Market Overview

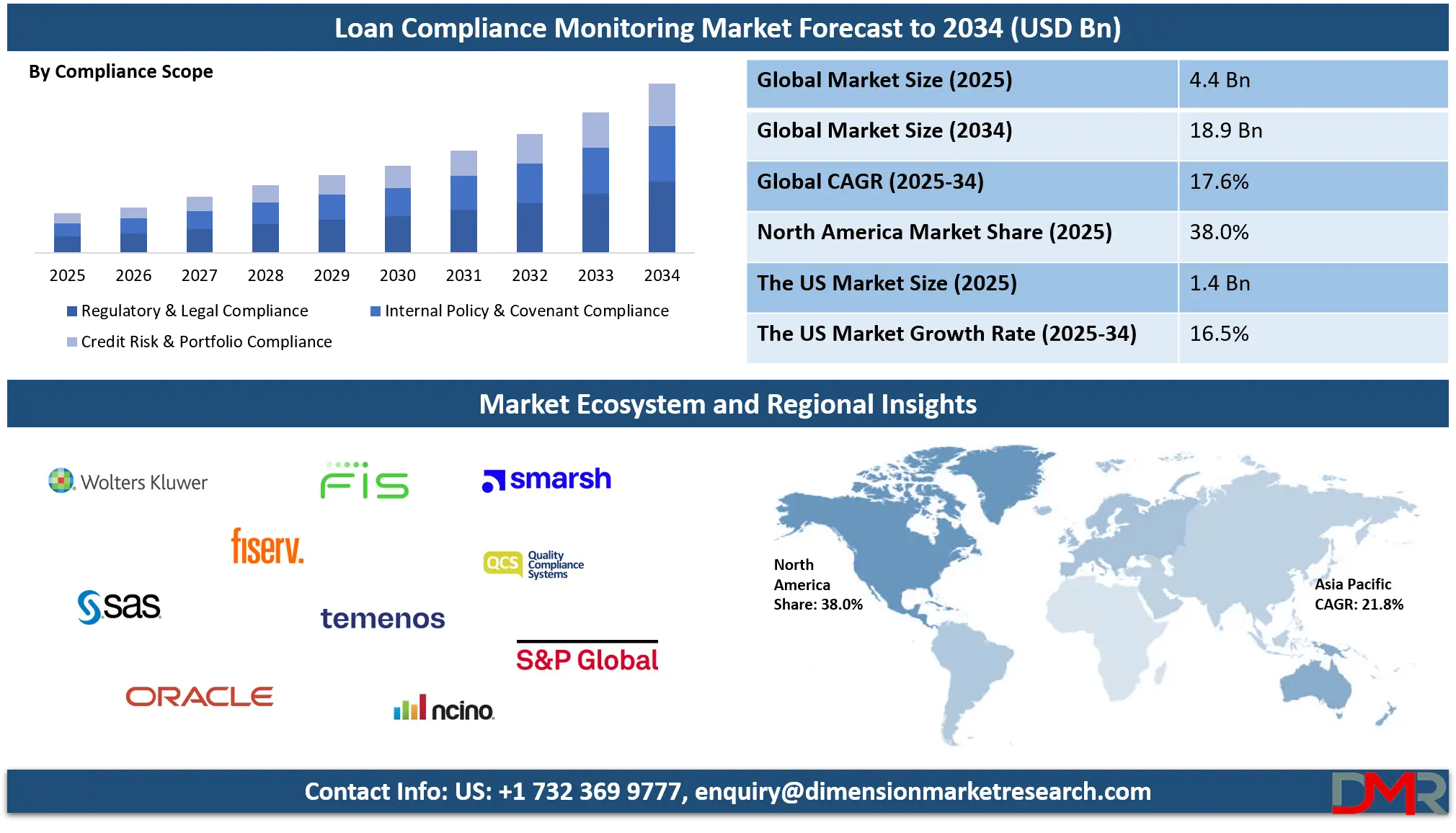

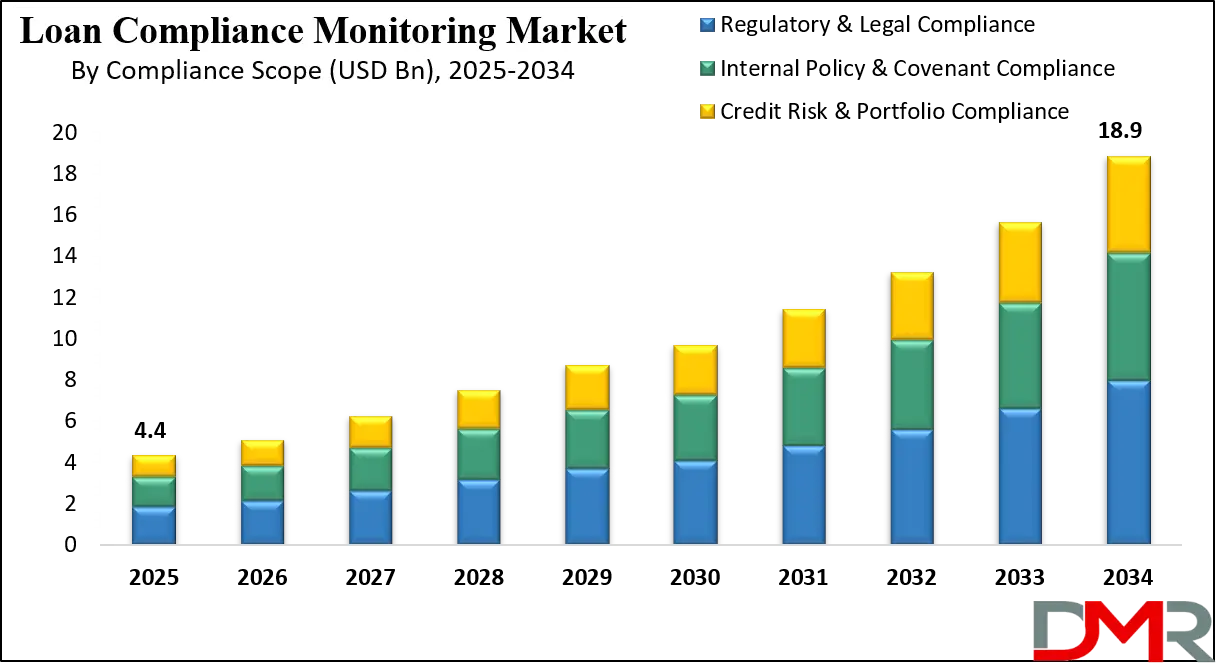

The global Loan Compliance Monitoring Market was valued at USD 4.4 billion in 2025 and is projected to reach USD 18.9 billion by 2034, growing at a CAGR of 17.6%, driven by rising regulatory compliance requirements increasing loan portfolio complexity adoption of compliance management software and growing demand for automated risk monitoring and regulatory reporting solutions across banks and financial institutions.

Loan Compliance Monitoring refers to the continuous and systematic process used by financial institutions to ensure that loan origination servicing and management activities adhere to applicable regulatory requirements internal credit policies and contractual obligations throughout the loan lifecycle. It involves tracking compliance with lending laws consumer protection norms risk thresholds documentation standards and covenant conditions using a combination of automated systems analytics and control frameworks. Effective loan compliance monitoring helps institutions identify violations early reduce regulatory penalties manage credit risk maintain audit readiness and ensure transparent and responsible lending practices across retail commercial mortgage and SME loan portfolios.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global Loan Compliance Monitoring Market represents the collective demand supply and adoption of software platforms and professional services that enable banks credit unions non-bank financial institutions and digital lenders to manage regulatory compliance and risk oversight at scale. The market is driven by increasing regulatory scrutiny rising loan volumes growing complexity of cross border regulations and the need for real time monitoring across diverse loan products. As financial institutions digitize lending operations the market increasingly emphasizes automated compliance checks centralized reporting compliance analytics and integration with core banking and loan servicing systems.

Globally the Loan Compliance Monitoring Market is evolving from rule based compliance tools toward advanced solutions that leverage artificial intelligence machine learning real time alerts and document intelligence to improve accuracy and efficiency. Growth is supported by expanding digital lending ecosystems stricter enforcement by financial regulators and the rising cost of non-compliance. Cloud based deployment adoption is accelerating particularly among mid-sized lenders while large institutions continue to invest heavily in enterprise grade platforms. Overall the market plays a critical role in strengthening governance risk management and operational resilience within the global financial services industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Loan Compliance Monitoring Market

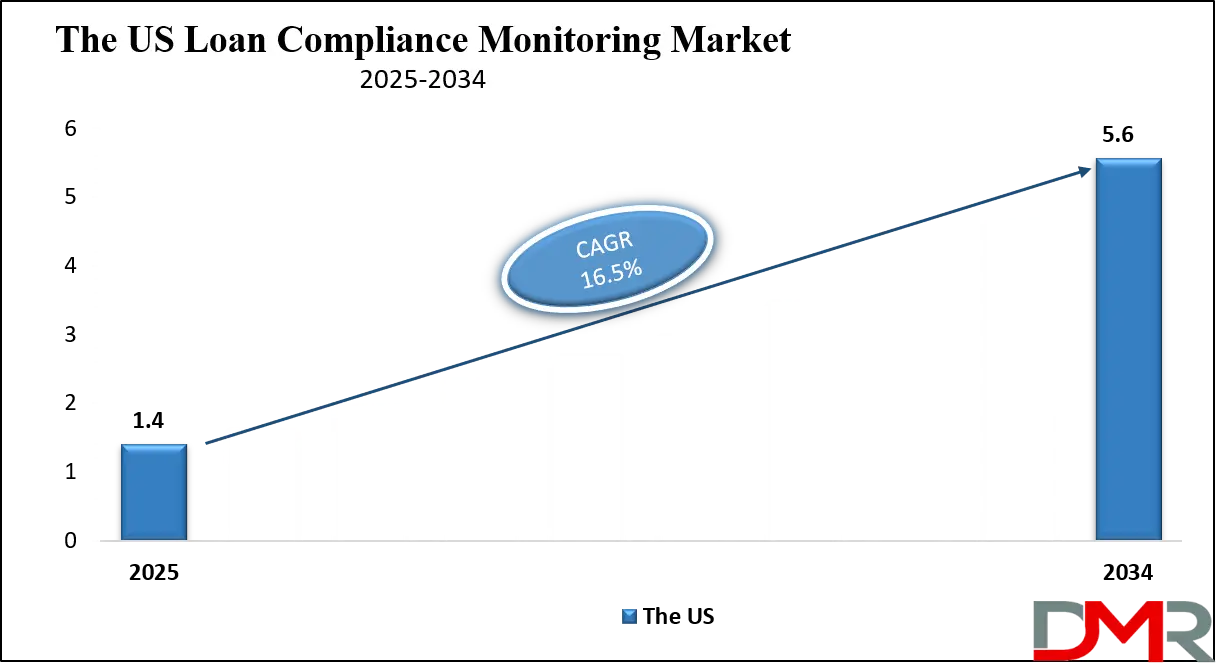

The U.S. Loan Compliance Monitoring Market size was valued at USD 1.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.6 billion in 2034 at a CAGR of 16.5%.

The US Loan Compliance Monitoring Market is driven by a highly regulated financial environment shaped by federal and state level oversight agencies such as the CFPB OCC and FDIC. Financial institutions face stringent requirements related to consumer protection fair lending disclosure accuracy and risk governance across retail commercial and mortgage loans. As loan volumes and product complexity increase US banks credit unions and non-bank lenders are investing in compliance monitoring solutions to automate regulatory checks enhance audit readiness and reduce exposure to penalties reputational risk and enforcement actions.

Market growth in the US is further supported by rapid digital transformation across lending operations and the increasing adoption of advanced compliance technologies. Institutions are integrating loan compliance monitoring platforms with core banking loan origination and servicing systems to enable real time monitoring predictive risk analytics and centralized reporting. The use of artificial intelligence machine learning and data analytics is gaining momentum to detect anomalies manage exceptions and improve compliance efficiency. Strong demand from large banks fintech lenders and mortgage providers continues to position the US as a leading contributor to global market revenue.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Loan Compliance Monitoring Market

The Europe Loan Compliance Monitoring Market was valued at approximately USD 1.1 billion in 2025, reflecting the region’s strong adoption of compliance management solutions across banks, credit unions, and non-bank financial institutions. The market is driven by stringent regulatory frameworks established by the European Central Bank, national financial authorities, and evolving lending regulations covering consumer protection, anti-money laundering, and risk governance. Financial institutions are increasingly investing in automated compliance platforms to manage regulatory reporting, real-time monitoring, and audit readiness across diverse loan portfolios including retail, commercial, and mortgage lending operations.

The market in Europe is projected to grow at a CAGR of 16.8%, supported by the rising need for centralized compliance management and advanced analytics solutions. Institutions are adopting AI-driven monitoring, machine learning, and cloud-based platforms to enhance risk detection, automate exception handling, and ensure adherence to complex regulations across multiple jurisdictions. Growth is further fueled by digital transformation in lending operations, increasing loan volumes, and the demand for efficient, scalable, and cost-effective compliance solutions, positioning Europe as a key contributor to the global Loan Compliance Monitoring Market.

Japan Loan Compliance Monitoring Market

The Japan Loan Compliance Monitoring Market was valued at approximately USD 264 million in 2025, reflecting the country’s growing emphasis on regulatory adherence and risk management within its financial sector. Japanese banks, credit unions, and non-bank lenders are facing increasingly stringent regulatory requirements covering consumer protection, anti-money laundering, and internal lending policies. To address these challenges, financial institutions are adopting loan compliance monitoring solutions that provide real-time tracking, automated reporting, and audit-ready documentation across retail, commercial, and mortgage loan portfolios, ensuring consistent compliance with domestic regulations and international best practices.

The market in Japan is projected to grow at a CAGR of 15.5%, driven by the digital transformation of lending operations and the adoption of advanced compliance technologies such as AI-powered monitoring, predictive analytics, and cloud-based platforms. These solutions enable efficient risk detection, proactive management of potential covenant breaches, and streamlined reporting to regulators. As financial institutions continue to expand loan volumes and diversify product offerings, the demand for scalable, automated, and cost-effective compliance management platforms is expected to strengthen, positioning Japan as a steadily growing segment within the global Loan Compliance Monitoring Market.

Global Loan Compliance Monitoring Market: Key Takeaways

- Market Growth: The global Loan Compliance Monitoring Market is rapidly expanding, driven by stricter regulations, rising loan portfolio complexity, and the adoption of automated compliance solutions across banks and financial institutions.

- Technology Adoption: Financial institutions are moving from rule-based systems to AI and machine learning platforms, with cloud-based deployment enabling real-time monitoring, predictive analytics, and automated reporting.

- Key Users: Large enterprises and banks lead adoption, while smaller banks and credit unions increasingly leverage cloud and SaaS solutions for efficient compliance management.

- Regional Insights: North America holds the largest market share due to strong regulatory frameworks, while Asia-Pacific shows the fastest growth driven by digital lending expansion and regulatory enforcement.

- Evolving Applications: Solutions now go beyond regulatory checks to include risk and covenant monitoring, exception management, audit support, and compliance analytics, enhancing operational efficiency and proactive risk management.

Global Loan Compliance Monitoring Market: Use Cases

- Regulatory Compliance Monitoring: Loan compliance monitoring solutions help financial institutions ensure adherence to lending regulations consumer protection rules and disclosure requirements across the loan lifecycle. Automated checks and centralized compliance management reduce regulatory risk improve audit preparedness and support consistent compliance across retail commercial and mortgage lending activities.

- Credit Risk and Covenant Monitoring: Lenders use compliance monitoring platforms to track credit risk metrics and loan covenant adherence in real time. Early warning alerts help identify potential breaches deteriorating borrower performance and rising non-performing loan risk enabling proactive risk mitigation.

- Audit and Regulatory Reporting Support: Compliance monitoring tools streamline internal audits and regulatory examinations by maintaining audit trails documentation records and compliance evidence. Automated reporting improves accuracy reduces manual effort and supports timely submission to financial regulators.

- Exception and Document Management: Financial institutions leverage loan compliance monitoring systems to manage documentation gaps policy exceptions and workflow approvals. Automated exception tracking improves operational efficiency reduces compliance delays and ensures consistent enforcement of internal lending policies.

Impact of Artificial Intelligence on the global Loan Compliance Monitoring market

Artificial Intelligence (AI) is reshaping the global Loan Compliance Monitoring market by enhancing the speed accuracy and depth of compliance and risk oversight across financial institutions. Traditional rule-based compliance tools often require manual configuration and frequent updates to keep pace with changing regulatory requirements. In contrast, AI-enabled systems leverage machine learning algorithms and natural language processing to continuously learn from data patterns, detect anomalies, and adapt to evolving standards without extensive human intervention. This reduces false positives, improves early detection of non-compliance events, and streamlines large-scale monitoring across diverse loan types including retail, commercial and mortgage portfolios.

AI also fuels predictive compliance and risk analytics, enabling lenders to forecast potential regulatory breaches or credit deterioration before they materialize. By integrating real-time data from loan origination systems, servicing platforms, and customer interactions, AI models help compliance teams prioritize high-risk areas and automate documentation, exception handling, and reporting processes. Furthermore, AI improves operational efficiency by reducing manual workloads, accelerating regulatory reporting cycles, and enhancing audit readiness. As a result, financial institutions adopting AI-driven loan compliance monitoring solutions can strengthen governance frameworks, support proactive risk management, and maintain robust regulatory adherence in an increasingly complex global lending environment.

Global Loan Compliance Monitoring Market: Stats & Facts

Reserve Bank of India (RBI Official Reports 2023–25):

- Gross non‑performing assets ratio of Indian banks dropped to 2.5% by September 2024, reflecting improved asset quality and compliance in loan monitoring practices.

- In fiscal year 2024–25, RBI imposed penalties totaling ₹54.78 crore on 353 regulated entities (banks, NBFCs, cooperative banks) for statutory contraventions and non‑compliance, underlining enforcement of regulatory standards.

- As of September 2024, the capital to risk-weighted assets ratio (CRAR) of scheduled commercial banks was 16.8%, exceeding regulatory minimums and indicating strong regulatory compliance in capital adequacy.

- The gross NPA amount declined by 15.9% year‑on‑year to Rs 4.8 lakh crore by March 31, 2024, showing ongoing improvements in credit and risk reporting.

European Central Bank (ECB Official Supervision Reports):

- The aggregate non‑performing loans (NPL) ratio for significant European institutions stood at 2.28% at the end of Q4 2024, with loans showing significant credit risk at 9.93%, reflecting stable compliance monitoring in EU banking.

- Loans to SMEs saw a NPL ratio of 4.75% in 2024, highlighting areas of increased risk exposure that require robust compliance and monitoring by financial institutions.

Bank for International Settlements (BIS International Statistics):

- Global cross‑border bank credit expanded by USD 1.5 trillion in the first quarter of 2025, reaching a record USD 34.7 trillion, indicating ongoing global credit growth and the need for enhanced global compliance monitoring frameworks.

- Cross‑border bank lending to emerging markets grew, with foreign currency credit rising 5–10% year‑on‑year in major currencies by end‑March 2025, pointing to expanding global lending exposures subject to compliance regimes.

Otoritas Jasa Keuangan (OJK — Indonesia’s Financial Regulator):

- In January 2025, Indonesia’s gross NPL ratio was 2.18% and net NPL was 0.79% in the banking sector, while liquidity indicators remained well above regulatory thresholds, reflecting sound risk and compliance profiles.

- Credit growth in Indonesia’s banking sector was 10.27% year‑on‑year in December 2024, with corporate loans up 15.81%, underscoring expanding lending volumes that require robust compliance systems.

Global Loan Compliance Monitoring Market: Market Dynamics

Global Loan Compliance Monitoring Market: Driving Factors

Rising Regulatory Stringency and Compliance Burden

Global financial regulators are continuously updating lending laws, consumer protection guidelines, and anti-money laundering standards, increasing the compliance burden on banks and non-bank lenders. This pushes institutions to adopt automated loan compliance monitoring systems that provide real-time oversight, regulatory reporting, and audit trails. The need to minimize penalties and reputational risk from non-compliance accelerates investment in advanced compliance management software across loan origination, servicing, and portfolio monitoring functions.

Growth in Digital Lending and Loan Volume Complexity

Rapid adoption of digital lending channels and diverse loan products has expanded the volume and complexity of loan portfolios managed by financial institutions. Traditional manual compliance processes struggle to scale with high transaction volumes and multi-jurisdictional regulatory requirements. Loan compliance monitoring platforms with analytics, exception tracking, and integrated risk controls help lenders manage complexity, improve operational efficiency, and ensure consistent regulatory adherence across consumer, SME, and commercial loan segments.

Global Loan Compliance Monitoring Market: Restraints

Integration Challenges with Legacy Banking Systems

Many financial institutions still operate core banking and loan servicing systems that are fragmented or outdated. Integrating sophisticated compliance monitoring solutions with these legacy infrastructures can be costly, time-consuming and technically complex. Disparate data formats, siloed systems, and slow decision support frameworks limit the seamless deployment of real-time monitoring tools across enterprise environments.

High Implementation and Maintenance Costs

Advanced loan compliance monitoring platforms often require significant upfront investment in software licensing, customization, and deployment. Smaller lenders and credit unions may find these costs prohibitive, especially when combined with training, ongoing support, and periodic updates to reflect new regulations. This financial barrier restrains wider adoption among mid-sized and resource-constrained institutions.

Global Loan Compliance Monitoring Market: Opportunities

AI-Driven Predictive Analytics for Proactive Compliance

There is significant opportunity for market growth through AI and machine learning-based compliance solutions that proactively identify risk patterns, predict potential breaches and automate exception management. These technologies enhance risk scoring models, anomaly detection and policy enforcement mechanisms, allowing lenders to prevent compliance issues before they escalate and optimize audit readiness across loan portfolios.

Expansion of Cloud-Based Compliance Monitoring Services

The shift toward cloud-native compliance platforms presents a major growth avenue, especially for small and mid-sized financial institutions seeking scalable, cost-efficient solutions. Cloud deployment enables easier updates, faster rollout of new compliance rules, and improved integration with digital lending ecosystems. As demand for subscription-based software increases, Software-as-a-Service (SaaS) offerings can broaden market reach and drive recurring revenue models in loan compliance technology.

Global Loan Compliance Monitoring Market: Trends

Adoption of Real-Time Monitoring and Automated Alerts

Financial institutions are increasingly prioritizing real-time compliance monitoring with automated alerts and dashboards. Continuous surveillance of loan portfolios, covenants, risk metrics and regulatory changes enables quicker corrective actions and better risk management. This trend reflects a shift from periodic reviews to continuous compliance, reducing response time to emerging issues.

Focus on Regulatory Reporting and Analytics Capabilities

There is growing demand for compliance platforms that provide advanced reporting, visualization and analytics functions, enabling easier generation of regulator-ready documents. Lenders seek tools that can automate regulatory submissions, track historical compliance performance, and offer actionable insights through data visualization. Enhanced analytics support strategic decision making and improve transparency across credit risk and compliance operations.

Global Loan Compliance Monitoring Market: Research Scope and Analysis

By Component Analysis

Software solutions are anticipated to dominate the Loan Compliance Monitoring Market by component, accounting for approximately 74.0% of the total market share in 2025, driven by the increasing need for automated regulatory compliance, real time monitoring, and centralized control across complex loan portfolios. Financial institutions are increasingly adopting compliance management software to handle frequent regulatory updates, multi-jurisdictional lending requirements, and high loan volumes while reducing manual intervention and operational risk.

These platforms enable continuous compliance checks, risk analytics, audit trail management, exception tracking, and regulatory reporting, making them essential for banks, credit unions, mortgage lenders, and non-bank financial institutions seeking accuracy, scalability, and cost efficiency in compliance operations.

Services also play a critical supporting role in this market segment by enabling effective deployment, customization, and ongoing optimization of loan compliance monitoring solutions. Professional services such as regulatory consulting, system integration, implementation support, training, and managed compliance services help financial institutions align software platforms with internal policies, legacy systems, and evolving regulatory frameworks.

As compliance requirements become more complex and institutions adopt advanced technologies such as artificial intelligence and cloud based platforms, demand for advisory and managed services continues to grow, particularly among mid-sized lenders and organizations with limited in house compliance expertise.

By Compliance Scope Analysis

Regulatory and legal compliance is anticipated to dominate the compliance scope segment of the Loan Compliance Monitoring Market, capturing approximately 42.0% of the total market share in 2025, driven by increasing regulatory scrutiny and strict enforcement of lending laws across global financial markets. Banks and lenders are required to comply with a wide range of regulations related to consumer protection fair lending disclosure standards anti money laundering and jurisdiction specific lending rules. Loan compliance monitoring solutions help institutions continuously track regulatory adherence automate compliance checks and maintain audit ready documentation which is critical to avoiding penalties reputational damage and operational disruptions in an increasingly complex regulatory environment.

Internal policy and covenant compliance represents another significant area within this market segment as financial institutions focus on enforcing internal credit policies and monitoring borrower specific contractual obligations. Compliance monitoring platforms enable lenders to track loan covenants financial ratios repayment conditions and exposure limits throughout the loan lifecycle. By automating covenant monitoring and internal policy enforcement institutions can detect early warning signals reduce credit risk and improve portfolio quality while ensuring consistency across commercial corporate and structured lending activities.

By Loan Type Covered Analysis

Commercial and corporate loans are anticipated to dominate the loan type covered segment in the Loan Compliance Monitoring Market, accounting for approximately 34.0% of the total market share in 2025, due to the large volumes, higher transaction values, and complex contractual structures associated with these loans. Financial institutions offering commercial and corporate credit face rigorous regulatory scrutiny and extensive internal policies, requiring continuous monitoring of borrower performance, financial ratios, and covenant compliance. Loan compliance monitoring solutions enable real time risk assessment, automated alerts for potential breaches, and centralized tracking of portfolio compliance, helping lenders mitigate credit risk and maintain regulatory adherence across diverse commercial lending operations.

Retail and consumer loans also form a significant part of this market segment, as banks, credit unions, and digital lenders seek to manage compliance across high volume personal lending portfolios including mortgages, auto loans, and personal credit. Compliance monitoring systems for retail lending track adherence to consumer protection regulations, loan documentation standards, and repayment performance, while automating reporting and exception handling. These solutions help institutions reduce operational errors, ensure consistent policy enforcement, and maintain transparency in loan servicing, particularly in markets with extensive regulatory requirements and large consumer loan bases.

By Organization Size Analysis

Large enterprises are anticipated to dominate the organization size segment of the Loan Compliance Monitoring Market, capturing approximately 70.0% of the total market share in 2025, due to their extensive loan portfolios, complex regulatory obligations, and high operational scale. These institutions, including major banks and multinational financial organizations, require robust compliance monitoring platforms to manage multi-jurisdictional lending regulations, automate risk assessments, track covenants, and ensure accurate regulatory reporting. The adoption of advanced software solutions helps large enterprises reduce manual workload, enhance audit readiness, and maintain consistent compliance across retail, commercial, and mortgage lending operations.

Small and medium enterprises also represent a growing segment within this market, driven by the increasing need for efficient compliance management despite limited in-house resources. SMEs, including regional banks, credit unions, and mid-sized digital lenders, leverage cloud-based compliance monitoring solutions and professional services to manage regulatory adherence, automate reporting, and monitor risk exposures. These solutions enable smaller institutions to improve operational efficiency, maintain policy consistency, and reduce regulatory penalties, making compliance management more accessible and scalable for organizations with smaller loan portfolios and fewer technical capabilities.

By Deployment Mode Analysis

On-premises deployment is anticipated to dominate the deployment mode segment of the Loan Compliance Monitoring Market, capturing approximately 59.0% of the total market share in 2025, as large financial institutions prioritize data security, control, and compliance with internal IT policies. Banks and multinational lenders prefer on-premises solutions to manage sensitive loan data, integrate with legacy banking systems, and maintain full oversight of compliance operations across retail, commercial, and mortgage portfolios. These deployments provide stable performance, customization capabilities, and reliable access to regulatory reporting and audit trails, making them suitable for institutions with complex infrastructures and high regulatory scrutiny.

Cloud-based deployment is gaining traction as a flexible and scalable alternative, particularly among small and medium-sized lenders and digital-first financial institutions. Cloud solutions enable easier integration with loan origination systems, faster implementation, and remote access to compliance monitoring tools without significant infrastructure investment. They support automated updates, real-time monitoring, and centralized reporting, allowing institutions to manage regulatory compliance efficiently across multiple locations. The cost-effectiveness and subscription-based models of cloud platforms are driving adoption among mid-sized banks and fintech lenders seeking to improve operational efficiency while maintaining adherence to evolving regulatory standards.

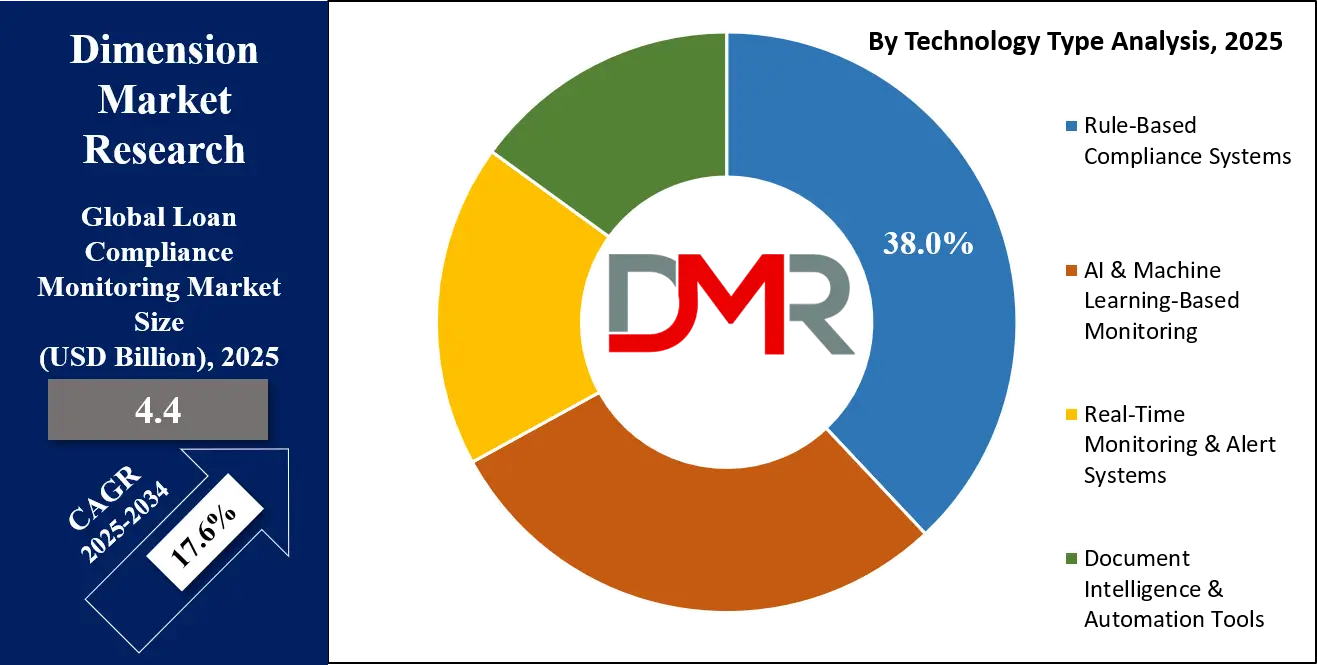

By Technology Type Analysis

Rule-based compliance systems are anticipated to dominate the technology type segment of the Loan Compliance Monitoring Market, capturing approximately 38.0% of the total market share in 2025, due to their widespread adoption among banks and financial institutions for automating traditional compliance checks. These systems operate using predefined rules and thresholds to monitor regulatory adherence, track loan covenants, and flag exceptions across retail, commercial, and mortgage lending portfolios. Their ability to enforce standardized policies, generate audit trails, and ensure consistent compliance makes them a reliable solution for institutions managing large loan volumes with established regulatory frameworks.

AI and machine learning-based monitoring is emerging as a transformative technology within this market segment, offering advanced capabilities beyond traditional rule-based systems. These solutions leverage predictive analytics, pattern recognition, and anomaly detection to identify potential regulatory breaches and credit risks before they materialize. By continuously learning from loan data, borrower behavior, and market trends, AI-powered compliance platforms enable proactive risk management, automated exception handling, and enhanced decision-making. Financial institutions adopting AI-driven monitoring benefit from improved accuracy, reduced false positives, and more efficient regulatory reporting, making these systems increasingly attractive for both large enterprises and digitally focused lenders.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Regulatory compliance monitoring is anticipated to dominate the application segment of the Loan Compliance Monitoring Market, capturing approximately 36.0% of the total market share in 2025, as financial institutions face increasing pressure to adhere to complex lending regulations and consumer protection laws. These solutions help banks, credit unions, and non-bank lenders continuously track compliance across loan origination, servicing, and portfolio management processes. Automated monitoring, real-time alerts, and audit trail management reduce manual errors, support timely reporting to regulators, and ensure that retail, commercial, and mortgage lending operations remain fully compliant with evolving legal and regulatory frameworks.

Risk management and early warning applications also play a significant role in this market segment by enabling institutions to identify potential loan defaults, covenant breaches, and portfolio risks before they escalate. Compliance monitoring platforms provide predictive analytics, continuous performance tracking, and exception alerts to detect deviations in borrower behavior, financial ratios, or repayment trends. By proactively highlighting high-risk loans and operational vulnerabilities, these solutions help lenders mitigate credit risk, improve loan portfolio quality, and maintain financial stability while ensuring that internal policies and regulatory requirements are consistently enforced.

By End User Analysis

Banks are anticipated to dominate the end user segment of the Loan Compliance Monitoring Market, capturing approximately 40.0% of the total market share in 2025, due to their extensive loan portfolios, complex regulatory obligations, and high transaction volumes. Financial institutions leverage compliance monitoring solutions to ensure adherence to lending regulations, consumer protection laws, and internal credit policies across retail, commercial, and mortgage lending operations. These platforms provide real-time monitoring, automated reporting, audit trails, and exception tracking, enabling banks to reduce regulatory risk, enhance operational efficiency, and maintain consistent compliance across all lending activities.

Credit unions also represent a notable segment within the market as they increasingly adopt loan compliance monitoring solutions to manage regulatory requirements, internal policies, and risk exposure. Smaller in scale compared to banks, credit unions face unique challenges such as limited technical resources and high member accountability. Compliance platforms help these institutions streamline documentation, monitor loan covenants, and automate reporting processes, allowing them to maintain regulatory adherence efficiently. Cloud-based and subscription models are particularly attractive for credit unions, offering scalable, cost-effective solutions that support consistent enforcement of lending policies across all loan types.

The Loan Compliance Monitoring Market Report is segmented on the basis of the following:

By Component

- Software

- Compliance Management Platforms

- Rules & Policy Engines

- Risk & Regulatory Analytics Modules

- Monitoring Dashboards & Alert Systems

- Document & Exception Tracking Tools

- Services

- Consulting & Regulatory Advisory

- Implementation & System Integration

- Training & Technical Support

- Managed Compliance Services

By Compliance Scope

- Regulatory & Legal Compliance

- Government & Financial Authority Regulations

- Cross-Border & Jurisdictional Compliance

- Internal Policy & Covenant Compliance

- Institutional Credit Policies

- Loan Covenant Monitoring

- Credit Risk & Portfolio Compliance

- Portfolio Concentration Limits

- Exposure & Risk Threshold Monitoring

By Loan Type Covered

- Commercial & Corporate Loans

- Large Enterprise Loans

- Syndicated & Structured Loans

- Retail & Consumer Loans

- Personal Loans

- Auto & Education Loans

- Mortgage & Housing Loans

- Residential Mortgages

- Commercial Real Estate Loans

- SME & Microfinance Loans

- Small Business Loans

- Microcredit & MSME Financing

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Deployment Mode

- On-Premises

- Enterprise Data-Center Deployment

- Private Infrastructure Hosting

- Cloud-Based

- Public Cloud (SaaS)

- Private Cloud

- Hybrid Cloud

By Technology Type

- Rule-Based Compliance Systems

- Predefined Regulatory Rule Engines

- Threshold & Checklist-Based Monitoring

- AI & Machine Learning-Based Monitoring

- Predictive Risk Analytics

- Anomaly & Pattern Detection

- Real-Time Monitoring & Alert Systems

- Continuous Loan Surveillance

- Instant Compliance Alerts

- Document Intelligence & Automation Tools

- OCR & Document Validation

- Automated Exception Identification

By Application

- Regulatory Compliance Monitoring

- AML & KYC Compliance

- Consumer Protection Regulations

- Lending & Disclosure Compliance

- Risk Management & Early Warning

- Credit Risk Monitoring

- Non-Performing Asset (NPA) Detection

- Covenant Breach Alerts

- Audit & Internal Control Management

- Audit Trails & Evidence Management

- Regulatory Examination Support

- Reporting & Compliance Analytics

- Regulatory Reporting Automation

- Compliance Dashboards & KPIs

- Workflow, Document & Exception Management

- Policy Update Tracking

- Exception Resolution Workflows

By End User

- Banks

- Credit Unions

- Non-Bank Financial Institutions

- Mortgage Lenders

- Other Lenders

Global Loan Compliance Monitoring Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global Loan Compliance Monitoring Market, capturing approximately 38.0% of the total market revenue in 2025, driven by stringent regulatory frameworks, high digital adoption in banking operations, and the presence of major financial institutions. Banks, credit unions, and fintech lenders in the region are increasingly investing in automated compliance monitoring solutions to manage complex loan portfolios, ensure adherence to federal and state lending regulations, and reduce operational and reputational risks. Advanced technologies such as AI, predictive analytics, and cloud-based platforms further support real-time monitoring, risk management, and regulatory reporting, reinforcing North America’s dominant position in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the Loan Compliance Monitoring Market over the coming years, driven by the rapid expansion of digital lending, increasing regulatory scrutiny, and the rising adoption of advanced compliance technologies among banks and non-bank financial institutions. Emerging economies such as China, India, and Southeast Asian countries are experiencing growing loan volumes, diverse financial products, and heightened focus on risk management and regulatory adherence. Cloud-based and AI-enabled compliance solutions are being increasingly adopted to automate monitoring, enhance reporting accuracy, and manage complex portfolios efficiently, positioning the region as a fast-growing market segment globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Loan Compliance Monitoring Market: Competitive Landscape

The competitive landscape of the global Loan Compliance Monitoring Market is characterized by the presence of a mix of established technology providers, specialist compliance solution vendors, and emerging fintech innovators, all striving to address the evolving regulatory, risk, and operational needs of financial institutions. Competition is driven by factors such as depth of analytics capabilities, integration with core banking and loan servicing systems, scalability across deployment models, and the ability to support real‑time monitoring and automated reporting.

Vendors are increasingly differentiating through advanced technologies like artificial intelligence, machine learning, and cloud‑native platforms to enhance predictive compliance, reduce false positives, and improve user experience. Strategic partnerships, continuous product enhancements, focus on region‑specific regulatory requirements, and comprehensive service offerings further shape competitive dynamics, leading to a market where innovation, adaptability, and customer support are key determinants of success.

Some of the prominent players in the global Loan Compliance Monitoring market are:

- Wolters Kluwer Financial Services

- Fiserv, Inc.

- SAS Institute Inc.

- Oracle Corporation

- FIS Global

- Temenos AG

- nCino, Inc.

- Smarsh, Inc.

- Compliance Systems, Inc.

- S&P Global Market Intelligence

- Moody’s Analytics, Inc.

- Experian plc

- Equifax Inc.

- ACI Worldwide, Inc.

- Pegasystems Inc.

- Intellect Design Arena Ltd.

- MetricStream

- ICE Mortgage Technology (Ellie Mae)

- Abrigo, Inc.

- Jack Henry & Associates, Inc.

- Other Key Players

Global Loan Compliance Monitoring Market: Recent Developments

- November 2025: S&P Global launched WSO Compliance Insights, a new compliance management solution designed to help private credit and CLO managers streamline credit risk reporting and regulatory compliance workflows with advanced rules modeling and transparency in test results.

- November 2025: Two RegTech firms combined forces as FundApps and SteelEye announced a merger to form a unified regulatory technology leader, strengthening global compliance and monitoring capabilities for financial institutions.

- October 2025: DocMagic introduced DocMagic One, an AI-powered platform that consolidates document preparation, automated compliance checks, closing coordination, and business intelligence to simplify mortgage production and improve audit readiness.

- September 2025: Automated regulatory intelligence company CUBE agreed to acquire agentic AI compliance specialist Kodex AI to enhance its compliance solutions with AI-driven regulatory monitoring and intelligent regulatory support functionality.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.4 Bn |

| Forecast Value (2034) |

USD 18.9 Bn |

| CAGR (2025–2034) |

17.6% |

| The US Market Size (2025) |

USD 1.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software, Services), By Compliance Scope (Regulatory & Legal Compliance, Internal Policy & Covenant Compliance, Credit Risk & Portfolio Compliance), By Loan Type Covered (Commercial & Corporate Loans, Retail & Consumer Loans, Mortgage & Housing Loans, SME & Microfinance Loans), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Deployment Mode (On-Premises, Cloud-Based), By Technology Type (Rule-Based Compliance Systems, AI & Machine Learning-Based Monitoring, Real-Time Monitoring & Alert Systems, Document Intelligence & Automation Tools), By Application (Regulatory Compliance Monitoring, Risk Management & Early Warning, Audit & Internal Control Management, Reporting & Compliance Analytics, Workflow, Document & Exception Management), and By End User (Banks, Credit Unions, Non-Bank Financial Institutions, Mortgage Lenders, Other Lenders) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Wolters Kluwer Financial Services, Fiserv, Inc., SAS Institute Inc., Oracle Corporation, FIS Global, Temenos AG, nCino, Inc., Smarsh, Inc., Compliance Systems, Inc., S&P Global Market Intelligence, Moody’s Analytics, Inc., Experian plc, Equifax Inc., ACI Worldwide, Inc., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Loan Compliance Monitoring market?

▾ The global Loan Compliance Monitoring market size was valued at USD 4.4 billion in 2025 and is expected to reach USD 18.9 billion by the end of 2034.

What is the size of the US Loan Compliance Monitoring market?

▾ The US Loan Compliance Monitoring market was valued at USD 1.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.6 billion in 2034 at a CAGR of 16.5%.

Which region accounted for the largest global Loan Compliance Monitoring market?

▾ North America is expected to have the largest market share in the global Loan Compliance Monitoring market, with a share of about 38.0% in 2025.

Who are the key players in the global Loan Compliance Monitoring market?

▾ Some of the major key players in the global Loan Compliance Monitoring market are Wolters Kluwer Financial Services, Fiserv, Inc., SAS Institute Inc., Oracle Corporation, FIS Global, Temenos AG, nCino, Inc., Smarsh, Inc., Compliance Systems, Inc., S&P Global Market Intelligence, Moody’s Analytics, Inc., Experian plc, Equifax Inc., ACI Worldwide, Inc., and Others.