Market Overview

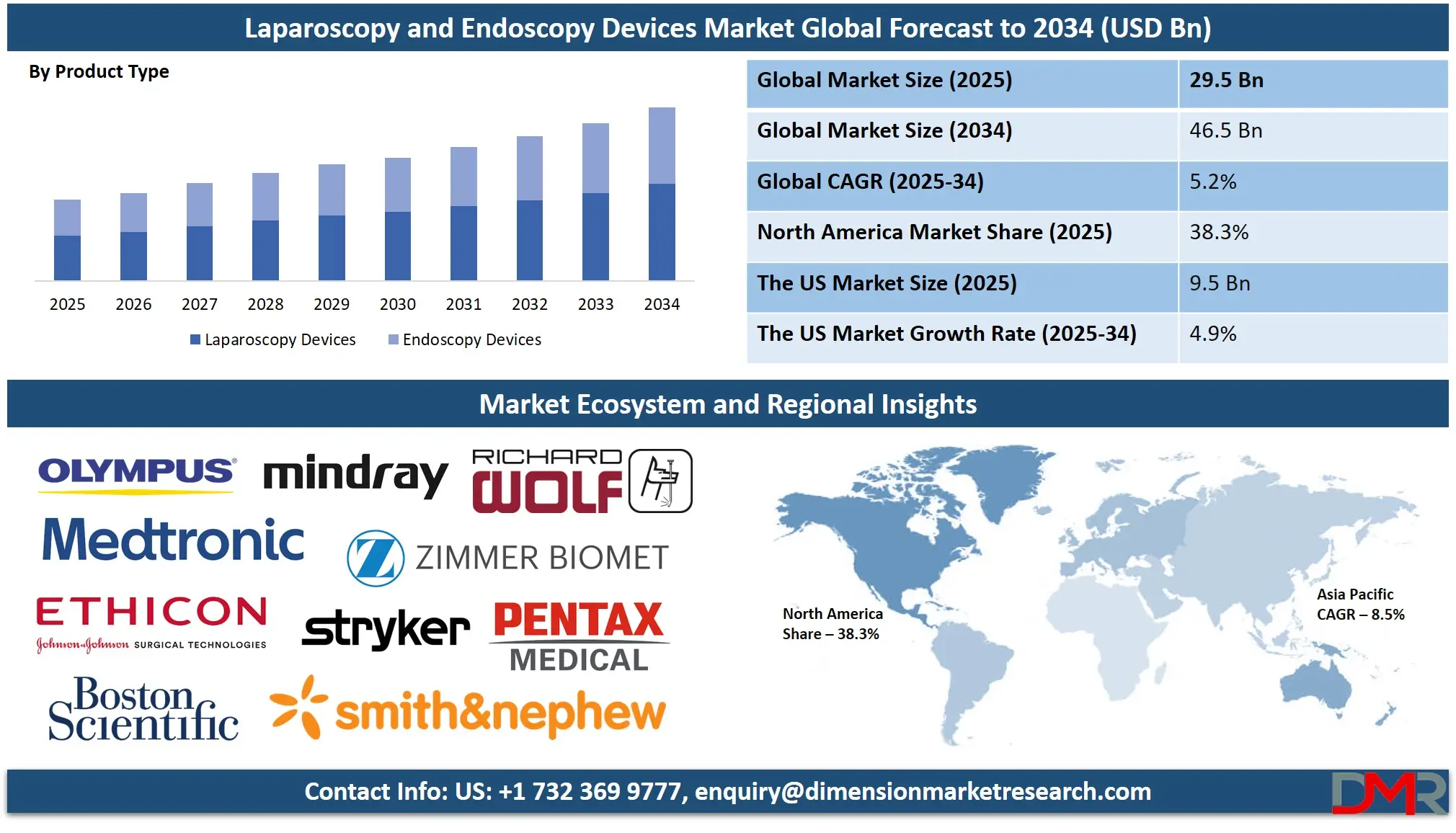

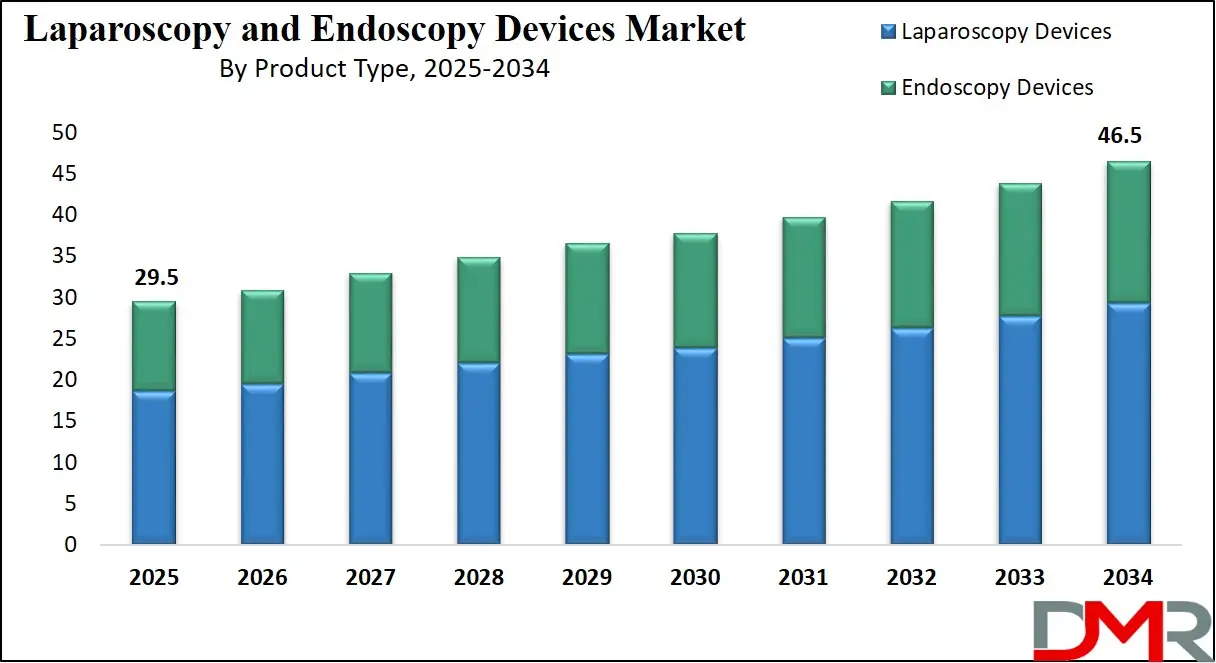

The Global Laparoscopy and Endoscopy Devices Market is projected to reach

USD 29.5 billion in 2025 and grow at a compound annual growth

rate of 5.2% from there until 2034 to reach a value of

USD 46.5 billion.

Global Laparoscopy and Endoscopy Devices Market is expanding at a fast rate owing to rising instances of gastrointestinal, gynecological, and urological disorders. Demand for minimally invasive surgeries is driving the market for sophisticated laparoscopy and endoscopy devices. Industry reports estimate the market to expand at a robust CAGR, with the rising geriatric population and healthcare spending as key drivers. Technological advancements in the form of AI-based endoscopic imaging, robotic-assisted surgery, and disposable endoscopes are transforming the industry. The shift towards outpatient and ambulatory surgery centers also drives demand for cost-effective and efficient medical devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the most notable trends in the market is the integration of artificial intelligence and augmented reality technology into endoscopic procedures, enabling better visualization and accuracy in surgical procedures. Single-use endoscopes are becoming a solution for reducing cross-contamination, thereby increasing patient safety. With increasing applications of laparoscopy and endoscopy for detecting disease at earlier stages, morbidity and mortality are being reduced.

The growing applications of capsule endoscopy for non-invasive visualization of the gastrointestinal tract are also driving growth for the market. The rise in the incidence of chronic diseases including colorectal cancer and gastroesophageal reflux disease (GERD) is also increasing demand for advanced diagnostic as well as therapeutic procedures.

