AI in the manufacturing market of the Kingdom of Saudi Arabia has been gaining prominent momentum, given the country's Vision 2030 to diversify its economy by embracing state-of-the-art technologies. Integrating AI into the manufacturing process has resulted in increased productivity, better quality, and improved efficiency of operation, thus enabling the sector to be more competitive in the global market.

The government has also actively invested in infrastructure, R&D, and digital transformation; hence, this market is going to see heavy growth in the forthcoming years. Several reports highlight the fact that key AI applications, like Predictive Maintenance, Process Automation, and Supply Chain Optimization among others, are also fast gaining ground and promise a very strong drift to Industry 4.0. This transformation is also driven by partnerships between local producers and global leaders in technology, enhancing innovation and skill development among the employees.

High costs for the implementation of these technologies, resistance to change, and shortages of specialized AI talent pose problems despite this growth prospect. Most manufacturing companies have difficulties in integrating AI technologies due to financial and technical problems, especially small- and medium-scale enterprises. Yet, it is also true that obstacles are being overcome gradually because of government initiatives on education and training, or subsidy provisioning for technological upgrades. The emergence of both cloud-based AI solutions and modular systems provides more affordable solutions, thus enabling businesses to adopt AI technologies incrementally.

The strategic geographical location of Saudi Arabia, combined with its robust industrial base, offers special opportunities for leveraging AI in manufacturing. The leading position of the country in industries like petrochemicals, automotive, and electronics manufacturing underlines the potential of AI-driven innovations for enhanced output and cost reduction. Since most of the industries are energy-intensive, AI can optimize supply chain management and energy consumption, thus aligning with the sustainability goals of the Kingdom. Besides, considering the development of robotics and automation in manufacturing, there is expected to be further demand for AI technologies, reinforcing this country's competitive position in the global market.

It also gains from a continuous inflow of foreign investments and collaborations that bring advanced AI tools and expertise to the local industries. Scalability, however, remains one of the major concerns for manufacturers. While larger enterprises tend to adopt AI-powered solutions more rapidly than small firms, small firms require customized approaches in order to fully take advantage of AI technologies. Therefore, sustained government assistance along with private sector participation are required in order to bridge any disparate manufacturing sector growth experiences and make manufacturing growth inclusive for everyone involved.

AI manufacturing will play a key role in Saudi Arabia's diverse economy and offer significant growth potential over the coming decade. According to estimates from analysts at Global Information Research Enterprise Centers and others, Saudi's focus on AI adoption demonstrates its place as a pioneer for innovation while at the same time remaining efficient under global manufacturing regime. This is where its synergistic effect of AI-influenced aspects of the industry will, no doubt, redefine the Kingdom's futuristic industrial blueprint with seamless compliance with the bigger economic perspectives.

