Market Overview

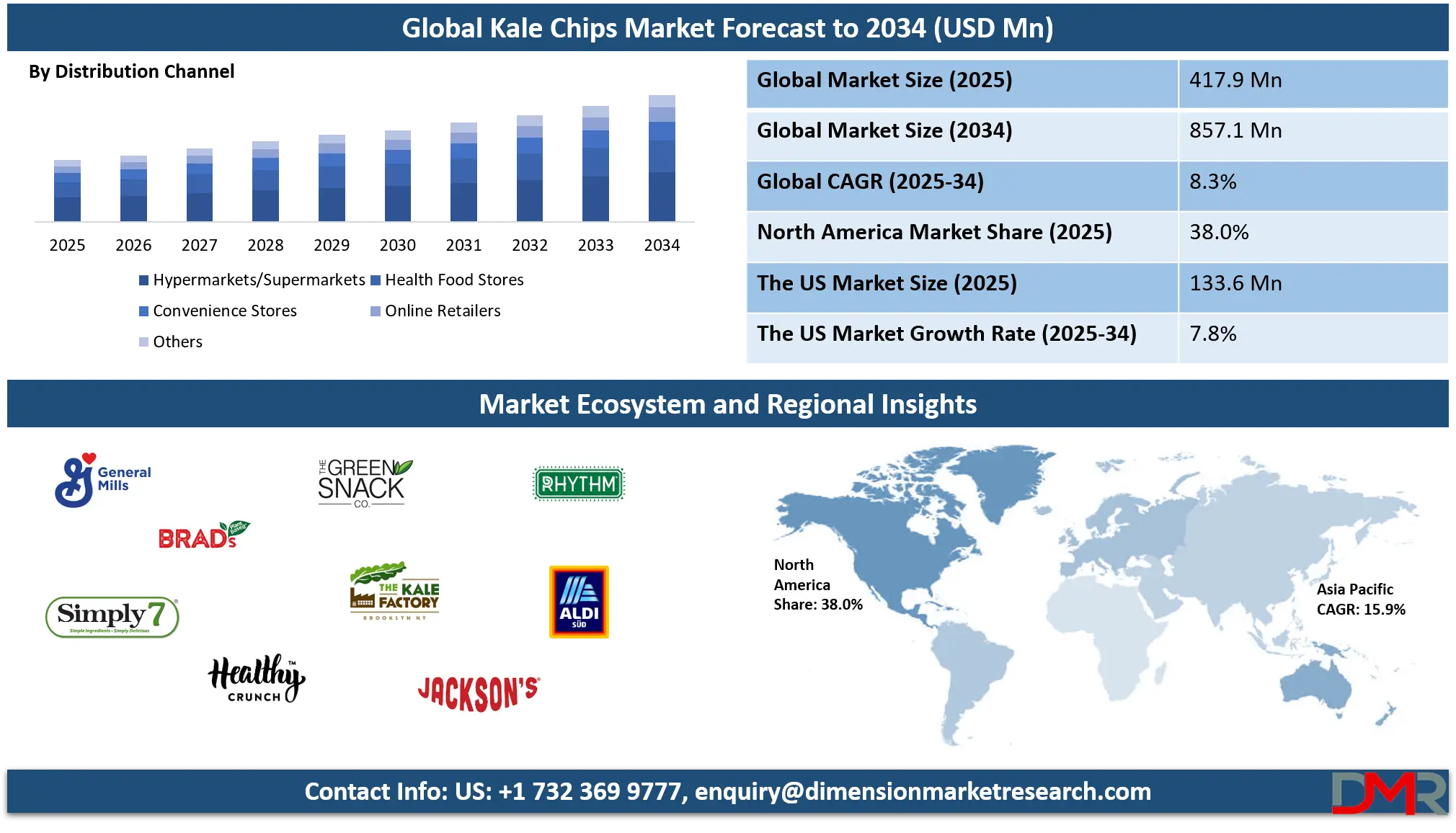

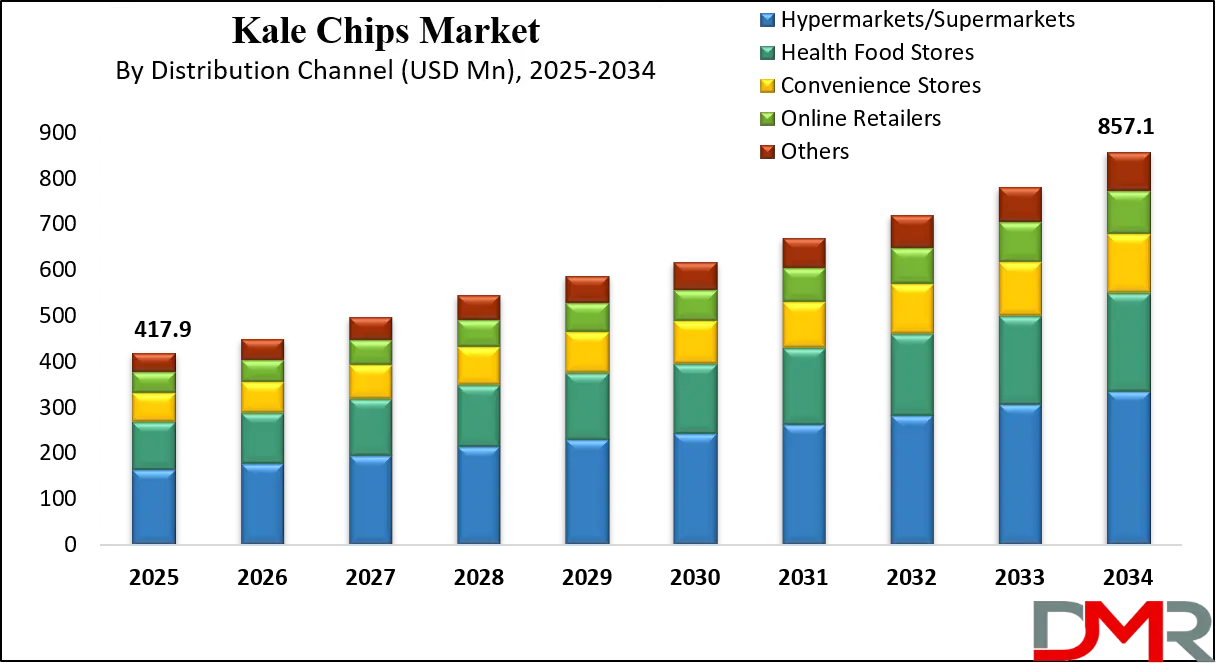

The global kale chips market is projected to reach USD 417.9 million in 2025 and is expected to expand to USD 857.1 million by 2034, registering a CAGR of 8.3%. Growing consumer demand for healthy snacks, plant-based alternatives, and nutrient-rich crunchy snacks is driving market growth, with baked, dehydrated, and flavored kale chips emerging as key product trends across North America, Europe, and Asia-Pacific.

Kale chips are a healthy snack made from kale leaves that are either baked, dehydrated, or lightly fried to achieve a crispy texture while preserving their nutritional value. Rich in vitamins A, C, and K, as well as minerals and antioxidants, kale chips provide a convenient alternative to traditional potato or corn-based chips. They are often seasoned with natural flavors such as sea salt, garlic, cheese, or chili to enhance taste without adding artificial additives. With the growing consumer preference for plant-based and nutrient-dense snacks, kale chips have become a popular choice among health-conscious individuals, fitness enthusiasts, and families seeking guilt-free snacking options that combine taste, texture, and nutritional benefits in a single package.

The global kale chips market has witnessed significant growth over the past few years driven by the increasing demand for organic, low-calorie, and high-fiber snack options. Consumers are becoming more aware of the health impacts of processed foods and are actively seeking alternatives that offer both flavor and functionality. This market encompasses a variety of product types including baked, dehydrated, and vacuum-fried kale chips, which are sold through multiple distribution channels such as supermarkets, health food stores, and online platforms. The market also benefits from innovations in flavors, packaging, and processing techniques, which cater to diverse consumer preferences across different regions.

