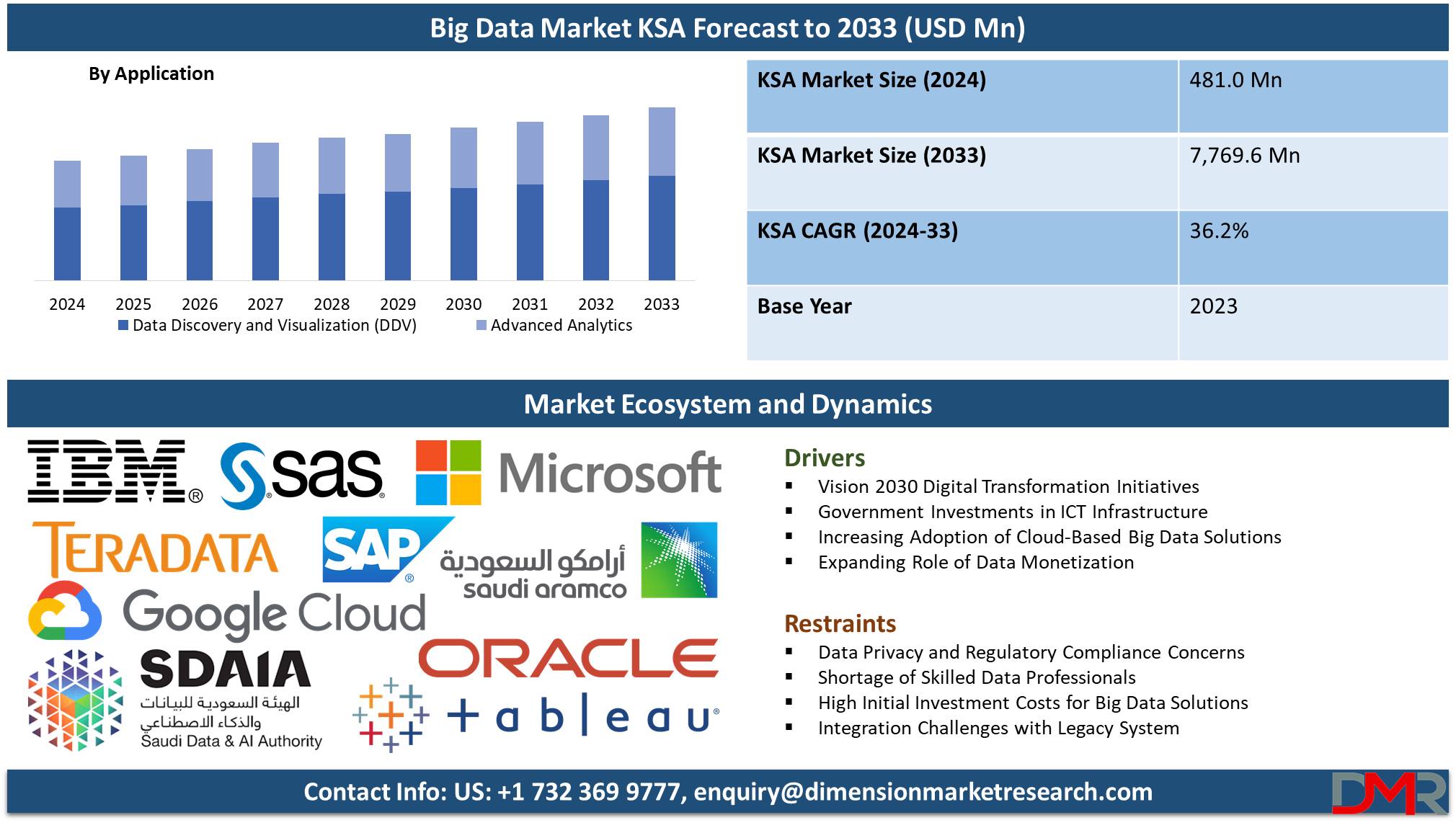

Market Overview

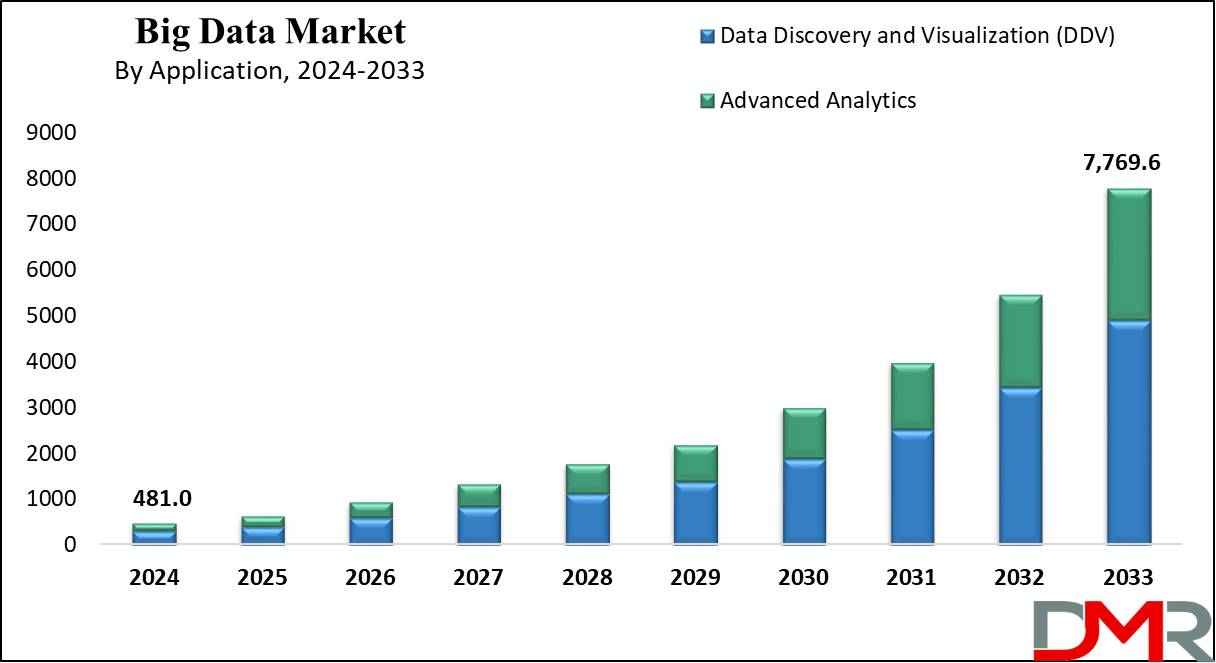

The

Kingdom of Saudi Arabia's Big Data Market size is expected to reach a

value of USD 481.0 million in 2024, and it is further anticipated to reach a market

value of USD 7,769.6 million by 2033 at a

CAGR of 36.2%.

The big data market in the Kingdom of Saudi Arabia has rapidly emerged, and the country is inspired by rapid changes from its Vision 2030. With an increasing drive for diversification of its economy and less reliance on oil, the adoption rate of big data technologies increased significantly across key sectors of the Kingdom. Big data analytics enables organizations to drive down their decisions, optimize operational activities, and improve the experience of their customers. The increasing internet penetration, rise in mobile usage, and digitization of various sectors drive the growth in this market.

Simultaneously, government-led initiatives for improving the digital infrastructure further push forward the adoption of big data solutions in both public and private sectors. AI and ML, when integrated with big data analytics, are two of the major trends in Saudi Arabia's

big data market. These technologies are gaining momentum due to their advanced insights, predictive modeling, and automation of complex processes.

Furthermore, the exponential increase in data from IoT devices, smart city projects, and digital platforms is driving unparalleled demand for scalable and efficient data management solutions. Most of the improvements in many areas, including health, retail, and manufacturing, are made using big data. For example, hospitals consider analytics as a way to improve their patient care and enable them to take better actions based on those analyses. Retail companies use this large volume of consumer behavioral data to refine marketing techniques and strengthen supply chain power.

Big Data keeps growing at a pace as in 2024, every day, 2.5 quintillion bytes of data are generated. This surge in data is driven by an increase in connected devices and accelerated digital transformation across sectors. This year, a total of 147 zettabytes of data are projected to be created worldwide, up 22.5% from 120 zettabytes in 2023. Projections indicate that this number will reach 181 zettabytes by 2025. Big Data analytics has come to play a big role, and more than 97% of businesses worldwide have already invested in it to derive valuable insights, improve efficiency, and ensure profitability.

