Market Overview

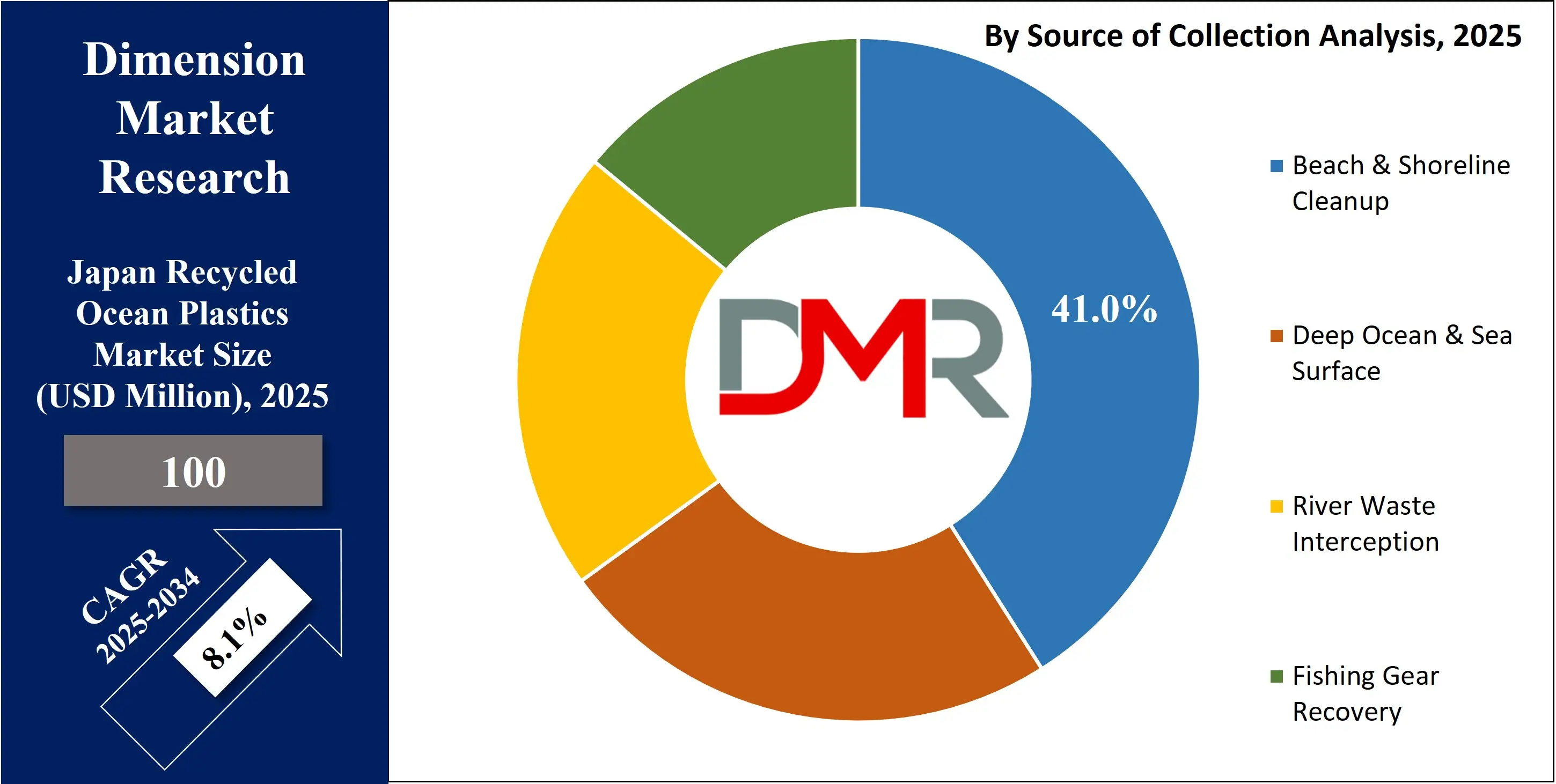

The Japan Recycled Ocean Plastics Market is projected to reach

USD 100 million in 2025, with a steady expansion anticipated over the forecast period. By 2034, the market is expected to attain a value of

USD 200 million, growing at a

CAGR of 8.1%. This growth is driven by rising environmental regulations, circular economy initiatives, and increased demand for sustainable packaging, marine waste recycling, and eco-friendly materials.