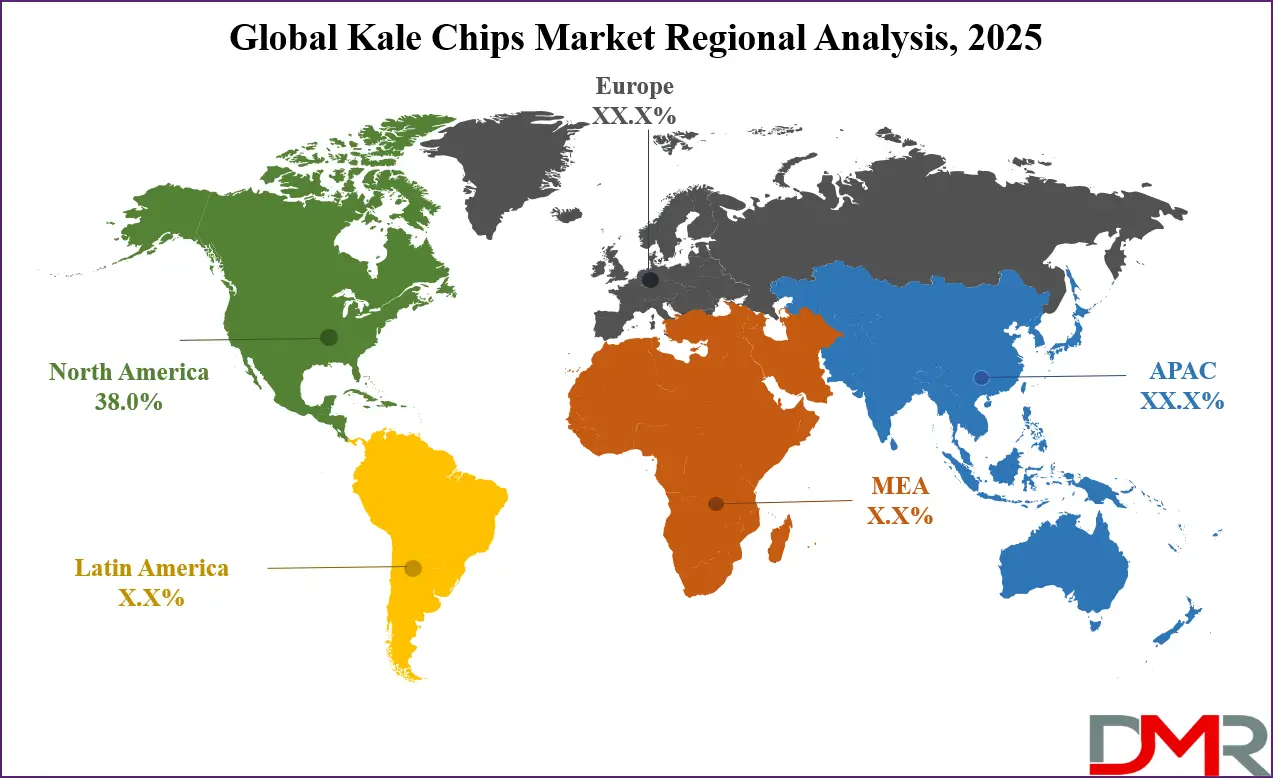

Geographically, the kale chips market is led by North America, where consumers are early adopters of healthy snacking trends, followed by Europe which has seen steady growth due to rising awareness of plant-based diets and wellness-focused lifestyles. The Asia-Pacific region is emerging as a high-growth market fueled by urbanization, increasing disposable incomes, and the rising popularity of western-style snacks.

Market dynamics are further influenced by partnerships between manufacturers and retail chains, expansion of product portfolios, and marketing campaigns emphasizing the nutritional advantages of kale-based snacks. As a result, the kale chips market continues to attract new entrants and foster competition while promoting innovation and diversification in the healthy snack segment.

The US Kale Chips Market

The U.S. Kale Chips market size is projected to be valued at USD 133.6 million by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 262.5 million in 2034 at a CAGR of 7.8%.

The United States kale chips market has experienced robust growth in recent years, driven by rising health consciousness and the increasing adoption of plant-based diets. Consumers in the US are actively seeking nutritious, low-calorie, and high-fiber snack options, which has propelled the demand for kale chips as a convenient alternative to traditional potato or corn-based chips.

The market is characterized by a diverse product portfolio including baked, dehydrated, and vacuum-fried kale chips, often enhanced with natural flavors such as sea salt, cheese, chili, or garlic to appeal to a broad range of taste preferences. Supermarkets, health food stores, and online retail platforms serve as the primary distribution channels, enabling easy access for consumers and fostering the growth of both premium and conventional kale chip products.

Market dynamics in the US are further shaped by innovations in packaging, portion control, and flavor varieties, which cater to busy urban lifestyles and on-the-go snacking trends. Regional players and established snack manufacturers are investing in product development, marketing campaigns, and partnerships with retail chains to expand their presence in the competitive healthy snacks segment.

Additionally, the rising awareness of clean-label products, non-GMO ingredients, and organic certification is influencing consumer purchasing behavior, providing opportunities for market expansion. The US kale chips market is expected to continue its upward trajectory, supported by evolving consumer preferences toward nutrient-dense, plant-based snacks and the growing emphasis on wellness-oriented eating habits.

Europe Kale Chips Market

The Europe kale chips market is projected to reach a value of approximately USD 125.1 million in 2025, reflecting the region's strong demand for healthy, plant-based, and nutrient-rich snacks. The market growth is driven by increasing consumer awareness of wellness and clean-label products, alongside a rising preference for convenient and on-the-go snacking options. Major European countries, including Germany, the United Kingdom, and France, are seeing steady adoption of kale chips due to the influence of health-conscious lifestyles, fitness trends, and the popularity of organic and minimally processed foods. Retailers are expanding shelf space for kale chips across supermarkets, specialty stores, and online platforms, further supporting market penetration.

