ℹ

To learn more about this report –

Download Your Free Sample Report Here

Healthcare in Saudi Arabia refers to the numerous services designed to maintain or improve health, like prevention, diagnosis, treatment, rehabilitation, and palliative care. The Kingdom’s healthcare system is mainly government-funded, offering its citizens free or subsidized healthcare. Saudi Arabia has made high investments in healthcare infrastructure and services, focusing on providing universal healthcare coverage and meeting the increase in demand owing to population growth, an aging demographic, and rising chronic diseases. The government has also focused on the importance of healthcare quality through its Vision 2030 initiative, which focuses on expanding healthcare access and improving service delivery across the Kingdom.

Growth in the Saudi healthcare market is driven by several factors, including rapid population growth, urbanization, and increased life expectancy. In recent times, Saudi Arabia's population has surpassed 35 million, with a large segment being young adults, which has increased the demand for both primary and specialized healthcare services. Moreover, the Kingdom's Vision 2030 focuses on reducing dependency on oil revenues and diversifying the economy, with healthcare being a key sector for investment. The growth is also driven by an influx of private sector players, international healthcare providers, and development in medical technology, which have led to a more competitive and dynamic market.

Further, there is a trend for major attention on chronic disease management, mental health, and wellness. Lifestyle-related diseases, like diabetes, heart disease, and obesity, are on the rise, creating greater demand for specialized care and preventive health services. In addition, the aging population is driving the demand for geriatric care and long-term healthcare services. The trend toward digital health, like telemedicine and e-health platforms, is also transformation in healthcare delivery, creating easier access to services and improving efficiency. Saudi Arabia is investing in building advanced healthcare infrastructure, like advanced hospitals and medical centers, and promoting the development of medical tourism.

Further, in the Saudi healthcare market, the growing role of public-private partnerships (PPP) in expanding healthcare infrastructure and enhancing service delivery. The Kingdom’s commitment to healthcare innovation through Vision 2030 will continue to influence market dynamics. Key players in the market are the Ministry of Health, private hospitals, pharmaceutical companies, and medical technology firms. Opportunities are prompted in the fields of medical equipment, digital health technologies, pharmaceuticals, and home care services. Furthermore, there is an aim on enhancing healthcare access in rural areas, addressing the gap in healthcare service provision across the Kingdom.

