Market Overview

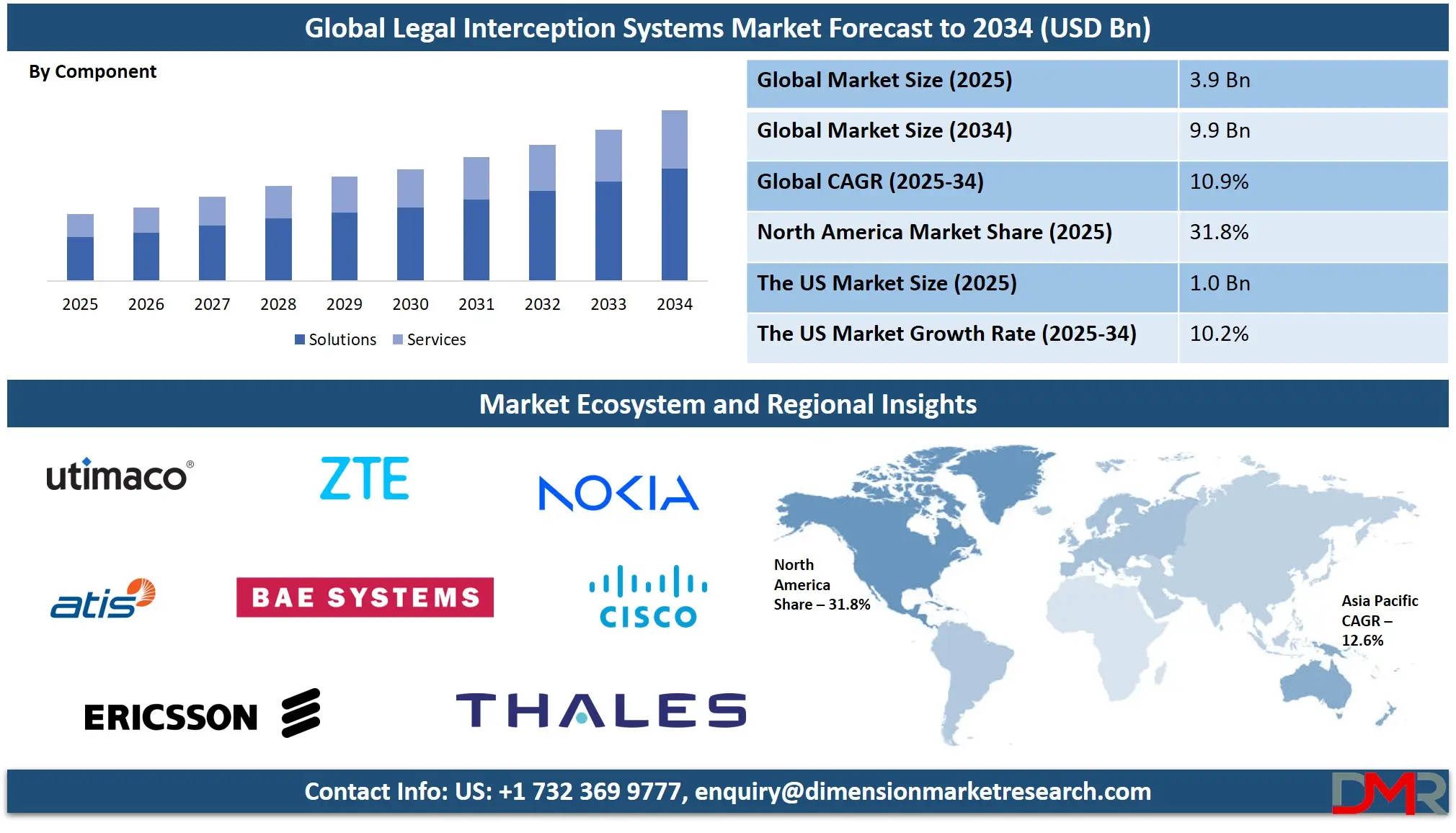

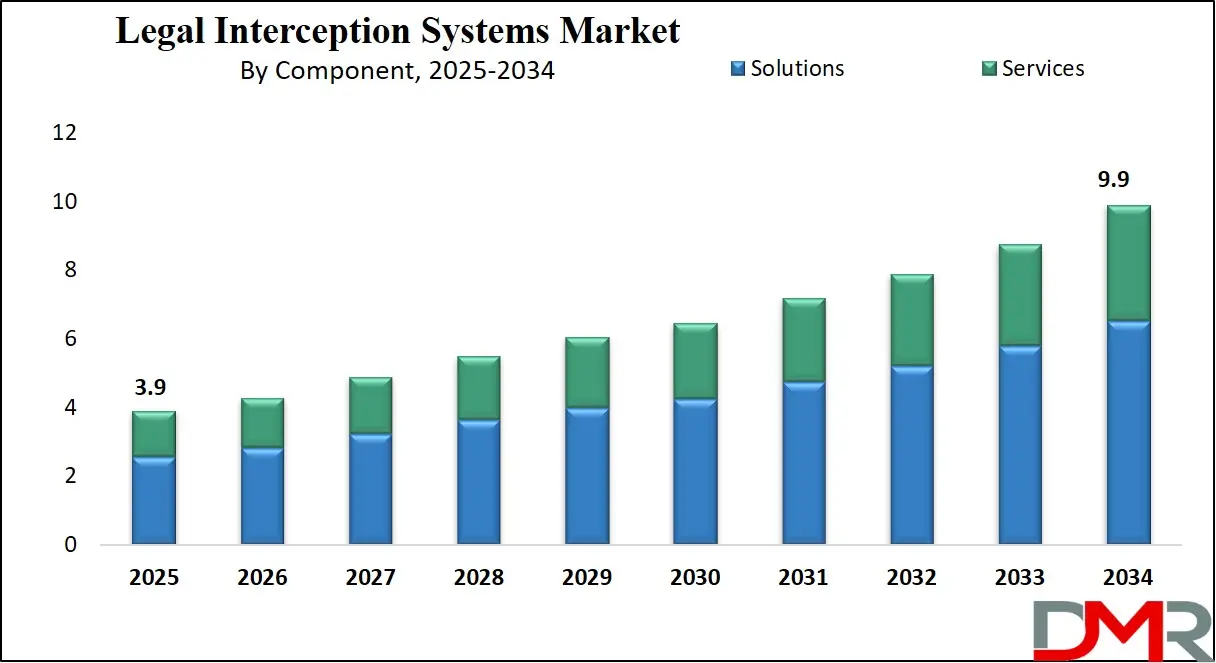

The Global Legal Interception Systems Market size is projected to reach USD 3.9 billion in 2025 and grow at a compound annual growth rate of 10.9% from there until 2034 to reach a value of USD 9.9 billion.

Legal Interception Systems are technologies used by law enforcement and government agencies to monitor and access communication data of individuals or groups as permitted by law. This process is known as Legal Interception Systems. These systems are not used for random surveillance; they are triggered only with legal approval, usually through a court order. The main goal is to help security forces prevent or investigate crimes like terrorism, drug trafficking, cybercrime, and organized crime. Legal Interception Systems are tightly regulated to balance public safety and privacy rights.

In recent years, there has been a growing demand for Legal Interception Systems, which is due to the rise in digital communication, as more people are using the internet, mobile phones, social media, and messaging apps. Criminals are also using these same platforms, making it necessary for authorities to find ways to monitor them legally. Secure Communication Monitoring tools are part of this system, focusing on encrypted chats and calls, which are harder to access without advanced technology. As threats become more sophisticated, the tools to detect and prevent them must also evolve.

A key trend is the shift from traditional phone tapping to advanced IP Interception Systems. As voice and data now travel over the internet, interception must cover more complex systems, including Voice over IP (VoIP), emails, and cloud-based communication. Legal Interception Systems today work across multiple network layers and support various protocols. Another trend is real-time monitoring. Authorities need to act fast, and systems now offer live tracking and analysis to support quick responses.

Recent years have seen countries updating their interception laws to cover new communication methods. Some nations have introduced policies requiring telecom and internet providers to install interception-ready equipment. Global events like rising cybersecurity threats and political instability have also pushed governments to strengthen their monitoring systems. Network Interception Technology has become more important, as it allows for deeper visibility into complex networks used by both civilians and criminals.

