Market Overview

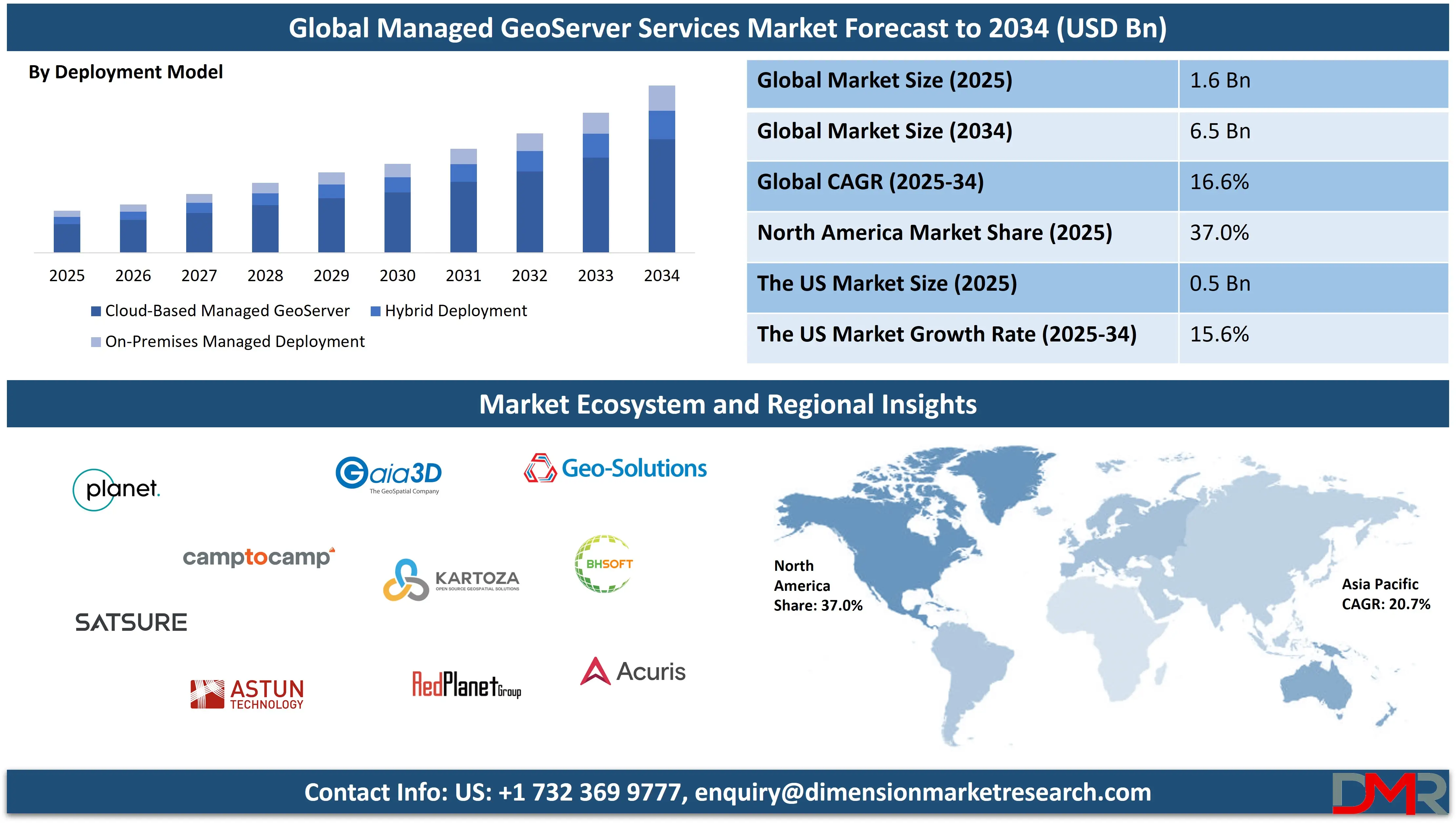

The global Managed GeoServer Services Market was valued at USD 1.6 billion in 2025 and is projected to reach USD 6.5 billion by 2034, growing at a CAGR of 16.6%, driven by rising adoption of cloud based GIS solutions increasing demand for managed geospatial infrastructure web mapping services spatial data management and enterprise location intelligence across public and private sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Managed GeoServer Services refer to outsourced professional services that handle the deployment configuration operation optimization and ongoing management of GeoServer based geospatial infrastructures for organizations. These services cover activities such as server setup spatial data publishing performance tuning security management system upgrades integration with GIS platforms cloud environments and enterprise applications and continuous technical support. By leveraging managed services organizations can ensure high availability scalable map services efficient handling of geospatial data compliance with open standards and reduced dependency on in house GIS expertise while focusing on core operational and analytical objectives.

