplified chemical and water usage and increased plant output. The integration of artificial intelligence with internet-connected systems makes remote sensing capable of providing predictive planning capabilities and data-driven decision outputs. The technology serves as a vital agricultural tool because it delivers high precision, trustworthy operations, and adjusts effectively to the small farming businesses of Japan to support their growing agricultural sector.

The Japan precision farming market demonstrates quick expansion through Variable Rate Technology as one of its primary development areas. Variable Rate Technology provides Japanese farms that work within small boundaries and with a restricted workforce the ability to use resources precisely according to individual field segment demands. This geospecific application methodology enables better cost control by reducing waste amounts while leading to higher yield outputs.

The early adoption of this technology in Japan, together with advancements in positioning systems and field sensors, has led to superior implementation of this technology and broader application. The emphasis on sustainable farming in Japan finds support through VRT technology because it reduces environmental hazards. The Japanese market has elevated its interest in

precision farming systems due to their deployment with automated equipment and smart navigation systems.

By Application Analysis

Japan precision farming market is likely to experience high revenue growth from yield monitoring, reaching

49.4% by 2025, because it proves vital for agricultural efficiency improvements and resource utilization maximization. Therefore, farmers gain essential information about crop yield statistics and moisture content levels during the harvest through this methodology.

The collected data enables farmers to see field discrepancies better while making smart choices through which they apply optimal strategies to enhance both profitability and productivity levels. Fujitsu and other companies have driven widespread adoption of GPS and satellite imagery together with

artificial intelligence to enhance yield monitoring operations by providing crop health and irrigation requirements data.

Field mapping functions as the second leading application for precision agriculture in Japan’s agricultural systems. The technology helps agriculture through geographic positioning systems and information systems to present detailed visual characteristics of fields for data-informed farming processes. The mapping system reveals detailed information about soil quality as well as soil moisture distribution, combined with land fertility data and elevation measurements for effective management of seeding processes and irrigation and fertilization operations.

The technology enhances crop productivity and enables better use of available resources. Variable rate technology applied with field mapping systems helps decrease both input expenses and environmental detrimental effects. Field mapping has emerged as a key element for smart farming development in Japan since the country continues its progress toward sustainable agricultural systems.

The Japan Precision Farming Market Report is segmented on the basis of the following:

By Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- Remote Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Wireless Modules

- Sensing Devices

- Soil Sensor

- Water Sensors

- Climate Sensors

- Others

- Antennas & Access Points

- Software

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Assisted Professional Types

By Technology

- Remote Sensing Technology

- Variable Rate Technology

- Guidance Technology

By Application

- Yield Monitoring

- Field Mapping

- Crop Scouting

- Weather Tracking & Forecasting

- Irrigation Management

- Farm Labor Management

- Others

Competitive Landscape

The Japan precision farming market is intensely competitive, with numerous key players who are constantly evolving their strategies to stay ahead. Leading companies in this sector include AgJunction Inc., Ag Leader Technology Inc., CropMetrics LLC, and AGCO Corporation, among others. These firms are actively pursuing strategic partnerships, technological advancements, and acquisitions to strengthen their positions and meet the growing demands of modern agriculture.

For example, AGCO Corporation has made substantial investments in smart farming technologies through its Fuse® platform, which integrates multiple technologies to enable real-time decision-making. Ag Leader Technology, on the other hand, continues to innovate in areas like data management systems and precision guidance tools. Meanwhile, CropMetrics focuses on precision irrigation, providing data-driven solutions designed to improve water efficiency in farming.

Acquisitions are also playing a crucial role in reshaping the market’s competitive dynamics. Companies are acquiring tech startups to quickly integrate cutting-edge capabilities such as AI-powered crop monitoring, drone surveillance, and predictive analytics into their portfolios.

In conclusion, the competitive landscape of the Japan precision farming market is characterized by rapid technological innovation, strategic partnerships, and the ability to adapt to the evolving needs of modern agriculture. As precision farming becomes increasingly essential for sustainable agricultural practices, industry leaders are expected to intensify their efforts to offer scalable, comprehensive solutions worldwide.

Some of the prominent players in the Japan Precision Farming Market are:

- Kubota Corporation

- Yanmar Co., Ltd.

- Iseki & Co., Ltd.

- IHI Shibaura Machinery Corporation

- Satake Corporation

- Fujitsu Limited

- NTT Agri Innovation

- Toshiba Corporation

- Panasonic Corporation

- Mitsubishi Electric Corporation

- NEC Corporation

- Hitachi Ltd.

- Yamaha Motor Co., Ltd.

- Denso Corporation

- Komatsu Ltd.

- Farmnote

- T-LIO

- Yutaka

- Spread

- Mirai Genomics

- Other Key Players

Recent Developments

- In March 2025, Kubota Corporation and Microsoft Japan Co., Ltd. renewed their strategic partnership, initially formed in 2020. This renewed collaboration aims to enhance operational efficiency using Microsoft’s AI technologies, including generative AI, and promote new work styles through advanced communication tools. Kubota, committed to solving social challenges in the fields of food, water, and the environment, will work closely with Microsoft Japan, which will contribute technological expertise and personnel. Together, they aim to accelerate innovation in Kubota’s operations and solutions to further address pressing societal needs.

- In March 2024, Kubota's smart agriculture solutions support over 25,000 Japanese farms with precision farming technologies. Using GPS-guided machinery, AI, and the cloud-based KSAS platform, farmers optimize planting, fertilization, and harvesting. This boosts productivity, reduces labor dependency, and ensures sustainable practices, helping Japan's aging agricultural sector stay efficient and competitive.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 347.2 Mn |

| Forecast Value (2034) |

USD 1,245.4 Mn |

| CAGR (2025–2034) |

15.2% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Hardware, Software, and Services), By Technology (Remote Sensing Technology, Variable Rate Technology, Guidance Technology), By Application (Yield Monitoring, Field Mapping, Crop Scouting, Weather Tracking & Forecasting, Irrigation Management, Farm Labor Management, and Others) |

| Regional Coverage |

Japan |

| Prominent Players |

Kubota Corporation, Yanmar Co., Ltd., Iseki & Co., Ltd.,IHI Shibaura Machinery Corporation, Satake Corporation, Fujitsu Limited, NTT Agri Innovation, Toshiba Corporation, Panasonic Corporation, Mitsubishi Electric Corporation, NEC Corporation, Hitachi Ltd., Yamaha Motor Co. Ltd., Denso Corporation, Komatsu Ltd., Farmnote, T-LIO, Yutaka, Spread, Mirai Genomics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Japan Precision Farming Market?

▾ The Japan Precision Farming Market size is estimated to have a value of USD 347.2 million in 2025 and is expected to reach USD 1,245.4 million by the end of 2034.

Who are the key players in the Japan Precision Farming Market?

▾ Some of the major key players in the Japan Precision Farming Market are Kubota Corporation, Yanmar Co. Ltd., Iseki & Co. Ltd., and many others.

What is the growth rate in the Japan Precision Farming Market?

▾ The market is growing at a CAGR of 15.2 percent over the forecasted period.