Market Overview

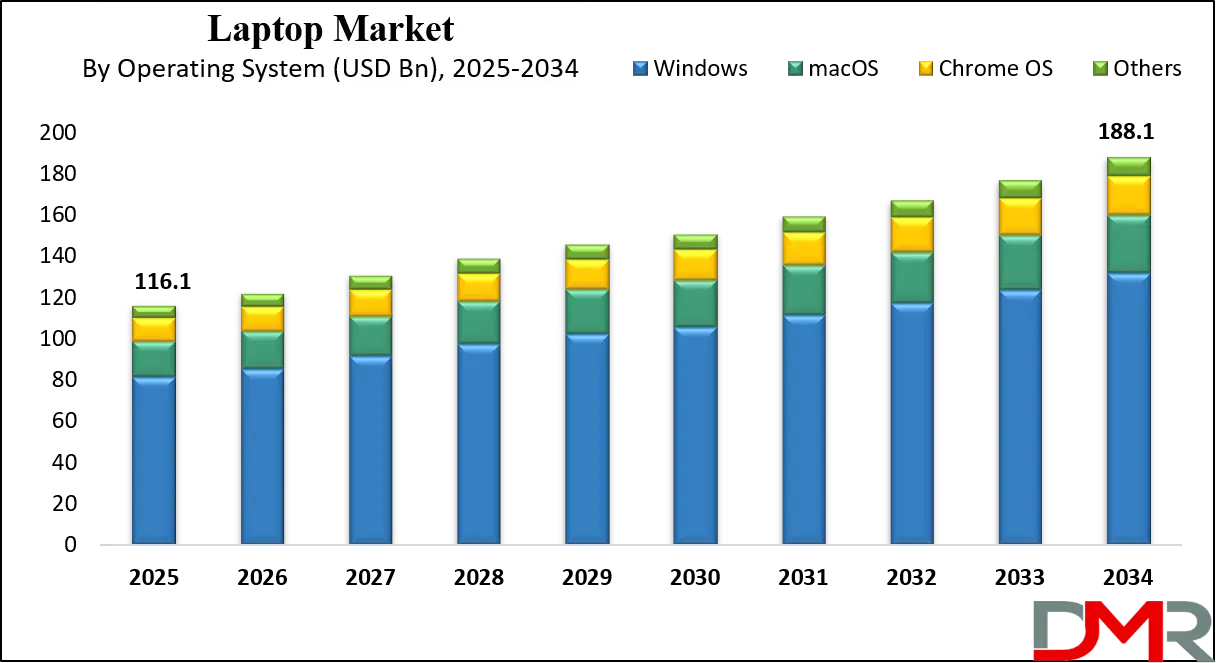

The global laptop market is projected to grow from USD 116.1 billion in 2025 to USD 188.1 billion by 2034, expanding at a CAGR of 5.5%. Rising demand for portable computing devices, growing adoption of remote work and e-learning solutions, and advancements in high-performance laptops and ultrabooks are driving market growth. Enhanced connectivity, energy-efficient processors, and innovative designs continue to fuel consumer and enterprise uptake across regions.

A laptop is a portable personal computer designed for mobility and ease of use, integrating all essential components such as the processor, memory, storage, display, keyboard, and battery into a single compact unit. Unlike desktop computers, laptops offer the flexibility to operate in various environments without the need for constant external power supply, making them ideal for remote work, education, gaming, and professional applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Modern laptops often incorporate high-resolution displays, advanced graphics capabilities, and connectivity options such as Wi-Fi and Bluetooth, enabling seamless interaction with cloud services, peripherals, and external networks. The development of lightweight materials and energy-efficient processors has further enhanced their portability, allowing users to maintain productivity while traveling or working in unconventional spaces.

The global laptop market encompasses the production, distribution, and sales of portable computing devices across consumer, business, and educational segments. This market has witnessed rapid growth due to growing digital transformation initiatives, remote work adoption, and the rise of e-learning platforms. Key factors influencing the market include advancements in processor technologies, expansion of wireless connectivity, and the introduction of innovative designs such as ultrabooks and convertible laptops. Regional demand is driven by a combination of economic growth, technological infrastructure development, and consumer preferences for performance, battery life, and affordability.

Market dynamics in the laptop industry are shaped by competition among leading manufacturers, evolving end-user requirements, and the integration of emerging technologies such as artificial intelligence and energy-efficient components. The proliferation of cloud computing, gaming applications, and multimedia content has contributed to heightened demand for high-performance laptops with advanced graphics and storage capabilities.