The global Managed GeoServer Services Market represents the collective demand for third party service providers delivering end to end management of GeoServer environments across public sector enterprises and commercial industries worldwide. The market is driven by increasing adoption of web based GIS solutions growth in spatial data volumes expansion of smart city initiatives and rising use of location intelligence across transportation utilities agriculture environmental monitoring and urban planning. Organizations are increasingly outsourcing GeoServer operations to achieve cost efficiency improved system reliability faster deployment cycles and seamless scalability across cloud and hybrid infrastructures.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition the global market is shaped by trends such as cloud native GIS adoption integration of GeoServer with data analytics and visualization tools growing emphasis on real time geospatial insights and stricter data governance requirements. Service providers are focusing on value added offerings including performance optimization security hardening API enablement and customized spatial workflows to meet diverse industry needs. As geospatial technologies become central to digital transformation strategies the Managed GeoServer Services Market continues to expand across both mature and emerging regions supported by increasing investments in geospatial intelligence and digital infrastructure.

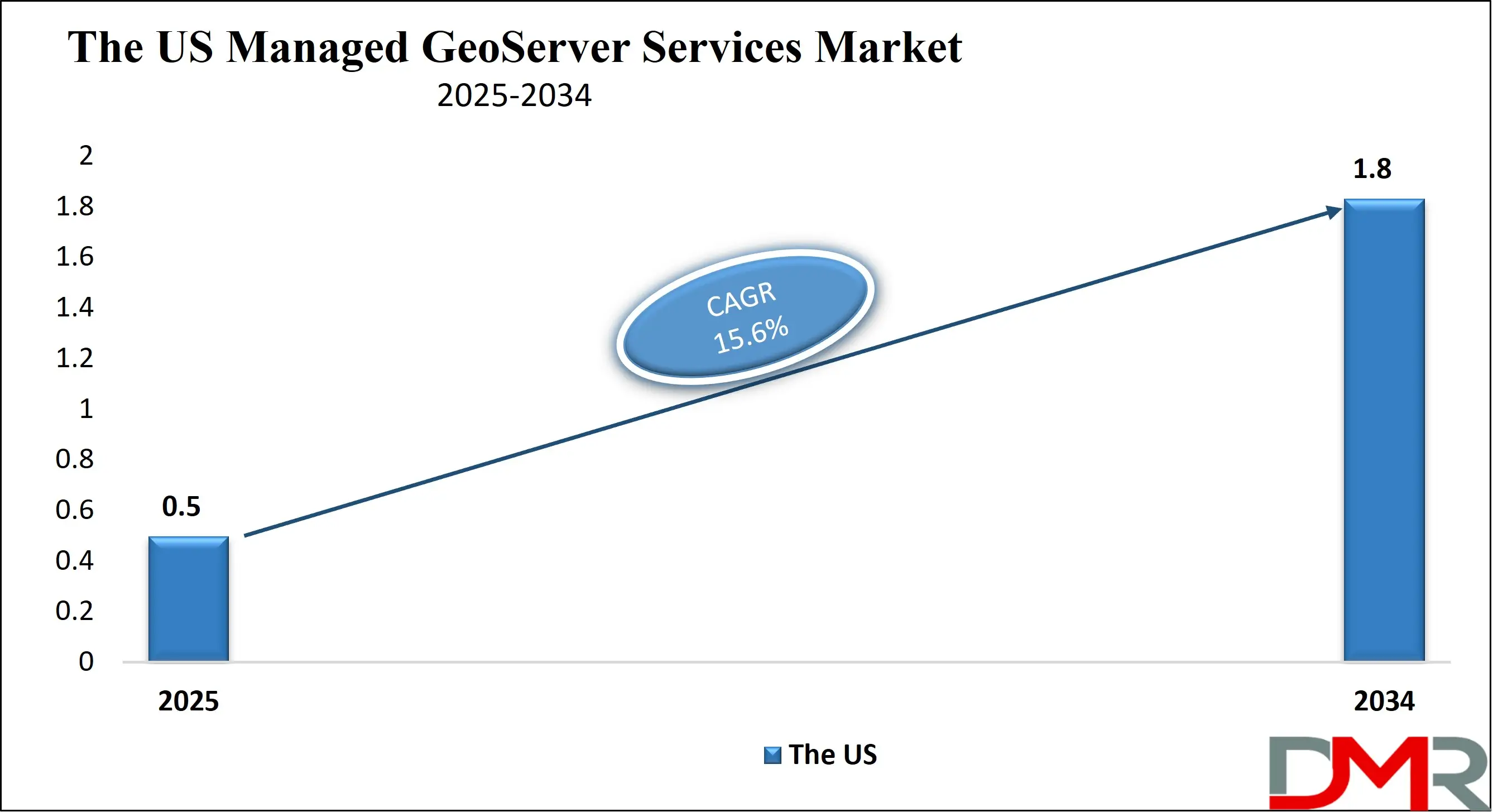

The US Managed GeoServer Services Market

The U.S. Managed GeoServer Services Market size was valued at USD 0.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.8 billion in 2034 at a CAGR of 15.6%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Managed GeoServer Services Market is driven by strong adoption of advanced geospatial technologies across government agencies, transportation authorities, utilities, and large enterprises. Federal and state level investments in smart infrastructure, disaster preparedness, land management, and defense related geospatial systems are accelerating demand for professionally managed GeoServer environments. Organizations increasingly prefer managed services to ensure high system availability, regulatory compliance, cybersecurity, and seamless integration with cloud platforms and enterprise GIS applications. The presence of a mature GIS ecosystem and strong cloud adoption further supports sustained market expansion.

