Market Overview

The Global Kombucha Market is projected to reach

USD 4.8 billion in 2025 and is expected to grow at a

CAGR of 14.0%, hitting

USD 15.6 billion by 2034. This growth is driven by rising demand for functional beverages, growing consumer focus on gut health, and the expanding popularity of fermented drinks across emerging and developed markets.

Kombucha is a naturally fermented, effervescent tea beverage made by adding a symbiotic culture of bacteria and yeast, known as a SCOBY, to a solution of brewed tea and sugar. Throughout fermentation, the mixture undergoes a metabolic process in which the sugar is converted into organic acids, vitamins, and a small amount of alcohol, resulting in a tangy, slightly sweet drink with probiotic benefits.

Widely praised for its digestive and detoxifying properties, kombucha is available in various flavors, often enhanced with herbs, fruits, or spices, making it a popular alternative to sugary sodas and artificial beverages among health-conscious consumers. Its unique taste profile and potential wellness attributes, such as gut health support, immune system enhancement, and natural energy boost, have elevated kombucha from a niche home-brewed item to a mainstream health beverage.

The global kombucha market has experienced robust growth over the past decade, driven by rising consumer interest in functional beverages and wellness-focused diets. As consumers shift toward products that offer nutritional benefits without compromising taste, kombucha has positioned itself as a frontrunner in the healthy drinks category. Increased awareness of gut microbiota, digestive health, and the advantages of fermented foods has significantly contributed to the products popularity, particularly among millennials and Gen Z consumers seeking organic, non-GMO, and low-sugar options. This trend has encouraged a proliferation of globally artisanal and commercial kombucha brands, leading to a competitive yet dynamic market environment.

Another factor fueling the global kombucha market is the expansion of distribution channels and the beverages integration into mainstream retail formats such as supermarkets, convenience stores, and online platforms. Innovations in packaging, shelf-life stability, and flavor variety have made kombucha more accessible and appealing to a wider demographic.

Furthermore, regions like North America and Western Europe remain strongholds for the market, while emerging markets in Asia-Pacific and the Middle East are witnessing growing adoption due to growing health awareness and urbanization. Key players are also investing heavily in marketing strategies and consumer education to communicate the benefits of live cultures, antioxidants, and natural fermentation.

With ongoing product diversification, including the emergence of hard kombucha with alcohol content and low-calorie formulations, the global kombucha market is poised for continued evolution. Companies are investing in sustainable sourcing of ingredients and scalable brewing methods to meet surging demand while ensuring product consistency and compliance with food safety regulations. The interplay of consumer lifestyle changes, growing demand for natural and clean-label beverages, and advancements in fermentation technology will shape the market trajectory over the coming years, placing kombucha as a resilient category within the broader health and wellness industry.

The US Kombucha Market

The U.S. Kombucha Market size is projected to be valued at USD 1.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.5 billion in 2034 at a CAGR of 13.1%.

The US kombucha market has emerged as one of the most mature and innovation-driven segments within the global functional beverage landscape. With a growing shift toward health-conscious consumption, American consumers are choosing kombucha as a natural alternative to sugary sodas and artificially flavored drinks. The popularity of fermented beverages in the US is heavily influenced by rising awareness around digestive wellness, probiotics, and the benefits of a balanced gut microbiome.

This has paved the way for kombuchas penetration not only in health food stores but also across mainstream retail outlets, cafes, and even bars offering hard kombucha options. The emphasis on clean-label products, organic certifications, and low-calorie beverages has further fueled its widespread appeal among millennials and wellness-focused demographics.

Innovation plays a critical role in the US kombucha market, with domestic brands experimenting with a wide array of functional ingredients such as adaptogens, botanical infusions, nootropics, and CBD. The growing demand for immunity-boosting drinks and sustainable food products aligns well with kombuchas natural and eco-friendly brand positioning. Companies are also focusing on transparent labeling, recyclable packaging, and small-batch brewing methods to cater to environmentally conscious consumers. As the US remains a trendsetter in the health beverage industry, kombucha continues to evolve from a niche probiotic tea into a dynamic, lifestyle-driven product category with strong roots in both wellness and consumer innovation.

The European Kombucha Market

The European kombucha market is poised to reach an impressive valuation of approximately

USD 1.2 billion in 2025, underscoring the regions growing consumer shift toward health-conscious and functional beverages. This robust market size reflects a growing demand for probiotic drinks, natural fermented beverages, and organic kombucha variants that cater to wellness-focused lifestyles. Key factors driving this surge include heightened awareness about gut health, digestive benefits, and immunity-boosting properties inherent in kombucha products.