Opportunities in the market accrue because of increasing investment in healthcare infrastructure, particularly in emerging economies. Government initiatives for improving access to endoscopic interventions and increasing awareness for early diagnosis of diseases are propelling growth in the market. Expansion through the rising adoption of tele-endoscopy and artificial intelligence (AI)-based diagnostics is also improving accuracy and efficiency in endoscopic interventions. The need for high-end endoscopic ultrasound (EUS) devices and laparoscopy-based robotic surgery systems is also creating opportunities for manufacturers.

Despite its rapid growth, several limitations confront the marketplace, including high prices for advanced endoscopic equipment and maintenance. The lack of skilled personnel for managing advanced laparoscopy and endoscopy devices is a challenge for several markets. Reimbursement and stringent regulatory approvals for new devices also limit marketplace penetration. Problems with infection risks associated with reusable endoscopes also pose a serious challenge, with improved sterilization practices and disposable products having to be implemented.

The market is poised for robust growth, fueled by increasing demand for minimally invasive surgeries and continuous technological advancements. Asia-Pacific will see the highest growth, fueled by increasing healthcare expenditure and an increase in medical tourism. North America continues to be the leader, with a high industry player presence and higher uptake of advanced surgical procedures. Europe is also developing strongly, with an emphasis on disease detection at an early stage, fueled by favorable government initiatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