In addition, the US market benefits from growing use of location intelligence, real time spatial analytics, and web based mapping solutions across commercial sectors such as logistics, energy, agriculture, and telecom. Rising spatial data volumes and the need for scalable performance optimized geospatial servers are pushing enterprises toward outsourced GeoServer management. Service providers in the US are focusing on advanced offerings including cloud native deployments, API enablement, security hardening, and performance tuning. Continuous innovation in geospatial analytics and digital transformation initiatives positions the US as a key revenue contributor globally.

Europe Managed GeoServer Services Market

The Europe Managed GeoServer Services Market was valued at approximately USD 480 million in 2025, reflecting a strong demand for geospatial data management and cloud based GIS solutions across government, transportation, utilities, and commercial sectors. The region has witnessed significant adoption of managed GeoServer deployments to support urban planning, smart city initiatives, environmental monitoring, and infrastructure management. Organizations are increasingly relying on managed services to ensure high availability, performance optimization, and secure access to spatial data while reducing operational complexity and internal GIS maintenance costs.

The market in Europe is projected to grow at a CAGR of 14.6%, driven by rising investments in digital infrastructure, cloud adoption, and integration of advanced analytics with geospatial platforms. Expansion of smart city projects, growing use of real time mapping and location intelligence, and regulatory compliance requirements are further boosting market growth. Service providers are enhancing their offerings with cloud native deployments, hybrid integration, and AI enabled geospatial analytics to meet evolving demands, positioning Europe as a key regional contributor in the global Managed GeoServer Services landscape.

Japan Managed GeoServer Services Market

The Japan Managed GeoServer Services Market was valued at approximately USD 96 million in 2025, reflecting increasing adoption of geospatial technologies across government agencies, utilities, transportation, and private enterprises. The country’s focus on smart infrastructure, disaster management, precision agriculture, and urban planning has driven demand for managed GeoServer deployments that ensure reliable, scalable, and secure spatial data management. Organizations are leveraging these services to integrate geospatial data with analytics platforms, optimize workflows, and maintain high performance for web based GIS applications.

The market in Japan is projected to grow at a robust CAGR of 17.8%, supported by rapid digital transformation initiatives, cloud adoption, and the integration of AI and machine learning into geospatial workflows. Rising investments in IoT enabled infrastructure, real time mapping, and location intelligence applications further accelerate market expansion. Managed service providers are increasingly offering hybrid and cloud native GeoServer solutions with enhanced security, performance tuning, and automated data management to meet the evolving requirements of enterprises and public sector organizations, positioning Japan as a high growth regional market within the global landscape.

Global Managed GeoServer Services Market: Key Takeaways

- Rapid Market Expansion Driven by Cloud and AI Adoption: The market is growing fast due to cloud GIS adoption, hybrid deployments, and AI‑powered spatial analytics, enabling scalable, efficient, and real time geospatial services.

- Large Enterprises and Government Agencies Lead Demand: Large organizations and public sector agencies dominate demand for high availability, secure GeoServer management, compliance, and reduced reliance on internal GIS teams.

- Regional Growth Highlights Mature and Emerging Markets: North America leads, while Asia Pacific and Japan show high growth from smart city initiatives, IoT adoption, and digital transformation; Europe grows steadily via cloud and analytics investment.

- Diverse Applications across Industries Fuel Market Potential: Key applications include urban planning, transportation, environmental monitoring, and disaster management, with utilities and commercial sectors leveraging geospatial data for real time decision making.

- Innovation, Security, and Service Differentiation are Key Competitive Factors: Providers focus on cloud/hybrid deployments, AI analytics, security, and performance, with strategic partnerships, acquisitions, and funding enhancing global capabilities.

Global Managed GeoServer Services Market: Use Cases

- Smart City and Urban Planning: Managed GeoServer Services enable governments and municipalities to publish and manage geospatial data for land use infrastructure utilities and zoning through web based GIS platforms. Managed deployment ensures scalability data security and reliable map services supporting smart city initiatives spatial analysis and urban decision making.

- Transportation and Logistics Optimization: Transportation authorities and logistics providers use managed GeoServer environments for route planning traffic visualization and network analysis. Outsourced GeoServer management ensures real time spatial data availability performance optimization and seamless integration with location intelligence systems.

- Environmental Monitoring and Resource Management: Managed GeoServer Services support environmental agencies in mapping land cover climate data and natural resources. Centralized geospatial data management improves data accessibility analysis accuracy and long term monitoring while ensuring compliance and system reliability.

- Disaster Management and Emergency Response: Emergency response organizations use managed GeoServer platforms to visualize risk zones incident locations and response routes. Managed services enable high availability secure access and rapid data updates critical for real time disaster planning response coordination and recovery efforts.