Key Takeaways

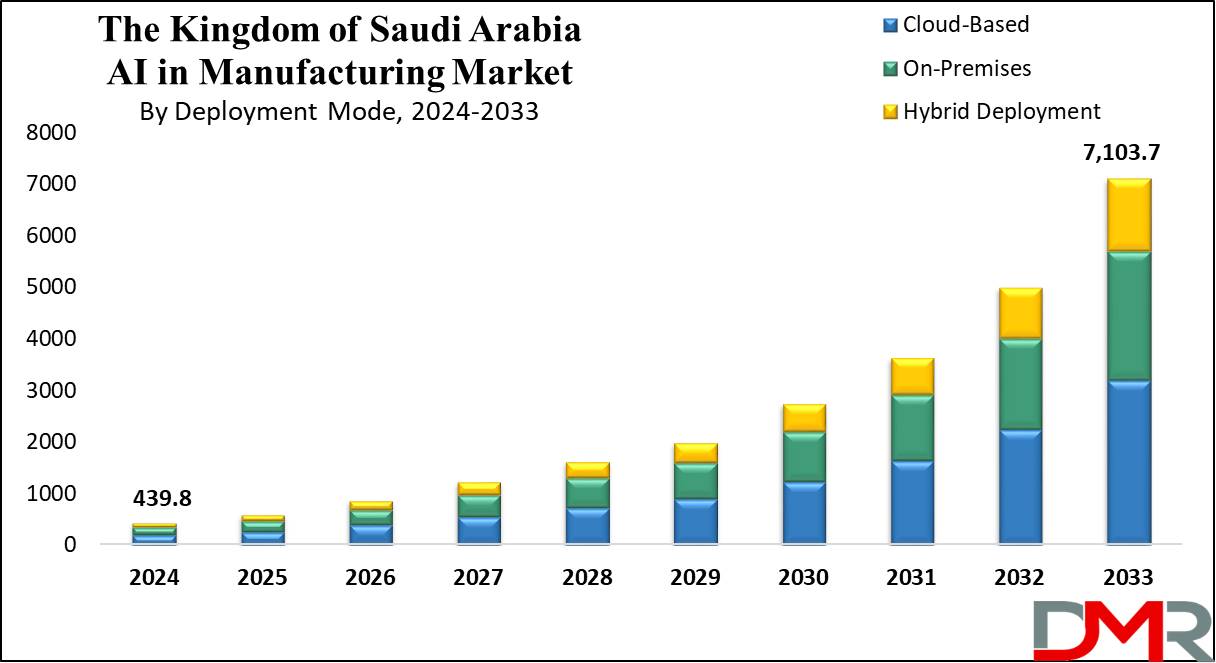

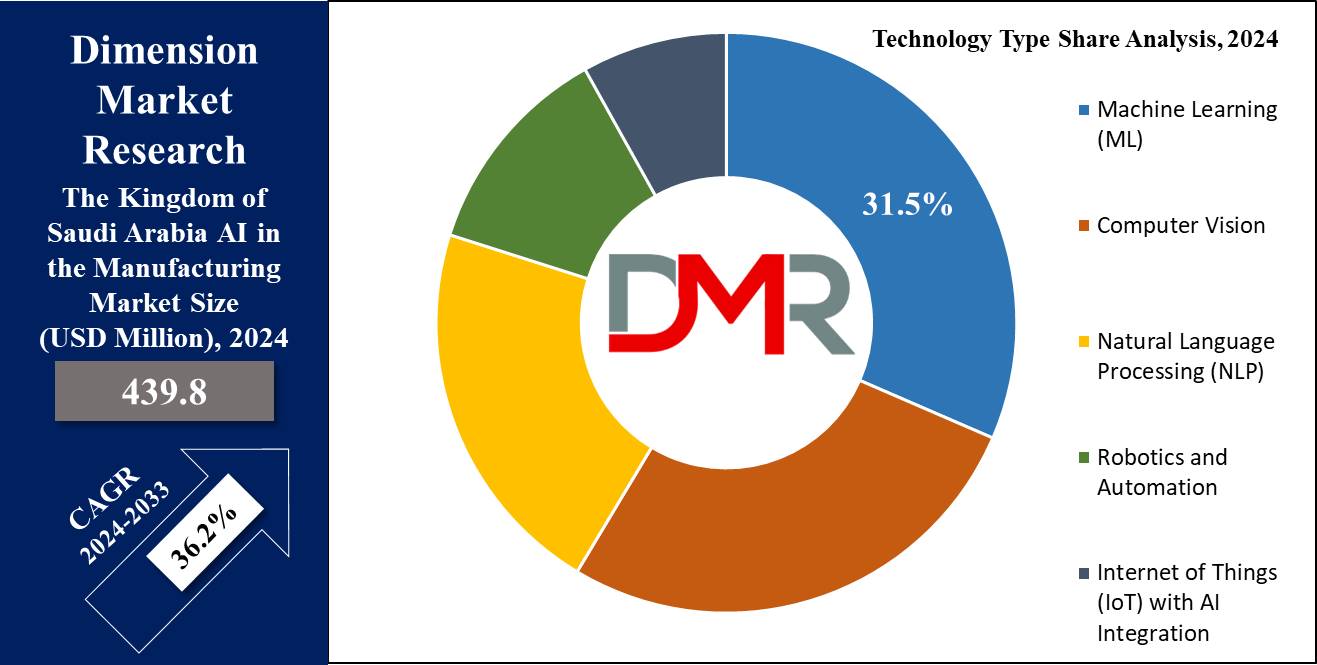

- Market Value: The Kingdom of Saudi Arabia AI in Manufacturing Market size is estimated to have a value of USD 439.8 million in 2024. It is expected to reach USD 7,103.7 million by the end of 2033.

