Market Overview

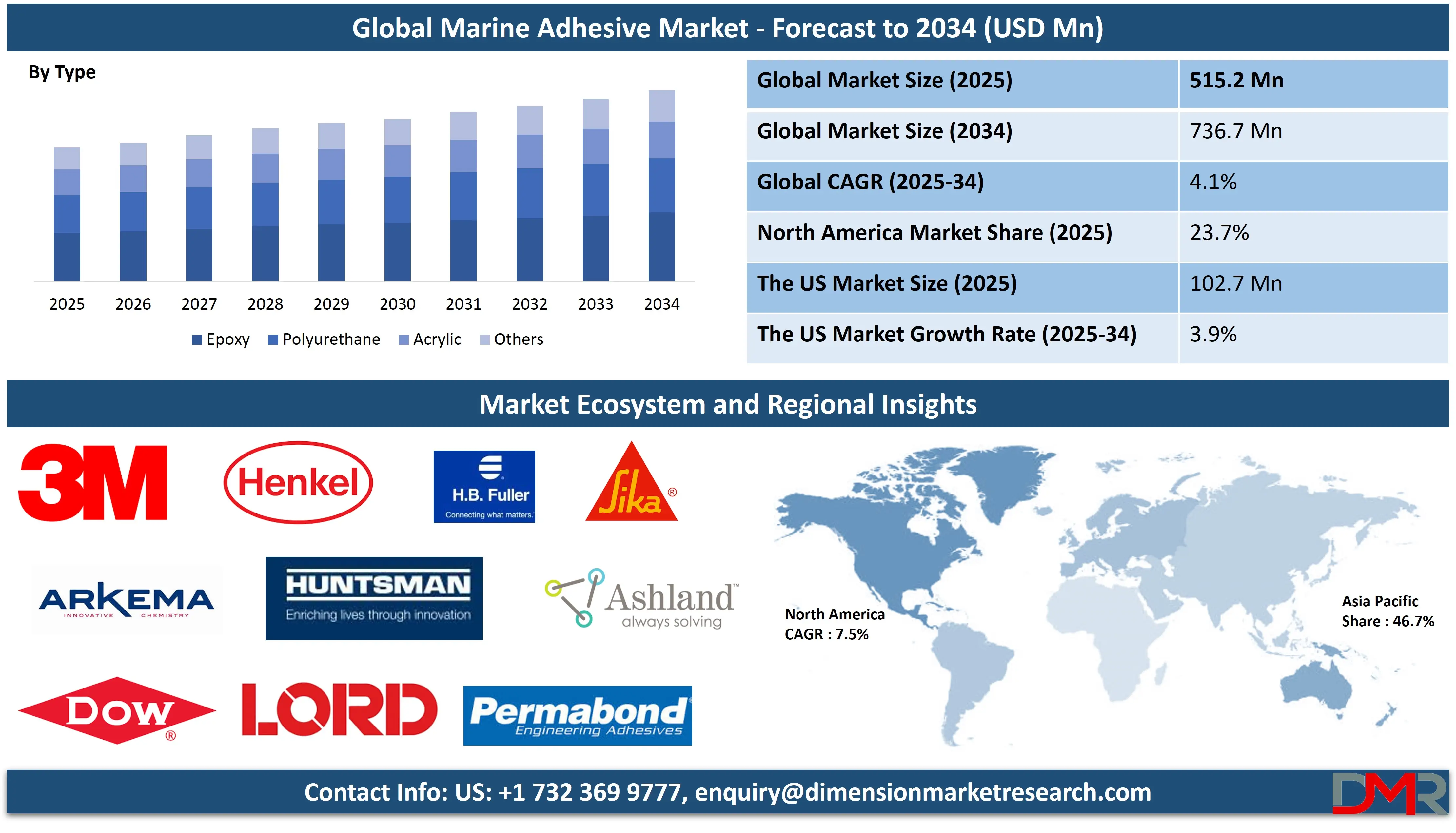

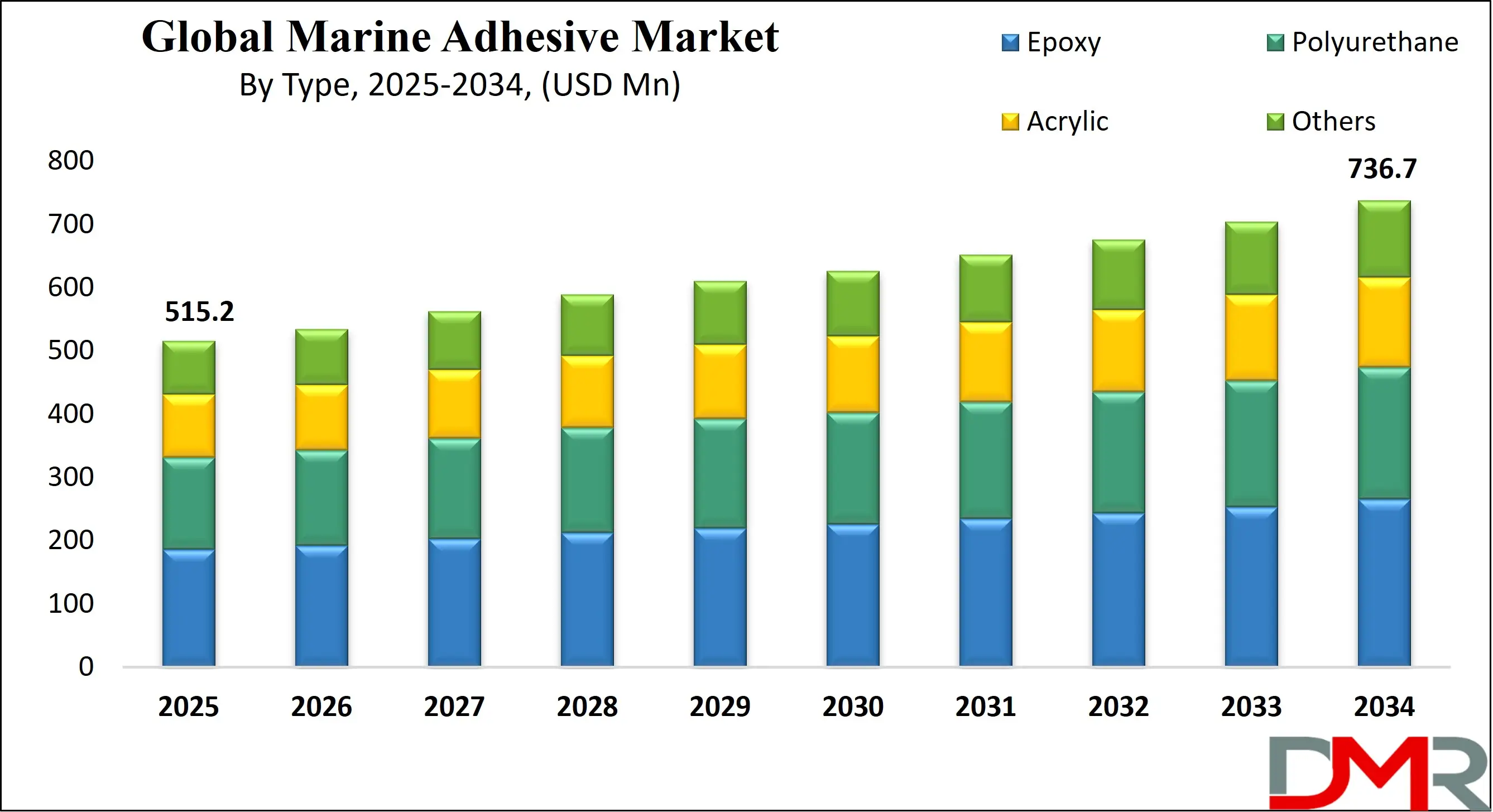

The Global Marine Adhesive Market is predicted to be valued at USD 515.2 million in 2025 and is expected to grow to USD 736.7 million by 2034, registering a compound annual growth rate (CAGR) of 4.1% from 2025 to 2034.

Marine adhesive is a specialized bonding agent designed to withstand harsh marine environments, including exposure to water, salt, UV rays, and extreme temperatures. It is used extensively in shipbuilding, boat repairs, and offshore structures to securely bond materials such as metal, wood, fiberglass, and plastic.

These adhesives offer excellent water resistance, flexibility, durability, and structural strength, making them ideal for both above and below the waterline applications. Marine adhesives are available in various chemistries, including epoxy, polyurethane, and acrylic, each suited to specific use cases such as sealing joints, fixing hull components, or installing deck fittings in marine vessels.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global marine adhesive market is experiencing consistent growth, driven by rising demand for durable and high-performance bonding solutions in marine applications. As the shipbuilding and boat repair industries continue to expand, particularly in emerging economies and coastal regions, the need for adhesives that can withstand harsh marine environments has become increasingly critical.

Marine adhesives are formulated to provide strong bonding under conditions of high moisture, salt exposure, and fluctuating temperatures, making them indispensable for the construction and maintenance of vessels, offshore platforms, and underwater structures.

Technological advancements have led to the development of environmentally friendly and high-strength adhesives that offer superior performance over traditional mechanical fasteners. Adhesives such as epoxy, polyurethane, and acrylic types are widely adopted for tasks including sealing, joining, and component assembly in both recreational and commercial vessels. These adhesive systems are valued for their corrosion resistance, flexibility, and ability to bond dissimilar materials, enhancing both safety and efficiency in marine operations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growing awareness of sustainability and the need for lightweight materials in the marine sector is pushing manufacturers to innovate with low-VOC and solvent-free formulations. Moreover, rising investment in offshore wind energy, oil & gas exploration, and coastal infrastructure further boosts demand for advanced marine bonding solutions.

End users such as shipyards, boatyards, and naval defense sectors are increasingly relying on adhesive technologies to improve structural integrity and reduce maintenance costs.

The competitive landscape is characterized by a mix of global chemical companies and regional manufacturers focusing on R&D, product customization, and strategic collaborations to meet evolving marine industry standards.