Impact of Artificial Intelligence on the global Managed GeoServer Services market

The impact of artificial intelligence on the global Managed GeoServer Services market is enabling smarter, faster and more efficient geospatial data handling and service delivery. AI-driven automation is being integrated into managed workflows to improve spatial data classification, pattern recognition, and map rendering, reducing manual intervention and operational costs. Predictive analytics powered by machine learning enhances performance optimization by forecasting server load, enabling preemptive scaling and intelligent resource allocation across cloud and hybrid environments. AI also strengthens security monitoring by detecting anomalous activity in real time and mitigating risks to geospatial infrastructure.

Moreover, artificial intelligence is expanding the value of managed GeoServer services by enhancing interoperability with advanced analytics tools and geospatial platforms. Natural language processing and computer vision models help extract insights from unstructured spatial data such as satellite imagery, sensor feeds and survey inputs, enriching location intelligence offerings. These capabilities support more accurate decision making in applications like environmental monitoring, urban planning, and transportation routing and disaster response. As a result, service providers that embed AI into managed GeoServer offerings can deliver higher performance, deeper analytics and greater automation, driving broader adoption across industries.

Global Managed GeoServer Services Market: Stats & Facts

-

United Nations Global Statistical Geospatial Framework (UNGGIM / UNSD)

- The UN Integrated Geospatial Information Framework was adopted and expanded in its 2nd edition in 2025 to guide national statistical offices in integrating geospatial data into official statistics supporting sustainable development and evidence‑based policymaking.

-

Saudi Open Government Data Platform (Saudi Data & AI Authority)

- As of 2024, the Saudi Open Government Data Platform had integrated over 8,700 datasets from more than 230 government entities. As of 2025, this expanded to over 11,439 datasets from 289 organizations, supporting machine‑readable access and API data delivery.

-

Cloud Strategy – Central Statistics Office (Ireland)

- In 2023, Ireland’s Central Statistics Office initiated a structured cloud transition plan prioritizing public cloud solutions (SaaS and PaaS) to improve scalability, cost‑effectiveness, and data management.

-

U.S. Department of Transportation GIS Usage (Geospatial Data Act reporting)

- The U.S. Department of Transportation uses geospatial data operationally for transportation safety, infrastructure planning, and data sharing across federal and state agencies as part of compliance with the Geospatial Data Act of 2018 (reporting through 2024).

-

Connecticut State GIS Strategy

- The Connecticut Geospatial Strategic Plan 2023–2028 (updated in 2025) emphasizes annual GIS capacity building, stakeholder engagement, and coordinated management of geospatial data for statewide decision support.

-

National Spatial Data Infrastructure Alignments (U.S. DOT)

- The U.S. DOT GIS Strategic Plan 2026–2030 (released late 2025) aligns federal geospatial initiatives with the broader National Spatial Data Infrastructure (NSDI) strategic plan, reinforcing coordinated geospatial data usage across agencies.

-

SVAMITVA Scheme – India

- The Indian government’s SVAMITVA scheme (2021–2025) uses drone‑based surveys to map rural property boundaries; by 2025, approximately 6.62 lakh villages were surveyed under this initiative.

Global Managed GeoServer Services Market: Market Dynamics

Global Managed GeoServer Services Market: Driving Factors

Increasing Adoption of Cloud Based GIS and Spatial Data Platforms

Enterprises and governments are rapidly migrating geospatial infrastructure to cloud environments, driving demand for managed GeoServer services that offer scalable performance, automatic updates, and lower total cost of ownership. Managed services help organizations integrate GeoServer with cloud native solutions and enterprise GIS platforms, enabling real time spatial data access, analytics, and visualization across distributed teams.

Growing Demand for Location Intelligence and Real Time Map Services

The surge in location aware applications across logistics, utilities, agriculture and smart city programs is boosting the need for reliable geospatial data publishing and map services. Managed GeoServer environments allow organizations to deliver consistent map layers, routing data, and spatial analytics to end users without investing in in house GIS operations.

Global Managed GeoServer Services Market: Restraints

Shortage of Skilled Geospatial and Cloud Specialists

The complexity of configuring, optimizing, and securing GeoServer at scale often requires specialized GIS and cloud expertise that is in limited supply. This talent gap increases reliance on external managed service providers and slows adoption for organizations lacking access to qualified personnel.

Data Security and Compliance Concerns

Managing sensitive spatial information such as infrastructure layouts, land records, and emergency response maps raises concerns around data governance, access control, and regulatory compliance. Organizations in heavily regulated industries may be hesitant to outsource GeoServer management without robust security assurances and clear compliance frameworks.

Global Managed GeoServer Services Market: Opportunities

Integration with Artificial Intelligence and Machine Learning

Embedding AI and ML into managed GeoServer workflows enables advanced spatial analytics, predictive mapping, and automated anomaly detection. Service providers can offer enhanced location intelligence capabilities, enriching geospatial insights for sectors such as environmental monitoring, precision agriculture, and infrastructure planning.

Expansion in Emerging Markets and IoT Driven Applications

Emerging economies are accelerating investments in digital infrastructure and IoT devices that generate real time spatial data. Managed GeoServer services can capitalize on demand from utilities, transportation networks, and smart farming deployments that rely on sensor data, satellite imagery, and location based analytics for operational efficiency.

Global Managed GeoServer Services Market: Trends

Shift Toward Hybrid and Multi Cloud Managed Deployments

Organizations are increasingly adopting hybrid and multi cloud models to balance performance, cost, and data sovereignty. Managed GeoServer services now include seamless orchestration across private data centers and multiple cloud platforms, enabling flexible workload distribution and optimized geographic latency.

Emphasis on Real Time Spatial Analytics and Visualization

There is a growing focus on delivering real time mapping and analytics capabilities that support dynamic decision making. Managed GeoServer services are being enhanced with streaming data integration, interactive dashboards, and web based GIS interfaces that allow stakeholders to visualize changing spatial patterns, monitor assets, and respond quickly to events.

Global Managed GeoServer Services Market: Research Scope and Analysis

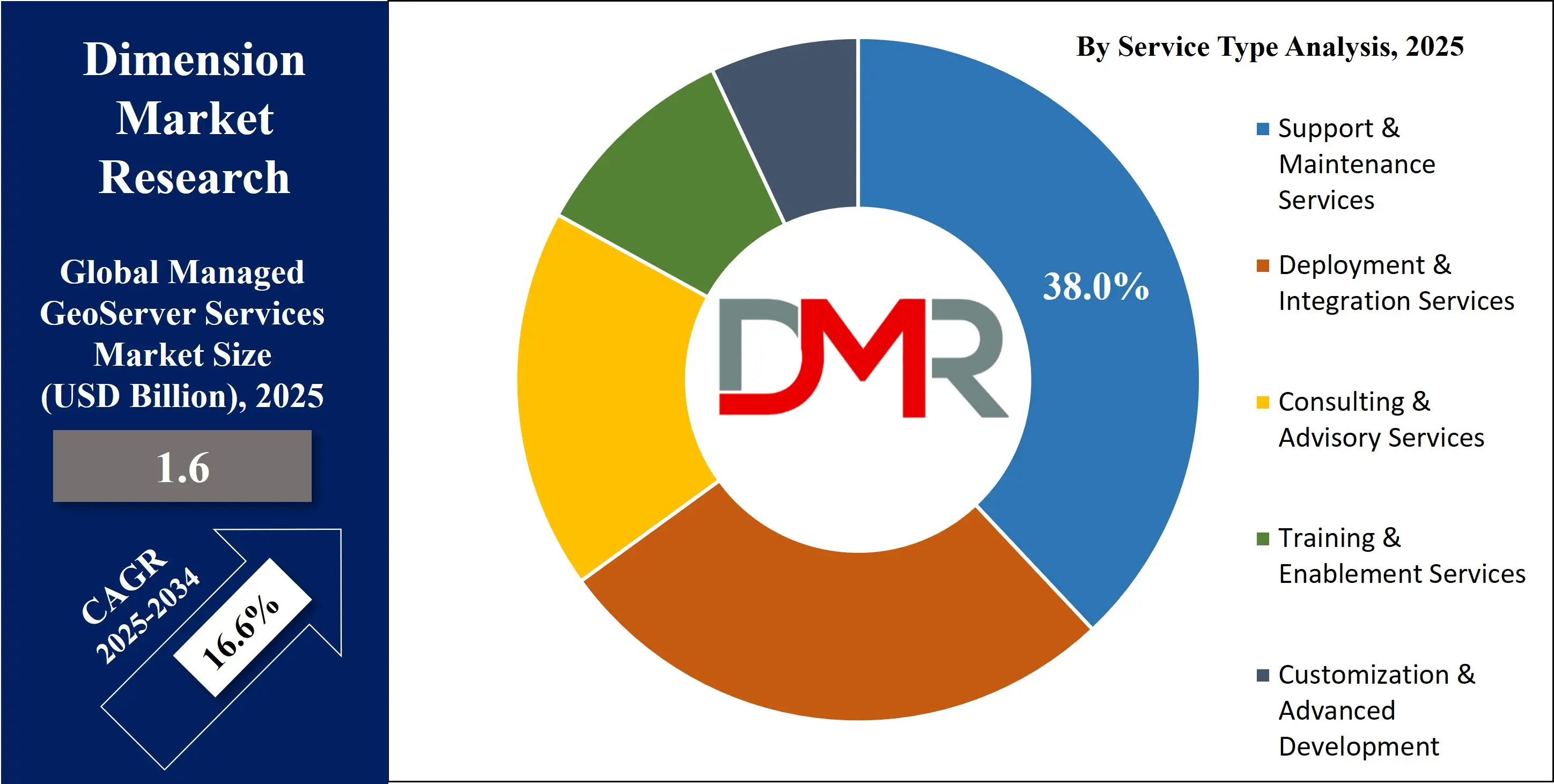

By Service Type Analysis

Support and Maintenance Services are anticipated to dominate the Service Type segment in the Managed GeoServer Services Market, capturing around 38.0% of the total market share in 2025, primarily due to the ongoing operational complexity of geospatial server environments. Organizations increasingly rely on continuous monitoring, performance optimization, security patching, version upgrades, and issue resolution to ensure uninterrupted access to web based GIS platforms and spatial data services. As GeoServer deployments support mission critical applications such as urban planning, transportation networks, and environmental monitoring, the need for high availability and reliable system performance drives sustained demand for long term support contracts. Managed support services also help organizations reduce internal GIS