The big data market of Saudi Arabia has plenty of opportunities, particularly in those areas that come under the circle of Vision 2030. The ambitious smart city project NEOM acts as a strong catalyst; given that it will be generating vast amounts of urban data, it will need advanced analytics for the proper utilization of resources and for making quick decisions. The other opportunity avails in the form of e-governance driven by the government where big data is supposed to contribute towards bringing efficiency in citizens' services and simplification of the administrative processes.

It therefore encompasses a growing number of new data-centric startups in the Kingdom which can promote big potential for innovation and thereby encourage job creation. These initiatives take an investment route and are joining hands to make the entire ecosystem stronger, thus precipitating localized solutions to exactly meet the needs of that region. This aligns with the strategic focus on expanding

The Kingdom of Saudi Arabia (KSA) Cloud Computing capabilities, ensuring secure, scalable, and efficient storage of vast datasets.

Big Data keeps growing at a pace as in 2024, every day, 2.5 quintillion bytes of data are generated. This surge in data is driven by an increase in connected devices and accelerated digital transformation across sectors. This year, a total of 147 zettabytes of data are projected to be created worldwide, up 22.5% from 120 zettabytes in 2023. Projections indicate that this number will reach 181 zettabytes by 2025.

Big Data analytics has come to play a big role, and more than 97% of businesses worldwide have already invested in it to derive valuable insights, improve efficiency, and ensure profitability.

Despite the promising growth trajectory, some restraints might hamper the growth of the big data market in Saudi Arabia. Data privacy and security remain paramount concerns, especially with the imposition of laws like the Personal Data Protection Law.

A balance has to be made between the complexities of compliance a business has to bear and ensuring the processes of data analytics meet very high standards of security. In addition, a shortage of skilled professionals in big data analytics remains one of the challenges. While universities and training institutes have just begun to offer programs for specialization, demand for qualified talent significantly outweighs supply. The high initial costs of adoption for big data technologies and infrastructure discourage smaller organizations from taking up this technology, hindering market penetration.

The statistical growth of the big data market in Saudi Arabia shows that it is gaining importance because of increased investments in the infrastructure of digital technology and also in the adoption of the solutions of advanced analytics by other sectors. Secondly, it can be said that governmental policy for innovation, taking support from tech incubators and accelerators, furthers market growth. Thirdly, the partnerships between global technology providers and Saudi companies drive the implementation of leading-edge big data solutions and thereby further enhance the value proposition of the market. Notably, integration of big data in sectors like

The Kingdom of Saudi Arabia (KSA) Tourism and Real Estate is enhancing service delivery, consumer insights, and investment planning.

Big Data keeps growing at a pace as in 2024, every day,

2.5 quintillion bytes of data are generated. This surge in data is driven by an increase in connected devices and accelerated digital transformation across sectors. This year, a total of 147 zettabytes of data are projected to be created worldwide, up 22.5% from 120 zettabytes in 2023. Projections indicate that this number will reach 181 zettabytes by 2025. Big Data analytics has come to play a big role, and more than 97% of businesses worldwide have already invested in it to derive valuable insights, improve efficiency, and ensure profitability.

Key Takeaways

- Market Value: The Kingdom of Saudi Arabia's Big Data Market size is estimated to have a value of USD 481.0 million in 2024 and is expected to reach USD 7,769.6 million by the end of 2033.

- Key Players: Some of the major key players in The Kingdom of Saudi Arabia's Big Data Market are IBM, Microsoft, Google Cloud, Oracle, Amazon Web Services (AWS), SAP, SAS Institute, Teradata, Cloudera, Palantir, and many others.