Key Takeaways

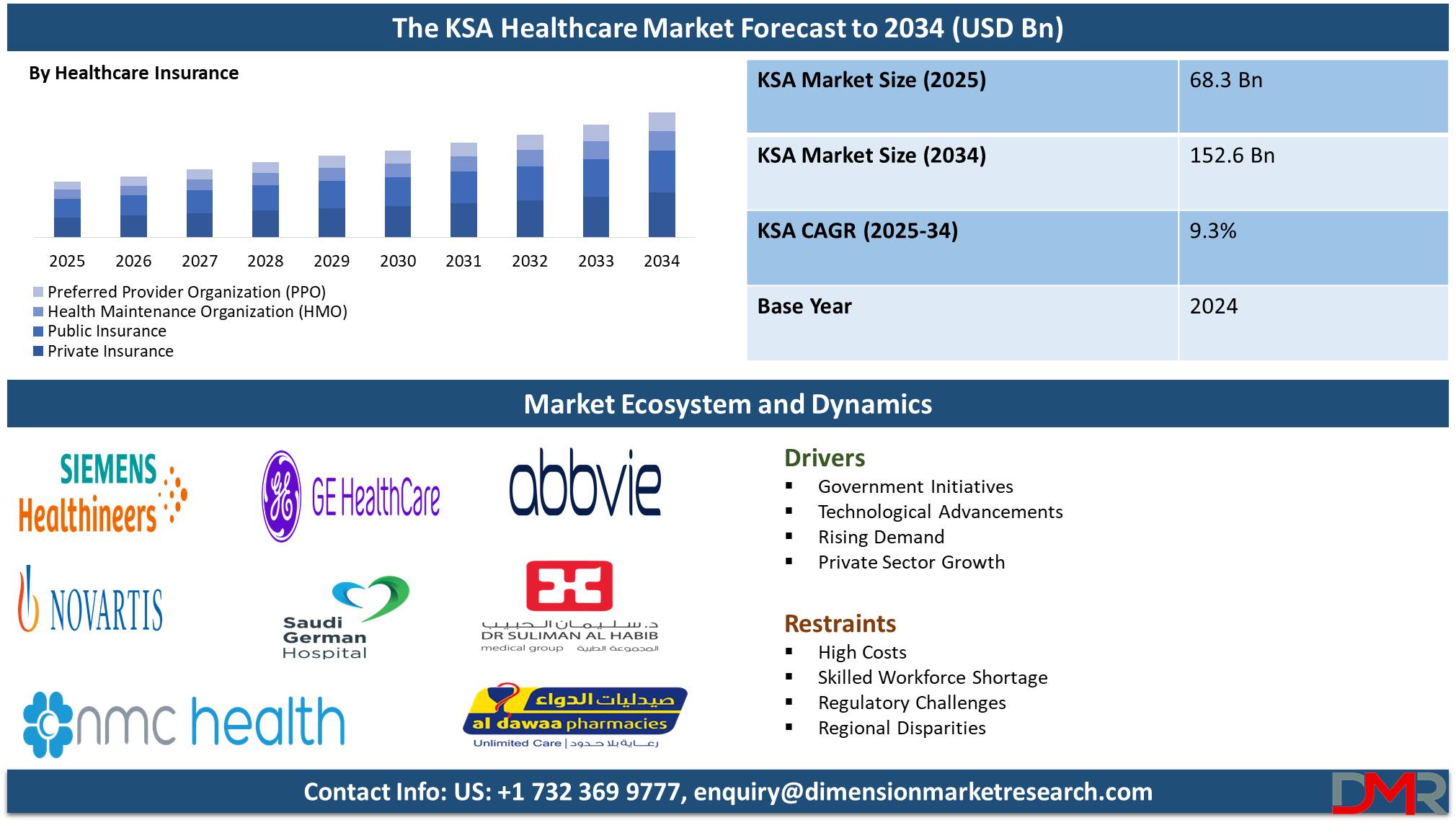

- Market Growth: The Kingdom of Saudi Arabia (KSA) Healthcare Market size is expected to grow by 78.6 billion, at a CAGR of 9.3% during the forecasted period of 2026 to 2034.

- By Healthcare Insurance: The Private Insurance segment is anticipated to get the majority share of the Kingdom of Saudi Arabia (KSA) Healthcare Market in 2025.

- By Biotechnology: The Vaccines segment is expected to get the largest revenue share in 2025 in the Kingdom of Saudi Arabia (KSA) Healthcare Market.

- Use Cases: Some of the use cases of The Kingdom of Saudi Arabia (KSA) Healthcare include medical tourism, chronic disease management, and more.

Use Cases

- Telemedicine and Digital Health: The Saudi government has invested in telemedicine platforms to enhance healthcare access, mainly in rural areas. These platforms allow patients to consult with healthcare professionals remotely, enhancing the reach and efficiency of medical services and minimizing the pressure on healthcare facilities.

- Chronic Disease Management: With the increase in cases of chronic diseases like diabetes and cardiovascular conditions, there is a major demand for specialized care and management programs. Healthcare providers are implementing comprehensive chronic disease management systems to monitor patients, provide personalized care, and prevent complications.

- Medical Tourism: Saudi Arabia is positioning itself as a hub for medical tourism, with world-class healthcare facilities providing high-quality treatments in areas like cardiology, orthopedics, and fertility. The government is working to attract international patients while strengthening the domestic healthcare market.

- Public-Private Partnerships (PPP): The government has been promoting public-private partnerships to expand healthcare infrastructure, build new hospitals, and enhance the quality of care, which helps leverage private investment and expertise to support the Kingdom's growing healthcare needs.

Market Dynamic

Driving Factors

Aging Population and Chronic Disease BurdenAs the population ages, there is a major demand for healthcare services related to geriatrics and the management of chronic diseases like diabetes, hypertension, and cardiovascular conditions, which is driving investments in specialized care facilities, rehabilitation services, and long-term healthcare solutions to meet evolving healthcare needs.