workload, control operational costs, and maintain compliance with evolving data governance and cybersecurity requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Deployment and Integration Services play a critical role in this market segment by enabling seamless implementation of GeoServer across cloud, hybrid, and on premises environments. These services focus on initial setup, configuration, data migration, and integration of GeoServer with enterprise GIS platforms, databases, APIs, and analytics tools. As organizations adopt cloud based GIS and location intelligence solutions, demand is rising for expert deployment services that ensure scalability, interoperability, and optimized performance from the outset. Integration services also support customization of geospatial workflows, allowing enterprises and public sector agencies to align GeoServer functionality with specific operational use cases and long term digital transformation goals.

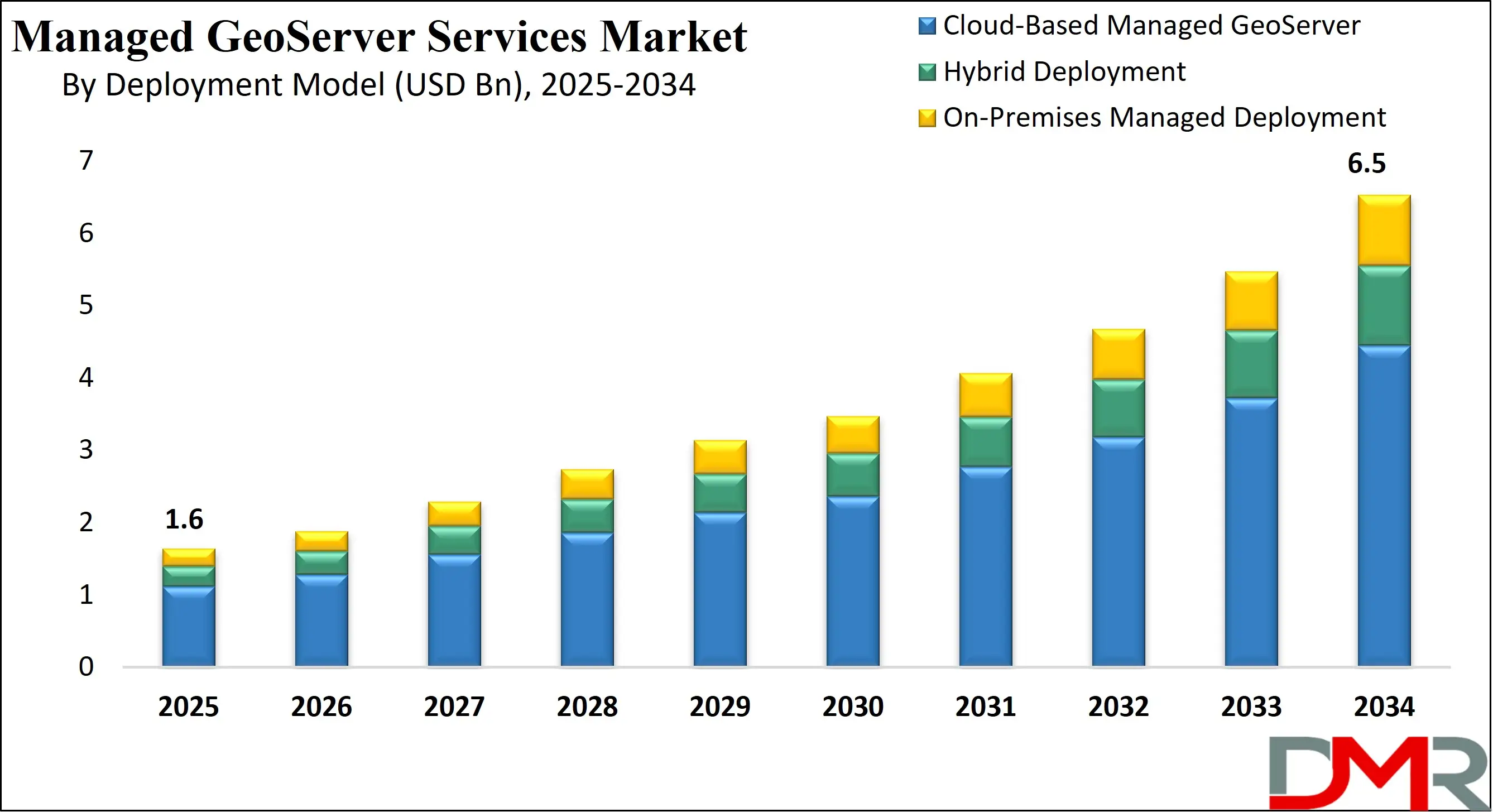

By Deployment Model Analysis

Cloud based Managed GeoServer deployments are anticipated to dominate the Deployment Model segment, accounting for approximately 68.0% of the total market share in 2025, driven by strong demand for scalable, flexible, and cost efficient geospatial infrastructure. Organizations across government and commercial sectors are increasingly adopting cloud based GIS platforms to handle growing spatial data volumes, support remote access, and enable real time map services. Managed cloud deployments allow automatic scaling, high availability, disaster recovery, and seamless integration with cloud analytics and storage services, reducing capital expenditure and accelerating deployment timelines while ensuring consistent performance for web mapping and location intelligence applications.

