Market Overview

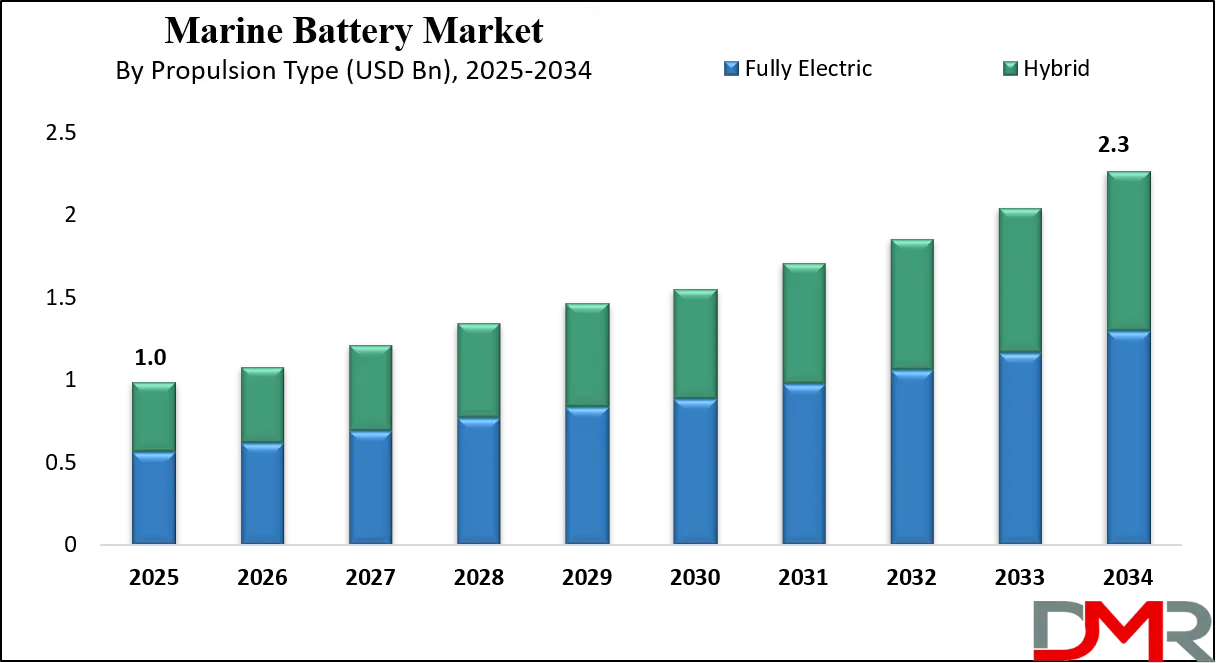

The Global Marine Battery Market size is projected to reach USD 1.0 billion in 2025 and grow at a compound annual growth rate of 9.7% from there until 2034 to reach a value of USD 2.3 billion

A marine battery is a special kind of battery used to power boats, ships, and other water-based vehicles. Unlike regular batteries, marine batteries are built to handle moisture, vibrations, and long periods of storage. They are used for starting engines, running onboard equipment like lights, navigation systems, or providing power when the engine is off. There are different types, such as lithium-ion, lead-acid, and absorbed glass mat (AGM), depending on the type and size of the vessel.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In recent years, demand for marine batteries has grown steadily. One key reason is the push for cleaner energy and reduced fuel use. Many ports and shipping companies are working to reduce emissions, which has encouraged the shift from traditional fuel-based engines to electric or hybrid systems that need reliable battery power.

Recreational boating has also become more popular, with people using electric boats for fishing, water sports, and short-distance travel.

Technology advancements have made marine batteries more efficient. Lithium-ion batteries are becoming popular because they are lightweight, charge faster, and last longer. These features make them ideal for modern boats and commercial vessels. Companies are focusing on making batteries safer and easier to maintain, with smart battery management systems that protect against overheating and overcharging. These improvements help boat owners get better performance and longer life from their batteries.

Another important trend is the use of batteries in ferries and commercial ships. Some countries have introduced electric ferries to cut emissions and noise pollution. This is especially important in places with strict environmental rules. Ports are also moving towards using battery-powered support equipment, such as tugboats and barges. These changes are part of a wider effort to create greener ports and coastal areas.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Major events have also played a role in shaping this market. Governments have launched policies that support electric and hybrid marine systems. Investments in marine electrification, particularly in Europe, Asia, and North America, have increased. New partnerships between battery makers and shipbuilders are helping to develop more advanced solutions tailored for marine needs.

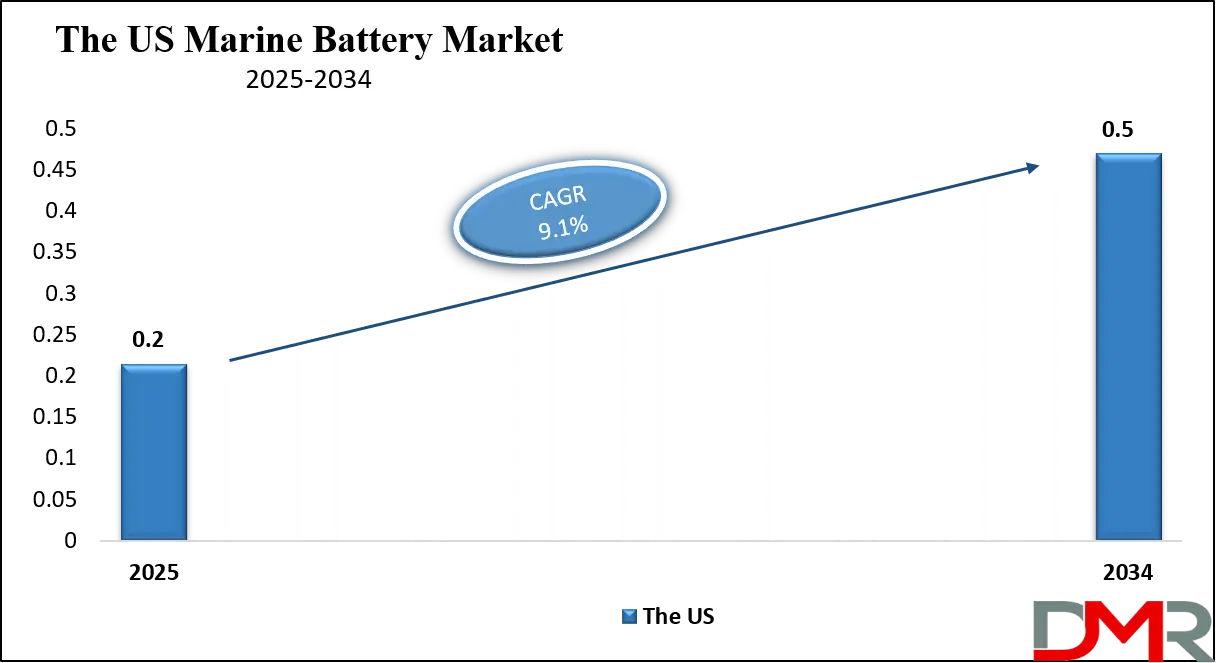

The US Marine Battery Market

The US Marine Battery Market size is projected to reach USD 0.2 billion in 2025 at a compound annual growth rate of 9.1% over its forecast period.

The US plays a key role in the marine battery market by driving innovation, funding research, and supporting clean marine transportation policies. With strong demand for electric and hybrid vessels in both commercial and recreational sectors, the US is fostering rapid adoption of marine batteries. Government agencies are investing in sustainable ports and electrified maritime systems to reduce emissions and improve air quality.

The US Navy and Coast Guard are also exploring battery-powered systems for improved efficiency and safety. In addition, American companies are developing advanced battery technologies, including lithium-ion and solid-state options, tailored for marine use. Through regulatory support, technological leadership, and environmental initiatives, the US is shaping global trends and setting high standards in the marine battery industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Marine Battery Market

Europe Marine Battery Market size is projected to reach USD 0.3 billion in 2025 at a compound annual growth rate of 9.3% over its forecast period.

Europe plays a leading role in the marine battery market, driven by strict environmental regulations, green port initiatives, and a strong push toward decarbonizing the maritime sector. The European Union has introduced policies and funding programs that support electric and hybrid marine vessels to meet its climate goals. Countries like Norway, the Netherlands, and Germany are pioneers in using battery-powered ferries, patrol boats, and inland cargo ships.

European shipbuilders and battery manufacturers are collaborating to develop advanced, safe, and efficient battery systems tailored for harsh marine environments. With a focus on clean energy, innovation, and public-private partnerships, Europe is setting global benchmarks in marine electrification and encouraging the transition toward low-emission and fully electric marine transportation.

Japan Marine Battery Market

Japan Marine Battery Market size is projected to reach USD 0.05 billion in 2025 at a compound annual growth rate of 11.3% over its forecast period.

Japan is a significant player in the marine battery market, leveraging its strong tech expertise and green ambitions. A prominent example is the e5 Project, a Japanese consortium powering commercial ships—including oil tankers and tugboats—with large-scale lithium-ion batteries and smart systems. The nation also leads in naval battery innovation: its latest Sōryū and Taigei‑class submarines are equipped with advanced lithium-ion batteries, greatly boosting underwater endurance and speed.

Companies in Japan are actively developing hybrid vessels that integrate renewable energy and battery storage, such as solar-assisted ferries and tugboats. Government support through certification, funding, and environmental goals further fuels marine electrification. Overall, Japan’s blend of cutting-edge design, industrial coordination, and strategic investment cements its leading role in transforming marine battery technologies.

Marine Battery Market: Key Takeaways

- Market Growth: The Marine Battery Market size is expected to grow by USD 1.2 billion, at a CAGR of 9.7%, during the forecasted period of 2026 to 2034.

- By Propulsion Type: The fully electric segment is anticipated to get the majority share of the Marine Battery Market in 2025.

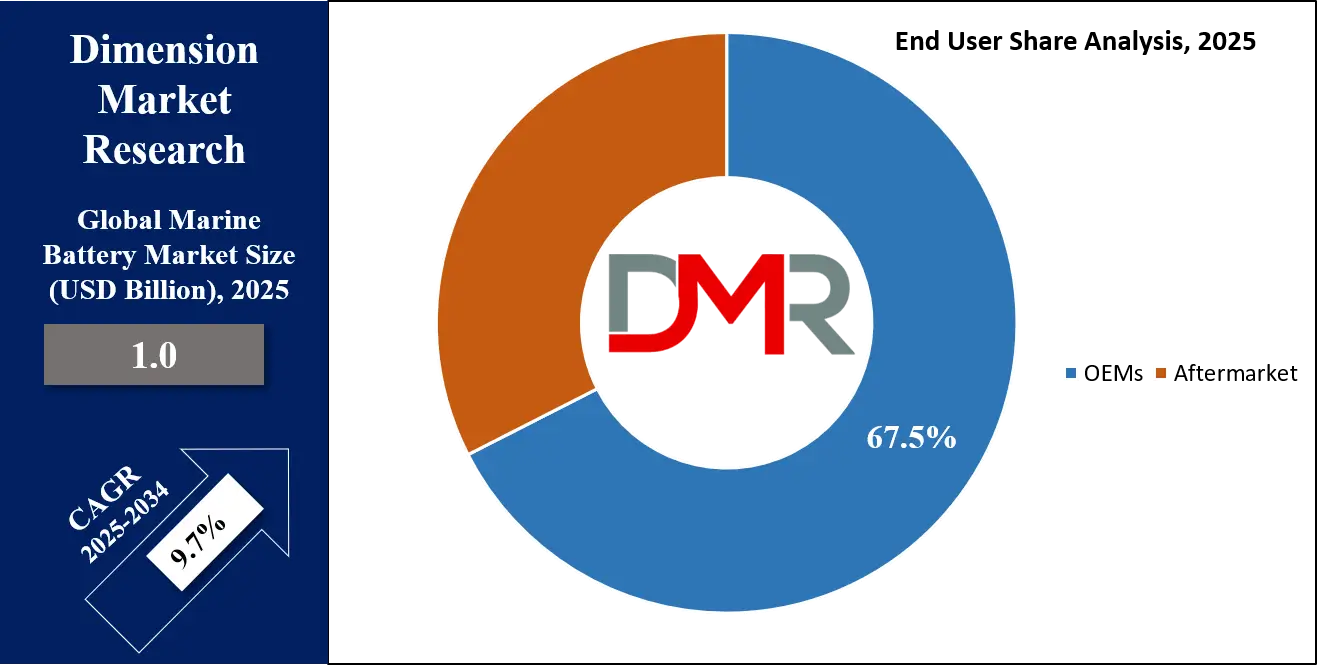

- By End User: The OEMs segment is expected to get the largest revenue share in 2025 in the Marine Battery Market.