Vision 2030 and Healthcare Privatization

The Saudi government’s Vision 2030 initiative focuses on diversifying the economy and improving public services, with a major focus on healthcare. Through increased privatization and public-private partnerships (PPPs), the Kingdom is modernizing its healthcare infrastructure, improving efficiency, and expanding access to high-quality care while minimizing government spending on healthcare services.

Restraints

Healthcare Workforce Shortages

Despite huge investments in healthcare, Saudi Arabia experiences challenges in maintaining a skilled workforce, mainly in specialized fields like nursing, geriatrics, and mental health. The country depends highly on foreign medical professionals, and a shortage of local healthcare workers could impact the delivery of high-quality services as demand grows.

High Healthcare Costs

While the government provides subsidized healthcare for citizens, the increase in the cost of medical treatments, advanced technologies, and pharmaceuticals remains a major restraint, which develops the financial burden on private healthcare providers and may lead to disparities in access, particularly in underserved regions or for non-citizen residents.

Opportunities

Expansion of Medical Tourism

Saudi Arabia has significant potential to become a leading medical tourism destination, with advanced healthcare facilities and world-class treatments available in areas such as orthopedics, cardiology, and fertility. The government’s focus on improving healthcare infrastructure and promoting the sector presents an opportunity to attract international patients and boost the economy.

Growth of Digital Health Solutions

The increasing demand for telemedicine, remote patient monitoring, and digital health platforms provides a valuable opportunity for technology companies to expand their presence in Saudi Arabia's healthcare market. With strong government help for e-health and innovation, there is room for the development of new solutions that enhance patient care and operational efficiency.

Trends

Adoption of Artificial Intelligence (AI) and Robotics

Saudi Arabia is increasingly integrating artificial intelligence and robotics in healthcare for diagnostics, surgery, and patient care management. AI-powered tools are being used to ease administrative tasks, improve decision-making in clinical settings, and enhance patient outcomes, positioning the Kingdom as a leader in healthcare innovation in the region.

Focus on Preventive Healthcare and Wellness

There is a major focus on preventive healthcare and wellness in Saudi Arabia, driven by an increase in chronic diseases like diabetes and obesity. Initiatives promoting healthy lifestyles, fitness, and early disease detection are gaining momentum, with both public health campaigns and private sector investments focused on reducing healthcare costs and improving quality of life.

Research Scope and Analysis

By Healthcare Services Analysis

Hospitals and clinics are set to lead Saudi Arabia’s healthcare market in 2025 by providing important medical services to the rise in the population. They provide numerous treatments, from basic care to specialized procedures, meeting the growing demand for healthcare due to factors like population growth and an increase in chronic diseases. These healthcare institutions are vital to the government’s efforts to improve healthcare access and quality, contributing significantly to both public health & the development of the healthcare sector, supported by improvement in technology and private sector investments.

Further, telehealth / telemedicine are transforming Saudi Arabia's healthcare market and are set to grow at a significant rate in the coming years by making medical services more accessible, mainly in remote areas. Patients can consult doctors through virtual platforms, minimizing travel time and enhancing efficiency, which is expanding access to healthcare, especially for chronic disease management and mental health support. Telemedicine helps the government’s goals for better healthcare delivery, providing convenience and reducing pressure on hospitals and clinics.

By Pharmaceuticals Analysis

Prescription drugs are expected to be a leading segment in Saudi Arabia's pharmaceutical market in 2025, driving much growth in the healthcare market. With an increasing demand for treatments related to chronic diseases, infections, and other health conditions, the need for effective prescription medications has risen. The Kingdom’s growing healthcare infrastructure and focus on enhancing healthcare access have been further driven by the demand for high-quality prescription drugs. As healthcare services evolve, pharmaceutical companies are playing a major role in providing essential medications, contributing to better health outcomes and overall market growth.

Biologics and biosimilars are highly important in Saudi Arabia’s pharmaceutical sector and are expected to be growing at a significant rate in the coming years by providing advanced treatments for complex diseases like cancer, diabetes, and autoimmune disorders. As the need for more effective therapies grows, biologics provide innovative solutions. Biosimilars, which are more cost-effective versions of biologics, help reduce healthcare costs while maintaining treatment quality. These products contribute to the growth of the healthcare market by improving patient outcomes and expanding treatment options.

By Biotechnology Analysis

In 2025, vaccines are expected to have an impact on Saudi Arabia’s healthcare market by preventing infectious diseases and enhancing public health. The government’s focus on immunization programs, especially during global health challenges like COVID-19, saw an increased demand for vaccines. Local production and international partnerships in vaccine development are boosting the biotechnology sector. Vaccines not only protect the population but also lower healthcare costs by preventing disease outbreaks, making them an important part of Saudi Arabia’s efforts to enhance its healthcare infrastructure and achieve long-term health goals.

Further, gene therapy is an emerging biotechnology segment driving growth in Saudi Arabia’s healthcare market by providing innovative treatments for genetic disorders and life-threatening diseases like cancer. It provides hope for conditions earlier considered untreatable by addressing the root causes at the genetic level. The Kingdom’s focus on advanced medical research & biotechnology through Vision 2030 assists in the adoption of gene therapy. Investment in specialized facilities and partnerships with global biotech companies are improving healthcare capabilities, positioning Saudi Arabia as a leader in advanced medical treatments, and improving patient outcomes.

By Medical Devices Analysis

Diagnostic devices are essential in driving the growth of Saudi Arabia’s healthcare market by allowing early detection and accurate diagnosis of diseases. These devices, like imaging systems, blood analyzers, and point-of-care testing tools, improve the efficiency and precision of medical care. With the increase in cases of chronic illnesses like diabetes and heart disease, the need for advanced diagnostic tools is growing. Supported by government initiatives and investments in healthcare infrastructure, diagnostic devices are improving patient outcomes, minimizing treatment costs, and playing a major role in the Kingdom’s expanding healthcare sector.

Wearable devices are transforming Saudi Arabia’s healthcare market by empowering individuals to monitor their health in real-time. These devices track important signs like heart rate, activity levels, and sleep patterns, promoting preventive care and early detection of health issues. As technology adoption grows, wearable devices support chronic disease management and wellness initiatives. Their incorporation with digital health platforms enhances healthcare delivery, making them a key driver in the Kingdom’s healthcare growth.

By Healthcare IT Analysis

In terms of healthcare IT, electronic health records (EHR) are expected to play a crucial role in the growth of Saudi Arabia’s healthcare market by enhancing the efficiency and accuracy of medical data management. EHR systems allow healthcare providers to store, access, and share patient information easily, leading to better coordination of care and faster decision-making. As part of Vision 2030, the government is encouraging healthcare digitization, making EHR a key focus. These systems improve patient safety by reducing errors, simplifying administrative processes, and supporting population health management. EHR adoption is driving innovation, enhancing healthcare quality, and contributing to a more connected and efficient healthcare system.

Further, mobile health apps (mHealth) are set to be driving the growth of Saudi Arabia’s healthcare market in the coming years by providing easy access to health services and information. These apps help users track fitness, manage chronic conditions, book appointments, and consult doctors remotely. As smartphone usage grows, mHealth apps are making healthcare more accessible and convenient. Supported by government initiatives like Vision 2030, they are improving patient engagement, enhancing health outcomes, and promoting preventive care across the Kingdom.

By Healthcare Infrastructure Analysis

Hospital construction is expected to expand Saudi Arabia’s healthcare market in 2025 and throughout the forecast period by giving access to high-quality medical services. With a growing population and rise in healthcare demands, the government is heavily investing in building advanced hospitals and healthcare facilities as part of Vision 2030. These projects aim to increase bed capacity, introduce advanced medical technologies, and enhance specialized care services. Public-private partnerships are also boosting hospital development, ensuring efficient infrastructure expansion. New hospitals are looking into regional disparities in healthcare access and supporting medical tourism, creating a more enhanced healthcare system, which is crucial to meeting the Kingdom’s long-term health and economic goals.

Further, medical tourism facilities are driving the growth of Saudi Arabia’s healthcare market by attracting international patients looking for high-quality medical care. The Kingdom is developing advanced hospitals and specialized centers providing treatments in areas like cardiology, orthopedics, and cosmetic surgery. With world-class infrastructure and skilled professionals, Saudi Arabia is positioning itself as a regional hub for medical tourism. Assisted by Vision 2030, these facilities boost healthcare revenue, enhance service standards, and contribute to the diversification of the economy.

By Healthcare Insurance Analysis

Based on healthcare insurance, private insurance is projected to dominate Saudi Arabia’s healthcare market in 2025 by expanding access to medical services and lowering the financial burden on individuals. With the government promoting privatization in healthcare, private insurance helps cover treatments in private hospitals and clinics, providing faster and more specialized care. It also helps the growing expatriate population, as private insurance is mandatory for non-citizens. With the rise in affordability and access to advanced treatments, private insurance drives the need for quality healthcare services. In addition, it helps diversify funding sources, minimizing the pressure on government resources and aligns with the Kingdom’s Vision 2030 goals for a sustainable and efficient healthcare system.

Further, Preferred Provider Organizations (PPOs) will be having significant growth in the coming years by offering flexible insurance plans that allow patients to choose from a large network of healthcare providers. PPOs allow competition among providers, enhancing service quality and affordability. They also help with the growing demand for private healthcare services by providing coverage for advanced treatments. As healthcare needs grows, PPOs play a key role in improving access and driving efficiency in the Kingdom’s healthcare system.

By Preventive & Wellness Care Analysis

In 2025, Health and wellness programs are set to have a significant share of Saudi Arabia’s healthcare market by promoting preventive care and healthier lifestyles. These programs aim to raise awareness about nutrition, physical activity, mental health, and early disease detection, helping to reduce the occurrence of lifestyle-related conditions like obesity, diabetes, and heart disease. Assisted by government initiatives under Vision 2030, wellness programs are encouraging individuals to take proactive steps toward improving their health. Employers are also adopting workplace wellness initiatives to boost employee well-being and productivity. By transforming the focus from treatment to prevention, these programs are minimizing healthcare costs, improving public health, and helping the Kingdom’s long-term healthcare sustainability goals.

Further, fitness services play a crucial role in the growth of Saudi Arabia’s healthcare market by promoting healthier lifestyles and preventing lifestyle-related diseases like obesity and diabetes. Gyms, fitness centers, and wellness programs are becoming more popular, encouraged by government initiatives prompting physical activity under Vision 2030. With the growing awareness about the importance of fitness, more people are adopting active lifestyles. Fitness services not only improve public health but also reduce healthcare costs by preventing chronic diseases and enhancing overall well-being.

The Kingdom of Saudi Arabia (KSA) Healthcare Market Report is segmented on the basis of the following

By Healthcare Services

- Hospital & Clinics

- Ambulatory Care Services

- Home Healthcare

- Telehealth / Telemedicine

- Long-Term Care Services

By Pharmaceuticals

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

- Biologics and Biosimilar

- Personalized Medicine

- Orphan Drugs

By Biotechnology

- Gene Therapy

- Cell Therapy

- Recombinant Proteins

- Vaccines

- Tissue Engineering

By Medical Devices

- Diagnostic Devices

- Surgical Devices

- Therapeutic Devices

- Wearable Devices

- Home Use Devices

- Smart Healthcare Devices

By Healthcare IT

- Electronic Health Records (EHR)

- Telemedicine

- Healthcare Analytics

- Mobile Health Apps (mHealth)

- Blockchain in Healthcare

- Cloud-Based Solutions

By Healthcare Infrastructure

- Hospital Construction

- Medical Tourism Facilities

- Specialized Care Centers

- Ambulatory Care Centers

By Healthcare Insurance

- Private Insurance

- Public Insurance

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

By Preventive & Wellness Care

- Health and Wellness Programs

- Nutritional Supplements

- Fitness Services

- Screening and Diagnostics

Competitive Landscape

The healthcare market in Saudi Arabia is highly competitive, owing to the participation of public and private providers, pharmaceutical manufacturers, and medical device companies. Government initiatives, like Vision 2030, encourage private sector involvement, leading to the rapid growth of hospitals, clinics, and specialized care centers. The market is shaped by advancements in technology, including telemedicine, digital health platforms, and modern diagnostic tools. Competition is further fueled by investments in biotechnology, pharmaceuticals, and infrastructure development. Providers are focusing on improving service quality, expanding offerings, and adopting innovative solutions to meet the growing healthcare demands across the Kingdom.