The US Marine Adhesive Market

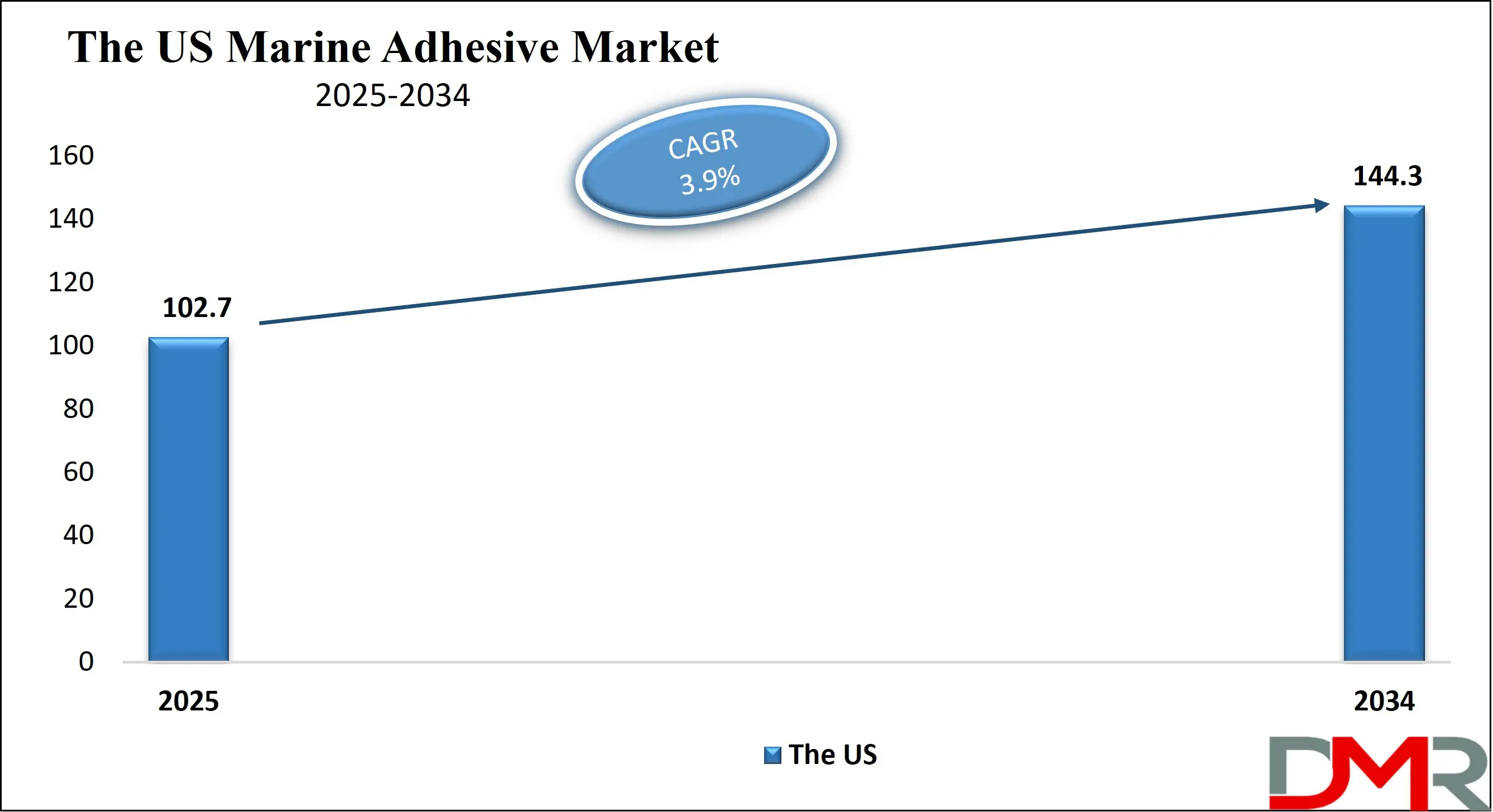

The US Marine Adhesive Market is projected to be valued at USD 102.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 144.3 million in 2034 at a CAGR of 3.9%.

The US marine adhesive market is driven by the country’s robust boatbuilding and repair sector, which demands high-performance bonding solutions for hull assembly, deck fitting, and interior applications. Increased use of lightweight composite materials in vessels, requiring advanced bonding agents for structural integrity, also fuels growth.

Moreover, the growing preference for eco-friendly and low-VOC adhesives in compliance with stringent environmental regulations pushes innovation. The rising popularity of recreational boating and water sports creates consistent demand from both OEMs and aftermarket service providers, further contributing to market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In the US, a key trend is the increasing adoption of hybrid adhesive technologies that combine mechanical strength with flexibility, catering to the performance needs of modern marine structures. There is also a notable shift toward UV-resistant and water-repellent adhesive formulations to enhance durability in saltwater environments.

Manufacturers are investing in bio-based and sustainable adhesive solutions to align with environmental standards and consumer preferences. Additionally, automation in boat manufacturing is prompting the development of fast-curing adhesives, which reduce assembly time and improve production efficiency.

The Japan Marine Adhesive Market

The Japan Marine Adhesive Market is projected to be valued at USD 48.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 69.4 million in 2034 at a CAGR of 4.0%.

Japan's marine adhesive market is primarily driven by its advanced shipbuilding industry, known for innovation and precision engineering. The country's focus on high-speed vessels and technological maritime solutions creates a steady demand for adhesives offering superior bonding, vibration resistance, and long-term durability.

Additionally, government initiatives supporting the modernization of fishing and coastal vessels help boost demand for high-performance adhesives. Japan’s reputation for quality in industrial manufacturing encourages the use of advanced adhesive technologies to ensure structural integrity, lightweight design, and resistance to harsh marine environments.

A notable trend in Japan’s marine adhesive market is the advancement of nanotechnology-based adhesives that enhance corrosion resistance and mechanical strength. The market is also seeing increased development of low-odor and quick-curing adhesives to support faster ship assembly lines.

There's a growing shift toward solvent-free, eco-friendly formulations in response to both domestic and international sustainability standards. Moreover, the integration of adhesive solutions with automation systems in shipyards reflects Japan’s continued commitment to efficient, high-tech manufacturing processes tailored for both domestic use and global export demands.

The Europe Marine Adhesive Market

The European Marine Adhesive Market is projected to be valued at USD 134.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 194.9 million in 2034 at a CAGR of 3.8%.

Europe’s marine adhesive market benefits from the strong presence of shipbuilding industries, particularly in countries like Germany, Italy, and the Netherlands. A significant driver is the demand for advanced bonding solutions in luxury yachts and commercial vessels, which require adhesives that can withstand harsh marine conditions.

EU environmental policies promoting sustainable maritime practices push the adoption of solvent-free and low-emission adhesives. Furthermore, the increase in retrofitting and maintenance of aging marine fleets is driving the need for high-performance adhesives compatible with diverse materials like composites, wood, and metals.

A growing trend in Europe’s marine adhesive market is the integration of smart adhesives with enhanced thermal, acoustic, and vibration-damping properties for greater onboard comfort. Manufacturers are also innovating with lightweight adhesive formulations to contribute to vessel fuel efficiency and regulatory compliance.

The rise in demand for modular ship designs is fostering the use of flexible and reworkable adhesives. Sustainability continues to shape the market, with a focus on recyclable packaging and adhesives made from renewable raw materials to reduce the environmental impact across the product lifecycle.

Marine Adhesive Market: Key Takeaways

- Market Overview: The global marine adhesives market is projected to reach a valuation of USD 515.2 million in 2025 and is forecasted to grow steadily, attaining approximately USD 736.7 million by 2034. This reflects a compound annual growth rate (CAGR) of 4.1% over the forecast period from 2025 to 2034.

- By Type Analysis: Epoxy adhesives are expected to lead the marine adhesives market by 2025, capturing over 43.7% of the global market share due to their superior bonding strength and resistance to harsh marine environments.

- By Substrate Analysis: Metal surfaces are projected to be the most commonly used substrate in the marine adhesives market by 2025, representing around 49.2% of the total usage, driven by their widespread application in shipbuilding and marine structures.

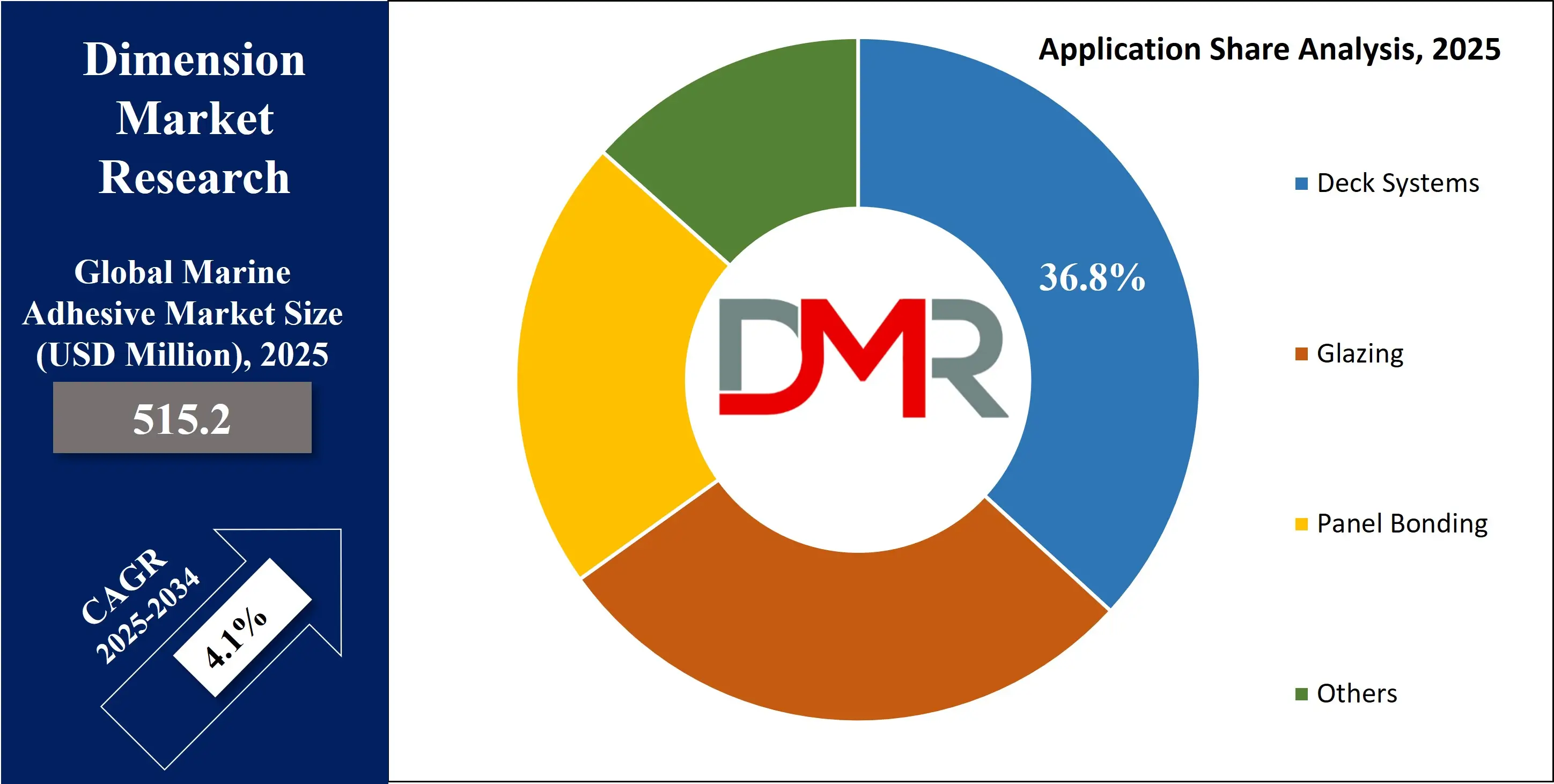

- By Application Analysis: Deck systems are anticipated to be the primary application area for marine adhesives by the end of 2025, contributing roughly 36.8% to the global market, owing to the critical need for durable and water-resistant bonding solutions.