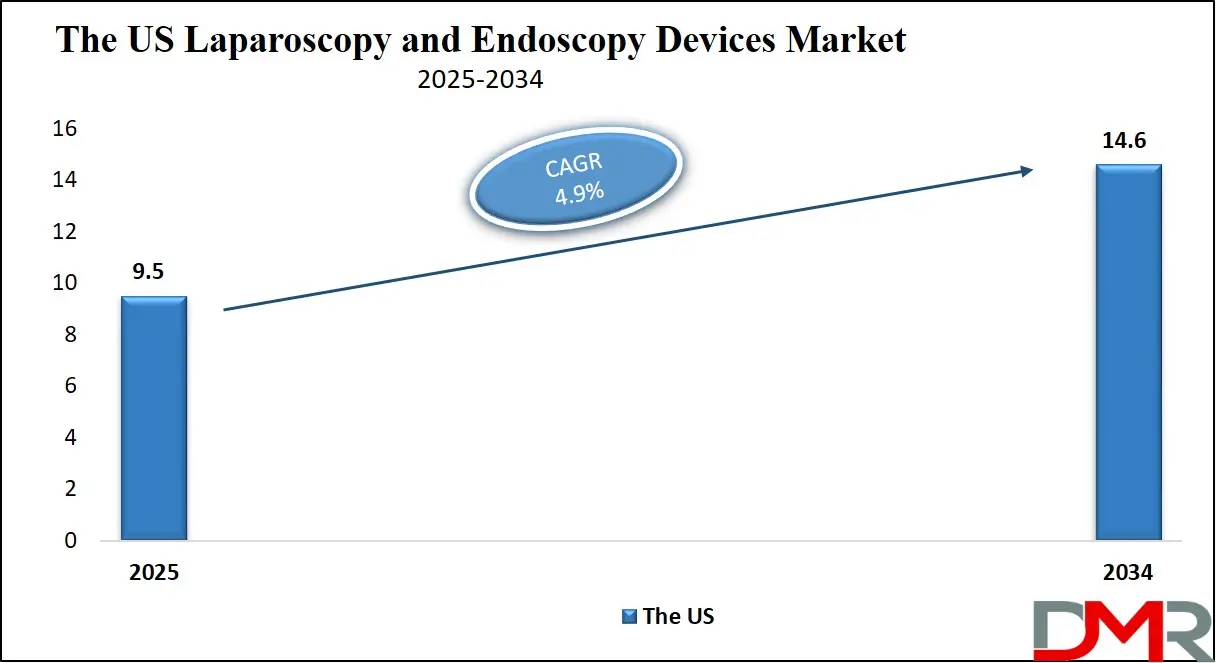

The US Laparoscopy and Endoscopy Devices Market

The US Laparoscopy and Endoscopy Devices Market is projected to reach

USD 9.5 billion in 2025 at a compound annual

growth rate of 4.9% over its forecast period.

The US laparoscopy and endoscopy devices market is a prominent segment of the global market, driven by advanced healthcare infrastructure, a high level of adoption for minimally invasive surgeries, and supportive reimbursement policies. The country has a well-established ambulatory surgical center network and hospital infrastructure with a high utilization rate for laparoscopic and endoscopic devices for diagnostic and treatment procedures. Increasing cases of obesity and colorectal cancer are propelling demand for advanced diagnostic and surgical devices. It is estimated that there are over 18 million endoscopic procedures performed annually in the US, a reflection of the high demand for these devices.

Demographically, growth is fueled primarily by the growing elderly population, as older individuals are at a higher risk for gastrointestinal, pulmonary, and urological disorders that require endoscopic interventions. The high obesity rate has also driven laparoscopic bariatric surgeries, further propelling growth. Advances in AI-guided endoscopic imaging and robotic-assisted laparoscopic surgery also are enhancing surgical precision and improving patient outcomes.

There is increasing demand for advanced devices with greater efficiency and safety because of the presence of key players and continuous investment for R&D. Rising demand for disposable endoscopes for infection risk minimization and compliance with stringent sterilization norms is propelling growth in the market. Increasing investment in telemedicine and AI-driven diagnostics is further revolutionizing the U.S. market. With continuous development and strong healthcare infrastructure, the U.S. laparoscopy and endoscopy devices market is poised to grow further.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Laparoscopy and Endoscopy Devices Market: Key Takeaways

- The Global Market Size Insights: The Global Laparoscopy and Endoscopy Devices Market size is estimated to have a value of USD 29.5 billion in 2025 and is expected to reach USD 46.5 billion by the end of 2034.

- The US Market Size Insights: The US Laparoscopy and Endoscopy Devices Market is projected to be valued at USD 9.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 14.6 billion in 2034 at a CAGR of 4.9%.

- Regional Market Insights: North America is expected to have the largest market share in the Global Laparoscopy and Endoscopy Devices Market with a share of about 38.3% in 2025.

- Key Players Insights: Some of the major key players in the Global Laparoscopy and Endoscopy Devices Market are Olympus Corporation, KARL STORZ SE & Co. KG, Stryker Corporation, Medtronic plc, Johnson & Johnson (Ethicon Endo-Surgery, Inc.), Boston Scientific Corporation, and many others.

- Global Growth Rate Insights: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

Global Laparoscopy and Endoscopy Devices Market: Use Cases

- Gastrointestinal Disease Diagnosis and Treatment: Laparoscopic and endoscopic instruments are widely used for detection as well as for disease treatment, including for diseases like colorectal cancer, GERD, and inflammatory bowel disease. Endoscopic ultrasound and biopsies aid in earlier detection, improving patient outcomes.

- Gynecological Surgeries: Minimally invasive laparoscopy is employed extensively for surgeries such as hysterectomy, ovarian cyst removal, and endometriosis surgery. Laparoscopic instruments' precision reduces recovery time and postoperative morbidity.

- Bariatric Surgery: Laparoscopic procedures like gastric bypass and sleeve gastrectomy are now routinely performed for weight loss. These are laparoscopic surgeries that have shorter hospital stays, less infection risk, and faster recovery compared with open surgery.

- Pulmonary Endoscopy: The bronchoscopes are employed for identifying lung cancer, performing biopsies, and clearing blockages within the airways. With advanced imaging technology, the accuracy of diagnosing pulmonary disease is enhanced.

- Orthopedic Applications: Arthroscopic: With arthroscopic surgery, visualization and correction of joint problems, such as torn ligaments and cartilage damage, are possible. These minimally invasive surgeries enhance mobility and minimize recovery time.

Global Laparoscopy and Endoscopy Devices Market: Stats & Facts

- Advanced Laparoscopic Surgeons of Morris partnered with New York Bariatric Group (NYBG) in May 2024 to enhance patient access to advanced surgical techniques. The collaboration introduced new offices in Edison and Florham Park, NJ, expanding NYBG's presence to 30 locations across the tri-state area.

- UC Davis Health adopted ConMed’s AirSeal System in November 2022, establishing low-pressure insufflation as the standard for laparoscopic surgeries. As the first multi-site U.S. health system to implement this technology, it enhances patient comfort and improves surgical outcomes, emphasizing the industry's commitment to technological advancements.