- Key Players: Some of the major key players in The Kingdom of Saudi Arabia's AI Manufacturing Market are IBM, Microsoft, Siemens, ABB, Honeywell, GE Digital, Schneider Electric, Rockwell Automation, and many others.

- By Technology Type Segment Analysis: Machine Learning (ML) is projected to dominate this market in the context of technology as it will hold 31.5% of market share in 2024.

- By Deployment Mode Segment Analysis: Cloud-Based deployment dominates this segment with 44.9% of the market share in 2024.

- Growth Rate: The market is growing at a CAGR of 36.2 percent over the forecasted period.

Use Cases

- Predictive Maintenance: With AI-powered systems, anomalies in machinery are detected, hence enabling proactive maintenance and reduction of downtimes by as much as 30%.

- Quality Control: Computer vision finds defects in the production of goods while maintaining high standards of quality with minimum human interference.

- Supply Chain Optimization: AI-powered analytics enhance demand forecasting, inventory management, and logistical efficiency to improve supply chain reliability.

- Robotic Process Automation: AI-enabled robots streamline tasks related to assembly lines, increasing production speed and precision while reducing operational costs.

Market Dynamic

Trends

Increasing Adoption of Industry 4.0The manufacturing sector of Saudi Arabia is hugely transforming with the help of technologies related to Industry 4.0. AI has become the cornerstone of this change, thus helping in the formation of smart factories based on real-time data and automation. Predictive maintenance now is one of the key applications, reducing equipment downtime by

up to 30.0% and enhancing operational efficiency.

Similarly, AI-powered automation is setting new standards for productivity related to the assembly line by increasing throughput by 25.0% while reducing errors. Standards such as these are now expected and further cement the fact that these technologies are indispensable, as manufacturers begin implementing AI to optimize processes, waste reduction, and cost efficiency.

Collaborations and Partnerships

Strategic alliances between local manufacturers and global AI leaders will accelerate the pace of innovation and the rate of AI adoption in Saudi Arabia. Such collaborations have grown by over 40.0% in recent years, thus indicating their importance. Besides providing state-of-the-art solutions, such alliances further allow knowledge transfer and acquiring key AI skills by local talent. This joint venture-the result of partnerships involving the likes of Saudi Aramco and global tech companies-will spur development towards proprietary AI solutions to create more competitive energy-intense industries, aligned with the country's Vision 2030.

Growth Drivers

Government Initiatives and Investments

AI adoption in manufacturing is catalyzed by the Saudi Arabian government's Vision 2030. Under the NIDLP, AI was one of the focus areas to be brought in for modernizing the manufacturing process. Total investments in AI R&D went above USD 500.0 million in the year 2023, and the government has announced various forms of subsidies and other financial incentives for manufacturers while using AI-driven solutions.

It also involves the development of a better-skilled workforce in these policies, through which more than 50,000 professionals have already gained training in AI and related areas, aided by various government-backed programs. Digital transformation will ensure that fully integrated AI within the core of manufacturers' operations drives productivity and competitiveness.

Growing Demand for Efficiency

As global competition intensifies, Saudi manufacturers are under pressure to optimize operations and reduce costs. AI applications such as process automation and supply chain analytics are central to meeting this demand, offering cost reductions of up to 20.0%. Additionally, AI-driven energy management systems have helped manufacturers lower energy costs by 15.0-25.0%, aligning with both financial objectives and sustainability goals. These efficiency gains not only support profit margins but also help position Saudi Arabia as a global hub for high-tech, efficient manufacturing.

Growth Opportunities

AI in Energy Management

The petrochemical and metals industries, which are among the largest contributors to Saudi Arabia's GDP, are energy-intensive. AI technologies can revolutionize energy management by identifying inefficiencies in energy use, predicting high-demand periods, and optimizing energy allocation. AI-powered energy monitoring solutions have already demonstrated cost reductions of up to 30.0% in pilot projects. By aligning with global sustainability standards, these innovations create opportunities for manufacturers to reduce their carbon footprint and enhance their reputation on the international stage.