Additionally, initiatives for sustainable production and eco-friendly materials are gradually influencing purchasing decisions, as consumers and enterprises increasingly prioritize environmental responsibility alongside computing performance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

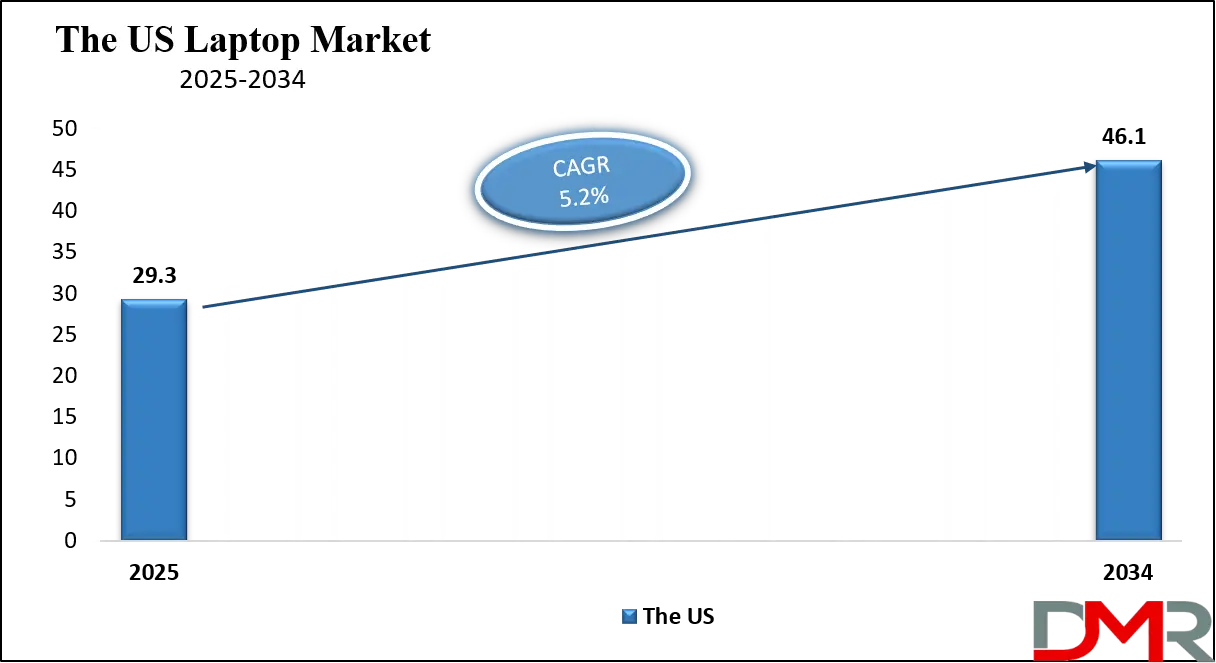

The US Laptop Market

The U.S. Laptop market size is projected to be valued at USD 29.3 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 46.1 billion in 2034 at a CAGR of 5.2%.

The US laptop market represents a significant portion of the North American computing industry, driven by high consumer adoption of portable computing devices across business, education, and personal segments. The demand for ultrabooks, gaming laptops, and 2-in-1 convertible devices has surged, fueled by the need for mobility, multitasking capabilities, and high-performance computing.

Enterprises are increasingly deploying laptops with enhanced security features, fast processors, and long battery life to support remote work and hybrid office environments. The rise of online learning and digital classrooms has also contributed to the steady expansion of the education segment, while consumer preferences for lightweight and compact laptops continue to shape product innovations.

Market growth in the US is further supported by technological advancements, including AI-enabled laptops, cloud-integrated devices, and high-resolution displays suitable for creative and professional work. Retail and e-commerce channels play a pivotal role in distribution, offering a wide range of laptops tailored for gaming, multimedia, and business productivity.

Sustainability trends are also influencing purchase decisions, with a growing focus on energy-efficient components, recyclable materials, and eco-friendly manufacturing practices. The competitive landscape is characterized by leading brands such as Apple, Dell, HP, Lenovo, and Microsoft, which continuously invest in research and development to meet evolving consumer expectations and maintain market share in a highly dynamic environment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Laptop Market

The Europe laptop market is projected to reach a value of approximately USD 27.8 billion in 2025, reflecting steady growth driven by strong consumer demand, enterprise adoption, and technological advancements. The market is characterized by widespread use of laptops across business, education, and personal segments, with an emphasis on portability, performance, and energy efficiency. Consumers increasingly prefer devices that offer a balance between affordability and advanced features such as high-resolution displays, fast processors, and solid-state storage, while businesses invest in secure, high-performance laptops to support remote work, hybrid office models, and collaboration tools.

The market is expected to grow at a compound annual growth rate of 4.5%, supported by continuous innovation in ultrabooks, 2-in-1 convertible devices, and AI-enabled laptops. European manufacturers and global brands are expanding product lines with features tailored to regional preferences, including lightweight designs, longer battery life, and enhanced connectivity options. Government initiatives promoting digital literacy and the adoption of smart education platforms further contribute to market expansion.

Additionally, sustainability trends and energy-efficient technologies are increasingly influencing purchasing decisions, ensuring that the European laptop market remains competitive and responsive to evolving consumer and enterprise needs.

Japan Laptop Market

The Japan laptop market is projected to reach approximately USD 5.1 billion in 2025, driven by the country’s high technology adoption rate, advanced infrastructure, and strong consumer demand for portable computing devices. Laptops are widely used across corporate, educational, and personal segments, with a focus on performance, compact design, and energy efficiency.

Japanese consumers and businesses often prioritize high-quality components, sleek designs, and innovative features, such as lightweight ultrabooks, 2-in-1 convertible laptops, and AI-enabled devices, which support productivity, remote work, and digital learning. The preference for reliable, durable, and technologically advanced laptops has helped the market maintain steady growth over recent years.

The market in Japan is expected to grow at a compound annual growth rate of 3.9%, fueled by continuous technological advancements and the adoption of high-performance laptops for professional and creative use. Manufacturers are focusing on features such as fast processors, enhanced graphics, high-resolution displays, and robust connectivity to cater to evolving consumer and business needs.

Additionally, government initiatives promoting digital education and smart office solutions, along with growing demand for eco-friendly and energy-efficient devices, are supporting market expansion. These factors collectively ensure that the Japanese laptop market remains stable, competitive, and aligned with global technology trends.

Global Laptop Market: Key Takeaways

- Market Value: The global Laptop market size is expected to reach a value of USD 188.1 billion by 2034 from a base value of USD 116.1 billion in 2025 at a CAGR of 5.5%.

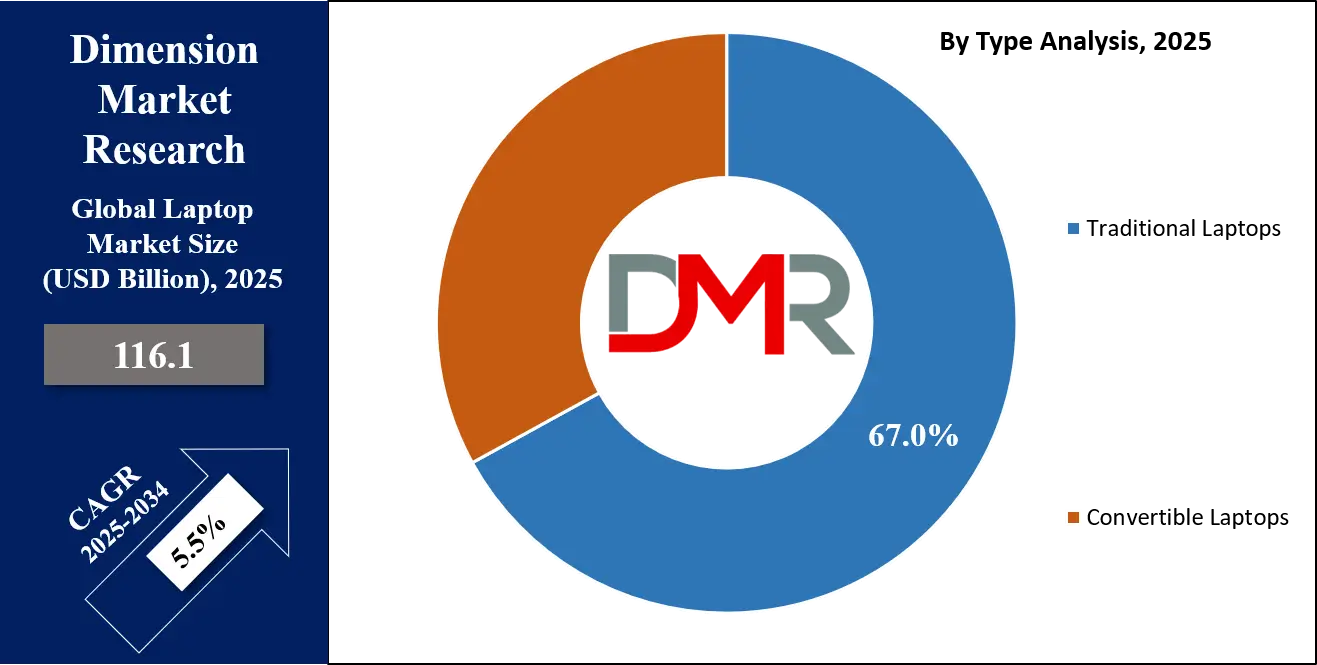

- By Type Analysis: Traditional Laptops are anticipated to dominate the type segment, capturing 67.0% of the total market share in 2025.

- By Screen Size Segment Analysis: 15 to 16.9-inch screens are expected to maintain their dominance in the screen size type segment, capturing 38.0% of the total market share in 2025.

- By Price Range Segment Analysis: USD 501 to USD 1000 will dominate the price range segment, capturing 40.0% of the market share in 2025.

- By Operating System Segment Analysis: Windows will capture the maximum share in the operating system segment, accounting for 70% of the market share in 2025.