The market in Europe is expected to grow at a robust CAGR of 9.5% over the forecast period, fueled by innovations in flavors, packaging, and product types such as baked, extruded, and dehydrated kale chips. Organic and functional variants are gaining traction, particularly among millennials and urban consumers who prioritize clean-label, non-GMO, and sustainable products.

The region also benefits from active marketing campaigns, collaborations between manufacturers and retail chains, and the rising trend of incorporating kale chips into salads, grain bowls, and gourmet recipes. As a result, Europe remains a key growth market for kale chips, with significant opportunities for both established players and emerging brands to expand their footprint.

Japan Kale Chips Market

The Japan kale chips market is projected to reach approximately USD 16.8 million in 2025, reflecting a growing but still emerging interest in healthy and plant-based snacks. Rising awareness of wellness, balanced diets, and nutrient-rich food options is driving consumer demand for kale chips in urban areas. Japanese consumers are increasingly seeking convenient, low-calorie, and high-fiber snacks, which has led to the adoption of baked, dehydrated, and lightly seasoned kale chip variants. Supermarkets, specialty health stores, and online retail channels are playing a key role in improving product accessibility and increasing brand visibility across the country.

The market in Japan is expected to expand at a CAGR of 8.5% during the forecast period, driven by innovation in flavors, clean-label options, and organic product offerings. Health-conscious consumers are showing interest in non-GMO, preservative-free, and functional snack options, encouraging manufacturers to develop premium and specialty kale chip products. Collaborations with local distributors and promotional campaigns highlighting nutritional benefits are further enhancing consumer adoption. As the Japanese market matures, opportunities exist for both domestic and international brands to capture market share by catering to evolving taste preferences, wellness trends, and convenience-oriented snacking habits.

Global Kale Chips Market: Key Takeaways

- Market Value: The global kale chips market size is expected to reach a value of USD 857.1 million by 2034 from a base value of USD 417.9 million in 2025 at a CAGR of 8.3%.

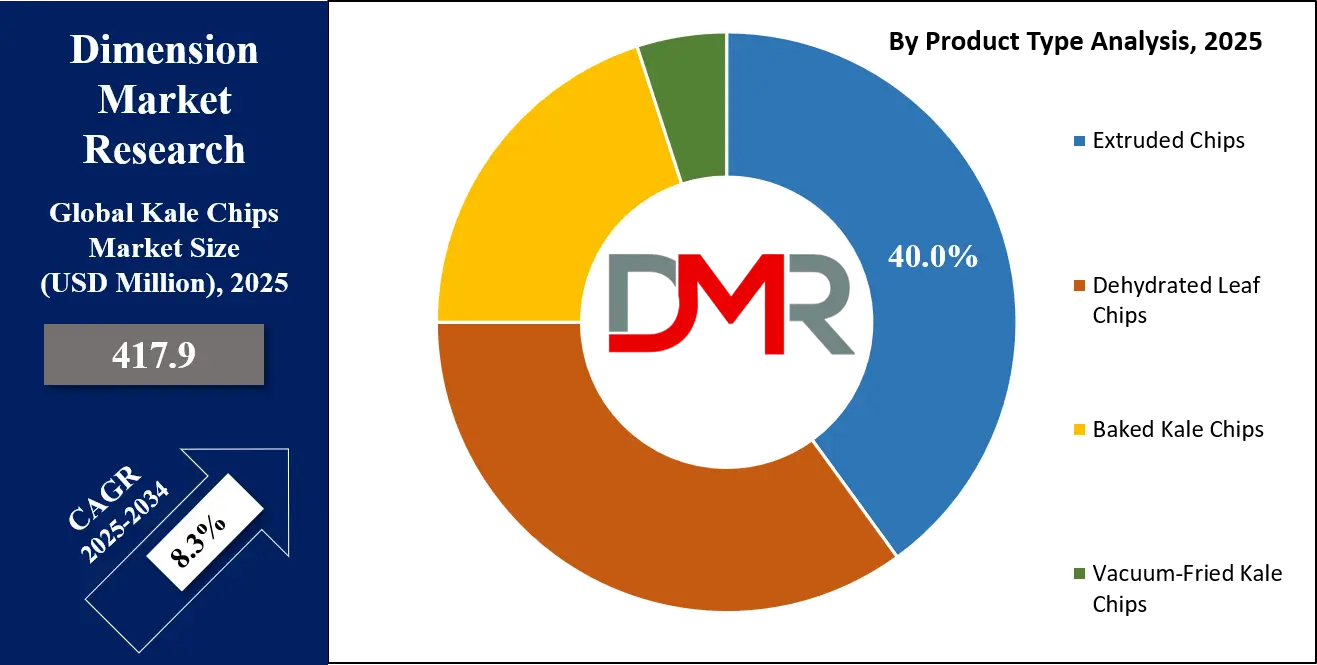

- By Product Type Analysis: Extruded Chips are anticipated to dominate the product type segment, capturing 40.0% of the total market share in 2025.