Emergence of Custom AI Solutions for SMEs

SMEs account for a significant portion of Saudi Arabia’s manufacturing sector, yet they often lack the resources to adopt large-scale AI implementations. Developing affordable, modular AI tools specifically designed for SMEs can unlock this untapped market. For instance, cloud-based AI platforms, which reduce upfront costs by up to 50.0%, enable SMEs to gradually adopt AI capabilities. This incremental approach allows smaller businesses to modernize without significant financial strain, creating a pathway for widespread AI integration across the manufacturing ecosystem.

Restraints

High Initial Costs

The deployment of AI technologies in manufacturing demands substantial upfront investment, covering hardware, software, and skilled personnel. AI system implementation costs can range from USD 100,000 to over USD 1.0 million, depending on the scale and complexity. For SMEs, which form 90.0% of the manufacturing base, these costs are a significant deterrent. To address this, tailored financing solutions, government-backed grants, and public-private partnerships are crucial to lowering barriers to entry and encouraging adoption.

Lack of Skilled Workforce

A critical bottleneck for AI adoption in Saudi Arabia’s manufacturing sector is the shortage of skilled professionals. The demand for data scientists, AI engineers, and technicians with expertise in robotics exceeds supply by 30.0%. While the government is investing in AI training programs, the skill gap remains a pressing issue. The establishment of AI-focused academic institutions and global talent partnerships is essential to bridging this divide. Without addressing this constraint, the full potential of AI-driven manufacturing may remain unrealized, stalling progress in key sectors.

Research Scope and Analysis

By Technology Type

Machine Learning (ML) acts as the backbone of AI adoption in Saudi Arabia's manufacturing industry, mainly because of its exceptional capability related to handling voluminous and complex datasets that stir efficiency and innovation in various industries. The inherent nature of ML to learn and improve over time will help manufacturers optimize workflows, minimize errors, and predict future outcomes with precision.

Condition Predictive maintenance will involve the action of ML-powered algorithms by analyzing sensor data from respective pieces of equipment to show early signals of wear and thus avoiding costly downtime with MachineryLife extension. In quality control, the ML models go as far as using advanced computer vision to detect products that are defective in quality during production, ensuring production consistency according to standards that create less waste. It is also a game-changer in supply chain optimization-data pattern analysis to predict demand, optimize inventories, and pave the way for smooth logistics in real-time.

In addition, in very resource-intensive sectors such as petrochemicals and metals, ML optimizes directly energy consumption and resource usage to contribute to cost savings and sustainability goals. As Industry 4.0 ushers in newer dimensions, ML facilitates real-time decision-making, allows autonomous operations, and propels smart factory initiatives forward. This adaptability to diversified applications and its continuous evolution ensure that ML will remain a cornerstone technology for transforming Saudi Arabia's manufacturing landscape.

By Deployment Mode

Cloud-based AI solutions in Saudi Arabia, with their unprecedented scalability, flexibility, and affordability, lead the market of manufacturing solutions. Manufacturers who need the most recent versions of various AI solutions for different verticals of a business get access without substantial upfront investments in infrastructure. This will be key in helping modernize such company operations aligned with the goals of the Kingdom's Vision 2030, a broad program of digital transformation.

Its integration is smooth with other IoT devices that can offer seamless real-time data acquisition and analysis for operations distributed across large areas. This enables predictive maintenance, process optimization, and energy management. Beyond that, cloud platforms drive collaboration ways to share data and analytics tools with remote teams that drive efficiency and innovation in a distributed manufacturing environment.

Top cloud providers like AWS, Microsoft Azure, and Oracle Cloud also address region-specific concerns related to data sovereignty, compliance, and cybersecurity, making it even easier for manufacturers to feel confident in their adoption. Hybrid models are also finding their way in offering a balance between on-premise control for sensitive operations and scalability in the cloud for wider analytics.

This dual approach will help manufacturers reap the advantages of the cloud while responding to the specific needs of their operations, hence making cloud-based solutions a linchpin in AI adoption in Saudi Arabia's manufacturing industry.

