The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

As businesses encounter more cyber threats, Managed Security Services (MSS) providers are expanding their portfolios with services designed to safeguard critical infrastructure and real-time threat monitoring - an investment trend which has attracted significant investments from both established and new vendors alike. Growing adoption of network security solutions and the rise of outsourced IT security services are further driving momentum in this evolving sector.

Schneider Electric unveiled its MSS operational technology (OT) security offering in August 2023, in response to increasing cyber risks associated with remote access and interconnected systems - in line with demand in industries like manufacturing and energy for connectivity.

This service addresses cyber risks related to remote access and interconnected systems; designed specifically to protect them against growing demands for connectivity within industries like manufacturing and energy.

Cloud security remains a top priority within the MSS sector, as more organizations migrate their operations and data storage onto cloud environments. This migration has created an increased demand for MSS providers specializing in protecting cloud infrastructure and data; providers have even evolved to offer hybrid and multi-cloud environments integrated security solutions.

MSS providers see great opportunity in the increasing complexity of cyber threats and demand for remote work solutions, making strategic partnerships, mergers, and acquisitions essential in remaining ahead of this rapidly evolvable market.

In terms of industry adoption, 65% of enterprises globally are now utilizing some form of managed security services. The financial sector remains the largest consumer, accounting for 30% of total MSS revenue. The healthcare industry follows, growing its MSS adoption by 15% year-on-year due to heightened data protection needs and the rapid integration of

Healthcare IT Solutions into digital infrastructures.

A Managed Security Service Provider (MSSP) provides external oversight & control for security systems & devices. Typical services include managed firewalls, intrusion detection, virtual private networks, vulnerability scanning, & antivirus solutions by using strong security operation centers, MSSPs deliver round-the-clock support to lower an enterprise's requirement for in-house security staff, training, & retention while ensuring a strong security stance.

Market Dynamic

Organizations facing complex architecture or specialized requirements can majorly benefit from customized security deployments. Dynamic resource allocation makes it essential for efficient automation for monitoring in changing environments. Rising cyber threat complexity drives the trend towards outsourcing security operations. Choosing between an in-house or outsourced Security Operations Center (SOC) leads to careful consideration of several factors.

However, budget constraints, integration challenges, and concerns over data privacy & compliance present significant challenges to the managed security service market's growth. Additionally, some organizations stumble due to a perceived loss of control over security functions & potential hindrances during the transition to outsourced services. This has prompted many enterprises to adopt specialized

Cybersecurity Consulting Services as a complementary strategy alongside MSSPs.

Research Scope and Analysis

By Deployment Type

In 2023, cloud deployment has become a driving force in the global managed security service market and is anticipated to persist the same throughout the forecasted period, as it is reshaping cybersecurity by offering agility, scalability, & fast threat response. This benefits organizations with expert monitoring, rapid incident resolution, & streamlined operations, bolstering defense against increasing and advancing threats. Such a strategic move optimizes resource allocation, enabling businesses to aim for core goals while navigating the dynamic digital landscape. As a result, this transformation is expected to continue driving the market's growth in the coming future.