Hybrid deployment models also play a significant role in the Managed GeoServer Services Market, particularly for organizations balancing cloud adoption with data sovereignty and regulatory requirements. In hybrid environments, sensitive spatial datasets remain on premises while processing, visualization, and analytics are handled through cloud infrastructure. Managed hybrid GeoServer services help organizations optimize performance, maintain compliance, and enable gradual cloud migration without disrupting existing GIS operations. This approach is especially relevant for public sector agencies, utilities, and infrastructure operators that require secure data control alongside scalable and resilient geospatial service delivery.

By Organization Size Analysis

Large enterprises are anticipated to dominate the Organization Size segment in the Managed GeoServer Services Market, capturing around 73.0% of the total market share in 2025, due to their extensive geospatial data requirements and mission critical GIS operations. These organizations manage large scale spatial datasets across multiple departments and regions, supporting applications such as infrastructure management, transportation planning, environmental monitoring, and enterprise location intelligence. Managed GeoServer services enable large enterprises to ensure high availability, performance optimization, security compliance, and seamless integration with existing enterprise systems while reducing the complexity and cost of maintaining in house GIS infrastructure.

Small and medium enterprises also represent an important segment of the market as they increasingly adopt geospatial technologies to support operational efficiency and data driven decision making. SMEs often lack dedicated GIS teams and advanced IT resources, making managed GeoServer services an attractive option for accessing professional deployment, support, and maintenance without significant capital investment. By outsourcing GeoServer management, SMEs can leverage scalable cloud based GIS platforms, improve access to spatial analytics, and deploy web mapping solutions quickly while focusing resources on core business activities.

By Application Analysis

Transportation and logistics are anticipated to dominate the Application segment of the Managed GeoServer Services Market, capturing approximately 22.0% of the total market share in 2025, driven by the growing reliance on location based data for route optimization, fleet tracking, and network analysis. Organizations in this sector require reliable web based GIS platforms to visualize traffic conditions, logistics corridors, delivery routes, and infrastructure assets in real time. Managed GeoServer services ensure consistent performance, high availability, and seamless integration with navigation systems, IoT sensors, and analytics tools, enabling efficient operations and improved decision making across complex transportation networks.

Urban planning and smart cities represent another significant application area as governments and municipal authorities increasingly adopt geospatial technologies to manage urban growth and infrastructure development. Managed GeoServer platforms support the publishing and analysis of spatial data related to land use, zoning, utilities, and public services through centralized GIS systems. These services enable planners to assess spatial patterns, support sustainable development initiatives, and enhance citizen services while ensuring secure data management, scalability, and interoperability across multiple departments and digital governance platforms.

By End-User Industry Analysis

Government and public sector organizations are anticipated to dominate the End User Industry segment of the Managed GeoServer Services Market, capturing approximately 35.0% of the total market share in 2025, supported by extensive use of geospatial data for governance, infrastructure planning, land administration, and public safety. National and local authorities rely on managed GeoServer platforms to publish and manage cadastral maps, urban development plans, transportation networks, and disaster risk data. Managed services provide high availability, data security, compliance with regulatory standards, and scalable GIS infrastructure, enabling efficient service delivery and data driven policy making.

Utilities and energy companies represent another key end user segment as they increasingly depend on geospatial intelligence to manage complex asset networks and operational workflows. Managed GeoServer services support mapping and visualization of power grids, water pipelines, renewable energy sites, and transmission networks. These services help utilities improve asset monitoring, outage management, and network planning while ensuring reliable access to spatial data, performance optimized map services, and secure integration with operational technology and enterprise systems.

The Managed GeoServer Services Market Report is segmented on the basis of the following

