Market Overview

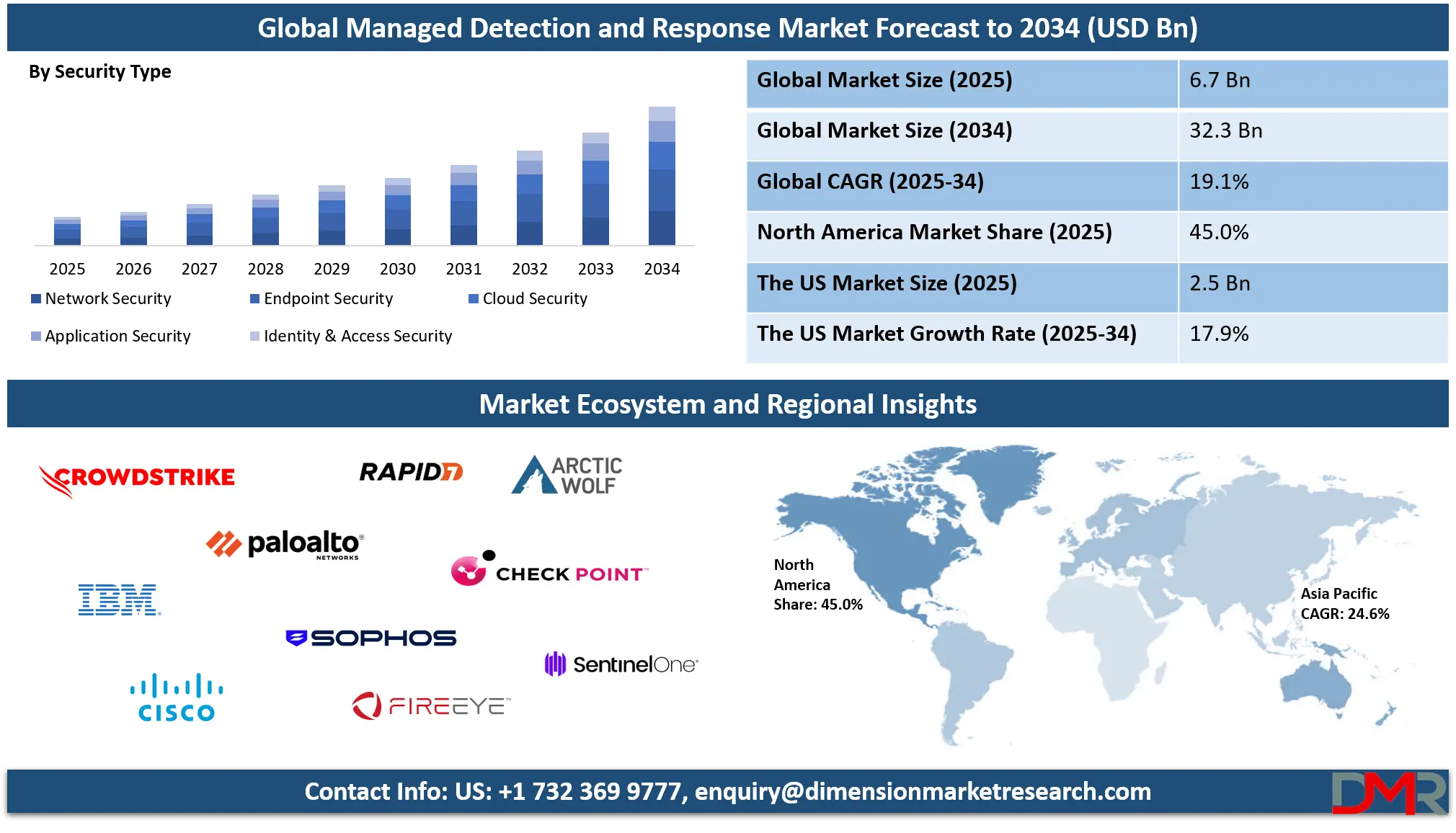

The Global Managed Detection and Response Market is valued at USD 6.7 billion in 2025 and is projected to reach USD 32.3 billion by 2034, growing at a CAGR of 19.1%. This growth is driven by the rising incidence of cyberattacks, growing cloud adoption, and the growing demand for proactive threat detection, incident response, and AI-driven security operations across enterprises globally.

Managed Detection and Response (MDR) is an advanced cybersecurity service that combines human expertise, threat intelligence, and next-generation technologies to proactively detect, analyze, and respond to cyber threats across an organization’s IT environment. It goes beyond traditional security monitoring by providing continuous threat hunting, real-time alert triage, and rapid incident response through a 24x7 managed security operations center.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

MDR solutions integrate analytics, endpoint detection and response (EDR), network traffic monitoring, and artificial intelligence to identify sophisticated attacks that evade conventional defenses. The service empowers organizations to strengthen their security posture without maintaining in-house SOC capabilities, ensuring faster mitigation of risks and minimizing the impact of cyber incidents.