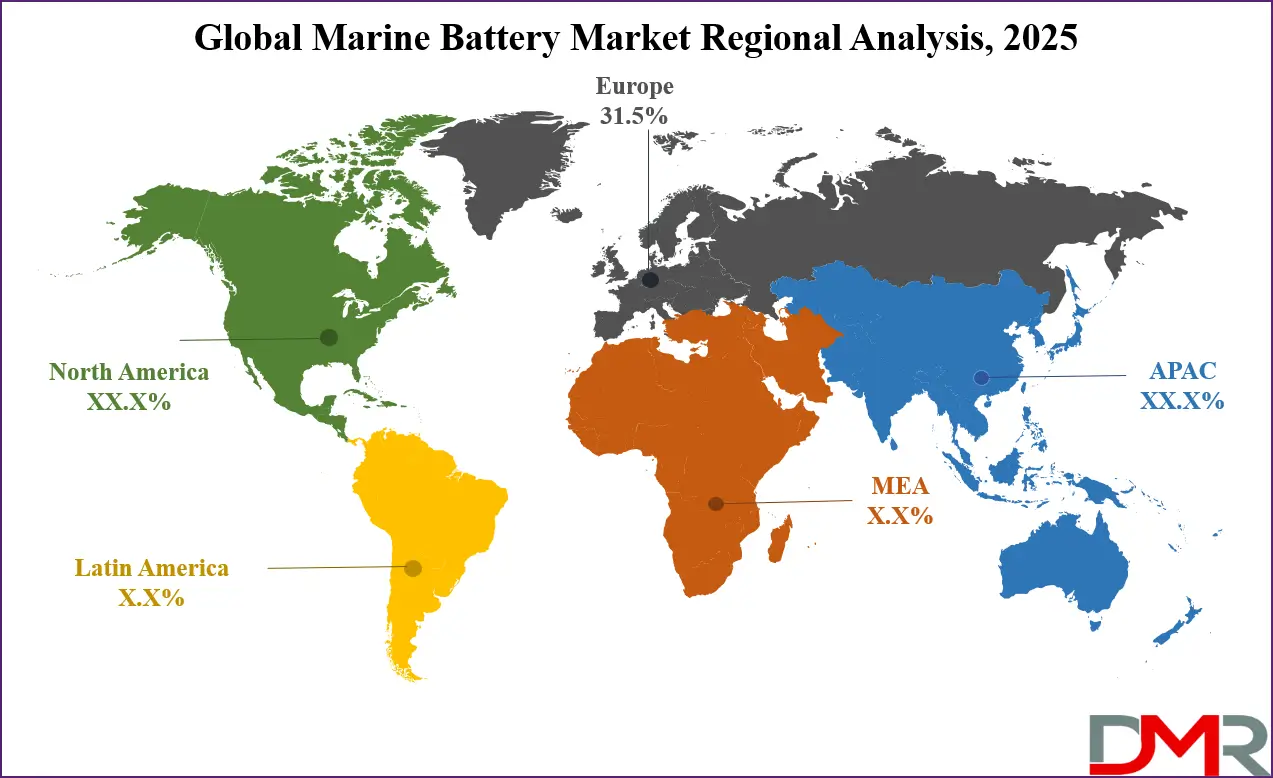

- Regional Insight: Europe is expected to hold a 31.5% share of revenue in the Global Marine Battery Market in 2025.

- Use Cases: Some of the use cases of Marine Battery include commercial vessels, recreational boating, and more.

Marine Battery Market: Use Cases

- Recreational Boating: Marine batteries are widely used in electric or hybrid boats for leisure activities like fishing, sailing, and cruising. They power trolling motors, onboard electronics, lighting, and other comforts without running the engine. Their quiet operation and low maintenance make them ideal for eco-friendly water adventures.

- Commercial Vessels: Ferries, cargo ships, and patrol boats use marine batteries to reduce fuel use and meet emission regulations. These batteries support hybrid propulsion systems or provide backup power. In ports with clean energy goals, battery-powered vessels help lower pollution and noise levels.

- Port and Harbor Operations: Marine batteries are used in tugboats, pilot boats, and other port service vessels. They ensure reliable power in areas where fuel restrictions are strict. Batteries also help reduce operating costs by minimizing engine wear and fuel consumption during idle times.

- Emergency and Backup Power: In marine safety systems, batteries act as a reliable backup during engine failure or power outages. They support essential systems like navigation, communication, and bilge pumps. Their stability and quick response make them critical for emergencies on the water.

Market Dynamic

Driving Factors in the Marine Battery Market

Rising Adoption of Electric and Hybrid Marine Vessels

One of the major growth drivers for the marine battery market is the increasing shift toward electric and hybrid propulsion systems in both recreational and commercial vessels. With global pressure to reduce carbon emissions and meet strict environmental regulations, shipping and boating industries are moving away from traditional fuel-based engines.

Marine batteries provide a clean, quiet, and efficient alternative that aligns with these sustainability goals. Governments are also offering incentives and subsidies to promote electric marine technologies. As a result, more ferry operators, port authorities, and yacht owners are investing in battery-powered systems. This transition not only cuts fuel costs but also reduces maintenance and enhances the overall performance of vessels, boosting battery demand.

Technological Advancements and Battery Innovation

The rapid development of battery technologies is significantly driving the marine battery market forward. Innovations such as lightweight lithium-ion batteries, improved energy density, faster charging times, and longer life cycles are making battery systems more practical for marine use. Advanced battery management systems help monitor performance and prevent issues like overheating or overcharging, enhancing safety and reliability.

These features are particularly important for long-distance and commercial marine operations. Ongoing research is also leading to better thermal control and weather resistance, which are essential in harsh marine environments. As battery systems become more efficient and affordable, their adoption across various vessel types is expanding rapidly.

Restraints in the Marine Battery Market

High Initial Costs and Limited Infrastructure

One of the key restraints in the marine battery market is the high upfront cost of advanced battery systems, especially lithium-ion variants. These costs include not only the battery itself but also installation, integration with propulsion systems, and safety mechanisms. For many small or budget-conscious operators, this becomes a major barrier to adoption.

Additionally, the lack of widespread charging infrastructure at ports, marinas, and docking stations limits the use of electric marine vessels on longer routes. Without reliable and accessible charging solutions, operators may hesitate to switch from conventional fuel-based engines. This infrastructure gap is especially evident in developing regions, where marine electrification is still at an early stage.

Weight, Range Limitations, and Technical Challenges

Despite improvements, marine batteries still face performance limitations that affect their wider use, particularly in larger commercial vessels. Batteries add significant weight, which can reduce the cargo capacity and efficiency of the vessel. The limited range of electric propulsion, especially compared to diesel engines, restricts battery-powered vessels to short-distance travel unless supported by hybrid systems.

In addition, harsh marine conditions such as saltwater exposure, high humidity, and extreme temperatures demand robust and weather-resistant battery designs. Managing battery life, charging cycles, and safety remains technically complex. These challenges can deter shipbuilders and operators from fully committing to battery-based solutions.

Opportunities in the Marine Battery Market

Growing Demand for Sustainable Maritime Tourism

The rise in eco-conscious tourism presents a strong opportunity for the marine battery market. Travelers are increasingly seeking environmentally friendly travel experiences, leading to demand for electric and hybrid boats used in coastal tours, wildlife excursions, and leisure cruises. Marine batteries enable quieter operation, zero emissions, and a smoother ride, enhancing the appeal of such vessels for tourists and tour operators alike.

Island destinations and protected marine areas are encouraging the use of electric boats to preserve fragile ecosystems. As tourism recovers and sustainability becomes a focus, investing in battery-powered marine transport offers operators a competitive edge. This trend is opening up new markets, especially in scenic and high-traffic coastal regions worldwide.

Electrification of Port and Harbor Operations

Another key opportunity lies in the shift toward the electrification of port and harbor operations. Many port authorities are adopting electric tugboats, pilot boats, and cargo-handling equipment to meet climate goals and reduce local air pollution. Marine batteries are central to this transition, offering clean, efficient power for short-haul operations and standby energy needs.

Governments and international agencies are funding green port projects, creating demand for marine battery systems in support vessels and port infrastructure. This electrification not only helps meet environmental regulations but also cuts fuel and maintenance costs. As more ports modernize, the need for customized marine battery solutions will grow, especially in high-volume trade hubs and environmentally sensitive zones.

Trends in the Marine Battery Market

Shift to Modular Battery Systems & Smart Controls

Marine battery setups are increasingly being built with modular designs, meaning boats and ships can choose just the right number of battery units for their needs. This flexibility makes installations easier, upgrades smoother, and maintenance simpler—especially useful for retrofit projects. On top of that, smart battery management systems (BMS) are becoming standard. These systems monitor battery health, prevent overheating, optimize charging, and alert operators early to any problems. This smart technology boosts safety and performance, making marine battery systems more reliable overall.

Growing Use of Lithium Iron Phosphate (LFP) Chemistry

A major trend lately is the rise of LFP batteries in marine applications. These batteries are cheaper, longer-lasting, and much safer than other lithium types. They’re less prone to catching fire and can serve many more charge cycles—perfect for the rough marine environment. They also perform well under heat or humidity and are easier to recycle. As LFP prices fall and proven reliability builds trust, more marine vessels—from leisure boats to small workboats—are choosing LFP over older lead-acid or NMC chemistries .

Research Scope and Analysis

By Battery Type Analysis

Lithium-ion batteries, leading in 2025 with a share of 61.5%, are playing a major role in the growth of the marine battery market due to their lightweight design, high energy density, and long cycle life. These batteries are becoming the top choice for electric and hybrid vessels, offering faster charging and better efficiency compared to traditional options. Their ability to power onboard systems and propulsion motors makes them ideal for both small recreational boats and large commercial ships. With more shipbuilders and operators choosing lithium-ion technology to meet emission targets and reduce fuel costs, this segment is set to dominate the market.

Ongoing innovations in battery safety, thermal management, and smart monitoring systems are further boosting their use. As more ports and fleets shift to electric solutions, lithium-ion batteries are expected to stay at the center of the marine electrification movement, driving long-term market growth.

Flow batteries, having significant growth over the forecast period, are gaining attention in the marine battery market for their long-duration energy storage and excellent safety features. These batteries use liquid electrolytes, making them more stable and less prone to overheating or fire risks, which is important in marine environments. Flow batteries are especially useful for vessels that need steady power over longer periods, such as ferries and support ships.

Their ability to scale easily and recharge through electrolyte replacement adds value for operations requiring extended range or endurance. With increasing demand for zero-emission vessels and reliable energy systems, flow battery technology is attracting interest for its potential in hybrid marine setups. As technology improves and costs gradually fall, more operators are expected to explore flow batteries as an alternative to lithium-based systems, helping diversify the battery landscape in the marine sector.

By Propulsion Type Analysis

Fully electric propulsion, leading in 2025 with a share of 57.1%, is becoming a key driver in the marine battery market as more vessels shift toward zero-emission solutions. This propulsion type eliminates the need for fuel-based engines, allowing boats and ships to run entirely on battery power, reducing both noise and pollution. Fully electric systems are ideal for short-distance routes, ferries, leisure boats, and port operations where clean energy use is prioritized.

The increasing number of eco-friendly regulations and growing public support for sustainable transportation are pushing the adoption of fully electric vessels. Improvements in battery range, charging speed, and onboard energy efficiency are making this propulsion method more practical and cost-effective. With ports upgrading infrastructure and vessel owners aiming to meet climate goals, fully electric propulsion is expected to continue leading market demand and shape the future of green marine transport.

Hybrid propulsion is showing strong momentum with significant growth over the forecast period, driven by its ability to combine battery systems with traditional engines for better flexibility and fuel savings. This setup allows vessels to operate on electric power during low-speed travel or in emission-sensitive zones, while still relying on engines for longer distances or high-power needs. Hybrid systems are gaining popularity in commercial shipping, ferries, and research vessels that require extended range and reliable performance.

The technology supports lower emissions without fully giving up engine power, making it a smart transition option for many operators. As fuel prices rise and emission limits tighten, hybrid propulsion offers a balanced solution that supports gradual electrification. Continuous advancements in marine battery storage and energy management are making hybrid systems even more efficient, attracting broader interest across the global maritime sector.

By Ship Type Analysis

Commercial ship type, leading in 2025 with a share of 48.9%, plays a vital role in the expansion of the marine battery market, as shipping companies seek cleaner and more efficient energy solutions. These vessels, including ferries, cargo ships, and workboats, are under pressure to reduce carbon emissions and operating costs while meeting stricter global regulations. Marine battery systems allow commercial ships to operate in low-emission zones, reduce fuel use during port stays, and support hybrid propulsion for longer routes.

As commercial maritime trade grows, so does the demand for reliable and high-capacity energy storage. Governments and port authorities are also pushing for battery-powered operations to cut local pollution. The steady shift toward electrification across major shipping routes is expected to further drive adoption. With advancements in battery performance and safety, the commercial segment continues to lead the way in transforming marine transport into a more sustainable industry.

Leisure ship type is gaining strong attention with significant growth over the forecast period, thanks to increasing interest in eco-friendly recreational boating. Yachts, sailboats, and small electric boats are adopting marine battery systems to offer a quiet, clean, and enjoyable experience for users. As more people choose sustainable travel options, demand for electric-powered leisure boats is rising in coastal tourism, lake tours, and personal watercraft.

Marine batteries help reduce noise, eliminate engine fumes, and cut fuel expenses, all of which enhance the boating experience. Easy maintenance and improved battery designs make them ideal for casual boaters and charter operators alike. With more models now offering fully electric or hybrid versions, and marinas starting to support charging infrastructure, the leisure segment is becoming a strong contributor to the overall growth of the marine battery market.

By Nominal Capacity

100–500 kWh nominal capacity segment, leading in 2025 with a share of 34.2%, plays a major role in the marine battery market due to its ideal balance between energy storage, weight, and cost for medium-sized vessels. This capacity range is well-suited for ferries, tugboats, offshore support vessels, and hybrid passenger boats that need dependable power for moderate distances and daily operations. Operators prefer this range as it offers a good mix of efficiency and runtime without requiring major design changes to the vessel.

It allows boats to operate cleanly in ports, emission-controlled areas, and during standby periods. With growing environmental regulations and support for electrified marine fleets, batteries in this category are becoming widely adopted. Continuous improvements in charge cycles, cooling systems, and space-saving designs further boost demand. This segment is expected to remain a preferred choice for commercial fleets looking to cut emissions while maintaining performance and affordability.

1000 kWh nominal capacity is showing significant growth over the forecast period as large vessels demand higher energy storage for extended routes and heavier operations. This segment is especially useful for ferries, cruise ships, and offshore vessels that require powerful battery systems to run longer without depending heavily on fuel engines. With the rise in hybrid and fully electric ships handling greater loads, the need for batteries with more than 1000 kWh is increasing. These high-capacity batteries help vessels reduce emissions on long routes and support port electrification goals.

As battery technology becomes more compact and efficient, shipbuilders are finding it easier to integrate large systems onboard. The strong push for zero-emission shipping and tighter international regulations is encouraging the use of high-capacity battery solutions in large-scale marine applications.

By End User Analysis

OEMs, leading in 2025 with a share of 67.5%, are playing a central role in the growth of the marine battery market by integrating advanced battery systems directly into new vessels during the manufacturing process. Original Equipment Manufacturers are increasingly working with battery suppliers to design ships that are optimized for electric or hybrid propulsion right from the start. This allows for better space management, weight distribution, and safety integration.

As global regulations tighten around marine emissions, OEMs are shifting focus to clean energy systems, making battery technology a core component in new ship designs. From ferries and yachts to commercial workboats, manufacturers are equipping vessels with energy storage systems that meet performance and environmental standards. This built-in approach not only improves efficiency but also reduces long-term operational costs. With growing demand for electric vessels, OEMs are expected to lead innovation and scale-up in marine battery adoption across the industry.

The aftermarket segment is showing significant growth over the forecast period as many ship operators upgrade existing fleets with marine battery systems to meet modern performance and environmental standards. Instead of buying new vessels, owners of older boats and ships are turning to retrofit solutions, replacing or adding battery packs to improve fuel efficiency and reduce emissions. This trend is especially strong among commercial operators, ferries, and smaller recreational boats that aim to lower operational costs and comply with green regulations.

The aftermarket path allows flexibility, making it easier for fleet owners to shift toward electrification gradually. As charging infrastructure improves and battery technologies become more compact and efficient, upgrading existing vessels becomes more attractive. This growing focus on retrofitting and replacement presents a strong opportunity for marine battery providers, enabling the aftermarket segment to steadily expand its footprint in the global marine battery market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Marine Battery Market Report is segmented on the basis of the following:

By Battery Type

- Lithium-ion

- Lead-acid

- Nickel-based

- Flow Batteries

- Others

By Propulsion Type

By Ship Type

- Commercial

- Ferries

- Cruise Ships

- Cargo Vessels

- Tankers

- Defense

- Leisure

- Yachts

- Recreational Boats

By Nominal Capacity

- <100 kWh

- 100–500 kWh

- 500–1,000 kWh

- 1,000 kWh

By End User

Regional Analysis

Leading Region in the Marine Battery Market

Europe, leading the marine battery market in 2025 with a share of 31.5%, plays a major role in driving the industry forward. The region’s strong focus on clean energy, strict emission rules, and government-backed green shipping initiatives are encouraging the shift from traditional fuel engines to electric and hybrid marine systems. Countries like Norway, the Netherlands, and Germany are at the front, using battery-powered ferries, passenger boats, and work vessels. Ports across Europe are also upgrading to support electric docking and charging facilities, making battery-powered operations more practical.

The European Union continues to fund research and innovation in marine battery technology, supporting both manufacturers and shipbuilders. Ship owners in Europe are increasingly adopting lithium-ion and other advanced battery systems to meet environmental standards and reduce fuel costs. With a clear focus on sustainability, strong policy support, and growing investments in battery solutions, Europe stands out as a key region pushing marine battery adoption and shaping the future of green maritime transport.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Marine Battery Market

Asia Pacific is showing significant growth over the forecast period in the marine battery market due to rising demand for cleaner marine transportation and strong government support. Countries like China, Japan, and South Korea are investing heavily in electric and hybrid shipbuilding, battery technology, and green port infrastructure.

The growing use of lithium-ion batteries in commercial vessels, ferries, and harbor crafts is helping reduce emissions and fuel dependence. Local manufacturing strength, rapid industrialization, and environmental policies are pushing the adoption of advanced battery systems. With continuous investments, rising maritime trade, and increased focus on sustainable shipping, Asia Pacific is estimated to be one of the fastest-growing regions in the marine battery industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The marine battery market is becoming more competitive as many companies work to develop better, safer, and longer-lasting batteries for boats and ships. New players are entering the market with advanced technology, while older companies are upgrading their products to stay ahead. The focus is on lighter batteries, faster charging, and better performance in tough marine conditions.

Many firms are also partnering with boat builders and marine system providers to create custom battery solutions. As the demand for electric and hybrid boats rises, more investment is going into research and development. The competition is not just about price but also about quality, safety, and innovation, with companies trying to win over customers by offering smarter, more reliable battery systems.

Some of the prominent players in the global Marine Battery are:

- Corvus Energy

- Siemens Energy

- Wärtsilä

- Leclanché

- LG Energy Solution

- Toshiba Corporation

- Saft (TotalEnergies)

- CATL

- ABB

- Rolls-Royce (mtu)

- MAN Energy Solutions

- Samsung SDI

- General Electric

- Kokam

- EnerSys

- XALT Energy

- Spear Power Systems

- EST-Floattech

- PowerTech Systems

- Other Key Players

Recent Developments

- In March 2025, Swedish battery maker Echandia raised SEK 220 million (USD 20.45 million) to scale up production of its marine battery systems and support global expansion. The funding will enhance operations in Sweden and the U.S., particularly at its new Washington State facility focused on advanced maritime batteries. Echandia’s systems are already used in ferries, tugboats, and waterbuses. While battery tech suits short-route vessels, deep-sea shipping still faces challenges due to low energy density and limited charging infrastructure, prompting exploration of alternative marine fuels.

- In January 2025, RELiON® Battery, a global leader in lithium battery innovation, launched its new 48V ELiTE lithium battery, setting a new benchmark in performance, reliability, and user convenience. Described as the most advanced and user-friendly model in their lineup, the ELiTE series offers consistent power delivery and a longer lifespan. Further, the group highlighted the battery’s safety, efficiency, and the company’s legacy of innovation in delivering dependable energy solutions for various applications.

- In June 2024, Microvast Holdings, Inc. announced a strategic partnership with Evoy, a Norwegian company known for high-performance electric motor systems for boats. This collaboration marks Microvast’s entry into the electric boat market and supports Evoy’s efforts to broaden its battery offerings across various marine applications. The partnership combines Microvast’s battery innovation with Evoy’s marine expertise, aiming to advance sustainable solutions and expand electrification in the global boating industry.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.0 Bn |

| Forecast Value (2034) |

USD 2.3 Bn |

| CAGR (2025–2034) |

9.7% |

| The US Market Size (2025) |

USD 0.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Battery Type (Lithium-ion, Lead-acid, Nickel-based, Flow Batteries, and Others), By Propulsion Type (Fully Electric and Hybrid), By Ship Type (Commercial, Defense, and Leisure), By Nominal Capacity (<100 kWh, 100–500 kWh, 500–1,000 kWh, and 1,000 kWh), By End User (OEMs and Aftermarket) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Corvus Energy, Siemens Energy, Wärtsilä, Leclanché, LG Energy Solution, Toshiba Corporation, Saft (TotalEnergies), CATL, ABB, Rolls-Royce (mtu), MAN Energy Solutions, Samsung SDI, General Electric, Kokam, EnerSys, XALT Energy, Spear Power Systems, EST-Floattech, PowerTech Systems, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Marine Battery Market?

▾ The Global Marine Battery Market size is expected to reach a value of USD 1.0 billion in 2025 and is expected to reach USD 2.3 billion by the end of 2034.

Which region accounted for the largest Global Marine Battery Market?

▾ Europe is expected to have the largest market share in the Global Marine Battery Market, with a share of about 31.5% in 2025.

How big is the Marine Battery Market in the US?

▾ The Marine Battery Market in the US is expected to reach USD 0.2 billion in 2025.

Who are the key players in the Global Marine Battery Market?

▾ Some of the major key players in the Global Marine Battery Market are Corvus Energy, Siemens Energy, Wärtsilä , and others

What is the growth rate in the Global Marine Battery Market?

▾ The market is growing at a CAGR of 9.7 percent over the forecasted period.