Market Overview

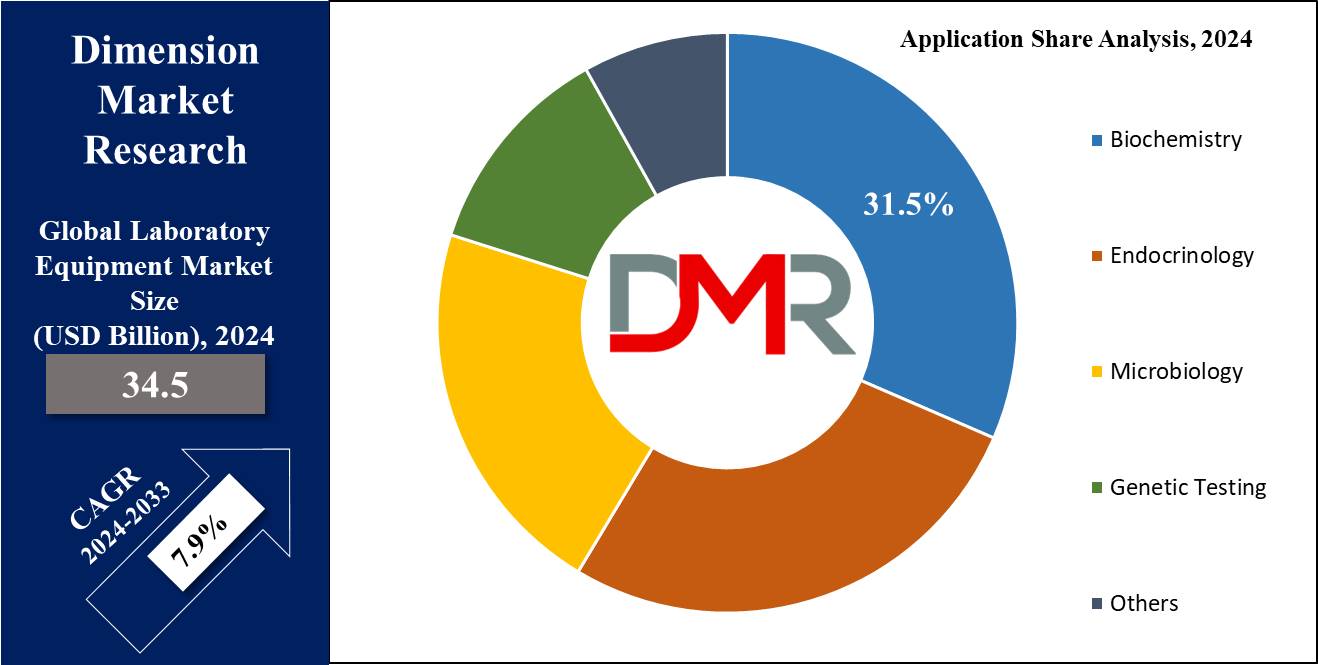

Global

Laboratory Equipment Market is forecasted to reach

USD 34.5 billion by the end of 2024 and grow to

USD 68.3 billion in 2033, with a

CAGR of 7.9%.

Laboratory equipment refers to the tools, instruments, and devices used by scientists, researchers, and technicians to conduct experiments, perform tests, and analyze data in various scientific fields. These tools range from simple items like beakers, test tubes, and microscopes to more advanced machinery like centrifuges, spectrophotometers, and chromatography systems.

Laboratory equipment is essential for measuring, mixing, heating, and cooling substances, as well as for observing and documenting experimental results. It plays a crucial role in fields such as chemistry, biology, physics, medicine, and environmental science, enabling precise and reliable scientific research and analysis.

The US Laboratory Equipment Market

The US Laboratory Equipment Market is projected to reach USD 11.3 billion by the end of 2024 and grow substantially to an expected USD 21.6 billion market by 2033 at an anticipated CAGR of 7.4%.

Technological advancements in equipment, such as automated analyzers and next-generation sequencing platforms, have further boosted market growth. The growing prevalence of chronic diseases like diabetes, cancer, and cardiovascular conditions has fueled the need for advanced diagnostic tools in healthcare and research.

Automated systems are increasingly being adopted in laboratories to improve accuracy, reduce human error, and enhance efficiency in workflows.

Laboratory Information Management Systems are also being adopted in tandem to streamline operations and ensure seamless integration of equipment with digital data systems. AI-powered equipment is aiding in data analysis, improving diagnostic precision, and accelerating research processes.

Key Takeaways

- Market Growth: The global laboratory equipment market is anticipated to expand by USD 31.4 billion, achieving a CAGR of 7.9%.

- Market Definition: Laboratory Equipment refers to various tools and instruments used in scientific laboratories for experimentation, analysis, and research.

- Product Analysis: General products are projected to hold the largest revenue share based on products in the market in 2024.

- Application Analysis: Biochemistry is forecasted to lead the global Laboratory Equipment market based on application with a revenue share, in 2024.

- End User Analysis: Healthcare is anticipated to dominate the market with the largest revenue share based on end users in the market in 2024.

- Regional Analysis: North America is projected to dominate the global laboratory equipment market, holding a market share of 39.8% by 2024.

Use Cases

- Clinical Diagnostics: Laboratory equipment is used to analyze blood samples, measure glucose levels, and detect pathogens, playing a crucial role in diagnosing conditions like diabetes, infections, and cancer.

- Genetic Testing: PCR machines, DNA sequencers, and electrophoresis equipment are used in genetic testing which help in the identification of genetic mutations, and hereditary diseases, and the development of personalized medicine based on a patient's genetic profile.

- Pharmaceutical Research: Laboratory equipment like chromatographs, spectrometers, and high-performance liquid chromatography systems are vital which assist in analyzing chemical compounds, ensuring drug purity, and testing the efficacy of new pharmaceutical formulations.

- Environmental Monitoring: Laboratory equipment like gas chromatographs, mass spectrometers, and turbidity is used to assess air, water, and soil quality in environmental studies.

Market Dynamic

Drivers

Biotechnology and Pharmaceutical Industries Biotechnology and pharmaceutical industries have emerged as major forces driving laboratory equipment markets worldwide. As these sectors expand, their demand for advanced and specialized laboratory equipment increases significantly to support research, development, and manufacturing activities in these sectors. Laboratories within these fields require diverse equipment based on specific purposes for optimal operations - therefore high-quality versatile tools become crucial components.

Technological Advancements in Laboratory Equipment

Technological advances are expected to play an essential part in driving market expansion over the coming years. Recent innovations in lab tools have significantly expanded their capacities, efficiency, and functionality while automating workflows with robotics or advanced software systems thereby expanding market reach further.

Restraints

Rising Costs of Laboratory Equipment

As advanced technologies advance productivity and efficiency, their integration has caused expenses associated with laboratory equipment services to rise significantly, which in turn could act as a restraint on market growth over the forecast period. Furthermore, increased expenses make it more challenging for laboratories in developing regions to afford these technologies, thus further diminishing market potential in those regions.

Shifting toward Point-of-Care Diagnostics

A shift from laboratory diagnostics toward

Point of Care Diagnostics Market testing poses another significant hurdle to the laboratory equipment market's expansion. Doing away with traditional laboratory facilities allows more accessible and immediate solutions outside the lab environment to become available more quickly, decreasing demand for laboratory infrastructure, which is important when applied in emerging and developing economies with insufficient lab services available to them. This transition is driving the growth of the Point of Care Diagnostics Market, as healthcare systems seek faster, more efficient, and cost-effective diagnostic solutions.

Opportunities

Automation and DigitalizationThe integration of advanced automation technologies, AI, and digital tools into laboratory equipment presents a significant growth opportunity. Automated systems for tasks like sample processing, data analysis, and workflow management increase productivity, accuracy, and efficiency. The demand for such technology is growing across industries like healthcare, biotechnology, and pharmaceuticals, offering manufacturers opportunities to innovate and meet these needs.