The global managed detection and response market has emerged as a key segment of the cybersecurity landscape, driven by the rising frequency of ransomware, data breaches, and advanced persistent threats targeting enterprises of all sizes. Growing digital transformation initiatives, cloud adoption, and the expanding remote workforce have significantly increased the complexity of IT ecosystems, creating a greater need for managed detection and response services. Organizations are increasingly shifting from reactive to proactive security models, leveraging MDR to gain continuous visibility, rapid threat containment, and strategic remediation guidance.

Across industries such as banking, IT, healthcare, and manufacturing, MDR adoption is accelerating as companies face regulatory compliance requirements and skill shortages in cybersecurity. The integration of artificial intelligence, automation, and extended detection and response (XDR) capabilities is enhancing MDR’s effectiveness and scalability. Vendors are focusing on delivering cloud-native MDR platforms that provide centralized threat management across hybrid infrastructures. This growing reliance on managed cybersecurity operations is positioning the MDR market as a cornerstone of modern enterprise defense strategies globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Managed Detection and Response Market

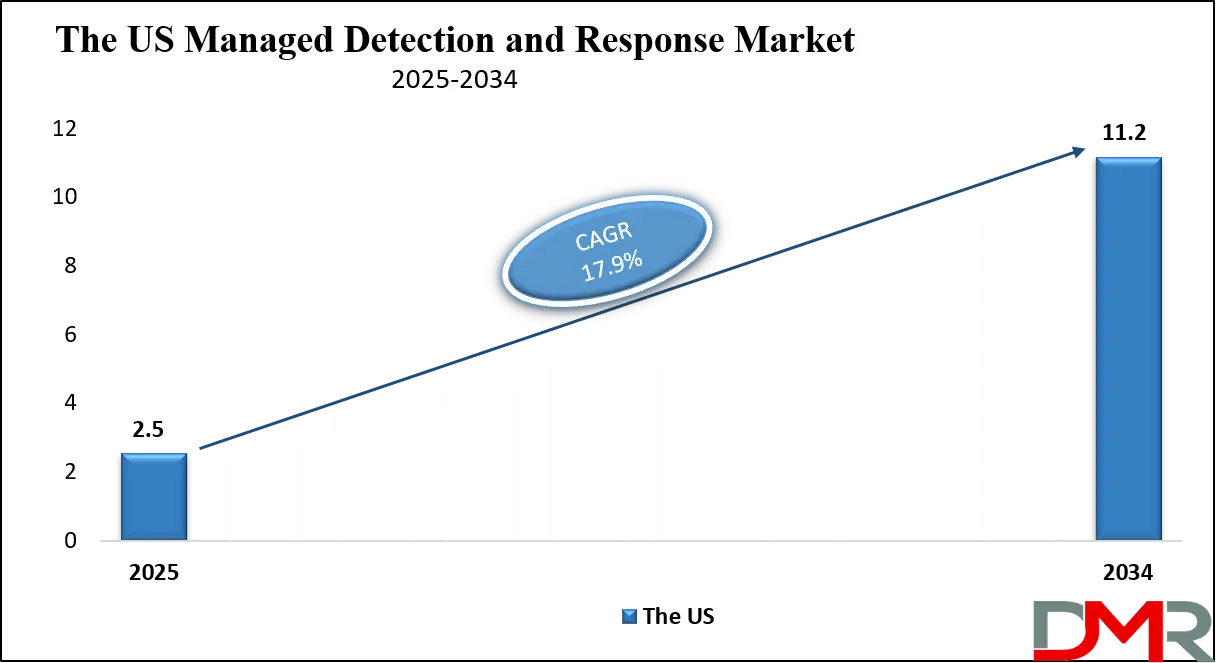

The US Managed Detection and Response Market is projected to be valued at USD 2.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 11.2 billion in 2034 at a CAGR of 17.9%.

The US Managed Detection and Response market is witnessing robust growth driven by the escalating frequency of sophisticated cyberattacks, ransomware incidents, and data breaches targeting critical infrastructure, enterprises, and government networks. With organizations rapidly adopting digital transformation and hybrid work environments, the complexity of IT ecosystems has increased, leading to heightened demand for advanced threat detection and incident response capabilities.

US enterprises are increasingly turning to managed detection and response providers to gain 24x7 monitoring, real-time threat hunting, and rapid remediation without the need to build costly in-house security operations centers. The strong presence of cybersecurity leaders, government-driven cybersecurity regulations, and rapid deployment of cloud-based security platforms are further fueling MDR adoption across the United States.

In addition, the growing emphasis on Zero Trust architecture, AI-driven threat intelligence, and integration with extended detection and response (XDR) solutions is transforming the US MDR landscape. Industries such as banking, healthcare, manufacturing, and technology are leading adopters due to their high exposure to data theft and compliance mandates such as HIPAA, PCI DSS, and CISA guidelines.

Service providers are enhancing their MDR offerings with automation, behavioral analytics, and machine learning to improve threat visibility and accelerate response times. As cyber risks continue to evolve, the US managed detection and response market is positioned as a critical component of enterprise cybersecurity strategy, ensuring proactive defense and resilience against emerging digital threats.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Managed Detection and Response Market

In 2025, the European Managed Detection and Response (MDR) market is projected to reach approximately USD 1.2 billion, reflecting a compound annual growth rate (CAGR) of 17.2%. This growth is fueled by the rising frequency and sophistication of cyber threats targeting enterprises across the region, including ransomware attacks, phishing campaigns, and advanced persistent threats.

Organizations are increasingly adopting MDR services to enhance continuous threat monitoring, AI-driven analytics, and rapid incident response across endpoints, networks, and cloud infrastructures. The ongoing digital transformation, growing cloud adoption, and the expansion of remote and hybrid work models are further driving the demand for proactive and managed cybersecurity solutions.

The European MDR market is also shaped by strong demand from industries such as banking, financial services, healthcare, and technology, which require real-time threat detection, regulatory compliance, and secure data management. Countries including Germany, the United Kingdom, and France are leading the growth, supported by strict cybersecurity regulations and growing enterprise investment in managed security operations.

MDR vendors are focusing on delivering scalable, AI-powered platforms that provide continuous visibility, actionable threat intelligence, and rapid response capabilities. This growth highlights Europe’s rising reliance on managed cybersecurity services to safeguard critical assets and ensure business continuity in an increasingly threat-prone digital environment.

Japan Managed Detection and Response Market

In 2025, the Japanese Managed Detection and Response (MDR) market is projected to reach approximately USD 200 million, with a compound annual growth rate (CAGR) of 14.6%. The market growth is driven by the growing adoption of digital technologies, cloud computing, and IoT solutions across enterprises, which has expanded the cybersecurity attack surface.

Organizations in Japan are increasingly recognizing the need for continuous threat monitoring, rapid incident response, and AI-driven threat detection to protect sensitive data, critical infrastructure, and business operations from ransomware, phishing, and advanced persistent threats. The growing focus on cybersecurity resilience and proactive defense strategies is further accelerating MDR adoption in the region.

The Japanese MDR market is supported by demand from industries such as manufacturing, finance, healthcare, and IT services, where data security and regulatory compliance are critical. Companies are investing in managed cybersecurity solutions to ensure real-time threat detection, compliance with data protection regulations, and operational continuity.

MDR providers in Japan are emphasizing scalable, AI-enabled platforms that integrate endpoint security, network monitoring, and cloud protection, enabling enterprises to respond quickly to emerging threats. This steady growth highlights Japan’s growing reliance on managed detection and response services as part of its broader digital and cybersecurity strategy.

Global Managed Detection and Response Market: Key Takeaways

- Market Value: The global Managed Detection and Response market size is expected to reach a value of USD 32.3 billion by 2034 from a base value of USD 6.7 billion in 2025 at a CAGR of 19.1%.

- By Component Segment Analysis: Services are expected to maintain their dominance in the component segment, capturing 85.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based mode will dominate the deployment mode segment, capturing 60.0% of the market share in 2025.

- By Service Type Segment Analysis: Threat Detection & Monitoring services are anticipated to dominate the service type segment, capturing 30.0% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises will dominate the organization size segment, capturing 55.0% of the market share in 2025.

- By Security Type Segment Analysis: Endpoint Security will account for the maximum share in the security type segment, capturing 30.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry will dominate the industry vertical segment, capturing 20.0% of the market share in 2025.

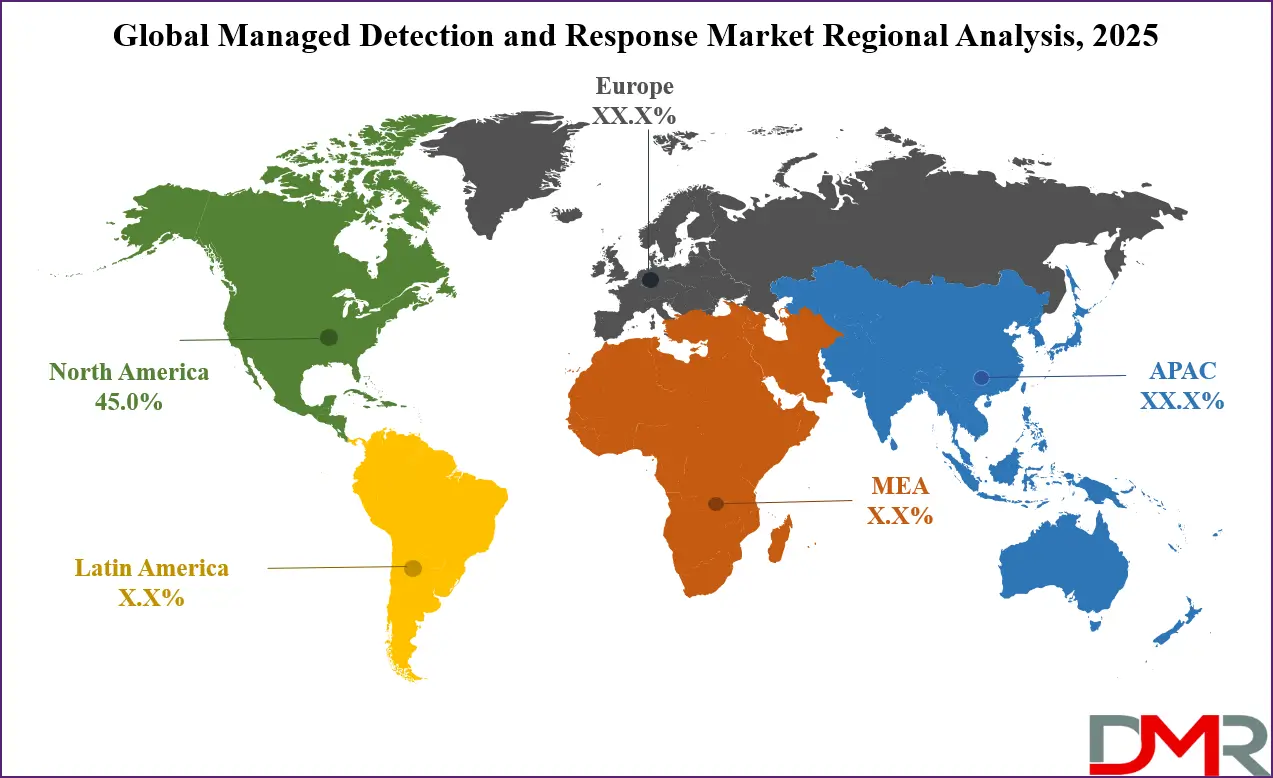

- Regional Analysis: North America is anticipated to lead the global Managed Detection and Response market landscape with 45.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Managed Detection and Response market include CrowdStrike Holdings, Inc., Palo Alto Networks, Inc., IBM Corporation, Cisco Systems, Inc., Rapid7, Inc., Sophos Ltd., Arctic Wolf Networks, Inc., Check Point Software Technologies Ltd., FireEye (now Trellix), SentinelOne, Inc., Secureworks, Inc., Atos SE, Deloitte Touche Tohmatsu Limited, Kroll, LLC, Trustwave Holdings, Inc., and Others.

Global Managed Detection and Response Market: Use Cases

- Proactive Threat Hunting and Incident Response: Managed Detection and Response solutions enable organizations to proactively identify and mitigate cyber threats before they cause damage. By using advanced analytics, AI-driven detection, and continuous monitoring, MDR providers help uncover hidden threats that bypass traditional firewalls and antivirus systems. This proactive approach minimizes dwell time, ensures faster containment of breaches, and enhances overall incident response efficiency. Enterprises benefit from 24x7 threat visibility, real-time response coordination, and reduced risk of ransomware and data loss.

- Cloud Security and Hybrid Infrastructure Protection: As organizations migrate workloads to cloud environments, the attack surface expands, making cloud-focused MDR services crucial. MDR platforms secure multi-cloud and hybrid infrastructures by monitoring cloud workloads, APIs, and identity access points for abnormal activities. They integrate with major platforms such as AWS, Microsoft Azure, and Google Cloud to deliver unified visibility and compliance assurance. This use case supports secure digital transformation while ensuring continuous cloud threat detection and remediation.

- Compliance Management and Regulatory Readiness: Enterprises in highly regulated industries such as BFSI, healthcare, and energy use MDR services to meet compliance standards like HIPAA, GDPR, PCI DSS, and ISO 27001. MDR solutions generate audit-ready reports, automate compliance tracking, and detect policy violations in real time. By maintaining continuous monitoring and security governance, MDR providers assist organizations in reducing regulatory risks, avoiding penalties, and aligning with evolving cybersecurity frameworks and data protection laws.

- Endpoint and Identity Protection for Remote Workforce: With the rise of remote and hybrid work models, MDR plays a key role in securing endpoints and user identities across distributed networks. MDR services use endpoint detection and response tools, behavioral analytics, and identity threat protection to identify compromised devices or stolen credentials. This ensures secure access control, reduces insider threat exposure, and maintains business continuity. The approach strengthens endpoint resilience and delivers adaptive defense against phishing, credential theft, and lateral movement attacks.

Impact of Artificial Intelligence on the global Managed Detection and Response market

The impact of artificial intelligence on the global Managed Detection and Response market has been transformative, reshaping how organizations detect, analyze, and respond to cyber threats. AI-driven analytics, machine learning algorithms, and behavioral modeling enable MDR providers to identify complex attack patterns and anomalous activities that traditional security tools often miss.

