Market Overview

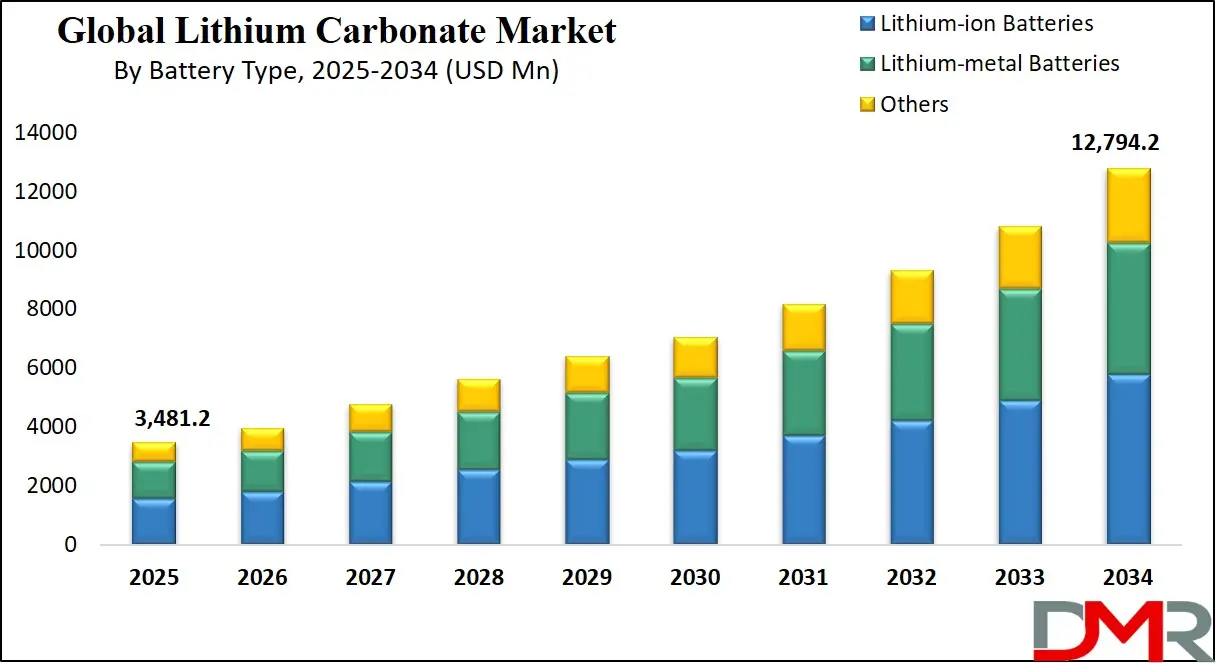

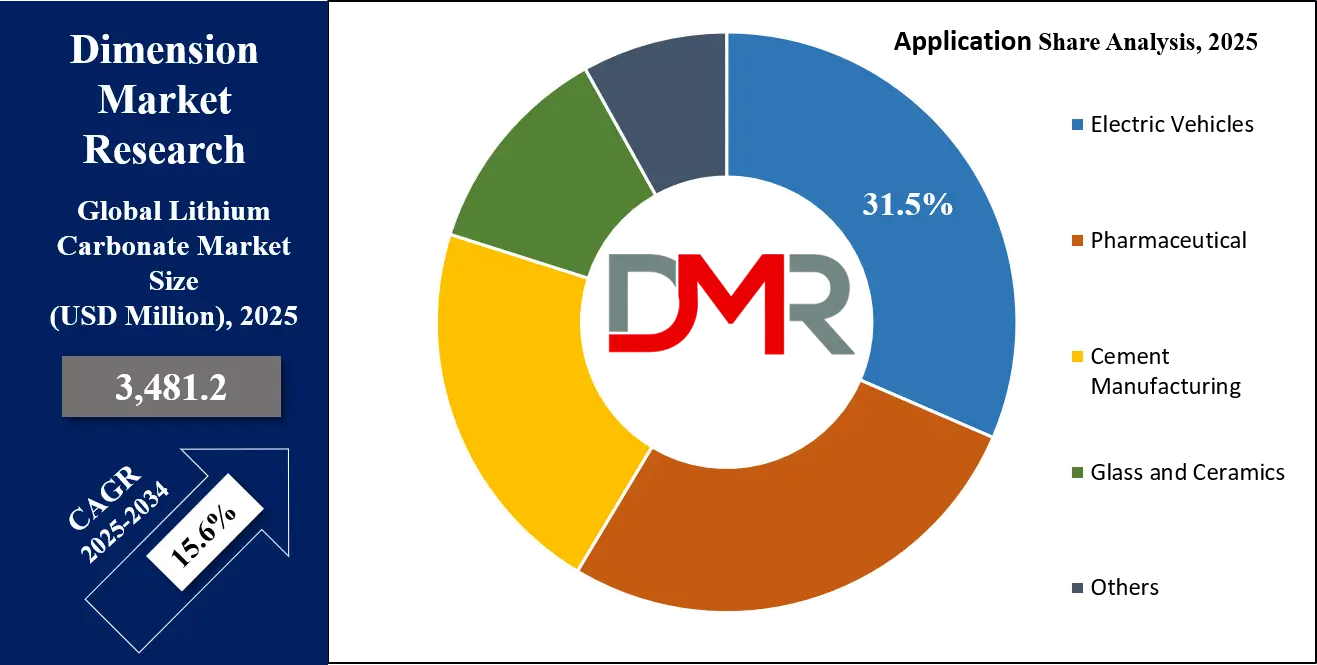

The Global Lithium Carbonate Market is projected to reach USD 3,481.2 million in 2025 and grow at a compound annual growth rate of 15.6% from there until 2034 to reach a value of USD 12,794.2 million.

The global lithium carbonate market is undergoing rapid expansion as the backbone of the electric mobility and energy storage revolution. Lithium carbonate is a key component in lithium-ion battery chemistries, particularly for cathodes used in electric vehicles (EVs), grid-level storage systems, and portable electronics. The global transition toward cleaner energy is significantly increasing the demand for high-purity, battery-grade lithium carbonate. With governments around the world committing to net-zero emissions and banning internal combustion engines within the next 10–15 years, lithium consumption is projected to rise exponentially.

Supply, however, remains geographically concentrated. Over

80% of the world’s lithium production comes from the Lithium Triangle (Chile, Argentina, Bolivia) and Australia. This has raised concerns about over-reliance and vulnerability to supply shocks. In response, countries like the U.S., Germany, India, and Canada are accelerating their critical mineral strategies and domestic extraction capabilities to diversify sourcing. Environmental regulations are also tightening due to the ecological concerns associated with brine evaporation and hard rock mining, including water depletion and ecosystem disruption.

Technological advancements such as Direct Lithium Extraction (DLE), solid-state battery development, and lithium-ion battery recycling present key opportunities to reduce environmental impact and stabilize long-term supply. Meanwhile, the emergence of sodium-ion batteries offers future competition, but lithium carbonate remains dominant in terms of performance and maturity.

The market is projected to grow at a double-digit CAGR through 2030 due to massive investments in gigafactories, grid storage, and electronics. Regions like Asia-Pacific are leading the charge, while North America and Europe are catching up with policy-driven initiatives. From a strategic standpoint, lithium carbonate will remain an indispensable mineral for global electrification, energy transition, and decarbonization, shaping the future of industrial, automotive, and power sectors for decades.

The US Lithium Carbonate Market

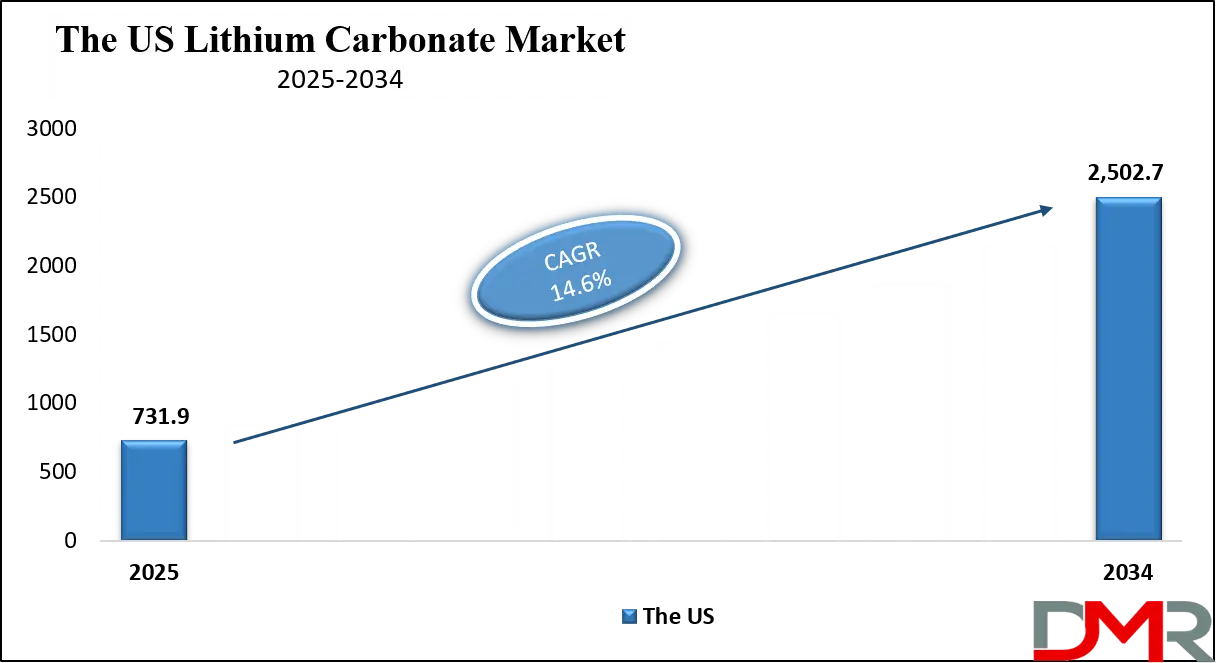

The US Lithium Carbonate Market is projected to reach USD 731.9 million in 2025 at a compound annual growth rate of 14.6% over its forecast period.

The United States is scaling up lithium carbonate production and refining capacity as part of its critical minerals strategy to reduce dependence on imports. According to the U.S. Geological Survey (USGS), the U.S. holds an estimated 1 million tons of lithium reserves, concentrated primarily in Nevada’s Clayton Valley, Arkansas’s Smackover Formation, and North Carolina’s Piedmont region. The Department of Energy (DOE) has committed billions through its Loan Programs Office to support lithium projects, including domestic processing and battery supply chains.

The Inflation Reduction Act of 2022 offers extensive tax incentives and grants to bolster lithium sourcing, recycling, and cell manufacturing within the U.S. These policies are designed to qualify batteries for EV tax credits only if critical minerals are sourced domestically or from free-trade partners. This legislative framework has accelerated investments in U.S.-based lithium extraction, especially from brine and sedimentary sources using more sustainable Direct Lithium Extraction (DLE) methods.

Demographically, the U.S. benefits from a technically skilled workforce and strong university-industry collaborations in chemical engineering, mining, and battery R&D. States like Nevada and California are emerging as lithium hubs due to favorable geology and logistical advantages.

EV adoption is also surging. According to the U.S. Department of Energy’s Vehicle Technologies Office, EV sales exceeded 1.5 million units in 2023, up 60% from 202To meet this demand, automakers are forming offtake agreements with domestic lithium developers. Moreover, battery recycling programs led by the Environmental Protection Agency (EPA) are laying the groundwork for a circular economy model. These factors combined are creating a robust and resilient lithium carbonate ecosystem in the U.S., well-positioned to meet national clean energy targets.

The European Lithium Carbonate Market

The European Lithium Carbonate Market is estimated to be valued at USD 522.1 million in 2025 and is further anticipated to reach USD 1,527.8 million by 2034 at a CAGR of 14.0%.

Europe is undergoing a lithium supply transformation, spearheaded by the European Union’s Critical Raw Materials Act and the Green Deal Industrial Plan. Lithium is classified as a critical raw material essential for clean technology, and the EU mandates that at least 10% of strategic minerals, including lithium carbonate, must be domestically mined and 15% recycled by 2030. These targets are accelerating exploration, permitting, and investment in local lithium projects.

Major lithium refining and gigafactory projects are underway in Germany, France, Spain, and Finland. Germany is developing domestic extraction via geothermal brine in the Upper Rhine Valley, while Portugal is advancing hard rock mining initiatives. EU-backed financing tools and public–private partnerships are helping de-risk these projects to reduce Europe’s reliance on imported lithium carbonate from China and South America.

The automotive sector is a major driver. Europe is home to automakers like Volkswagen, BMW, Renault, and Stellantis, all of which have committed to full EV lineups by 2035. To support battery production, over 50 battery gigafactories are in various stages of development across the continent. Lithium carbonate is foundational for cathode production in these facilities.

Demographically, the EU's strong labor protection, high R&D expenditure, and specialized battery workforce support lithium carbonate market development. According to Eurostat, renewable energy already accounts for over 22% of the EU’s energy mix, and BESS systems enabled by lithium carbonate are essential to stabilizing this grid expansion.

Strict EU environmental standards ensure that local lithium production will be among the cleanest globally, though permitting hurdles and community opposition remain challenges. Nevertheless, Europe’s lithium carbonate market is growing rapidly and is on track to achieve partial self-sufficiency through 2030, aligned with its climate and industrial strategies.

The Japan Lithium Carbonate Market

The Japan Lithium Carbonate Market is projected to be valued at USD 208.8 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 587.4 million in 2034 at a CAGR of 12.0%.

Japan’s lithium carbonate market reflects its commitment to energy security and innovation in clean technologies. The country lacks significant domestic lithium resources and is heavily reliant on imports, mainly from Chile, Argentina, and China. However, through strategic trade partnerships, Japan secures stable lithium supplies. As per Japan’s Ministry of Finance, lithium carbonate imports in 2023 were valued at over $1 billion, covering pharmaceutical, industrial, and battery-grade applications.

Japan’s Ministry of Economy, Trade and Industry (METI) has prioritized lithium under its Green Innovation Fund and Basic Energy Plan. These policies allocate funds for lithium-ion and next-generation solid-state battery R&D, critical to both automotive electrification and grid-level storage. Domestic companies like Panasonic and Toyota are world leaders in battery innovation and continue to invest in lithium refining and recycling capabilities.

Demographically, Japan’s aging population and compact urban environments make it ideal for distributed storage solutions, hybrids, and compact EVs, all of which require lithium carbonate. According to the Japan Automobile Manufacturers Association (JAMA), hybrid vehicles make up over 40% of new car sales, and EV penetration continues to grow annually.

Japan also leads in battery recycling. Under its Home Appliance Recycling Law and End-of-Life Vehicle guidelines, lithium batteries are systematically collected and processed. The government is incentivizing urban mining and secondary lithium extraction from used electronics and EVs, reducing dependency on raw material imports.

Environmental regulation is strict, but Japan’s industrial discipline, automation, and R&D capacity allow it to lead in precision lithium processing and battery material purity. While vulnerable to supply chain disruptions, Japan’s coordinated policy, trade, and technological approach ensures that its lithium carbonate market remains globally competitive and strategically resilient.

Global Lithium Carbonate Market: Key Takeaways

- Global Market Size Insights: The Global Lithium Carbonate Market size is estimated to have a value of USD 3,481.2 million in 2025 and is expected to reach USD 12,794.2 million by the end of 2034.

- The US Market Size Insights: The US Lithium Carbonate Market is projected to be valued at USD 731.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,502.7 million in 2034 at a CAGR of 14.6%.

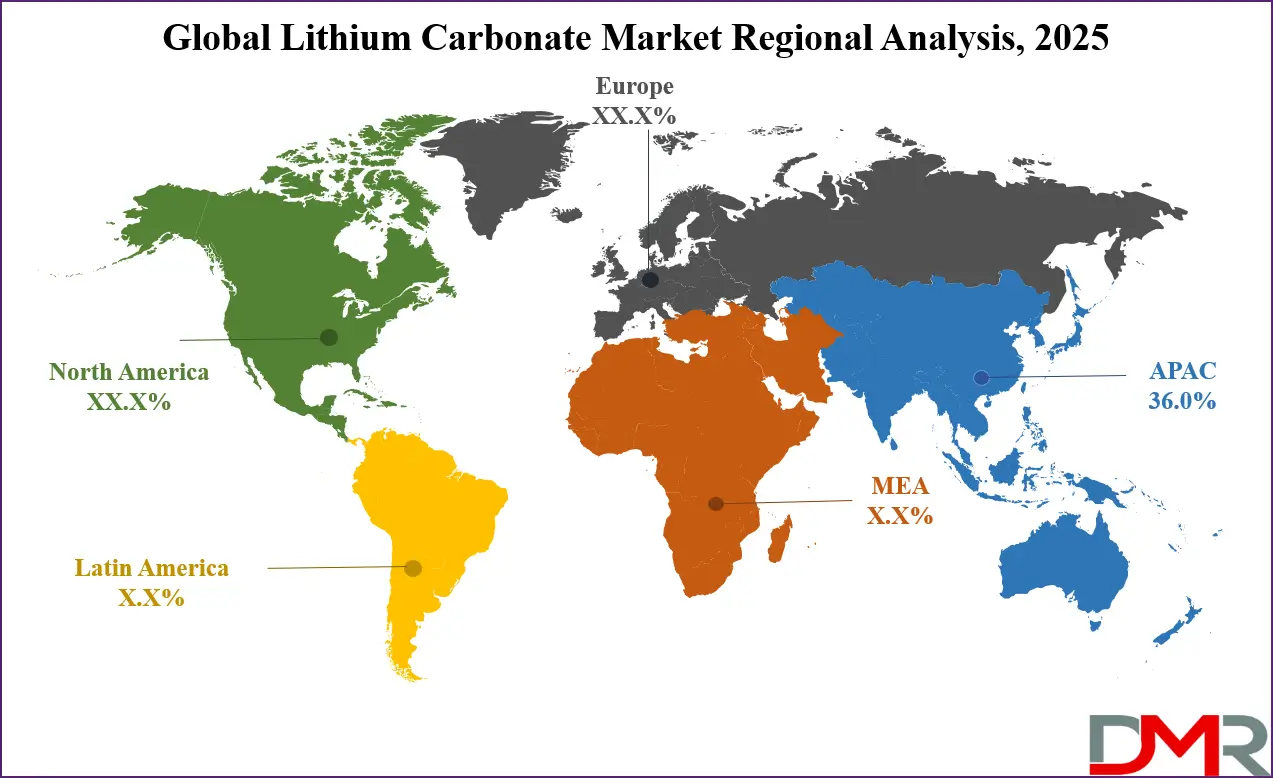

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Lithium Carbonate Market with a share of about 36.0% in 2025.

- Key Players: Some of the major key players in the Global Lithium Carbonate Market are Albemarle Corporation, SQM, Ganfeng Lithium Co., Ltd., Tianqi Lithium Corporation, Livent Corporation, Mineral Resources Limited, Lithium Americas Corp., Allkem Limited, Piedmont Lithium Inc., Nemaska Lithium, Bacanora Lithium, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 15.6 percent over the forecasted period of 2025.

Global Lithium Carbonate Market: Use Cases

- Electric Vehicles (EVs): Lithium carbonate is critical in manufacturing lithium-ion battery cathodes used in EVs. It enhances energy density, prolongs battery life, and supports rapid charging. As nations ban gasoline cars, demand for lithium carbonate is directly tied to the automotive sector's electrification trajectory.

- Grid-Level Energy Storage: Used in battery energy storage systems (BESS), lithium carbonate enables load balancing and peak shaving in electrical grids. It supports renewable integration by storing surplus solar and wind energy, allowing dispatch during low-production periods, thus enhancing grid reliability and efficiency.

- Glass and Ceramics Industry: Lithium carbonate acts as a flux to reduce melting points in glass and ceramic production. It improves thermal shock resistance and durability, making it indispensable in heat-resistant cooktops, smartphones, industrial glass, and specialty ceramics used in electronics and aerospace.

- Pharmaceutical Applications: Pharmaceutical-grade lithium carbonate is a vital compound in mood disorder treatment, particularly for bipolar disorder. It stabilizes mood swings and has been used in psychiatry for decades. Though low in volume, this niche demands a high-purity, tightly regulated lithium carbonate supply.

- Lubricants and Air Conditioning Systems: In industrial greases and air conditioning systems, lithium carbonate contributes to thermal stability, anti-corrosion properties, and smooth operational performance. It plays a key role in manufacturing lithium-based lubricating greases used in heavy machinery, transport, and high-temperature industrial processes.

Global Lithium Carbonate Market: Stats & Facts

- According to USGS, the average U.S. price of battery-grade lithium carbonate fluctuated between $8,600 and $68,100 per metric ton from 2018 to 2023.

- Data from USGS reveals that only about 70 employees are involved annually in U.S. lithium mine and mill operations, indicating high efficiency or automation.

- USGS estimates that the United States relies on imports for over 25% of its total lithium consumption.

- Based on USGS findings, there are around 40 lithium battery recycling companies in North America and 50 in Europe.

- As per USGS statistics, global lithium production saw a surge from 146,000 tons in 2022 to 180,000 tons in 2023, reflecting a 23% annual increase.

- USGS reported that global lithium consumption also rose sharply to 180,000 tons in 2023, keeping pace with production.

- According to USGS trade data, U.S. lithium imports between 2019 and 2022 were sourced 51% from Argentina, 43% from Chile, and 3% from China.

- USGS resource assessments place total global lithium reserves at approximately 17 million tons, with identified global resources at 63 million tons.

- The USGS highlights that the U.S. has 1.8 million tons of lithium reserves and 14 million tons of broader lithium resources.

- From USGS project data, the Thacker Pass site in Nevada contains 13.7 million tons of LCE and is expected to produce up to 66,000 tons annually.

- IEA analysis indicates that global battery-grade lithium demand reached 140,000 tons in 2023, representing 85% of all lithium use.

- According to the IEA, EV battery installations globally hit 750 GWh in 2023, marking a 40% year-over-year growth.

- IEA estimates show that energy storage systems had a global installed capacity of 2,400 GWh in 2023, up from just a fraction of that in 2020.

- IEA's 2023 update notes that 40 GW of battery storage capacity was added globally, doubling 2022's figures.

- Investment data from the IEA shows that over USD 115 billion was spent on EV battery supply chains in 2023, while total battery investments hit USD 150 billion.

- According to IEA demand models, lithium consumption jumped to approximately 200,000 tons LCE in 2023, with production growing at a comparable pace.

- IEA cautions that without new capacity, lithium supply could meet just 50% of projected demand by 2035.

- IEA's technical review states that 66% of global lithium comes from brine sources, offering a 97% recovery efficiency.

- IEA projections suggest lithium demand may grow 10-fold by 2050, fueled largely by EVs and grid storage.

- IEA concludes that batteries alone will drive 50% of the global increase in demand for critical minerals like lithium.

- Wikipedia's global mining data places 2023 lithium production at 204,000 tons, with reserves of 30 million tons and resources over 116 million tons.

- According to UN data, Australia led global lithium production with 91,700 tons in 2023 and holds 7 million tons in reserves.

- UN sources state that Chile followed with 41,400 tons produced and 9.3 million tons in reserves in 2023.

- Based on DOE figures, China’s lithium output in 2023 reached 35,700 tons, and its reserves are estimated at 3 million tons.

- IRENA reports that Argentina produced 8,630 tons of lithium in 2023 and has 4 million tons in proven reserves.

- Publicly available USGS-Wikipedia data confirm that the U.S. produced 870 tons of lithium in 2023, backed by 1.8 million tons of reserves.

- UN Geological Centre reports that Bolivia possesses about 100 million tons of lithium in Salar de Uyuni, over half of the globally known reserves.

- Water sustainability reports estimate that 1.9 million liters of water are consumed per ton of lithium extracted, creating environmental concerns.

- Life cycle assessments from public research put the carbon footprint of Li-ion battery production at around 73 kg CO₂e per kWh of storage.

- Institutional sources like DOE and EIA estimate that hard-rock mining (e.g., spodumene) achieves 94% lithium recovery, slightly less than brine-based methods.

Global Lithium Carbonate Market: Market Dynamics

Driving Factors in the Global Lithium Carbonate Market

Exponential Growth in Electric Vehicle (EV) Adoption

The primary growth driver of the lithium carbonate market is the global acceleration in electric vehicle (EV) adoption. Governments worldwide have introduced aggressive decarbonization policies and emission regulations that promote EVs over internal combustion engine vehicles. For instance, the European Union aims to end the sale of new petrol and diesel cars by 2035, while the U.S. Inflation Reduction Act provides extensive tax incentives for EV production and adoption. Lithium carbonate is a critical raw material used in lithium-ion batteries, particularly in LiFePO4 (LFP) and NMC chemistries.

The average EV battery contains approximately 8–10 kg of lithium carbonate equivalent (LCE), making the material indispensable. As EV production scales, projected to surpass 20 million units by 2025, the demand for lithium carbonate is expected to grow accordingly. China, the largest EV market, continues to dominate battery production and is investing heavily in lithium mining to meet domestic requirements. The synergy between policy, consumer behavior, and technological improvements in EVs will continue to fuel robust growth in lithium carbonate demand globally.

Government Support and Strategic Reserves Initiatives

Global governments are increasingly recognizing lithium as a strategic mineral, which is translating into robust policy support, funding initiatives, and national stockpiling programs. Countries like the United States, Canada, Chile, and Australia are streamlining regulatory approvals, offering tax incentives, and investing in domestic mining and refining capacity for lithium carbonate. For example, the U.S. Department of Energy has allocated over $3 billion under the Bipartisan Infrastructure Law for domestic battery material processing.

The European Union has also included lithium in its Critical Raw Materials Act, simplifying permitting processes and encouraging private-public partnerships. These initiatives are designed to reduce dependency on Chinese refining capacity and establish more geographically diversified supply chains.

Additionally, government-backed R&D is facilitating the development of sustainable lithium extraction technologies. Strategic reserves are also being built to buffer against supply shocks. Together, these supportive measures are accelerating lithium project development timelines and ensuring that domestic industries can meet rising demand in a geopolitically stable and economically viable manner.

Restraints in the Global Lithium Carbonate Market

Environmental and Water Resource Challenges

One of the major restraints facing the lithium carbonate market is the environmental impact associated with lithium extraction, especially from brine sources. Brine-based lithium mining, predominant in regions like Chile's Atacama Desert, consumes vast amounts of water, approximately 500,000 gallons per ton of lithium extracted in some of the driest regions on Earth. This leads to groundwater depletion, biodiversity loss, and conflict with local communities over water rights.

As environmental scrutiny intensifies, such ecological concerns may result in stricter regulatory oversight, delayed project approvals, and increased operational costs. Furthermore, indigenous groups and NGOs are actively opposing unsustainable mining practices, sometimes halting projects altogether. Public backlash and legal actions are becoming increasingly common. These environmental risks could impede capacity expansion and affect investor confidence.

The industry is under pressure to shift toward sustainable extraction methods like Direct Lithium Extraction (DLE), but these technologies are still being commercialized. Until more eco-friendly alternatives are widely adopted, environmental factors will remain a significant bottleneck in scaling up lithium carbonate production globally.

Geopolitical Instability and Trade Concentration Risks

Geopolitical volatility in key lithium-producing regions poses a significant threat to the lithium carbonate market. Currently, a large portion of the global lithium supply chain, including mining, refining, and battery-grade processing, is concentrated in a handful of countries, primarily China, Chile, and Argentina. This lack of diversification makes the market vulnerable to political disruptions, regulatory changes, or trade disputes.

For instance, China's dominance in lithium processing, accounting for over 60% of global refining capacity, gives it immense leverage over downstream markets. Trade tensions between China and Western economies could result in export restrictions, impacting the global supply and increasing prices. Similarly, political instability in South American nations could disrupt mining operations or deter foreign investment.

Nationalization policies and royalty increases have already created uncertainty for investors. The lack of robust lithium production in the U.S. and EU further amplifies dependency risks. This geopolitical fragility creates volatility in pricing and limits the ability of downstream industries to secure long-term, stable lithium carbonate supplies.