- By End-User Segment Analysis: Consumers will account for the maximum share in the end-user segment, capturing 55.0% of the total market value.

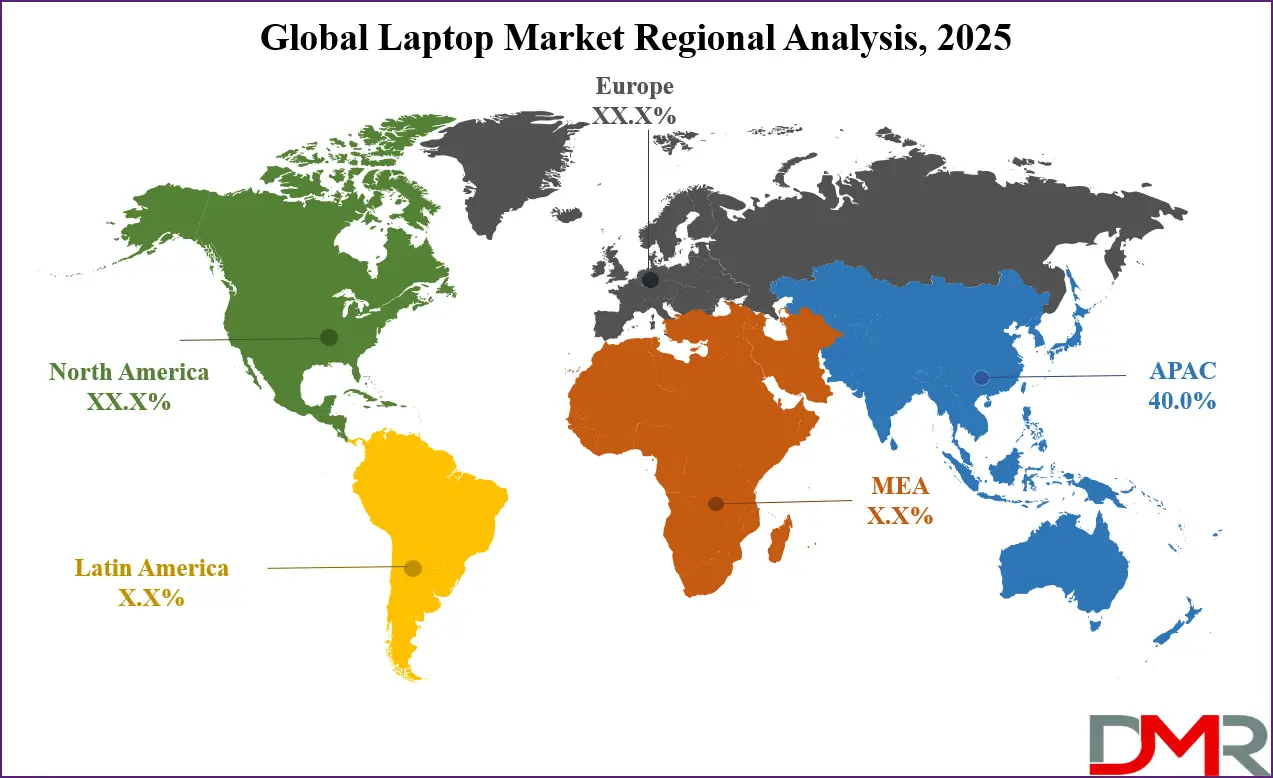

- Regional Analysis: Asia Pacific is anticipated to lead the global Laptop market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Laptop market include HP, Dell, Lenovo, Apple, Acer, Asus, Microsoft, Samsung, Toshiba, MSI, Razer, LG, Huawei, Google, Sony, Fujitsu, Panasonic, Alienware, and Others.

Global Laptop Market: Use Cases

- Remote Work and Hybrid Office Environments: Laptops are central to supporting remote work and hybrid office models, providing professionals with mobility, productivity, and collaboration tools. High-performance laptops with fast processors, long battery life, and secure connectivity enable seamless access to cloud applications, video conferencing platforms, and enterprise software. Organizations increasingly rely on lightweight ultrabooks and business laptops to enhance employee efficiency while reducing IT infrastructure costs. Features like VPN support, biometric security, and AI-assisted productivity applications further enhance workflow and safeguard sensitive corporate data.

- Education and E-Learning Solutions: The education sector is driving significant demand for laptops as digital classrooms and e-learning platforms expand globally. Students and educators leverage portable devices for virtual learning, research, and multimedia content creation. Chromebooks, budget laptops, and convertible 2-in-1 devices are popular for their affordability, portability, and ease of integration with online learning management systems. Enhanced connectivity, cloud storage, and pre-installed educational software allow institutions to deliver interactive learning experiences, improve engagement, and facilitate collaboration across remote classrooms.