Additionally, the expansion of distribution channels across supermarkets, specialty health stores, and e-commerce platforms has facilitated wider accessibility and consumer adoption. With countries like Germany, the United Kingdom, and France leading consumption, the European kombucha sector is also benefiting from continuous product innovation and flavor diversification, which further enhances its appeal among millennials and Gen Z consumers seeking alternative, low-sugar, and natural refreshment options.

Looking ahead, the European kombucha market is expected to sustain a healthy compound annual growth rate (CAGR) of around 12.0%, reflecting strong and steady market momentum. This growth trajectory is supported by growing investment in product research and development, strategic marketing efforts emphasizing the beverages functional health benefits, and rising consumer inclination towards clean-label and sustainable products.

Moreover, the surge in demand for non-alcoholic, low-calorie beverages aligns perfectly with evolving dietary trends across Europe, including veganism and keto-friendly lifestyles, further bolstering kombuchas market penetration. The synergy between rising health awareness and premiumization trends is encouraging beverage manufacturers to launch innovative kombucha variants infused with adaptogens, botanicals, and superfoods, thereby tapping into the expanding market potential. Overall, Europes kombucha market stands as a dynamic segment within the global functional beverages landscape, poised for continued expansion fueled by consumer wellness trends and evolving taste preferences.

The Japanese Kombucha Market

The Japan kombucha market is projected to achieve a valuation of approximately USD 0.3 billion in 2025, highlighting a steady rise in consumer interest for fermented health beverages within the country. This growth is fueled by growing awareness of gut health, probiotics, and the benefits of natural, functional drinks that promote digestion and immunity. Japanese consumers, known for their traditional affinity toward fermented products such as miso, natto, and sake, are gradually embracing kombucha as a modern extension of these healthful dietary practices.

The availability of organic kombucha, low-sugar variants, and innovative flavor profiles has also contributed to the beverages rising popularity. Furthermore, Japans expanding retail landscape, including supermarkets, convenience stores, and online platforms, has improved accessibility, enabling more consumers to explore and adopt kombucha as part of their daily wellness routines.

Looking forward, the Japan kombucha market is expected to maintain a healthy compound annual growth rate (CAGR) of around 10.0%, reflecting sustained consumer demand for functional and probiotic beverages. This growth is driven by evolving health and wellness trends among Japanese consumers, particularly the younger demographic who seek natural alternatives to sugary soft drinks. Additionally, there is a growing preference for beverages that support digestive health, weight management, and overall vitality, aligning well with kombuchas probiotic-rich profile.

Manufacturers are responding by introducing new kombucha formulations that incorporate traditional Japanese ingredients and superfoods, further appealing to local tastes and cultural preferences. With the rising popularity of plant-based diets and clean-label products in Japan, kombuchas position as a nutritious, low-calorie drink continues to strengthen, promising a dynamic growth trajectory in the countrys functional beverages market.

Global Kombucha Market: Key Takeaways

- Market Value: The global kombucha market size is expected to reach a value of USD 15.6 billion by 2034 from a base value of USD 4.8 billion in 2025 at a CAGR of 14.0%.

- By Type Segment Analysis: Flavored Kombucha type is poised to consolidate its dominance in the type segment, capturing 74.5% of the total market share in 2025.

- By Nature Segment Analysis: Organic Kombucha is anticipated to maintain its dominance in the nature segment, capturing 71.3% of the total market share in 2025.

- By Product Type Segment Analysis: Conventional Kombucha products are expected to maintain their dominance in the product type segment, capturing 86.2% of the total market share in 2025.

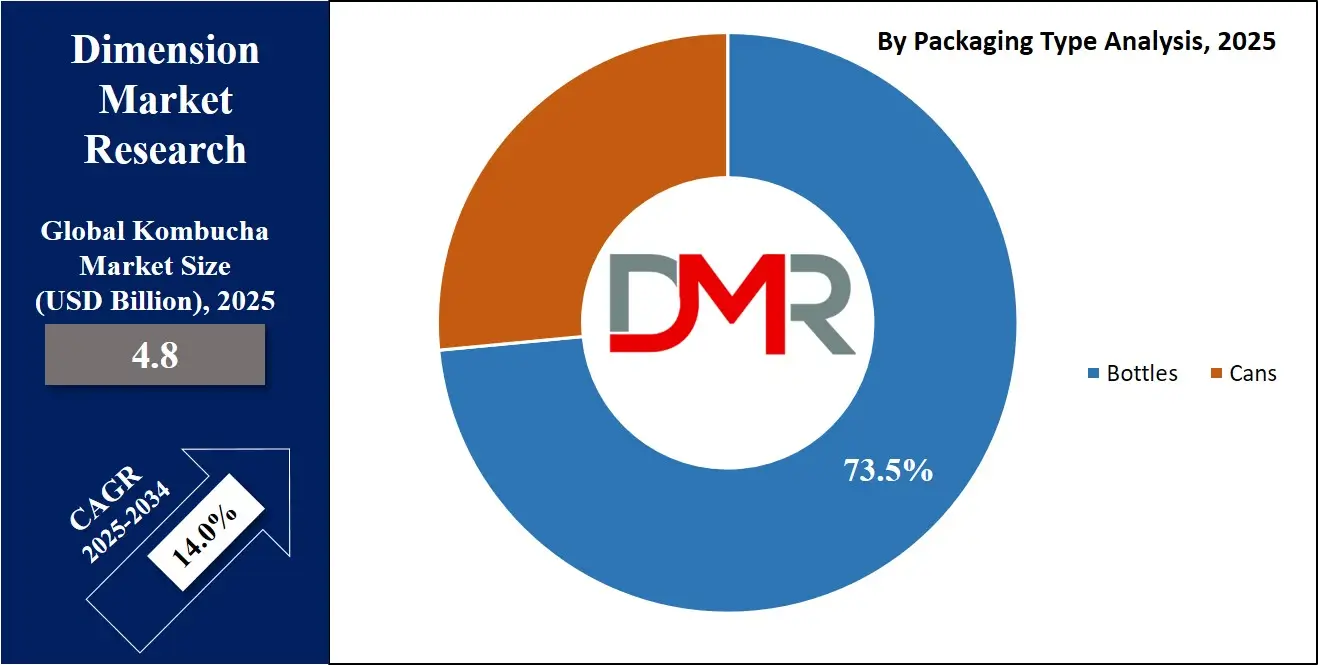

- By Packaging Type Segment Analysis: Bottles are poised to consolidate their market position in the packaging type segment, capturing 73.5% of the total market share in 2025.

- By Distribution Channel Segment Analysis: Supermarkets and Hypermarkets are anticipated to maintain their dominance in the distribution channel segment, capturing 43.5% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global kombucha market landscape with 44.6% of total global market revenue in 2025.

- Key Players: Some key players in the global kombucha market are GTs Living Foods, Health-Ade, Brew Dr. Kombucha, Humm Kombucha, Remedy Drinks, Revive Kombucha, Wonder Drink, NessAlla Kombucha, Buchi Kombucha, Equinox Kombucha, Craft Kombucha, Kombucha 221 BC, Aqua ViTea, Happy Leaf Kombucha, Unity Vibration, Kosmic Kombucha, Wild Kombucha, Better Booch, Big Easy Bucha, and Other Key Players.

Global Kombucha Market: Use Cases

- Functional Beverage Innovation for Digestive Health: Kombuchas primary use case lies in its role as a functional beverage designed to promote digestive wellness through its natural probiotic content. The fermentation process, involving a symbiotic culture of bacteria and yeast (SCOBY), generates beneficial organic acids, enzymes, and live probiotics that support gut microbiota balance. Advanced fermentation technologies enable producers to optimize this process, ensuring consistent probiotic viability and enhancing flavor profiles without compromising shelf stability. Innovations in biofermentation methods and controlled environmental conditions help manufacturers tailor kombuchas health benefits, catering to consumers seeking natural alternatives to traditional supplements. This positions kombucha as a preferred choice in the growing digestive health segment within the global functional foods and beverages market.

- Clean Label and Organic Product Development: In response to growing consumer demand for transparency and natural ingredients, kombucha brands are leveraging clean label technologies and organic sourcing to differentiate their products. The kombucha production process emphasizes natural fermentation without artificial preservatives or additives, aligning well with clean label standards. Companies invest in sustainable supply chain management and ingredient traceability, sourcing organic teas, cane sugar, and botanicals to appeal to health-conscious and environmentally aware consumers. Emerging technologies like cold chain logistics and improved packaging materials, including recyclable glass bottles and eco-friendly cans, preserve product integrity while reducing carbon footprint. This use case highlights the intersection of production technology, sustainability practices, and regulatory compliance, driving growth in organic and clean-label kombucha segments globally.

- Product Diversification through Flavor Innovation and Functional Additives: The global kombucha market thrives on product diversification enabled by technological advances in flavor infusion and functional additive incorporation. Modern blending techniques and enzymatic treatment allow producers to integrate a wide range of natural flavors such as fruit extracts, herbs, and spices, meeting evolving consumer taste preferences. Moreover, the inclusion of functional ingredients like adaptogens, antioxidants, vitamins, and plant-based nootropics enhances the beverages health appeal, expanding its use case beyond traditional probiotic benefits. Processors employ controlled fermentation and precise ingredient dosing technologies to maintain product consistency and efficacy. This use case reflects how kombucha manufacturers leverage R&D, sensory science, and bioprocessing technology to create differentiated products in the competitive functional beverage landscape.