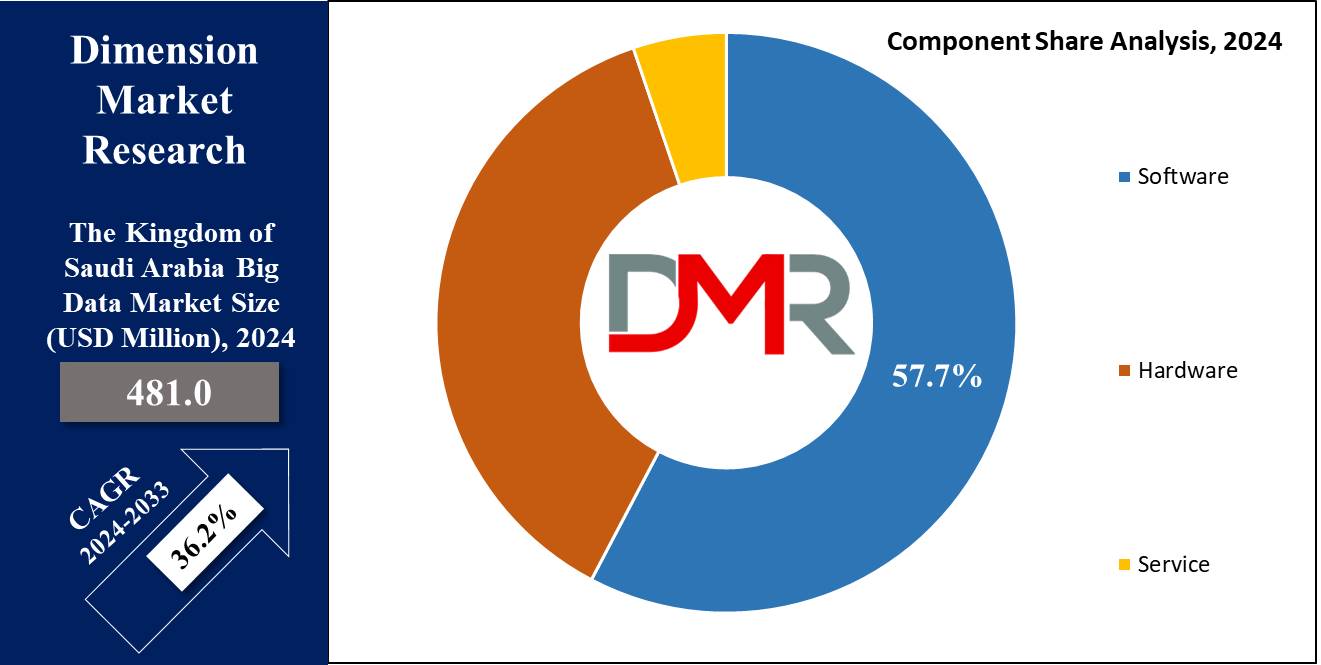

- By Component Segment Analysis: Software is projected to dominate the component segment with 57.7% of market share in 2024.

- By Enterprise Type Segment Analysis: Large enterprises are anticipated to dominate this segment with the highest market share in 2024.

- Growth Rate: The market is growing at a CAGR of 36.2 percent over the forecasted period.

Use Cases

- Smart City Development: Big data technologies are going to form the backbone for Saudi Arabia's most ambitious plan, known as the Vision 2030 initiative, in building futuristic smart cities like

- NEOM: for efficient infrastructure management, flow of traffic, use of energy, and delivery of public services.

- Healthcare Analytics: Sophisticated big data analytics raises the healthcare system in Saudi Arabia to an entirely new stratum in patient care with predictive models for disease outbreaks, and operational efficiencies in hospitals, among many, related to patient data management.

- Oil and Gas Optimization: Big data analytics plays a major role in Saudi Arabia's energy-dominated economy for the betterment of exploration activities, refining operational efficiencies, and enabling predictive maintenance.

- Retail Personalization: Big data analytics help the growing e-commerce and retail industries in the Kingdom with more personalized marketing campaigns, better customer segmentation, efficient inventory management, and a personalized shopping experience for consumers, leading to brand loyalty.

Market Dynamic

Trends

Adoption of AI-Integrated Big Data SolutionsSaudi Arabian organizations use AI-infested big data tools that enable the revolution in decision-making and operational efficiencies, coupled with the capability to truly personalize their services. The AI-driven Big Data thus helps to predict the health conditions of the patients, coupled with priorities for optimizing the resources, while, on the finance side, predictive analytics reduce risks and find those changes that would result in profitable deals.

On one side, retail chains utilize big data insight gained by enhanced analytics by AI and experiences coupled with supply chain improvements. AI integration also allows for automation, thereby reducing manual processes and accelerating workflows that result in cost savings and increased accuracy across industries.