- By End User Analysis: Cargo ships are forecasted to be the largest end user of marine adhesives by 2025, accounting for approximately 41.5% of overall demand, supported by the growing need for reliable bonding in commercial shipping vessels.

- Regional Analysis: Asia Pacific is poised to dominate the global marine adhesives market by 2025, with an expected market share of 46.7%, driven by the region’s robust shipbuilding industry and increasing investments in maritime infrastructure.

Marine Adhesive Market: Use Cases

- Boat and Shipbuilding Assembly: Marine adhesives are widely used in boat and ship construction for bonding structural components like hulls, decks, and bulkheads. They provide high strength, water resistance, and durability, allowing for seamless integration of various materials, including fiberglass, metal, and wood, which enhances vessel integrity and performance.

- Underwater Repairs: Marine adhesives enable quick and reliable underwater repairs on vessels, docks, and pipelines without the need for dry docking. Their ability to cure in wet conditions and resist saltwater corrosion makes them essential for emergency fixes, reducing downtime and operational costs in marine infrastructure maintenance.

- Deck Hardware and Fixture Bonding: Marine adhesives are used to secure deck fittings, rails, cleats, and hatches without mechanical fasteners. They provide strong adhesion while absorbing shock and vibrations, minimizing wear and tear. This reduces the need for drilling, thus preserving structural integrity and improving aesthetic appearance in both recreational and commercial vessels.

- Interior Marine Applications: For interior components such as panels, flooring, and cabinetry, marine adhesives offer a cleaner alternative to screws and nails. Their strong bond and resistance to humidity and temperature fluctuations ensure long-term performance, especially in luxury yachts and passenger ships where comfort and finish quality are critical.

- Composite and Multi-Material Bonding: Modern boats use composites and dissimilar materials for weight reduction and strength. Marine adhesives effectively bond these varied substrates—like aluminum to composites, ensuring a flexible, durable connection. This facilitates innovative design and construction methods while enhancing fuel efficiency and reducing environmental impact in marine transport.

Marine Adhesive Market: Stats & Facts

- FAO (Food and Agriculture Organization): According to FAO, global food production must increase by 70% by 2050 to meet population demands, driving higher adoption of yield-enhancing inputs like agricultural films.

- PlasticsEurope: In 2022, the European agricultural sector consumed approximately 300,000 tonnes of plastic films, including mulching, greenhouse, and silage films.

- Ellen MacArthur Foundation: Around 6.7 million tonnes of plastic are used annually in agriculture worldwide, much of which includes films for crop protection and soil coverage.

- Statista: China accounted for over 60% of global mulch film usage in 2021, largely due to its extensive horticultural and vegetable farming operations.

- European Commission: The use of biodegradable agricultural films is projected to grow by 10–15% annually in the EU due to stricter environmental regulations.

- National Bureau of Statistics of China: In 2020, China used over 2.5 million tonnes of agricultural plastic film, with polyethylene mulch being the most dominant type.

- USDA (United States Department of Agriculture): U.S. farms using plasticulture systems, including plastic mulch and row covers, reported yield increases of 20%–60%, depending on the crop and region.

- OECD: The average productivity gain from greenhouse films in protected horticulture ranges between 30% to 100%, compared to open-field cultivation.

- United Nations Environment Program (UNEP): Agricultural plastics, including films, contribute to over 12 million tonnes of waste annually, raising sustainability and recycling concerns.

- World Bank: In countries like India and Egypt, subsidized programs for agricultural films have helped smallholder farmers increase irrigation efficiency by 25–35%, reducing water stress in arid regions.

Marine Adhesive Market: Market Dynamics

Driving Factors in the Marine Adhesive Market

Rising Demand for Lightweight and Fuel-Efficient Vessels

The increasing preference for lightweight materials in shipbuilding is significantly driving the marine adhesive market. Marine adhesives are extensively used to bond composite panels, fiberglass, and lightweight metals, replacing traditional mechanical fasteners. This not only reduces vessel weight but also improves fuel efficiency and performance.

The shift toward energy conservation and reduction of carbon emissions in the maritime sector supports the adoption of advanced bonding solutions. Moreover, manufacturers of marine-grade adhesives are innovating with high-performance epoxy and polyurethane adhesives that provide durability and water resistance, aligning with global regulatory standards.

These benefits are essential for modern boatbuilding and repair, particularly in commercial shipping, military marine applications, and recreational boating.

Expanding Shipbuilding Industry in Emerging Economies

The rapid expansion of the shipbuilding industry, especially in Asia-Pacific regions like China, South Korea, and India, is a major growth driver for the marine adhesive market. These nations are witnessing a surge in investments in naval defense, offshore energy infrastructure, and commercial vessels, all of which demand reliable bonding solutions.

Marine adhesives offer corrosion resistance, flexibility, and high structural strength, making them ideal for complex maritime environments. Polyurethane and acrylic adhesives are increasingly adopted in the construction and maintenance of ships and yachts due to their ease of application and long-term performance. The robust marine manufacturing ecosystem in these countries enhances adhesive demand across repair, refit, and OEM applications.

Restraints in the Marine Adhesive Market

Fluctuating Raw Material Prices

Volatile raw material prices act as a major restraint on the growth of the marine adhesive market. Key ingredients like epoxy resins, polyurethane, and acrylics are derived from petroleum-based sources, making them highly susceptible to global oil price fluctuations. These cost variations directly impact production expenses and lead to uncertain pricing strategies for manufacturers.