By Service Type

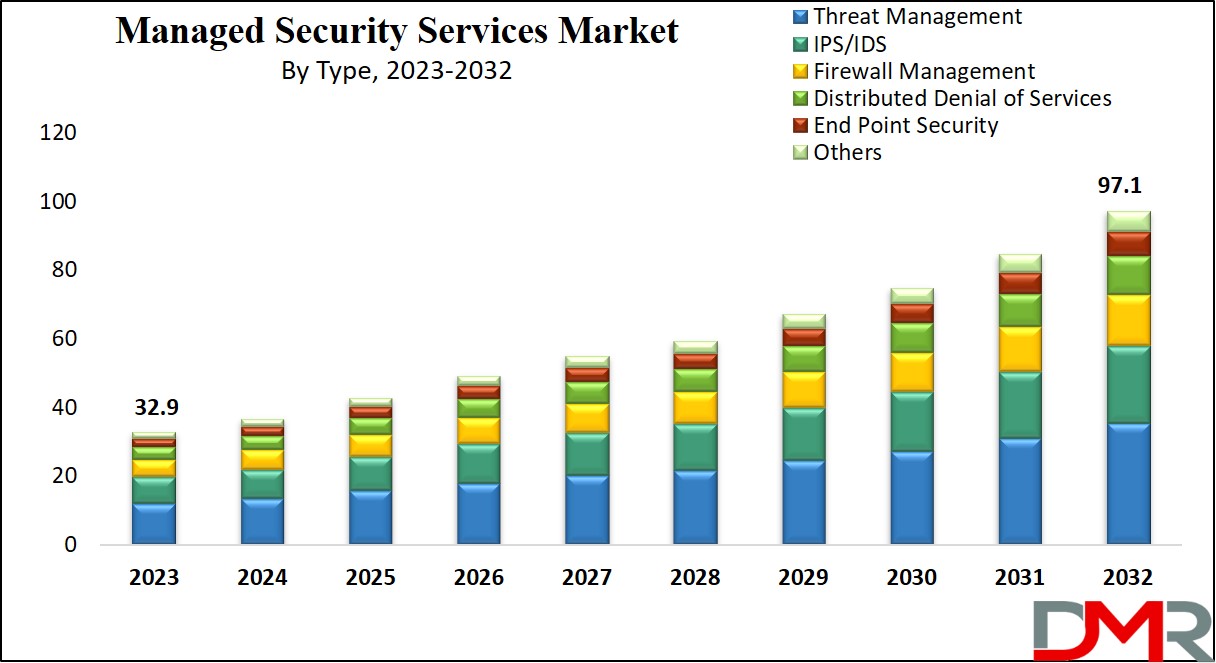

Threat management is one of the major service types contributing to the revenue of the global Managed Security Services Market in 2023, as it delivers expert monitoring, quick threat detection, & efficient incident response. By outsourcing this function, businesses can improve their security, lower vulnerabilities, & look at core activities while navigating the dynamic cyber threat landscape. This proactive approach allows strong protection, reduces operational complexities, and offers a cost-effective solution for safeguarding critical assets.

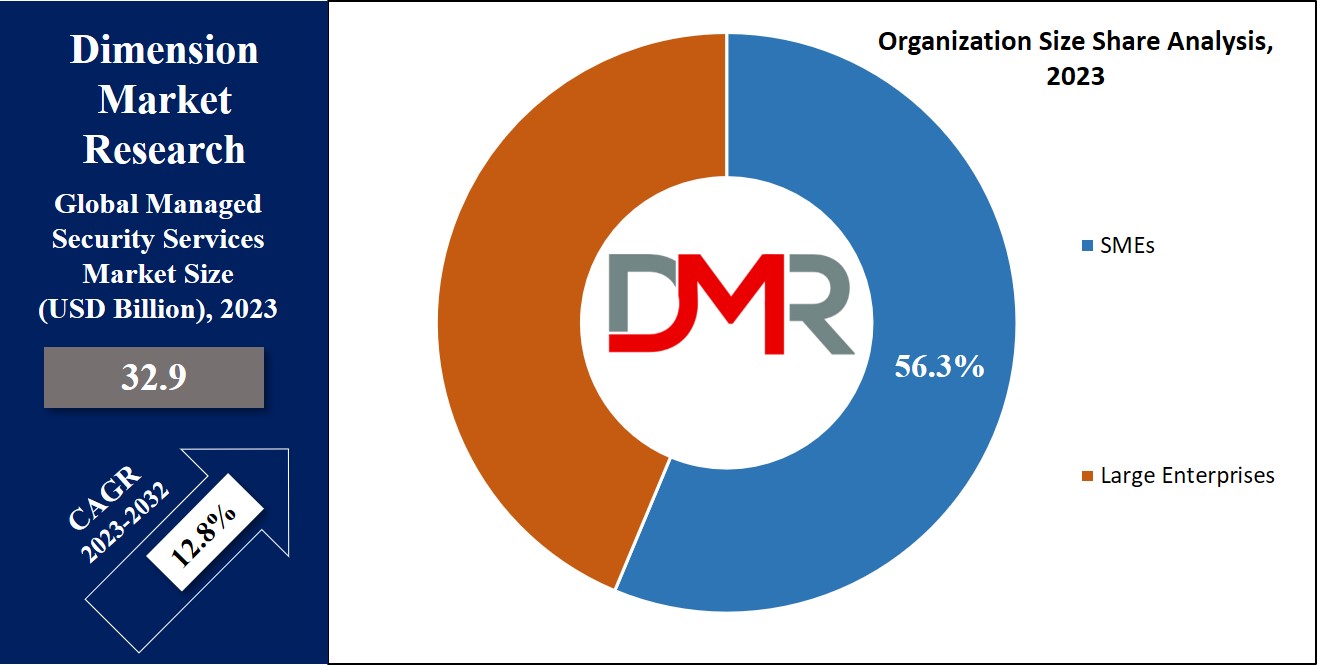

By Organization Size

SMEs are one of the major driving factors for the managed security services market in 2023 by contributing significantly towards the overall global revenue, as the market offers SMEs expert cybersecurity, comprising of real-time threat monitoring & quick incident response, which allows SMEs to lower operational complexities, concentrate on growth, & ensure cost-effective protection against evolving cyber threats.