- Expansion of Distribution through Omnichannel Retail Strategies: The kombucha markets growth is also driven by advancements in distribution technology and omnichannel retail strategies that improve product accessibility and consumer engagement. Manufacturers and retailers utilize digital supply chain management systems and data analytics to optimize inventory levels across supermarkets, online platforms, convenience stores, and specialty health shops. Cold chain storage solutions ensure product freshness and probiotic viability during transit and shelf life. Additionally, e-commerce growth has encouraged the adoption of direct-to-consumer models supported by subscription services and personalized marketing campaigns using AI-driven consumer insights. This use case underscores the critical role of logistics technology, retail innovation, and customer experience optimization in scaling the global kombucha market across diverse geographies and consumer segments.

Global Kombucha Market: Stats & Facts

United States

- U.S. Food and Drug Administration (FDA)

- Kombucha must contain less than 0.5% alcohol by volume (ABV) at bottling to be classified as a non-alcoholic beverage.

- Mandatory nutritional labeling on kombucha products to ensure transparency.

- Food safety guidelines exist for safe kombucha fermentation and production to avoid contamination.

- U.S. Department of Agriculture (USDA)

- Organic certification is available for kombucha if it meets USDA standards, including the use of organic ingredients.

- Conducts food safety risk assessments related to kombucha production.

- Enforces inspection protocols to ensure kombucha production facility safety.

- U.S. Environmental Protection Agency (EPA)

- Promotes recycling and sustainable packaging for kombucha glass bottles.

- Provides guidelines and educational programs on environmental sustainability in beverage packaging.

- U.S. Census Bureau

- E-commerce sales of beverages, including kombucha, have increased significantly, influencing market accessibility and distribution.

European Union

- European Food Safety Authority (EFSA)

- Kombucha is regulated under the Novel Foods Regulation, requiring safety assessments before market approval.

- General guidance on fermentation processes to ensure food safety in beverages.

- Monitoring of microbial content to prevent health risks associated with unregulated fermentation.

- Eurostat (Statistical Office of the EU)

- In 2023, the EU functional beverages market (including fermented drinks) grew by approximately. 8% in volume sales year-on-year.

- Organic food sales, including fermented beverages, increased by 12% in 2023 across EU countries, driven by consumer demand for natural products.

Japan

- Ministry of Health, Labour and Welfare (MHLW)

- Kombucha is classified under “health foods” and regulated for safety under the Food Sanitation Act.

- Probiotic beverages saw a 7% growth in consumer consumption from 2021 to 2024.

- Safety standards are applied to fermented beverages, focusing on microbial limits and alcohol content.

Australia

- Food Standards Australia New Zealand (FSANZ)

- Kombucha is regulated as a non-alcoholic beverage, requiring ABV below 1.15% (different from the US standard).

- Mandatory labeling requirements include ingredients, nutritional info, and alcohol content.

- FSANZ sets fermentation safety standards to control risks associated with probiotic beverages.

Canada

- Health Canada

- Kombucha beverages must contain less than 1.1% alcohol by volume (ABV) to be sold as non-alcoholic.

- Labeling laws require detailed ingredient and nutritional disclosures.

- Health Canada provides guidelines for safe fermentation practices to avoid contamination.

South Korea

- Ministry of Food and Drug Safety (MFDS)

- Kombucha is regulated under functional health foods.

- Sales of fermented health beverages grew 10% annually between 2020 and 2024.

- Stringent microbial safety standards are enforced for fermented drinks.

New Zealand

- Ministry for Primary Industries (MPI)

- Kombucha must comply with non-alcoholic beverage standards (less than 1.15% ABV).

- Mandatory ingredient disclosure and safety standards for fermented beverages.

- MPI encourages sustainable packaging practices similar to Australias EPA initiatives.

Global Kombucha Market: Market Dynamics

Global Kombucha Market: Driving Factors

Rising Consumer Awareness of Gut Health and Probiotics

Increasing awareness around digestive wellness and the importance of a balanced gut microbiome is a key driver for the kombucha market. Consumers are actively seeking beverages enriched with live probiotics and organic acids that aid digestion, improve nutrient absorption, and boost immunity. This surge in demand for gut-friendly functional drinks has propelled kombucha from niche health stores into mainstream retail channels. Moreover, educational campaigns highlighting the benefits of natural fermentation and probiotic technology have further stimulated consumer adoption globally.

Growing Preference for Natural and Clean Label Beverages

The global shift towards clean-label and organic products is another significant driver fueling kombuchas popularity. Consumers prefer beverages made without artificial additives, preservatives, or high sugar content, aligning perfectly with kombuchas natural fermentation process. The growing inclination towards plant-based, non-GMO, and sustainable products has created a favorable market environment for kombucha brands that emphasize transparent ingredient sourcing, eco-friendly packaging, and ethical production methods.