- Karl Storz SE & CO. entered a merger agreement with Asensus Surgical in June 2024, expanding its surgical robotics division. Upon finalization in Q3 2024, Asensus will become a subsidiary of KARL STORZ Endoscopy-America, strengthening its position in the robotic-assisted surgery market.

- B. Braun Melsungen AG inaugurated a new manufacturing facility in Switzerland in May 2024, increasing production capacity for advanced medical devices. Designed for efficiency and quality, the expansion aligns with the company's innovation strategy, reinforcing its leadership in the global MedTech industry.

- The IFSO Global Registry Report stated in 2019 that 833,687 bariatric surgeries were performed across 61 countries, demonstrating strong procedural demand. This trend continues to drive market growth, highlighting the increasing adoption of laparoscopic procedures for obesity management and surgical efficiency.

- The World Obesity Federation reported in 2024 that over one billion people now live with obesity, including 880 million adults and 159 million children. With nearly 3 billion affected by overweight or obesity, demand for laparoscopic tools and energy-based surgical devices continues to rise.

- The CDC recorded 125.7 million outpatient department visits in the U.S. in 2024, reflecting a growing demand for surgical equipment. Increasing angioplasties, organ transplants, and trauma procedures, along with an aging population, drive demand for laparoscopic devices to treat noncommunicable diseases.

- The expansion of Ambulatory Surgical Centers (ASCs) accelerated in 2024, with 9,600 active centers in the U.S., according to Definitive Healthcare. The high surgical volume capacity of ASCs is expected to sustain laparoscopic device adoption, supporting efficient, minimally invasive procedures.

- The CDC reported in 2022 that heart disease accounted for 702,880 deaths in the U.S., fueling demand for minimally invasive procedures. As precision-driven techniques gain popularity, the laparoscopic devices market is projected to expand, improving patient recovery and surgical outcomes.

- The FDA approved Virtual Incision Corporation’s MIRA Surgical System in February 2024, a miniaturized robotic-assisted device for colectomy procedures. Authorized under the De Novo Classification process, it represents a major advancement in minimally invasive surgical technology, enhancing precision and procedural efficiency.

- The International Diabetes Federation reported in May 2023 that 61 million Europeans were living with type 2 diabetes, a figure expected to reach 67 million by 2030. This increasing prevalence is driving demand for minimally invasive laparoscopic procedures, particularly in metabolic and bariatric surgery.

- Germany's International Diabetes Federation data in 2021 indicated a 10% diabetes prevalence among 62 million adults, totaling 6.2 million cases. This growing burden is increasing demand for laparoscopic-assisted metabolic surgeries, supporting improved diabetes management and treatment outcomes.

Global Laparoscopy and Endoscopy Devices Market: Market Dynamic

Driving Factors in the Global Laparoscopy and Endoscopy Devices Market

Rising Prevalence of Gastrointestinal, Urological, and Gynecological DisordersThe rising incidence of gastrointestinal ailments such as colorectal cancer, gastroesophageal reflux disease (GERD), and inflammatory bowel disease (IBD) are driving demand for sophisticated endoscopic procedures. Colorectal cancer, according to the World Health Organization (WHO), is one of the leading cancers that result in death worldwide, and universal implementation of diagnostic and therapeutic endoscopic procedures is needed. Similarly, increasing incidences of urological and gynecological conditions such as endometriosis, prostate ailments, and kidney stones are driving demand for laparoscopy-based surgical interventions. All these elements underpin rising laparoscopy and endoscopy device usage.

Expanding Geriatric Population Driving Demand for Minimally Invasive Procedures

An aging population globally is one of the key drivers for endoscopy and laparoscopy devices since elderly individuals are at higher risk of having chronic diseases that require repetitive diagnostic and therapeutic interventions. The global population of 60 years and above will reach 2.1 billion by 2050, as estimated by the United Nations, with a significant increase in demand for minimally invasive surgeries. Older patients prefer endoscopic and laparoscopic procedures since they have shorter recovery times, lower risks for complications, and improved post-surgery outcomes compared to open surgeries. This demographic trend is driving growth, particularly in developed countries with well-established healthcare systems.

Restraints in the Global Laparoscopy and Endoscopy Devices Market

High Cost of Advanced Endoscopic and Laparoscopic Equipment

One of the primary barriers to market growth is that advanced laparoscopy and endoscopy devices are costly to acquire and maintain. Robotic-assisted laparoscopic suites, high-definition imaging equipment, and AI-empowered endoscopic devices are pricey, and their uptake is limited due to high initial investment levels. Furthermore, maintenance, software upgrades, and training healthcare staff on how to utilize these advanced devices also place additional financial loads on medical facilities. Hence, small clinics and hospitals, particularly those based in emerging markets, are not able to adopt new endoscopic and laparoscopic technology.

Stringent Regulatory Approvals and Reimbursement Challenges

The laparoscopy and endoscopy equipment market is highly regulated, with stringent approval requirements set out by regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and China's National Medical Products Administration (NMPA). Time-consuming and lengthy regulatory approval procedures delay product launches, limiting access to advanced equipment.

Suboptimal reimbursement schemes for minimally invasive procedures in certain countries impose financial burdens on patients and healthcare providers. Limited insurance coverage for advanced endoscopic procedures also acts as a growth barrier, particularly for underdeveloped and emerging healthcare economies. Overcoming these regulatory and reimbursement barriers remains a primary challenge for industry players aiming for international expansion.

Opportunities in the Global Laparoscopy and Endoscopy Devices Market

Increasing Healthcare Investments in Emerging Markets

Rapidly developing healthcare infrastructure in emerging nations such as India, China, and Brazil is creating huge growth opportunities for the laparoscopy and endoscopy devices market. Private healthcare providers and governments are investing heavily in the development of medical infrastructure and the implementation of advanced surgical technology. Supportive regulatory initiatives and efforts at enhancing access to minimally invasive procedures are also improving market penetration. The growing middle-class population and healthcare awareness in these economies are likely to drive higher adoption of laparoscopy and endoscopy devices throughout the forecast period.

Advancements in 3D and 4K Imaging Technology for Enhanced Visualization

Continuous advancements in imaging technology are opening up enormous opportunities for expanding markets, particularly with the adoption of 3D and 4K ultra-high-definition (UHD) imaging systems for endoscopic and laparoscopic procedures. These newer imaging modalities provide better clarity, greater depth perception, and better color reproduction, allowing surgeons to perform very accurate interventions.

The addition of fluorescence imaging, narrow-band imaging (NBI), and chromoendoscopy techniques are also improving mucosal pattern and vascular structure visualization, enabling the detection of disease at earlier stages. With medical centers around the world continuing to invest in advanced imaging technology, demand for high-resolution laparoscopy and endoscopy devices is poised to increase dramatically.

Trends in the Global Laparoscopy and Endoscopy Devices Market

Integration of Artificial Intelligence (AI) and Machine Learning in Endoscopic Procedures

Integration of AI and machine learning into laparoscopy and endoscopy equipment is revolutionizing the sector with increased diagnostic accuracy and surgical precision. AI-driven endoscopic image systems help healthcare professionals detect abnormalities, such as cancers at early stages, polyps, and lesions, with better accuracy than currently available methodologies.

Deep learning algorithms are also improving real-time image analysis, reducing human errors, and enabling better-targeted biopsies. AI-driven automated documentation for endoscopic procedures is also streamlining workflow efficiency, allowing doctors to focus on patient care. Increasing demand for AI-assisted endoscopic devices among clinics and hospitals will drive the market towards technologically advanced products.

Growing Adoption of Single-Use and Disposable Endoscopes

There is growing momentum for single-use and disposable endoscopes due to cross-contamination and infection issues with reusable endoscopes. Reusable endoscopes undergo rigorous cleaning and sterilization, which, if not effectively carried out, can cause hospital-acquired infection. Single-use endoscopes eliminate this risk as well as save on reprocessing costs, ensure patient safety, and enhance procedural efficiency. Regulatory agencies such as the FDA and CDC are also promoting increased adoption of disposable endoscopes for infection outbreak prevention. The trend is also expected to gain further momentum with manufacturers emphasizing cost-effective and sustainable disposable endoscopic products.

Global Laparoscopy and Endoscopy Devices Market: Research Scope and Analysis

By Product Type Analysis

Laparoscopy devices are projected to have the majority share in the global laparoscopy and endoscopy devices market due to their high utility for minimally invasive surgeries. Laparoscopes, trocars, insufflators, energy devices, and robotic-assisted platforms are some devices that have revolutionized modern surgery due to faster patient recovery, fewer complications after surgery, and increased procedural accuracy. The demand for laparoscopy devices is fueled due to their high utility for general surgery, gynecology, urology, and obesity surgeries. Laparoscopic procedures have smaller incisions, reduced hospital stay, and less healthcare cost compared to open surgeries, and due to these factors, they have become a popular choice among patients and healthcare providers.

Technological advancements such as 3D imaging, HD cameras, and fluorescence-guided surgery have increased the accuracy and speed at which laparoscopic procedures are performed. Robotic-assisted laparoscopy has also increased adoption, with better dexterity and visualization for complex surgeries. Furthermore, a rise in diseases such as gallbladder disease, obesity, and colorectal cancer has increased demand for laparoscopic procedures.

The increasing emphasis on minimally invasive procedures across developed and emerging economies, coupled with supportive reimbursement schemes for key markets such as the United States, Germany, and Japan, has solidified laparoscopy devices' dominance. Furthermore, continuous product innovations from industry players including Olympus Corporation, Stryker Corporation, and Medtronic have expanded laparoscopic procedures' reach. With growing investment into healthcare, growing patient preference for minimally invasive procedures, and continuous technological advancements, laparoscopy devices are set to maintain their dominance in the global market.