The approach provides access to advanced security technologies and expertise, preserving data integrity & system availability. This strategic outsourcing improves SMEs' competitiveness in the digital landscape by safeguarding critical assets while maintaining focus on core business objectives.

By Application

In 2023, the healthcare sector in managed security services is playing a major role in driving the market, by protecting patient data & upholding regulatory compliance like HIPAA. These services enable constant monitoring, rapid threat detection, & incident response to reduce cyber risks. By outsourcing security, healthcare organizations can focus on patient care while ensuring data integrity & confidentiality.

Managed security services also specialize in

medical device security, ransomware defense, & adapting to growing threats. This proactive approach builds patient trust, operational efficiency, & overall resilience, addressing the complex cybersecurity landscape within the healthcare industry. Such trends & factors will allow the healthcare industry to drive the global managed security service market over the forecasted period.

The Global Managed Security Services Market Report is segmented on the basis of the following

By Deployment Type

By Service Type

- IPS/IDS

- Threat Management

- Firewall Management

- Distributed Denial of Services

- End Point Security

- Others

By Organization Size

By Application

- BFSI

- Healthcare

- Retail

- IT & Telecom

- Others

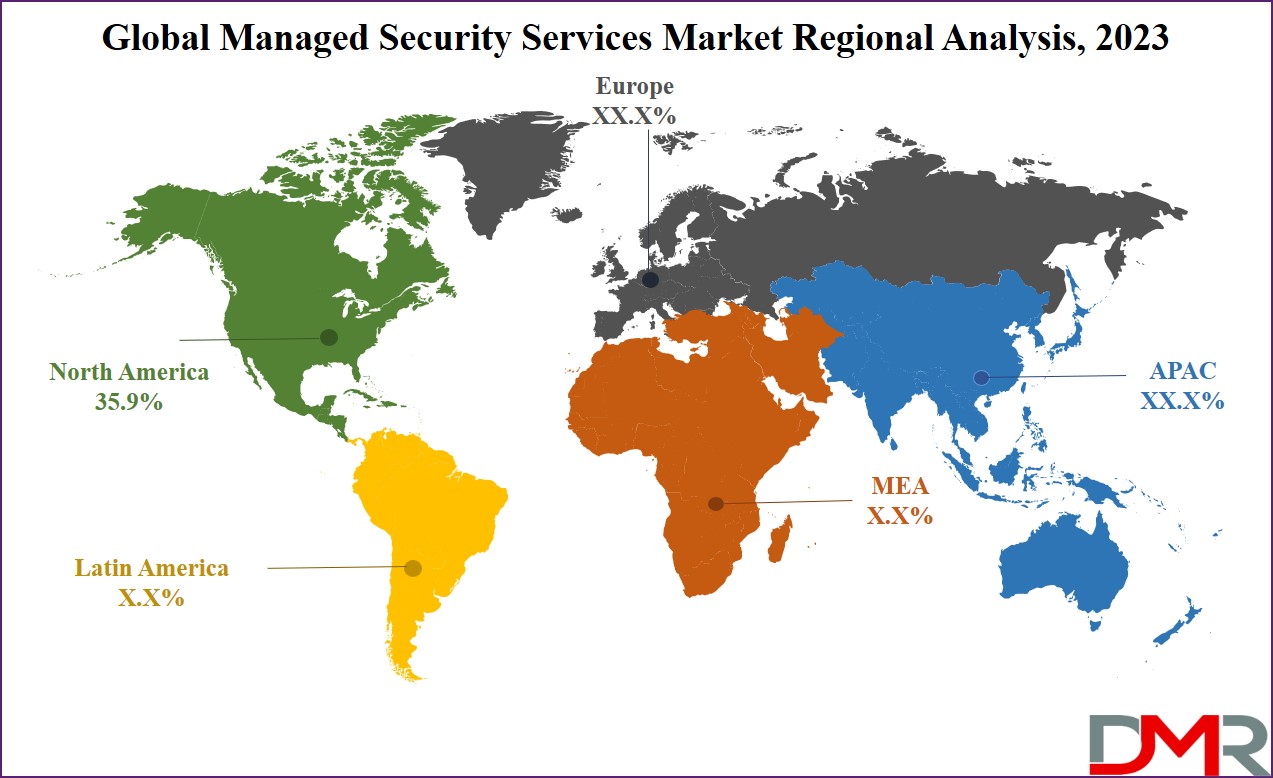

Regional Analysis

In 2023, the North American region has a substantial market share, commanding

about 35.9% of the total revenue in the Global Managed Security Services Market. This dominance is anticipated to persist, driven by growing outsourcing requests from many tech giants.

Managed service solutions customized to specific requirements, along with the increasing demand for cloud computing, network security, & data protection, which is also anticipated to play a role in sustaining regional expansion. The increasing count, assortment, and intricacy of cyber threats, strategically focused on broadening their reach, are instrumental in driving the market demand.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Managed Security Services (MSS) market is highly fragmented, featuring both established players and emerging vendors competing to offer comprehensive cybersecurity solutions. As cyber threats evolve and become more sophisticated, organizations increasingly turn to MSS providers for protection against network attacks, DoS attacks, risk assessments and conducting risk analyses. Furthermore, this market has seen significant investments into strategic partnerships, mergers acquisitions and service launches by businesses looking to enhance their security capabilities.

One notable trend in the MSS market is an increasing need for solutions tailored to operational technology (OT). As industries adopt more connected devices and remote work solutions, cyber attacks targeting critical infrastructure and industrial control systems has increased dramatically. To combat this threat, MSS providers have begun providing tailored OT protection services designed to thwart potential cyber threats.

Schneider Electric announced in August 2023 a new MSS offering dedicated to protecting OT domains, with remote access and interconnected technologies becoming more prevalent than ever before, this service helps organizations mitigate any associated cyber risks associated with these trends. It highlights the increasing significance of cybersecurity within industries like manufacturing, energy and utilities where disruptions could have far-reaching repercussions; therefore partnerships and innovative service launches will likely continue driving MSS market growth as organizations prioritize the protection of both IT and OT infrastructures in an ever more connected world.

Some of the prominent players in the Global Managed Security Services Market are:

- AT&T

- Symantec

- IBM Corp

- BAE Systems

- Verizon

- Capgemini

- Fujitsu

- NTT

- Trustwave

- Atos

- Other Key Players

Recent Developments

- August 2025: LevelBlue partnered with Akamai to launch a Managed Web Application and API Protection (WAAP) service, featuring next-gen WAF, DDoS mitigation, bot protection, and AI-driven automated policy management—designed to simplify and secure modern digital infrastructures.

- August 2025: SonicWall unveiled its Generation 8 firewall lineup, including nine cloud-managed models (from compact TZ280 to NSa 5800) tailored for MSPs and MSSPs, integrating unified management, Zero Trust Network Access, co-managed security services, and optional cyber insurance.

- June 2025: Netgear acquired Bengaluru-based cybersecurity startup Exium, boosting its cybersecurity services for MSPs and clients to deliver more unified and secure networking solutions.

- August 2025: Accenture agreed to buy CyberCX from BGH Capital in its biggest cybersecurity acquisition to date, aiming to bolster its offerings across the Asia-Pacific region, particularly in offensive security, threat intelligence, and cloud security.

- ( Bonus mention—since you asked for two) April 2025 (announced): Palo Alto Networks declared its intent to acquire CyberArk in a cash-and-stock deal valued at roughly $25 billion, strengthening its identity security capabilities.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 32.9 Bn |

| Forecast Value (2032) |

USD 97.1 Bn |

| CAGR (2023-2032) |

12.8% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Deployment (Cloud and On-Premises), By Service Type (IPS/IDS, Threat Management, Firewall Management, Distributed Denial of Services, End Point Security Service and Others), By Organization Size (SMEs and Large Enterprise), By Application (BFSI, Healthcare, Retail, IT & Telecom and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AT&T, Symantec, IBM Corp, BAE Systems, Verizon, Capgemini, Fujitsu, NTT, Trustwave Atos, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |