Market Overview

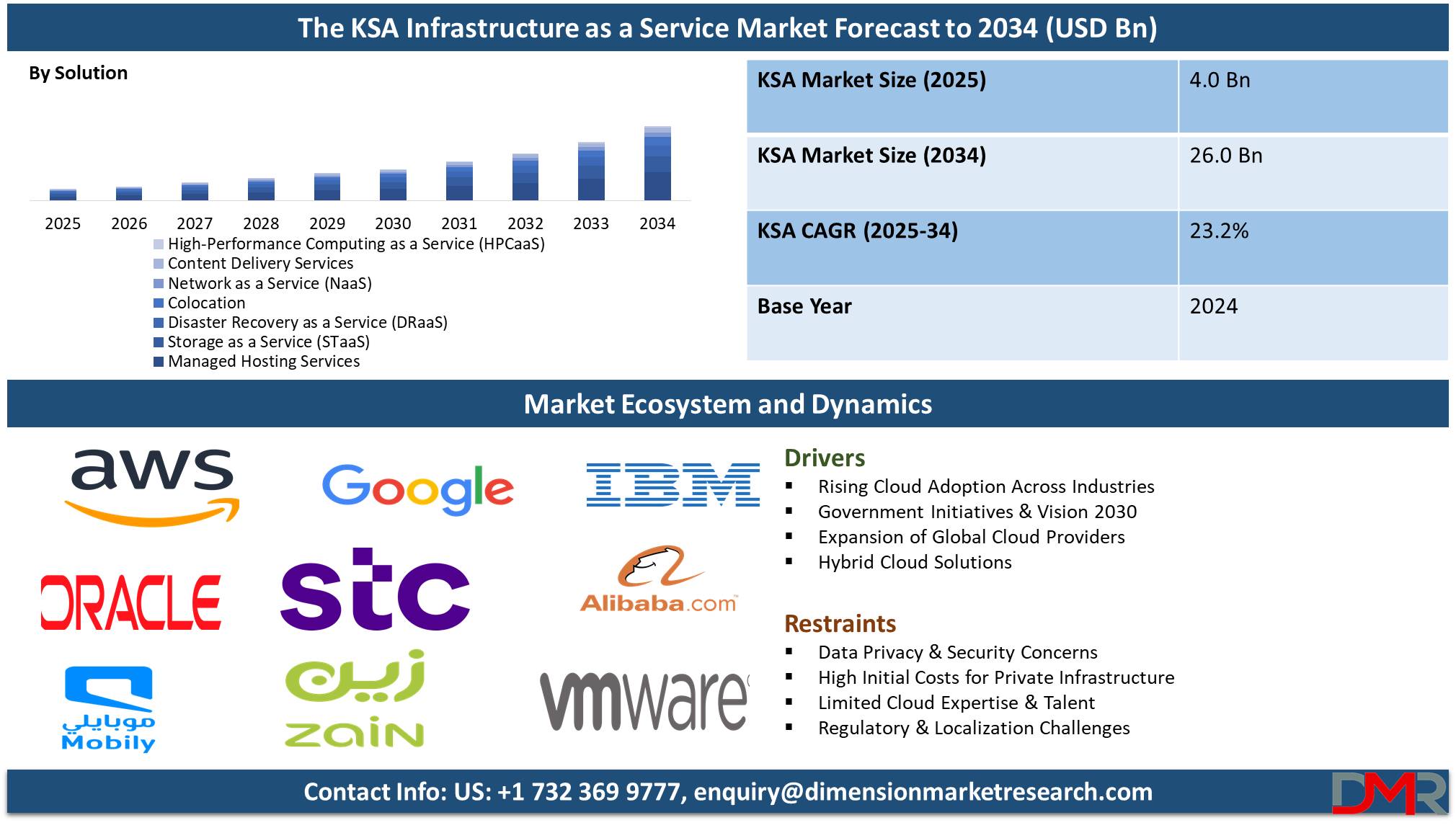

The

Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market is projected to reach

USD 4.0 billion in 2025 and grow at a compound annual

growth rate of 23.2% from there until 2034 to reach a

value of USD 26.0 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Infrastructure as a Service (IaaS) is a cloud computing service model that provides virtualized computing resources over the internet. These resources contain servers, storage, networking, and data center space, allowing businesses to reduce the requirements for on-premises IT infrastructure. IaaS provides scalability, flexibility, and cost efficiency, making it a preferred choice for enterprises looking to innovate and reduce operational costs. In Saudi Arabia, IaaS has gained momentum as organizations majorly adopt cloud solutions to help the Kingdom’s Vision 2030, which focuses on digital transformation and economic diversification.

Further, Saudi Arabia’s IaaS market has been experiencing rapid growth, driven by government initiatives and investments in digital infrastructure. The market is expected to expand significantly, assisted by the country’s efforts to position itself as a regional technology hub. Key drivers like the expansion of smart cities like NEOM, the growth in e-commerce, and the higher dependency on remote work and digital services. Global players like AWS, Microsoft Azure, and Huawei, alongside local providers like STC Cloud, have made major contributions to this growth. In addition, the growing demand for advanced data analytics, artificial intelligence, and Internet of Things (IoT) applications has further fueled the adoption of IaaS.

In addition, the rise in demand for scalable and secure cloud infrastructure solutions in sectors like healthcare, finance, and education highlights the Kingdom’s commitment to innovation. Trends shaping the IaaS market like hybrid and multi-cloud strategies, edge computing, and better cybersecurity solutions to address data sovereignty concerns. Businesses in Saudi Arabia are also using IaaS to implement disaster recovery plans, ensure business continuity, and improve operational efficiency. With initiatives like the Saudi Cloud First Policy, organizations are supported to switch to cloud platforms, further promoting the demand for IaaS solutions.

Moreover, Saudi Arabia’s focus on modernizing its digital economy provides fertile ground for IaaS providers to thrive. Investments in 5G networks, data centers, and renewable energy sources for sustainable cloud operations are pivotal to the sector’s future. Local companies are majorly collaborating with global providers to meet the distinctive needs of the market while adhering to local regulations. As competition intensifies, IaaS providers must prioritize innovation, affordability, and customer-centric services to maintain their edge. The Saudi IaaS market is poised for transformative growth, underpinned by the Kingdom’s ambition to lead the digital revolution in the Middle East.

Key Takeaways

- Market Growth: The Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market size is expected to grow by 21.2 billion, at a CAGR of 23.2% during the forecasted period of 2026 to 2034.

- By Solution: The Managed Hosting Services segment is anticipated to get the majority share of the Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market in 2024.

- By Organization Size: The large enterprises segment is expected to be leading the market in 2024

- By Deployment: The Public segment is expected to get the largest revenue share in 2024 in the Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market.

- Use Cases: Some of the use cases of The Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) include healthcare digitization, e-government services, and more.

Use Cases

- Smart Cities Development: Projects like NEOM and The Red Sea Project rely on IaaS to build scalable cloud infrastructure for real-time data processing, IoT integration, and advanced analytics for urban planning and sustainability.

- E-Government Services: IaaS helps Saudi Arabia’s push for digital governance under Vision 2030 by hosting applications, ensuring data security, and allowing easy access to public services for citizens.

- Healthcare Digitization: Hospitals and healthcare providers utilize IaaS for electronic health records, telemedicine platforms, and big data analysis to improve patient care and operational efficiency.

- Disaster Recovery and Business Continuity: Enterprises across sectors use IaaS for reliable disaster recovery solutions, ensuring uninterrupted operations and data protection during unexpected disruptions.

Market Dynamic

Driving Factors

Government-Led Digital Transformation InitiativesSaudi Arabia's Vision 2030 focuses on digital transformation as a key pillar for economic diversification. Programs such as the Saudi Cloud First Policy and investments in smart cities drive the adoption of IaaS by encouraging a cloud-first approach in the public and private sectors. These initiatives focus on modernizing infrastructure, enhancing operational efficiency, and attracting global tech giants to the region.

Expanding Data Center and 5G Infrastructure

The Kingdom's major investments in data centers and 5G networks create a strong foundation for IaaS growth. Partnerships with global providers like AWS, Microsoft Azure, and Huawei allow enterprises to access scalable, secure, and high-speed cloud services, which support emerging technologies like IoT, AI, and big data, further accelerating IaaS adoption across industries.

Restraints

Data Sovereignty and Regulatory Challenges

Strict data sovereignty laws in Saudi Arabia require sensitive data to remain within the country, which can limit the adoption of global IaaS providers lacking local data centers. Compliance with evolving regulations creates challenges for providers and enterprises, increasing operational complexities and costs for ensuring adherence to legal standards.

High Implementation and Migration Costs

The initial costs of adopting IaaS, like migration, integration, and staff training, can impact small and medium-sized enterprises (SMEs). In addition, concerns over vendor lock-in and the need for specialized IT expertise to manage cloud infrastructure create barriers to broad IaaS adoption in the Kingdom.

Opportunities

Growth in Smart City Projects and IoT Integration

Mega-projects like NEOM and The Red Sea Project provide many opportunities for IaaS providers to provide scalable cloud infrastructure for smart city ecosystems. With the growth in the adoption of IoT devices, IaaS can support live data processing, predictive analytics, and easy connectivity, driving innovation in urban development and sustainability.

Rising Demand for AI and Big Data Solutions

The increase in the adoption of AI and big data analytics across industries in Saudi Arabia develops opportunities for IaaS providers to deliver high-performance computing capabilities. Sectors like healthcare, finance, and retail are using these technologies to improve decision-making, improve customer experiences, and drive operational efficiency, fueling demand for IaaS services.

Trends

Hybrid and Multi-Cloud Adoption

Organizations in Saudi Arabia are majorly adopting hybrid and multi-cloud strategies, integrating both public and private cloud solutions, which allows businesses to optimize cost, improve security, and avoid vendor lock-in, giving them more flexibility and control over their cloud environments. Hybrid cloud solutions are becoming majorly popular in sectors with sensitive data requirements, like finance and healthcare.

Emphasis on Cloud Security and Compliance

As the use of IaaS grows in Saudi Arabia, there is a major focus on strong cloud security and regulatory compliance. Companies are placing importance on implementing advanced cybersecurity measures, like encryption, access control, and secure data storage, to safeguard sensitive information. Ensuring compliance with local laws, like the Saudi Data Protection Law, is also a major trend driving demand for secure IaaS solutions.

Research Scope and Analysis

By Solution Analysis

Managed hosting services play a major role in the growth of the IaaS market in Saudi Arabia and are expected to contribute significantly in 2025 by providing businesses with complete managed infrastructure solutions. These services allow companies to offload the responsibility of managing and maintaining servers, networks, and data centers, allowing them to focus on core business operations. With managed hosting, Saudi businesses benefit from better performance, security, and scalability without the need for major in-house IT expertise. As cloud adoption grows, managed hosting supports companies to migrate seamlessly to IaaS platforms while ensuring compliance with local regulations. This ease of use and enhanced reliability make managed hosting a key driver for the expansion of IaaS in Saudi Arabia’s rapidly growing digital economy.

High-Performance Computing as a Service (HPCaaS) is expected to grow significantly in the coming years as it plays a major role in expanding Saudi Arabia's IaaS market by providing businesses with access to powerful computing resources for complex tasks like data analysis, simulations, and AI development. HPCaaS allows organizations to scale their computing needs without heavy investments in physical infrastructure, which allows sectors like healthcare, finance, and research to use advanced computing power, driving innovation and accelerating digital transformation in Saudi Arabia’s economy.

By Deployment Analysis

In 2025, public cloud deployment will play a key role in the growth of Saudi Arabia's IaaS market by providing scalable, flexible, and affordable cloud solutions to businesses across numerous sectors. Public clouds allow organizations to access powerful computing resources without the need for major upfront investments in infrastructure, which is mainly beneficial for small and medium-sized businesses (SMBs) in Saudi Arabia, as they can use enterprise-level capabilities on a pay-as-you-go model. In addition, public cloud providers like AWS, Microsoft Azure, and Google Cloud are expanding their presence in Saudi Arabia, contributing to the country's digital transformation. As more businesses adopt public cloud services, it helps boost the growth of the IaaS market by making cloud computing accessible to numerous organizations.

Further, hybrid cloud deployment will grow significantly during the forecast period, as it supports the growth of Saudi Arabia's IaaS market by combining the benefits of both public and private clouds. This approach enables organizations to keep sensitive data on private clouds for security while taking advantage of public cloud resources for scalability and cost-efficiency. Hybrid clouds provide better flexibility, making them ideal for industries in Saudi Arabia with complex infrastructure and regulatory requirements.

By Organization Size Analysis

Large enterprises will have the majority share of Saudi Arabia’s IaaS market in 2025 due to their high demand for strong, scalable, and secure cloud solutions. These organizations need powerful computing resources to handle complex operations, big data analytics, and high-volume transactions. IaaS helps these enterprises minimize the need for expensive on-premises infrastructure and allows them to scale their resources as needed. With the transformation towards digital transformation, many large enterprises in Saudi Arabia are adopting cloud solutions to enhance efficiency, cut costs, and enhance innovation. As a result, the growing number of large enterprises adopting IaaS is driving the market’s expansion, mostly in sectors like finance, healthcare, and retail, where data security and performance are of huge importance.

Small and medium-sized enterprises (SMEs) are expected to contribute majorly to the growth of Saudi Arabia's IaaS market by adopting cloud solutions to access affordable, scalable, and secure computing resources. IaaS allows SMEs to avoid large upfront infrastructure costs, allowing them to compete with larger businesses. With easy access to strong tools and services, SMEs can improve productivity, innovate, and expand their operations, driving the adoption of cloud technologies and fueling the overall growth of the IaaS market in Saudi Arabia.

By Industry Vertical Analysis

In 2025, Banking, Financial Services, and Insurance (BFSI) sector will be leading Saudi Arabia's IaaS market due to its high demand for secure, reliable, and scalable cloud infrastructure. With the growth in the amount of financial data being generated, IaaS solutions provide BFSI companies with the required resources to manage and analyze large volumes of data efficiently. The sector also needs better disaster recovery, data security, and compliance with regulatory standards, all of which can be effectively achieved through IaaS platforms. As Saudi Arabia continues its digital transformation, banks and financial institutions are embracing cloud technologies to simplify operations, improve customer experiences, and drive innovation, which is helping fuel the growth of the IaaS market within the BFSI vertical in the Kingdom.

Further, the government and public sector in Saudi Arabia will play a vital role in the growth of the IaaS market by driving digital transformation initiatives, like e-government services and smart city projects. Cloud infrastructure enables government agencies to enhance efficiency, reduce costs, and improve citizen services. With a focus on modernization and Vision 2030, the public sector’s adoption of IaaS is accelerating the growth of cloud services in the Kingdom.

The Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market Report is segmented on the basis of the following

By Solution

- Managed Hosting Services

- Storage as a Service (STaaS)

- Storage Area Network (SAN)

- Network Attached Storage (NAS)

- Disaster Recovery as a Service (DRaaS)

- Colocation

- Network as a Service (NaaS)

- Content Delivery Services

- High-Performance Computing as a Service (HPCaaS)

By Deployment

By Organization Size

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- IT and Telecom

- Government and Public Sector

- Retail and E-commerce

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare

- Others

Competitive Landscape

The competitive landscape of Saudi Arabia's IaaS market is marked by both local and international players providing a variety of cloud services. Local providers are majorly expanding their offerings to meet the increase in demand for secure, scalable, and affordable cloud infrastructure. At the same time, global giants are establishing a stronger presence in the Kingdom, bringing advanced technologies and expertise. The competition is intensifying as companies focus on providing customized solutions, better security features, and compliance with local regulations, making the market dynamic and fast-growing as businesses across various sectors embrace cloud technologies.

Some of the prominent players in the Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) are

- AWS

- Google

- Oracle

- IBM

- Alibaba

- VMWare

- Red Hat

- Saudi Telecom Company (STC)

- Mobily

- Advanced Electronic Company (AEC)

- Zain KSA

- Other Key Players

Recent Developments

- In September 2024, Mobiz announced its expansion into Saudi Arabia, by opening its latest branch in the Kingdom, which follows Mobiz IT’s successful launch in Bahrain and highlights the company’s commitment to enhancing its service offerings and accessibility across the Gulf Cooperation Council (GCC) region. Due to this, the company plans to focus on better-serving clients across the region in response to the increase in demand for advanced IT services.

- In September 2024, The Oracle Database@Azure infrastructure-as-a-service offering from Oracle and Microsoft is getting new capabilities, including integrations with key Microsoft data and security services. As integration between Fabric, Microsoft's large data intelligence platform, and OCI GoldenGate, Oracle's database replication and heterogeneous data integration service. Also, the combination of OCI GoldenGate's continuous, low-latency data availability in Microsoft Fabric's complete data and analytics tools, like Power Bl and Copilot, allows customers to connect their essential data sources -- both Oracle and non-Oracle -- to drive better insights and decision-making

- In July 2024, Sirius Digitech Limited signed binding agreements for the acquisition of Coredge.io Private Limited, a cutting-edge sovereign AI and cloud platform company. As, Sovereign Data Centers become extremely important for protecting sensitive information and maintaining national security, given the exponential growth in artificial intelligence-driven demand for computation and sovereign data stack

- In April 2024, Mastek announced that the company attained the multi-tower deal from Yanbu Cement Company (YCC) to optimize the efficiency of YCC’s production line. After the execution of multiple back office and Enterprise Resource Planning (ERP) transformation programs in the first phase, Mastek will kick off the second phase, aiming to automate YCC’s front office operations and simplify the lead-to-cash cycle. By using the Oracle Fusion stack across integrated layers of ERP systems, Mastek will allow YCC to enhance customer & employee experience, reduce order fulfilment turnaround time (TAT), optimize material loading & dispatch processes, and enhance quality with governance excellence.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.0 Bn |

| Forecast Value (2033) |

USD 26.0 Bn |

| CAGR (2024-2033) |

23.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution (Managed Hosting Services, Storage as a Service (STaaS), Disaster Recovery as a Service (DRaaS), Colocation, Network as a Service (NaaS), Content Delivery Services, and High-Performance Computing as a Service (HPCaaS)), By Deployment (Public, Private, and Hybrid), By Organization Size (Small & Medium-sized Enterprises (SMEs), and Large Enterprises), By Industry Vertical (BFSI, IT and Telecom, Government and Public Sector, Retail and E-commerce, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare, and Others) |

| Regional Coverage |

Saudi Arabia |

| Prominent Players |

Google, Oracle, IBM, Alibaba, VMWare, Red Hat, Saudi Telecom Company (STC), Mobily, Advanced Electronic Company (AEC), Zain KSA, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market?

▾ The Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market size is expected to reach a value of USD 4.0 billion in 2025 and is expected to reach USD 26.0 billion by the end of 2034.

Who are the key players in the Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market?

▾ Some of the major key players in the Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market are AWS, Google, IBM, and others.

What is the growth rate in the Kingdom of Saudi Arabia (KSA) Infrastructure as a Service (IaaS) Market?

▾ The market is growing at a CAGR of 23.2 percent over the forecasted period.