Expansion of Cloud-Based Big Data Services

This transformation into cloud-based big data platforms revolutionizes the way Saudi Arabian businesses manage, store, and process large volumes of data. Cloud solutions ensure scalability, flexibility, and enhanced security features according to the needs of the organization. This is further driven by global cloud providers partnering with local entities that build robust cloud infrastructure in the Kingdom.

For example, such partnerships provide localization of data, adherence to regulations, and improved disaster recovery options. Much less expensive upfront costs and ease of deployment - big data analytics on cloud-based services can be provided to SMEs and large corporations alike, thus making it all-pervasive.

Growth Drivers

Vision 2030 as a Catalyst

Vision 2030 is a transformative initiative that drives digitalization across Saudi Arabia. It underlines the deployment of big data in public services, smart city projects such as NEOM, and digital healthcare platforms. Big data has been instrumental in optimizing resource management, enhancing the efficiency of public services, and promoting transparency.

For example, NEOM utilizes data-driven systems to manage energy, water, and transportation. Other developments include the centralized patient database in the health sector and predictive models in disease control. These few developments just show that the Kingdom is serious about its commitment to being among the leading innovation hubs globally, with technologically driven solutions.

Government Investments in ICT Infrastructure

The heavy investments in ICT infrastructure in Saudi Arabia provide a very solid foundation for big data technologies. Initiatives include the establishment of state-of-the-art data centers, AI research hubs, and nationwide digital transformation programs. These projects aim at integrating big data analytics into sectors such as education, energy, and transportation.

For instance, advanced data centers support real-time analytics in the energy sector, which helps in efficient oil exploration and predictive maintenance. These investments will add to innovation, attract international technology companies, create an enabling ecosystem for local startups, and support the Kingdom's ambition to lead the global digital economy.

Growth Opportunities

Expanding Role of Data Monetization

The growing relevance of data as an economic asset means increasing opportunities for businesses in Saudi Arabia. By leveraging big data analytics, actionable insights can be obtained that drive revenue growth and enhanced customer experiences. For instance, e-commerce platforms put big data into use when analyzing purchasing habits and thus make targeted promotions.

In energy, data monetization helps achieve predictive modeling for efficient operations. Financial institutions use data for fraud detection and personalized banking services. Increasing monetization of data grows competitive advantage and drives a data-driven culture across industries.

Support for Startups and Partnerships

Proactive support for fostering innovation by the Kingdom has led several startups to emerge in the big data space. Initiatives such as the Saudi Data and AI Authority by the government, coupled with partnerships with international tech giants, create a collaborative ecosystem for innovation. The startups are developing niche big data solutions catering to the peculiar needs of the local market, such as real-time traffic management and energy consumption optimization.

These partnerships also facilitate knowledge transfer, upskilling of the workforce, and the creation of customized solutions for industries like retail, healthcare, and logistics, thereby contributing to market growth.

Restraints

Data Privacy and Regulatory Concerns

Some of the major challenges in big data adoption in Saudi Arabia relate to issues concerning data privacy and compliance with both local and global regulatory requirements. Sensitive industries, such as those linked to healthcare and finance, need strong frameworks to deter leakage, unauthorized access, or mishandling of such important data.

For example, unauthorized access to sensitive personal information about medical history, financial transactions, and credit card information may seriously hamper reputation and can, even entail legal consequences. The organizations should be well equipped with cybersecurity measures and must abide by the regulatory requirements such as PDPL that will minimize such risks, which may delay big data projects and hinder innovation.

Shortage of Skilled ProfessionalsThe key constraint on the major growth of the big data market in Saudi Arabia is the limited availability of professionals skilled in data science, machine learning, and analytics. Despite encouragement by the government to enhance STEM education and training, the talent gap is very high. Firms tend to rely on expatriate expertise or outsource key functions, adding significantly to operational costs and making companies less agile.

This talent shortage further dampens the speed at which big data adoption takes place since most SMEs are not equipped to handle talent acquisition and retention processes. In other words, for the talent gap to be bridged, continuous investments in educational, training, and upskilling programs will have to take place.

Research Scope and Analysis

By Component

In Saudi Arabia's big data market, the software is projected to dominate the component segment with 57.7% of market share in 2024. In the Saudi Arabian big data market, the software segment is expected to achieve the highest growth during the forecast period with a CAGR higher than the regional and global averages, especially due to data visualization. Key drivers for this growth include an increase in demand for real-time and mobile data visualization solutions, driven by the need of businesses for immediate access to actionable insights.