Recycled ocean plastics refer to waste materials, predominantly plastic debris, that are collected from marine environments such as oceans, seas, rivers, and coastlines, and are then processed and converted into reusable raw materials. This includes plastics retrieved from fishing nets, bottles, packaging waste, and microplastics accumulated in water bodies due to improper waste management and global consumption patterns.

These recovered plastics undergo various mechanical or chemical recycling processes to produce materials that can be used to manufacture new products such as textiles, consumer goods, packaging, and automotive components. The aim is not only to reduce plastic pollution in marine ecosystems but also to promote sustainable production cycles, support the circular economy, and mitigate the harmful effects of plastic waste on aquatic life and coastal communities.

The Japanese recycled ocean plastics market is emerging as a strategic pillar in the country’s environmental and circular economy initiatives. Japan, being a major island nation with an advanced industrial base and significant coastal activity, generates and also faces substantial marine plastic pollution. In response, both public and private sectors have ramped up efforts to recover and repurpose ocean-bound plastics. Companies are investing in cutting-edge technologies such as biodegradable polymers, closed-loop recycling systems, and AI-powered sorting for improved waste segregation.

Additionally, collaborations between petrochemical firms, NGOs, and municipalities are creating structured collection and recycling channels to intercept plastics from rivers and fishing zones before they reach open waters. The government’s Plastic Resource Circulation Strategy further strengthens regulatory support for integrating recycled ocean plastics into product life cycles.

Driven by rising environmental awareness and consumer demand for sustainable products, Japanese corporations across industries such as automotive, packaging, retail, and electronics are incorporating recycled ocean plastics into their supply chains. Luxury brands and retail giants are launching eco-friendly product lines made from marine plastics to meet ESG goals and align with global sustainability trends. Furthermore, innovation hubs in regions like Osaka and Tokyo are fostering startups and research institutions focused on polymer science and ocean cleanup technologies.

International partnerships and participation in global frameworks such as the G20’s Osaka Blue Ocean Vision are also amplifying Japan’s influence in the recycled ocean plastics value chain. The market is poised for steady growth as material traceability, eco-labeling, and zero-emission manufacturing become standard across industrial verticals.

Japan Recycled Ocean Plastics Market: Key Takeaways

- Market Value: The Japanese recycled ocean plastics market is expected to reach USD 200 million by 2034 from a base value of USD 100 million in 2025, at a CAGR of 8.1%.

- By Source of Collection Segment Analysis: Beach & Shoreline Cleanup is anticipated to dominate the source of collection segment, capturing 41.0% of the total market share in 2025.

- By Polymer Type Segment Analysis: Polyethylene Terephthalate (PET) is poised to consolidate its dominance in the polymer type segment, capturing 35.7% of the total market share in 2025.

- By Processing Method Segment Analysis: Mechanical Recycling methods are expected to maintain their dominance in the processing method segment, capturing 65.0% of the total market share in 2025.

- By Distribution Channel Analysis: Direct Sales to Manufacturers are anticipated to dominate the distribution channel segment, capturing 61.0% of the market share in 2025.

- By Application Segment Analysis: Textiles & Fashion applications will lead in the application segment, capturing 37.0% of the market share in 2025.

- By End-User Industry Segment Analysis: The Textile & Apparel Industry will dominate the end-user industry segment, capturing 39.0% of the market share in 2025.

- Key Players: Some key players in the Japanese recycled ocean plastics market are Mitsubishi Chemical, JEPA, Nippon Steel Chemical, Mitsui Chemicals, Idemitsu Kosan, Toray Industries, Sanko Plastics, Ricoh, Sumitomo Chemical, Toyota Tsusho, Sekisui Chemical, Mitsubishi Plastics, and Other Key Players.

Japan Recycled Ocean Plastics Market: Use Cases

- Eco-Friendly Packaging in the Food & Beverage Industry: Japanese F&B giants like Suntory Holdings and Kewpie Corporation are incorporating recycled ocean plastics into their packaging materials as part of their sustainability roadmaps. These companies are replacing conventional PET with ocean-bound PET for bottles, condiment containers, and food trays to reduce plastic pollution and align with Japan's Plastic Resource Circulation Strategy. The move not only enhances brand environmental responsibility but also appeals to eco-conscious consumers, boosting market demand for marine waste-derived polymers in FMCG packaging.

- Automotive Interiors Using Ocean-Recovered Polymers: Automotive players like Toyota Tsusho and partners within the Toyota Group are utilizing recycled ocean plastics for interior car components such as door panels, seat fabrics, and floor mats. These materials offer durability and reduce dependency on virgin resins, aligning with the automotive sector’s carbon neutrality targets. By adopting marine-sourced recycled polymers, automakers are contributing to green mobility while meeting Japan's tightening regulations on industrial plastic waste reduction.

- Consumer Electronics Enclosures and Accessories: Technology and electronics manufacturers such as Ricoh Company, Ltd. are utilizing recycled ocean plastic resin compounds to produce printer casings, computer accessories, and office equipment parts. This initiative supports eco-design principles and reduces the lifecycle emissions of electronic products. Japan’s strong focus on e-waste management and corporate ESG goals is pushing electronics firms to partner with recyclers for sourcing marine plastic-derived raw materials, creating a niche yet expanding market.

- Apparel and Textile Brands Promoting Sustainable Fashion: Japanese textile companies and fashion brands are embracing recycled ocean plastics to manufacture performance fabrics for shoes, bags, and outdoor wear. Companies like Toray Industries and Asahi Kasei are leading innovations in ocean-based nylon and polyester production. These textiles are used by both local and global fashion brands, promoting sustainable clothing. Growing consumer awareness and global sustainability certifications (e.g., GRS) are driving the demand for low-impact marine-sourced fibers.

Japan Recycled Ocean Plastics Market: Stats & Facts

- Japan Meteorological Agency

- In 2023, 12 pieces of floating plastic debris were observed per 100 km in waters around Japan.

- Along the 137°E meridian, the observation dropped to 2 pieces per 100 km in 2023.

- Since the 1990s, average debris counts were around 5 pieces per 100 km, with a rising trend in recent years.

- During spring and summer, regions like the East China Sea and southern Honshu often exceed 10 pieces per 100 km; Tsushima Strait occasionally sees over 50 pieces per 100 km.

- From 2011 to 2020, average surface debris composition included over 50% styrofoam, followed by other plastics, fishing gear, and thin-film plastics.

- Floating plastic amounts along the 137°E line have mostly remained under 5 pieces per 100 km since the early 2000s.

- Ministry of the Environment

- An estimated 11,000 to 27,000 tonnes of plastic debris flows from land into Japanese waters annually.

- In 2022, total annual plastic waste generation in Japan was 8.23 million tonnes.

- Of this, 87% (7.17 million tonnes) was effectively utilized, including thermal recovery.

- Packaging and container waste made up 49.1% of the total plastic waste, or approximately 4.04 million tonnes.

- Polyethylene production in 2022 reached 2.24 million tonnes, while polypropylene reached 2.12 million tonnes, together representing 45% of domestic plastic production.

- Japan aims for 100% reuse and recycling of used plastics by 2035 under the Plastic Resource Circulation Strategy.

- In FY2018, over 70% of land-origin marine plastic consisted of microplastics.

- Japan’s budget for coastal debris reduction increased from ¥40 million in FY2017 to ¥3.85 billion in FY2018.

- Umito Nagisa (Marine Cleanup Organization)

- Japan-origin plastic debris from fisheries is estimated at 1,958 tonnes per year.

- Total marine plastic debris nationally is estimated at up to 65,000 tonnes annually.

- Fishing gear made from plastic used domestically totals 108,379 tonnes per year, with an outflow rate of 1.8% (1,958 tonnes).

- The breakdown of gear loss includes:

- Fishing nets: 34,761 tonnes used; 348 tonnes lost

- Floats: 10,361 tonnes used; 131 tonnes lost

- Rope and lines: 61,153 tonnes used; 1,118 tonnes lost

- Other gear: 9,104 tonnes used; 361 tonnes lost

- Gear loss by fishery type:

- Nets fisheries: 616 tonnes lost

- Other fisheries: 251 tonnes lost

- Net aquaculture: 66 tonnes lost

- Other aquaculture: 1,025 tonnes lost

- Marine gear outflow per production tonne is 0.5 kg in Japan, compared to the global average of 7.7 kg.

- Japan contributes 3% of marine plastics from fishing gear globally; surrounding countries contribute 21%, while the global average is 9.4%.

- Ministry of Foreign Affairs / OECD Sources

- Global annual plastic waste generation in 2019 reached 353 million tonnes, nearly double that of 2000.

