Market Overview

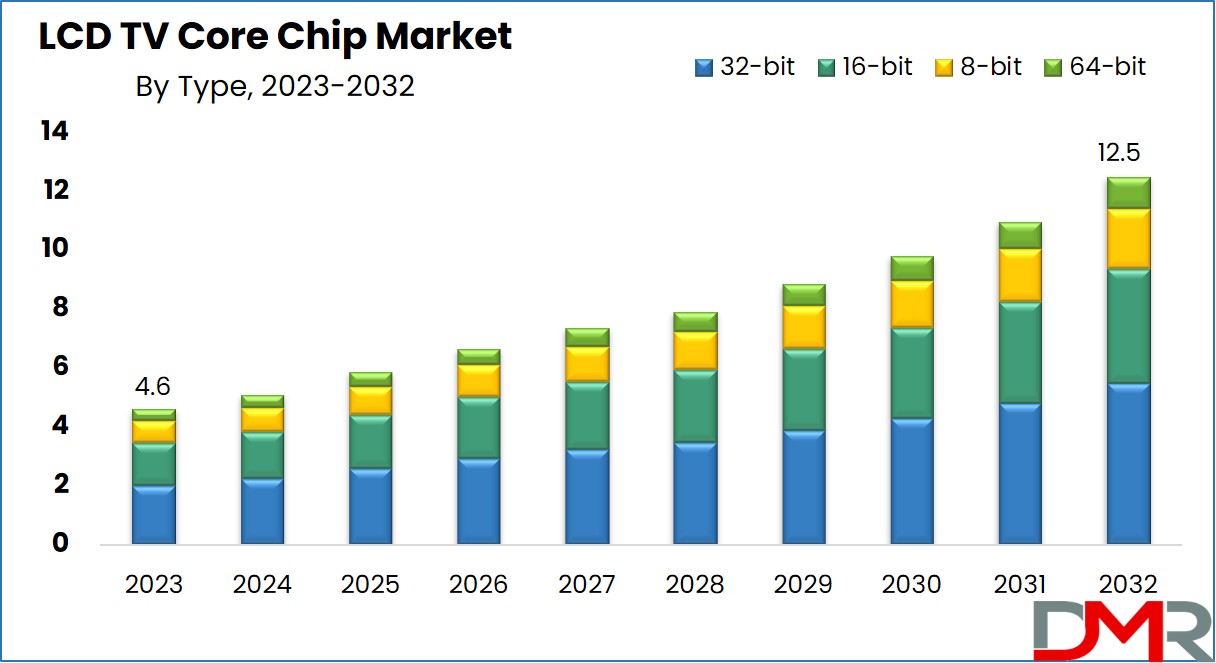

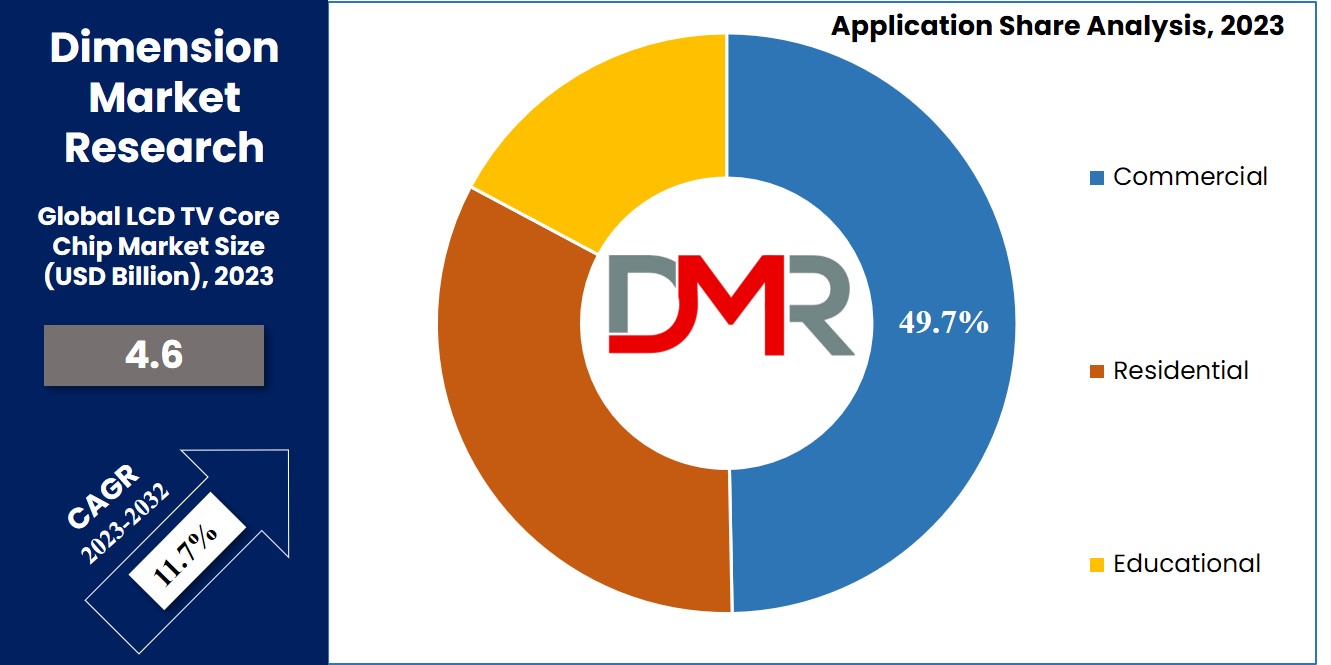

The Global LCD TV Core Chip Market is expected to reach a value of USD 4.6 billion in 2023, and it is further anticipated to reach a market value of USD 12.5 billion by 2032 at a CAGR of 11.7%. The market has seen a significant increase in the recent past and is predicted to grow significantly during the forecasted period as well.

The LCD TV core chip is the fusion of LCD TV technology with a processor core chip, improving the computational capabilities offered through television sets. This integration combines the strengths of LCD TVs and core chip functionalities, increasing the computing performance within TVs. Emerging display driver ICs and advanced semiconductor modules are further accelerating the performance efficiency of these chips.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The use of core chips in LCD TVs not only improves the user experience by seamlessly merging internet-based information & content from TV providers into a balanced platform known as smart television but also eliminates the need for separate set-top boxes. As a result, users can effortlessly access online stores, and websites, and download desired content, optimizing the utility of smart TVs.

The combination of LCD TV and core chip technology introduces a new level of convenience & versatility to television viewing. This innovative pairing not only enriches the computing capabilities of television sets but also simplifies the overall user experience by providing a unified hub for content consumption and online interaction. By seamlessly combining traditional broadcasting with online connectivity, the LCD TV core chip contributes to a more streamlined and interactive entertainment landscape.

The global LCD TV core chip market can be divided into residential, commercial, and educational categories. Of these applications, residential applications dominate due to an unprecedented surge in consumer adoption of 4K TV and smart LCD TVs; driven largely by demand for enhanced viewing experiences and advanced features in Smart Home Systems.

Furthermore, core chip types can be divided into 8-bit, 16-bit 32-bit and 64-bit variants which each serve specialized performance needs; higher bit core chips providing additional functions such as higher resolution displays AI capabilities as well as increased processing efficiencies.

Key Takeaways

- The Global LCD TV Core Chip Market is projected to grow from USD 4.6 billion in 2023 to USD 12.5 billion by 2032, at a CAGR of 11.7%, driven by smart TV adoption and enhanced content consumption.

- Residential applications dominate the market due to growing consumer demand for smart, AI-enabled TVs supporting UHD/4K/8K content and online streaming services.

- 32-bit core chips are the leading segment, offering advanced processing capabilities for smart TVs, interactive commercial displays, and cloud gaming applications.

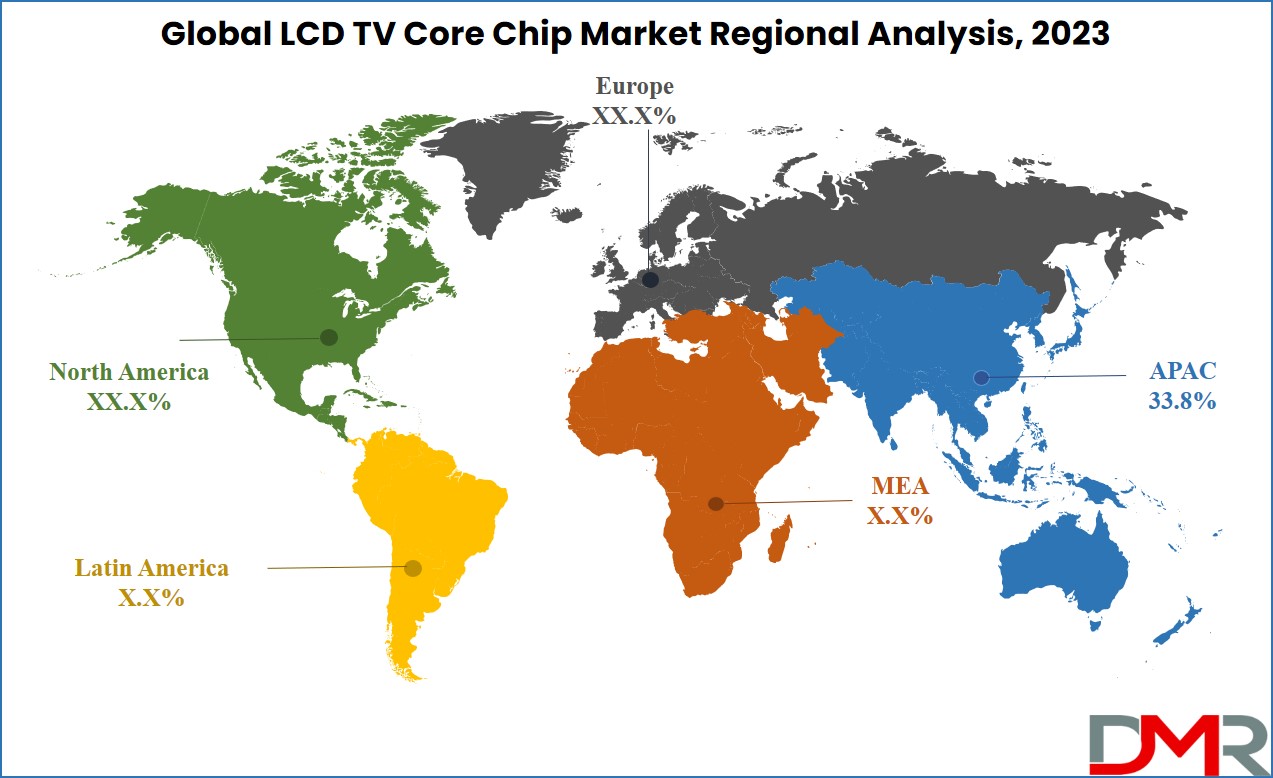

- Asia-Pacific holds the largest regional share (33.8%) in 2023, supported by the presence of major manufacturers such as Samsung, LG, and Xiaomi, and strong demand for smart TVs.

- Key market drivers include rising demand for high-resolution content, AI and machine learning integration, cloud gaming compatibility, and smart home ecosystem expansion.

- Market restraints and challenges include semiconductor shortages, supply chain disruptions, competition from alternative display technologies (LED, OLED), and high R&D investment requirements to stay competitive.

Use Cases

- Residential Smart TVs: Core chips enhance home entertainment by enabling seamless streaming, online shopping, UHD/4K/8K content, AI-based picture optimization, and voice recognition, eliminating the need for additional set-top boxes.

- Commercial Interactive Displays: Used in retail, hospitality, and corporate sectors, these chips power digital signage, multimedia content delivery, and cloud gaming, transforming spaces into engaging, interactive environments.

- Educational Applications: Core chips support interactive classrooms and training centers, enabling real-time content delivery, multimedia presentations, and integration with online learning platforms to boost engagement and teaching efficiency.

- Type-Specific Use Cases: 32-bit chips dominate smart TVs and commercial displays for performance and AI features, 64-bit chips support premium UHD and IoT functionalities, while 8-bit and 16-bit chips cater to entry-level or cost-sensitive devices.

- Regional Adoption Opportunities: Asia-Pacific leads due to integrated manufacturing, North America sees growth from smart TV and digital signage adoption, and emerging markets (Latin America, Africa, MEA) offer potential through rising digital adoption and disposable income.

Market Dynamic

The global growth of the LCD TV core chip market is being driven by factors like increasing internet usage, simplified content downloading, and convenient access to online content. Additionally, major progress in LCD TV core chip technology and significant research & development investments by key players in regional markets are contributing and driving to the growth and expansion of the global LCD TV core chip market.

However, the increase and adoption of alternative technologies like LED Smart TVs create a significant obstacle to the growth of the global LCD TV core chip market. Furthermore, the advancement of OLED (Organic LED) display panels and the substantial reliance on technology providers to establish a foothold in the LCD TV market emerge as crucial factors impeding the growth of the worldwide LCD TV core chip market.

Driving Factors

Rising demand for HD and UHD content is one of the primary drivers of LCD TV core chips market growth. Consumer preference is driving manufacturers to integrate more sophisticated core chips, supporting 4K, 8K resolutions and HDR.

Smart TV adoption also increases demand as these chips enable seamless connectivity, AIdriven functionalities and efficient power usage further propelling market expansion. In addition, global middle class population expansion and declining prices make advanced television technologies accessible to a larger consumer base.

Trending Factors

Integrating AI and machine learning technology into LCD TV core chips has become an emerging market trend, supporting features such as voice recognition, content recommendation and realtime optimization of picture and sound quality. Manufacturers have taken note of this trend by shifting production towards smaller nodes such as 7nm and 5nm technologies that enable manufacturers to improve performance while decreasing power consumption.

Cloud gaming compatibility is another growing trend as core chips provide smoother rendering for game streaming services like Twitch. Increasing consumer demand is driving this demand for multifunctional TVs capable of entertainment, gaming services compatibility plus home automation functions all in one device.

Restraining Factors

Supply chain disruptions and semiconductor shortages pose major restraints on the LCD TV core chips market. Geopolitical tensions, the COVID19 pandemic and intense competition from small producers add additional obstacles for success; production delays result in higher raw material costs; pricing pressures cause profits for manufacturers to suffer, as does technological progress' rapid pace, which requires companies to continuously invest in R&D to remain competitive.

Smaller producers may struggle to keep pace with such innovation requirements, leading to market consolidations for consumers resulting in reduced options available to consumers as a result of consolidation within markets due to limited options offered.

Opportunity

The rapidly evolving smart home ecosystem presents an attractive market for LCD TV core chips. As televisions serve as hubs for connected devices, core chips with advanced IoT capabilities have become more important. Emerging markets across AsiaPacific, Africa and Latin America represent unrealized potential due to rising disposable incomes and digital adoption.

Partnerships between chip manufacturers and streaming service providers can create innovative solutions tailored to provide superior user experiences. Furthermore, government incentives encourage developing energy efficient technologies which create opportunities for developing sustainable highperformance chips suitable for ecoconscious consumers.

Research Scope and Analysis

By Application

The commercial application for the global LCD TV core chips market has been a major driving factor of the market in 2023 and is anticipated to stay across the forecasted period, as the LCD TV core chips hold vital commercial significance, seamlessly integrating computational power into TVs, allowing smart TV features that merge online content & traditional broadcasting, they elevate gaming consoles, digital signage, and interactive touchscreens.

This increases real-time updates, multimedia displays, and dynamic content delivery, transforming spaces across hospitality, retail, education, and corporate sectors into engaging, interactive environments. This versatile technology enriches user experiences, catering to diverse commercial demands and amplifying engagement.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Type

In 2023, the 32-bit LCD TV core chips were one of the major segments driving the market and contributed significantly towards the global revenue, as integrating 32-bit LCD TV core chips empowers television sets with smart TV capabilities, seamlessly integrating online content & traditional broadcasting.

These chips also improve digital signage, interactive touchscreens, and gaming consoles, facilitating real-time updates, dynamic content delivery, and multimedia presentations. Across sectors like hospitality, retail, education, and corporate communication, these chips transform spaces into immersive, interactive environments, enriching user experiences and meeting diverse business needs, and are anticipated to drive the future of the market.

The Global LCD TV Core Chip Market Report is segmented on the basis of the following:

By Application

- Residential

- Commercial

- Educational

By Type

- 8-bit

- 16-bit

- 32-bit

- 64-bit

Regional Analysis

Asia Pacific holds a major market share of the global LCD TV core chip market, accounting for 33.8% of the total revenue of the overall revenue of market in 2023, and is anticipated to hold its lead throughout the forecasted period. This lead in the market is primarily due to the strong presence of both LCD TVs & core chip manufacturers within this region such as LG, Samsung, etc.

Along with it, leading economies in Asia Pacific, including China, Japan, Korea, and Taiwan, are home to a significant number of manufacturers who specialize in the production of LCD TV core chips. Also, there has been a significant increase in the expansion of LCD Smart TVs in the North American market in recent years, and is expected to grow more over the forecasted period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global LCD TV core chip market has high fragmentation, as both established manufacturers and emerging contenders compete for leadership. Innovation, advanced technologies, & strategic collaborations serve as key growth drivers. In addition, prioritizing core chip optimization, energy efficiency, & advanced features align with evolving consumer preferences. This dynamic scenario stimulates innovation & leads towards the advancement of LCD TV core chip capabilities.

For instance, in June 2023, Xiaomi launched the Xiaomi TV EA43 in China, a 32-inch variant, which retains the core features of the 2022 edition, using similar enhancements to the 43-inch version. Mainly, it features a 64-bit quad-core CPU, a significant improvement from the previous dual-core Amlogic chipset. Further, this technological upgrade enhances Xiaomi's dedication to improve TV performance as well as user experience.

Some of the prominent players in the Global LCD TV Core Chip Market are:

- Amlogic

- Lenovo

- LG

- MediaTek

- Panasonic

- Philips

- Sony

- Samsung

- Toshiba

- Xiaomi

- Broadcom

- Other Key Players

Recent Developments

- August 2025: The global LCD TV core chip market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 15.7 billion by 2034.

- July 2025: In 2025, large-area LCD shipments are forecast to increase by 2.4% year-over-year, while shipment area is projected to increase by 3.9% year-over-year.

- May 2025: Large-area LCD unit shipments are forecast to increase by 2.0% year-over-year, while shipment area is projected to increase by 3.9% year-over-year in 2025.

- April 2025: Chinese TV makers refilled more panels in Q1 2025 to build strategic stocks during the tariff war and price negotiations; however, inventory is on the rise owing to weaker demand in Q2 2025.

- March 2025: The LCD TV core chip market is projected to grow from USD 7.0 billion in 2025 to USD 17.0 billion by 2035, at a CAGR of 9.3%.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.6 Bn |

| Forecast Value (2033) |

USD 12.5 Bn |

| CAGR (2024-2033) |

11.7% |

| Historical Data |

2018 - 2023 |

| Forecast Data |

2024 - 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Application (Residential, Commercial and Educational), By Type (8-bit, 16-bit, 32-bit and 64-bit). |

| Regional Coverage |

North America - The US and Canada; Europe - Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific - China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America - Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa - Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Amlogic, Lenovo, LG, MediaTek, Panasonic, Philips, Sony, Samsung, Toshiba, Xiaomi, Broadcom, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global LCD TV Core Chip Market?

▾ The Global LCD TV Core Chip Market is estimated to reach USD 4.6 billion in 2023, which is further expected to reach USD 12.5 billion by 2032.

Which region accounted for the largest Global LCD TV Core Chip Market?

▾ Asia Pacific dominates the Global LCD TV Core Chip Market with a share of 33.8% in 2023.

Who are the key players in the Global LCD TV Core Chip Market?

▾ Some of the major key players in the Global LCD TV Core Chip Market are Samsung, Lenovo, Sony Corp, and many others.

What is the growth rate in the Global LCD TV Core Chip Market?

▾ The market is growing at a CAGR of 11.7 percent over the forecasted period.