Another strong driver of growth is the analytics segment, which is seeing strong adoption across different industries. This points to a growing need to draw strategic insights from big data analytics factor that bodes well and aligns with the focus of Vision 2030 on digital transformation and the use of advanced technologies to further diversify the economy. The drive for big data analytics is all about enabling organizations to make informed, risk-averse decisions in an increasingly competitive landscape.

The growth of the big data software and analytics markets in Saudi Arabia is mainly influenced by their increasing adoption by small and large-scale enterprises. Through these technologies, businesses are gaining a competitive advantage, adhering to regulatory compliances, and minimizing the risk involved in strategic decisions.

By Enterprise Type

Large enterprises are anticipated to dominate Saudi Arabia’s big data market and account for the highest market share in 2024, and the trend is likely to continue during the forecast period of 2033. Large enterprises usually have complex supply chains and diversified business operations with extensive customer bases, which create massive volumes of data. Large organizations in Saudi Arabia are investing more in the deployment of advanced big data solutions that involve AI-driven analytics and machine learning tools to extract deeper insights.

This is highly relevant to sectors such as oil and gas, banking, and retail, which have large volumes of data requiring sophisticated management capability. Moreover, the necessity to adhere to various regulations, both locally and internationally, concerning the protection of data, among others, has driven big enterprises toward advanced analytics and big data solutions.

Investments in cloud-based technologies in scalable infrastructures have further opened ways for big data tools to be utilized by SMEs. Thus, SMEs, empowered by cloud solutions, use big data for improving customer experience and operational efficiency, thus closing the gap with bigger organizations.

By Application

Data Discovery and Visualization is the leading application in the Saudi big data market, revolutionizing the way organizations interact with complex datasets. These tools transform huge volumes of data into understandable visual formats that enable businesses to uncover actionable insights, identify trends, and make informed decisions. This capability is particularly crucial for dynamic industries such as healthcare, retail, and logistics, where real-time analytics are essential in maintaining operational efficiency and responding swiftly to market changes.

The intuitive interfaces of the DDV tools have made them so popular in Saudi Arabia that even non-technical users can explore and interpret data. This democratization of data access fosters a culture of informed decision-making across all levels of the organization. Equipped with advanced analytics, such as predictive modeling and anomaly detection, DDV platforms let businesses look beyond static reporting into deeper insights about future trends and risks.

Moreover, DDV is very important for Saudi Arabia's digital transformation in order to achieve the goals of Vision 2030 with regard to operational efficiency and fostering innovation. Interconnected with a more extensive data management and analytics setup, DDV solutions ensure better collaboration between departments, enhanced resource allocation, and higher organizational agility. These have become so intrinsic to the big data ecosystem in the Kingdom that they are an absolute necessity for businesses to be competitive and data-driven in such a challenging economic environment.

By End User

The Banking, Financial Services, and Insurance (BFSI) sector remains the leading adopter of big data technologies in Saudi Arabia, accounting for the largest market share in 2024. This probably indicates that there is much reliance on intrinsic data in terms of fraud, risk, compliance, and real-time decision-making present within this BFSI. Big Data in BFSI will be about allowing more customers through with personalization-insights regarding behavior and their preferences-customized offerings for them to consider. It also supports credit scoring, operational efficiency improvements, and cost reduction-important building blocks as financial institutions position themselves in Saudi Arabia's ever-evolving regulatory environment.

Apart from BFSI, industries like healthcare, retail, and telecommunication are increasing big data investments rapidly. Big data in the healthcare sector will be used to enhance patient care and operational efficiency, for example, in line with national initiatives such as Vision 2030, emphasizing advances in healthcare infrastructure and service delivery. Further, big data finds its use in retail for personalized marketing and inventory management. Similarly, the telecom sector deploys big data on network optimization and customer retention.

Supported by such governmental initiatives as the Saudi Data and Artificial Intelligence Authority, or SDAIA, the digital transformation agenda drives the wide adoption of big data solutions across Saudi Arabia. This strategic focus will place the nation in a position to exploit big data technologies for economic and operational excellence.

