Market Overview

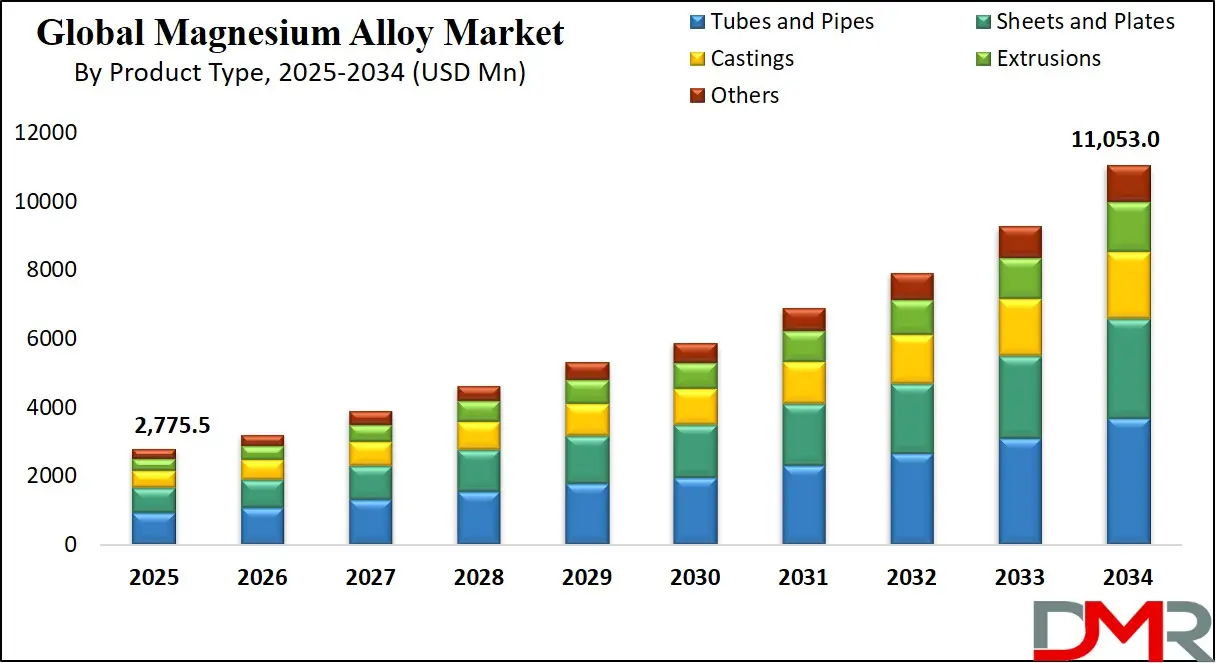

The Global Magnesium Alloy Market is projected to reach USD 2,775.5 million in 2025 and grow at a compound annual growth rate of 16.6% from there until 2034 to reach a value of USD 11,053.0 million.

The global magnesium alloy market is experiencing strong growth, driven by the demand for lightweight and high-strength materials across automotive, aerospace, electronics, and medical industries. A significant trend shaping the market is the automotive sector’s rapid shift toward fuel-efficient and electric vehicles. Magnesium alloys offer a superior strength-to-weight ratio, making them an ideal substitute for heavier metals like steel and even aluminum in applications such as engine blocks, transmission cases, and interior components. Another trend is the rising preference for sustainable materials, encouraging the development of recyclable and eco-friendly magnesium alloys.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Opportunities are emerging across the aerospace and electronics sectors, where the demand for high-performance, lightweight components is surging. Aircraft and defense manufacturers are incorporating magnesium alloys to improve fuel efficiency and reduce emissions. In consumer electronics, their use in casings for laptops,

smartphones, and cameras supports sleek, durable, and lightweight designs. These applications are expected to expand significantly over the next decade as innovation in alloy processing enhances durability and corrosion resistance.

However, the market is constrained by certain challenges. One of the major restraints is the environmental impact of magnesium production, especially in regions reliant on energy-intensive methods like the Pidgeon process. This method emits substantial carbon dioxide and relies heavily on coal-based energy sources. Additionally, the use of sulfur hexafluoride (SF₆), a potent greenhouse gas, in casting operations has come under scrutiny, prompting stricter regulations and higher production costs.

Statistically, global magnesium production exceeded 1 million metric tons annually, with China accounting for over 85% of the supply. The overall magnesium alloy market is projected to grow at a CAGR of over 16% through 2034, with applications in lightweight automotive and aerospace components expanding rapidly.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Looking ahead, growth prospects remain robust as industries across the globe prioritize weight reduction, energy efficiency, and sustainability, ensuring widespread adoption of magnesium alloys in advanced manufacturing systems.

The US Magnesium Alloy Market

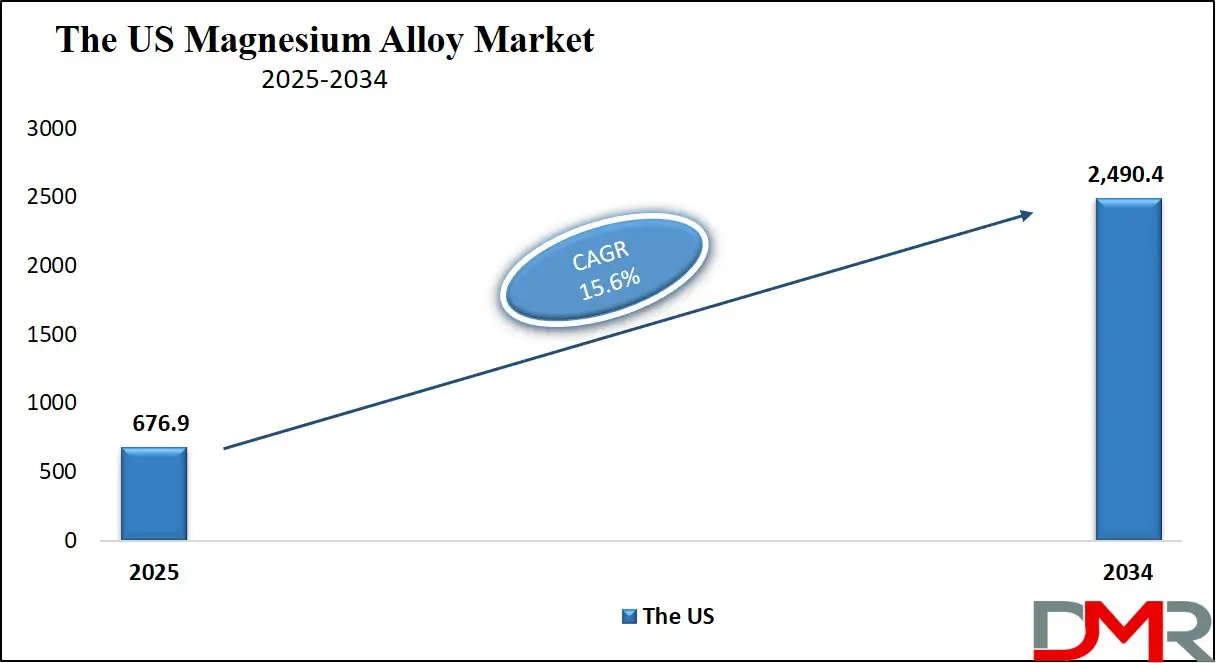

The US Magnesium Alloy Market is projected to reach USD 676.9 million in 2025 at a compound annual growth rate of 15.6% over its forecast period.

The United States magnesium alloy market is underpinned by strong industrial capacity, policy support, and innovation in sustainable materials. According to the U.S. Geological Survey, the U.S. is one of the few countries with domestic magnesium production capacity, primarily located in Utah. US Magnesium LLC is a leading producer, utilizing solar evaporation of brines from the Great Salt Lake. This approach reduces the carbon footprint compared to conventional Pidgeon methods, which dominate globally.

Energy conservation is a key driver in U.S. manufacturing policy. The U.S. Department of Energy has estimated that current technologies for producing magnesium alloys could save over 20 billion British thermal units (Btu) annually, with even greater potential through the adoption of advanced, low-energy processes. This aligns with the broader push to modernize American manufacturing under sustainability mandates.

The United States has a demographic advantage in the form of its mature automotive and aerospace sectors. Magnesium alloy demand is growing in these industries as OEMs seek to reduce vehicle and aircraft weight to improve fuel economy and meet environmental standards. Additionally, military applications and defense budgets provide a stable demand for magnesium in aircraft frames, vehicle parts, and missile systems.

The Environmental Protection Agency (EPA) has also taken steps to reduce the use of harmful gases like SF₆ in magnesium processing, promoting cleaner production. With a favorable regulatory environment, access to raw materials, and technological leadership, the U.S. magnesium alloy market is well-positioned for long-term growth across multiple end-use sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Magnesium Alloy Market

The European Magnesium Alloy Market is estimated to be valued at USD 416.3 million in 2025 and is further anticipated to reach USD 1,353.8 million by 2034 at a CAGR of 14.0%.

Europe’s magnesium alloy market is undergoing rapid development, driven by the region’s ambition to secure supply chains and reduce dependence on imported materials. Currently, the European Union imports over 90% of its magnesium, predominantly from China. Recognizing the strategic importance of magnesium as a lightweight and high-strength material, the European Commission has designated it as a critical raw material under the EU’s Critical Raw Materials Act.

This legislation mandates that by 2030, at least 10% of raw materials must be extracted, 40% processed, and 25% recycled within the EU. These targets are stimulating investment in domestic production and recycling capacity. Countries like Germany, Norway, and the Netherlands are leading this transition by funding magnesium alloy R&D and supporting recycling infrastructure for vehicle parts and electronics.

Automotive and aerospace sectors are major drivers of demand in Europe, particularly as the EU pushes for zero-emission vehicles and fuel-efficient aircraft. Lightweight magnesium components help meet carbon neutrality goals while maintaining performance. In Germany, several manufacturers are already using magnesium alloys in electric vehicle platforms and structural parts. The European aerospace sector, including companies like Airbus, is also integrating magnesium alloys into aircraft interiors to reduce weight.

Moreover, the European Space Agency and national defense programs are funding the development of corrosion-resistant, high-performance magnesium alloys. Europe’s demographic advantage lies in its skilled workforce, advanced manufacturing base, and coordinated policy frameworks. Together, these elements are enabling the continent to transition from reliance on imports to becoming a resilient, self-sufficient hub for magnesium alloy innovation and production.

The Japan Magnesium Alloy Market

The Japan Magnesium Alloy Market is projected to be valued at USD 444.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,562.2 million in 2034 at a CAGR of 15.0%.

Japan’s magnesium alloy market is characterized by its advanced materials science, strong industrial demand, and resource-efficient manufacturing practices. While Japan imports most of its primary magnesium, it has developed a sophisticated domestic value chain based on high recycling rates and precision alloy development. The country has one of the most efficient magnesium recycling systems in the world, especially for end-of-life vehicles and electronics.

Japanese institutions such as the National Institute for Materials Science (NIMS) and major universities are at the forefront of research into magnesium processing. Innovations include rapid solidification methods, heat treatment for enhanced formability, and corrosion-resistant coatings. These techniques enable magnesium alloys to be used in high-stress environments, including structural automotive parts and aerospace components.

Automotive manufacturers in Japan, including Toyota and Honda, have invested heavily in magnesium components for engine brackets, transmission cases, and hybrid system housings. The shift toward lighter vehicles is aligned with Japan’s commitment to carbon reduction under the Green Growth Strategy and 2050 net-zero targets. Lightweighting with magnesium contributes to both fuel efficiency and battery optimization in electric vehicles.

Japan’s robust electronics industry also supports magnesium demand. Companies use the metal in laptops, smartphones, and cameras due to its strength and weight advantages over plastic and aluminum. The medical device sector, another area of growth, is exploring magnesium’s bioresorbable properties for temporary implants.

With limited natural resources, Japan maximizes efficiency and innovation. Its demographic structure is aging, but highly skilled supports high-value manufacturing, making Japan a global leader in specialized, sustainable magnesium alloy applications.

Global Magnesium Alloy Market: Key Takeaways

- Global Market Size Insights: The Global Magnesium Alloy Market size is estimated to have a value of USD 2,775.5 million in 2025 and is expected to reach USD 11,053.0 million by the end of 2034.

- The US Market Size Insights: The US Magnesium Alloy Market is projected to be valued at USD 676.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,490.4 million in 2034 at a CAGR of 15.6%.

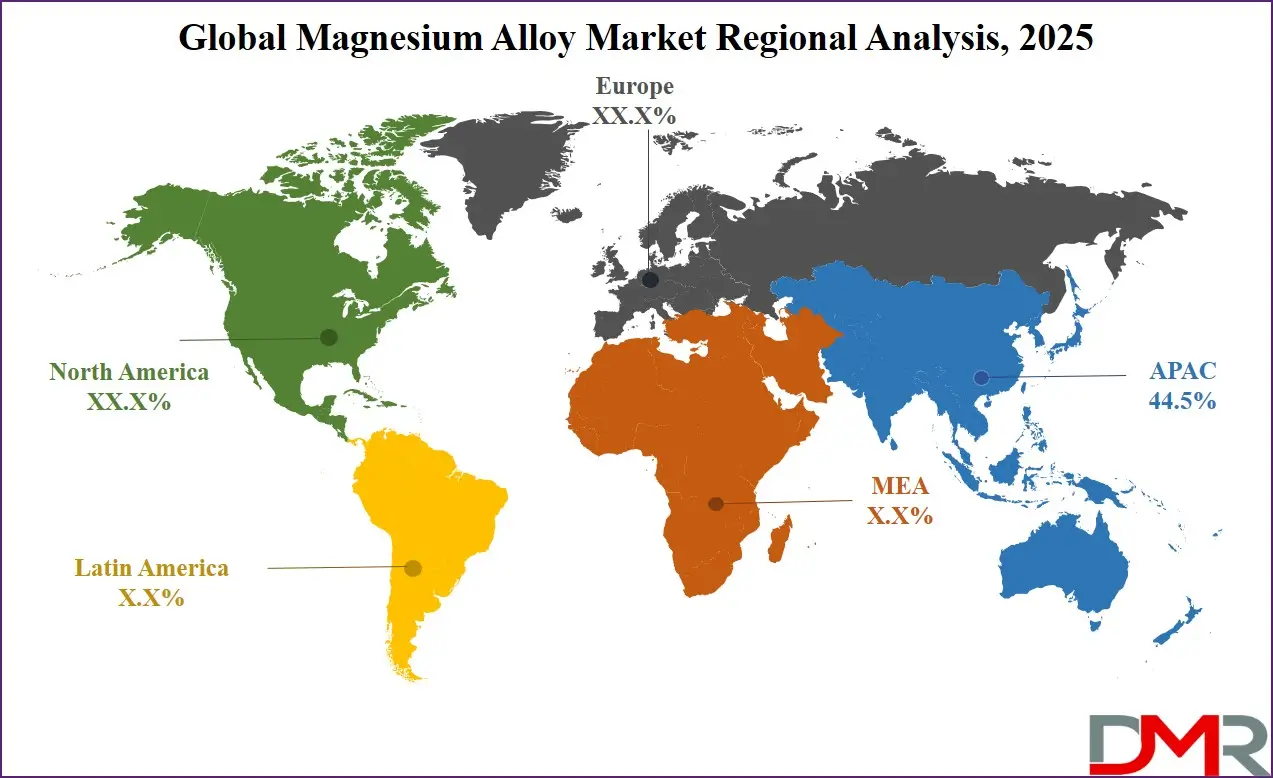

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Magnesium Alloy Market with a share of about 44.5% in 2025.

- Key Players: Some of the major key players in the Global Magnesium Alloy Market are Magnesium Elektron, US Magnesium, Nanjing Yunhai Special Metals, Meridian Lightweight, China Magnesium Corp, Western Magnesium, Wuhan Magnesium, Dead Sea Magnesium, POSCO, Gonda Metal, RIMA Group, Yunhai Metal, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 16.6 percent over the forecasted period of 2025.

Global Magnesium Alloy Market: Use Cases

- Automotive Lightweighting: Magnesium alloys are widely used in car bodies, engine blocks, and transmission casings to reduce vehicle weight and enhance fuel efficiency. This supports automakers' efforts to meet stricter emission regulations and improve vehicle range in electric cars. Their high machinability and structural strength make magnesium alloys an ideal choice for next-generation mobility solutions.

- Aerospace Structures: In aircraft design, magnesium alloys are replacing traditional metals in cabin frames, seat supports, and gear housings. Their lightweight nature helps reduce aircraft weight, lower fuel consumption, and improve overall performance. Their damping capacity and resistance to vibration further enhance safety and comfort, making them ideal for both commercial and defense aerospace applications.

- Portable Electronics: Magnesium alloy casings in laptops, tablets, and smartphones provide a premium finish and lightweight design while offering excellent structural integrity. Unlike plastic or heavier metals, magnesium delivers both durability and portability, enabling more compact devices. Electronics manufacturers prefer magnesium for its recyclability and performance under heat and mechanical stress.

- Medical Devices: Magnesium alloys are being explored in medical applications for their biocompatibility and biodegradability. They are particularly suited for temporary implants like bone screws and plates, which dissolve inside the body over time. This eliminates the need for secondary surgeries and reduces long-term complications, making magnesium-based implants an emerging innovation in orthopedic care.

- Power Tools and Outdoor Equipment: Magnesium alloys are ideal for use in power tools, lawn equipment, and bicycles. They reduce tool weight while maintaining strength, improving user ergonomics, and battery efficiency. Magnesium components, such as housings, gears, and handles, are favored in high-performance tools designed for both professional and home use, enhancing durability and ease of handling.

Global Magnesium Alloy Market: Stats & Facts

U.S. Geological Survey (USGS)

- Magnesium's abundance: Magnesium accounts for roughly 2% of the Earth’s crust, making it one of the most abundant elements. It is also the third most abundant element dissolved in seawater.

- Commercially important minerals: Of over 60 known magnesium-bearing minerals, only five, dolomite, magnesite, brucite, carnallite, and olivine, are considered economically viable for commercial use.

- Primary applications: Magnesium metal is widely used as an alloying agent to strengthen aluminum, especially in the production of beverage cans, automotive parts, and aerospace components.

- Steel industry use: Magnesium serves an important role in the desulfurization process in steel production.

- Production leadership: The United States was once the world’s leading producer of primary magnesium and remains a significant player in magnesium recycling and alloy manufacturing.

- Recycling efficiency: Recycling magnesium alloys consumes only about 5% of the energy required to produce new (primary) magnesium metal from raw materials.

- Material recovery rate: The functional recycling rate of magnesium is approximately 50%, while for steel it is closer to 90%.

- Carbon emissions comparison: Producing one tonne of primary magnesium releases around 7.2 tonnes of CO₂, which is significantly higher than steel (1.8 tonnes CO₂ per tonne). However, recycled magnesium emits just 0.24 tonnes of CO₂ per tonne of metal, compared to 0.72 tonnes for steel.

- U.S. non-fuel mineral production value: In 2024, the total value of U.S. mineral production was $106 billion, including $33.5 billion from metal production.

- Import reliance: Over 50% of the apparent U.S. consumption of 46 non-fuel minerals, including magnesium, is fulfilled via imports. For 12 minerals, including some magnesium compounds, the country is 100% import reliant.

- Industrial minerals: U.S. production of nonfuel industrial minerals, which often include magnesium compounds used in refractories, was valued at $72.1 billion.

European Commission / Eurostat

- China's dominance: In 2023, China supplied 99% of all magnesium imports into the European Union, exposing the region to a single-source dependency risk.

- Import-export ratio: The EU imported approximately 6.3 tonnes of magnesium for every one tonne it exported, underlining a significant trade imbalance.

- Volatility in import volumes: Magnesium import volumes into the EU surged by 27% in 2022 before dropping by about 33% in 2023 due to price and supply disruptions.

- Price inflation: Magnesium import prices in the EU rose from €2.9 per kilogram in 2021 to €5.5 per kilogram in 202Export prices increased from €3.2 to €7.4 per kilogram in the same timeframe.

- CRM designation: In March 2023, the European Commission officially listed magnesium as a “critical raw material” due to its strategic importance and supply risk.

- 2030 strategic goals: The EU aims to domestically extract at least 10% of its magnesium demand, process 40% within Europe, and recycle at least 25% of used magnesium by 2030.

- Domestic production target: The European Commission aims to reduce import reliance by targeting at least 15% of total magnesium demand (about 40,000 tonnes) from EU-based production by 2030.

- Romania's strategic project: The Verde Magnesium project in Romania is expected to produce 90,000 tonnes of magnesium per year by 2027, enough to meet about half of the EU’s current demand.

- Project investments: As part of its strategic raw material push, the EU has approved 47 key mineral development projects across 13 member states. These include initiatives related to magnesium supply and processing.

United Nations Environment Programme (UNEP)

- Natural sources: UNEP confirms that magnesium is present in over 60 types of minerals and is widely available in seawater, making it one of the most globally accessible industrial metals.

- Sustainable recovery potential: Due to its recyclability and wide natural occurrence, magnesium is considered one of the most sustainable metals when properly managed.

European Critical Raw Materials Act (CRMA)

- Historical expansion of critical materials list: The EU’s list of critical raw materials expanded from 14 items in 2011 to 34 by 2023. Magnesium has consistently remained on the list due to its role in automotive and defense manufacturing and its dependency risk.

- Circular economy targets: Under the CRMA, magnesium recycling and value chain localization are pivotal for reducing environmental impact and enhancing supply security.

Japanese Government & Industrial Statistics

- Advanced alloys: Japan has developed high-performance magnesium-neodymium master alloys used in lightweight components for aerospace, electric vehicles, and robotics, showcasing a shift toward niche, high-strength alloys.

Financial Times / Industry Sources (Citing Public Data)

- China’s near-total control: Over 90% of Europe’s magnesium comes from China, presenting significant geopolitical and economic risk, particularly for the automotive and electronics sectors.

- Emissions data: The production of magnesite-based magnesium compounds can emit about 1.8 tonnes of CO₂ per tonne of output, which is a key concern for energy-intensive sectors.

- Romanian investment outlook: Verde Magnesium in Romania is being positioned as Europe’s only large-scale domestic magnesium supplier, with plans to meet half of the EU’s annual magnesium demand.

Global Magnesium Alloy Market: Market Dynamic

Driving Factors in the Global Magnesium Alloy Market

Electric Vehicle (EV) Boom and Fuel Economy Regulations

The rapid proliferation of electric vehicles is a powerful growth driver for the magnesium alloy market. EVs demand lightweighting for better battery efficiency and extended range, and magnesium offers an unmatched strength-to-weight ratio at a lower cost compared to carbon fiber composites. As leading EV manufacturers like Tesla, BYD, and Volkswagen increasingly utilize magnesium in powertrain housings, battery enclosures, and structural components, demand is soaring.

Simultaneously, global regulations like the European Union’s 2035 combustion engine ban and the U.S. Inflation Reduction Act are incentivizing clean mobility solutions. This regulatory environment makes magnesium alloys indispensable to future automotive design, both for performance and compliance. Magnesium’s electromagnetic shielding properties also make it suitable for e-mobility applications like battery cooling and motor housings.

Expanding Aerospace and Defense Applications

Defense and aerospace manufacturers are pushing toward lightweight, high-strength materials to meet demanding performance and safety standards. Magnesium alloys are increasingly being integrated into fighter aircraft, helicopters, and satellites due to their machinability, vibration-damping, and resistance to mechanical fatigue. The U.S. Department of Defense and NATO countries are modernizing fleets with materials that reduce mass and improve thrust-to-weight ratios.

Concurrently, commercial aviation is booming post-COVID, with new aircraft orders from Airbus and Boeing driving demand for light alloys. Innovations in fire-retardant magnesium alloys are also overcoming previous adoption barriers in passenger aircraft cabins. As geopolitical tensions rise, defense spending is increasing globally, further accelerating demand for specialty magnesium alloys in drones, missile systems, and surveillance equipment.

Restraints in the Global Magnesium Alloy Market

Corrosion Susceptibility and Material Limitations

Despite its advantages, magnesium alloy adoption is hampered by its inherent corrosion susceptibility, particularly in humid and marine environments. This issue restricts its use in exterior automotive parts and marine applications unless protective coatings or alloying with rare-earth elements (like neodymium or yttrium) is applied, increasing cost.

Additionally, magnesium is more reactive than aluminum, requiring careful storage and machining protocols. Fire risk during casting or welding further complicates handling. These limitations necessitate significant R&D investment, which smaller manufacturers may struggle to afford. Without robust corrosion resistance, many industries remain cautious about substituting traditional metals with magnesium, especially in safety-critical or long-life applications.

Supply Chain Concentration and Volatile Prices

Another major restraint is the extreme concentration of magnesium production in China, which accounts for more than 85% of global output. This monopoly exposes global buyers to high supply chain risk, as witnessed during the 2021 magnesium shortage when China curtailed production due to energy cuts. Prices spiked by over 400%, causing disruptions across the European automotive and aerospace sectors.

This volatility discourages long-term procurement contracts and deters OEMs from heavily integrating magnesium alloys in core designs. With limited secondary production facilities and a lack of refining infrastructure outside Asia, global supply remains highly fragile. These risks are particularly detrimental for industries where cost predictability and just-in-time supply chains are critical.

Opportunities in the Global Magnesium Alloy Market

Domestic Production and Critical Mineral Security in North America and Europe

The magnesium alloy market is witnessing a robust opportunity due to the strategic push for domestic mineral sourcing and processing in the U.S. and Europe. Both regions rely heavily on China, which accounts for over 85% of global magnesium production. However, concerns around supply chain vulnerabilities, trade restrictions, and geopolitical risks have prompted initiatives to develop local supply chains.

The European Commission’s Critical Raw Materials Act aims to extract 10%, process 40%, and recycle 25% of domestic magnesium demand by 2030. Similarly, the U.S. is expanding domestic mining and magnesium alloy recycling under the Defense Production Act and the bipartisan infrastructure law. Companies in Romania, Canada, and Nevada are launching new mining and processing projects, supported by public-private funding. These moves will reduce import dependency, stabilize prices, and unlock growth through sustainable and secure sourcing.

Biomedical and Medical Device Innovations

Magnesium alloys offer excellent biocompatibility and biodegradability, creating new opportunities in the biomedical sector. These alloys are being explored for orthopedic implants, vascular stents, and bone scaffolds due to their ability to degrade naturally within the body while promoting bone regeneration. Research institutions and startups are developing magnesium-based implants that eliminate the need for secondary surgeries, improving patient outcomes and reducing healthcare costs.

The global rise in orthopedic surgeries, especially among aging populations in Japan, Europe, and the U.S., is creating a lucrative market for these next-gen materials. Regulatory progress is also accelerating commercialization, with clinical trials underway and CE and FDA approvals for specific magnesium-based products. This represents a high-margin, tech-driven growth frontier for alloy producers seeking to diversify beyond industrial and transportation applications.

Trends in the Global Magnesium Alloy Market

Rising Adoption of Lightweight Materials in Transportation and Aerospace

One of the most prominent trends in the magnesium alloy market is the growing use of lightweight materials in the automotive and aerospace sectors to enhance fuel efficiency and reduce emissions. Magnesium alloys are about 75% lighter than steel and 33% lighter than aluminum, making them ideal for weight-sensitive applications. With global regulatory pressure mounting on automakers to meet emission reduction targets (e.g., Euro 7, CAFE standards in the U.S.), OEMs are increasingly substituting heavier materials with magnesium alloys in structural and interior parts, especially in EVs and hybrid vehicles.

In aerospace, these alloys are used in gearboxes, fan frames, and seat components in commercial aircraft and fighter jets, driven by the need for enhanced payload capacity and improved fuel economy. This trend is further supported by advancements in corrosion resistance and heat tolerance in newer magnesium alloys, broadening their scope of applications.

Advancements in Recycling and Circular Economy Integration

A second major trend is the shift toward sustainable manufacturing, with magnesium alloys becoming central to circular economy strategies. Magnesium is among the most recyclable metals, and secondary production (from scrap) uses only about 5% of the energy required for primary production.

This is particularly attractive in Europe and Japan, where environmental compliance and energy efficiency are top policy priorities. Companies are investing in closed-loop recycling systems and low-emission refining processes to meet ESG goals and secure raw material supply. The trend aligns with the EU’s Critical Raw Materials Act and U.S. initiatives to onshore and recycle critical metals, fostering demand for post-consumer recycled magnesium alloys in electronics and mobility sectors.

Global Magnesium Alloy Market: Research Scope and Analysis

By Product Type Analysis

Tubes and pipes are poised to represent the leading product segment in the magnesium alloy market due to their extensive application in critical industries like automotive, aerospace, and medical devices. Their dominance is rooted in their combination of lightweight structure, high strength-to-weight ratio, and superior machinability, making them ideal for fluid transfer, structural support, and thermal management systems.

In automotive manufacturing, magnesium alloy tubes are widely used in fuel lines, brake systems, and structural supports for chassis and suspension components. Their low weight contributes significantly to overall vehicle light-weighting strategies aimed at improving fuel economy and reducing emissions, particularly in electric vehicles (EVs) and hybrid platforms.

In the aerospace industry, magnesium alloy tubes are employed in hydraulic systems, airframes, and engine components where weight savings translate directly into performance and cost benefits.

Additionally, their high vibration-damping and resistance to fatigue make them ideal for long-term aerospace applications. In the medical sector, magnesium tubes are being explored for biodegradable stents and bone scaffolds due to their biocompatibility and safe degradation inside the body. The growth of minimally invasive surgical techniques further boosts demand for small-diameter, high-precision tubing.

Technological advancements in extrusion and seamless pipe manufacturing, along with improved corrosion resistance treatments, have broadened the application scope of magnesium tubes. With rising investments in lightweight engineering, sustainability, and biomedical innovation, the dominance of tubes and pipes as a magnesium alloy product type is expected to remain robust over the forecast period.

By Alloy Series Analysis

AZ Series Alloys is expected to dominate the global magnesium alloy market primarily due to their balanced mechanical properties, cost-effectiveness, and widespread availability. These alloys, typically composed of magnesium, aluminum (A), and zinc (Z), are known for their excellent strength-to-weight ratio, good castability, and moderate corrosion resistance. AZ91, the most popular grade within this series, offers high tensile strength and good ductility, making it the standard alloy for many structural and automotive applications. The AZ series is extensively used in die casting, which remains the largest production method for magnesium components globally due to its efficiency and low cost.

Their versatility makes AZ series alloys the material of choice for a wide range of applications, from electronics housings and engine blocks to aircraft seat frames and power tool casings. This broad applicability supports economies of scale, making production cheaper and more reliable for OEMs across industries. These alloys are also easier to process compared to more exotic rare-earth-based magnesium alloys, making them attractive for mass production.

Moreover, AZ series alloys have benefited from continuous R&D, leading to improvements in corrosion resistance through surface treatments and heat treatment methods. Their compatibility with recycling processes further strengthens their position in a sustainability-driven industrial environment. As lightweighting becomes a central focus in sectors like transportation and defense, the AZ series’ dominance is expected to continue, especially with increasing adoption in electric mobility and consumer electronics requiring thin-walled, high-precision magnesium components.

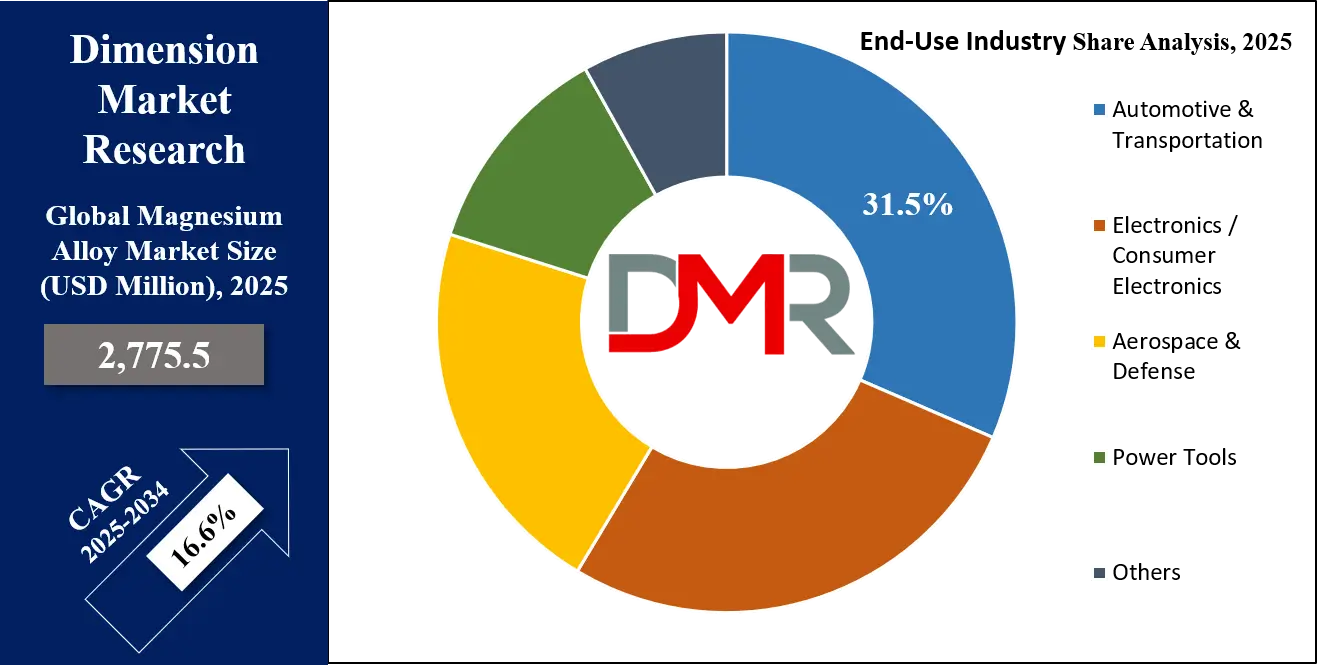

By End-Use Industry Analysis

The automotive and transportation sector is projected to hold the largest share of the magnesium alloy market due to the pressing need for vehicle light-weighting and compliance with stringent fuel economy and emission regulations worldwide. Magnesium alloys are approximately 33% lighter than aluminum and 75% lighter than steel, offering automakers a powerful material solution for improving vehicle efficiency without sacrificing structural integrity or performance.

This weight reduction translates to better mileage, improved battery range for electric vehicles, and lower CO₂ emissions, making magnesium a strategic material in the automotive industry's transition to sustainability.

Magnesium alloys are widely used in transmission cases, engine blocks, steering wheels, seat frames, dashboards, and even body panels, especially in electric and hybrid vehicle platforms. Major automakers such as BMW, Mercedes-Benz, and General Motors are already using magnesium components in large volumes, particularly AZ and AM series alloys. The emergence of gigacasting technology in electric vehicles like Tesla's casting of large structural parts further accelerates magnesium alloy usage due to its castability and mechanical strength.

Moreover, lightweight magnesium alloys enhance vehicle handling, reduce wear on tires and brakes, and improve crash safety by absorbing more energy per unit mass. Besides road vehicles, the transportation segment includes high-speed rail and public transit, where lightweight materials extend service life and reduce energy use. With growing global demand for sustainable and fuel-efficient mobility and rising EV penetration, the automotive and transportation segment is poised to maintain its leadership in magnesium alloy consumption well into the next decade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Magnesium Alloy Market Report is segmented on the basis of the following:

By Product Type

- Tubes and Pipes

- Sheets and Plates

- Castings

- Extrusions

- Others

By Alloy Series

- AZ Series Alloys

- AM Series Alloys

- AJ Series Alloys

- Others

By End-Use Industry

Global Magnesium Alloy Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to lead the global magnesium alloy market as it holds 44.5% market share bin 2025, due to its robust manufacturing infrastructure, abundant raw material availability, and strong demand from automotive, aerospace, and electronics sectors. China, in particular, is the world’s largest producer and consumer of magnesium, accounting for over 85% of global magnesium production. This regional dominance ensures a stable, cost-effective supply of primary magnesium for alloy manufacturing.

Additionally, the region’s established die casting and component manufacturing ecosystem, especially in China, Japan, and South Korea, drives large-scale use of magnesium alloys in electronics, vehicles, and industrial applications.

Automotive giants like Toyota, Hyundai, and Honda have increasingly integrated magnesium alloys into their lightweighting strategies. The electronics industry, concentrated in Japan, Taiwan, and China, also utilizes magnesium in casings for smartphones, laptops, and cameras.

Moreover, Asia-Pacific governments actively support lightweight, energy-efficient technologies in line with environmental goals. Japan, for instance, is investing in magnesium alloys for biodegradable medical implants. Rapid urbanization, rising income levels, and strong export-oriented industries continue to fuel demand. Collectively, these factors make Asia-Pacific the largest and most influential region in the global magnesium alloy market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America is expected to register the highest CAGR in the magnesium alloy market, driven by growing demand for lightweight materials in the electric vehicle (EV) and aerospace industries. The U.S., in particular, is pushing for domestic production of critical minerals, including magnesium, through policy frameworks such as the Defense Production Act and bipartisan infrastructure investments. This policy support aims to reduce reliance on Chinese imports and develop resilient supply chains for magnesium and its alloys.

Rising EV adoption, supported by federal tax incentives and state-level zero-emission vehicle mandates, is prompting automakers to use more magnesium in vehicle structures, battery enclosures, and powertrains.

Additionally, the region’s dominant aerospace sector, led by Boeing and Lockheed Martin, is increasingly adopting magnesium alloys for structural parts due to their weight-saving benefits and vibration-damping properties. Defense applications, including lightweight gear and drone components, further contribute to demand. These trends, combined with growing biomedical innovation and recycling initiatives, position North America for rapid, sustained growth in the magnesium alloy market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Magnesium Alloy Market: Competitive Landscape

The magnesium alloy market is moderately consolidated, with a mix of global and regional players competing across the value chain from raw material mining to alloy processing and component fabrication. Key companies include Magnesium Elektron (Luxfer Holdings), Norsk Hydro ASA, US Magnesium LLC, RIMA Group, Meridian Lightweight Technologies, and POSCO, all of which hold significant market share due to their integrated operations and long-term partnerships with automotive and aerospace OEMs.

Asian companies such as China Magnesium Corporation, Shanxi Yinguang Huasheng Magnesium Co., and Taiwan-based Dead Sea Magnesium Ltd. dominate primary magnesium production and casting operations, supplying low-cost materials to global manufacturers. In contrast, Western players are focusing on high-performance, specialty alloys for aerospace, biomedical, and defense markets. These firms invest heavily in R&D for corrosion resistance, fire retardancy, and biocompatibility.

Recent developments include strategic collaborations between magnesium alloy producers and EV manufacturers to support light-weighting targets. Companies are also expanding into magnesium recycling and secondary production to ensure sustainability and regulatory compliance. Furthermore, government-funded initiatives in the U.S., EU, and Japan are catalyzing innovation and infrastructure development. As demand surges, competition is intensifying around proprietary alloy formulations, supply chain localization, and advanced casting technologies.

Some of the prominent players in the Global Magnesium Alloy Market are:

- Magnesium Elektron (Luxfer Group)

- US Magnesium LLC

- Nanjing Yunhai Special Metals Co., Ltd.

- Meridian Lightweight Technologies

- China Magnesium Corporation Ltd.

- Western Magnesium Corporation

- Wuhan Magnesium Co., Ltd.

- Dead Sea Magnesium Ltd.

- POSCO

- Gonda Metal Industry Co., Ltd.

- RIMA Group

- Yunhai Metal Co., Ltd.

- Taiyuan Tongxiangyuan Fine Material Co., Ltd.

- Amacor (American Magnesium Corp.)

- Magontec Limited

- Qinghai Salt Lake Magnesium Co., Ltd.

- China Hongqiao Group Limited

- Regal Magnesium Limited

- Magnesium Alloy Products Co. (MAPC)

- Terves Inc.

- Other Key Players

Recent Developments in the Global Magnesium Alloy Market

April 2025

- 2025 Magnesium Industry Chain & Market Forum (Shanghai, China): Held from March 31 to April 2, this event featured major manufacturers such as Lufei Magnesium, Kangtai Metal, Aolang Intelligence, Shenmu Lizhen, and Magnesium Yang Intelligent Equipment. These companies showcased large-scale investments in semi-solid injection molding, fully automated die-casting lines, and intelligent factory systems. Investment plans worth up to 500 million CNY were announced to expand casting, extrusion, and forming capabilities.

- 13th Magnesium Summit (Ningbo, China): Organized by Asian Metal in April 2025, this summit brought together industry leaders, traders, and government stakeholders to discuss magnesium alloy price trends, processing innovations, and global market balance. A key focus was on decarbonizing the supply chain and creating strategic reserves.

May 2024

- Changchun Automotive Magnesium Alloy Base Project: As part of China’s "Made in China 2025" and NEV Development Plan (2021–2035), a magnesium alloy manufacturing base was initiated in the South Korea-China International Cooperation Zone in Changchun. The facility is geared toward producing lightweight structural parts for electric vehicles, targeting exports to Korea and Europe.

September 2023

- Xpeng Huitian Flying Car Launch: Xpeng's innovative flying car prototype, the “Land Aircraft Carrier,” integrated high-performance magnesium alloy structural parts supplied by Regal Metal. The project marks the entry of magnesium alloys into advanced mobility solutions such as aerial transport.

- FDA Breakthrough Device Designation for Magnesium Bone Screw: Suzhou Innocare received the U.S. FDA's Breakthrough Device designation for its bioresorbable magnesium alloy bone screw. This paves the way for accelerated approval of magnesium-based orthopedic implants in the U.S. healthcare system.

April–May 2023

- IBEX Engineering (India) Expansion: The company doubled its magnesium alloy recycling capacity to 4,000 tonnes per year by installing a second Rauch furnace. This investment supports India’s automotive and aerospace sectors with sustainable magnesium supply.

- Meridian Lightweight Technologies Receives Honda Award: Recognized for exceptional quality and delivery performance, Meridian received the 2023 Excellence in Delivery & Quality Award from Honda. Meridian is a key supplier of cast magnesium parts to global OEMs.

February 2023

- Latrobe Magnesium & Metal Exchange Corporation Agreement: An 8,000 tpa binding magnesium supply agreement was signed between Australia’s Latrobe Magnesium and U.S.-based Metal Exchange Corp. The deal strengthens U.S. supply chains under its anti-dumping and domestic sourcing policies.

- Alliance Magnesium & Triple M Metal Partnership: These two North American firms joined forces to expand magnesium alloy recycling capacity at Alliance’s Danville facility, advancing circular economy goals in the critical metals space.

- Magnium Australia Grant Funding: The Australian government provided almost AUD 2 million in funding to Magnium Australia for feasibility studies on a zero-carbon magnesium refinery in Western Australia.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,775.5 Mn |

| Forecast Value (2034) |

USD 11,053.0 Mn |

| CAGR (2025–2034) |

16.6% |

| The US Market Size (2025) |

USD 676.9 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Tubes and Pipes, Sheets and Plates, Castings, Extrusions, Others), By Alloy Series Outlook (AZ Series Alloys, AM Series Alloys, AJ Series Alloys, Others), By End-Use Industry (Automotive & Transportation, Electronics/Consumer Electronics, Aerospace & Defense, Power Tools, Others)

|

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Magnesium Elektron, US Magnesium, Nanjing Yunhai Special Metals, Meridian Lightweight, China Magnesium Corp, Western Magnesium, Wuhan Magnesium, Dead Sea Magnesium, POSCO, Gonda Metal, RIMA Group, Yunhai Metal, Taiyuan Tongxiangyuan, Amacor, Magontec, Qinghai Salt Lake Magnesium, China Hongqiao, Regal Magnesium, MAPC, Terves Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Magnesium Alloy Market?

▾ The Global Magnesium Alloy Market size is estimated to have a value of USD 2,775.5 million in 2025 and is expected to reach USD 11,053.0 million by the end of 2034

What is the size of the US Magnesium Alloy Market?

▾ The US Magnesium Alloy Market is projected to be valued at USD 676.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,490.4 million in 2034 at a CAGR of 15.6%.

Which region accounted for the largest Global Magnesium Alloy Market?

▾ Asia Pacific is expected to have the largest market share in the Global Magnesium Alloy Market with a share of about 44.5% in 2025.

Who are the key players in the Global Magnesium Alloy Market?

▾ Some of the major key players in the Global Magnesium Alloy Market are Magnesium Elektron, US Magnesium, Nanjing Yunhai Special Metals, Meridian Lightweight, China Magnesium Corp, Western Magnesium, Wuhan Magnesium, Dead Sea Magnesium, POSCO, Gonda Metal, RIMA Group, Yunhai Metal, and many others.

What is the growth rate in the Global Magnesium Alloy Market in 2025?

▾ The market is growing at a CAGR of 16.6 percent over the forecasted period of 2025.