Opportunities in the Global Lithium Carbonate Market

Lithium Recycling and Circular Economy Models

The rise of lithium battery recycling presents a major growth opportunity for the lithium carbonate market. With a typical lithium-ion battery life cycle of 8–12 years, the wave of retired EV and energy storage batteries is approaching. Recycling can recover up to 95% of the lithium content, significantly reducing the dependency on primary mining and lowering the environmental footprint of battery production.

Companies like Redwood Materials and Li-Cycle are setting up commercial-scale recycling plants that convert used batteries into battery-grade lithium carbonate and other cathode materials. This supports the emergence of a circular economy in the battery value chain.

Regulatory mandates in the EU and U.S. are also beginning to require end-of-life battery recycling, which further strengthens market viability. Additionally, recycling can buffer against price volatility and supply shortages by supplementing primary lithium sources. As technology and logistics around battery collection improve, recycled lithium carbonate is expected to make up an increasingly larger share of the total supply, opening a new sub-market with significant scalability potential.

Untapped Resources in Latin America and Africa

Emerging lithium resources in Latin America and Africa present lucrative expansion opportunities. The Lithium Triangle, comprising Chile, Argentina, and Bolivia, holds over 60% of the world's known lithium reserves. While Chile and Argentina are already operational hubs, Bolivia's Salar de Uyuni remains underutilized due to political and infrastructural constraints. However, recent bilateral collaborations and the introduction of foreign direct investment frameworks may open this vast resource up to international developers.

Similarly, African nations like Zimbabwe and the Democratic Republic of the Congo are being explored for hard rock lithium mining potential. Improved geopolitics, infrastructure development, and environmental governance could enable these regions to become key players in the global lithium carbonate supply chain. Foreign companies are actively partnering with local governments to build joint ventures, ensuring mutual benefits and sustainable practices. These untapped reserves offer not only additional supply security but also the potential for cost-competitive production, thereby attracting investment and strengthening global supply resilience.

Trends in the Global Lithium Carbonate Market

Vertical Integration Across the Supply Chain

One of the most dominant trends in the global lithium carbonate market is the move toward vertical integration by major players, particularly battery manufacturers and automotive OEMs. Companies such as Tesla, BYD, and CATL are investing directly in mining operations and lithium processing facilities to gain control over raw material supply and reduce dependency on third-party suppliers. This integration ensures cost predictability, quality assurance, and secure supply, especially vital during lithium shortages and price volatility.

The trend is being supported by government grants and policies in regions like the U.S., EU, and China, which incentivize domestic critical mineral sourcing. This shift also enhances ESG compliance since companies can directly influence the environmental and labor standards across their supply chain. Additionally, vertical integration reduces logistical complexities and lead times, making operations more efficient. With EV sales and gigafactory construction booming, this trend is poised to deepen as companies seek to de-risk their supply chains and support rapid scaling.

Transition from Brine to Direct Lithium Extraction (DLE)

The adoption of Direct Lithium Extraction (DLE) technology is revolutionizing the lithium carbonate market. Unlike traditional brine evaporation, which can take over 12 months and is water-intensive, DLE enables extraction within hours, reduces environmental degradation, and offers higher lithium recovery rates (often exceeding 90%). Companies like Lilac Solutions and EnergyX are developing modular DLE systems that can be deployed at scale and integrated into existing brine operations.

This trend addresses growing scrutiny over the ecological impact of lithium mining, especially in water-scarce regions such as Chile’s Atacama Desert. The DLE approach also makes previously non-viable deposits economically feasible, significantly expanding the exploitable lithium resource base. With increasing investor interest and pilot programs underway globally, this trend is expected to reshape how lithium carbonate is produced in the next five years. Moreover, DLE aligns with regulatory expectations around sustainability and accelerates the lead time from discovery to production, which is crucial given the rapidly growing demand from EV and energy storage markets.

Global Lithium Carbonate Market: Research Scope and Analysis

By Grade Analysis

Battery-grade lithium carbonate is projected to dominate the market due to its critical role in the production of high-performance lithium-ion batteries, which power a wide spectrum of technologies, including electric vehicles (EVs), smartphones, laptops, and grid-scale energy storage systems. Battery-grade lithium carbonate must meet stringent purity requirements (typically ≥99.5% Li₂CO₃ content), ensuring its compatibility with the precise electrochemical processes within rechargeable batteries. The rise of global electrification, particularly in transportation, has sharply increased the demand for battery-grade materials.

According to the International Energy Agency (IEA), over 85% of all lithium produced in 2023 was used in batteries, with lithium carbonate serving as a foundational raw material for cathode chemistries such as lithium iron phosphate (LFP), NMC (Nickel Manganese Cobalt), and others.

The dominance of battery-grade lithium carbonate is also reinforced by massive government incentives and regulatory policies aimed at expanding clean mobility and renewable energy infrastructure. Nations including the U.S., Germany, China, and South Korea are offering subsidies and building domestic supply chains for critical battery materials.

In addition, battery manufacturers and EV companies are prioritizing long-term contracts and direct investment in battery-grade lithium projects to secure a high-purity supply. Battery-grade lithium’s higher value per ton, compared to technical or industrial grades, also makes it more economically lucrative for miners and refiners. As battery production scales, especially in gigafactories, the demand for ultra-pure lithium carbonate will continue to surpass other grades, ensuring its sustained dominance in the market.

By Battery Type Analysis

Lithium-ion batteries are the is anticipated to dominate battery technology, driving global lithium carbonate demand, accounting for the largest share of its consumption. This dominance is anchored in lithium-ion's superior energy density, lightweight design, rechargeability, and scalability across a wide range of applications from consumer electronics to electric vehicles and grid storage.

Among lithium battery chemistries, LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt) require large volumes of lithium carbonate for cathode material production, particularly in the early processing stages. Their high efficiency, thermal stability, and relatively long lifecycle make them ideal for mass-market EVs and stationary storage systems.

As per data from the U.S. Department of Energy (DOE) and the International Renewable Energy Agency (IRENA), over 90% of electric vehicles globally are powered by lithium-ion batteries, and this figure is growing annually. Moreover, the average EV battery requires 40–60 kg of lithium carbonate equivalent, depending on battery capacity. With EV production forecasted to exceed 25 million units by 2030, lithium-ion technology continues to be the preferred platform due to ongoing innovation and cost improvements. Major global automakers and battery suppliers are investing billions into expanding lithium-ion gigafactory capacities.

The wide adoption of lithium-ion in industrial robotics, drones, aerospace, and data centers further secures its dominant role. While alternative battery technologies like solid-state or sodium-ion are under research, none have matched lithium-ion’s maturity or commercial viability at scale. This ensures lithium-ion batteries will remain the primary consumer of lithium carbonate through the foreseeable future.

By Application Analysis

Electric vehicles (EVs) are anticipated to be the largest and fastest-growing application segment driving the demand for lithium carbonate globally. This dominance stems from the core role lithium carbonate plays in manufacturing lithium-ion batteries, the power source for virtually all mainstream EVs. Each electric vehicle battery requires anywhere from 30 to 60 kg of lithium carbonate equivalent, depending on the chemistry and vehicle size. As per the International Energy Agency (IEA), global EV sales surpassed 14 million units in 2023, with projections exceeding 25 million units by 2025, directly translating into surging lithium carbonate consumption.

Governments worldwide are implementing strict emissions regulations, offering tax incentives, and banning internal combustion engine (ICE) vehicle sales in the upcoming decades. For instance, the EU aims to end ICE sales by 2035, while China and California have set similar mandates. These policy shifts, combined with consumer interest in clean mobility, are accelerating EV adoption at an unprecedented pace. Automakers such as Tesla, Volkswagen, BYD, and Ford are rapidly expanding their EV fleets, all of which depend on high-capacity lithium-ion batteries.

The EV sector also benefits from robust investment in charging infrastructure, battery R&D, and supply chain localization efforts, especially in the U.S., Europe, and Asia-Pacific. With multiple nations classifying lithium as a critical mineral and integrating EVs into net-zero carbon strategies, the segment will remain the primary growth driver for lithium carbonate demand. As technology advances and EVs become more affordable and accessible, lithium carbonate’s relevance in this space is expected to grow exponentially.

The Global Lithium Carbonate Market Report is segmented on the basis of the following:

By Grade

- Battery Grade

- Technical Grade

- Industrial Grade

By Battery Type

- Lithium-ion Batteries

- Lithium-metal Batteries

- Others

By Application

- Electric Vehicles

- Pharmaceutical

- Cement Manufacturing

- Glass and Ceramics

- Others

Global Lithium Carbonate Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to dominate the global lithium carbonate market as it holds 36.0% of the total revenue by the end of 2025, due to its vast mineral reserves, expansive manufacturing base, and strong integration across the battery and electric vehicle (EV) value chains. China, Australia, and Chile (with strong trade ties to Asia) are the world’s largest lithium producers, ensuring abundant raw material access. China alone controls over 60% of global lithium processing capacity and is home to major lithium carbonate refiners such as Ganfeng Lithium and Tianqi Lithium.

Furthermore, Asia Pacific leads in EV and battery production, with China, South Korea, and Japan hosting some of the largest battery manufacturers, including CATL, BYD, LG Energy Solution, and Panasonic.

The region also benefits from aggressive policy support. China's “Made in China 2025” and its new energy vehicle (NEV) policy are designed to scale domestic battery and EV production rapidly. Similarly, Japan’s Green Growth Strategy and South Korea’s K-Battery initiative strengthen the lithium carbonate demand outlook. Additionally, a dense network of gigafactories and chemical processors in China ensures localized, cost-effective, and vertically integrated supply chains. This comprehensive ecosystem gives Asia Pacific a clear competitive edge in terms of output, pricing power, and scalability.

Region with the Highest CAGR

North America is projected to register the highest compound annual growth rate (CAGR) in the lithium carbonate market due to surging EV adoption, government funding, and a strategic push toward domestic supply chain development. The United States, in particular, is rapidly expanding its lithium extraction, refining, and battery manufacturing capabilities to reduce dependency on foreign sources, especially China. Legislation like the Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law allocates billions in tax incentives and grants to boost lithium processing and secure raw materials domestically.

In addition, automakers such as General Motors, Tesla, and Ford are building gigafactories in the U.S. and Canada, fueling demand for battery-grade lithium carbonate. The Department of Energy has also prioritized lithium as a critical mineral and is funding recycling technologies to bolster supply resilience. With growing public and private investment, plus rising consumer demand for EVs and energy storage systems, North America is positioned for rapid growth. These dynamics make it the fastest-growing regional market despite current lower production levels compared to Asia Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Lithium Carbonate Market: Competitive Landscape

The global lithium carbonate market is characterized by a mix of vertically integrated mining giants, specialized chemical companies, and rapidly emerging players from battery-producing nations. China dominates the competitive landscape with leading firms such as Ganfeng Lithium Co., Ltd., Tianqi Lithium Corporation, and China Lithium Products Technology Co., Ltd., all of which benefit from government support and strong domestic demand. These companies maintain upstream control over extraction and downstream processing into battery-grade carbonate, ensuring competitive pricing and scalability.

Australia-based Pilbara Minerals and Allkem Ltd. (formerly Orocobre) are notable suppliers focused on exporting lithium concentrate to Asia. Chile’s SQM (Sociedad Química y Minera de Chile) and Albemarle Corporation, a U.S.-based company with major operations in the Atacama Desert, remain global leaders in both brine and hard rock lithium operations. North America’s landscape is evolving, with companies like Livent Corporation and Piedmont Lithium investing heavily in new refining facilities to localize supply chains.

Meanwhile, new entrants such as Lithium Americas, Sigma Lithium, and technology-focused startups like EnergyX are reshaping competition by exploring direct lithium extraction (DLE) and sustainable mining practices. Strategic partnerships, long-term offtake agreements with automakers, and joint ventures are intensifying competition and accelerating project timelines across the globe.

Some of the prominent players in the Global Lithium Carbonate Market are:

- Albemarle Corporation

- SQM (Sociedad Química y Minera de Chile S.A.)

- Ganfeng Lithium Co., Ltd.

- Tianqi Lithium Corporation

- Livent Corporation

- Mineral Resources Limited

- Lithium Americas Corp.

- Orocobre Limited (now Allkem Limited)

- Piedmont Lithium Inc.

- Nemaska Lithium

- Bacanora Lithium

- Eramet Group

- AVZ Minerals Limited

- European Lithium Ltd.

- Sayona Mining Limited

- Sibelco

- Volt Resources Limited

- China Lithium Products Technology Co., Ltd.

- Jiangxi Ganfeng Lithium Industrial Co., Ltd.

- Chengxin Lithium Group Co., LTd.

- Other Key Players

Recent Developments in the Global Lithium Carbonate Market

- June 2025: Zimbabwe announced a landmark decision to ban the export of unprocessed lithium concentrates starting January 2027. This policy aims to stimulate domestic refining industries and increase value addition within the country. The move follows over US$ $1 billion worth of Chinese investments in Zimbabwe’s lithium sector since 2021, including Sinomine Resource Group and Zhejiang Huayou Cobalt’s ventures into local lithium carbonate and hydroxide processing plants. The upcoming ban is expected to accelerate the development of lithium refineries and reshape global supply flows.

- May 2025: In a major geopolitical collaboration, Rio Tinto entered a strategic partnership with Chile’s state-owned mining company Codelco to jointly develop a large-scale lithium mine in northern Chile. With a proposed investment of approximately US$ $900 million, the project aims to leverage Chile’s rich lithium brine reserves while ensuring sustainable extraction and processing methods. This alliance reinforces Rio Tinto’s ambition to become a major lithium supplier for the battery and EV industry.

- April 2025: The 2025 MMLC Lithium Industry Conference was hosted in Xining, Qinghai province, China from April 28–30. The conference attracted over 1,300 industry stakeholders, including battery manufacturers, chemical engineers, and government delegates. The event focused on topics such as direct lithium extraction (DLE), battery recycling technologies, lithium supply-demand trends, and environmental sustainability in lithium mining. The conference solidified Qinghai’s position as a hub for lithium carbonate production in China.

- March 2025: Rio Tinto finalized the acquisition of Arcadium Lithium for US$ $6.7 billion, establishing the new Rio Tinto Lithium division. The merger makes Rio the world’s third-largest lithium producer, significantly enhancing its presence across both hard rock and brine-based lithium resources. Arcadium Lithium, formed from the merger of Livent and Allkem in January 2024, brought with it integrated lithium operations in Argentina, Australia, and Canada, along with valuable processing capabilities for battery-grade carbonate.

- December 2024: Rio Tinto approved a US$ $2.5 billion investment to expand its Rincon Lithium Project in Argentina. The plan aims to boost production capacity to 60,000 metric tons per year of battery-grade lithium carbonate by 2031. The investment underscores the company's confidence in the long-term demand trajectory for electric vehicle batteries and energy storage systems.

- December 2024: General Motors finalized a US$ $625 million investment in Lithium Americas Corp, acquiring a 38% equity stake in the Thacker Pass lithium project in Nevada. This joint venture ensures GM a direct supply of battery-grade lithium carbonate for its electric vehicle fleet, particularly under its Ultium platform, starting from 2026.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,481.2 Mn |

| Forecast Value (2034) |

USD 12,794.2 Mn |

| CAGR (2025–2034) |

15.6% |

| The US Market Size (2025) |

USD 731.9 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Grade (Battery Grade, Technical Grade, Industrial Grade), By Battery (Lithium-ion Batteries, Lithium-metal Batteries, Others), By Application (Electric Vehicles, Pharmaceutical, Cement Manufacturing, Glass and Ceramics, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Albemarle Corporation, SQM, Ganfeng Lithium Co., Ltd., Tianqi Lithium Corporation, Livent Corporation, Mineral Resources Limited, Lithium Americas Corp., Allkem Limited, Piedmont Lithium Inc., Nemaska Lithium, Bacanora Lithium, Eramet Group, AVZ Minerals Limited, European Lithium Ltd., Sayona Mining Limited, Sibelco, Volt Resources Limited, China Lithium Products Technology Co., Ltd., Jiangxi Ganfeng Lithium Industrial Co., Ltd., Chengxin Lithium Group Co. Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Lithium Carbonate Market size is estimated to have a value of USD 3,481.2 million in 2025 and is expected to reach USD 12,794.2 million by the end of 2034.

The US Lithium Carbonate Market is projected to be valued at USD 731.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,502.7 million in 2034 at a CAGR of 14.6%.

Asia Pacific is expected to have the largest market share in the Global Lithium Carbonate Market with a share of about 36.0% in 2025.

Some of the major key players in the Global Lithium Carbonate Market are Albemarle Corporation, SQM, Ganfeng Lithium Co., Ltd., Tianqi Lithium Corporation, Livent Corporation, Mineral Resources Limited, Lithium Americas Corp., Allkem Limited, Piedmont Lithium Inc., Nemaska Lithium, Bacanora Lithium, and many others.

The market is growing at a CAGR of 15.6 percent over the forecasted period of 2025.