- By Flavor Segment Analysis: Flavored chips are expected to maintain their dominance in the flavor segment, capturing 67.0% of the total market share in 2025.

- By Category Segment Analysis: The Conventional category will dominate the category segment, capturing 72.0% of the market share in 2025.

- By Distribution Channel Segment Analysis: Hypermarkets/Supermarkets will account for the maximum share in the distribution channel segment, capturing 39.0% of the total market value.

- Regional Analysis: North America is anticipated to lead the global kale chips market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global kale chips market include General Mills Inc., Brad’s Plant Based LLC, Simply 7 Snacks LLC, Healthy Crunch, The Green Snack Co., Vermont Kale Chips, The Kale Factory, Rhythm Foods Pty Ltd, Aldi Süd (Just Nature), Jackson’s Chips, LesserEvil LLC, Organic Raw Trade Co., Simply Nature (ALDI), and Others.

Global Kale Chips Market: Use Cases

- Healthy Snacking Alternative: Kale chips serve as a nutritious and low-calorie alternative to conventional snacks such as potato chips and fried snacks. Rich in vitamins, minerals, and antioxidants, they cater to health-conscious consumers seeking plant-based, high-fiber, and nutrient-dense options. Their portability and convenience make them ideal for on-the-go snacking, lunchboxes, or office breaks, driving demand in retail and e-commerce channels.

- Fitness and Sports Nutrition: Fitness enthusiasts and athletes increasingly include kale chips in their diet due to their high fiber content, essential micronutrients, and natural protein. These chips provide a wholesome snacking option that complements pre- or post-workout nutrition, supporting weight management, energy maintenance, and overall wellness. Market growth is supported by the rising trend of functional and clean-label snacks.

- Organic and Specialty Food Segments: Kale chips are gaining traction in the organic, gluten-free, and specialty food markets. Consumers with dietary restrictions or preferences for non-GMO, organic, and allergen-free products prefer kale chips as a safe and nutritious snack choice. Retailers and manufacturers are responding with premium and flavored variants to cater to this niche, high-value segment.

- Culinary and Gourmet Applications: Beyond snacking, kale chips are increasingly used as toppings for salads, soups, and grain bowls, adding texture, flavor, and nutritional value. Chefs and home cooks are incorporating them into gourmet and health-focused dishes, creating opportunities for product diversification and collaboration with foodservice providers. This trend encourages innovation in seasoning, packaging, and ready-to-eat meal integration.

Impact of Artificial Intelligence on the global Kale Chips market

Artificial Intelligence is increasingly influencing the global kale chips market by optimizing production processes, improving supply chain efficiency, and enhancing product innovation. AI-powered analytics help manufacturers predict consumer preferences for flavors, packaging, and health-focused formulations, enabling data-driven decisions for new product launches. Machine learning algorithms also support demand forecasting, reducing waste and ensuring consistent product quality, while AI-driven marketing tools target health-conscious and plant-based snack consumers more effectively. Overall, AI adoption is driving operational efficiency, accelerating innovation, and strengthening market competitiveness in the kale chips industry.

Global Kale Chips Market: Stats & Facts

U.S. Food and Drug Administration (FDA)

- The FDA updated its guidance on low-moisture ready-to-eat food safety standards in 2024, impacting manufacturers of kale chips and similar products.

- The FDA's Food Safety Modernization Act (FSMA) continues to influence food safety practices for manufacturers, including those producing kale chips.

U.S. Bureau of Labor Statistics (BLS)

- The BLS reported an increase in employment in the food manufacturing sector from 2023 to 2025, potentially affecting the production capacity for kale chips.

- Data from the BLS indicates a rise in wages within the food manufacturing industry, which could influence the cost structure of kale chip production.

U.S. Census Bureau

- The Census Bureau's 2024 Economic Census highlighted growth in the snack food manufacturing industry, which includes companies producing kale chips.

- According to the Census Bureau, there was an increase in the number of establishments in the snack food industry from 2023 to 2024.

