Market Overview

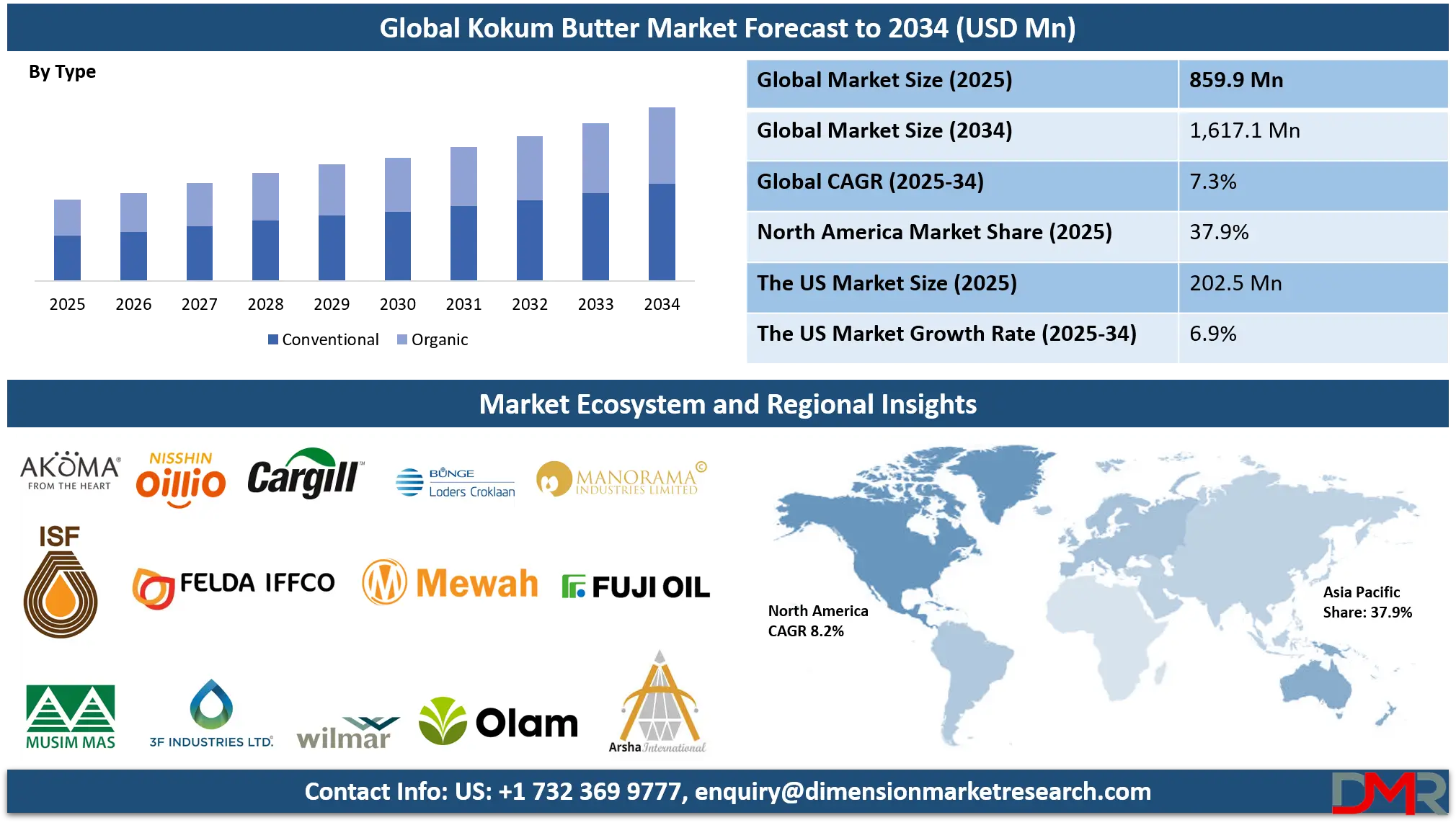

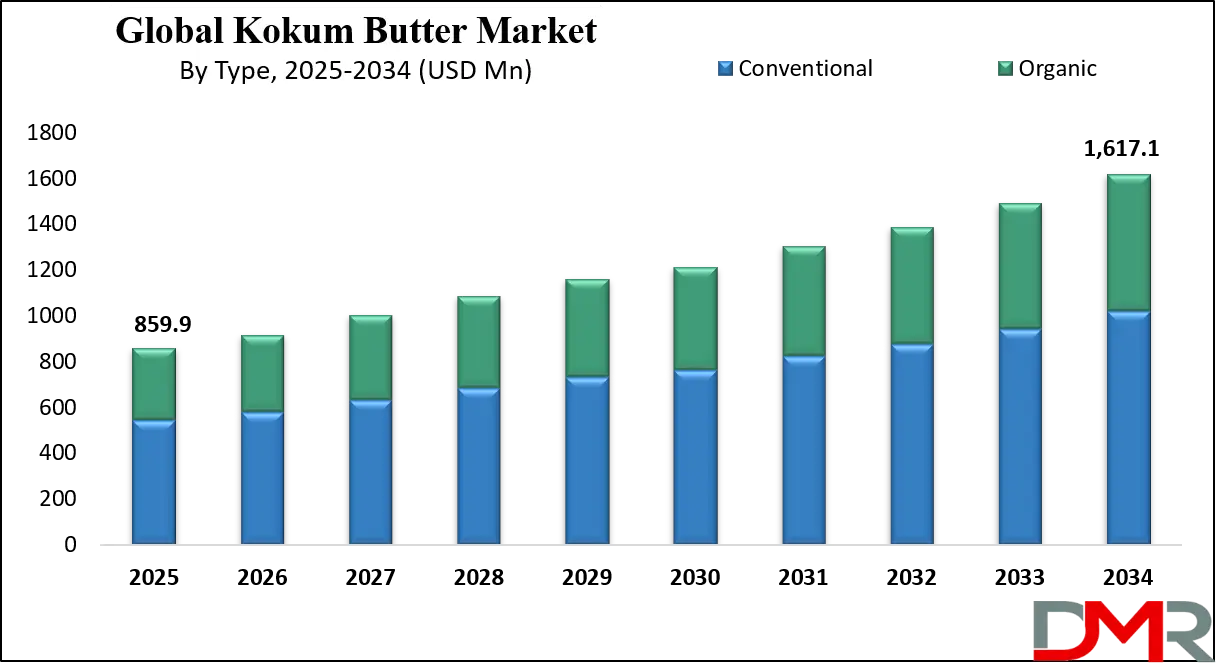

The Global Kokum Butter Market is projected to reach USD 859.9 million in 2025 and is expected to grow at a CAGR of 7.3% from 2025 to 2034, attaining a value of USD 1,617.1 million by 2034. The market's steady growth is driven by the rising demand for natural and plant-based ingredients in cosmetics, pharmaceuticals, and the food industry, combined with increasing consumer awareness of clean-label and sustainable products.

Kokum butter, extracted from the seeds of the Garcinia indica tree, is valued for its high stearic acid content, emollient properties, and non-greasy texture. It supports skin healing, reduces inflammation, and provides a stable fat base, making it ideal for formulations in moisturizers, lip balms, hair conditioners, pharmaceutical ointments, and specialty chocolates. The model addresses growing consumer preference for ethically sourced, non-comedogenic, and vegan alternatives to synthetic butters and animal fats.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Technological advancements in cold-pressing extraction, refining processes, and sustainable agroforestry are enhancing product purity, yield, and supply chain transparency. Integration of kokum butter into multifunctional cosmetic formulations, nutraceutical blends, and premium confectionery is expanding its application scope. The rise of e-commerce platforms and digital B2B ingredient sourcing further accelerates global trade.

Growing government initiatives promoting agroforestry, biodiversity conservation, and the export of non-timber forest products in kokum-producing regions further support market expansion. However, barriers such as seasonal yield variability, limited cultivation areas, high extraction costs, and inconsistent quality standards remain. Despite these limitations, the convergence of clean beauty trends, functional food innovation, and sustainable sourcing practices positions kokum butter as a niche but growing segment in the global natural ingredients market through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Kokum Butter Market

