The global liquid cooling system market has seen phenomenal growth due to the high demand for effective thermal management across various industries. Liquid cooling systems are used to dissipate heat from critical components through the use of liquids, which could be water or even specialty coolants. As industries increasingly rely on thermal management systems, the adoption of liquid-based cooling becomes even more essential.

These systems possess advantages in terms of efficiency compared to traditional air cooling, are less noisy, and are compact; hence, they are preferred for data centers, power electronics, and industrial applications. The rising need for advanced liquid cooling solutions is further accelerating market expansion.

Advances in technology, such as the increase in edge computing,

artificial intelligence, and IoT, have added to the growth in demand for liquid cooling solutions. A major rise in data creation and processing requires better cooling methodologies in order for these systems to perform at their best in class while avoiding overheating.

Besides this, energy efficiency considerations are gaining momentum and placing more focus on research and development to find environmentally friendly ways of cooling; this is thus supportive of this market segment, too. The introduction of high-efficiency cooling technologies is contributing to greener and more effective cooling infrastructures.

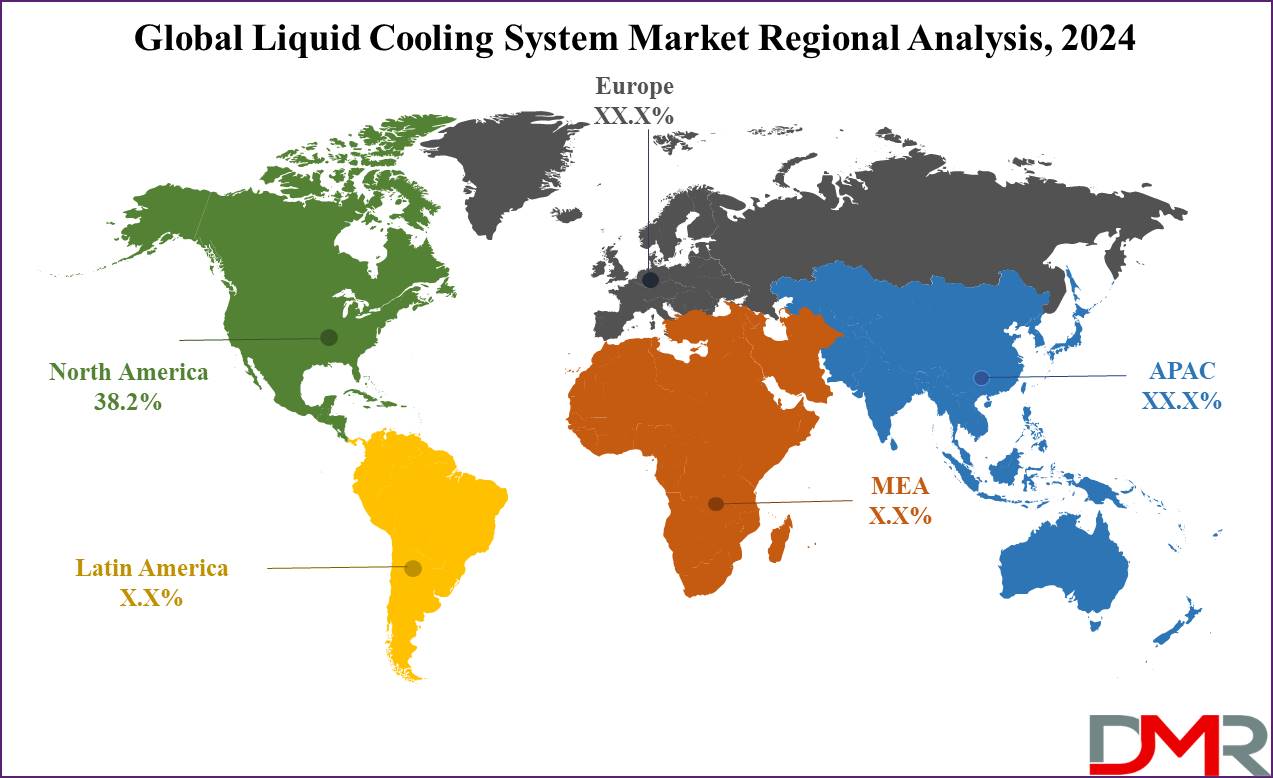

While North America and Europe are leading the market regionally, it is because advanced infrastructure pushes demand for it in regions with strong sectors such as IT, telecom, and manufacturing. Also, rapid industrialization, growth in data centers, and higher investment in advanced technologies have established Asia Pacific as an emerging market as well.

Liquid cooling system kits are experiencing increased interest due to increasing demands for efficient thermal management in various industries, particularly electronics and data centers. As devices become increasingly powerful, effective cooling solutions become essential in avoiding overheating and optimizing performance.

Technological innovations are shaping the market, with developments in liquid cooling techniques that provide increased efficiency with smaller form factors. Companies are creating eco-friendly cooling solutions that reduce energy usage while mitigating environmental impacts to fuel demand for next-gen cooling kits. Additionally, the growing integration of

Next-Gen Biometric Authentication technologies is further accelerating the need for advanced, efficient cooling systems to support high-performance and security-driven applications.

Gaming and high-performance computing (HPC) industries are two primary drivers of market expansion. Gamers and professionals alike have increasingly adopted liquid cooling kits to optimize their systems for improved performance and increased hardware life span, with customizable options and aesthetic appeal of such systems also contributing to their popularity among these sectors.

Opportunities are expanding in emerging regions, where rapid industrialization and data center growth is driving increased demand for advanced cooling solutions. Strategic partnerships between manufacturers and technology companies as well as product innovations are opening doors to further market expansion - two factors expected to propel liquid cooling system kit sales forward over time.

The US Liquid Cooling System Market

The US Liquid Cooling System Market is projected to be valued at USD 2.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.2 billion in 2033 at a CAGR of 5.4%.

U.S. liquid cooling system market growth is strong, driven by several key trends. Most prominent among them is the rapid adoption of high-performance computing systems within data centers; as data centers grow to accommodate greater amounts of information generated from IoT devices, AI applications, and cloud services influx, they must rely on energy-efficient cooling solutions that cut energy use while optimizing performance for their new workloads.

Another trend involves increasing emphasis on sustainability and energy efficiency. Companies, in response to rising energy costs and demand for greener technologies, have increasingly turned towards liquid cooling systems which offer superior thermal management while using significantly less energy than traditional air cooling methods. Opportunities abound within IT and telecom sectors - specifically as 5G networks rapidly expand while smart cities create demands for advanced cooling technology solutions.

Recent innovations in the US market include AI-driven cooling systems that optimize performance in real-time and increase liquid cooling solutions' efficacy, further driving growth. Modular data centers requiring compact yet effective cooling solutions are another source of growth.

Key Takeaways

- Global Value: The Global Liquid Cooling System Market size is estimated to have a value of USD 8.2 billion in 2024 and is expected to reach USD 13.4 billion by the end of 2033.

- The US Market Value: It is expected to witness subsequent growth in the upcoming period as it holds USD 4.2 billion in 2033 at a CAGR of 5.4%.

- By Component Segment Analysis: Solutions are projected to dominate the global liquid cooling system market as it hold 60.0% of market share in 2024.

- By Type Segment Analysis: Liquid heat exchanger systems are projected to dominate the global liquid cooling system as it is anticipated to hold 63.1% of the market share in 2024. G

- Regional Analysis: North America is expected to have the largest market share in the global liquid cooling system market with a share of about 38.2% in 2024.

- Global Growth Rate: The market is growing at a CAGR of 5.7 percent over the forecasted period.

Use Cases

- Data Centers: Liquid cooling systems are crucial for maintaining optimal temperatures in data centers, ensuring efficient operation of servers, reducing energy costs, and minimizing the risk of downtime.

- High-Performance Computing (HPC): Liquid cooling enables HPC systems to operate at peak performance, dissipating heat generated by powerful processors used in scientific research, financial modeling, and complex simulations.

- Industrial Applications: In manufacturing and automation, liquid cooling systems manage heat in power electronics and machinery, improving efficiency, prolonging equipment lifespan, and preventing overheating in harsh environments.

- Telecom Infrastructure: Liquid cooling is essential in telecom for maintaining the reliability of base stations, especially in 5G networks, where high data transmission rates generate significant heat.

Market Dynamic

Trends

Adoption of AI, IoT, and High-Performance Computing

The increased adoption of high-level technologies like AI, IoT, and HPC drives the demand for liquid cooling systems. These technologies create immense heat due to the intensive processes they carry out; therefore, they need cooling solutions. Liquid cooling systems, considering their efficiency and effectiveness in managing heat, are more considered in AI and IoT essential environments, including data centers, autonomous vehicles, and smart cities. As AI and IoT expand into several industries, the demand associated with handling such loads through advanced cooling systems is expected to rise, determining market growth.

Shift to Edge Computing and 5G Infrastructure

One of the major trends affecting the liquid cooling system market is the transition toward edge computing with the deployment of 5G infrastructure. With edge computing, data needs to be processed closer to its source in smaller and more scattered locations. This demands the installation of compact and high-efficiency cooling solutions since traditional air cooling may not serve the purpose.

Liquid cooling solutions are highly essential in these applications, offering high efficiency in cooling with minimal form factors. Another factor adding to the demand is the rollout of 5G infrastructure, considering that equipment is normally set up closely together and generates immense heat, therefore, driving further the advancements in cooling technologies, enabling operation reliably and continuously.

Growth Drivers

Increase in Construction and Expansion of Data Centers

The rapid proliferation of data centers across the world is one factor that has caused great demand for liquid cooling systems. Recently, the exponential growth of data because of increasing cloud computing, big data analytics, and digital transformation initiatives has opened up very large-scale demand for data centers.

These centers operate on a gigantic scale with thousands of servers. The reason is that liquid cooling systems function better, consume less energy, and reduce the chances of overheating equipment in data centers. Since more companies are now investing in data center expansion to meet the increased demand for the processing of data, it would be the first time increased growth in the liquid cooling system market.

Energy Efficiency Regulations and Sustainability Goals

To maintain sustainability in industrial and technological operations, the government and other regulatory bodies adopt more stringent energy efficiency standards across borders. This necessitates the implementation of energy-efficient technologies, including liquid cooling systems. Liquid cooling systems afford much better thermal management than conventional air cooling systems, which significantly cuts down on energy consumption and becomes pertinent to meet global sustainability goals.

Most industries, such as those in the fields of IT, telecom, and manufacturing, where pressure is increasing to minimize carbon footprint, are finding their compliance with liquid cooling solutions while optimizing operational efficiencies.

Growth Opportunities

Asia-Pacific Emerging Markets

In the case of the liquid cooling system market, the Asia-Pacific region would continue to realize significant gains on account of rapid industrialization, urbanization, and the increasing penetration of advanced technologies. Countries such as China, India, and Southeast Asian countries are investing decently in data center infrastructures, telecommunication networks, and manufacturing plants, for which liquid cooling systems would be required.

The expanding industry of IT and telecom, with government initiatives for the promotion of digitalization and smart city development, will drive the demand for liquid cooling systems. Liquid cooling technologies, thus, are very likely to see wide adoption as companies in emerging markets try to improve operational efficiency and meet growing energy efficiency standards.

Technological Innovations in Liquid Cooling Systems

Many developments are taking place in liquids cooling technologies. Newer coolants with higher efficiency, better heat exchanger designs, and AI-powered cooling systems are improving the performance-reliability quotient of liquid cooling solutions and presenting tremendous opportunities for growth in the market.

These innovations not only improve cooling efficiency but also reduce maintenance and environmental impact, making liquid cooling systems more attractive to a wide range of industries. Furthermore, smart technologies that can allow real-time monitoring and optimization of cooling systems are foreseen to be adopted in sectors that require accuracy and reliability as key factors.

High Initial Investment Costs

The high initial investment installation cost is one of the main factors that may hamper growth in the liquid cooling system market. Liquid cooling systems include complex structural infrastructures, special equipment, and installation and maintenance activities that make their initial investment cost much higher compared to conventional air cooling methods.

It might prove to be very expensive for SMEs or those organizations that have to operate on a relatively stringent budgeting system. Despite the long-term benefits of energy savings and improved performance, the significant initial expenditure may deter some companies from adopting liquid cooling systems, especially in industries with limited financial resources.

Complexity and Maintenance Issues

The complexity of liquid cooling systems supplies another hinge in the market, whereas regular maintenance requires monitoring against leakage and coolant replacement to form correct functioning components. Specialized technicians and special tools in their management require further increased operational costs and challenge organizations lacking expertise in areas concerning these systems.

Besides, some environmental types may not welcome liquid cooling solutions due to the risk of coolant leakages that could cause damage to sensitive equipment. One of the challenges to many fluid cooling systems is that they are quite a bother to maintain, making them less attractive for many industries that seek easy and less costly cooling solutions.

Research Scope and Analysis

By Component

Solutions are projected to dominate the global liquid cooling system market as it hold 60.0% of market share in 2024. In the global liquid cooling system market, solutions dominate the segment, over services, by a large margin, which could be attributed to several key factors. Solutions, in particular, direct and indirect liquid cooling systems, comprise the core technology that efficiently addresses the critical need related to thermal management in a wide range of applications.

In direct liquid cooling, coolant is in direct contact with heat generation. It gives high efficiency in cooling and hence finds extensive application in high-performance areas such as data centers and industries. Indirect cooling is employed where safety and ease of maintenance assume prime importance, thus finding wider applications in various industries.

With the ability to make immediate and serious improvements in performance and energy efficiency, as well as tough competition, the dominance of the solution makes a whole difference. That is why more and more companies are trying to invest resources in these systems to optimize their operations, reduce the cost of energy, and ensure compliance with environmental regulations.

With the growing complexity of AI, IoT, and edge computing applications a substantial amount of heating further accelerates the demand for robust liquid cooling solutions. While design, consulting, and maintenance are indeed key services, they all pretty much enable the installation and ongoing operation of these kinds of solutions. In that vein, core value truly lies within the solution itself, serving to directly impact performance, efficiency, and overall system sustainability.

By Type

Liquid heat exchanger systems are projected to dominate the global liquid cooling system as it is anticipated to hold 63.1% of the market share in 2024. Liquid heat exchanger systems dominate the global liquid cooling system market segment due to their versatility, efficiency, and broad application range. The dominance of liquid heat exchanger systems is largely due to their adaptability; they can be integrated into diverse environments, from data centers to industrial machinery, making them a preferred choice across sectors.

This is partly because liquid-based heat exchanger systems have dominated the industry due to their ability to adapt to diverse environments data centers any given industrial machinery-whipping them into shape and making them the first choice for industries.

It is with these liquid heat exchanger systems that the most popular ways have resulted not just from high heat loads but also from operation under very severe conditions. They allow scalable solutions to be tailored to your specific cooling needs, whether in high-performance computing, power electronics, or telecom infrastructure.

Reciprocating chillers are also more specialized, usually used in niche applications requiring very specific temperature control-for example, laboratory equipment, and medical devices. However, due to the broader applicability and efficiency of liquid heat exchanger systems, they hold a significant edge in the market, especially as industries are moving toward flexible and energy-efficient cooling systems to support advanced technologies.

By Cooling Capacity (Watt)

The largest share in the global liquid cooling system market is contributed by the segment of 500–2500-watt cooling capacity because it strikes an optimal balance between performance and applicability. This range holds immense significance for varied high-performance applications and provides the most versatile and widely adopted cooling capacity.

The range of capacity for this kind of cooling is rather optimal for data centers in dissipating the heat from servers and other critical infrastructure without needing highly extensive or expensive cooling systems, capable of providing the substantial power needed to maintain ideal temperatures efficiently in most standard server setups.

