The development of this industry is mostly based on the increasing demand for UPR (unsaturated polyester resins), which are an essential component in fiberglass-reinforced resins. The maleic anhydride market is a very dynamic industry focused on the production and application of maleic anhydride, which is a key component with various uses.

Additionally, Maleic Anhydride contributes to additives, coatings, pharmaceutical intermediates, & agricultural chemicals. The market's growth stems from sectors reliant on its products & a global shift toward environmental friendly practices. As industries seek greener options, maleic anhydride becomes pivotal for ecological-conscious players.

Also, increasing concerns regarding harmful gas discharges have also led regulatory bodies worldwide to impose rules & regulations like the Clean Fuel Program in the United States. These regulations have caused oil companies to include specialized fuel additives,

specialty fuel additives into transportation fuels.

Key Takeaways

- Market Size & Growth: The global maleic anhydride market is projected to reach USD 4,867.7 million by 2033, growing at a CAGR of 4.8% between 2024 and 2033.

- Leading Segments: n-Butane is the dominant raw material segment, while Unsaturated Polyester Resins (UPR) account for the largest application revenue share at 50.3% in 2024. Benzene-based maleic anhydride is also expected to show significant growth potential.

- Applications & Use Cases: Maleic anhydride is widely used in producing UPR for fiberglass-reinforced plastics, lubricants and additives, coatings, 1,4-butanediol (BDO), agricultural chemicals, surfactants, paper sizing, and water treatment, supporting versatile industrial applications.

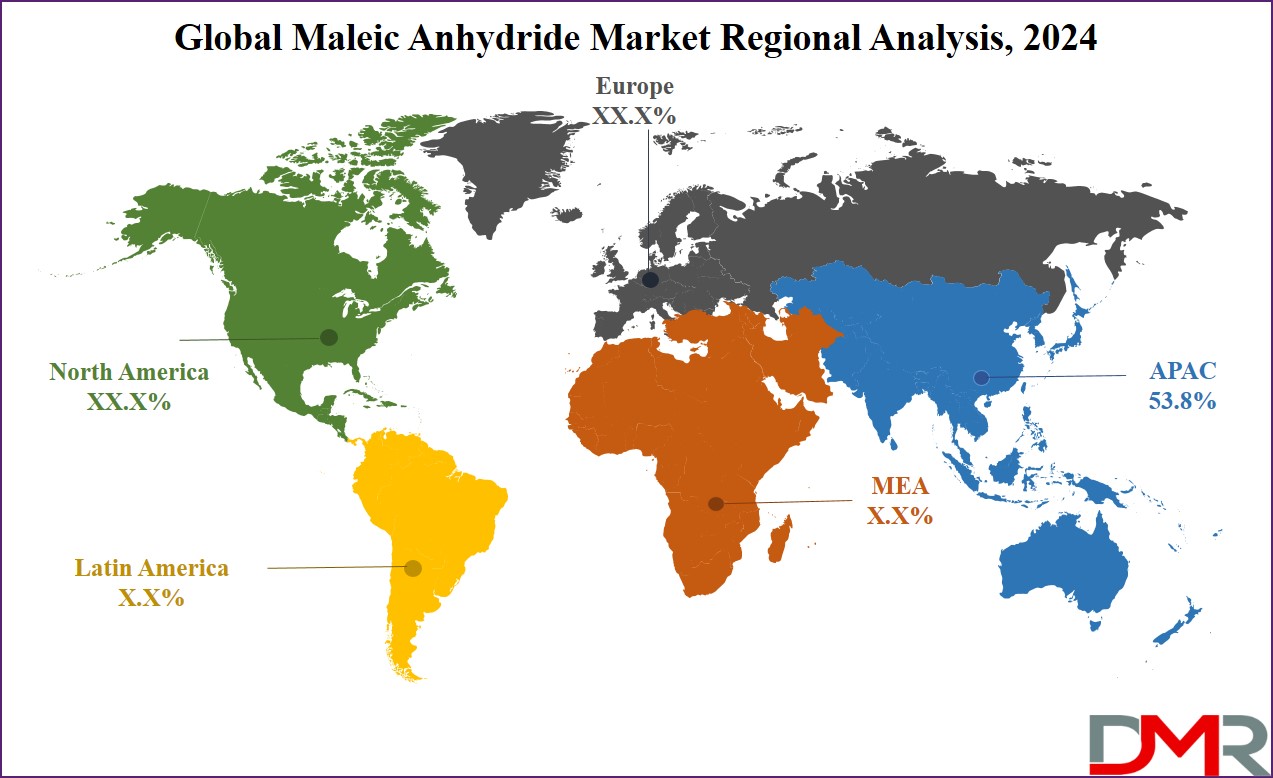

- Regional Performance: Asia Pacific leads the market with a 53.8% revenue share in 2024, driven by industrial growth in construction, automotive, pharmaceuticals, and personal care sectors. North America and MEA regions are also showing notable demand growth.

- Growth Drivers: Market expansion is fueled by rising demand for lightweight and durable materials, growth in construction and automotive sectors, regulatory focus on eco-friendly processes, and increasing adoption of bio-based maleic anhydride.

Use Cases

- Fiberglass-Reinforced Plastics: Maleic anhydride is crucial in producing unsaturated polyester resins (UPR), providing strength, durability, and lightweight properties for automotive, construction, and consumer goods.

- Lubricants & Additives: Used in manufacturing lubricant additives, maleic anhydride enhances viscosity, thermal stability, and overall performance of oils and industrial fluids.

- Agricultural Chemicals: Maleic anhydride derivatives improve the stability and effectiveness of pesticides, herbicides, and other agrochemicals, supporting higher crop yields.

- Paper & Packaging Industry: Acts as a sizing agent in paper production, improving water resistance, printability, and durability for packaging materials.

- Water Treatment & Surfactants: Serves as a coagulant aid in water treatment and contributes to surfactants and detergents by enhancing emulsifying and dispersing properties for cleaning applications.

Market Dynamic

The rising demand for unsaturated polyester resin, marked by its several advantages, has resulted in the heightened utilization of maleic anhydride. The role of maleic anhydride extends to being a critical component in the copolymer’s formation, leading to the creation of sustainable items for applications like, corrosion inhibition, binding wood fibers into plastics & protective coatings.

The versatility of unsaturated polyester resins is underscored by their amalgamation with various fillers & reinforcing elements, culminating in the creation of distinct thermoset articles distinguished by several chemical & mechanical attributes. The demand for unsaturated polyester resins is experiencing a rapid ascent, with a primary focus on sectors such as construction & sanitary ware.

While maleic anhydride's core significance lies in the domain of fiberglass composites, its demand trajectory is anticipated to rise, driven by these influential factors. Moreover, this points towards a growing necessity for maleic anhydride in the foreseeable future. Technological advances, regional economies, & regulations mark the market's direction. For example, In North America, the U.S. stands as the primary consumer of the product. This can be accredited to the growth of the automotive, agricultural, & construction sectors within the nation.

Driving Factors

Maleic anhydride market growth is being driven by its wide array of applications across industries like automotive, construction and packaging. Rising demand for unsaturated polyester resins (UPR), used widely in automotive components, building materials, and marine equipment applications is an integral factor of growth for the market expansion of unsaturated polyester resins (UPR).

Maleic anhydride's increased use in producing additives, lubricants, and coatings also supports its expansion. Construction industries in emerging economies are driving increased demand for durable yet lightweight materials made of maleic anhydride derivatives, fuelled by rising construction activity. Furthermore, sustainable manufacturing processes with bio based feedstocks further accelerate market expansion across various sectors.

Trending Factors

One key trend in the maleic anhydride market is the increasing adoption of bio based production methods, as companies prioritize sustainability and environmental compliance. As production of maleic anhydride uses renewable feedstocks like bio succinic acid to decrease dependence on fossil fuels, advances in catalyst technologies have also enhanced process efficiency while decreasing emissions during its synthesis process.

Maleic anhydride based composites have become an increasingly popular choice in lightweight automotive applications worldwide, reflecting global shifts toward fuel efficiency. Furthermore, manufacturers are exploring regional expansion strategies in high growth markets like Asia Pacific to take advantage of rapid industrialization and infrastructure growth.

Restraining Factors

The maleic anhydride market faces restraints due to volatile raw material prices, particularly those for butane and benzene which have an enormous effect on production costs. Environmental regulations regarding emissions and waste disposal present additional difficulties during production.

Furthermore, its dependence on petrochemical derivatives renders it vulnerable to fluctuations in crude oil prices; competition from alternative materials (epoxy resins and polyolefins for instance) reduces growth potential while high capital investments required for production facilities and technological advancement may prevent small and medium enterprises from entering this market.

Opportunity

The maleic anhydride market offers significant promise due to growing demand in emerging economies driven by rapid industrialization and infrastructure development. Asia Pacific regions' growing automotive and construction sectors present an abundance of opportunity for maleic anhydride based products such as UPRs and lubricants that utilize maleic anhydride.

Bio based maleic anhydride production provides opportunities to satisfy environmentally aware consumers and meet stricter regulations. Maleic anhydride derivatives' increasing use in niche applications like pharmaceuticals and personal care offers opportunities for diversification. Collaborations and investments in R&D may further increase market penetration and product innovation.

Research Scope and Analysis

By Raw Material

In terms of raw material, the n-butane category is expected to maintain its lead, with a maximum revenue share in 2024. The maleic anhydride derived from n-butane is expected to hold the larger share in both volume and value throughout the forecast period. This dominance is set to persist because of its robust demand from the expanding automotive, and building & construction sectors.

Furthermore, the n-butane segment is predicted to experience accelerated growth in the forthcoming years, driven by stringent regulations & policies governing the usage of benzene in the production of maleic anhydride.

These regulations are prompting industries & sectors to move towards more eco- friendly & compliant substitutes, thereby propelling the demand for n-butane-based maleic anhydride. The combination of sustained demand from major industries & regulatory dynamics is expected to maintain the prominence of n-butane as the preferred raw material in the Maleic Anhydride Market.

By Application

In terms of applications, Unsaturated Polyester Resins (UPR) predicted to dominates with a 50.3% revenue share in 2024 and show the subsequent growth potential in the upcoming period of 2024 to 2033. This is because the unsaturated polymer resin has broad applications in industries such as construction & aerospace due to its robust features like chemical, abrasion, and heat resistance.

It is environmentally friendly and structurally robust, making it highly suitable for use in marine construction, wind energy transportation, and electrical infrastructure. An emerging application is 1,4-butanediol (BDO), derived from maleic anhydride. BDO serves as a key ingredient in the production of PTMEG, PBT, GBL, and THF & PU, which are utilized across a wide range of industries including medicines, industrial plastics, and

vegan cosmetics.

The Maleic Anhydride Market Report is segmented on the basis of the following

By Raw Material

By Application

- Unsaturated Polyester Resins (UPR)

- 1,4-Butanediol (BDO)

- Additives (Lubricants & Oil)

- Copolymers

- Others

Regional Analysis

The Asia Pacific region is anticipated to lead the way with

53.8% of the revenue share in 2024. This growth is influenced by the increasing construction, pharmaceuticals, and also personal care & cosmetics industries in that area.

The uses of maleic anhydride in the construction and pharmaceuticals as unsaturated polymer resin, and also personal care cosmetics for hair fixatives & styling products are very important. The fact that China was standing second among the consumers of cosmetics also added to the increasing demand for maleic anhydride. This trend is likely to persist, enhancing the demand.

The other area registering high growth is the MEA due to rising demand in the sectors such as agriculture & construction. This is driving the demand for maleic anhydride in the MEA region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The maleic anhydride market is highly competitive, featuring numerous independent small- and also large-scale manufacturers and suppliers. In order to maintain their status in the market, the participants of this industry are tactfully pursuing acquisition and growth plans.

For instance, Indian Oil Corporation's Board has greenlit the creation of the country's first large-scale Maleic Anhydride Plant. This facility, to be located at the Panipat Refinery & Petroleum Complex (PRPC), will have a capacity of 120 KTA (kilo tonnes per annum) for producing Maleic Anhydride (MAH). MAH is a crucial ingredient used in making specialty products like polyester resins, surface coatings, plasticizers, agrochemicals, and lubricant additives.

Some of the prominent players in the Global Maleic Anhydride Market are

Recent Development

- In December 2023, NEXTCHEM (MAIRE) received a technology licensing and catalyst supply award in China. CONSER, its subsidiary, will provide expertise for its Duetto technology, producing biodegradable plastics intermediates.

- In December 2023, BASF Environmental Catalyst and Metal Solutions (ECMS) will acquire Arc Metal AB in Sweden, enhancing smelting capacity for spent automotive catalyst recycling in Europe, the Middle East, and Africa. The deal aligns with sustainability efforts.

- In June 2023, PETRONAS Chemicals Group Berhad (PCG) has decided to fully acquire a 113 ktpa Maleic Anhydride plant in Kuantan by 2025, expanding product offerings and exploring new markets.

- In May 2023, McDermott secures project management consultancy from India Oil Corporation Limited for a Maleic Anhydride unit at Panipat Refinery, emphasizing experience and capabilities. The Gurugram, India Center of Excellence will manage India's first mega-scale Maleic Anhydride plant.

- In June 2022, Polynt has unveiled its plan for an expansion project, which involves setting up a new esterification plant in Atlacomulco, Mexico. This facility will concentrate on the manufacture of plasticizers covering trimellitates primarily whose aim is to increase the production capability, ensuring a strategic fit with the ever-increasing needs of the expanding automotive and electrical industries.

Report Details