Legal Interception Systems are closely linked to Secure Communication Monitoring, IP Interception Systems, and Network Interception Technology. These are all parts of the broader goal of Lawful Interception. While Legal Interception Systems focus on legal access and control, Secure Communication Monitoring handles encrypted or hidden data, IP Interception focuses on internet-based data, and Network Interception covers the infrastructure level, ensuring nothing slips through.

The future of Legal Interception Systems will continue to evolve as technology advances. With 5G, IoT (Internet of Things), and cloud computing, there is more data than ever to manage. Systems must remain flexible and up-to-date to be effective. However, concerns about privacy and misuse remain important. Governments and tech providers must work together to ensure these systems are used responsibly and in accordance with the law. Balancing safety and rights is a constant challenge in the development of legal interception tools.

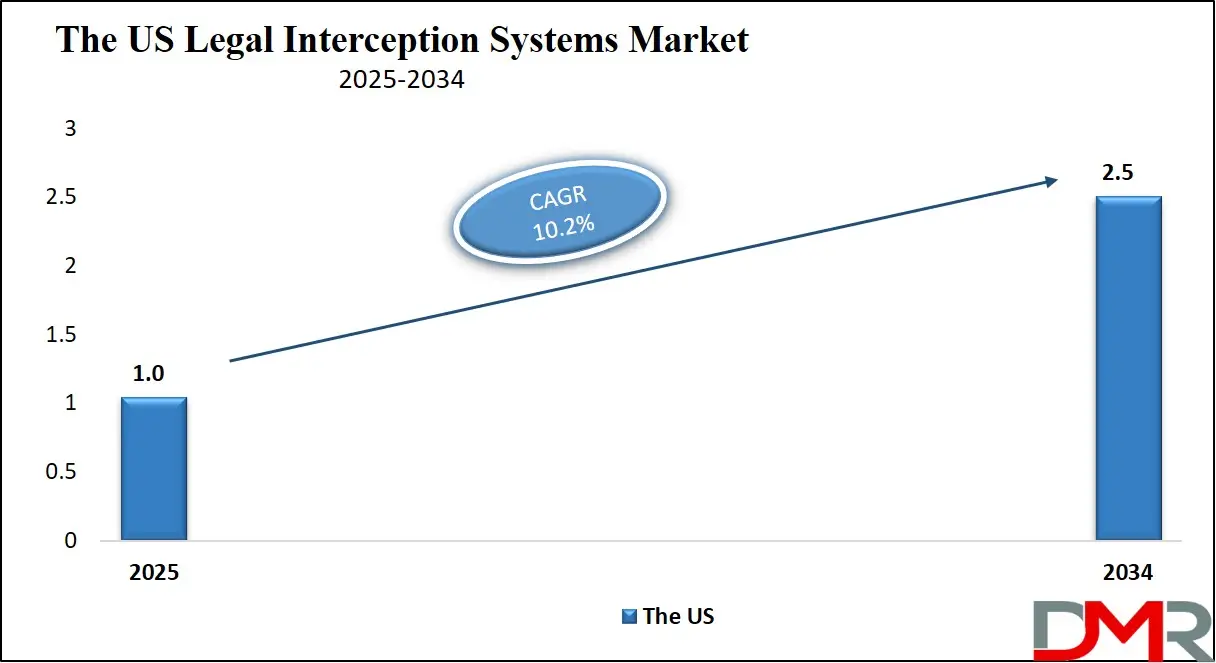

The US Legal Interception Systems Market

The US Legal Interception Systems Market size is projected to reach USD 1.0 billion in 2025 at a compound annual growth rate of 10.2% over its forecast period.

The US plays a major role in the Legal Interception Systems market due to its advanced surveillance infrastructure and strong focus on national security. With a high level of digital communication and internet usage, the US government and law enforcement agencies invest heavily in interception technologies. The country has well-defined legal frameworks that support lawful interception while addressing privacy concerns.

The US also influences global standards and policies related to surveillance and data access. Its tech industry contributes significantly by developing cutting-edge interception tools, including solutions for encrypted communication and real-time monitoring. As cybersecurity threats rise, the US continues to lead in innovation, research, and deployment of Legal Interception Systems, setting trends followed by other nations.