- Gaming and High-Performance Computing: Gaming laptops and high-performance devices are a major use case in the global market, catering to both casual and professional gamers. These laptops feature advanced graphics cards, high-refresh-rate displays, and fast SSD storage to support immersive gaming, VR experiences, and competitive e-sports. Beyond gaming, creative professionals rely on powerful laptops for video editing, 3D rendering, and AI-driven applications. The growing popularity of esports and content creation platforms fuels demand for high-spec devices that combine portability with workstation-level performance.

- Business and Enterprise Productivity: Laptops remain essential for enterprise productivity, enabling employees to access business applications, manage data, and communicate effectively while on the move. Business laptops are optimized for multitasking, secure cloud connectivity, and compatibility with enterprise software such as CRM and ERP systems. Features like enhanced cybersecurity, fingerprint sensors, and robust battery performance are critical for organizations to maintain operational efficiency. The integration of collaboration tools, AI-powered assistants, and remote management solutions ensures that companies can adapt to evolving work environments while maintaining productivity and security standards.

Impact of Artificial Intelligence on the global Laptop market

The integration of artificial intelligence is transforming the global laptop market by enhancing device performance, user experience, and productivity. AI-powered laptops leverage intelligent algorithms for optimized power management, predictive maintenance, and adaptive system performance, allowing devices to run efficiently under varying workloads. Features such as AI-assisted virtual assistants, smart multitasking, and real-time language translation are improving workflow efficiency for both personal and professional users.

Additionally, AI-enabled security solutions, including facial recognition technology and anomaly detection, are reinforcing data protection, making laptops more suitable for enterprise environments and sensitive applications.

Artificial intelligence is also driving innovation in high-performance and gaming laptops by enabling intelligent graphics rendering, resource allocation, and personalized performance tuning. Content creators and data scientists benefit from AI-accelerated tasks such as video editing, 3D modeling, and machine learning computations, which enhance productivity and reduce processing time.

The adoption of AI in laptops is further expanding opportunities for manufacturers to differentiate products through smart features and automation, thereby influencing consumer preference and fueling market growth across business, education, and gaming segments.

Global Laptop Market: Stats & Facts

2025

- India Ministry of Electronics and Information Technology (MeitY): Allocated ₹26,026.25 crore for electronics development, including laptop manufacturing incentives.

- India Ministry of Education: Budgeted ₹12,865.30 crore for digital education initiatives, indirectly supporting laptop demand.

- Germany Federal Statistical Office (Destatis): Reported 75.5 laptops/notebooks per 100 households in 2022.

- UK Department for Education: Approximately 2.9 million students pursued higher education in 2023.

- Japan Ministry of Internal Affairs and Communications: National digital literacy programs provided laptops for over 1.1 million students in 2025.

- India Ministry of Electronics and Information Technology (MeitY): Initiated skill development programs, distributing laptops to 450,000 beneficiaries.

- India Ministry of Education: Launched initiatives providing free or subsidized laptops to 200,000 rural students.

2024

- India Ministry of Electronics and Information Technology (MeitY): Implemented e-governance initiatives, including laptop allocations to government employees.

- India Ministry of Education: Deployed laptops to support digital classrooms in over 1,000 schools.

- Germany Federal Statistical Office (Destatis): Survey indicated 68% of households with school-age children had laptops in 2024.

- UK Department for Education: Distributed laptops to 150,000 disadvantaged students to ensure remote learning access.

- Japan Ministry of Internal Affairs and Communications: Rolled out digital tools, including laptops, for government-led vocational training programs.

- India Ministry of Electronics and Information Technology (MeitY): Partnered with educational institutions to provide laptops for IT skill programs.

- India Ministry of Education: Sponsored regional laptop distribution programs in underdeveloped areas.

2023

- India Ministry of Electronics and Information Technology (MeitY): Launched a “Laptop for All” pilot program in selected districts.

- India Ministry of Education: Allocated resources to provide laptops in digital education pilot projects.

- Germany Federal Statistical Office (Destatis): Reported that 72% of urban households had access to laptops for personal and educational use.

- UK Department for Education: Distributed laptops for digital learning programs in primary and secondary schools.

- Japan Ministry of Internal Affairs and Communications: Introduced laptop lending programs in public libraries and community centers.

- India Ministry of Electronics and Information Technology (MeitY): Supported small-scale laptop manufacturing initiatives under government schemes.

- India Ministry of Education: Partnered with NGOs to provide laptops for e-learning in rural schools.

- Germany Federal Ministry for Education and Research: Launched STEM laptop distribution programs for high school students.

- UK Department for Education: Implemented digital inclusion programs supplying laptops to underserved areas.

- Japan Ministry of Education: Initiated laptop-based distance learning programs for remote regions.

Global Laptop Market: Market Dynamics

Global Laptop Market: Driving Factors

Increasing Demand for Remote Work and E-Learning Solutions

The growing adoption of remote work and online learning is a primary driver for the laptop market. Organizations and educational institutions are investing in portable computing devices with high-performance processors, long battery life, and cloud-enabled collaboration tools. Laptops facilitate seamless access to video conferencing platforms, productivity software, and virtual classrooms, supporting hybrid work environments and interactive learning experiences. This rising need for mobility and flexible computing is pushing manufacturers to innovate with lightweight ultrabooks, 2-in-1 devices, and enterprise-grade laptops.

Technological Advancements in Performance and Connectivity

Advancements in processor technologies, solid-state storage, high-resolution displays, and energy-efficient components are enhancing laptop performance and user experience. Integration of features like AI-powered applications, high-speed Wi-Fi, and Bluetooth connectivity ensures faster data transfer, multitasking, and seamless synchronization with cloud platforms. These innovations cater to professional users, gamers, and content creators, driving demand for laptops capable of handling intensive workloads, gaming applications, and multimedia editing while maintaining portability.

Global Laptop Market: Restraints

High Cost of Premium Laptops

Premium laptops with advanced features such as dedicated graphics cards, AI-enabled processors, and ultralight designs often come with high price points. This can restrict adoption among price-sensitive consumers, students, and small businesses. Despite offering superior performance and durability, the initial investment and higher maintenance costs may discourage widespread penetration, particularly in emerging economies where affordability remains a key consideration.

Short Product Lifecycle and Rapid Obsolescence

The fast-paced evolution of laptop technologies leads to shorter product lifecycles, making older models quickly obsolete. Consumers and businesses often need to upgrade frequently to benefit from the latest performance enhancements, improved battery efficiency, and updated security features. This rapid obsolescence can result in higher electronic waste and may deter buyers from investing in new devices due to concerns over depreciation and long-term value.

Global Laptop Market: Opportunities

Growth in AI-Enabled Laptops and Smart Features

The integration of artificial intelligence in laptops presents significant growth opportunities. AI-powered applications can optimize system performance, enhance graphics rendering, automate routine tasks, and provide smart virtual assistance. Businesses, students, and creative professionals are increasingly seeking devices capable of AI-driven multitasking, predictive analytics, and adaptive resource allocation. Manufacturers can capitalize on this trend by developing AI-optimized laptops that deliver superior performance, energy efficiency, and personalized computing experiences.

Rising Demand in Emerging Markets

Emerging markets such as India, Southeast Asia, and Latin America are witnessing increased demand for affordable, high-performance laptops due to digital transformation, remote work, and expanding e-learning platforms. Growing internet penetration, rising disposable incomes, and government initiatives to promote digital literacy are fueling laptop adoption. Manufacturers have opportunities to introduce budget-friendly ultrabooks, Chromebooks, and 2-in-1 devices tailored to local consumer preferences, thereby expanding their market share in these high-growth regions.

Global Laptop Market: Trends

Shift towards Ultrabooks and Convertible Laptops

The market is increasingly witnessing a preference for ultrabooks and 2-in-1 convertible laptops that combine portability, performance, and flexibility. Consumers favor devices with slim designs, lightweight builds, and touchscreen functionality, which support both professional work and entertainment. This trend is encouraging manufacturers to innovate with hybrid devices that serve as both laptops and tablets, offering enhanced mobility and productivity for modern users.

Focus on Sustainability and Energy Efficiency

Sustainability is becoming a key trend in the laptop market, with manufacturers adopting eco-friendly materials, energy-efficient processors, and recyclable components. Consumers and enterprises are increasingly prioritizing devices that reduce carbon footprint and comply with environmental regulations. Green computing initiatives, including low-power chips, solar-assisted charging, and sustainable packaging, are influencing purchase decisions while positioning brands as environmentally responsible and future-ready.

Global Laptop Market: Research Scope and Analysis

By Type Analysis

Traditional laptops are expected to maintain a dominant position in the global laptop market, accounting for around 67% of the total market share in 2025. Their continued preference is driven by their versatility, robust performance, and wide availability across consumer, business, and educational segments. Traditional laptops cater to users seeking reliable computing for everyday tasks such as office productivity, multimedia consumption, online learning, and professional applications.

They offer larger screens, higher storage capacities, and stronger processing capabilities compared to smaller or hybrid devices, making them suitable for multitasking and resource-intensive software. Their established presence in the market, combined with ongoing technological upgrades such as faster processors, improved graphics, and longer battery life, reinforces their strong adoption across global regions.

Convertible laptops, also known as 2-in-1 devices, are gaining traction as a flexible alternative to traditional laptops. These devices combine the functionality of a standard laptop with the portability and touchscreen features of a tablet, enabling users to switch seamlessly between laptop mode for typing-intensive tasks and tablet mode for media consumption or drawing. Convertible laptops appeal to students, creative professionals, and mobile workers who prioritize portability, versatility, and convenience.

They often come with features such as stylus support, lightweight designs, and adaptive hinge mechanisms, making them suitable for interactive learning, presentations, and remote collaboration. While their market share is smaller compared to traditional laptops, the segment is experiencing steady growth due to rising demand for hybrid computing solutions that cater to modern work and lifestyle requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Screen Size Analysis

Laptops with screen sizes between 15 and 16.9 inches are projected to dominate the screen size segment, capturing approximately 38% of the total market share in 2025. This preference is largely due to the balance they offer between portability and display area, making them ideal for a wide range of users including professionals, students, and casual consumers. These laptops provide sufficient screen space for multitasking, content creation, multimedia consumption, and business applications, while still being portable enough for mobility.

Enhanced graphics, high-resolution displays, and improved battery performance in this category further contribute to their widespread adoption, as users seek devices that can handle both productivity and entertainment needs efficiently.

Laptops with screen sizes between 13 and 14.9 inches are also popular, particularly among users who prioritize portability without sacrificing usability. This segment appeals to professionals and students who frequently travel or work remotely, as the smaller form factor allows for easy handling and lightweight mobility.

Despite the reduced display area compared to larger laptops, advancements in display technology, such as higher resolution panels and slim bezels, ensure a comfortable viewing experience. These laptops are also favored for office work, note-taking, and light multimedia tasks, making them an important segment that balances convenience with adequate performance for everyday computing needs.

By Price Range Analysis

Laptops priced between USD 501 and USD 1000 are expected to dominate the price range segment, capturing approximately 40% of the market share in 2025. This segment is favored by a wide range of consumers, including students, professionals, and small businesses, because it offers a balance between affordability and performance.

Devices in this range typically feature mid-range processors, sufficient RAM, decent storage options, and reliable battery life, making them suitable for everyday computing tasks, online learning, remote work, and multimedia consumption. The popularity of this price range is also driven by the availability of well-known brands offering value-for-money laptops that meet both performance and portability requirements, ensuring broad market penetration.

Laptops priced between USD 1001 and USD 1500 cater to users seeking higher performance and enhanced features without reaching premium pricing levels. This segment includes devices with faster processors, dedicated graphics cards, higher-resolution displays, and additional storage, making them suitable for gaming, creative work, and professional applications.

Users in this range often prioritize multitasking capabilities, design quality, and advanced connectivity options such as high-speed Wi-Fi and Thunderbolt ports. The growing demand for ultrabooks, lightweight laptops, and 2-in-1 convertible devices in this price bracket reflects a preference for devices that combine performance, portability, and durability, addressing both professional and personal computing needs.

By Operating System Analysis

Windows-based laptops are expected to capture the largest share of the operating system segment, accounting for approximately 70% of the market in 2025. Their dominance is driven by widespread adoption in business, education, and consumer sectors, owing to compatibility with a wide range of software applications, productivity tools, and enterprise solutions. Windows laptops offer flexibility, scalability, and support for advanced features such as high-performance processors, gaming graphics, and extensive peripheral connectivity. The platform’s familiarity among users, along with the availability of devices across multiple price ranges and form factors, further reinforces its strong presence in the global laptop market.

macOS laptops, offered exclusively by Apple, hold a smaller but significant share of the market, appealing primarily to creative professionals, designers, and users seeking a premium computing experience. macOS is valued for its stability, seamless integration with other Apple devices, and optimized software ecosystem, including creative applications for video editing, graphic design, and music production.

The segment benefits from strong brand loyalty and a focus on high-quality build, energy-efficient performance, and user-friendly interfaces. While macOS accounts for a smaller percentage compared to Windows, it continues to grow steadily due to growing demand for reliable, high-performance laptops in niche professional and premium consumer segments.

By End-User Segment Analysis

Consumers are expected to account for the largest share in the end-user segment, capturing approximately 55% of the total market value in 2025. This dominance is driven by growing demand for personal computing devices for everyday tasks such as web browsing, social media, entertainment, online learning, and remote work. Consumer laptops often prioritize affordability, portability, and user-friendly features, making them accessible to a wide range of individuals including students, freelancers, and home users. The availability of versatile models, including traditional laptops, ultrabooks, and 2-in-1 convertibles, further fuels adoption among this segment, as users seek devices that balance performance, battery life, and convenience for both personal and multimedia use.

Business users represent a significant portion of the market, driven by enterprises, startups, and professional organizations seeking laptops optimized for productivity, security, and collaboration. Devices in this segment often feature enhanced performance specifications, robust build quality, long battery life, and enterprise-grade security solutions such as encryption and biometric authentication.

Laptops for business use are commonly integrated with productivity software, cloud platforms, and collaboration tools to support remote work, hybrid office setups, and corporate operations. The demand for lightweight ultrabooks and portable business laptops is growing as organizations prioritize mobility, efficient workflows, and seamless connectivity across employees and departments.

The Laptop Market Report is segmented on the basis of the following:

By Type

- Traditional Laptops

- Convertible Laptops

By Screen Size

- Up to 10.9 inches

- 11 to 12.9 inches

- 13 to 14.9 inches

- 15 to 16.9 inches

- Above 17 inches

By Price Range

- Up to USD 500

- USD 501 to USD 1000

- USD 1001 to USD 1500

- USD 1501 to USD 2000

- Above USD 2000

By Operating System

- Windows

- macOS

- Chrome OS

- Others

By End-User

- Consumer

- Business

- Education

Global Laptop Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global laptop market, accounting for approximately 40% of total market revenue in 2025. The region’s dominance is driven by strong consumer demand, rapid digital transformation, and the presence of major manufacturing hubs in countries such as China, India, and South Korea. Rising internet penetration, growing disposable incomes, and increased adoption of remote work and e-learning solutions further fuel market growth. Additionally, the availability of a wide range of laptops across different price segments, along with government initiatives to promote digital literacy and technological infrastructure, supports sustained expansion in both consumer and enterprise segments across the region.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa region is expected to witness significant growth in the global laptop market over the coming years. Increasing adoption of digital technologies, rising demand for remote work and online education, and expanding IT infrastructure are driving the need for portable computing devices in these regions. Governments are investing in smart education programs and digital initiatives, while businesses are upgrading their IT assets to enhance productivity and connectivity. Affordable laptops, Chromebooks, and 2-in-1 devices are gaining traction among consumers and enterprises alike, making the Middle East and Africa a high-growth market for laptop manufacturers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Laptop Market: Competitive Landscape

The global laptop market is highly competitive, dominated by established players such as HP, Dell, Lenovo, Apple, and Asus, alongside emerging brands like Xiaomi and Huawei. Companies are focusing on product innovation, incorporating high-performance processors, AI capabilities, lightweight designs, and energy-efficient components to differentiate their offerings. Strategic initiatives such as mergers, partnerships, and regional expansions are common to strengthen market presence and distribution networks.

Additionally, brands are investing in research and development to cater to specific segments like gaming, business, education, and ultrabooks, ensuring they remain competitive in a rapidly evolving market driven by consumer preferences, technological advancements, and regional demand dynamics.

Some of the prominent players in the global Laptop market are:

- HP (Hewlett-Packard)

- Dell

- Lenovo

- Apple

- Acer

- Asus

- Microsoft

- Samsung

- Toshiba

- MSI (Micro-Star International)

- Razer

- LG

- Huawei

- Google (Pixelbook)

- Sony

- Fujitsu

- Panasonic

- Alienware (Dell subsidiary)

- Xiaomi

- Dynabook

- Other Key Players

Global Laptop Market: Recent Developments

- June 2025: Dell launched the Dell 14 Premium and Dell 16 Premium laptops, offering improved performance for students, creators, and professionals.

- May 2025: HP unveiled the HP EliteBook X Flip G1i and EliteBook Ultra G1i, featuring AI-powered capabilities for enhanced productivity.

- March 2025: Apple acquired an AI startup specializing in natural language processing to integrate advanced features into MacBooks.

- February 2025: Lenovo completed the acquisition of a European software company to strengthen its enterprise laptop offerings.

- January 2025: Dell secured a USD 500 million investment to accelerate development of AI-driven laptops and advanced features.

- December 2024: ASUS raised USD 300 million to expand AI-powered laptop offerings and enhance global distribution.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 116.1 Bn |

| Forecast Value (2034) |

USD 116.1 Bn |

| CAGR (2025–2034) |

5.5% |

| The US Market Size (2025) |

USD 29.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Traditional Laptops, Convertible Laptops), By Screen Size (Up to 10.9 inches, 11 to 12.9 inches, 13 to 14.9 inches, 15 to 16.9 inches, Above 17 inches), By Price Range (Up to USD 500, USD 501 to USD 1000, USD 1001 to USD 1500, USD 1501 to USD 2000, Above USD 2000), By Operating System (Windows, macOS, Chrome OS, Others), and By End-User (Consumer, Business, Education) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

HP, Dell, Lenovo, Apple, Acer, Asus, Microsoft, Samsung, Toshiba, MSI, Razer, LG, Huawei, Google, Sony, Fujitsu, Panasonic, Alienware, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Laptop market?

▾ The global Laptop market size is estimated to have a value of USD 116.1 billion in 2025 and is expected to reach USD 188.1 billion by the end of 2034.

What is the size of the US Laptop market?

▾ The US Laptop market is projected to be valued at USD 29.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 46.1 billion in 2034 at a CAGR of 5.2%.

Which region accounted for the largest global Laptop market?

▾ Asia Pacific is expected to have the largest market share in the global Laptop market, with a share of about 40.0% in 2025.

Who are the key players in the global Laptop market?

▾ Some of the major key players in the global Laptop market are HP, Dell, Lenovo, Apple, Acer, Asus, Microsoft, Samsung, Toshiba, MSI, Razer, LG, Huawei, Google, Sony, Fujitsu, Panasonic, Alienware, and Others.

What is the growth rate of the global Laptop market?

▾ The market is growing at a CAGR of 5.5 percent over the forecasted period