By Company Size

Large companies are driving the adoption of AI in Saudi Arabia's manufacturing sector, and their strong financial capability aligns with government-backed initiatives such as Vision 2030 and the National Industrial Development and Logistics Program. Large organizations involved in capital-intensive industries like petrochemicals, automotive, and metals can achieve considerable operational efficiencies through the use of AI technologies such as robotics, automation, and advanced analytics.

At their most critical levels, therefore, assembly-line robotics with artificial intelligence-driven automation technologies also significantly cut human error in manufacturing, further increasing productivity by saving colossal sums and boosting efficiency immeasurably. Large enterprises have several other competitive edges: these can, of course, take up strategic partnerships to acquire state-of-the-art big-ticket technologies and vital insights available only with world leaders in these areas. Large budgets allow them to make investments in the training of the workforce to develop them to fill the gap of skills that are necessary actually to realize the power of such AI solutions.

Also, scaling up the deployments on more than one facility increases their ability to be the leading edge in leveraging AI to gain a competitive advantage. The large enterprise acts as an early adopters of such innovations, setting the standard in a manner likely to encourage other, usually smaller-scale companies, to follow through, thereby driving AI adoption in the entire manufacturing ecosystem within the Kingdom.

By Functionality

AI-driven planning and scheduling tools are, therefore, indispensable for the manufacturing industries of Saudi Arabia, where operational efficiency is still a dire need in the highly competitive global market. Advanced algorithms use historical data, real-time input, and predictive models to generate the best resource allocation and seamless production flow. The key to the planning tools built on a foundation of AI-driven systems is to have the lowest amount of productivity-sapping inefficiency.

In case of demand fluctuation, supply chain disruption, or equipment failure, the dynamic adjustment of the schedule keeps the entire auto and petrochemical world on an even keel, as their timelines are inextricably tied with tight supply chains around the world. Furthermore, AI consolidates data from many sources into one platform and allows manufacturers to predict bottlenecks, thus reassigning resources more intelligently and aligning production schedules with inventory and logistics needs.

All this coordination makes them very responsive to market demands, reducing downtimes and minimizing costs in the process. As Saudi Arabia gears up for an industrial transformation under Vision 2030, the ability to optimize planning and scheduling with AI is fast becoming a key differentiator for manufacturers striving to achieve operational excellence and global competitiveness.

By Application

Some of those AI applications are predictive maintenance and machine monitoring that bring metamorphosis, hence commanding the dominant share in the construction industries of Saudi Arabia by addressing vital challenges such as unforeseen factory downtime, inefficiency in critical equipment, and high maintenance costs. Running data gathered from machinery sensors, an AI-powered system detects anomalies, predicts impending failure, and provides recommendations on timely interventions to enable manufacturers to shift from reactive to proactive maintenance strategies.

This shift cuts downtime by half and maintenance costs up to 30%, thereby unlocking tremendous financial and operational savings. Applications are very critical to capital-intensive industries, the likes of which include petrochemical and automotive industries, even minute disruption may result in losses to the tune of crores. Additionally, machine monitoring ensures quality standards by detecting deviations during the processes in real time to ensure fewer defects and wastages.

This further gets enhanced with the integration of IoT devices with AI that will enable manufacturers to monitor the health and performance of equipment at remote locations. Predictive maintenance and machine monitoring have become an integral part of smart manufacturing, enhancing efficiency, sustainability, and resilience in the sector, as Saudi Arabia continues its adoption of Industry 4.0 principles.

By Industry Vertical

Automotive manufacturing is at the forefront of AI adoption in Saudi Arabia, as the automotive represents the vanguard that is driven by precision, efficiency, and innovation that is required within the sector. The Kingdom of Saudi Arabia is positioning itself for a critical contribution to industrial growth through significant investments that result from the expansion of the current automotive sector, all linked to the economic diversification goals of Vision 2030.

AI-powered tools are now central to this transformation. This has, in particular, ensured that quality control uses computer vision algorithms for defect identification in real time to maintain consistent product standards with minimal waste. Robotics and automation technologies enhance efficiency on the assembly line, enabling manufacturers to mass-produce quality vehicles with a lower cost of production. AI further revolutionizes supply chain management through its capacity to optimize logistical, inventory, and procurement processes agility toward fluctuating market demands.