These capabilities allow for faster threat detection, reduced false positives, and automated incident response, enhancing the efficiency of security operations centers. By integrating AI, MDR solutions can continuously learn from evolving threats, improve predictive capabilities, and provide proactive defense across endpoints, networks, cloud environments, and applications.

Artificial intelligence also enables scalability and cost efficiency in the MDR market by automating routine monitoring and response tasks, allowing security analysts to focus on high-priority incidents and strategic threat mitigation. Industries such as banking, healthcare, and IT increasingly rely on AI-powered MDR to protect sensitive data, comply with regulatory requirements, and defend against advanced persistent threats, ransomware, and phishing attacks.

Furthermore, AI integration supports extended detection and response (XDR) frameworks, unifying telemetry from multiple sources to deliver holistic threat intelligence and real-time mitigation strategies. This growing reliance on AI is driving market growth, innovation, and adoption of managed cybersecurity services globally.

Global Managed Detection and Response Market: Stats & Facts

U.S. Government Accountability Office (GAO)

- Federal agencies reported 32,211 information security incidents in fiscal year 2023.

- The mean time to resolve cybersecurity incidents across federal agencies was 20 days in 2023.

- U.S. Cybersecurity and Infrastructure Security Agency (CISA)

- A U.S. government shutdown in October 2025 led to the furlough of most CISA staff, retaining only 889 eployees, or 35% of its workforce.

- The expiration of the CISA 2015 law during the shutdown reduced legal protections for companies sharing cyber threat intelligence.

European Union Agency for Cybersecurity (ENISA)

- Disruptive cyberattacks in the European Union doubled from the fourth quarter of 2023 to the first quarter of 2024.

- Many of these attacks were linked to groups backed by Russia, with increased activity following the invasion of Ukraine in February 2022.

U.S. Department of Homeland Security

- The Department of Homeland Security reported a 30% increase in cybersecurity incidents from 2023 to 2024.

- The average time to detect a cybersecurity breach in federal agencies was 45 days in 2024.

U.S. Federal Trade Commission (FTC)

- The FTC received 15,000 reports of cyber fraud in 2023, with a 25% increase in such reports in 2024.

- The financial losses from cyber fraud reported to the FTC totaled USD 50 million in 2023, rising to USD 62.5 million in 2024.

U.S. Department of Defense (DoD)

- The DoD identified 5,000 cybersecurity vulnerabilities in its systems in 2023, with a 20% increase in 2024.

- The average time to patch critical vulnerabilities in DoD systems was 60 days in 2023, improving to 50 days in 2024.

U.S. National Institute of Standards and Technology (NIST)

- NIST published 12 new cybersecurity frameworks in 2023, with an additional 15 released in 2024.

- The adoption rate of NIST's cybersecurity frameworks among federal agencies increased from 70% in 2023 to 85% in 2024.

U.S. Federal Communications Commission (FCC)

- The FCC reported a 40% increase in cyberattacks targeting telecommunications infrastructure from 2023 to 2024.

- The number of reported data breaches in the telecommunications sector rose from 200 in 2023 to 280 in 2024.

Global Managed Detection and Response Market: Market Dynamics

Global Managed Detection and Response Market: Driving Factors

Rising Frequency and Complexity of Cyber Threats

The growing volume of sophisticated cyberattacks, including ransomware, phishing, and advanced persistent threats, is compelling organizations to adopt proactive security measures. Managed Detection and Response services provide continuous threat monitoring, behavioral analytics, and rapid incident response to protect enterprise networks, cloud environments, and endpoints. The growing reliance on digital transformation, cloud computing, and remote workforces has expanded attack surfaces, making MDR solutions critical for enterprise cybersecurity strategies and regulatory compliance.

Shortage of Skilled Cybersecurity Professionals

The global shortage of trained cybersecurity experts limits the ability of organizations to maintain effective in-house security operations. MDR providers bridge this gap by offering 24x7 security operations center support, expert threat hunting, and AI-driven analytics. This ensures businesses can detect, analyze, and respond to threats without investing heavily in internal SOC teams, reducing operational costs while enhancing overall threat intelligence and security posture.

Global Managed Detection and Response Market: Restraints

High Implementation Costs

Adopting managed detection and response solutions often requires significant investment in subscription fees, integration with existing security tools, and employee training. Small and medium-sized enterprises may face challenges in allocating budgets for MDR adoption, which can limit market penetration despite the growing need for proactive cybersecurity solutions.

Integration Challenges with Legacy Systems

Organizations with complex legacy IT environments and on-premises infrastructures may face difficulties integrating MDR services. Ensuring seamless interoperability with existing security tools, SIEM platforms, and cloud applications can slow deployment and reduce the effectiveness of threat detection and response operations, acting as a barrier to widespread adoption.

Global Managed Detection and Response Market: Opportunities

Expansion in Cloud and Hybrid Environments

The accelerated adoption of cloud computing, multi-cloud strategies, and hybrid IT infrastructures presents significant growth potential for MDR providers. Securing cloud workloads, APIs, and virtual networks through AI-driven threat detection and automated incident response offers enterprises a proactive security layer, making MDR services essential for digital transformation initiatives and compliance with data protection regulations.

Integration of Artificial Intelligence and Automation

The integration of AI, machine learning, and automation into MDR services enhances threat detection, predictive analytics, and response efficiency. By reducing manual intervention and improving real-time threat intelligence, MDR providers can deliver scalable and cost-effective solutions. This creates opportunities to offer industry-specific packages, including healthcare, BFSI, and manufacturing-focused MDR solutions, expanding market reach.

Global Managed Detection and Response Market: Trends

Adoption of Extended Detection and Response (XDR) Capabilities

MDR providers are increasingly integrating XDR frameworks that unify telemetry across endpoints, networks, cloud workloads, and identity systems. This trend enables a more holistic view of the threat landscape, allowing faster detection, contextual analysis, and coordinated response across multiple attack vectors, strengthening enterprise cybersecurity resilience.

Focus on Compliance-Driven Security Services

With stringent regulations such as HIPAA, GDPR, PCI DSS, and CISA guidelines, organizations are prioritizing compliance-driven MDR adoption. Providers are offering tailored solutions that generate audit-ready reports, continuously monitor security controls, and align with regulatory frameworks. This trend not only reduces regulatory risks but also reinforces trust with customers and stakeholders, boosting MDR adoption across regulated industries.

Global Managed Detection and Response Market: Research Scope and Analysis

By Component Analysis

In the Managed Detection and Response market, the services segment is expected to continue its dominant position, capturing approximately 85.0% of the total market share in 2025. This dominance is driven by the growing complexity of cyber threats, the rising frequency of ransomware attacks, and the shortage of skilled cybersecurity professionals in organizations.

Services such as 24x7 threat monitoring, incident response, threat intelligence, and proactive threat hunting are critical for enterprises to protect their networks, cloud environments, and endpoints. Managed services offer continuous visibility into potential threats, reduce the dwell time of attacks, and provide rapid mitigation without requiring organizations to maintain costly in-house security operations centers, making them the preferred choice for large and medium-sized businesses.

Solutions in this market segment refer to the software and platform-based tools that organizations can deploy to enhance their threat detection and response capabilities. These include endpoint detection and response (EDR) platforms, network monitoring tools, and security analytics software that support automated threat detection, real-time alerting, and integration with existing IT infrastructure.

While solutions account for a smaller portion of the market compared to managed services, they are increasingly adopted by organizations seeking a more hands-on approach or those that prefer a hybrid model combining in-house capabilities with external MDR support. Solutions provide flexibility, scalability, and centralized management of security operations, allowing businesses to customize threat detection workflows and integrate advanced analytics and AI-based monitoring to improve their overall cybersecurity posture.

By Deployment Mode Analysis

In the Managed Detection and Response market, the cloud-based deployment mode is expected to dominate, capturing around 60.0% of the market share in 2025. The preference for cloud-based MDR solutions is largely driven by the growing adoption of cloud computing, multi-cloud strategies, and remote work environments across organizations. Cloud deployment offers scalability, flexibility, and cost efficiency, enabling businesses to access advanced threat detection, continuous monitoring, and rapid incident response without investing heavily in on-premises infrastructure.

Additionally, cloud-based MDR platforms integrate seamlessly with existing cloud workloads and applications, providing centralized visibility and real-time threat intelligence, which is crucial for organizations managing dynamic IT environments and seeking proactive cybersecurity solutions.

The hybrid deployment mode in the MDR market combines elements of both cloud-based and on-premises solutions, allowing organizations to maintain certain critical security operations in-house while leveraging the scalability and flexibility of cloud platforms. This approach is particularly beneficial for enterprises with complex IT infrastructures, regulatory constraints, or legacy systems that require on-premises management.

Hybrid deployment enables organizations to customize their security strategy, ensuring sensitive data remains protected locally while still benefiting from advanced analytics, AI-driven threat detection, and continuous monitoring provided by cloud-based MDR services. It offers a balance between control, compliance, and operational efficiency, making it an attractive option for businesses transitioning to cloud environments gradually.

By Service Type Analysis

In the Managed Detection and Response market, threat detection and monitoring services are expected to lead the service type segment, capturing approximately 30.0% of the total market share in 2025. These services are critical for organizations aiming to continuously identify potential cyber threats across endpoints, networks, and cloud environments. By leveraging advanced analytics, machine learning, and behavioral monitoring, threat detection and monitoring solutions enable enterprises to uncover hidden attacks, unusual patterns, and vulnerabilities that traditional security tools may miss.

Continuous monitoring ensures early warning of security incidents, reduces the dwell time of attacks, and allows security teams to take proactive measures to mitigate risks before they escalate into significant breaches. This high level of vigilance is particularly essential in industries with sensitive data and strict regulatory requirements, where even minor security lapses can have severe consequences.

Incident response services in the MDR market focus on the rapid containment, investigation, and remediation of detected threats. Once a security incident is identified, incident response teams coordinate immediate actions to isolate affected systems, neutralize malware, and prevent lateral movement of attackers within the network.

These services also include forensic analysis to determine the root cause of breaches, report generation for compliance, and guidance for improving overall security posture. By providing structured and expert-led response protocols, incident response services help organizations minimize operational disruption, protect critical assets, and enhance resilience against future attacks, making them an integral part of a comprehensive managed detection and response strategy.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

In the Managed Detection and Response market, large enterprises are expected to dominate the organization size segment, capturing around 55.0% of the market share in 2025. This dominance is driven by the complexity and scale of their IT infrastructures, higher exposure to sophisticated cyber threats, and stringent regulatory compliance requirements.

Large organizations often manage multiple networks, cloud environments, and endpoints across geographies, which increases the need for 24x7 monitoring, advanced threat detection, and rapid incident response. By leveraging MDR services, these enterprises can strengthen their security posture, reduce the risk of data breaches, and ensure business continuity while optimizing security operations without heavily expanding internal SOC teams.

Small and medium-sized enterprises (SMEs) in the MDR market are increasingly adopting managed detection and response solutions to compensate for limited in-house cybersecurity resources. SMEs often face challenges such as a shortage of skilled security professionals, budget constraints, and lack of advanced security infrastructure.

MDR services provide these businesses with access to expert threat monitoring, AI-driven analytics, and incident response capabilities that would otherwise be costly or complex to implement internally. By outsourcing cybersecurity operations, SMEs can protect critical data, maintain regulatory compliance, and respond promptly to emerging threats, enabling them to compete securely in an increasingly digital and threat-prone business environment.

By Security Type Analysis

In the Managed Detection and Response market, endpoint security is expected to account for the largest share in the security type segment, capturing around 30.0% of the market share in 2025. This is primarily due to the growing reliance on remote work, mobile devices, and distributed IT environments, which expand the attack surface for organizations.

Endpoint security services monitor and protect workstations, laptops, servers, and mobile devices from malware, ransomware, and unauthorized access. By integrating with MDR platforms, endpoint security enables continuous threat detection, real-time alerting, and rapid response to suspicious activities, helping organizations safeguard sensitive data and maintain operational continuity across all endpoints.

Network security in the MDR market focuses on protecting the communication infrastructure, including corporate networks, cloud connections, and virtual private networks, from unauthorized access, intrusions, and data exfiltration. MDR solutions analyze network traffic, detect anomalies, and identify potential attacks such as lateral movement, DDoS attempts, and advanced persistent threats. By continuously monitoring and securing network communications, organizations can prevent the spread of malware, detect compromised devices, and maintain the integrity and confidentiality of their data. Network security services complement endpoint protection and form a critical layer in a holistic cybersecurity strategy, particularly for large enterprises and highly regulated industries.

By Industry Vertical Analysis

In the Managed Detection and Response market, the Banking, Financial Services, and Insurance (BFSI) industry is expected to dominate the industry vertical segment, capturing approximately 20.0% of the market share in 2025. The dominance of BFSI is driven by the high volume of sensitive financial data, growing digital transactions, and the rising frequency of cyberattacks targeting financial institutions.

Managed detection and response services provide continuous threat monitoring, AI-driven analytics, and rapid incident response to protect against ransomware, phishing, and other sophisticated attacks. BFSI organizations also rely on MDR solutions to ensure regulatory compliance with standards such as PCI DSS, GLBA, and SOX, while maintaining customer trust and operational resilience in an increasingly digital financial ecosystem.

The government and defense sector in the MDR market requires advanced cybersecurity measures to safeguard critical national infrastructure, confidential information, and sensitive defense networks. MDR solutions deployed in this sector focus on continuous monitoring, threat intelligence, and proactive incident response to counter cyber espionage, state-sponsored attacks, and advanced persistent threats.

These services also support compliance with national cybersecurity frameworks, data protection regulations, and security guidelines. By leveraging MDR, government agencies and defense organizations can enhance network visibility, strengthen security posture, and ensure the integrity of operations against evolving cyber threats, making MDR a critical component of national and organizational defense strategies.