The Kingdom of Saudi Arabia Big Data Market Report is segmented on the basis of the following

By Component

- Software

- Credit Risk Management

- Business Analytics

- CRM Analytics

- Compliance Analytics

- Workforce Analytics

- Others

- Hardware

- Service

By Enterprise Type

- Large Enterprise

- Small & Medium Enterprise

By Application

- Data Discovery and Visualization (DDV)

- Advanced Analytics

By End User

- BFSI

- Automotive

- Telecom/Media

- Healthcare

- Retail

- Energy & Utility

- Others

Competitive Landscape

The Kingdom of Saudi Arabia's big data market is highly competitive, driven by both global technology giants and emerging local players. Key international companies like IBM, Microsoft, Google Cloud, and Oracle dominate with their advanced cloud-based big data platforms, offering scalable and secure analytics solutions tailored to diverse industries. These firms leverage their global expertise to collaborate with Saudi government initiatives, including Vision 2030 projects, to drive innovation in areas like smart cities and healthcare.

Local companies, such as SDAIA (Saudi Data and Artificial Intelligence Authority) and Aramco's data analytics divisions, play a pivotal role by focusing on region-specific solutions. SDAIA spearheads efforts to foster data-driven decision-making across public sectors, while Aramco uses advanced analytics to optimize oil and gas operations. These localized players benefit from government support and incentives, enabling them to address unique market challenges, such as cultural nuances and regulatory compliance.

In addition to established players, the market sees rising competition from startups and mid-sized firms specializing in niche areas like retail analytics, predictive maintenance, and energy optimization. Collaborations between global tech companies and local firms are also strengthening the competitive landscape. Strategic partnerships, investments in research and development, and the integration of artificial intelligence (AI) are key differentiators in this competitive market. The Kingdom’s commitment to fostering innovation ensures sustained growth and competitiveness in its big data ecosystem.

Some of the prominent players in The Kingdom of Saudi Arabia's Big Data Market are

- IBM

- Microsoft

- Google Cloud

- Oracle

- Amazon Web Services (AWS)

- SAP

- SAS Institute

- Teradata

- Tableau (a Salesforce company)

- Cloudera

- Palantir Technologies

- Aramco

- Saudi Data and Artificial Intelligence Authority (SDAIA)

- Other Key Players

Recent Developments

- September 2024: The IDC Saudi Arabia CIO Summit 2024, scheduled for 18–19 September, will bring together IT leaders and CIOs to discuss digitalization, AI-driven innovations, and strategies to transform the IT landscape in the Kingdom.

- May 2024: The Informatica Summit Saudi Arabia 2024 was focused on data integration, management, and analytics, featuring insights into the latest trends and technologies in the evolving data landscape.

- May 2023: STC Group announced investments exceeding SAR 3.5 billion in social, educational, and health initiatives, aiming to drive local economic growth and enhance the community through these impactful projects.

- February 2023: STC Group launched a corporate investment fund (CIF) focusing on early-stage startups in sectors such as cybersecurity, AI, digital gaming, IoT, and blockchain to accelerate innovation in emerging technologies.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 481.0 Mn |

| Forecast Value (2033) |

USD 7,769.6 Mn |

| CAGR (2024-2033) |

36.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software, Hardware and Service), By Enterprise Type (Large Enterprise and Small & Medium Enterprise), By Application (Data Discovery and Visualization (DDV) and Advanced Analytics), By End User (BFSI, Automotive, Telecom/Media, Healthcare, Retail, Energy & Utility and Others. |

| Regional Coverage |

The Kingdom of Saudi Arabia |

| Prominent Players |

IBM, Microsoft, Google Cloud, Oracle, Amazon Web Services (AWS), SAP, SAS Institute, Teradata, Tableau (a Salesforce company), Cloudera, Palantir Technologies, Aramco, Saudi Data and Artificial Intelligence Authority (SDAIA), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Kingdom of Saudi Arabia Big Data Market size is estimated to have a value of USD 481.0 million in 2024 and is expected to reach USD 7,769.6 million by the end of 2033.

Some of the major key players in The Kingdom of Saudi Arabia's Big Data Market are IBM, Microsoft, Google Cloud, Oracle, Amazon Web Services (AWS), SAP, SAS Institute, Teradata, Tableau (a Salesforce company), Cloudera, Palantir, and many others.

The market is growing at a CAGR of 36.2 percent over the forecasted period.