Collateral collaborations with global auto giants accelerate this integration process further by encouraging innovation and knowledge transfer. With a growing reliance on AI technologies for operational improvements, it forms the cornerstone of the sector in Saudi Arabia in establishing the ground for an internationally competitive presence of the Kingdom in the automotive market.

The Kingdom of Saudi Arabia AI in Manufacturing Market Report is segmented on the basis of the following

By Technology Type

- Machine Learning (ML)

- Computer Vision

- Natural Language Processing (NLP)

- Robotics and Automation

- Internet of Things (IoT) with AI Integration

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid Deployment

By Company Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Functionality

- Planning and Scheduling

- Product Design and Customization

- Workforce Management

By Application

- Predictive Maintenance and Machine Monitoring

- Quality Control and Inspection

- Supply Chain Optimization

- Process Automation

- Energy Management

By Industry Vertical

- Automotive Manufacturing

- Chemical and Petrochemicals

- Food and Beverage

- Metals and Machinery

- Electronics and Semiconductor

Competitive Landscape

The competitive landscape in the AI market of the KSA includes global technology players, local enterprise initiatives, and the involvement of the public sector. Global companies such as IBM, Microsoft, and Siemens are among the most active in collaborating with Saudi manufacturers to deploy state-of-the-art AI solutions, leveraging their expertise in predictive analytics, robotics, and supply chain optimization. Such projects often involve large-scale industrial projects and are fully aligned with the emphasis on digital transformation in Vision 2030.

They are being joined by local players such as Alat, a conglomerate with financial backing from the Public Investment Fund. Alat has forged strategic partnerships with international companies such as Dahua Technology and SoftBank to enhance its AI capabilities in energy management and automated production lines. These deals reflect a growing trend of nurturing local innovation through knowledge transfer and skill development.

Public initiatives such as the National Industrial Development and Logistics Program will also be important in influencing the market. The commitment of the government to increasing the adoption of AI by providing financial incentives and infrastructure development has lured numerous global players, further increasing the competition.

SMEs also take part in the development but contribute to localized innovations, while high initial costs and shortages of skilled labor put difficulties for small entities entering this field, so established players gain a competitive advantage. The market is very fast-growing, while collaboration and innovation drive its dynamics further with government support.

Some of the prominent players in The Kingdom of Saudi Arabia AI in Manufacturing Market are

- IBM

- Microsoft

- Siemens

- ABB

- Honeywell

- GE Digital

- Schneider Electric

- Rockwell Automation

- Oracle

- SAP

- Alat

- SAS Institute

- PTC

- Other Key Players

Recent Developments

- November 2024: Saudi Arabia Announces USD 100.0 Million AI Initiative to establish an AI technology hub, aiming to position itself as a regional leader in AI and compete with neighboring countries.

- November 2024: Elon Musk Engages Middle Eastern Investors for xAI funding with discussions with investors from Saudi Arabia and Qatar to raise funds for his AI startup, xAI, potentially increasing its valuation to USD 45.0 million.

- October 2024: PIF Shifts Focus to Domestic Projects Saudi Arabia's Public Investment Fund (PIF) announced a strategic shift from global investments to prioritizing domestic projects, including significant investments in AI, aligning with Vision 2030 objectives.

- September 2024: Saudi Arabia AI in Manufacturing Industry Research Report Published that report highlighted the collaborative landscape between Saudi Arabia and global tech leaders, emphasizing partnerships that accelerate AI adoption in manufacturing.

- August 2024: The Public Investment Fund (PIF) of Saudi Arabia announced plans to create a USD 40.0 million fund focused on investing in artificial intelligence, potentially in collaboration with firms like Andreessen Horowitz, to position the Kingdom as a major AI player.

- February 2024: Saudi Arabia's Crown Prince Mohammed bin Salman launched 'Alat,' a conglomerate owned by the Public Investment Fund, aiming to make the Kingdom a global hub for electronics and advanced industries, including AI-driven manufacturing.

- February 2024: Alat entered into partnerships with global companies such as Carrier Global, Dahua Technology, SoftBank Group, and Tahakom to enhance its capabilities in AI and advanced manufacturing sectors.