Some of the prominent players in the Kingdom of Saudi Arabia (KSA) Healthcare are

- Siemens Healthineers

- GE Healthcare

- AbbVie

- Medtronic

- Novartis

- King Faisal Specialist Hospital & Research Centre (KFSH&RC)

- Saudi German Hospitals Group

- Al Habib Medical Group

- NMC Health (NMC Healthcare)

- Al-Dawaa Pharmacies

- Other Key Players

Recent Developments

- In December 2024, The Public Investment Fund’s fully owned National Unified Procurement Co. signed a memorandum of understanding (MoU) with Shenzhen-based BGI Group, which is focused on improving healthcare cooperation and using BGI’s advanced expertise to help Saudi Arabia to deliver comprehensive, high-quality healthcare services to its citizens.

- In October 2024, Saudi Arabia’s Minister of Health, announced an investment deals worth more than 13.3 billion in order to boost the healthcare sector. The major deals are agreements with NUPCO and Novo Nordisk and Sanofi for pharmaceutical manufacturing deal, Fakeeh Care Group for expansion, and Almoosa Health Group to create new care centres and hospitals.

- In October 2024, The World Health Organization (WHO) and the Kingdom of Saudi Arabia (KSA) announced a new collaboration by expanding the Hajj health card initiative to help the roughly 3 million pilgrims who undertake the holy pilgrimage every year. The Hajj health card, built on the WHO Global Digital Health Certification Network's public key infrastructure, summarizes critical health information like medication needs, allergies, immunization status, and pre-existing conditions.

- In August 2024, The Saudi Ministry of Health launched the "Regulatory Healthcare Sandbox" program, which is set to play an important role in promoting advanced solutions that will reshape the future of healthcare in Saudi Arabia. Further, the Sandbox provides a secure platform for innovators to experiment and refine their ideas, a move that marks a major milestone in boosting investment and modernizing Saudi Arabia's healthcare system.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 68.3 Bn |

| Forecast Value (2033) |

USD 152.6 Bn |

| CAGR (2024-2033) |

9.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Healthcare Services (Hospitals & Clinics, Ambulatory Care Services, Home Healthcare, Telehealth / Telemedicine, and Long-Term Care Services), By Pharmaceuticals (Prescription Drugs, Over-the-Counter (OTC) Drugs, Biologics and Biosimilar, Personalized Medicine, and Orphan Drugs), By Biotechnology (Gene Therapy, Cell Therapy, Recombinant Proteins, Vaccines, and Tissue Engineering), By Medical Devices (Diagnostic Devices, Surgical Devices, Therapeutic Devices, Wearable Devices, Home Use Devices, and Smart Healthcare Devices), By Healthcare IT (Electronic Health Records (EHR), Telemedicine, Healthcare Analytics, Mobile Health Apps (mHealth), Blockchain in Healthcare, and Cloud-Based Solutions), By Healthcare Infrastructure (Hospital Construction, Medical Tourism Facilities, and Specialized Care Centers, Ambulatory Care Centers), By Healthcare Insurance (Private Insurance, Public Insurance, Health Maintenance Organization (HMO), and Preferred Provider Organization (PPO)), By Preventive & Wellness Care (Health and Wellness Programs, Nutritional Supplements, Fitness Services, and Screening and Diagnostics) |

| Regional Coverage |

Saudi Arabia |

| Prominent Players |

Siemens Healthineers, GE Healthcare, AbbVie, Medtronic, Novartis, King Faisal Specialist Hospital & Research Centre (KFSH&RC), Saudi German Hospitals Group, Al Habib Medical Group, NMC Health (NMC Healthcare), Al-Dawaa Pharmacies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |