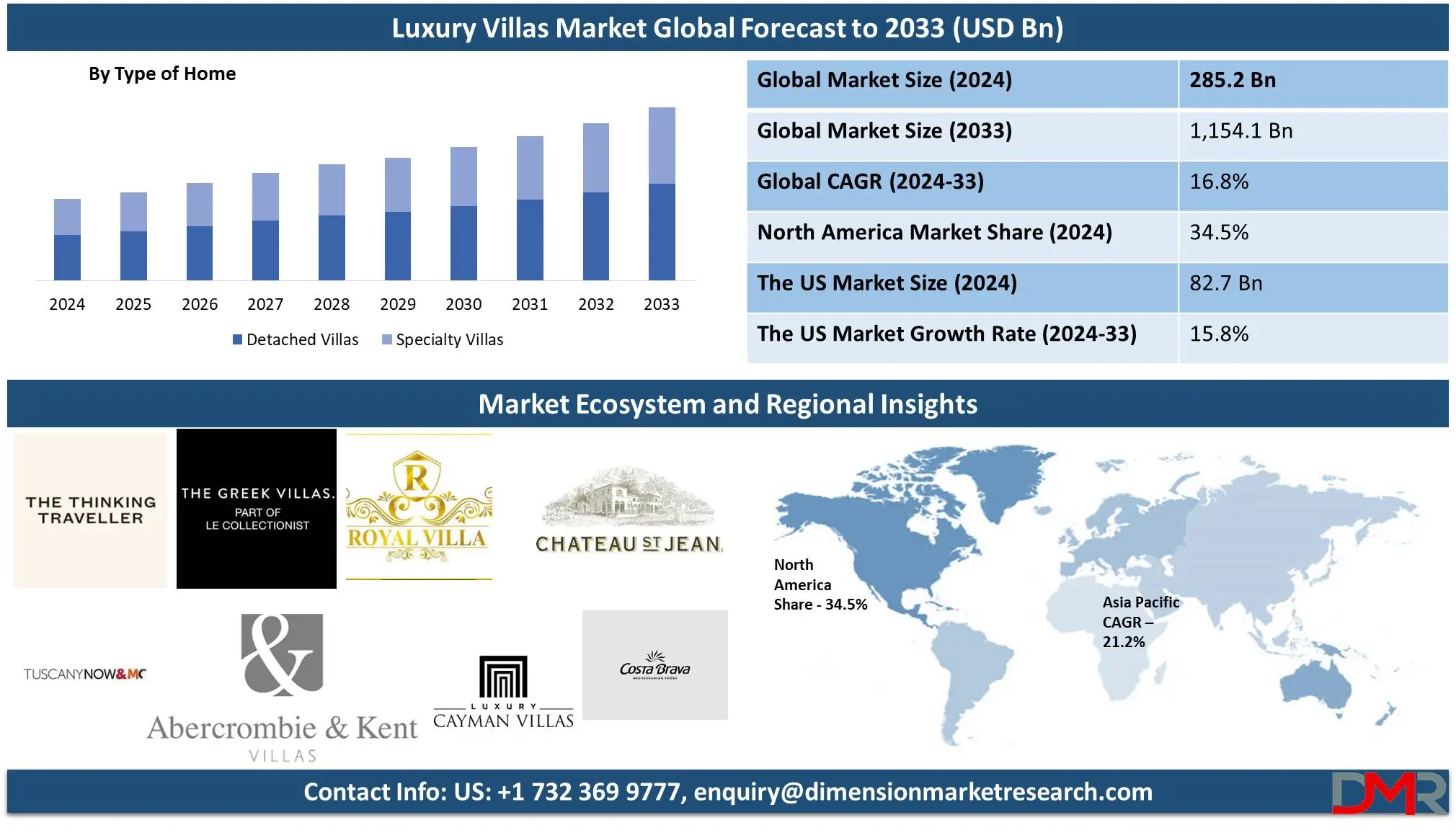

Market Overview

The

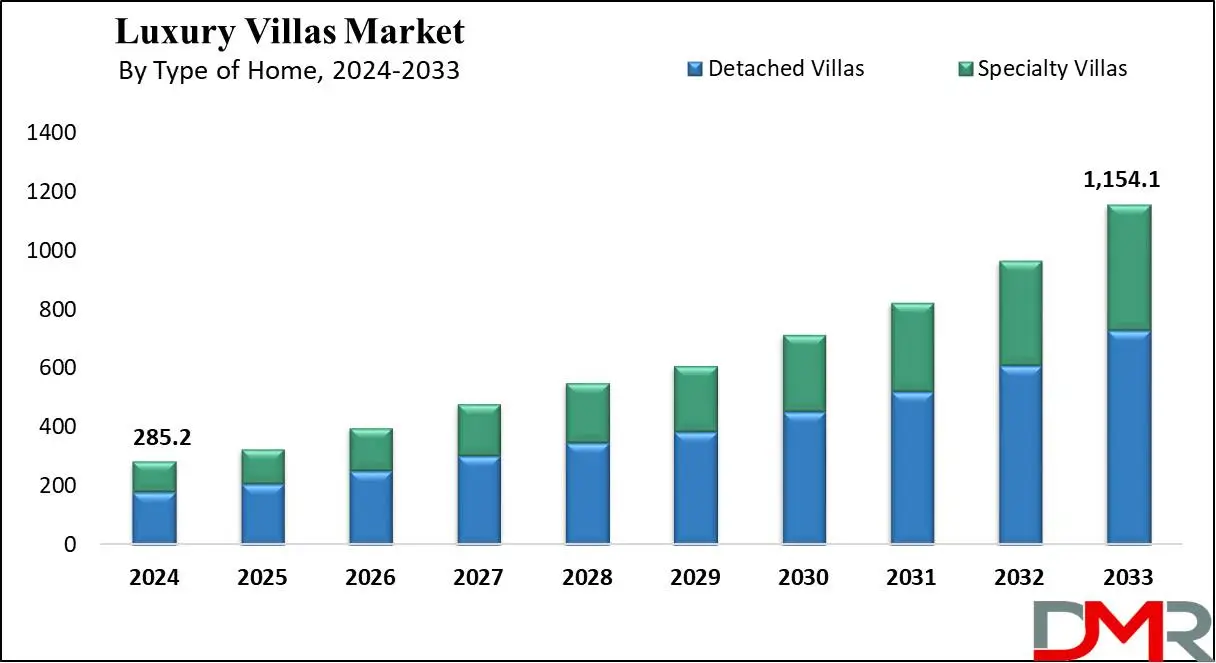

Global Luxury Villas Market size is expected to reach a

value of USD 285.2 billion in 2024, and it is further anticipated to reach a market

value of USD 1,154.1 billion by 2033 at a

CAGR of 16.8%.

Luxury villas are high-end properties designed with elegance and designed to provide unmatched comfort and sophistication, featuring spacious layouts with top-tier amenities that enhance their overall design and state-of-the-art features. Set in prime locations such as golf clubs or luxury real estate developments, luxury villas provide a private environment ideal for relaxation, entertainment, and lavish living experiences. These properties often serve as status symbols as investment opportunities that increase over time while simultaneously serving as a refuge from daily life with personalized services and high-end features that add quality of life enhancement features enhancing their residents' quality of life experience.

Luxury villa markets worldwide have experienced remarkable expansion over the past years due to an upsurge in high-end property demand among affluent individuals. Affluent individuals increasingly demand exclusive, spacious properties offering privacy, advanced amenities, and prime locations whether for vacation use or long-term living purposes - such as coastal regions, iconic cities, or countryside locales where villas blend modern design with timeless luxury. This market is marked by strong investments in real estate, particularly emerging markets that help increase demand. Furthermore, experiential luxury services and personalized living experiences drive continued market expansion.

The global luxury villa market has witnessed an increase in demand, with significant growth in high-net-worth individuals seeking exclusive properties. In 2023, luxury villa transactions grew by 18%, and destinations like Dubai saw a 25% rise in sales. In regions like Europe, luxury villa investments accounted for 15% of total real estate transactions, highlighting a growing trend.

Luxury villa prices have surged, with average prices in destinations like the French Riviera reaching €25 million per property. In Asia, the Philippines recorded a 30% increase in luxury villa sales from 2022 to 2023. The Middle East saw the highest demand, with Dubai witnessing a 35% year-on-year rise in villa sales, driven by foreign investment. According to ValuStrat, the capital value of residential villas in Emirates Hills in Dubai increased by 1.4 percent as compared to the previous month as of December 2022. The capital value in this location reached around 46.58 million United Arab Emirates dirhams as of December 2022.

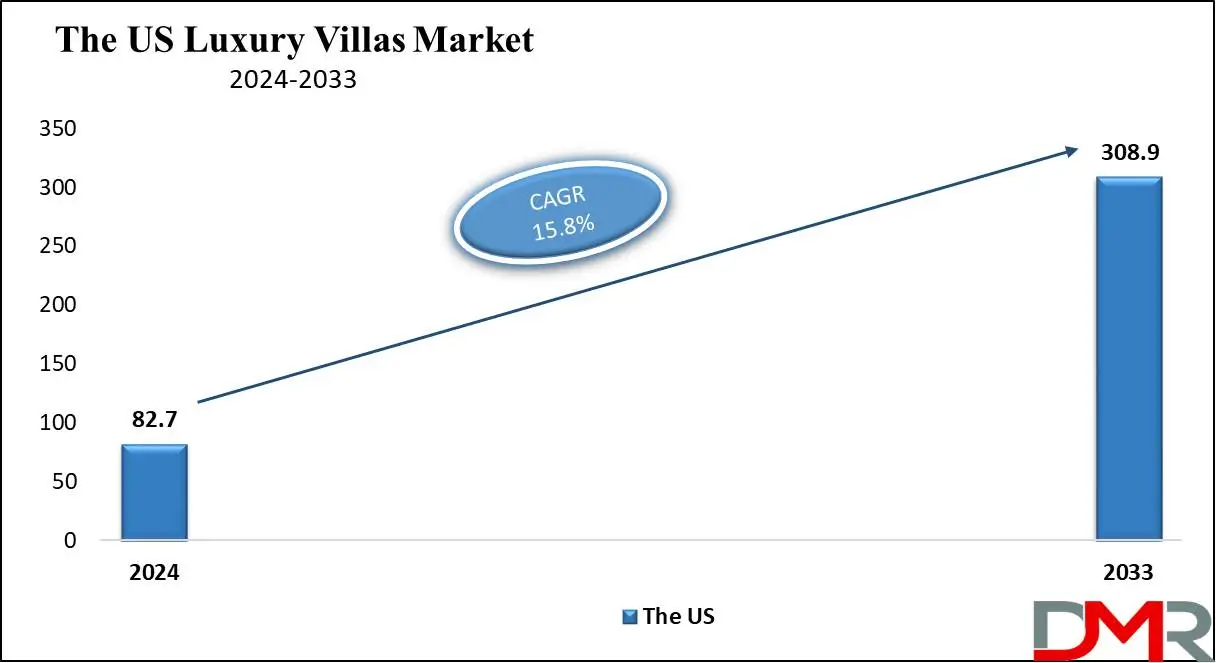

The US Luxury Villas Market

The US Luxury Villas Market is projected to be valued at USD 82.7 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 308.9 billion in 2033 at a CAGR of 15.8%.

The growth of the US luxury villa market is driven by several factors, including increasing wealth among high-net-worth individuals (HNWIs), rising demand for private, exclusive vacation homes, and the desire for personalized and luxurious living spaces. Additionally, the growing trend of remote work allows affluent buyers to invest in second homes or private retreats.

Smart home technology, offering automation for security, entertainment, and energy management, is increasingly popular. There's also an increased demand for wellness-oriented villas with dedicated spa spaces, fitness centers, and outdoor living areas. Additionally, properties offering privacy, large estates, and panoramic views are in high demand.