Europe Legal Interception Systems Market

Europe Legal Interception Systems Market size is projected to reach USD 0.9 billion in 2025 at a compound annual growth rate of 10.8% over its forecast period.

Europe plays a significant role in the Legal Interception Systems market, balancing strong security needs with strict privacy regulations. Many European countries have updated laws to support lawful interception while protecting citizens' data rights under regulations like GDPR. This creates a demand for advanced systems that comply with both legal and privacy standards. European governments and telecom providers invest in technologies that can handle encrypted communications and complex network structures.

The region also focuses on interoperability between different countries’ interception systems to combat cross-border crime and terrorism. Europe's careful approach to privacy and security drives innovation in secure, transparent, and legally compliant interception solutions, influencing global market trends and encouraging the development of responsible surveillance technologies.

Japan Legal Interception Systems Market

Japan Legal Interception Systems Market size is projected to reach USD 0.2 billion in 2025 at a compound annual growth rate of 11.7% over its forecast period.

Japan plays an important role in the Legal Interception Systems market, driven by strong national security policies and advanced technology adoption. The country has established clear laws regulating lawful interception, ensuring that surveillance is conducted legally while respecting privacy rights. Japan actively integrates modern technologies like cloud computing, artificial intelligence, and machine learning into its interception systems to enhance real-time monitoring and threat detection.

Additionally, Japan collaborates internationally to share intelligence and best practices, helping improve global security efforts. This combination of legal rigor, technological innovation, and global cooperation positions Japan as a key player in the development and growth of lawful interception solutions within the Asia-Pacific region and worldwide.

Legal Interception Systems Market: Key Takeaways

- Market Growth: The Legal Interception Systems Market size is expected to grow by USD 5.6 billion, at a CAGR of 10.9%, during the forecasted period of 2026 to 2034.

- By Component: Thesolution segment is anticipated to get the majority share of the Legal Interception Systems Market in 2025.

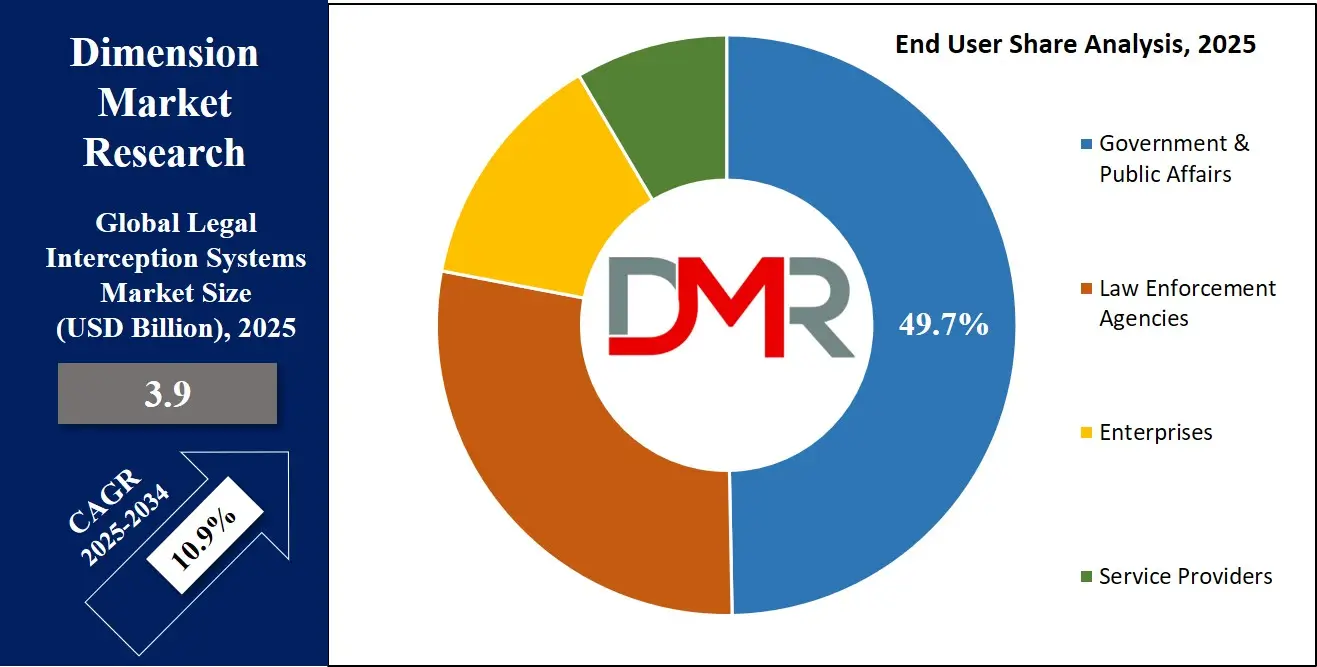

- By End User: The government & public affair segment is expected to get the largest revenue share in 2025 in the Legal Interception Systems Market.

- Regional Insight: North America is expected to hold a 31.8% share of revenue in the Global Legal Interception Systems Market in 2025.

- Use Cases: Some of the use cases of Legal Interception Systems include counter-terrorism operations, drug trafficking control, and more.

Legal Interception Systems Market: Use Cases

- Counter-Terrorism Operations: Legal Interception Systems are used by security agencies to monitor suspects involved in terrorism. These systems help track calls, messages, and online activity in real time. The data collected supports prevention efforts and helps authorities respond quickly to potential threats.

- Cybercrime Investigation: Authorities use Legal Interception to uncover illegal online activities like hacking, phishing, and fraud. By legally accessing internet traffic and encrypted messages, investigators can trace the source of cyberattacks. This helps build strong evidence for prosecution.

- Drug Trafficking Control: Legal Interception Systems assist in tracking communication between drug traffickers across borders. Monitoring calls and texts helps map out criminal networks and plan arrests. It’s a key tool for dismantling organized crime groups.

- National Security Protection: Governments use interception systems to secure the country against espionage and foreign interference. These tools monitor suspicious communications that may threaten political or economic stability. They play a vital role in intelligence gathering and decision-making.

Market Dynamic

Driving Factors in the Legal Interception Systems Market

Rising Use of Encrypted Communication Services

One major growth driver of the Legal Interception Systems market is the widespread use of encrypted communication platforms. Messaging apps, VoIP services, and secure email tools are becoming more popular among both general users and criminals. These platforms use strong encryption, making it difficult for law enforcement to access communication data through traditional means.

Legal Interception Systems are now designed to handle these advanced protocols, allowing authorities to monitor data without breaking encryption rules. The demand for tools that can decode, analyze, or lawfully access encrypted messages is growing fast. This shift pushes governments to invest in upgraded systems and encourages tech providers to innovate. As encryption becomes standard in digital communication, interception systems must evolve to remain effective.

Global Focus on National Security and Public Safety

Another key driver is the increasing global focus on national security, especially with the rise of terrorism, organized crime, and cyber threats. Governments around the world are strengthening surveillance regulations and requiring service providers to support lawful interception. This creates a consistent demand for reliable and legally compliant systems. Countries are also investing in modern network infrastructures like 5G and cloud computing, which require new types of interception technology.

Legal Interception Systems must now be scalable and adaptable to work across various digital platforms. Public safety concerns push for real-time data access, early threat detection, and improved coordination among law enforcement agencies. All of these factors are boosting the growth of the Legal Interception Systems market worldwide.

Restraints in the Legal Interception Systems Market

Privacy Concerns and Legal Challenges

One major restraint in the Legal Interception Systems market is the growing concern over privacy and civil liberties. People are increasingly aware of their digital rights and fear misuse or overreach by surveillance systems. Legal Interception must strictly follow national and international privacy laws, which vary widely and can be complex to navigate. Any violation can result in legal action, public backlash, or damage to trust in institutions.

These concerns make telecom providers and governments cautious about deploying new interception technologies. The balance between public safety and individual privacy remains a sensitive issue. Companies developing these systems must ensure transparency and compliance, which adds complexity and slows down adoption in some regions.

High Implementation Costs and Technical Complexity

Another restraint is the high cost and technical difficulty involved in setting up Legal Interception Systems. These systems need to integrate with a wide range of telecom networks, internet services, and cloud platforms, all while meeting strict legal and security standards. For smaller service providers or developing nations, the investment in hardware, software, and skilled personnel can be too expensive.

Maintenance and regular updates are also necessary to keep up with evolving communication technologies. Furthermore, as networks become more complex with 5G and IoT, interception becomes even more challenging. These technical and financial barriers can limit market growth, especially in regions with limited resources.

Opportunities in the Legal Interception Systems Market

Adoption of 5G and Next-Gen Network Technologies

The rollout of 5G networks and other advanced communication technologies presents a major opportunity for the Legal Interception Systems market. With faster speeds, lower latency, and a greater number of connected devices, 5G increases the volume and complexity of data transmitted. This requires more advanced interception systems that can handle large-scale, high-speed data flows across multiple network layers. Companies developing legal interception solutions have the chance to create specialized tools for 5G and future networks.

This also includes support for IoT, where smart devices can be used for both legitimate and criminal purposes. As governments and telecom operators upgrade infrastructure, they will need compatible and future-ready interception technologies, opening up new market segments and long-term growth potential.

Rising Demand in Developing and Emerging Markets

Emerging economies are becoming significant opportunities for the growth of Legal Interception Systems. Many countries in Asia, Africa, and Latin America are expanding their digital infrastructure and introducing stronger national security laws. As digital communication grows in these regions, so does the need for effective surveillance and monitoring tools.

Governments are increasingly investing in lawful interception capabilities to fight cybercrime, terrorism, and organized crime. Since many of these markets are building systems from the ground up, there is an opportunity to offer scalable, adaptable, and cost-effective solutions. Vendors can provide tailored services that meet both legal requirements and budget constraints. This growing demand from developing nations is expected to drive market expansion in the coming years.

Trends in the Legal Interception Systems Market

Integration of AI and Machine Learning in Interception Solutions

A significant trend in the Legal Interception Systems market is the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. These advancements enable systems to analyze vast amounts of communication data more efficiently, identifying patterns and anomalies that may indicate illicit activities. By automating complex tasks, AI and ML reduce the reliance on manual processes, allowing for quicker response times in investigations.

This technological shift enhances the precision of surveillance efforts, ensuring that critical information is not overlooked. As communication channels continue to evolve, incorporating AI and ML becomes essential for maintaining effective and timely interception capabilities.

Shift Towards Cloud-Based Interception Solutions

Another emerging trend is the transition to cloud-based Legal Interception Systems. Cloud technologies offer scalability and flexibility, allowing agencies to adapt to the increasing volume and complexity of digital communications. By leveraging cloud infrastructure, interception systems can be deployed more rapidly and maintained with greater ease, reducing operational costs.

Additionally, cloud-based solutions facilitate real-time data processing and analysis, which is crucial for timely decision-making in security operations. This shift also supports remote access and collaboration among different agencies, enhancing the overall efficiency of lawful interception activities. As digital communication continues to expand, cloud-based systems are becoming a preferred choice for modern surveillance needs.

Research Scope and Analysis

By Component Analysis

Solution as a component in the Legal Interception Systems (LSI) market will be leading in 2025, with an estimated share of 65.9%. Solutions include software and hardware that enable law enforcement agencies to monitor and intercept communications effectively. The growing complexity of communication networks and the increasing use of encrypted and internet-based services drive the demand for advanced LSI solutions.

hese solutions help agencies access data in real-time and ensure compliance with legal requirements. Continuous innovation and integration of technologies like AI and cloud computing within these solutions make them more efficient and reliable. The strong focus on upgrading network infrastructure and addressing security threats will continue to push the adoption of LSI solutions, contributing significantly to the overall market growth during the forecast period.

Services as a component in the Legal Interception Systems (LSI) market are expected to see significant growth over the forecast period. These services include installation, maintenance, training, and support that help organizations use LSI solutions effectively. As interception technologies become more complex, demand for professional services to manage and optimize these systems grows.

Governments and telecom operators increasingly rely on expert service providers to ensure lawful interception compliance and smooth system operation. The growing need for customized solutions and ongoing system updates will drive the expansion of service offerings, making them an important part of the LSI market’s overall growth.