Additionally, any disruption in the petrochemical supply chain can result in adhesive shortages, delaying marine manufacturing and repair schedules. Such unpredictability poses challenges for small and medium marine adhesive suppliers, limiting their competitiveness in both local and global markets. This pricing instability may also discourage end-users from switching to premium adhesive solutions in cost-sensitive projects.

Environmental and Health Regulations

Stringent environmental and safety regulations concerning the use of chemical-based adhesives are constraining the marine adhesive market. Many traditional adhesives release volatile organic compounds (VOCs), which are harmful to both human health and the marine ecosystem. Regulatory bodies like the EPA and REACH are enforcing strict guidelines on VOC emissions and chemical compositions used in adhesives.

As a result, marine adhesive manufacturers face pressure to reformulate products using eco-friendly and low-emission materials, which may involve high R&D costs. Compliance with these regulatory standards can delay product launches and increase production complexity. Moreover, customers may face limitations on adhesive usage in sensitive applications like cruise ships and offshore structures.

Opportunities in the Marine Adhesive Market

Development of Eco-Friendly and Bio-Based Adhesives

The increasing emphasis on sustainability in the marine industry presents a lucrative opportunity for eco-friendly and bio-based marine adhesives. Shipbuilders and naval architects are seeking alternatives to solvent-based adhesives to meet environmental compliance and reduce ecological impact.

Manufacturers are investing in the development of water-based and biodegradable adhesive formulations that offer similar bonding strength while being non-toxic and low in VOC emissions. These sustainable adhesives are especially gaining traction in yacht building and luxury boat segments where green certifications are valued. As marine operators move toward more sustainable construction and maintenance practices, the demand for green marine adhesives is expected to witness significant growth globally.

Rising Demand from Offshore Renewable Energy Sector

The global transition toward renewable energy is boosting demand for marine adhesives in offshore wind and wave energy projects. These installations require durable and weather-resistant bonding solutions for structural components, nacelles, blades, and underwater cables. Marine adhesives, particularly epoxy and hybrid systems, provide strong adhesion, excellent fatigue resistance, and long-term durability under harsh saltwater conditions.

With expanding investments in offshore wind farms in Europe, North America, and Asia-Pacific, adhesive manufacturers have an opportunity to supply high-performance products tailored to this sector. The offshore renewable energy segment opens a new growth avenue for the marine adhesive industry beyond traditional shipbuilding and repair applications.

Trends in the Marine Adhesive Market

Integration of Smart Adhesive Technologies

A significant trend in the marine adhesive market is the integration of smart adhesives embedded with sensing capabilities. These advanced adhesives are designed to monitor stress, strain, or environmental changes within bonded joints. Used primarily in defense and high-performance marine applications, such smart adhesives enhance safety by enabling predictive maintenance and reducing the risk of structural failure.

Innovations in nanotechnology and materials science are accelerating the development of these intelligent bonding systems. Smart marine adhesives can also support automation in shipbuilding processes, aligning with the maritime industry's broader move toward digitalization and Industry 4.0 integration in manufacturing operations.

Increasing Use of Hybrid Adhesive Solutions

The marine industry is increasingly adopting hybrid adhesive systems that combine the properties of different chemistries, such as epoxy-polyurethane blends, to deliver enhanced performance. These adhesives offer the flexibility of polyurethanes and the strength of epoxies, making them suitable for dynamic load-bearing joints in vessels.

Hybrid adhesives are being used for bonding dissimilar materials like metal to composite, which is becoming common in modern boat design. As vessel designs become more complex and performance expectations rise, shipbuilders are demanding versatile adhesives with superior mechanical and environmental resistance. The growing preference for hybrid marine adhesives is driving innovation in formulation and application technologies.

Marine Adhesive Market: Research Scope and Analysis

By Type Analysis

Epoxy adhesives are predicted to dominate the global marine adhesives market by the end of 2025, accounting for over 43.7% of the total market share. This dominance is attributed to their superior bonding strength, durability in harsh marine conditions, and excellent chemical resistance. Epoxy resins are widely used in structural bonding for shipbuilding and repair operations.

With increasing investments in high-performance marine coatings and the growing demand for environmentally resilient bonding agents, epoxy-based marine bonding agents are witnessing strong demand. Advancements in hull and keel construction, where load-bearing adhesives are critical, also support their expanding usage across deep-sea vessels and recreational boats.

Polyurethane adhesives are expected to register the highest CAGR in the global marine adhesives market by 2025. Their flexibility, UV resistance, and ability to bond dissimilar substrates such as metals and composites make them a preferred choice in modular ship design.

The rising trend toward lightweight boats and energy-efficient vessels is driving the need for elastic adhesives that tolerate vibration and stress in dynamic marine environments. Additionally, the surge in demand for green shipbuilding practices and solvent-free bonding solutions is pushing manufacturers to innovate polyurethane-based sealants and adhesives with low-VOC emissions.

By Substrate Analysis

Metal substrates are anticipated to dominate the marine adhesives market by the end of 2025, with a share of around 49.2%. Metals are extensively used in the construction of hulls, engine parts, and structural frameworks of both commercial and defense vessels. The demand for corrosion-resistant adhesives that maintain adhesion under saltwater exposure continues to rise.

As the industry moves toward reducing mechanical fasteners, metal bonding solutions offer greater design flexibility and strength. The expansion of naval defense fleets and retrofitting of cargo liners further enhance demand for robust marine adhesives compatible with ferrous and non-ferrous metals.

Composite substrates are projected to experience the fastest growth rate by 2025. Their usage in lightweight ship components, such as decks and superstructures, is accelerating due to the increasing adoption of advanced materials in ship design. Composite bonding adhesives are preferred for their high load-bearing capacity and resistance to fatigue and delamination.

With sustainability becoming a focal point, marine architects are favoring composites paired with eco-friendly adhesive solutions. The rising interest in hybrid and electric-powered boats also bolsters the application of adhesives in composite-based assembly processes.

By Application Analysis

Deck systems are expected to dominate the marine adhesives market by 2025, securing approximately 36.8% of the total market. Adhesives used in deck installations must endure extreme temperatures, water exposure, and heavy foot traffic, making them vital to ship safety and performance. With growing demand for luxurious yachts and passenger ships, high-quality adhesives for deck finishing and structural integration are in focus. Non-slip coatings and noise-reducing underlayment bonded with adhesives are also key drivers in this application segment, particularly in recreational and naval crafts.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Glazing applications are likely to witness the fastest CAGR by 2025. Modern ships increasingly feature large glass windows and portholes for improved aesthetics and visibility. Adhesives for glazing must provide high UV stability and flexibility to handle glass-to-metal or composite bonding.

Innovations in frameless window systems and aerodynamic ship designs further enhance the importance of high-performance glazing adhesives. Additionally, demand for lighter, panoramic glass on cruise liners and ferries supports this segment’s growth.

By End User Analysis

Cargo ships are predicted to dominate the global marine adhesives market by the end of 2025, accounting for about 41.5% of total demand. The large-scale use of adhesives in constructing, maintaining, and refurbishing bulk carriers, container ships, and tankers is the key growth driver.

Marine adhesives provide long-lasting bonds that resist salt corrosion and extreme operational stress, reducing the need for mechanical fastening. With global trade and logistics expanding, durable adhesives for cargo holds, storage areas, and hull assemblies are in high demand.

Boats are projected to grow at the highest CAGR in the marine adhesives market by 2025. Increasing popularity of recreational boating and water sports, especially in North America and Europe, is fueling this growth. Smaller vessels benefit from lightweight bonding materials, particularly in deck flooring, seating, and glazing applications.

The shift toward DIY boat repair and refurbishment has also boosted the sale of user-friendly marine adhesives. Moreover, the rise in electric and hybrid leisure boats is opening opportunities for adhesive products suited to modular and noise-reducing assembly needs.

The Marine Adhesive Market Report is segmented based on the following:

By Type

- Epoxy

- Polyurethane

- Acrylic

- Others

By Substrate

- Metal

- Composites

- Plastic

- Others

By Application

- Deck Systems

- Glazing

- Panel Bonding

- Others

By End User

- Cargo Ships

- Passenger Ships

- Boats

- Others

Regional Analysis

Region with the largest Share

Asia Pacific is expected to hold the largest share of 46.7% in the global marine adhesives market by the end of 2025. This dominance is primarily driven by the booming shipbuilding industries in countries like China, South Korea, and Japan. These nations have strong maritime infrastructures and large commercial fleets, leading to higher demand for advanced marine bonding solutions in cargo, passenger, and naval vessels.

Additionally, growing investments in marine tourism and coastal development in Southeast Asia are contributing to increased boat and yacht production. The availability of low-cost labor and raw materials further strengthens the region's adhesive manufacturing capacity. Rapid industrialization and expansion in marine trade make Asia Pacific a crucial contributor to the market’s growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America is projected to grow at the highest CAGR in the global marine adhesives market by 2025. The region’s expansion is fueled by technological advancements in marine composite structures and increased focus on lightweight, fuel-efficient vessels. The U.S. is witnessing significant innovation in eco-friendly adhesive formulations, driven by strict environmental regulations and the demand for sustainable shipbuilding materials.

The recreational boating industry is also booming across the U.S. and Canada, supported by rising disposable incomes and interest in marine leisure. Furthermore, the modernization of defense fleets and investments in port infrastructure are prompting higher consumption of high-performance adhesives. These trends position North America as the fastest-growing region for marine bonding technologies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Marine Adhesive Market

- Advanced Formulation Development: AI accelerates the development of high-performance marine adhesives by simulating chemical interactions and predicting optimal formulations. Machine learning models analyze vast datasets to improve properties like water resistance, bonding strength, and corrosion resistance, helping manufacturers create innovative solutions tailored to harsh marine environments and regulatory standards.

- Process Efficiency and Automation: AI optimizes adhesive manufacturing processes by controlling mixing ratios, curing times, and environmental conditions. Through real-time monitoring and predictive analytics, AI ensures consistent quality and minimizes production waste. This enhances operational efficiency, reduces energy consumption, and allows faster scale-up of customized marine adhesive products.

- Predictive Maintenance and Quality Assurance: AI-driven predictive maintenance systems monitor production equipment to prevent unexpected breakdowns. Simultaneously, AI-powered vision and sensor technologies ensure precise quality control, identifying defects or inconsistencies during manufacturing. These tools help maintain high-quality standards and ensure the reliability of adhesives used in shipbuilding and offshore applications.

- Sustainability and Material Innovation: AI supports sustainability in the marine adhesive market by identifying eco-friendly raw materials and evaluating lifecycle impacts. It enables supply chain optimization, reducing carbon footprints and material waste. As environmental regulations tighten, AI facilitates the shift toward greener, bio-based adhesive solutions without compromising performance or safety.

Competitive Landscape

The global marine adhesives market is characterized by intense competition, with key players focusing on product innovation, strategic partnerships, and regional expansion to gain a competitive edge. Major companies such as 3M Company, Henkel AG & Co. KGaA, Sika AG, and H.B. Fuller are investing heavily in the development of high-performance bonding solutions tailored to withstand marine environments. These players are emphasizing eco-friendly adhesives, corrosion-resistant bonding agents, and low-VOC marine sealants to meet the growing demand for sustainable marine construction.

Innovation in adhesive technologies for shipbuilding, particularly those used in structural bonding, deck systems, and glass glazing, is a key area of competition. The shift toward lightweight vessels, driven by fuel efficiency and emission norms, is pushing manufacturers to create adhesives compatible with composites and plastic substrates.

Additionally, regional players in Asia Pacific are expanding their presence through cost-effective production and a strong distribution network in emerging maritime markets. Strategic mergers and acquisitions are further enabling companies to strengthen their portfolios in marine-grade adhesives.

With the rise in recreational boating, offshore structures, and defense marine applications, companies are increasingly aligning their R&D efforts with the latest performance standards, regulatory compliance, and customer-specific bonding requirements.

Some of the prominent players in the Global Marine Adhesive Market are:

- 3M Company

- Henkel AG & Co. KGaA

- Sika AG

- H.B. Fuller Company

- Arkema Group

- Huntsman Corporation

- Ashland Global Holdings Inc.

- Dow Inc.

- Lord Corporation

- Permabond LLC

- Scott Bader Company Ltd

- Parson Adhesives Inc.

- Master Bond Inc.

- ITW Performance Polymers

- DELO Industrial Adhesives

- Bostik SA

- Gurit Holding AG

- Avery Dennison Corporation

- Chemence Ltd

- Wacker Chemie AG

- Other Key Players

Recent Developments

- In November 2024, Arxada announced its participation in ChinaCoat 2024, taking place in Guangzhou from December 3–5. The company plans to highlight its advanced Omadine® technology, developed to improve marine antifouling coatings by boosting performance, reducing leaching, and supporting sustainability. Arxada will also showcase adhesive additives designed to enhance coating durability and provide environmental benefits. Visitors can learn more at Booth 2.1 B15.

- In November 2024, Henkel revealed a new collaboration with Celanese to develop adhesives made using captured CO₂ emissions. This partnership focuses on sustainable emulsion production by utilizing carbon capture technology, thereby reducing environmental impact. The initiative supports a circular economy model by repurposing industrial CO₂ into high-performance adhesive solutions, reinforcing Henkel’s dedication to eco-innovation.

- In September 2024, Bostik launched Fast Glue Ultra+, an instant adhesive made from 60% bio-based ingredients. This new product advances sustainability in the adhesive industry without compromising bonding strength. Developed using a proprietary synthesis method, the adhesive reflects Bostik’s technical leadership and strengthens Arkema’s role in the field of environmentally friendly adhesive solutions.

- In September 2024, BioBond Adhesives, Inc. announced the opening of its headquarters and R&D labs in Lafayette, Indiana. The company is focused on the development of biodegradable, plant-based adhesives aimed at replacing conventional options in the marine sector. These innovations are designed to provide eco-conscious bonding alternatives for marine vessels and structures.

- In May 2024, 3M is investing USD 67.0 million to expand its Valley, Nebraska facility by 90,000 square feet and add 40 new jobs. The enhancement includes new production lines and equipment to meet the rising demand for marine adhesives. This investment further solidifies 3M’s long-term presence in Nebraska and underscores its strategic focus on marine adhesive manufacturing.

- In February 2024, Henkel has completed its acquisition of Seal for Life Industries, a U.S.-based leader in protective coatings and sealing technologies. The deal strengthens Henkel’s marine adhesive portfolio and expands its maintenance, repair, and operations (MRO) capabilities. Seal for Life’s sustainable technologies support asset durability in sectors like marine, oil & gas, and infrastructure, aligning with Henkel’s broader growth strategy in adhesive technologies.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 515.2 Mn |

| Forecast Value (2034) |

USD 736.7 Mn |

| CAGR (2025–2034) |

4.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 102.7 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Epoxy, Polyurethane, Acrylic, Others), By Substrate (Metal, Composites, Plastic, Others), By Application (Deck Systems, Glazing, Panel Bonding, Others), By End User (Cargo Ships, Passenger Ships, Boats, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

3M Company, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, Arkema Group, Huntsman Corporation, Ashland Global Holdings Inc., Dow Inc., Lord Corporation, Permabond LLC, Scott Bader Company Ltd, Parson Adhesives Inc., Master Bond Inc., ITW Performance Polymers, DELO Industrial Adhesives, Bostik SA, Gurit Holding AG, Avery Dennison Corporation, Chemence Ltd, Wacker Chemie AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Marine Adhesive Market?

▾ The Global Marine Adhesive Market size is estimated to have a value of USD 515.2 million in 2025 and is expected to reach USD 736.7 million by the end of 2034.

Which region accounted for the largest Global Marine Adhesive Market?

▾ Asia Pacific is expected to be the largest market share for the Global Marine Adhesive Market with a share of about 46.7% in 2025.

Who are the key players in the Global Marine Adhesive Market?

▾ Some of the major key players in the Global Marine Adhesive Market are 3M Company, Henkel AG & Co. KGaA, Sika AG, and many others.

How big is the US Marine Adhesive Market?

▾ The US Marine Adhesive Market size is estimated to have a value of USD 102.7 million in 2025 and is expected to reach USD 144.3 million by the end of 2034.

What is the growth rate in the Global Marine Adhesive Market?

▾ The market is growing at a CAGR of 4.1% over the forecasted period.