Key Takeaways

- Market Growth: The global Luxury Cruise market is anticipated to expand by USD 826.1 billion, achieving a CAGR of 16.8% from 2025 to 2033.

- By Type of Home Analysis: Detached villas are projected to take the largest revenue share within the luxury villas market by 2024.

- Ownership Analysis: Investment buyers are likely to dominate the global market in terms of type with the largest market share in 2024.

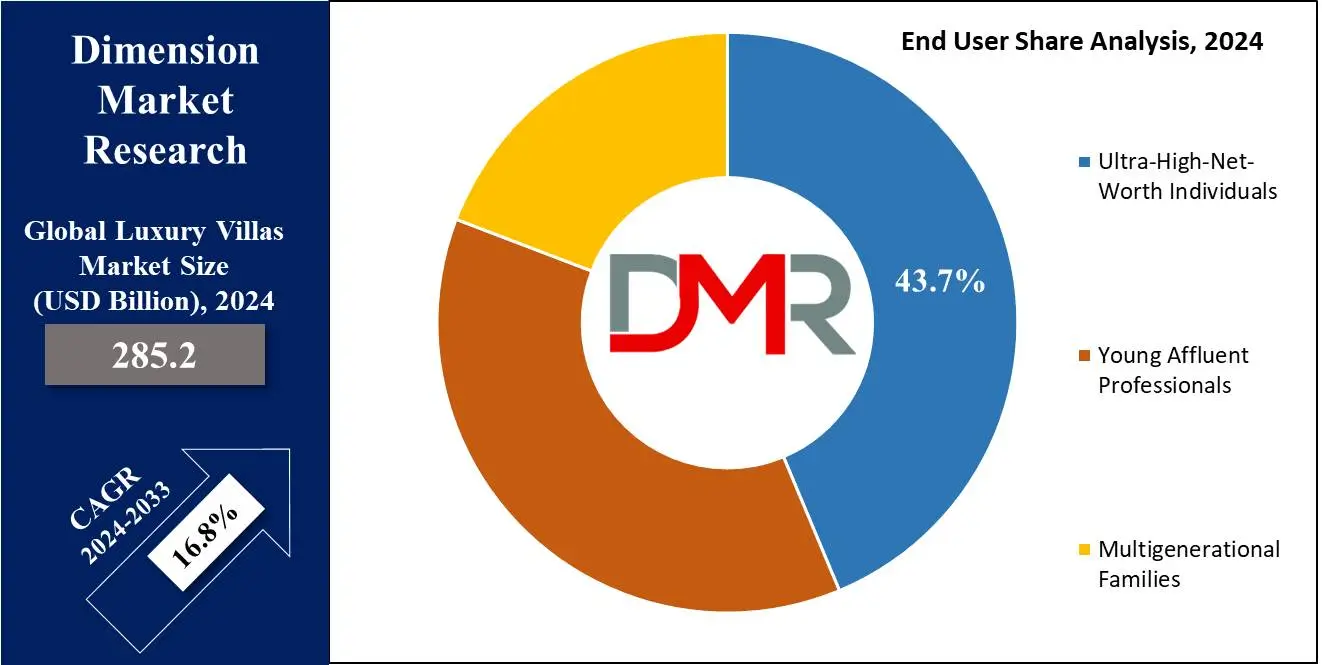

- End User Analysis: Ultra-high-net-worth individuals are predicted to dominate the global market in terms of end users with the largest market share in 2024.

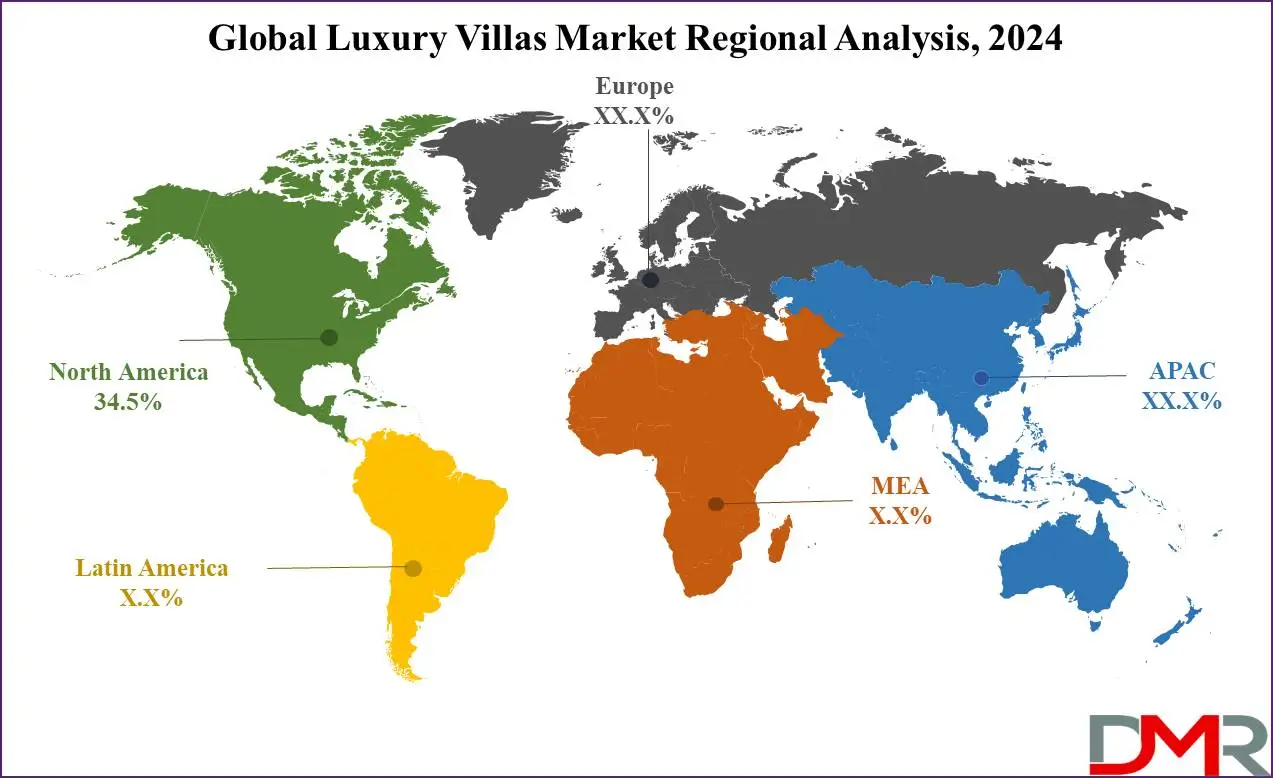

- Regional Analysis: North America is projected to dominate the global Luxury Cruise market, holding a market share of 34.5% by 2024.

Use Cases

- Private Residences: Luxury villas serve as exclusive private homes for individuals or families seeking an opulent lifestyle. These properties often feature personalized designs and high-end amenities such as private pools, landscaped gardens, and state-of-the-art smart home systems.

- Vacation Rentals: As vacation rentals, luxury villas cater to discerning travelers looking for extraordinary holiday experiences. Fully furnished and equipped with features like breathtaking views, private chefs, and concierge services, these properties offer short-term stays that are both exclusive and memorable

- Event Venues: Luxury villas are ideal for hosting private events, such as weddings, family celebrations, or corporate retreats. With expansive grounds, elegant interiors, and the capacity to accommodate large groups, they provide an intimate yet grand setting.

- Wellness Retreats: Many luxury villas are transformed into wellness retreats, offering an escape from the stress of urban life. With yoga studios, spas, meditation spaces, and tranquil natural surroundings, they provide a sanctuary for relaxation and rejuvenation.

Market Dynamic

Drivers

Rising Disposable IncomesAs global economies grow, the number of high-net-worth individuals (HNWIs) continues to increase, leading to greater disposable incomes. This affluence drives the demand for luxury villas as wealthy individuals seek exclusive properties for personal use, second homes, or investment opportunities. The rise in disposable income allows these buyers to afford the premium prices associated with luxury villas, with many willing to invest in properties offering privacy, security, and high-end amenities. This trend is particularly noticeable in emerging markets where wealth generation is accelerating, thus expanding the market for luxury real estate.

Private and Exclusive Spaces

Affluent buyers are increasingly drawn to private, secluded, and exclusive living environments. Luxury villas offer privacy and escape from crowded urban areas, making them particularly attractive. These villas provide a sense of safety and tranquility, which is appealing in today’s fast-paced and sometimes uncertain world. Many buyers are now prioritizing comfort and privacy over traditional urban living, leading to an upsurge in demand for luxury villas in prime, remote, or scenic locations. This preference is expected to continue growing, especially as affluent buyers seek a more personalized and private lifestyle.

Restraints

High Maintenance and Operating Costs

Luxury villas come with substantial maintenance costs due to their expansive size and high-end amenities. Property management, landscaping, and upkeep of premium features like pools, security systems, and spas contribute to significant operational expenses. These ongoing costs can be a deterrent for potential buyers, particularly when there is a lack of financial incentives to support such investments. Some luxury villa buyers may find themselves overwhelmed by the continuous financial outlay required to maintain these properties, especially if they are not used frequently. This can limit market appeal, especially in economically uncertain times.

Economic Uncertainty and Market Volatility

The luxury real estate market is vulnerable to global economic shifts and volatility. Factors such as political instability, financial crises, and economic downturns can make wealthy buyers hesitant to invest in luxury villas, even if the long-term outlook is favorable. These economic uncertainties cause fluctuations in demand, as the ultra-wealthy may delay or scale back investment in luxury real estate during times of instability. This volatility is a significant restraint, as it can create market hesitancy and disrupt the steady growth of the luxury villa market, especially in times of recession or global crises.

Opportunities

Rising Demand for Vacation and Rental Villas

Since Airbnb entered the scene, demand for luxury vacation rental properties has skyrocketed. Travelers increasingly opt for private luxury villas over hotels for personalized experiences, privacy, and unique amenities; villa owners can capitalize on this trend by renting them to wealthy tourists; offering personalized experiences while earning significant returns on their investments from year-round rentals in high-demand tourist spots or by simply offering year-long lease agreements as a source of consistent revenue stream - this trend presents owners and investors in luxury real estate an exceptional opportunity.

Sustainability and Eco-Friendly Villas

Sustainability has quickly become one of the main criteria when buying luxury villas, especially among environmentally aware high net-worth individuals. Villas offering energy-efficient technologies, sustainable materials, and eco-friendly designs are becoming more desirable among buyers looking for luxury living without an impactful environmental footprint. Developers looking to provide eco-certified villas see this market segment as an opportunity. More and more consumers desire villas that combine luxurious living with eco-conscious building practices; further propelling eco-friendly design trends within luxury villas markets.

Trends

Integration of Smart Home Technology in Luxury Villas

Smart homes equipped with sophisticated automation systems such as lighting, climate control, security, and entertainment provide owners with greater comfort. Technological integration also increases energy efficiency while improving safety as owners can monitor and control their properties remotely from afar. This trend appeals to tech-savvy individuals seeking personalized living spaces while taking advantage of modern tech innovations - luxury villas equipped with these integrated systems are increasingly becoming the standard in high-end real estate investments.

Rising Demand for Wellness-Oriented Villas

There has been an exponentially rising interest in luxurious villas that provide health, wellness, and lifestyle experiences. Villas designed with features like home spas, fitness centers, meditation rooms, and access to natural surroundings demonstrate this shift toward holistic living. As health-conscious living becomes more mainstream among buyers seeking properties offering not just luxury but also well-being - organic design elements with outdoor fitness spaces offering personalized wellness services are becoming popular with ultra-wealthy individuals; this trend highlights an affluent lifestyle prioritizing mental, physical, and emotional wellbeing further increasing these properties' appeal among ultra-wealthy buyers looking for properties which offer both luxury AND well-being benefits to remain on-trend.