European Commission

- The European Commission's 2023 report on organic farming showed a 5% increase in organic farming land in the EU, potentially affecting the supply of organic kale for kale chips.

- In 2024, the European Commission implemented new food labeling regulations that may impact the marketing of kale chips in Europe.

Global Kale Chips Market: Market Dynamics

Global Kale Chips Market: Driving Factors

Growing Health and Wellness Awareness

Rising consumer awareness about healthy eating habits and the adverse effects of processed snacks is significantly boosting the demand for kale chips. Consumers are increasingly seeking plant-based, nutrient-rich, and low-calorie snacks, positioning kale chips as a preferred alternative. The focus on antioxidant-rich, vitamin-packed, and high-fiber snacks is driving adoption across both urban and health-conscious populations.

Expansion of Retail and Online Distribution Channels

The proliferation of supermarkets, health food stores, and e-commerce platforms has enhanced the availability of kale chips globally. Online retail channels allow manufacturers to reach a wider audience, provide convenient doorstep delivery, and offer variety packs, contributing to increased market penetration. This omni-channel presence supports brand visibility and encourages trial among new consumers.

Global Kale Chips Market: Restraints

High Production and Raw Material Costs

Kale chips manufacturing involves specialized processes such as baking, dehydration, and vacuum-frying, which increase production costs. Additionally, sourcing organic or high-quality kale adds to expenses, limiting affordability and wider consumer adoption in price-sensitive regions.

Limited Consumer Awareness in Emerging Markets

While demand is high in North America and Europe, kale chips remain a niche product in many developing countries. Lack of awareness about their health benefits and limited marketing initiatives can hinder market growth in regions with untapped potential.

Global Kale Chips Market: Opportunities

Innovation in Flavors and Product Variants

There is a growing opportunity for manufacturers to introduce flavored and functional kale chips, including options with superfood blends, protein fortification, or low-sodium seasoning. Such innovation can attract millennials and fitness-conscious consumers seeking both taste and health benefits.

Expansion into Emerging Markets

Rising disposable incomes, urbanization, and increasing awareness of healthy snacking in Asia-Pacific, Latin America, and the Middle East offer significant growth opportunities. Targeted marketing campaigns, local partnerships, and e-commerce expansion can accelerate market penetration in these regions.

Global Kale Chips Market: Trends

Shift toward Organic and Clean-Label Snacks

Consumers are increasingly preferring non-GMO, organic, and preservative-free kale chips. The clean-label trend is driving manufacturers to highlight natural ingredients, transparent sourcing, and eco-friendly packaging to appeal to health-conscious buyers.

Integration with Functional and Gourmet Foods

Kale chips are being incorporated into functional snacks, salads, grain bowls, and ready-to-eat meals, aligning with gourmet and wellness-focused eating trends. This trend encourages cross-segment innovation, creating opportunities for collaborations with restaurants, meal kit providers, and foodservice chains.

Global Kale Chips Market: Research Scope and Analysis

By Product Type Analysis

In the global kale chips market, extruded chips are anticipated to dominate the product type segment, capturing around 40.0% of the total market share in 2025. Extrusion is a high-pressure manufacturing process in which kale leaves are mixed with other natural ingredients and pushed through specialized machinery to form uniform, crispy shapes. This process not only improves the texture and crunchiness of the chips but also allows for the incorporation of a variety of flavors, seasonings, and even functional nutrients such as protein or fiber.

Extruded kale chips are particularly popular among consumers seeking convenient, ready-to-eat snacks that combine taste with health benefits, making them widely available across supermarkets, health food stores, and online retail platforms. Their long shelf life, consistent quality, and ability to be produced in bulk further strengthen their position as a preferred product type in the kale chips market.

Dehydrated leaf chips hold an important share in the market as well, offering a healthier and minimally processed alternative. These chips are made by carefully drying whole or chopped kale leaves at controlled low temperatures, which removes moisture while preserving essential vitamins, minerals, and antioxidants. Unlike extruded chips, dehydrated leaf chips maintain the natural structure and flavor of the kale, making them appealing to consumers who prioritize clean-label, nutrient-rich snacks.

They are often lightly seasoned with natural flavors such as sea salt, garlic, or chili, enhancing taste without adding artificial additives. Dehydrated leaf chips are popular among health-conscious individuals, fitness enthusiasts, and parents seeking nutritious snack options for children, positioning them as a key product segment in the expanding kale chips market. Their versatility allows them to be consumed directly as a snack or incorporated into salads, soups, and other gourmet dishes, further broadening their appeal across different consumer groups.

By Flavor Analysis

In the global kale chips market, flavored chips are projected to maintain their dominance in the flavor segment, accounting for approximately 67.0% of the total market share in 2025. Flavored kale chips are seasoned with a variety of natural and innovative ingredients, such as sea salt, garlic, cheese, chili, barbecue, and herb blends, to enhance taste while retaining the health benefits of kale.

The popularity of flavored chips is largely driven by consumers’ desire for tasty yet nutritious snacking options that cater to diverse taste preferences. These chips appeal to a wide demographic, including fitness enthusiasts, young adults, and families seeking flavorful, plant-based snacks. Manufacturers are also leveraging flavored variants to differentiate their products, attract repeat purchases, and expand their presence across retail and e-commerce platforms.

Additionally, flavored kale chips often incorporate functional ingredients like vitamins, protein, or superfoods, adding value and aligning with the growing trend of health-focused, functional snacking.

Unflavored kale chips, on the other hand, represent a smaller but significant portion of the market, catering to consumers who prefer the natural taste and nutritional purity of kale. These chips are typically lightly processed with minimal seasoning, preserving the authentic flavor, color, and nutrients of the leaves. Unflavored kale chips appeal to health-conscious consumers, clean-label enthusiasts, and those who prefer to customize their snacks with their own seasonings at home.

They are often marketed as organic, non-GMO, or preservative-free, aligning with the demand for minimally processed and wholesome foods. Despite being less popular than flavored variants, unflavored chips are valued for their versatility, allowing them to be incorporated into salads, soups, and other recipes while providing a nutrient-rich, low-calorie snacking option.

By Category Analysis

In the global kale chips market, the conventional category is projected to dominate, capturing around 72.0% of the market share in 2025. Conventional kale chips are produced using standard agricultural practices and traditional processing methods, making them widely accessible and more affordable for mainstream consumers. They include a range of baked, extruded, and dehydrated variants that cater to different taste and texture preferences.

The popularity of conventional kale chips is driven by their availability in supermarkets, convenience stores, and online retail platforms, as well as their consistent quality and variety of flavors. Consumers are drawn to these products for their combination of taste, nutrition, and convenience, making them a preferred choice in everyday snacking.

Organic kale chips, on the other hand, occupy a smaller but steadily growing segment of the market. These chips are made from kale grown without synthetic pesticides, herbicides, or genetically modified organisms, appealing to health-conscious and environmentally aware consumers. Organic variants are often positioned as premium products and are marketed for their clean-label attributes, superior nutrient retention, and sustainable sourcing. Although they are generally priced higher than conventional chips, the increasing consumer preference for natural, non-GMO, and eco-friendly snacks is driving steady growth in this segment, particularly among urban populations and wellness-focused buyers seeking nutritious, guilt-free snacking options.

By Distribution Channel Analysis

In the global kale chips market, hypermarkets and supermarkets are expected to account for the largest share of the distribution channel segment, capturing around 39.0% of the total market value. These large retail formats provide wide accessibility and visibility for kale chip products, offering a variety of brands, flavors, and packaging options under one roof. Consumers are drawn to the convenience, organized shopping experience, and promotional offers available in these stores. The dominance of hypermarkets and supermarkets is also supported by strong partnerships between manufacturers and retailers, ensuring consistent supply, prominent shelf placement, and attractive marketing campaigns that encourage trial and repeat purchases.

Health food stores, in contrast, represent a smaller yet influential segment of the distribution channel. These stores cater specifically to health-conscious consumers who prioritize organic, non-GMO, gluten-free, and minimally processed snacks. Kale chips sold in health food stores are often positioned as premium or specialty products, highlighting their nutritional benefits, clean-label ingredients, and functional properties. This channel appeals to consumers seeking high-quality, nutrient-dense, and plant-based snacks, providing manufacturers with an opportunity to target a niche market that values wellness-oriented products and is willing to pay a premium for perceived health benefits.

The Kale Chips Market Report is segmented on the basis of the following:

By Product Type

- Extruded Chips

- Dehydrated Leaf Chips

- Baked Kale Chips

- Vacuum-Fried Kale Chips

By Flavor

By Category

By Distribution Channel

- Hypermarkets/Supermarkets

- Health Food Stores

- Convenience Stores

- Online Retailers

- Others

Global Kale Chips Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global kale chips market, accounting for approximately 38.0% of the total market revenue in 2025. The region’s dominance is driven by high consumer awareness of health and wellness, increasing demand for plant-based and nutrient-rich snacks, and widespread adoption of clean-label and organic products. The presence of established snack manufacturers, extensive retail and online distribution networks, and innovative product offerings in flavors and packaging further strengthen market growth.

Additionally, the growing trend of convenient, ready-to-eat, and on-the-go snacking among urban consumers supports the expansion of kale chips across North America, making it the largest and most mature market globally.

Region with significant growth

The Asia-Pacific region is poised to register significant growth in the global kale chips market due to rising disposable incomes, rapid urbanization, and increasing consumer awareness of healthy and plant-based snacking options. Countries such as China, India, and Japan are witnessing a growing preference for low-calorie, nutrient-rich, and convenient snacks among millennials and working professionals. Expansion of modern retail chains, the rise of e-commerce platforms, and targeted marketing campaigns by both international and local manufacturers are driving greater product availability and adoption.

Additionally, the increasing influence of Western dietary trends and wellness-focused lifestyles is further accelerating the demand for kale chips in this high-growth region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Kale Chips Market: Competitive Landscape

The global kale chips market features a competitive landscape with a mix of established multinational food companies and niche health-focused brands striving to capture market share through innovation, branding, and distribution expansion. Key players are differentiating themselves by offering diverse product portfolios that include baked, extruded, and dehydrated variants with various flavors and functional ingredients.

Companies are also investing in organic, non-GMO, and clean-label products to cater to health-conscious consumers. Strategic initiatives such as collaborations with retail chains, online sales expansion, and marketing campaigns highlighting nutritional benefits are intensifying competition, driving innovation, and shaping market dynamics in the rapidly growing kale chips industry.

Some of the prominent players in the global Kale Chips market are:

- General Mills Inc.

- Brad’s Plant Based LLC

- Simply 7 Snacks LLC

- Healthy Crunch

- The Green Snack Co.

- Vermont Kale Chips

- The Kale Factory

- Rhythm Foods Pty Ltd

- Aldi Süd (Just Nature)

- Jackson’s Chips

- LesserEvil LLC

- Organic Raw Trade Co.

- Simply Nature (ALDI)

- Made in Nature

- SunChips (PepsiCo)

- The Angel Kale Co.

- Lydia’s Foods Inc.

- Alive & Radiant Foods

- Bett`r (Smart Organic)

- Chicago Kale Chip Co.

- Other Key Players

Global Kale Chips Market: Recent Developments

- February 2025: An emerging kale chips brand secured seed funding to expand its operations and product line. The investment will support the brand's growth in the competitive healthy snack market.

- December 2024: A startup specializing in kale chips successfully closed its first funding round, achieving 161.4% of its funding goal. This overachievement indicates strong investor confidence and market interest in innovative kale chip products.

- July 2024: Healthy Crunch, a Canadian health food brand, acquired The Kale Factory, a company known for its kale-based products. The acquisition aims to strengthen Healthy Crunch's position in the kale snack market and broaden its product offerings.

- June 2024: Rhythm Superfoods unveiled a refreshed packaging design for its Zesty Nacho Organic Kale Chips. The new packaging highlights the product's organic and non-GMO attributes, aiming to attract health-conscious consumers seeking flavorful snack options.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 417.9 Mn |

| Forecast Value (2034) |

USD 857.1 Mn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 133.6 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Extruded Chips, Dehydrated Leaf Chips, Baked Kale Chips, Vacuum-Fried Kale Chips), By Flavor (Flavored, Unflavored), By Category (Conventional, Organic), By Distribution Channel (Hypermarkets/Supermarkets, Health Food Stores, Convenience Stores, Online Retailers, Others)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

General Mills Inc., Brad’s Plant Based LLC, Simply 7 Snacks LLC, Healthy Crunch, The Green Snack Co., Vermont Kale Chips, The Kale Factory, Rhythm Foods Pty Ltd, Aldi Süd (Just Nature), Jackson’s Chips, LesserEvil LLC, Organic Raw Trade Co., Simply Nature (ALDI), and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global kale chips market size is estimated to have a value of USD 417.9 million in 2025 and is expected to reach USD 857.1 million by the end of 2034.

The US kale chips market is projected to be valued at USD 133.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 262.5 million in 2034 at a CAGR of 7.8%.

North America is expected to have the largest market share in the global kale chips market, with a share of about 39.0% in 2025.

Some of the major key players in the global kale chips market are General Mills Inc., Brad’s Plant Based LLC, Simply 7 Snacks LLC, Healthy Crunch, The Green Snack Co., Vermont Kale Chips, The Kale Factory, Rhythm Foods Pty Ltd, Aldi Süd (Just Nature), Jackson’s Chips, LesserEvil LLC, Organic Raw Trade Co., Simply Nature (ALDI), and Others.

The market is growing at a CAGR of 8.3 percent over the forecasted period.