This range of 500-2500 watts will also be suitable for the cooling of power electronics, control systems, and other machinery that generate heat at a moderate to high level in the industrial and manufacturing fields. This capacity is also preferred in telecom infrastructure, where it efficiently manages thermal loads arising from equipment used in 5G networks and other high-demand environments.

The cost-effectiveness further drives the dominance of this segment. This is the happy medium where users have access to huge cooling performances without the increased prices that come with larger capacity systems. The option becomes appealing for companies trying to balance performance against budget concerns when dealing with a wide array of applications.

By Distribution Channel

The distribution channel segment, in the global liquid cooling market, was dominated by direct sales since these systems are immensely specialized and application-specific. Liquid cooling systems need to be tailored mainly for the operation needs of sectors like data centers, manufacturing, and telecom, where thermal management is crucial. Direct sales channels permit close collaboration of manufacturers with end-users in terms of proper designing and installation of provided cooling solutions. This also permits better customer support and after-sales service for customers.

Liquid cooling systems, being much more complex than traditional air cooling, help manufacturers offer comprehensive consulting, installation, and maintenance because of direct sales to make sure the systems are correctly integrated and maintained over time. This level of service is critical in industries where any kind of downtime can cause huge operational disruption.

Furthermore, direct sales channels allow the manufacturer to establish close relations with their clients and, consequently, acquire greater levels of trust and brand loyalty. For the liquid cooling market, this is important since the efficiency and reliability of the cooling systems will have great consequences for the end customer's operations. That makes direct sales the first choice of sale in this particular market segment since it enables the sale of customized solutions with dedicated support.

By Application

The BFSI sector accounts for the largest share of the application segment of the global liquid cooling system market, as the sector requires highly reliable and efficient data management. Liquid cooling systems find their applications in the BFSI industry for data processing and storage applications that are crucial for maintaining the performance and uptime of servers and data centers.

BFSI has to deal with a great amount of sensitive and real-time information. Thus, powerful IT infrastructures are required to perform non-stop activities such as online banking, financial transactions, and data analytics. Contrasting to air cooling, liquid cooling systems offer an advanced level of thermal management. These solutions maintain data centers at the ideal, cool level, reducing the threat of overheating and failure within the system that may also result in huge losses of finances.

The demand for high-performance computing has also increased in the BFSI sector due to the greater drive toward digital transformation and the adoption of fintech solutions. Application: This drives the need for advanced cooling solutions that will support intense processing with energy efficiency. Hence, liquid cooling is also a preference in a sector focusing ever so much on compliance and data security, where data integrity and system reliability are controlling regulatory requirements and customer trust.

The Liquid Cooling System Market Report is segmented on the basis of the following

By Component

- Solutions

- Direct Liquid Cooling

- Indirect Liquid Cooling

- Services

- Design and Consulting

- Installation and Deployment

- Support and Maintenance

By Type

- Liquid Heat Exchanger Systems

- Liquid to Air Systems

- Liquid to Liquid Systems

- Recirculating Chillers

- Compressor based Systems

- Thermoelectric-based Systems

By Cooling Capacity (Watt)

- Upto 500

- 500-2500

- 2500-3500

- Above 3500

By Distribution Channel

- Direct Sale

- Indirect Sale

By Application

- BFSI

- Manufacturing

- IT & Telecom

- Media & Entertainment

- Retail

- Government & Defense

- Healthcare

- Energy

- Others

Regional Analysis

North America is projected to dominate the global liquid cooling system market as it will

hold 38.2% of the market share in 2024. North America has the largest share in the liquid cooling system market due to the reason of its highly developed technological infrastructure, well-grounded industries, and early adoption tendency of emerging technologies. It hosts most of the data centers of the world with more coming up owing to escalating demands for

cloud services, big data analytics, artificial intelligence, and IoT.

With high-powered heat being generated by the compactly integrated high-performance computing system, these data centers are becoming increasingly dependent on effective thermal management systems to get rid of the heat. Therefore, liquid cooling systems are now an essential part of their infrastructures.

The United States currently dominates this market, especially due to the current increase in investments being put into technology and innovation. Its tech giants, including Google, Microsoft, and Amazon, keep scaling their operations for data centers higher, hence increasing demand for liquid cooling solutions.

The powerful presence of industries related to telecom, manufacturing, and financial services in North America itself develops a strong market for these systems, as they are highly important in maintaining the reliability and efficiency of critical infrastructure. Another contributing factor is the energy efficiency and sustainability orientation of the region.

With strict environmental laws and a growing emphasis on carbon footprints, many companies are working toward meeting this goal through liquid cooling systems. The availability of skilled professionals and advanced R&D capabilities also gives further support to this region for leadership in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global liquid cooling system market is highly competitive, characterized by the presence of several key players that drive innovation and market growth. Companies such as Asetek, Schneider Electric, Rittal, and Vertiv are among the leading players, each offering a range of advanced cooling solutions tailored to various industrial needs.

Asetek is known for its pioneering work in liquid cooling technology, particularly in high-performance computing and data center applications. The company's innovative solutions are widely adopted in sectors that require reliable and efficient thermal management. Schneider Electric and Rittal, both global leaders in energy management and industrial automation, offer comprehensive liquid cooling systems integrated with their broader data center infrastructure solutions.

Their focus on sustainability and energy efficiency has made them preferred partners for companies looking to optimize their thermal management. Vertiv, another major player, specializes in providing end-to-end solutions for critical infrastructure, including liquid cooling systems. The company's emphasis on innovation and customer-centric solutions has helped it maintain a strong position in the market.

The competitive landscape is also marked by ongoing mergers and acquisitions, as companies seek to expand their product portfolios and geographic reach. The market's dynamic nature drives continuous advancements in technology, ensuring that liquid cooling systems remain at the forefront of thermal management solutions.

Some of the prominent players in the Global Liquid Cooling System Market are

- Asetek

- Cooler Master

- Corsair

- Enermax

- EKWB (EK Water Blocks)

- Alphacool

- Arctic

- Thermaltake

- Deepcool

- SilverStone Technology

- Noctua

- Laird Thermal Systems

- Rittal

- Other Key Players

Recent Developments

- July 2024: Schneider Electric launched its latest liquid cooling system, specifically designed for edge computing environments. This new system features advanced AI-driven temperature management that dynamically adjusts cooling levels based on real-time data, significantly improving energy efficiency and reducing operational costs.

- June 2024: Asetek introduced an innovative direct-to-chip liquid cooling solution tailored for high-density data centers. This new product offers up to a 20% improvement in energy efficiency compared to traditional cooling methods, making it particularly attractive to data centers looking to reduce their energy consumption and carbon footprint.

- May 2024: Vertiv completed the acquisition of a specialized liquid cooling technology company to expand its product portfolio and enhance its market presence in the Asia-Pacific region. This strategic move aims to leverage the acquired company’s innovative technologies and local expertise to better serve the rapidly growing data center and telecom markets in the region.

- April 2024: Rittal unveiled a new integrated liquid cooling system designed specifically for industrial automation applications. This system is engineered to improve cooling efficiency by 15%, particularly in harsh operating environments where traditional cooling methods struggle to maintain performance.

- March 2024: A significant collaboration was announced between a leading global telecom giant and a prominent liquid cooling system manufacturer. The partnership aims to develop cutting-edge cooling solutions for 5G infrastructure, focusing on the unique challenges posed by high-density installations and the need for reliable, energy-efficient cooling.

- February 2024: A new industry standard for liquid cooling systems in data centers was proposed by a leading consortium of technology companies and industry experts. This standard aims to enhance the interoperability of liquid cooling systems across different platforms and vendors, reducing installation and maintenance costs. It also focuses on improving the efficiency and sustainability of cooling solutions, with guidelines for using eco-friendly coolants and optimizing energy use.

- January 2024: Asetek announced a partnership with a major renewable energy company to co-develop sustainable liquid cooling solutions aimed at reducing the carbon footprint of large-scale data centers. This collaboration will focus on integrating renewable energy sources with advanced cooling technologies to create a more sustainable data center ecosystem.