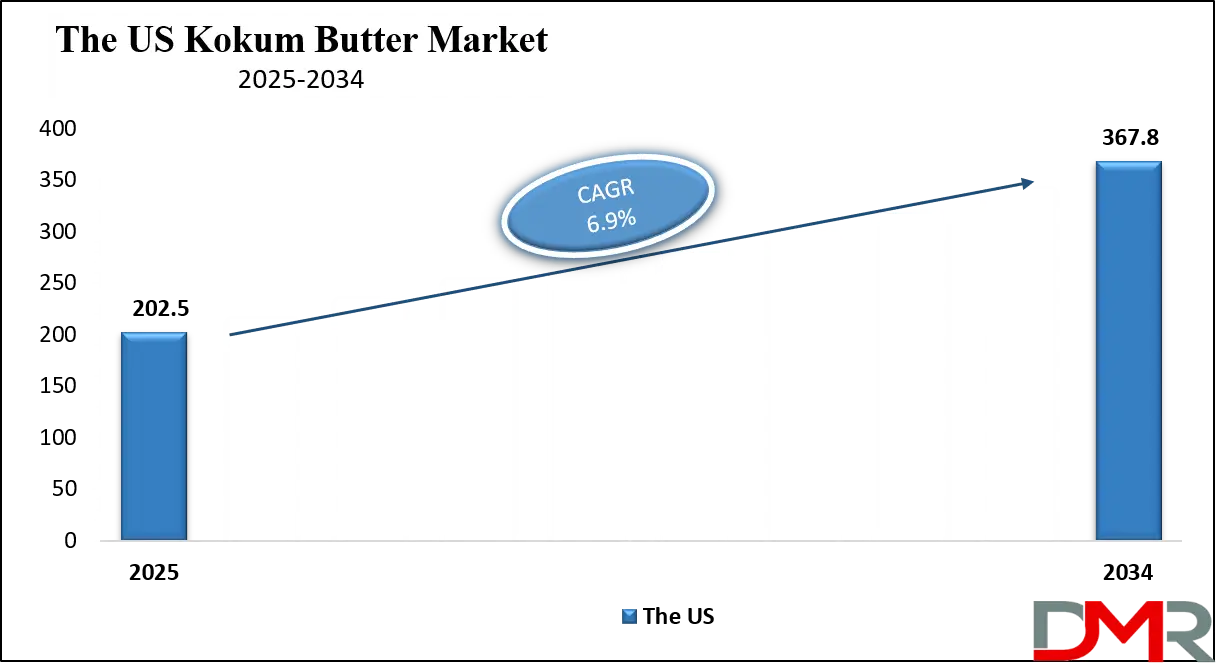

The US Kokum Butter Market is projected to reach USD 202.5 million in 2025 at a compound annual growth rate of 6.9% over its forecast period.

The United States kokum butter market is experiencing steady growth, fueled by a fundamental shift in consumer preferences toward natural, plant-based, and sustainably sourced ingredients. Its integration is most prominent within the cosmetics and personal care industry, where it is highly prized for its non-greasy, deeply emollient texture. Formulators favor it for moisturizers, body butters, lip care products, and hair treatments, as it aligns perfectly with the clean beauty movement's demand for effective, recognizable, and ethically produced components. Beyond topical application, a parallel rise in health and wellness awareness is fostering interest in its potential dietary and supplemental uses, though this remains a more niche segment.

The market's expansion is directly tied to broader trends championing health, wellness, and environmental responsibility. Consumers increasingly seek transparency in sourcing, favoring ingredients with ethical supply chains, which positions kokum butter favorably against some synthetic alternatives. While the market presents significant opportunity, it also contends with challenges such as ensuring consistent supply, managing costs associated with sustainable sourcing and importation, and competing within a crowded field of natural butter and oil alternatives.

However, continuous innovation in product development and extraction techniques, coupled with the enduring strength of the natural personal care sector, supports a positive outlook. The future trajectory will depend on the ability of industry participants to educate consumers, secure sustainable supply chains, and integrate kokum butter into novel product formulations that meet evolving market demands.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Kokum Butter Market

The Europe Kokum Butter Market is projected to be valued at approximately USD 215.0 million in 2025 and is projected to reach around USD 404.3 million by 2034, growing at a CAGR of about 7.1% from 2025 to 2034. Europe's demand is anchored by stringent regulations promoting natural and organic ingredients in cosmetics (EC No 1223/2009), a mature organic personal care market, and high consumer awareness of ethical sourcing.

Countries such as Germany, France, the U.K., Italy, and the Nordic region are major importers and innovators in natural cosmetics. European brands extensively incorporate kokum butter in certified organic skincare, lip care, and haircare products due to its non-greasy texture and compatibility with sensitive skin. The region's strong regulatory framework for cosmetics safety and labeling drives demand for high-purity, sustainably sourced kokum butter.

The "clean beauty" movement, vegan product trends, and demand for sustainably sourced exotic butters further drive kokum butter adoption. Major European cosmetic manufacturers and formulators are integrating kokum butter into multifunctional products, often marketed with claims of sustainability, biodiversity support, and community fair trade. Partnerships with certified suppliers in Asia and Africa ensure a transparent and reliable supply chain, reinforcing Europe as a high-value market.

The Japan Kokum Butter Market

The Japan Kokum Butter Market is projected to be valued at USD 68.8 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 129.4 million in 2034 at a CAGR of 7.1%.

In Japan's highly discerning consumer market, kokum butter is establishing a distinct presence, driven by a sophisticated and evolving approach to beauty and wellness. The market growth is fundamentally aligned with Japan's deep cultural appreciation for meticulous skincare and a strong, accelerating trend toward natural, clean beauty products. Consumers are actively seeking plant-based, ethically sourced ingredients with transparent origins, favoring formulations that are both effective and gentle. This shift away from synthetic chemicals creates a natural opportunity for kokum butter.

Its primary and most significant application is within the premium cosmetics and personal care sector, where it is valued for its non-greasy, fast-absorbing texture. This makes it particularly suitable for lotions, creams, and serums in Japan's humid climate, meeting the demand for lightweight yet deeply hydrating products. The ingredient's stability and potential soothing properties also resonate with concerns for sensitive skin and anti-aging, key focus areas for Japanese consumers.

Beyond mainstream personal care, kokum butter is finding a niche in the growing market for artisanal, DIY beauty and wellness products. The rise of specialized e-commerce platforms allows smaller brands to introduce this exotic butter to consumers interested in creating homemade balms or soaps. While less dominant, there is also latent potential for its use as a specialty fat in the food industry, particularly in high-end confectionery, due to its functional properties.

The market's path is not without challenges. Japan relies entirely on imports for its supply, creating inherent vulnerabilities in logistics and consistent quality. Successfully navigating the country's stringent regulatory framework for cosmetic ingredients also requires diligence from importers and brands. Nevertheless, the future outlook for kokum butter in Japan appears steady, supported by the enduring strength of the natural beauty movement, continued consumer education, and a focus on sustainable, innovative ingredients that meet the high standards of the Japanese market.

Global Kokum Butter Market: Key Takeaways

- Steady Global Market Growth Outlook: The Global Kokum Butter Market is expected to be valued at USD 859.9 million in 2025 and is projected to reach USD 1,617.1 million by 2034, showcasing consistent expansion supported by rising demand for natural, sustainable, and multifunctional ingredients across multiple industries.

- CAGR Driven by Natural Product Adoption: The market is expected to grow at a CAGR of 7.3% from 2025 to 2034, fueled by the clean beauty movement, growth in plant-based pharmaceuticals, and increasing use of specialty fats in food.

- Cosmetics & Personal Care Dominates Application: The Cosmetics & Personal Care segment is expected to capture the largest market share, supported by kokum butter's superior emollient properties, non-comedogenic nature, and alignment with natural formulation trends.

- Rise of Organic and Sustainably Sourced Variants: Increasing consumer preference for certified organic, fair-trade, and sustainably sourced ingredients is driving innovation and premiumization within the kokum butter supply chain.

- Growing Applications in Functional Food and Pharma: Beyond cosmetics, kokum butter is gaining traction in pharmaceutical ointments and as a stable, vegan fat alternative in premium food products, diversifying its revenue streams.

Global Kokum Butter Market: Use Cases

- Premium Moisturizers & Creams: Cosmetic formulators use kokum butter for its rich, non-greasy texture and skin barrier repair properties in high-end face creams and body lotions.

- Therapeutic Lip Balms & Healing Ointments: Its high melting point and healing characteristics make it ideal for medicated lip care and topical pharmaceutical preparations for dry or damaged skin.

- Natural Hair Conditioners: Incorporated into hair masks and conditioners to provide deep conditioning, reduce frizz, and improve hair strength without heaviness.

- Specialty Chocolate & Confectionery: Used as a heat-stable, vegan cocoa butter equivalent or complement in artisan chocolate, health bars, and gourmet confectionery.

- Ayurvedic & Herbal Formulations: A key base ingredient in traditional Ayurvedic medicines, massage balms, and aromatherapy products due to its believed therapeutic properties.

Global Kokum Butter Market: Stats & Facts

Kokum Butter Basic Facts

- Kokum butter is derived from the seeds of the kokum tree (Garcinia indica).

- Fruits are collected manually by handpicking during harvest.

- A kokum tree yields 10–15 kg of seeds on average per tree.

- Fruit contains 5–8 large seeds each.

- Seeds account for 20–23% of fruit weight.

- The kernel accounts for 60% of fruit weight and 61% of seed weight.

- Oil content of seeds is 23–26%.

- Oil content of seed kernel is ~44% of seed weight.

- Kernel contains 41–42% oil and up to 17% protein.

Agricultural & Botanical Surveys

Garcinia / Kokum Cultivation & Distribution:

- India hosts ~35 species of Garcinia, many endemic.

- Of these, ~7 species are endemic to the Western Ghats.

- Kokum cultivation area in Konkan region is ~1,000 hectares.

- Approximately 4,500 tonnes of kokum fruit produced in that area.

- ~46,600 kokum trees recorded in Maharashtra forests.

- ~43,000 trees are in Ratnagiri and Sindhudurg districts.

- Historical research reports 10,200 tonnes of kokum produced in India.

- Of this, ~9,000 tonnes were processed.

- 1,674 tonnes of fruit used for dried rind.

- 757 tonnes used for syrup production.

- 40 tonnes used specifically for kokum butter manufacture.

- Kokum cultivation occurs from Surat district to Kerala’s coastal belt in the Western Ghats.