Research Scope and Analysis

By Type of Home

Detached villas are projected to take the largest revenue share within the luxury villas market by 2024. These villas command an exceptional status due to their universal appeal, versatility, and suitability for an array of audiences seeking exclusivity, privacy, and personalization in their living environments. These standalone residences provide plenty of space, the freedom to customize it as desired, and an inviting ambiance often sought by wealthy buyers. Their flexible designs cater to various buyer preferences - be they families prioritizing privacy or individuals looking for luxurious retreats.

The lack of shared walls and expansive outdoor areas further increase their desirability in locations where land is at a premium. Attracting niche markets, specialty villas specialize in specific designs or features aimed at particular themes or purposes - for instance, eco-friendly designs, historic restoration projects, and wellness features that cater specifically to certain buyer preferences and needs. Due to this focus on niche products, they typically reach only buyers with specific tastes or needs.

Specialty villas may provide exclusive accommodations and an elevated experience; however, their market remains significantly smaller compared to detached villas due to fewer luxury buyers seeking them out. Detached villas' growth is further amplified by trends like remote working; where wealthy individuals desire spacious yet private living arrangements outside urban centers.

By Ownership Type

Investment buyers are predicted to lead the luxury villas market with the highest revenue share by 2024 due to high-end real estate's secure asset class status and lucrative yield potential; they view luxury villas as an effective hedge against inflation while diversifying their portfolios. These buyers may be drawn to prime properties located in attractive locales due to the potential of significant capital appreciation, high-net-worth tenants paying market-related rent, and the prestige associated with owning prime real estate assets in desirable locales.

Luxury villas located near coastal regions, picturesque hilltops, or metropolitan hotspots offer investors strong returns through reliable demand and long-term returns. Affluent individuals and institutional investors capitalize on favorable market conditions, tax benefits, or citizenship programs tied to property ownership in specific countries. This further solidifies the dominance of investment buyers in the luxury villas segment. On the other hand, primary home buyers in the luxury segment, though significant, form a smaller share of the market. These buyers prioritize lifestyle factors such as comfort, exclusivity, and proximity to essential services or nature.

By End User

The Ultra-High-Net-Worth Individuals are predicted to dominate the luxury villa market based on end-users in 2024, primarily due to their unparalleled purchasing power and preference for exclusive, high-value assets. These individuals typically seek properties that offer exceptional privacy, bespoke amenities, and prime locations, aligning perfectly with the offerings of luxury villas. For UHNWIs, luxury villas are not only residences but also symbols of status, wealth, and sophistication. Their ability to acquire multiple properties globally further solidifies their dominance in this market segment.

Luxury villas appeal to UHNWIs because they often prioritize high-end features such as expansive living spaces, state-of-the-art security systems, private pools, and proximity to prestigious neighborhoods or natural landscapes. Additionally, UHNWIs are likely to invest in villas that provide a seamless blend of leisure and functionality, such as those with integrated home offices, wellness areas, or personal staff accommodations.

While young affluent professionals contribute to the luxury market, they generally lean towards properties that offer a blend of modernity and accessibility, often opting for luxury apartments or townhomes over expansive villas due to their comparatively limited financial resources. Similarly, multigenerational families, though significant, tend to choose villas based on practicality and shared spaces, which can limit their participation in the ultra-luxury segment.

The Luxury Villas Market Report is segmented based on the following

By Type of Home

- Detached Villas

- Specialty Villas

By Ownership Type

- Primary Home Buyers

- Investment Buyers

By End User

- Young Affluent Professionals

- Ultra-High-Net-Worth Individuals

- Multigenerational Families

Regional Analysis

North America is predicted to dominate the luxury villas market with a

revenue share of 34.5%, driven by a combination of economic strength, diverse real estate offerings, and a robust demand for high-end properties. The region is home to some of the world’s most sought-after locations for luxury living, including Beverly Hills, Aspen, Miami, and the Hamptons. These areas are renowned for their exclusivity, world-class amenities, and proximity to cultural, financial, and recreational hubs, making them magnets for affluent buyers both domestically and internationally. The stability of North America’s real estate market further reinforces its dominance.

The U.S., in particular, has long been a preferred destination for global investors seeking secure, high-yield assets. Luxury villas in the region are seen as safe investments, with consistent appreciation in value due to limited land availability in prime areas and sustained demand. Additionally, the rise of remote work has shifted preferences toward spacious homes in serene locations, further boosting the appeal of luxury villas in suburban and scenic areas.

North America’s leadership in luxury real estate is also supported by its strong infrastructure, world-class healthcare, and vibrant cultural scene, all of which appeal to ultra-high-net-worth individuals. Moreover, favorable policies in certain states, such as tax advantages or foreign investment incentives, attract a growing pool of international buyers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The luxury villa market features a competitive landscape comprising established developers, boutique firms, and regional operators. Dominant players like The Thinking Traveller, Tuscany Now & More, and The Greek Villas hold significant market share. Companies employ strategies such as exclusive property listings, bespoke architectural designs, and concierge services to attract high-net-worth individuals. Emerging firms focus on niche offerings, including eco-friendly villas and culturally immersive experiences.

Moreover, global leaders are expanding into underdeveloped markets and prime vacation hotspots to diversify portfolios. Collaborations with luxury brands for branded villas and curated services further enhance market presence, appealing to affluent buyers and investors worldwide.

Some of the prominent players in the Global Luxury Villas Market are

- Tuscany Now & More

- The Greek Villas

- The Thinking Traveler

- Luxury Cayman Villas

- Abercrombie & Kent Villas

- Château Saint-Jean

- Costa Brava

- The Royal Villa

- Amanzoe Villas

- Palazzo di Amore

- Other Key Players

Recent Developments

- In September 2024, Nocturne Luxury Villas announced a collaboration with Gladstone Investment Corporation (NASDAQ: GAIN) (“Gladstone Investment”), acquired West Indies Management Company, a leading villa rental manager on the island of Saint Barthélemy in the French West Indies, including its sister company based in St. Jean, WIMCOsbh (“WIMCO”). This investment is the third by Nocturne who last year announced its acquisition of Exceptional Stays based in Telluride, CO, and St. Barth Properties.

- In December 2024, Oberoi Realty announced a major development project in Alibaug, leveraging an 81-acre land deal with local landowners. The Mumbai-based real estate giant aims to construct a 5-star hotel and luxury villas, solidifying its reputation for high-end developments.

- In January 2024, Solvilla, a Spanish development firm is announced a new partnership with Finca Cortesín, a five-star property touting some of the world's best golfing experiences. The pair has delivered nine new luxury developments just miles away from Marbella, Spain, in the village of Casares on the country's Costa Del Sol, offering quite a few plots that lie just steps from the fairway.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 285.2 Bn |

| Forecast Value (2033) |

USD 1,154.1 Bn |

| CAGR (2024-2033) |

16.8% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 82.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type of Home(Detached Villas, and Specialty Villas), By Ownership Type (Primary Home Buyers, and Investment Buyers), By End User (Young Affluent Professionals, Ultra-High-Net-Worth Individuals, and Multigenerational Families) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Tuscany Now & More, The Greek Villas, The Thinking Traveler, Luxury Cayman Villas, Abercrombie & Kent Villas, Château Saint-Jean, Costa Brava, The Royal Villa, Amanzoe Villas, Palazzo di Amore,and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Luxury Villas Market size is estimated to have a value of USD 285.2 billion in 2024 and is expected to reach USD 1,154.1 billion by the end of 2033.

The US Luxury Villas Market is projected to be valued at USD 82.7 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 308.9 billion in 2033 at a CAGR of 15.8%.

North America is expected to have the largest market share in the Global Luxury Villas Market with a share of about 34.5% in 2024.

Some of the major key players in the Global Luxury Villas Market are The Thinking Traveller, Tuscany Now & More, The Greek Villas, and many others.

The market is growing at a CAGR of 16.8 percent over the forecasted period.