Emerging Markets and Healthcare Expansion

Developing countries are increasingly investing in healthcare infrastructure, research, and diagnostics, which creates opportunities for laboratory equipment manufacturers. With growing populations, rising disease burdens, and the need for more advanced healthcare services, they are becoming lucrative markets for laboratory equipment providers.

Trends

Miniaturization and Portability

There is a growing trend toward the development of smaller, portable laboratory devices which are called miniaturized equipment which allows for point-of-care testing, field research, and decentralized laboratory functions. It is driven by the need for flexibility, rapid results, & the ability to conduct tests in remote or resource-limited settings.

Sustainability and Eco-friendly Practices

The focus on sustainable and environmentally friendly laboratory equipment is becoming more prominent. Manufacturers are increasingly developing energy-efficient, low-waste, and recyclable laboratory instruments. This trend aligns with the global push for green technology & sustainability, as laboratories seek to reduce their environmental footprint.

Research Scope and Analysis

By Product

General product is predicted to dominate the laboratory equipment market with the largest revenue share of 33.2% in 2024, due to its wide application across diverse research fields and industries. General equipment is designed to accommodate a broad range of laboratory needs, which makes it highly versatile across various research disciplines.

This equipment includes essential tools like balances, centrifuges, pipettes, and glassware, which are foundational for any laboratory operation. There is a strong demand for this equipment due to its versatility and necessity in routine lab processes across multiple sectors, including pharmaceuticals, biotechnology,

Construction Equipment testing, and academic institutions. There is a huge dependency on general equipment due to continuous growth in research activities, along with increasing automation.

Meanwhile, the analytical segment is predicted to be the second most dominating due to the increasing need for precision in testing and analysis. Analytical equipment, like spectrometers, chromatography systems, and mass spectrometers, are essential for conducting complex chemical, biological, and material analyses. Industries like healthcare, environmental testing, and food safety heavily depend on analytical tools for accurate measurements and diagnostics.

By Application

Biochemistry is expected to become the dominant laboratory equipment application in revenue share by 2024 due to its wide use across numerous scientific research topics and clinical diagnostic procedures. Studies of biochemical processes within living organisms provide critical knowledge needed for understanding disease mechanisms, drug development, and metabolic functions.

This field requires extensive laboratory equipment such as spectrophotometers, centrifuges, and analyzers to conduct various biochemical assays and experiments. Biochemistry's dominance can also be explained by advancements in personalized medicine, biotech advances, and its necessity in fields like drug discovery and molecular biology - factors that contribute significantly to its rise.

They can be applied across healthcare, pharmaceuticals, & academic research settings making laboratory equipment an integral component for success and driving the market demand for lab products. Endocrinology studies hormones & the endocrine system, with special attention paid to diseases like diabetes, thyroid disorders, & hormonal imbalances. Laboratory equipment like immunoassay analyzers, hormone analyzers, & diagnostic kits play a pivotal role in this field in measuring hormone levels accurately as well as conducting various hormone-related tests.

By End User

Healthcare is projected to lead the laboratory equipment market with a high revenue share of 45.3% by 2024 due to its central role in patient care and diagnostic and clinical laboratories' involvement. Laboratory equipment is required in hospitals, diagnostic centers, and clinics for blood analysis, biochemistry assays, microbiological culture cultivation, and genetic testing procedures as well as personalized medicine trials and more frequent chronic illness occurrence.

Healthcare institutes continue investing in this equipment due to chronic illnesses' increasing incidence rates among an aging population with growing demands for personalized medicine treatments; lab equipment also plays a pivotal role when conducting experiments, analyzing samples, or researching various aspects of disease and treatments and thus driving investment through personalized medicine initiatives by hospitals, clinics or institutes investing heavily into personalizing healthcare institutes' investment policies that promote personalized medicine practices through conducting experiments; conducting analyses samples while uncovering various aspects related to various diseases or treatments used during patient encounters or research purposes.

Veterinary is expected to experience the fastest compound annual compound average growth over its projected lifetime as it encompasses numerous diagnostic and research activities that utilize specialized laboratory equipment for early disease detection and accurate diagnoses of animals. Modern advances in veterinary diagnostics allow early disease identification with accurate diagnoses in animals using devices like hematology, chemistry, and molecular diagnostic analyzers that play an essential part in detecting infections, assessing organ functions, and managing chronic illnesses in their animals.

Global Laboratory Equipment Market Report is segmented on the basis of the following

By Product

- General

- Analytical

- Clinical

- Support

- Specialty

By Application

- Biochemistry

- Endocrinology

- Microbiology

- Genetic Testing

- Others

By End User

- Healthcare

- Research Institutions

- Veterinary

- Others

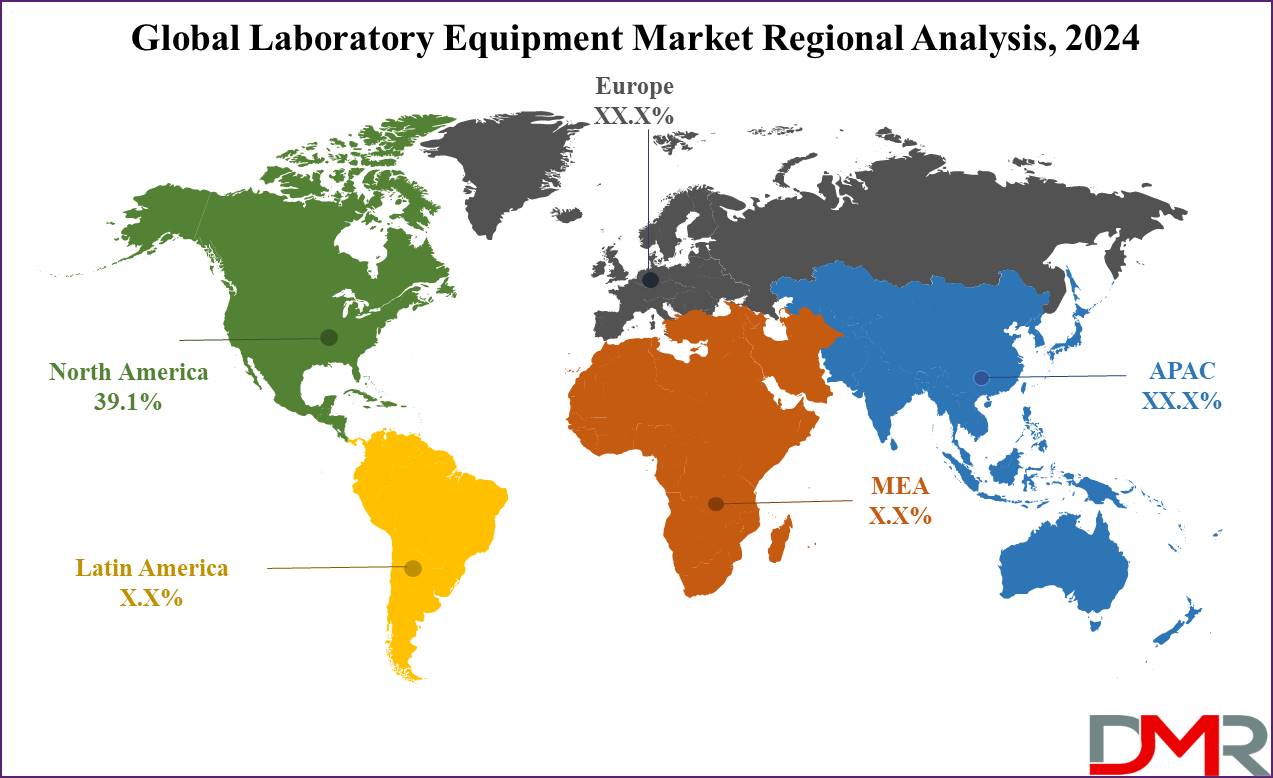

Regional Analysis

North America is projected to lead the laboratory equipment market with an anticipated revenue

share of 39.1% by 2024 due to numerous pharmaceutical and biopharmaceutical companies that specialize in research and development activities. Increased grants from government bodies like the National Institutes of Health to support research initiatives are anticipated to fuel market expansion.

They boast strong track records and established company credibility that should lead them to attract additional investments into research during the forecast period and drive the market expansion of the laboratory equipment market. Regional regulatory frameworks help laboratories adhere to stringent quality standards, necessitating them to invest in cutting-edge equipment. Biopharmaceutical industry research funding ranks amongst the highest sectors, and many biopharmaceutical firms focusing on creating leads and building up sample inventories are major providers for laboratory equipment needs.

North America is also at the forefront of personalized medicine, genetic testing, and biopharmaceuticals--which require cutting-edge laboratory technologies. Asia Pacific is expected to experience the second-fastest compound annual compound annual compound annual compound growth rate during its forecast period, driven by technological innovations within healthcare services and facilities. Asia Pacific has long been considered an early adopter of cutting-edge laboratory technologies like molecular diagnostics, automated systems and advanced diagnostic platforms.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Leading companies are prioritizing research and development to expand their product offerings, which is expected to further drive growth in the laboratory equipment market. Market participants are also implementing strategic initiatives to enhance their global presence. These include mergers and acquisitions, collaborations, product launches, partnerships, and joint ventures. For example, in June 2023, Waters Corporation and Sartorius AG strengthened their collaboration to provide a comprehensive range of bioanalytical solutions for downstream biomanufacturing. Notable players in the global laboratory equipment market include Agilent Technologies Inc., BD, and Beckman Coulter Inc.

Some of the prominent players in the global laboratory equipment market are

- Agilent Technologies Inc.

- BD

- Beckman Coulter Inc.

- Bio-Rad Laboratories Inc.

- Bruker

- Sartorius AG

- Eppendorf AG

- Hoffmann LA-Roche AG

- PerkinElmer Inc.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Other Key Players

Recent Development

- In August 2024, Agilent Technologies introduced the Agilent 1260 Infinity II Prime LC System, which features advanced flow technology for improved resolution and sensitivity in liquid chromatography applications.

- In July 2024, PerkinElmer released the PerkinElmer® Spectrum Two™ FT-IR Spectrometer, featuring a new optical design that enhances measurement speed and sensitivity for various applications, including pharmaceuticals and food safety.

- In June 2024, Beckman Coulter Life Sciences launched the new Navios EX Flow Cytometer, offering enhanced detection capabilities for complex cellular analysis, aimed at improving research in cancer and immunology.

- In May 2024, Eppendorf announced the new Eppendorf BioSpectrometer® kinetic, which provides precise UV-Vis spectroscopy with advanced data analysis software, tailored for life science research.

- In April 2024, Waters Corporation introduced the ACQUITY PREMIER UPLC System, featuring new technologies for improved performance in analytical chemistry and quality control labs.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 34.5 Bn |

| Forecast Value (2033) |

USD 68.3 Bn |

| CAGR (2024-2033) |

7.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 11.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (General, Analytical, Clinical, Support, and Specialty), By Application (Biochemistry, Endocrinology, Microbiology, Genetic Testing, and Others), By End User (Healthcare, Research Institutions, Veterinary, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Agilent Technologies Inc., BD, Beckman Coulter Inc., Bio-Rad Laboratories Inc., Bruker, Sartorius AG, Eppendorf AG, Hoffmann LA-Roche AG, PerkinElmer Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Laboratory Equipment Market size is estimated to have a value of USD 34.5 billion in 2024 and is expected to reach USD 68.3 billion by the end of 2033.

North America is expected to be the largest market share for the Global Laboratory Equipment Market with a share of about 39.1 % in 2024.

Some of the major key players in the Global Laboratory Equipment Market are Agilent Technologies Inc., BD, and Beckman Coulter Inc., and many others.

The market is growing at a CAGR of 7.9 percent over the forecasted period.

The Global US Market size is estimated to have a value of USD 11.3 billion in 2024 and is expected to reach USD 21.6 billion by the end of 2033.