By Communication Content Analysis

Voice as a communication content segment in the Legal Interception Systems (LSI) market is set to hold a significant share of around 38.5% in 2025. Voice communication remains a primary mode of interaction, making it a critical focus for lawful interception. With the continued use of traditional phone calls alongside newer technologies like VoIP, law enforcement agencies require reliable LSI solutions to capture and analyze voice data effectively.

The growing need to monitor voice traffic for security and crime prevention drives investments in advanced interception tools that can handle high volumes of calls in real time. As voice communication continues to evolve, its importance in the LSI market is expected to grow steadily, supporting overall market expansion during the forecast period.

Video as a communication content segment in the Legal Interception Systems (LSI) market is expected to experience significant growth over the forecast period. With the rise of video calls, streaming, and conferencing, video communication has become more common across personal and business use.

This creates a growing need for LSI technologies capable of intercepting and analyzing video data securely and legally. Enhanced video interception helps authorities track suspicious activities and gather evidence more effectively. As video communication expands with better network infrastructure like 5G, the demand for specialized video interception solutions is increasing, contributing notably to the growth of the overall LSI market.

By Network Technology Analysis

LTE as a network technology segment in the Legal Interception Systems (LSI) market is expected to hold a significant share of about 23.7% in 2025. LTE networks support high-speed mobile data and voice communication, making them widely used across the globe. The increasing reliance on LTE for both personal and business communication drives the need for effective lawful interception tools tailored to this technology.

LSI solutions designed for LTE can capture and analyze large volumes of data traffic securely and in real time. As LTE continues to expand and evolve, law enforcement agencies require robust interception systems to monitor and prevent illegal activities. This ongoing demand will contribute to the steady growth of LTE-focused LSI solutions within the overall market.

VoIP as a network technology segment in the Legal Interception Systems (LSI) market is set to see significant growth over the forecast period. VoIP allows voice communication over the internet, making it popular due to its cost efficiency and flexibility. However, VoIP’s digital nature requires specialized interception solutions to capture calls legally and effectively.

The growing adoption of VoIP in businesses and daily communication increases the need for LSI tools that can monitor these communications while ensuring compliance with legal standards. Enhanced VoIP interception capabilities help law enforcement track suspicious activities and gather critical evidence. As internet usage grows, VoIP’s role in the LSI market will continue to expand, driving overall market growth.

By End User Analysis

The government and public sector as an end-user segment in the Legal Interception Systems (LSI) market will be leading with an estimated share of 49.7% in 2025. Governments rely heavily on LSI technologies to ensure national security, prevent crime, and support law enforcement agencies in monitoring communications within legal boundaries. The growing need to combat terrorism, cybercrime, and other threats drives public sector investment in advanced interception systems.

Governments also focus on compliance with regulations, making reliable and secure LSI solutions essential. Public safety concerns and the expansion of digital communication networks increase the demand for effective monitoring tools. This strong involvement of government and public agencies will continue to be a key factor in driving the growth of the LSI market during the forecast period.

Enterprises as an end-user segment in the Legal Interception Systems (LSI) market are expected to see significant growth over the forecast period. Many businesses are adopting LSI solutions to monitor internal communications for compliance, data security, and risk management. Enterprises use lawful interception to prevent data breaches, insider threats, and to ensure regulatory compliance.

The increasing digitization of business processes and growing cyber threats push companies to invest in interception technologies. Demand for real-time monitoring and secure communication tools within enterprises will continue to rise, making this segment an important contributor to the overall growth of the LSI market.

The Legal Interception Systems Market Report is segmented on the basis of the following:

By Component

By Communication Content

- Voice Communication

- Text Messaging

- Email Communication

- Video Communication

- File Transfer

- Others

By Network Technology

- Voice over IP (VoIP)

- Long-Term Evolution (LTE)

- Wireless Local Area Network (WLAN)

- Digital Subscriber Line (DSL)

- Integrated Services for Digital Network (ISDN)

- Public Switched Telephone Network (PSTN)

- Others

By End User

- Government & Public Affairs

- Law Enforcement Agencies

- Enterprises

- Service Providers

Regional Analysis

Leading Region in the Legal Interception Systems Market

North America will be leading the growth of the Legal Interception Systems (LSI) market, with an estimated share of 31.8% in 2025. The region’s strong focus on national security, rising cyber threats, and increasing digital communication use are driving demand for advanced lawful interception technologies. Governments and law enforcement agencies in North America invest heavily in LSI solutions to monitor encrypted communications, internet traffic, and mobile networks within legal frameworks.

The presence of well-established telecom infrastructure and strict regulations supporting lawful surveillance further support market growth. Additionally, technological innovation in the region, including the adoption of 5G networks and AI-based monitoring tools, helps improve the effectiveness of interception systems. These factors combined make North America a key player in the global LSI market, with continuous investments and upgrades expected to fuel further expansion in the coming years.

Fastest Growing Region in the Legal Interception Systems Market

The Asia Pacific region is showing significant growth in the Legal Interception Systems (LSI) market over the forecast period. Rapid digitalization, increasing internet and mobile users, and rising security concerns are driving the demand for effective lawful interception solutions. Many countries in this region are updating their laws to support LSI technologies, aiming to combat cybercrime, terrorism, and other threats.

Growing investments in advanced network infrastructure, including 5G, are also boosting the need for modern interception systems. The expanding telecom sector and government focus on public safety are expected to fuel the adoption of LSI solutions, making Asia Pacific a rapidly growing market in the global lawful interception industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Legal Interception Systems market is becoming more competitive as the need for secure and reliable surveillance tools grows worldwide. Many technology providers are developing advanced systems that can handle modern communication methods like internet calls, encrypted messages, and social media activity.

Companies compete by offering solutions that are easy to integrate with telecom networks, support real-time monitoring, and meet strict legal requirements. Some focus on software, while others specialize in hardware or complete solutions. The market also sees constant updates to keep up with changing laws and threats. As more countries tighten security laws and demand better surveillance, providers are racing to offer flexible, scalable, and legally compliant tools that can serve both national and regional needs.

Some of the prominent players in the global Legal Interception Systems are:

- Cisco Systems

- Nokia

- Ericsson

- Thales Group

- BAE Systems

- ATIS Systems

- SSB Networks

- ZTE Corp

- Utimaco

- Incognito Software Systems

- CyberGym

- GTEN

- TeleStrategies

- IPFnet

- VASTech

- Signalogic

- Elaman GmbH

- Other Key Players

Recent Developments

-

In December 2024, The Pakistan Telecommunication Authority (PTA) has introduced a new strategy to regulate Virtual Private Networks (VPNs) following the failure of earlier compliance efforts. Under this plan, a new licensing category will be created, allowing companies to apply for permits to offer VPN services legally. This initiative aims to resolve the issue of unregistered VPNs, as only those provided by licensed firms will be recognized. All other proxy services will be classified as unregistered and subsequently blocked by the authorities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.9 Bn |

| Forecast Value (2034) |

USD 9.9 Bn |

| CAGR (2025–2034) |

10.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Communication Content (Voice Communication, Text Messaging, Email Communication, Video Communication, File Transfer, and Others), By Network Technology (Voice over IP (VoIP), Long-Term Evolution (LTE), Wireless Local Area Network (WLAN), Digital Subscriber Line (DSL), Integrated Services for Digital Network (ISDN), Public Switched Telephone Network (PSTN), Others), By End User (Government & Public Affairs, Law Enforcement Agencies, Enterprises, and Service Providers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cisco Systems, Nokia, Ericsson, Thales Group, BAE Systems, ATIS Systems, SSB Networks, ZTE Corp, Utimaco, Incognito Software Systems, CyberGym, GTEN, TeleStrategiesIPFnet, VASTech, Signalogic, Elaman GmbH, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Legal Interception Systems Market size is expected to reach a value of USD 3.9 billion in 2025 and is expected to reach USD 9.9 billion by the end of 2034.

North America is expected to have the largest market share in the Global Legal Interception Systems Market, with a share of about 31.8% in 2025.

The Legal Interception Systems Market in the US is expected to reach USD 1.0 billion in 2025.

Some of the major key players in the Global Legal Interception Systems Market are Cisco Systems, Nokia, Ericsson, and others

The market is growing at a CAGR of 10.9 percent over the forecasted period.