Global Kombucha Market: Restraints

Flavor and Taste Acceptance Challenges

Despite its health benefits, kombuchas distinct tangy and slightly acidic flavor profile can be off-putting to some consumers, limiting wider market penetration. Many first-time buyers find the taste unfamiliar or too sour compared to traditional soft drinks. This sensory barrier, integrated with limited awareness about flavor varieties and innovations, poses a challenge for mass-market acceptance. Overcoming taste resistance requires continuous product innovation and consumer education about flavor options and health benefits.

Regulatory and Labeling Complexities

The regulatory landscape for kombucha varies significantly across regions, creating compliance challenges for manufacturers. Issues related to alcohol content, due to natural fermentation, and labeling requirements around probiotic claims can restrict market expansion and delay product launches. Additionally, stringent food safety standards and the need for batch consistency impose operational constraints on producers, particularly smaller artisanal brands lacking the resources to navigate complex regulations.

Global Kombucha Market: Opportunities

Expansion into Emerging Markets and Untapped Regions

Emerging economies in Asia-Pacific, Latin America, and the Middle East present vast growth opportunities for kombucha manufacturers. Increasing urbanization, rising disposable incomes, and growing health awareness in these regions are driving demand for functional beverages. Localizing product offerings with region-specific flavors and culturally relevant marketing strategies can help brands capture new consumer bases and establish early leadership in these developing markets.

Product Innovation with Functional Additives and Alcoholic Variants

The trend of enhancing kombucha with additional functional ingredients such as adaptogens, vitamins, antioxidants, and CBD opens up new product segments and consumer niches. Additionally, the rising popularity of hard kombucha, kombucha with higher alcohol content, targets consumers seeking healthier alcoholic alternatives. Innovations in formulation and fermentation technology enable producers to diversify their portfolios, attracting both wellness-focused and social drinkers, thus expanding market reach and revenue streams.

Global Kombucha Market: Trends

Sustainability and Eco-Friendly Packaging Adoption

Sustainability is becoming a cornerstone trend in the kombucha market, with brands prioritizing recyclable glass bottles, biodegradable labels, and reduced plastic use. Consumers demand transparency about environmental impact, prompting manufacturers to implement sustainable sourcing of ingredients and carbon-neutral production processes. This eco-conscious approach not only supports corporate social responsibility but also resonates with environmentally aware consumers, strengthening brand loyalty.

Integration of Digital Marketing and Direct-to-Consumer Sales Models

The kombucha industry is witnessing a growing reliance on digital platforms for consumer engagement, education, and sales. Brands are leveraging social media, influencer partnerships, and content marketing to communicate product benefits and build communities around wellness lifestyles. Furthermore, the rise of e-commerce and subscription services facilitates direct-to-consumer distribution, offering convenience and personalized experiences. This trend enables brands to gather valuable consumer data and rapidly adapt to evolving preferences, driving sustained market growth.

Global Kombucha Market: Research Scope and Analysis

By Type Analysis

Flavored kombucha is poised to consolidate its dominance in the type segment, capturing 74.5% of the total market share in 2025. This stronghold is primarily attributed to consumer preference for enhanced taste experiences that balance health benefits with enjoyable flavor profiles. As the kombucha category expands beyond health food aisles into mainstream retail, flavor innovation has become a key strategy for brands to attract and retain diverse customer segments.

Flavored kombucha varieties often incorporate natural fruit juices, botanical extracts, herbs, and spices, creating a wide array of options like blueberry ginger, lemon cayenne, passionfruit mint, and more. These formulations not only improve palatability for first-time drinkers but also offer added nutritional value through functional ingredients such as antioxidants and adaptogens.

Advances in flavor infusion and controlled fermentation techniques ensure that the taste enhancements do not compromise the integrity of live probiotic cultures, further boosting consumer trust and repeat purchases. With heightened interest in wellness beverages that deliver both health and sensory appeal, flavored kombucha is set to remain the market leader across global retail channels.

Unflavored kombucha, while a smaller segment in terms of market share, continues to play an essential role in the overall product landscape. This variant is favored by traditional kombucha enthusiasts who value authenticity and purity in the fermentation process. Crafted primarily from green or black tea, sugar, and the SCOBY culture, unflavored kombucha showcases the natural tartness, effervescence, and acidic complexity characteristic of the drink. It attracts consumers who are highly informed about probiotic benefits and prefer minimalistic ingredient lists without any added flavors or sweeteners.

Additionally, unflavored kombucha serves as a base product for many commercial uses, including in restaurants, cafes, and mixology applications where customization is preferred. It is also popular among home brewers and clean-label advocates who seek the most natural form of the beverage. Despite its smaller footprint in the market, unflavored kombucha maintains a dedicated consumer base and complements the broader category by reinforcing kombuchas identity as a traditionally fermented health drink.

By Nature Analysis

Organic kombucha is anticipated to maintain its dominance in the nature type segment, capturing 71.3% of the total market share in 2025. This dominance is driven by the global shift toward clean-label products, rising consumer awareness about food safety, and the growing demand for beverages made from non-genetically modified and chemical-free ingredients.

Organic kombucha is brewed using certified organic tea leaves, organic cane sugar, and other naturally sourced inputs, ensuring that no synthetic pesticides, herbicides, or artificial additives are used throughout the production process. This aligns with the preferences of health-conscious consumers who prioritize transparency, ingredient traceability, and environmental sustainability in their purchasing decisions.

Moreover, many organic kombucha brands are also associated with eco-friendly practices such as sustainable sourcing, recyclable packaging, and carbon-neutral operations, further strengthening their market appeal. With growing regulatory support for organic labeling and expanding shelf space in premium and natural food retail chains, organic kombucha continues to lead the segment by offering both superior product quality and ethical consumption value.

Inorganic kombucha, while accounting for a smaller share of the market, plays a key role in ensuring affordability and mass-market reach. This variant is typically produced using conventionally farmed ingredients that do not carry organic certification. It appeals to price-sensitive consumers who seek the probiotic benefits of kombucha without the premium pricing associated with organic products.

Inorganic kombucha allows brands to scale production efficiently, meet higher volume demands, and distribute across mainstream supermarkets and convenience stores. While it may lack the perceived purity and environmental advantages of organic kombucha, it offers the same core fermentation process and health functionality, including support for digestion and gut health.

For many new consumers entering the kombucha category, inorganic options serve as an accessible entry point, especially in regions where organic certification is less emphasized or recognized. As such, inorganic kombucha supports category expansion by broadening consumer reach and fulfilling demand across varying price tiers and market demographics.

By Product Type Analysis

Conventional kombucha products are expected to maintain their dominance in the product type segment, accounting for 86.2% of the total market share in 2025. This segment continues to lead due to its strong alignment with health and wellness trends, its versatility across consumer age groups, and widespread retail availability. Conventional kombucha, which typically contains less than 0.5% alcohol by volume, is regarded as a non-alcoholic functional beverage. It is rich in probiotics, enzymes, organic acids, and antioxidants derived from natural fermentation, offering a host of benefits such as digestive support, immune enhancement, and detoxification.

Consumers seek alternatives to sugary sodas and artificially flavored drinks, making conventional kombucha an ideal option for daily wellness routines. The category is further strengthened by flavor innovation, attractive packaging, and endorsements from health experts, fitness influencers, and holistic wellness communities. With its wide presence in supermarkets, health food stores, cafés, and online platforms, conventional kombucha has established itself as the go-to option for both experienced and first-time functional beverage consumers.

Hard kombucha, while emerging as a niche segment, is gaining traction among adults looking for a better-for-you alcoholic option that combines moderate alcohol content with natural fermentation benefits. Typically containing between four and seven percent alcohol by volume, hard kombucha blends the probiotic nature of traditional brews with a refreshing buzz, making it an appealing alternative to beer, cider, or cocktails.

This product type is especially popular among health-conscious millennials and Gen Z consumers who seek mindful drinking experiences without compromising taste or lifestyle values. Brands in this space often experiment with unique botanical blends, exotic fruits, and functional ingredients like adaptogens or hemp extracts to elevate flavor complexity and differentiate offerings.

Despite its relatively smaller market footprint, hard kombucha is witnessing increased distribution in bars, restaurants, and liquor stores, along with growing visibility at wellness events and music festivals. As social norms shift toward low-calorie, clean-label alcoholic beverages, hard kombucha is expected to carve out a loyal consumer base and contribute to the broader evolution of functional alcohol within the beverage industry.

By Packaging Type Analysis

Bottles are poised to consolidate their market position in the packaging type segment, capturing 73.5% of the total market share in 2025. This dominance stems from the kombucha industrys long-standing preference for glass and PET bottles, which are viewed as optimal containers for preserving the integrity of the live cultures and the overall fermentation quality of the beverage. Glass bottles in particular are non-reactive and maintain the pH stability of kombucha, preventing flavor alteration and ensuring a premium drinking experience.

Additionally, bottled kombucha is often associated with artisanal quality and authenticity, attracting health-conscious consumers who value product transparency, shelf presence, and visual appeal. Bottled formats allow for elegant branding, comprehensive labeling, and visible effervescence, all of which enhance consumer trust and product differentiation. As a result, bottles remain the preferred choice across health stores, supermarkets, cafés, and specialty beverage retailers, reinforcing their leadership in both chilled and ambient retail sections.

Cans, while representing a smaller share, are quickly emerging as a high-growth segment in kombucha packaging, driven by their portability, convenience, and eco-friendly potential. Canned kombucha is gaining momentum among on-the-go consumers who seek wellness beverages that can be easily carried to work, the gym, or outdoor events. The rise of ready-to-drink formats and single-serve sizes has made cans an attractive option for younger demographics and active lifestyles.

Advances in lining technology have addressed early concerns about fermentation acidity reacting with metal, enabling safe containment without compromising flavor or probiotic potency. Additionally, aluminum cans are highly recyclable and contribute to reduced shipping costs due to their lighter weight, aligning with sustainability goals for both producers and consumers.

By Distribution Channel Analysis

Supermarkets and hypermarkets are anticipated to maintain their dominance in the distribution channel segment, capturing 43.5% of the total market share in 2025. This leadership position is anchored in their ability to offer extensive shelf space, diverse brand availability, and high consumer footfall. These large-format retail environments allow kombucha brands to showcase a broad range of flavors, pack sizes, and product types, catering to impulse buyers as well as regular health-focused shoppers. Refrigerated sections within these outlets help preserve the integrity of live cultures in kombucha, which is crucial for maintaining product quality and extending shelf life.

Moreover, supermarkets and hypermarkets often support in-store promotions, sampling activities, and loyalty programs that encourage brand trial and repeat purchases. Their strategic presence in urban centers and residential zones makes them an accessible and convenient choice for everyday wellness beverage shopping, reinforcing their pivotal role in the retail ecosystem for kombucha products.

Online retail stores are rapidly reshaping the kombucha market by providing consumers with unparalleled convenience, product discovery, and niche availability. E-commerce platforms enable kombucha brands to reach a geographically dispersed audience without the limitations of physical shelf space.

They also offer direct-to-consumer capabilities, allowing smaller and emerging brands to build loyal customer bases through subscriptions, bundled offerings, and personalized recommendations. Online channels are particularly popular for specialty and organic variants, hard-to-find flavors, and premium kombucha lines that may not be widely available offline.

Advanced cold-chain logistics and eco-friendly insulated packaging have improved the feasibility of shipping live cultures safely, ensuring product integrity from warehouse to doorstep. Additionally, the rise of health-conscious digital consumers has increased the demand for transparency, verified reviews, and detailed nutritional information, all of which are more readily accessible through online platforms. As digital shopping habits continue to evolve, online retailers are expected to play a significant role in shaping consumer access and brand visibility in the global kombucha market.

The Kombucha Market Report is segmented on the basis of the following:

By Type

-

Unflavored

- Flavored

-

Herbs & Spices

-

Citrus

-

Berries

-

Apple

-

Flowers

- Other Flavors

By Nature

By Product Type

By Packaging Type

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retailers

- Specialist Stores

- Convenience Stores

- Other Distribution Channels

Global Kombucha Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global kombucha market landscape, capturing 44.6 percent of total global market revenue in 2025. This regional dominance is fueled by a highly aware consumer base, strong demand for functional beverages, and an established health and wellness culture that continues to evolve. The United States, in particular, serves as the innovation hub for kombucha, with a wide range of brands offering both conventional and hard variants in multiple flavors and formats.

Extensive retail penetration across supermarkets, organic food stores, and online platforms, combined with widespread consumer education about probiotics and gut health, further strengthens the market’s growth trajectory in the region. North America's focus on clean-label products, sustainable packaging, and wellness-driven lifestyle trends positions it as the most mature and influential region in shaping the global evolution of kombucha consumption.

Region with significant growth

The Asia Pacific region is projected to register the highest compound annual growth rate in the global kombucha market over the forecast period. This rapid expansion is driven by rising health awareness, growing disposable incomes, and a growing shift toward natural and functional beverages across key markets such as China, Japan, South Korea, and India.

The expanding urban population and growing preference for gut-friendly, immunity-boosting drinks are encouraging both local startups and international brands to invest in this emerging space. Additionally, the region’s deep-rooted tea culture and familiarity with fermented products create a receptive environment for kombucha adoption, further accelerating its market growth potential.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Kombucha Market: Competitive Landscape

The global competitive landscape of the kombucha market is characterized by a dynamic mix of established beverage corporations, rapidly growing niche brands, and innovative startups, all striving to capture market share through product differentiation and strategic positioning. Leading players are focusing on expanding their portfolios with diverse flavors, organic formulations, and functional enhancements to cater to evolving consumer preferences. Mergers, acquisitions, and partnerships are common, with major food and beverage companies investing in or acquiring kombucha brands to tap into the fast-growing health and wellness segment.

Companies are also leveraging digital marketing, sustainability initiatives, and direct-to-consumer models to enhance brand loyalty and market reach. As the category continues to gain global momentum, competition is intensifying not only in flavor innovation and product quality but also in packaging, distribution, and pricing strategies, making the kombucha market both vibrant and highly competitive on a global scale.

Some of the prominent players in the Global Kombucha Market are:

- GT's Living Foods

- Health-Ade

- Brew Dr. Kombucha

- Humm Kombucha

- Remedy Drinks

- Revive Kombucha

- Wonder Drink

- NessAlla Kombucha

- Buchi Kombucha

- Kombucha

- Equinox Kombucha

- Craft Kombucha

- Kombucha 221 BC

- Aqua ViTea

- Happy Leaf Kombucha

- Unity Vibration

- Kosmic Kombucha

- Wild Kombucha (by Mobtown Fermentation)

- Better Booch

- Big Easy Bucha

- Other Key Players

Global Kombucha Market: Recent Developments

- Product Launches

- May 2025: Tata Motors has revealed the facelifted version of its premium hatchback, the Tata Altroz, ahead of its official launch on May 22, 2025. The new model features refreshed exterior styling, a redesigned interior, and upgraded features, although the engine lineup remains unchanged. Bookings are expected to open soon, with deliveries set to begin shortly after the official launch date.

- May 2025: Reliance Power has agreed with Green Digital Private Limited, a government-owned company in Bhutan, to develop the nation’s largest solar energy project. Valued at Rs 2,000 crore, the project aims to generate 500 megawatts (MW) of electricity, significantly advancing Bhutan’s clean energy capabilities. This collaboration represents a major step toward sustainable energy development in the region and strengthens energy ties between India and Bhutan.

- Mergers & Acquisitions

- May 2025: JSW Paints has positioned itself as the leading contender to acquire Akzo Nobel India, surpassing a rival bid from the consortium of Advent International and Indigo Paints. After weeks of intense negotiations, JSW Paints and Akzo Nobel India have signed an exclusivity agreement, enabling bilateral discussions to finalize the terms and documentation for a share purchase agreement. A formal acquisition announcement is anticipated following the conclusion of these negotiations.

- April 2025: Delhivery Ltd and Ecom Express have sought the Competition Commission of India's (CCI) approval for their Rs 1,400-crore deal. Delhivery will acquire a controlling stake in Ecom Express for a cash consideration. The proposed transaction reflects the Indian economy's continuous requirement for improvements in cost efficiency, speed, and reach of logistics.

- Funding Activities

- May 2025: Bat VC, a New York-based venture capital firm founded by Indian tech veterans from Yahoo, Twitter India, and Intuit, has announced the launch of its second fund with a target of USD 100 million. The fund aims to support early-stage startups in AI, fintech, and enterprise sectors across the US and India, offering investment checks between USD 3 million and USD 5 million. This move builds upon the firm’s first USD 8.2 million fund, which achieved a 29% internal rate of return and yielded two successful exits.

- April 2025: Leap Finance, the student lending arm of Leap, an end-to-end study abroad platform, has secured a USD 100 million debt facility from HSBC under its ASEAN Growth Fund to expand its US operations and partnerships. Leap Finance has funded over 5,000 students with USD 250 million in education loans and plans to use the funding to deepen its presence in India, expand its presence across the US, among other countries, and increase its university partnerships.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.8 Bn |

| Forecast Value (2034) |

USD 15.6 Bn |

| CAGR (2025–2034) |

14.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Unflavored, Flavored), By Nature (Organic, Inorganic), By Product Type (Hard, Conventional), By Packaging Type (Cans, Bottles), and By Distribution Channel (Supermarkets/Hypermarkets, Online Retailers, Specialist Stores, Convenience Stores, Other Distribution Channels) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

GT's Living Foods, Health-Ade, Brew Dr. Kombucha, Humm Kombucha, Remedy Drinks, Revive Kombucha, Wonder Drink, NessAlla Kombucha, Buchi Kombucha, Equinox Kombucha, Craft Kombucha, Kombucha 221 BC, Aqua ViTea, Happy Leaf Kombucha, Unity Vibration, Kosmic Kombucha, Wild Kombucha, Better Booch, Big Easy Bucha, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global kombucha market size is estimated to have a value of USD 4.8 billion in 2025 and is expected to reach USD 15.6 billion by the end of 2034.

The US kombucha market is projected to be valued at USD 1.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.5 billion in 2034 at a CAGR of 13.1%.

North America is expected to have the largest market share in the global kombucha market, with a share of about 44.6% in 2025.

Some of the major key players in the global kombucha market are GT's Living Foods, Health-Ade, Brew Dr. Kombucha, Humm Kombucha, Remedy Drinks, Revive Kombucha, Wonder Drink, NessAlla Kombucha, Buchi Kombucha, Equinox Kombucha, Craft Kombucha, Kombucha 221 BC, Aqua ViTea, Happy Leaf Kombucha, Unity Vibration, Kosmic Kombucha, Wild Kombucha, Better Booch, Big Easy Bucha, and Other Key Players

The market is growing at a CAGR of 14.0 percent over the forecasted period.