- In 2019, only 9% of global plastic waste was recycled, 19% was incinerated, 50% was landfilled, and 22% leaked into the environment or was openly burned.

- An estimated 8 million tonnes of plastic enters oceans annually, with 1.7 million tonnes from rivers.

- Japan’s per capita plastic waste was 69 kg per year, compared to 221 kg in the U.S. and 114 kg across OECD Europe.

- Japan ranked 30th among 192 coastal countries in terms of marine plastic leakage, contributing approximately 0.4% of the global total.

Japan Recycled Ocean Plastics Market: Market Dynamics

Japan Recycled Ocean Plastics Market: Driving Factors

Government Regulations and Policy PushJapan’s aggressive stance on plastic pollution, particularly through the Plastic Resource Circulation Strategy, mandates stricter recycling targets and encourages the use of sustainable raw materials. These initiatives have compelled manufacturers to integrate marine plastic waste into their production cycles. Additionally, subsidies and partnerships with local governments for coastal cleanup projects and waste interception further support the growth of this market.

Rising Corporate ESG Commitments

Japanese corporations, particularly in the automotive, packaging, and consumer goods sectors, are adopting environmental, social, and governance (ESG) frameworks. These companies are turning to ocean-sourced recycled polymers to meet emissions targets and respond to investor demand for sustainable practices. The growing use of traceable recycled materials enhances brand image and promotes circular supply chains.

Japan Recycled Ocean Plastics Market: Restraints

High Processing Costs and Material Limitations

Converting ocean-collected plastics into usable, high-grade materials involves extensive cleaning, sorting, and polymer stabilization, making the process capital-intensive. Additionally, the degraded quality of plastics recovered from marine environments may limit their application in food-grade or high-performance sectors, restricting scalability.

Fragmented Collection and Supply Chain Infrastructure

Despite Japan’s technological leadership, the lack of standardized ocean plastic collection systems and inefficient segregation mechanisms hinders consistent material supply. Regional disparities in marine waste retrieval capabilities and reliance on NGO-led cleanup efforts make it difficult for manufacturers to maintain steady sourcing pipelines.

Japan Recycled Ocean Plastics Market: Opportunities

Export Potential for Sustainable Materials

With global demand rising for ocean-safe products, Japanese firms have a unique opportunity to export certified recycled ocean plastics to eco-conscious markets like Europe and North America. Japan’s reputation for quality, combined with sustainable material innovation, positions it well to lead in the global green materials supply chain.

Innovation in Chemical Recycling and Polymer Engineering

Japanese chemical and materials companies are pioneering advanced recycling techniques, such as depolymerization and molecular regeneration, to improve the quality of recycled marine plastics. These innovations allow for the recovery of high-grade materials from even heavily contaminated plastic waste, expanding use cases in automotive, healthcare, and electronics.

Japan Recycled Ocean Plastics Market: Trends

Brand Collaborations for Sustainable Product Launches

Leading Japanese brands are collaborating with NGOs, startups, and material scientists to launch products made from upcycled ocean plastics. Whether it’s clothing lines, electronics accessories, or packaging, these co-branded sustainability initiatives are shaping consumer behavior and enhancing green marketing strategies.

Adoption of Blockchain for Material Traceability

To ensure supply chain transparency and verify the authenticity of ocean-sourced recycled materials, some Japanese companies are integrating blockchain-based tracking systems. This trend supports traceable recycling practices, promotes consumer trust, and aligns with global certifications for environmental compliance.

Japan Recycled Ocean Plastics Market: Research Scope and Analysis

By Source of Collection Analysis

In the Japan Recycled Ocean Plastics Market, beach and shoreline cleanup is expected to lead the source of collection segment, accounting for 41.0% of the total market share in 2025. This dominance is primarily due to the accessibility and cost-effectiveness of collecting marine debris from coastal areas compared to deep-sea retrieval. Coastal zones across Japan, including major regions like Okinawa and Kanagawa, face high volumes of plastic waste accumulation due to ocean currents and human activity, making them focal points for organized cleanup drives by municipalities, NGOs, and community groups. These efforts not only help recover usable plastic materials but also raise public awareness and community involvement in sustainable practices.

On the other hand, deep ocean and sea surface collection, while technologically feasible, contributes a smaller share to the market due to higher operational costs and logistical challenges. Plastics found in these areas often require the use of autonomous or remotely operated vehicles, sonar-guided collection systems, and specially equipped vessels. However, this segment is gradually gaining traction, particularly through innovation-led initiatives and collaborations between Japanese tech firms and marine institutes that aim to improve the efficiency of oceanic waste interception. While not yet mainstream, deep ocean and sea surface recovery represents a critical long-term strategy for addressing non-visible marine plastic pollution.

By Polymer Type Analysis

Polyethylene Terephthalate (PET) is projected to maintain its stronghold in the polymer type segment of the Japan Recycled Ocean Plastics Market, accounting for 35.7% of the total market share in 2025. PET is widely used in beverage bottles, food packaging, and various consumer product containers, which are among the most commonly found plastic wastes along Japanese coastlines and river mouths. Its recyclability, relatively stable physical properties, and strong demand from the packaging industry make PET a preferred material for recovery and reuse. Japanese companies are investing in closed-loop recycling systems for PET, allowing them to convert used ocean plastics into new bottles or textile fibers efficiently, aligning with both sustainability goals and cost-effective raw material sourcing.

High-Density Polyethylene (HDPE) also holds a significant place in this market, primarily due to its widespread use in products such as detergent bottles, bottle caps, and plastic containers. HDPE collected from ocean waste offers durability and is particularly suited for non-food packaging and industrial applications. In Japan, recycling firms are optimizing mechanical recycling processes to retain the structural integrity of HDPE, making it a viable alternative to virgin plastic. While PET leads in volume and demand, HDPE continues to grow steadily, supported by its versatility and growing adoption in sectors seeking robust and eco-friendly packaging materials.

By Processing Method Analysis

Mechanical recycling is anticipated to retain its leading position in the processing method segment of the Japan Recycled Ocean Plastics Market, securing approximately 65.0% of the total market share in 2025. This dominance is driven by the relatively low cost, established infrastructure, and technological maturity of mechanical recycling processes in Japan. The method involves sorting, cleaning, shredding, and re-melting collected plastic waste, particularly PET and HDPE, into pellets or flakes for reuse. Many Japanese recyclers and municipal facilities are optimized for mechanical processing, making it the go-to solution for converting shoreline and nearshore plastic debris into usable materials for packaging, construction, and consumer goods industries.

Chemical recycling, although currently occupying a smaller portion of the market, is emerging as a promising alternative, especially for plastics that are heavily degraded, mixed, or contaminated—conditions often seen in deep ocean-sourced waste. This method breaks down plastic polymers into their original monomers or fuels through processes such as pyrolysis, gasification, or depolymerization. In Japan, chemical recycling is gaining traction due to government backing, R&D initiatives, and the need to address the limitations of mechanical recycling. As technologies improve and become more cost-efficient, chemical recycling is expected to play a vital role in enabling full circularity, particularly for complex plastic streams that mechanical processes cannot efficiently handle.

By Distribution Channel Analysis

Direct sales to manufacturers are projected to dominate the distribution channel segment of the Japan Recycled Ocean Plastics Market, accounting for 61.0% of the market share in 2025. This channel remains the most efficient and cost-effective way to supply recycled plastics in bulk, especially to industries such as automotive, electronics, packaging, and textiles that require consistent quality and volume. Manufacturers prefer direct procurement to ensure traceability, quality control, and alignment with specific production standards. In Japan, major chemical and materials companies often establish long-term contracts or joint ventures with recyclers to secure a steady stream of marine-sourced polymers, facilitating closed-loop systems and integrating sustainability directly into their supply chains.

On the other hand, the retail and online distribution segment, while smaller, is steadily growing as sustainability becomes a priority among individual consumers and small-scale businesses. This channel includes the sale of recycled plastic pellets, sheets, or consumer products made from ocean plastics through e-commerce platforms and eco-friendly retail outlets. It also supports startups and niche brands focused on sustainable fashion, home goods, and lifestyle products. In Japan, where digital commerce is highly developed and consumer environmental awareness is rising, online platforms serve as important channels for promoting transparency, traceability, and ethical sourcing of recycled ocean materials to end users.

By Application Analysis

Textiles and fashion applications are set to lead the application segment of the Japan Recycled Ocean Plastics Market, capturing 37.0% of the total market share in 2025. The growing demand for sustainable fabrics, particularly in the activewear, outdoor, and casual clothing categories, is driving this trend. Leading Japanese textile firms and fashion brands are using ocean-sourced recycled PET and nylon to produce eco-friendly garments, footwear, and accessories. This shift is fueled by rising consumer awareness, brand commitments to environmental responsibility, and global certifications like GRS (Global Recycled Standard), which ensure material traceability and sustainable production. Japan’s advanced textile innovation ecosystem, combined with government support for circular fashion, is further accelerating this segment’s growth.

Packaging is another significant application area in this market, with growing adoption across the food and beverage, cosmetics, and household goods sectors. Recycled ocean plastics, especially PET and HDPE, are being used to manufacture bottles, caps, containers, and flexible films. Companies like Suntory and Kao are integrating these materials into their packaging lines to meet plastic reduction targets and consumer demand for environmentally friendly products. While packaging applications face stricter regulatory and safety standards, particularly for food-grade use, advancements in sorting and decontamination technologies are expanding the scope of marine plastic utilization in this segment. The push for circular packaging models and zero-waste branding continues to open up new opportunities for recycled ocean plastics in Japan’s packaging industry.

By End-User Industry Analysis

The textile and apparel industry is expected to dominate the end-user industry segment of the Japan Recycled Ocean Plastics Market, capturing 39.0% of the market share in 2025. This growth is primarily driven by the rising demand for sustainable fashion and the availability of high-quality recycled materials such as ocean-sourced PET and nylon. Japanese apparel brands and textile manufacturers are adopting these materials to create eco-conscious collections, particularly in sportswear, outdoor gear, and everyday clothing. The industry benefits from Japan’s advanced fiber processing capabilities and growing alignment with international sustainability standards. Moreover, consumer preferences are shifting toward ethically made garments, pushing brands to use recycled ocean plastics as a differentiating factor in a competitive retail environment.

The FMCG and beverage industry is also emerging as a major consumer of recycled ocean plastics, especially in packaging applications. Companies in this segment are under growing regulatory and consumer pressure to reduce their environmental footprint. Leading beverage and household product brands in Japan are incorporating ocean-sourced recycled PET and HDPE into bottles, caps, and labels as part of their plastic reduction strategies. While the industry faces challenges related to food safety and quality assurance, advancements in decontamination and purification techniques are enabling wider adoption of marine plastics in primary packaging. This shift supports both environmental objectives and brand positioning, as sustainable packaging becomes a core element of product appeal in Japan's competitive FMCG sector.

The Japan Recycled Ocean Plastics Market Report is segmented on the basis of the following

By Source of Collection

- Beach & Shoreline Cleanup

- Deep Ocean & Sea Surface

- River Waste Interception

- Fishing Gear Recovery

By Polymer Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low-Density Polyethylene (LDPE)

- Nylon

- Others

By Processing Method

- Mechanical Recycling

- Chemical Recycling

- Energy Recovery

By Distribution Channel

- Direct Sales to Manufacturers

- Retail/Online

- Third-Party Distributors

By Application

- Textiles & Fashion

- Packaging

- Consumer Goods

- Automotive & Transportation

- Construction Materials

- Industrial Use

By End-User Industry

- Textile & Apparel Industry

- FMCG & Beverage Industry

- Electronics & Consumer Goods

- Automotive

- Retail & Commercial Packaging

- Construction & Infrastructure

Japan Recycled Ocean Plastics Market: Competitive Landscape

The competitive landscape of the Japan Recycled Ocean Plastics Market is characterized by a mix of established chemical conglomerates, specialized recycling firms, and collaborative industry consortia. Major players like Mitsubishi Chemical, Toray Industries, Mitsui Chemicals, and Asahi Kasei are leveraging their advanced polymer processing technologies and R&D capabilities to produce high-grade recycled materials from marine waste. These companies are often engaged in partnerships with environmental NGOs, local governments, and global sustainability alliances to secure raw material sources and enhance recycling efficiency.

Meanwhile, niche players and startups are focusing on innovations in sorting, upcycling, and traceability solutions, carving out space in segments such as sustainable packaging and fashion textiles. The market is also influenced by corporate ESG mandates and national policies that promote circular economy practices, making competition centered on sustainability credentials, product quality, and transparent supply chains.

Some of the prominent players in the Japanese recycled ocean plastics market are

- Mitsubishi Chemical Corporation

- Japan Environmental Packaging Association (JEPA)

- Nippon Steel Chemical & Material Co., Ltd.

- Mitsui Chemicals, Inc.

- Idemitsu Kosan Co., Ltd.

- Toray Industries, Inc.

- Sanko Plastics Co., Ltd.

- Ricoh Company, Ltd.

- Sumitomo Chemical Company, Limited

- Toyota Tsusho Corporation

- Sekisui Chemical Company, Limited

- Mitsubishi Plastics

- Nissui Corporation

- Kewpie Corporation

- Suntory Holdings

- Kaneka Corporation

- Daicel Corporation

- Asahi Kasei Corporation

- Fukusuke Kogyo Co., Ltd.

- Seiko International Inc.

- Other Key Players

Japan Recycled Ocean Plastics Market: Recent Developments

- June 2025: Japanese researchers launch a seawater-soluble plastic. Scientists from RIKEN and the University of Tokyo unveiled a groundbreaking new polymer that completely dissolves in seawater within hours, leaving no microplastic residue, positioning it as a revolutionary solution for eliminating marine pollution.

- June 2025: Development banks pledge €3 billion for ocean plastics. A consortium of global development banks, including Japanese participation, committed at least €3 billion through 2030 to fund ocean plastics recovery and management projects, boosting funding for technology and beach-to-deep-sea cleanup initiatives.

- April 2025: JICA launches Southeast Asia plastic cleanup financing. Through the Japan-ASEAN Integrative Fund, JICA announced financial support for monitoring and reducing marine debris, including microplastics, in major river systems across Asia, enhancing Japan’s leadership in regional ocean cleanup efforts.

- April 2024: Seiko International releases “Re: Ocean@TSUSHIMA” pellets. Seiko International introduced “Re: Ocean@TSUSHIMA” – plastic resin pellets made entirely from marine debris collected on Tsushima Island, transforming approximately 40 tons of shoreline waste into usable raw materials.

- March 2024: Japan-based recycling startup debuts on NYSE via SPAC. JEPLAN's SPAC move was highlighted again as it officially landed on the NYSE through its merger with AP Acquisition, underscoring strong investor confidence in Japan’s chemical recycling sector.

- June 2023: JEPLAN enters SPAC deal to list on NYSE. JEPLAN, a leader in PET chemical recycling, announced a definitive merger with AP Acquisition Corp (NYSE: APCA), valuing the combined business at approximately USD 300 million, and aimed at scaling its recycled PET resin production.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 100 Mn |

| Forecast Value (2034) |

USD 200 Mn |

| CAGR (2025–2034) |

8.1% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Source of Collection (Beach & Shoreline Cleanup, Deep Ocean & Sea Surface, River Waste Interception, and Fishing Gear Recovery), By Polymer Type (Polyethylene Terephthalate [PET], High-Density Polyethylene [HDPE], Polypropylene [PP], Low-Density Polyethylene [LDPE], Nylon, and Others), By Processing Method (Mechanical Recycling, Chemical Recycling, and Energy Recovery), By Distribution Channel (Direct Sales to Manufacturers, Retail/Online, and Third-Party Distributors), By Application (Textiles & Fashion, Packaging, Consumer Goods, Automotive & Transportation, Construction Materials, and Industrial Use), and and By End-User Industry (Textile & Apparel Industry, FMCG & Beverage Industry, Electronics & Consumer Goods, Automotive, Retail & Commercial Packaging, and Construction & Infrastructure |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Mitsubishi Chemical, JEPA, Nippon Steel Chemical, Mitsui Chemicals, Idemitsu Kosan, Toray Industries, Sanko Plastics, Ricoh, Sumitomo Chemical, Toyota Tsusho, Sekisui Chemical, Mitsubishi Plastics, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Japanese recycled ocean plastics market size is estimated to have a value of USD 100 million in 2025 and is expected to reach USD 200 million by the end of 2034.

Some of the major key players in the Japanese recycled ocean plastics market are Mitsubishi Chemical, JEPA, Nippon Steel Chemical, Mitsui Chemicals, Idemitsu Kosan, Toray Industries, Sanko Plastics, Ricoh, Sumitomo Chemical, Toyota Tsusho, Sekisui Chemical, Mitsubishi Plastics, and Other Key Players.

The market is growing at a CAGR of 8.1 percent over the forecasted period.