By Service Type

- Support & Maintenance Services

- Performance monitoring & optimization

- Security management & patching

- Version upgrades & server availability management

- Deployment & Integration Services

- GeoServer installation & configuration

- Data migration & system integration

- API, GIS, and enterprise system integration

- Consulting & Advisory Services

- GIS architecture design

- Cloud & scalability consulting

- Compliance, governance & spatial data strategy

- Training & Enablement Services

- Administrator & developer training

- End-user enablement

- Knowledge transfer programs

- Customization & Advanced Development

- Custom plugins & extensions

- Advanced spatial analytics enablement

- Workflow automation

By Deployment Model

- Cloud-Based Managed GeoServer

- Hybrid Deployment

- On-Premises Managed Deployment

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Transportation & Logistics

- Urban Planning & Smart Cities

- Environmental & Climate Monitoring

- Disaster Management & Emergency Response

- Agriculture & Precision Farming

- Other Spatial Applications

By End-User Industry

- Government & Public Sector

- Utilities & Energy

- Transportation Authorities & Operators

- Environmental & Urban Service Providers

- Agriculture & Agri-Tech

- Other Industries

Global Managed GeoServer Services Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global Managed GeoServer Services Market, accounting for approximately 37.0% of total market revenue in 2025, driven by widespread adoption of advanced geospatial technologies across government agencies, transportation, utilities, and large enterprises. The region benefits from strong investments in smart city initiatives, digital infrastructure, and cloud based GIS platforms, along with a mature ecosystem of service providers offering managed GeoServer deployment, integration, and support. High demand for real time spatial analytics, location intelligence, and scalable map services further strengthens North America’s dominance in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the Managed GeoServer Services Market due to increasing investments in digital infrastructure, smart city projects, and IoT enabled spatial data applications. Rapid urbanization, expanding transportation networks, and rising adoption of cloud based GIS platforms are driving demand for managed geospatial services across government, utilities, and commercial sectors. Additionally, emerging economies in the region are leveraging managed GeoServer solutions for environmental monitoring, precision agriculture, and disaster management, creating new opportunities for service providers and contributing to accelerated market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Managed GeoServer Services Market: Competitive Landscape

The competitive landscape of the global Managed GeoServer Services Market is characterized by a mix of established GIS service providers, emerging managed service specialists, and cloud technology integrators offering comprehensive geospatial solutions. Companies are focusing on differentiating through advanced service offerings such as cloud based deployment, hybrid integration, performance optimization, AI enabled spatial analytics, and security management. Strategic initiatives like partnerships, mergers, acquisitions, and expansion into emerging markets are being leveraged to enhance geographic presence, service portfolio, and customer base. The market is increasingly driven by innovation, customization, and the ability to deliver scalable and reliable managed GeoServer environments.

Some of the prominent players in the global Managed GeoServer Services market are

- Boundless Spatial Inc. (Planet Labs)

- Camptocamp SA

- SatSure Private Limited

- Astun Technology Limited

- Gaia3D Inc.

- Kartoza Proprietary Limited

- GeoSolutions

- BHSoft

- RedPlanet Group Pty Ltd

- AcuGIS

- Geomatys SAS

- GIS4Business Limited

- GeoCat BV

- Georepublic UG

- Terrestris GmbH & Co. KG

- North River Geographic Systems, Inc.

- Refractions Research Inc.

- Gispo Oy

- Safe Software

- Esri

- Other Key Players

Global Managed GeoServer Services Market: Recent Developments

- January 2026: A geospatial imagery and analytics platform raised USD 12.7 million in Series A funding to scale access to overhead and satellite data combined with analytics services.

- December 2025: GeoWGS84 Corp completed the acquisition of a renowned geospatial software suite including high‑performance image compression tools, expanding its portfolio and AI analytics capabilities for large data workflows.

- October 2025: A leading GIS platform announced integration of generative AI capabilities with cloud infrastructure to enhance spatial workflows, enabling enterprises to deploy advanced AI‑powered geospatial analysis and mapping across industries.

- June 2025: A GIS‑focused mapping startup secured USD 15 million in funding to advance its AI‑driven custom mapping and dashboard tools used by commercial and public sector clients.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.6 Bn |

| Forecast Value (2034) |

USD 6.5 Bn |

| CAGR (2025–2034) |

16.6% |

| The US Market Size (2025) |

USD 0.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Support & Maintenance Services, Deployment & Integration Services, Consulting & Advisory Services, Training & Enablement Services, Customization & Advanced Development), By Deployment Model (Cloud-Based Managed GeoServer, Hybrid Deployment, On-Premises Managed Deployment), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Application (Transportation & Logistics, Urban Planning & Smart Cities, Environmental & Climate Monitoring, Disaster Management & Emergency Response, Agriculture & Precision Farming, Other Spatial Applications), By End-User Industry (Government & Public Sector, Utilities & Energy, Transportation Authorities & Operators, Environmental & Urban Service Providers, Agriculture & Agri-Tech, Other Industries) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Boundless Spatial Inc., Camptocamp SA, SatSure Private Limited, Astun Technology Limited, Gaia3D Inc., Kartoza Proprietary Limited, GeoSolutions, BHSoft, RedPlanet Group Pty Ltd, AcuGIS, Geomatys SAS, GIS4Business Limited, GeoCat BV, Georepublic UG, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Managed GeoServer Services market?

▾ The global Managed GeoServer Services market size was valued at USD 1.6 billion in 2025 and is expected to reach USD 6.5 billion by the end of 2034.

What is the size of the US Managed GeoServer Services market?

▾ The US Managed GeoServer Services market was valued at USD 0.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.8 billion in 2034 at a CAGR of 15.6%.

Which region accounted for the largest global Managed GeoServer Services market?

▾ North America is expected to have the largest market share in the global Managed GeoServer Services market, with a share of about 37.0% in 2025.

Who are the key players in the global Managed GeoServer Services market?

▾ Some of the major key players in the global Managed GeoServer Services market are Boundless Spatial Inc., Camptocamp SA, SatSure Private Limited, Astun Technology Limited, Gaia3D Inc., Kartoza Proprietary Limited, GeoSolutions, BHSoft, RedPlanet Group Pty Ltd, AcuGIS, Geomatys SAS, GIS4Business Limited, GeoCat BV, Georepublic UG, and Others.