Global Kokum Butter Market: Market Dynamic

Driving Factors in the Global Kokum Butter Market

Rising Demand for Natural & Clean-Label Ingredients

The accelerating global shift toward clean beauty, holistic wellness, and ingredient transparency continues to be a powerful growth engine. Consumers increasingly scrutinize INCI lists, favoring minimally processed, plant-derived ingredients with multifunctional benefits. Kokum butter’s non-greasy texture, high oxidative stability, and absence of strong aroma make it particularly attractive for leave-on formulations. Its compatibility with sensitive and acne-prone skin further strengthens adoption in dermocosmetics, baby care, and premium wellness brands. Additionally, the rising popularity of vegan and cruelty-free products reinforces kokum butter’s appeal as a sustainable, plant-based alternative to animal-derived fats.

Expansion of the Organic Personal Care Industry

The global organic personal care and cosmetics industry continues to expand at a robust pace, driven by stricter chemical regulations and rising eco-conscious consumer behavior. Kokum butter’s ability to comply with international organic standards positions it as a preferred lipid component in certified organic formulations. Brands are increasingly leveraging organic kokum butter to differentiate premium product lines, particularly in facial care, lip balms, and therapeutic skincare. The alignment of kokum butter with “farm-to-face” and “forest-sourced” branding narratives further accelerates its uptake in luxury and niche organic segments.

Restraints in the Global Kokum Butter Market

Supply Chain and Yield Limitations

Kokum butter production remains highly dependent on wild and semi-wild Garcinia indica trees, with limited commercial plantation-scale cultivation. Harvest yields fluctuate due to climate variability, monsoon dependence, and deforestation pressures in native regions. Fragmented supply chains, reliance on smallholder collectors, and limited mechanization constrain scalability and consistency. These factors result in longer lead times and price instability, which can deter multinational manufacturers seeking long-term supply contracts and standardized quality specifications.

Competition from Other Plant-Based Butters

Despite its functional advantages, kokum butter competes with well-established alternatives such as shea, cocoa, and mango butter. These competing butters benefit from stronger global awareness, extensive agronomic infrastructure, and broader supplier bases. In cost-sensitive formulations, manufacturers often favor these substitutes due to lower procurement risk and economies of scale. This competitive pressure necessitates greater investment in marketing, education, and technical support to clearly communicate kokum butter’s differentiated performance benefits to formulators.

Opportunities in the Global Kokum Butter Market

Product Diversification and Value-Added Offerings

There is significant untapped potential in developing application-specific kokum butter derivatives. Fractionated, deodorized, and micronized variants can cater to advanced cosmetic, pharmaceutical, and nutraceutical formulations. Value-added offerings such as pre-formulated emulsions, butter-based actives, and functional lipid carriers can reduce formulation complexity for manufacturers. Additionally, incorporating kokum butter into hybrid ingredients—such as emulsifier systems or bioactive delivery platforms—can unlock premium B2B opportunities and improve supplier margins.

Geographic Expansion of Cultivation

Expanding kokum cultivation beyond India represents a strategic opportunity to reduce supply concentration risk. Feasibility studies indicate that regions with similar agro-climatic conditions—such as Southeast Asia, parts of East Africa, and Latin America—could support Garcinia species cultivation. Public–private partnerships, agroforestry models, and sustainable livelihood programs could accelerate adoption in these regions. Over the long term, diversified cultivation would stabilize global supply, improve pricing predictability, and support growing international demand.

Trends in the Global Kokum Butter Market

Sustainability and Ethical Sourcing Transparency

Sustainability is evolving from a marketing claim into a procurement requirement. Manufacturers increasingly demand full traceability, from forest collection to finished ingredient, to support ESG commitments and regulatory disclosures. Ethical sourcing initiatives—such as direct farmer engagement, fair compensation models, and biodiversity conservation programs—are becoming decisive factors in supplier selection. Kokum butter sourced through transparent, community-driven value chains commands premium pricing and stronger brand loyalty.

Innovation in Fusion Blends

The trend toward functional optimization has led to increased innovation in kokum-based butter blends. By combining kokum butter’s hardness and stability with the softness or nutrient density of other exotic butters, formulators achieve improved sensory profiles and performance characteristics. These fusion blends enable targeted claims such as “fast-absorbing,” “high-melt stability,” or “enhanced barrier repair,” supporting differentiation in crowded cosmetic and wellness markets.

Global Kokum Butter Market: Research Scope and Analysis

By Type Analysis

The Conventional kokum butter segment currently accounts for the largest share of the global market, primarily due to its wider availability, relatively lower cost, and well-established supply networks. Conventional kokum butter is extensively used by small- and mid-scale cosmetic manufacturers, soap makers, and traditional pharmaceutical producers who prioritize functional performance over certification. Its affordability and consistent availability make it suitable for mass-market personal care products, herbal formulations, and regional brands, particularly in Asia-Pacific and parts of Africa. Additionally, fewer regulatory and documentation requirements enable faster procurement and easier integration into existing production systems, further supporting its dominance in volume terms.

In contrast, the Organic kokum butter segment is projected to register the fastest CAGR during the forecast period, driven by structural shifts in consumer preferences and regulatory environments. Stricter cosmetic regulations in Europe and North America, coupled with rising demand for certified natural and organic products, are accelerating adoption.

Organic kokum butter is increasingly favored by premium and luxury cosmetic brands seeking compliance with certifications such as COSMOS, USDA Organic, and Ecocert. Its strong association with sustainability, traceability, ethical sourcing, and biodiversity conservation enhances its appeal in high-value export markets. As consumers demonstrate a willingness to pay premium prices for clean-label and ethically sourced ingredients, organic kokum butter is expected to gain significant traction despite its higher production and sourcing costs.

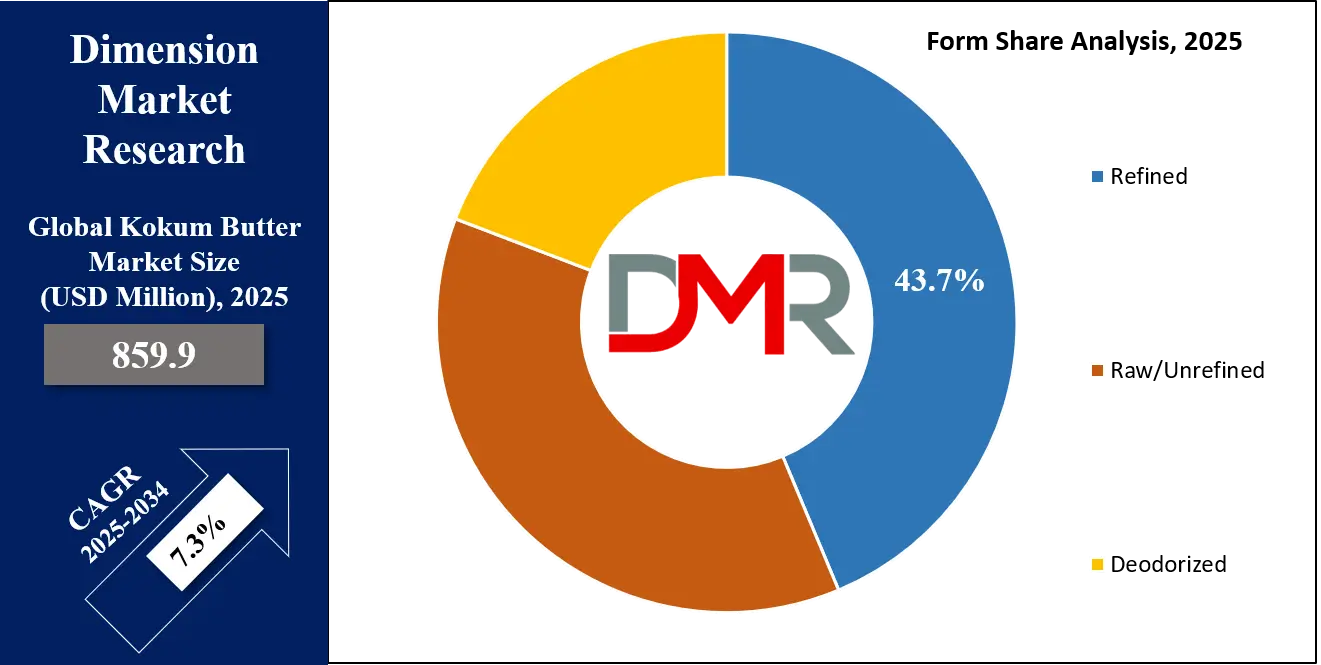

By Form Analysis

Refined kokum butter holds the largest share in the product-type segment of the global kokum butter market. This form undergoes processing to remove impurities, color, and odor (often including deodorization), producing a neutral-scent, consistent-texture butter that is highly suitable for large-scale cosmetic, personal care, and food applications. Its long shelf life, uniform appearance, and compliance with quality standards make it the preferred choice for mass-manufacturers and global brands, especially in cosmetics where predictable performance and formulation compatibility are critical.

It is estimate that refined variants comprise a majority share of total revenue in this segment as of 2024 due to these advantages and broad industrial adoption. Raw or unrefined kokum butter retains its natural aroma, color, and higher levels of bioactive compounds. While its market share is smaller than refined product, it is increasingly popular among artisanal, organic, and clean-beauty brands that emphasize minimal processing and nutrient retention. This form appeals to health-conscious consumers and niche producers but faces scalability and shelf-stability challenges compared with refined butter.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

The Cosmetics & Personal Care segment dominates the global kokum butter market and is expected to maintain its leading position throughout the forecast period. Kokum butter’s exceptional emollient properties, high oxidative stability, non-greasy texture, and compatibility with sensitive skin make it highly suitable for a wide range of formulations. It is widely used in moisturizers, lip balms, body butters, soaps, sunscreens, and haircare products, where it enhances skin barrier repair and provides long-lasting hydration. Its natural origin and vegan profile further strengthen its demand among clean beauty and organic brands globally.

The Pharmaceuticals segment represents the second-largest application area. Kokum butter is increasingly utilized as a natural excipient and base material in topical ointments, medicated creams, balms, and transdermal formulations. Its anti-inflammatory, wound-healing, and soothing properties make it valuable in dermatological and herbal medicines, particularly in treatments targeting dry skin conditions, burns, and minor wounds.

Meanwhile, the Food & Beverage segment, though relatively niche, is witnessing steady growth. Kokum butter is gaining traction in premium chocolates, confectionery coatings, and functional foods due to its stable fat composition, high melting point, and clean-label appeal, especially among health-conscious consumers.

By End User Analysis

Commercial and industrial buyers such as large cosmetics manufacturers, food processors, and pharmaceutical companies account for the largest portion of kokum butter demand globally. These users purchase kokum butter in bulk quantities to incorporate as a key ingredient in creams, lotions, body butters, specialty foods, and medicated formulations. Their requirements for consistent quality, reliable supply, and regulatory compliance make them the dominant revenue generators in the market, with estimates commonly above ~70% share of total end-user revenue. This dominance is driven by long-term contracts and large-scale production needs, especially in developed regional markets with strong natural personal care and food industries.

Individual end-users retail consumers buying kokum butter for personal skincare, hair care, DIY products, and wellness uses are a fast-growing segment thanks to online availability and rising interest in natural beauty products. However, this segment remains smaller in total market share compared with commercial buyers due to lower purchase volumes per buyer and less consistent demand.

Small and artisanal enterprises (handmade soap makers, boutique brands) and salons/spas contribute niche but important demand, especially for premium, bespoke, or specialty cocoon butter products. While they support product diversity and niche innovation, their aggregate share is much lower than that of commercial/industrial users.

The Global Kokum Butter Market Report is segmented on the basis of the following:

By Type

By Form

- Refined

- Raw/Unrefined

- Deodorized

By Application

- Cosmetics & Personal Care

- Pharmaceuticals

- Food & Beverage

- Others

By End User

- Individual

- Small Enterprise/Artisanal

- Commercial/Industrial

- Salons & Spas

- Others

Impact of Artificial Intelligence in the Global Kokum Butter Market

- Fair Trade and Ethical Sourcing: Fair-trade certification ensures equitable income for forest-dependent communities, promotes sustainable harvesting practices, and enhances social impact credentials for brands. These certifications increasingly influence purchasing decisions among multinational buyers.

- Organic Certification: Organic certification enables access to regulated and premium markets, supports higher price realization, and aligns with the compliance requirements of certified natural and organic brands.

- Geographical Indication (GI) Tags: GI tagging of region-specific kokum varieties protects authenticity, reinforces provenance storytelling, and supports premium positioning in global markets.

- Supply Chain Traceability: Advanced traceability solutions, including digital ledgers and blockchain pilots, are gaining importance for ESG reporting, risk management, and consumer transparency, particularly among large-scale manufacturers.

Global Kokum Butter Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to lead the global market with a 37.9% of market share by the end of 2025. This dominance is due to its status as the native and primary production hub (India), strong domestic consumption in traditional and modern applications, and supportive government policies for agriculture and non-timber forest products. The region's vast and growing population, coupled with rising disposable incomes driving cosmetic sales, further consolidates its leading position. This gives the region an unmatched supply-side advantage with established agroforestry systems and traditional harvesting knowledge.

Furthermore, domestic demand is strong and deeply rooted. Kokum butter has been used for centuries in local cuisines as a souring agent and in Ayurvedic medicine and personal care, creating a stable and culturally significant consumption base. Supportive government policies in India that promote non-timber forest products and the AYUSH wellness system further solidify this regional dominance, making APAC both the primary source and a major traditional market for the product.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America exhibits the highest CAGR due to explosive demand for premium, natural ingredients, starting from a smaller initial market base. The region's consumers are at the forefront of the "clean beauty" and clean-label food movements, actively seeking plant-based, sustainably sourced, and ethically produced ingredients. Kokum butter is perfectly positioned for this trend as a non-comedogenic, vegan emollient for high-end skincare and as a specialty fat in artisanal chocolates and health foods. This rapid commercial adoption in high-value product categories is driven by major cosmetic and food manufacturers reformulating their products. The growth rate is high because this represents a new, fast-expanding market for an ingredient that was previously niche, fueled by consumer trends rather than local production.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Kokum Butter Market: Competitive Landscape

The global Kokum Butter market features a moderately fragmented competitive landscape characterized by the presence of diverse participants, including ingredient suppliers, cosmetic corporations, specialized niche brands, and various entities along the supply chain. The market comprises a mix of large-scale global suppliers of natural ingredients and smaller, specialized producers focusing on organic and ethically sourced products. Leading multinational ingredient corporations have established large-scale manufacturing plants to meet global demand efficiently and are actively expanding into this natural ingredient segment-. These companies leverage their extensive distribution networks and R&D capabilities to serve large cosmetic and food manufacturers.

Alongside these giants, specialized ingredient suppliers and chemical companies form a crucial part of the competitive ecosystem. Firms such as Lachemi Chemorgs, Protameen Chemicals, and Vantage Specialty Ingredients are key players specifically noted in the Garcinia Indica Seed Butter market. These suppliers often compete by offering high-purity, specialized grades of butter tailored for the cosmetic and personal care industries. Additionally, the market includes dedicated companies like the Kokum Butter Co. (IN), which focus specifically on this niche, often emphasizing their proximity to the raw material source in India.

Some of the prominent players in the Global Kokum Butter Market are:

- Manorama Industries Limited

- AAK (AAK Kamani)

- Bunge Loders Croklaan

- Wilmar International

- Fuji Oil

- Olam International

- Cargill

- Mewah Group

- 3F Industries Ltd

- Nisshin Oillio Group

- Felda Iffco

- Musim Mas

- Intercontinental Specialty Fats (ISF)

- The Pure Company

- The Savannah Fruits Company

- Akoma Cooperative

- International Oils & Fats Limited

- Aarsha International

- The Kokum Factory

- Ekologie Forte Pvt. Ltd.

- Other Key Players

Recent Developments in the Global Kokum Butter Market

- November 2025: A.G. Industries introduced a blockchain-based traceability system for its organic kokum butter, allowing customers to track the ingredient's journey from specific farming cooperatives in Maharashtra to the finished product, enhancing transparency for European and North American brands.

- August 2025: The European Food Safety Authority (EFSA) began a safety evaluation for the use of kokum butter as a novel food ingredient in specific confectionery categories, potentially opening a significant new application avenue in the food sector.

- September 2024: Manorama Industries Limited announced expansion of its kokum butter processing capacity in western India to meet rising global demand from cosmetics and food manufacturers.

- July 2024: Avi Naturals (natural ingredients producer) collaborated with Fair Trade USA and cooperatives to strengthen sustainable kokum seed sourcing and farmer income in Maharashtra and Karnataka.

- March 2024: Vedic Supercriticals & Biotechnologies commissioned a supercritical CO₂ extraction facility in India to produce pharmaceutical-grade kokum butter for nutraceutical and medical sectors.

- January 2024: Kerala Naturals received international organic certification for its kokum butter products, enabling wider penetration into North American and European clean-label markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 859.9 Mn |

| Forecast Value (2034) |

USD 1,617.1 Mn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 202.5 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Conventional, Organic), By Form (Refined, Raw/Unrefined, Deodorized), By Application (Cosmetics & Personal Care, Pharmaceuticals, Food & Beverage, Others), By End User (Individual, Small Enterprise/Artisanal, Commercial/Industrial, Salons & Spas, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Manorama Industries Limited, AAK (AAK Kamani), Bunge Loders Croklaan, Wilmar International, Fuji Oil, Olam International, Cargill, Mewah Group, 3F Industries Ltd, Nisshin Oillio Group, Felda Iffco, Musim Mas, Intercontinental Specialty Fats (ISF), The Pure Company, The Savannah Fruits Company, Akoma Cooperative, International Oils & Fats Limited, Aarsha International, The Kokum Factory, Ekologie Forte Pvt. Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Kokum Butter Market?

▾ The Global Kokum Butter Market size is estimated to have a value of USD 859.9 million in 2025 and is expected to reach USD 1,617.1 million by the end of 2034.

What is the growth rate in the Global Kokum Butter Market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period of 2025 to 2034

What is the size of the Asia-Pacific Kokum Butter Market?

▾ The Asia-Pacific Kokum Butter Market is projected to be valued at USD 202.5 million in 2025. It is expected to reach USD 367.8 million in 2034 at a CAGR of 6.9%.

Which region accounted for the largest Global Kokum Butter Market?

▾ Asia-Pacific is expected to have the largest market share in the Global Kokum Butter Market with a share of about 37.9% in 2025.

Who are the key players in the Global Kokum Butter Market?

▾ Some of the major key players in the Global Kokum Butter Market are A.G. Industries, Avi Naturals, Herbal Creations, Nature's Natural India, Aromaaz International, and many others.