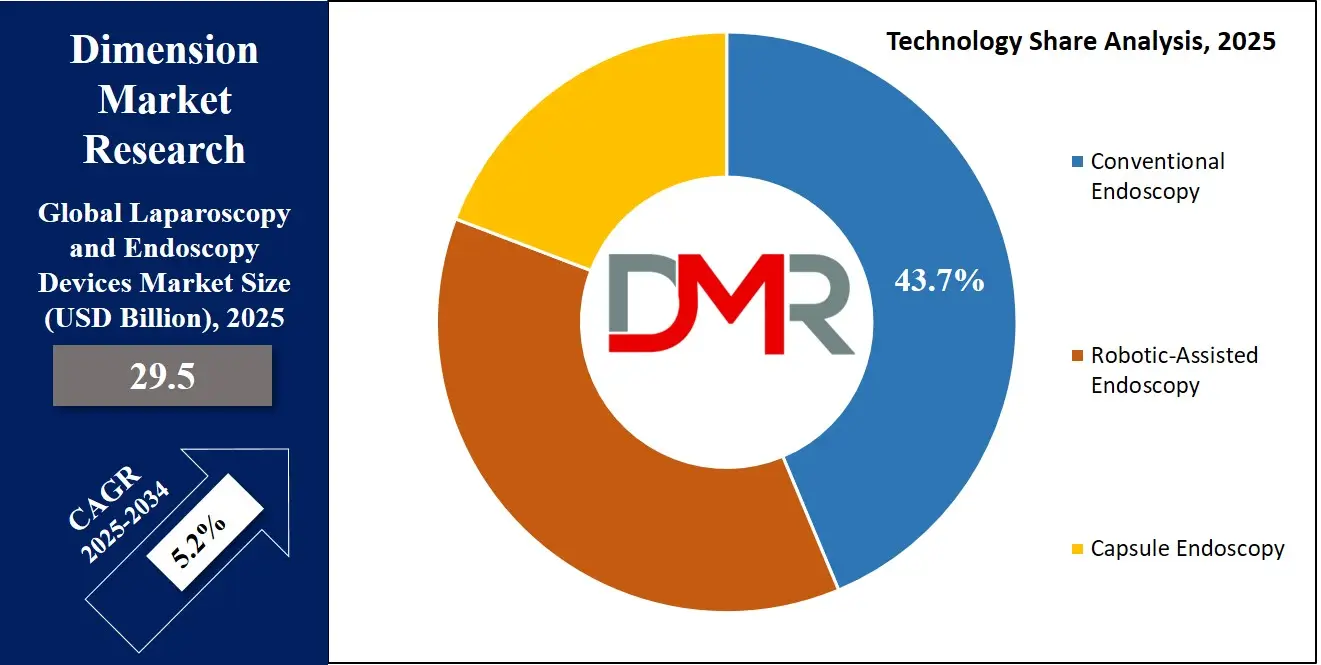

By Technology Analysis

Conventional endoscopy is anticipated to dominate the laparoscopy and endoscopy devices market on a global scale due to its pivotal role in diagnosing and managing gastrointestinal, respiratory, and urological diseases. Although advanced robotic-assisted and capsule endoscopy have not gained much traction, traditional endoscopic procedures remain the benchmark for real-time visualization, sampling through a biopsy, and therapeutic interventions such as polypectomy and hemostasis. The ready accessibility of flexible and rigid endoscopes, and the relatively low cost of traditional endoscopic procedures compared with newer options, have solidified its position as a market leader.

One of the advantages of traditional endoscopy is that it can provide high-resolution imaging and direct access to tissue, allowing doctors to detect abnormalities with increased accuracy. Improvements including NBI, CLE, and chromoendoscopy have also raised diagnostic accuracy, allowing for earlier detection of conditions such as colorectal cancer and Barrett's esophagus. The adaptability of traditional endoscopy for a range of medical specialties—including gastroenterology, pulmonology, urology, and gynecology has also played a part.

With a rise in the burden of gastrointestinal disorders, including irritable bowel syndrome (IBS), Crohn's disease, and gastric ulcers, there has also been a rise in demand for traditional endoscopic procedures. With greater investment in healthcare, particularly in emerging economies such as China, India, and Brazil, access to traditional endoscopic procedures has increased. Standardization of procedural skills, improved training modules, and cost-effectiveness compared with robotic-assisted endoscopy or capsule endoscopy maintain its popularity. With healthcare facilities placing greater emphasis on efficiency and affordability, traditional endoscopy is the leading technological segment in the global laparoscopy and endoscopy devices market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Laparoscopy applications are anticipated to dominate the global laparoscopy and endoscopy devices market due to the increasing adoption of minimally invasive surgeries (MIS) across various medical specialties. Laparoscopic operations are widely used for general surgery, gynecology, urology, and bariatrics, with superior patient outcomes compared with open surgeries. Demand for laparoscopic operations is driven primarily by the increasing incidence of colorectal cancer, gallbladder diseases, endometriosis, and obesity, all requiring precise surgical correction.

One of the primary reasons for laparoscopic procedures' popularity is that they cause less post-operative pain, have faster recovery, and have fewer complication risks than traditional surgical procedures. Laparoscopic procedures have small incisions, which translate into minimal blood loss and a reduced hospital stay, thereby reducing overall healthcare costs. Also, continuous advancements in laparoscopic technology, such as 4K UHD imaging, 3D laparoscopy, and robotic platforms, have raised surgical accuracy, making these operations even more effective and accessible.

Growing global interest in cost-effective, patient-centric surgical procedures has further driven laparoscopy adoption. Developed economies such as the U.S., Germany, and Japan possess a robust healthcare infrastructure and reimbursement frameworks that are supportive of laparoscopic procedures, driving their growth. Emerging economies, however, are seeing growing investment in laparoscopic devices and training, with laparoscopic procedures becoming increasingly available. With its advantages of surgical precision, patient safety, and cost-effectiveness, laparoscopy applications will remain a leader in the global laparoscopy and endoscopy devices market.

By End User Analysis

Original Equipment Manufacturers (OEMs) are anticipated to dominate the global laparoscopy and endoscopy devices market due to their role as a primary provider of cost-effective, technologically advanced, and high-quality endoscopic and laparoscopic devices. Major OEMs collaborate with medical device companies, healthcare organizations, and research institutions to manufacture major components such as endoscopes, cameras, light sources, trocars, and insufflators, ensuring a steady stream of advanced surgical instruments. Demand for OEM-manufactured devices has increased due to increased demand for high-performing, standardized, and affordable endoscopy and laparoscopy devices.

One of the primary reasons for OEM dominance is that they provide tailored solutions according to the evolving specifications of healthcare facilities. Hospitals and surgical facilities mostly adopt devices produced by OEMs due to their dependability, scalability, and compliance with stringent regulatory norms of bodies like the FDA, EMA, and CFDA. OEMs also provide private-label branding, and as a result, medical device companies can expand their footprint in the marketplace without having to make investments in manufacturing infrastructure.

Technological advancements have also strengthened the position of the OEMs, with AI, 4K imaging, and robotic-assisted surgical platforms being added to endoscopic and laparoscopic devices. With healthcare providers constantly demanding highly efficient, durable, and innovative surgical instruments, OEMs remain at the center of addressing these demands. With increasing investment across the globe for manufacturing medical devices and with minimally invasive surgeries gaining popularity, OEMs are expected to retain their grip on the end-user segment for laparoscopy and endoscopy devices.

The Global Laparoscopy and Endoscopy Devices Market Report is segmented on the basis of the following

By Product Type

- Laparoscopy Devices

- Laparoscopes

- Trocars and Cannulas

- Insufflators

- Hand Instruments

- Laparoscopic Suction/Irrigation Systems

- Closure Devices

- Endoscopy Devices

- Endoscopes

- Rigid Endoscopes

- Flexible Endoscopes

- Capsule Endoscopes

- Robot-Assisted Endoscopes

- Visualization Systems

- Endoscopic Cameras

- Video Processors & Recorders

- Light Sources

- Monitors & Display Systems

- Endoscopic Ultrasound (EUS) Devices

- Endoscopic Accessories

- Guidewires

- Biopsy Forceps

- Cleaning Brushes

By Technology

- Conventional Endoscopy

- Robotic-Assisted Endoscopy

- Capsule Endoscopy

By Application

- Laparoscopy Applications

- Gynecological Surgeries

- General Surgery

- Urological Surgeries

- Colorectal Surgeries

- Bariatric Surgeries

- Other Laparoscopic Applications

- Endoscopy Applications

- Gastrointestinal (GI) Endoscopy

- Pulmonary Endoscopy

- ENT (Ear, Nose, and Throat) Endoscopy

- Urology Endoscopy (Cystoscopy)

- Gynecology Endoscopy

- Neurological Endoscopy

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Global Laparoscopy and Endoscopy Devices Market: Regional Analysis

Region with Highest Market Share in the Global Laparoscopy and Endoscopy Devices Market

North America is expected to be a leader in the laparoscopy and endoscopy devices global market, as it holds

38.3% of total revenue by the end of 2025 with its well-established healthcare system, high adoption rate for minimally invasive surgeries (MIS), and well-established dominance of major players.

The United States leads the region, with the highest market share, because of high per capita healthcare expenditures, favorable reimbursement practices, and a high population of elderly individuals with a requirement for endoscopic and laparoscopic procedures for disease control. The increasing incidence rate for gastrointestinal diseases, colorectal cancers, and obesity surgeries has also raised demand for these devices.

Technological advancements such as robotic-assisted laparoscopy, 4K imaging, and AI-based endoscopy devices have fueled growth in North America. Having major medical device players, including Stryker Corporation, Medtronic, and Boston Scientific, ensures constant innovation and product offerings. Additionally, government campaigns for the early detection and preventive treatment of diseases have driven procedural volumes. Established hospital networks, skilled healthcare providers, and increasing investment in surgical robots will continue to maintain North America as a leader in the global laparoscopy and endoscopy devices market.

Region with the Highest CAGR

Asia-Pacific is expanding at the highest CAGR among all laparoscopy and endoscopy device markets globally due to greater investment in healthcare, rising awareness regarding minimally invasive procedures, and a large and expanding patient population. China, India, and Japan are at the forefront, driven by a growing population, a rise in gastrointestinal disease burden, and expanding healthcare infrastructure. Medical tourism growth, particularly in India and Thailand, has also contributed further to the demand for cost-effective, high-quality laparoscopic and endoscopic procedures.

Government initiatives for the modernization of healthcare facilities, increased medical insurance coverage, and reduction in surgical costs have all played a major role in boosting growth in the market. Additionally, increasing disposable income, increased availability of advanced medical technology, and increased numbers of laparoscopic training centers are also fueling demand for these devices. Robust economic growth, increasing hospital networks, and aggressive market penetration by global and regional players will cause Asia-Pacific to grow at the highest rate in the global laparoscopy and endoscopy devices market over the next few years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Laparoscopy and Endoscopy Devices Market: Competitive Landscape

Laparoscopy and endoscopy devices have a highly competitive global market with players competing on technological advancements, product development, strategic acquisitions, and market expansion to maintain their dominance. Olympus Corporation, Stryker Corporation, Medtronic, Karl Storz, and Boston Scientific Corporation are some of the major players with a strong product portfolio including laparoscopes, endoscopes, imaging devices, and robotic-assisted surgical platforms.

A primary competitive strategy among leading players is constant investment in R&D for enhancing image quality, surgical precision, and AI-based analytics. Olympus and Medtronic, for instance, have rolled out AI-based endoscopy platforms that facilitate detection of abnormalities with increased efficiency. Additionally, expansion in robotic-assisted laparoscopic surgeries, led by Intuitive Surgical's da Vinci Surgical System, has raised competition, with players developing next-generation robotic platforms.

Mergers, acquisitions, and partnerships are crucial drivers for influencing competition. Boston Scientific's acquisitions, for example, such as EndoChoice and Apollo Endosurgery, have strengthened its position in endoscopic technology. Similarly, Medtronic's strategic partnerships for Asia-Pacific have driven business expansion in high-growth markets. With increasing demand for minimally invasive procedures, players are focused on expanding their global footprint, enhancing product portfolios, and investing in emerging markets for long-term growth for the laparoscopy and endoscopy devices business.

Some of the prominent players in the Global Laparoscopy and Endoscopy Devices Market are

- Olympus Corporation

- KARL STORZ SE & Co. KG

- Stryker Corporation

- Medtronic plc

- Johnson & Johnson (Ethicon Endo-Surgery, Inc.)

- Boston Scientific Corporation

- Richard Wolf GmbH

- Fujifilm Holdings Corporation

- Hoya Corporation (Pentax Medical)

- Conmed Corporation

- Smith & Nephew plc

- B. Braun Melsungen AG

- STERIS plc

- Zimmer Biomet Holdings, Inc.

- Cook Medical

- Ambu A/S

- EndoChoice, Inc. (Part of Boston Scientific)

- XION Medical GmbH

- Shenzen Mindray Bio-Medical Electronics Co., Ltd.

- SonoScape Medical Corp.

- Other Key Players

Recent Developments in Global Laparoscopy and Endoscopy Devices Market

- In August 2024: Olympus Corporation launched 5mm POWERSEAL Sealer/Divider devices, expanding its bipolar surgical energy portfolio. These devices enhance sealing, dissection, and grasping capabilities for laparoscopic and open surgeries, reducing jaw closure force and improving surgical precision.

- In July 2024: Amber Therapeutics, a University of Oxford-affiliated start-up, secured $100 million in Series A funding to advance Amber-UI, an implantable therapy for mixed urinary incontinence (MUI). This device targets the pudendal nerve through minimally invasive procedures, supporting clinical trials and U.S. regulatory approval efforts.

- In June 2024: Intuitive Surgical announced the FDA clearance of a labeling update for the da Vinci X and Xi robotic surgical systems, specifically for radical prostatectomy procedures. This update ensures enhanced procedural safety and efficiency in robotic-assisted surgeries.

- In April 2024: Medtronic unveiled an AI-powered Touch Surgery Live Stream, integrating 14 AI algorithms to enhance post-operative analysis. This innovation provides AI-driven surgical insights for laparoscopic and robotic-assisted surgeries, improving procedural accuracy, decision-making, and overall surgical efficiency.

- In February 2024: The FDA approved Virtual Incision Corporation’s MIRA Surgical System, a miniaturized robotic-assisted device for colectomy procedures. Authorized under the De Novo Classification process, this system improves precision in minimally invasive surgeries and is based on U.S. clinical trials conducted under IDE approval.

- In July 2023: Genesis MedTech received regulatory approval from China’s National Medical Products Administration to market the ArtiSential laparoscopic surgical device in China. This approval facilitates access to articulating laparoscopic instruments, improving surgical dexterity and precision.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 29.5 Bn |

| Forecast Value (2034) |

USD 46.5 Bn |

| CAGR (2025-2034) |

5.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 9.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Laparoscopy Devices, Endoscopy Devices), By Technology (Conventional Endoscopy, Robotic-Assisted Endoscopy, Capsule Endoscopy), By Application (Laparoscopy Applications, Endoscopy Applications), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Olympus Corporation, KARL STORZ SE & Co. KG, Stryker Corporation, Medtronic plc, Johnson & Johnson (Ethicon Endo-Surgery, Inc.), Boston Scientific Corporation, Richard Wolf GmbH, Fujifilm Holdings Corporation, Hoya Corporation (Pentax Medical), Conmed Corporation, Smith & Nephew plc, B. Braun Melsungen AG, STERIS plc, Zimmer Biomet Holdings, Inc., Cook Medical, Ambu A/S, EndoChoice, Inc. (Part of Boston Scientific), XION Medical GmbH, Shenzen Mindray Bio-Medical Electronics Co., Ltd., SonoScape Medical Corp., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Laparoscopy and Endoscopy Devices Market?

▾ The Global Laparoscopy and Endoscopy Devices Market size is estimated to have a value of USD 29.5

billion in 2025 and is expected to reach USD 46.5 billion by the end of 2034.

What is the size of the US Laparoscopy and Endoscopy Devices Market?

▾ The US Laparoscopy and Endoscopy Devices Market is projected to be valued at USD 9.5 billion in 2025.

It is expected to witness subsequent growth in the upcoming period as it holds USD 14.6 billion in 2034

at a CAGR of 4.9%.

Which region accounted for the largest Global Laparoscopy and Endoscopy Devices Market?

▾ North America is expected to have the largest market share in the Global Laparoscopy and Endoscopy

Devices Market with a share of about 38.3% in 2025.

Who are the key players in the Global Laparoscopy and Endoscopy Devices Market?

▾ Some of the major key players in the Global Laparoscopy and Endoscopy Devices Market are Olympus

Corporation, KARL STORZ SE & Co. KG, Stryker Corporation, Medtronic plc, Johnson & Johnson (Ethicon

Endo-Surgery, Inc.), Boston Scientific Corporation, and many others.

What is the growth rate in the Global Laparoscopy and Endoscopy Devices Market in 2025?

▾ The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.