The Managed Detection and Response Market Report is segmented on the basis of the following:

By Component

By Deployment Mode

- Cloud-based

- Hybrid

- On-premises

By Service Type

- Threat Detection & Monitoring

- Incident Response

- Threat Intelligence

- Security Analytics

- Risk & Compliance Management

By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

By Security Type

- Network Security

- Endpoint Security

- Cloud Security

- Application Security

- Identity & Access Security

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Government & Defense

- IT & Telecom

- Healthcare & Life Sciences

- Manufacturing

- Retail & E-commerce

- Energy & Utilities

- Others

Global Managed Detection and Response Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global Managed Detection and Response market, accounting for approximately 45.0% of total market revenue in 2025. The region’s dominance is driven by the presence of a large number of established cybersecurity vendors, widespread adoption of advanced security technologies, and growing frequency of sophisticated cyberattacks targeting enterprises and critical infrastructure.

The rapid shift toward cloud computing, remote work, and digital transformation initiatives has expanded the attack surface, fueling demand for 24x7 threat monitoring, incident response, and AI-driven security operations. Strong regulatory frameworks, cybersecurity awareness, and significant investments in managed security services further reinforce North America’s position as the largest regional market for MDR solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the global Managed Detection and Response market over the coming years. Rapid digital transformation, growing adoption of cloud computing, and the expansion of IT infrastructure across countries like India, China, Japan, and Australia are driving the demand for advanced threat detection and incident response services.

Rising cybercrime, growing awareness of cybersecurity risks, and the need to comply with emerging data protection regulations are prompting enterprises and government organizations to adopt MDR solutions. Additionally, the growing presence of global MDR vendors and investments in AI-driven and automated security platforms are contributing to the accelerated market growth in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Managed Detection and Response Market: Competitive Landscape

The global Managed Detection and Response market is highly competitive, driven by the growing demand for proactive cybersecurity solutions and advanced threat intelligence. Key players focus on offering scalable, AI-powered platforms that provide continuous threat monitoring, rapid incident response, and seamless integration with enterprise IT environments.

The market is also shaped by innovation in automation, behavioral analytics, and extended detection and response capabilities, enabling organizations to detect complex threats across endpoints, networks, and cloud workloads. Strategic partnerships and technology enhancements are further intensifying competition, as providers strive to deliver comprehensive, cost-effective, and industry-specific MDR solutions to meet the evolving cybersecurity needs of enterprises globally.

Some of the prominent players in the global Managed Detection and Response market are:

- CrowdStrike Holdings, Inc.

- Palo Alto Networks, Inc.

- IBM Corporation

- Cisco Systems, Inc.

- Rapid7, Inc.

- Sophos Ltd.

- Arctic Wolf Networks, Inc.

- Check Point Software Technologies Ltd.

- FireEye (now Trellix)

- SentinelOne, Inc.

- Secureworks, Inc.

- Atos SE

- Deloitte Touche Tohmatsu Limited

- Kroll, LLC

- Trustwave Holdings, Inc.

- eSentire, Inc.

- Red Canary, Inc.

- Kudelski Security

- Binary Defense Systems

- NTT Security

- Other Key Players

Global Managed Detection and Response Market: Recent Developments

- October 2025: LevelBlue announced its acquisition of Cybereason, aiming to expand its leadership in MDR, XDR, incident response, and threat intelligence services.

- May 2025: Wirespeed, a cybersecurity startup, secured seed funding to accelerate its mission to modernize MDR services, focusing on innovative threat detection solutions.

- July 2024: Secureworks launched Taegis™ ManagedXDR Plus, a new MDR offering designed to provide mid-market organizations with tailored security solutions that meet their unique requirements.

- June 2024: AirMDR closed a USD 5 million funding round to advance its AI-native MDR service, enhancing its capabilities in threat detection and response.

- June 2024: Darktrace introduced a new Managed Detection and Response service that combines AI-powered threat containment with 24/7 human expert support, enhancing security operations for enterprises.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.7 Bn |

| Forecast Value (2034) |

USD 32.3 Bn |

| CAGR (2025–2034) |

19.1% |

| The US Market Size (2025) |

USD 2.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

The Managed Detection and Response market can be segmented as follows: By Component (Services, Solutions), By Deployment Mode (Cloud-based, Hybrid, On-premises), By Service Type (Threat Detection & Monitoring, Incident Response, Threat Intelligence, Security Analytics, Risk & Compliance Management), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises), By Security Type (Network Security, Endpoint Security, Cloud Security, Application Security, Identity & Access Security), By Industry Vertical (Banking, Financial Services, and Insurance, Government & Defense, IT & Telecom, Healthcare & Life Sciences, Manufacturing, Retail & E-commerce, Energy & Utilities, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

CrowdStrike Holdings, Inc., Palo Alto Networks, Inc., IBM Corporation, Cisco Systems, Inc., Rapid7, Inc., Sophos Ltd., Arctic Wolf Networks, Inc., Check Point Software Technologies Ltd., FireEye (now Trellix), SentinelOne, Inc., Secureworks, Inc., Atos SE, Deloitte Touche Tohmatsu Limited, Kroll, LLC, Trustwave Holdings, Inc., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |