Market Overview

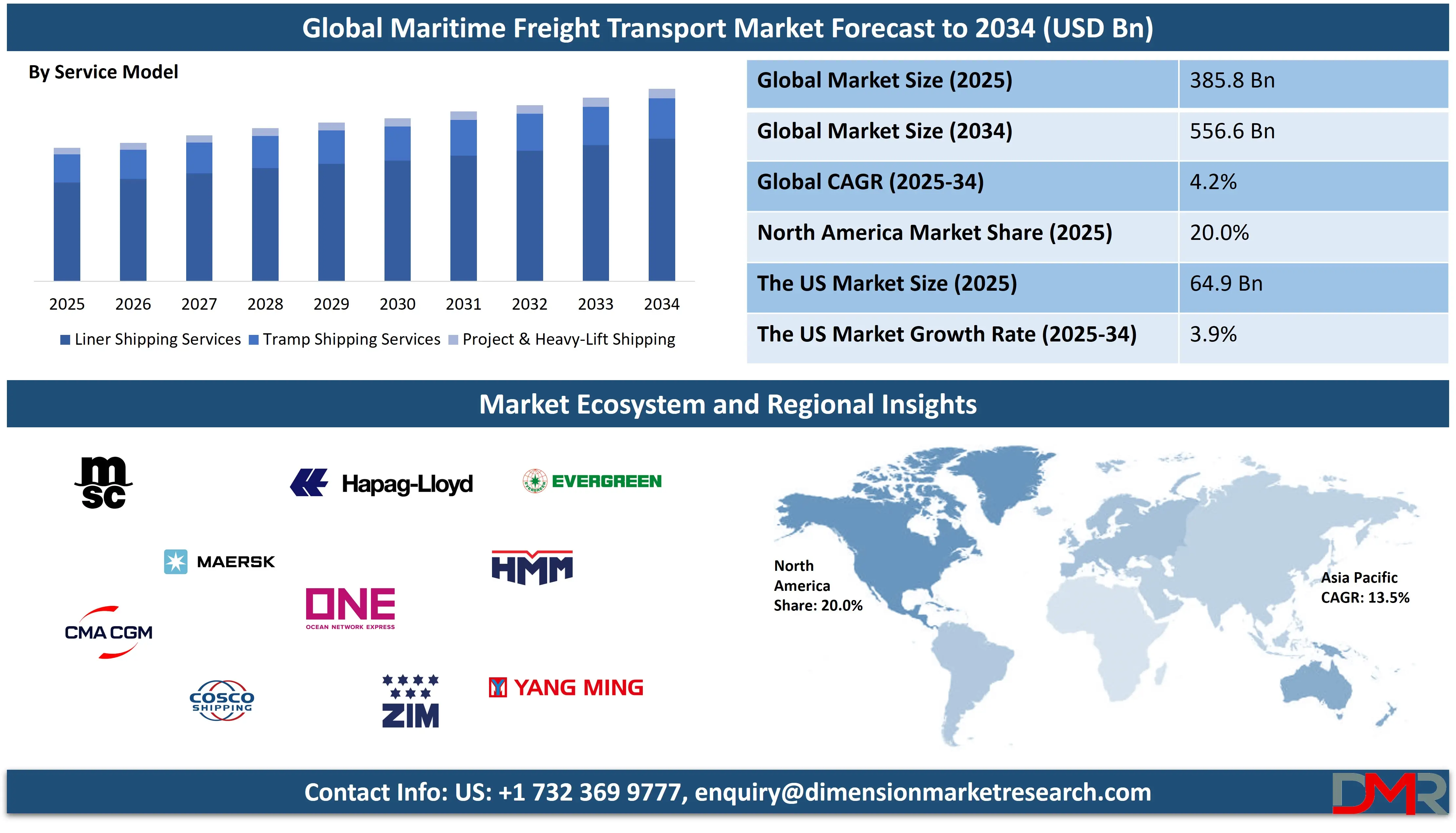

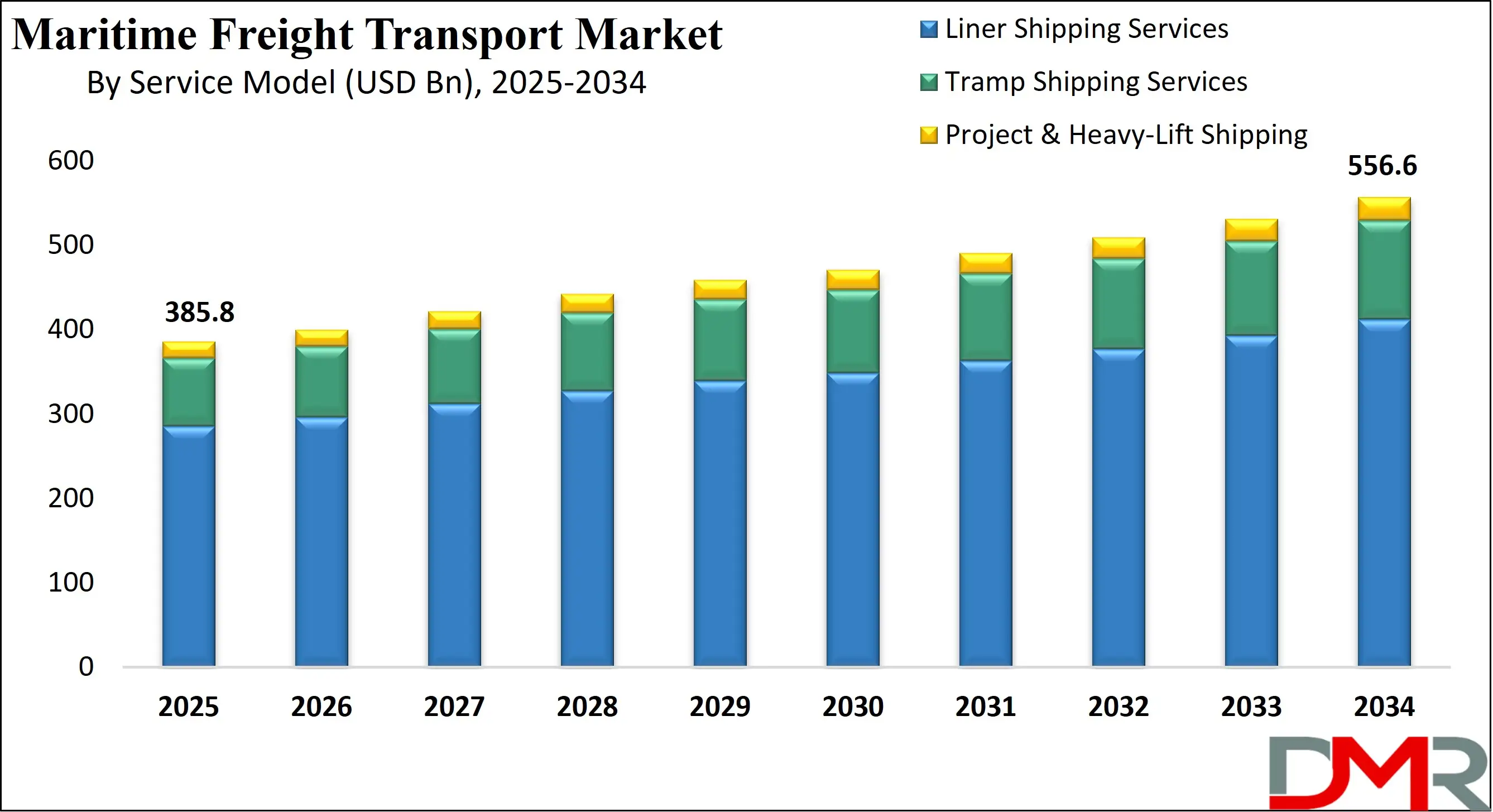

The Global Maritime Freight Transport Market was valued at USD 385.8 billion in 2025 and is projected to reach USD 556.6 billion by 2034, expanding at a CAGR of 4.2%, driven by rising seaborne trade volumes, container shipping demand, bulk cargo movement, and growth in international logistics and port based freight operations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Maritime freight transport refers to the organized movement of goods and commodities across oceans and seas using commercial vessels that are specifically designed to handle different cargo formats such as containers, bulk materials and liquid shipments. It forms the backbone of international logistics by enabling large scale trade between producers and consumers located in different countries and continents. Through port infrastructure shipping lanes and maritime logistics networks this mode of transport supports cost efficient long distance movement of raw materials intermediate goods and finished products while ensuring supply chain continuity for industries ranging from manufacturing to energy and agriculture.

The global Maritime Freight Transport Market represents the combined economic activity generated by shipping companies port operators freight forwarders and logistics service providers that facilitate ocean based cargo movement worldwide. This market is driven by expanding international trade globalized manufacturing and rising demand for container shipping bulk carriers and tanker services. Increasing consumption of consumer goods energy resources and industrial inputs continues to push cargo volumes higher while investments in port infrastructure and vessel capacity support the long term growth of seaborne trade across all major trade routes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition the global Maritime Freight Transport Market is shaped by evolving supply chain strategies digital shipping platforms and regulatory frameworks aimed at improving safety and environmental performance. The growing use of smart ports vessel tracking systems and integrated maritime logistics is enhancing operational efficiency and cargo visibility for shippers and carriers alike. As emerging economies increase their participation in global trade and established economies modernize their shipping fleets the market continues to expand in value and strategic importance within the broader transportation and logistics ecosystem.

The US Maritime Freight Transport Market

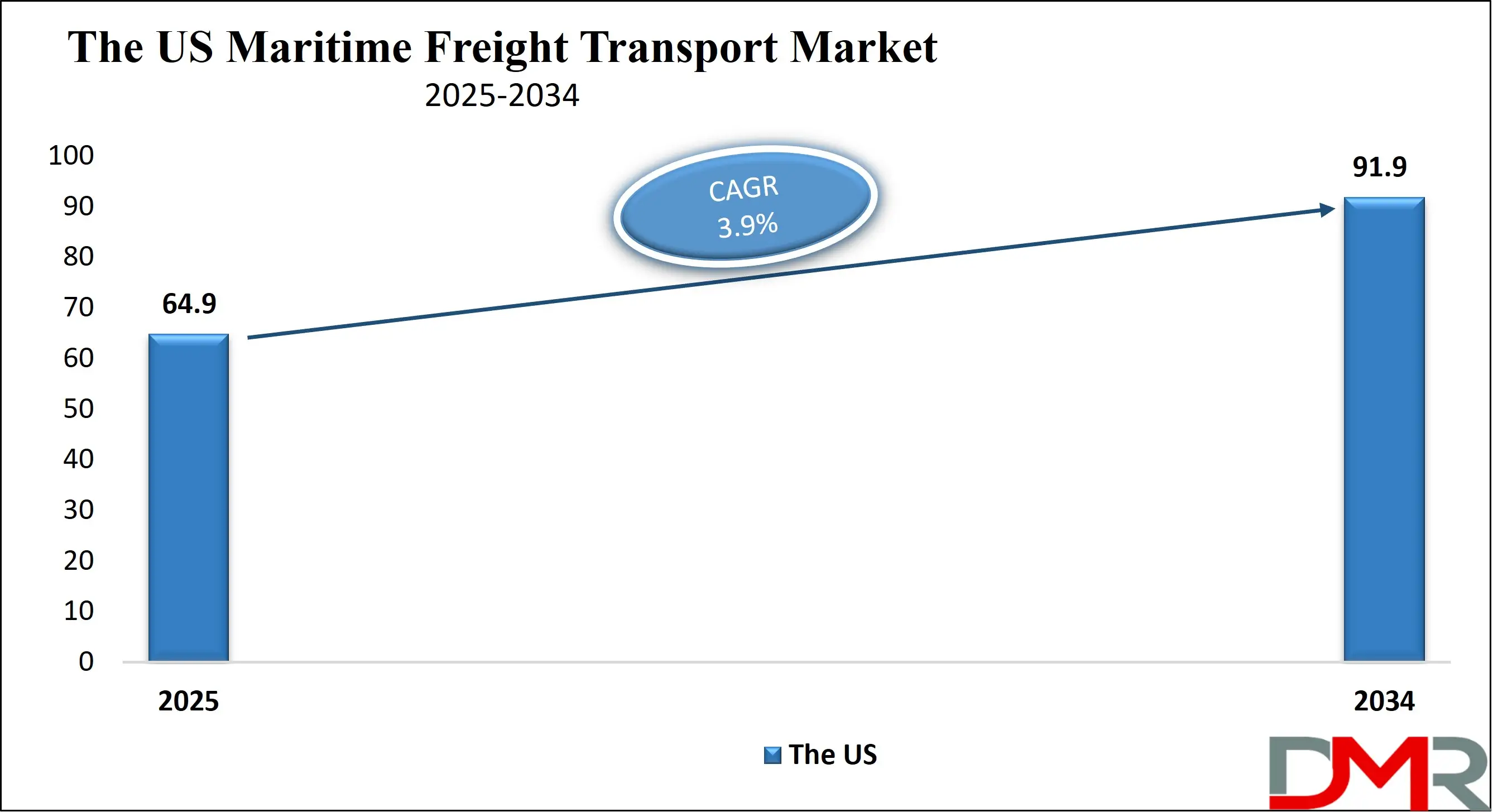

The U.S. Maritime Freight Transport Market size was valued at USD 64.9 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 91.9 billion in 2034 at a CAGR of 3.9%.

The US Maritime Freight Transport Market plays a central role in supporting the country’s international trade, industrial supply chains, and consumer goods distribution. Major ports along the Pacific Atlantic and Gulf coasts handle massive volumes of containerized cargo bulk commodities and energy shipments linking the United States with Asia Europe and Latin America.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Strong demand from manufacturing agriculture retail and automotive sectors drives consistent cargo flows while advanced port infrastructure and intermodal connectivity enable smooth integration with rail and trucking networks, making maritime shipping a cost efficient and reliable logistics backbone for the US economy.

The market is also being shaped by digitalization sustainability initiatives and port modernization programs aimed at improving cargo handling efficiency and reducing emissions. Investments in smart ports automated terminals and vessel tracking systems are enhancing operational visibility and turnaround times for shipping lines and freight forwarders. Growing e commerce activity and nearshoring trends are further increasing demand for container shipping and coastal trade. At the same time environmental regulations and the adoption of cleaner fuels are pushing carriers to modernize fleets, strengthening the long term competitiveness of the US maritime freight transport ecosystem.

Europe Maritime Freight Transport Market

The European maritime freight transport market was valued at USD 88.7 billion in 2025, reflecting the region’s strong role in global trade and logistics. Europe’s extensive port infrastructure, including major hubs like Rotterdam, Hamburg, and Antwerp, facilitates high volumes of containerized cargo, bulk commodities, and liquid shipments across international routes. The region serves as a critical gateway for imports and exports between Asia, North America, and intra-European trade, supporting industries such as manufacturing, automotive, retail, and energy. Efficient port operations, intermodal connectivity, and advanced logistics systems underpin Europe’s sizable market share in global maritime freight transport.

The market in Europe is projected to grow at a CAGR of 3.9%, driven by steady industrial demand, modernization of port facilities, and investments in digital shipping technologies. Adoption of smart port systems, automated cargo handling, and green shipping initiatives are improving operational efficiency while supporting environmental compliance. In addition, intra-European trade and short-sea shipping are gaining prominence due to regional integration, supply chain optimization, and nearshoring trends. These factors collectively strengthen Europe’s position as a stable and strategically important segment of the global maritime freight transport market.

Japan Maritime Freight Transport Market

The Japanese maritime freight transport market was valued at USD 19.3 billion in 2025, highlighting the country’s strategic role in Asia-Pacific trade and its strong shipping infrastructure. Japan’s major ports, including Tokyo, Yokohama, and Kobe, handle significant volumes of containerized cargo, bulk commodities, and industrial goods, connecting the nation with key markets in North America, Europe, and neighboring Asian countries. The market is supported by Japan’s advanced manufacturing sector, including automotive, electronics, and machinery exports, which rely heavily on efficient maritime logistics for timely delivery and global competitiveness.

The market in Japan is projected to grow at a CAGR of 4.2%, in line with the global maritime freight transport growth rate, driven by increasing international trade, technological adoption, and fleet modernization. Investments in port automation, smart logistics solutions, and eco-friendly shipping practices are enhancing operational efficiency and sustainability. Additionally, Japan’s focus on expanding intra-Asia trade, supporting e-commerce exports, and upgrading coastal shipping networks contributes to the steady growth of its maritime freight transport market, reinforcing its strategic importance within the global shipping ecosystem.

Global Maritime Freight Transport Market: Key Takeaways

- Steady Market Growth: The global maritime freight transport market is experiencing steady growth, projected to rise from USD 385.5 billion in 2025 to USD 556.6 billion by 2034 at a CAGR of 4.2%, driven by increasing seaborne trade, container shipping demand, and bulk cargo movement across international trade routes.

- Dominance of Containerized Cargo: Containerized cargo dominates the market, reflecting the importance of standardized shipping for consumer goods, e‑commerce, and industrial products, while dry bulk, liquid bulk, and Ro-Ro segments continue to support critical sectors such as energy, agriculture, and automotive exports.

- Technological Transformation: Technological adoption, including AI, digital ports, and smart logistics, is transforming the market by improving operational efficiency, cargo visibility, predictive maintenance, and vessel optimization, thereby enhancing competitiveness and sustainability across maritime supply chains.

- Regional Market Dynamics: Regional dynamics reveal Asia Pacific as the largest revenue contributor, accounting for 39.0% of global market share in 2025, while the Middle East & Africa emerges as a high-growth region due to rising energy exports, port infrastructure investments, and strategic shipping lane advantages.

- Sustainability and Regulatory Impact: Sustainability and regulatory compliance are reshaping operations, with green shipping initiatives, alternative fuels, and emission reduction targets becoming crucial for carriers. Integration of IoT, predictive analytics, and automation further strengthens service reliability, operational efficiency, and environmental performance.

Global Maritime Freight Transport Market: Use Cases

- Containerized Trade for Consumer Goods: Maritime freight transport supports global container shipping of electronics apparel and retail products between major ports, enabling cost efficient international logistics and steady supply chain flow.

- Bulk Shipping for Energy and Resources: Bulk carriers and tankers move crude oil coal iron ore and LNG across oceans, supporting global energy trade and industrial production through reliable seaborne transport.

- Automotive and Machinery Exports: Ro Ro and container vessels transport vehicles and heavy equipment between manufacturing hubs and overseas markets, supporting cross border automotive and industrial trade.

- Agricultural and Food Commodity Transport: Maritime shipping enables large scale movement of grains food products and refrigerated cargo, ensuring global food supply through temperature controlled and bulk freight services.

Impact of Artificial Intelligence on the global Maritime Freight Transport market

Artificial intelligence is transforming the global maritime freight transport market by enhancing efficiency, visibility, and decision-making across the shipping ecosystem. AI-driven predictive analytics are enabling carriers and logistics providers to forecast demand, optimize routing, and reduce fuel consumption by identifying the most efficient sailing paths based on weather, current, and congestion data. Automated systems powered by machine learning improve port operations and terminal productivity by predicting peak handling times and equipment requirements, which reduces vessel turnaround and lowers overall transport costs. Enhanced cargo tracking and real-time condition monitoring supported by AI improve shipment visibility for shippers and receivers, enabling proactive exception management and stronger supply chain resilience.

In addition, AI technologies are accelerating the development of autonomous and semi-autonomous vessel operations, where smart navigation systems can process sensor data to avoid collisions, optimize speed, and manage fuel efficiency. Natural language processing and intelligent automation are also streamlining administrative tasks such as documentation, customs compliance, and freight invoicing, reducing manual errors and administrative overhead. By integrating AI with digital twin platforms and IoT-enabled maritime networks, stakeholders gain deeper insights into asset performance and logistics bottlenecks, driving innovation and competitiveness in the global maritime freight transport market.

Global Maritime Freight Transport Market: Stats & Facts

- Port Connectivity & Network Stats

- In Q2 2024, 937 ports were connected to at least one regular liner shipping service globally.

- Asia’s container ports recorded a 12% increase in connectivity over the last decade

- EU Maritime Data

- Approximately 13 billion tonnes of goods were transported by sea globally in 2023.

- EU‑27 gross weight of goods handled in ports declined 3.9% in 2023.

- UK Government Port Freight Stats

- All UK ports handled 429.7 million tonnes of cargo in 2024.

- Major UK ports accounted for 421.0 million tonnes of traffic in 2024.

- Minor UK ports handled 8.7 million tonnes in 2024.

- Total UK port freight tonnage fell 1% in 2024 vs 2023.

Global Maritime Freight Transport Market: Market Dynamics

Global Maritime Freight Transport Market: Driving Factors

Expansion of Global Trade and Containerized Cargo Movement

Rising international trade volumes continue to strengthen the maritime freight transport market, especially through container shipping used for consumer goods, electronics, and industrial products. Growth in e commerce and cross border manufacturing has increased container throughput at major seaports, driving demand for liner services and ocean freight capacity. As businesses seek cost efficient logistics for long distance cargo movement, maritime transport remains the preferred mode for high volume and high value shipments across key global trade routes.

Infrastructure Upgrades and Digital Port Modernization

Investments in port infrastructure and digital terminal systems are improving cargo handling efficiency and vessel turnaround time. Automated cranes, smart yard management, and integrated port community platforms are helping shipping lines reduce congestion and improve service reliability. These advancements enhance port productivity and support higher container and bulk cargo volumes, making maritime logistics more competitive and responsive to global supply chain requirements.

Global Maritime Freight Transport Market: Restraints

Volatility in Fuel Prices and Operating Costs

Fluctuating bunker fuel prices create uncertainty for shipping companies and increase operating expenses across the maritime freight sector. Higher energy costs directly impact freight rates and profit margins, particularly for bulk carriers and tankers that operate on long distance routes. To manage fuel expenses, carriers often adopt slow steaming practices, which can extend transit times and reduce overall supply chain efficiency for shippers.

Regulatory Compliance and Environmental Restrictions

Tightening environmental regulations aimed at reducing emissions from vessels place financial and operational pressure on maritime operators. Compliance with sulfur limits and decarbonization targets requires investments in cleaner fuels, exhaust treatment systems, and fleet upgrades. These regulatory requirements increase capital costs and influence shipping economics, especially for older fleets operating in global trade lanes.

Global Maritime Freight Transport Market: Opportunities

Adoption of Green Shipping and Alternative Fuels

The shift toward sustainable maritime logistics is creating strong growth potential for the market. Shipping companies are increasingly adopting LNG, biofuels, and low carbon propulsion technologies to meet environmental standards and attract eco conscious cargo owners. Green shipping initiatives also improve brand positioning and open access to new trade partnerships, supporting long term expansion of ocean freight services.

Integration of IoT and Predictive Analytics

The use of Internet of Things sensors and predictive analytics is transforming fleet management and cargo visibility. Real time vessel monitoring, route optimization, and maintenance forecasting help reduce downtime and improve fuel efficiency. These digital capabilities strengthen coordination between ports, carriers, and logistics providers, leading to more reliable and data driven maritime freight operations.

Global Maritime Freight Transport Market: Trends

Digitalization and Autonomous Shipping Technologies

Rapid digital transformation is reshaping maritime freight transport through the adoption of artificial intelligence, automation, and smart navigation systems. Autonomous vessel technologies and digital documentation platforms are reducing human error, improving safety, and accelerating cargo processing. These innovations enhance operational efficiency and allow shipping lines to manage complex trade networks more effectively.

Shift toward Regionalized Supply Chains and Nearshoring

Changes in global manufacturing strategies are driving increased focus on regional and coastal shipping routes. Nearshoring and regional production hubs are boosting demand for short sea shipping and intra regional maritime trade. This trend is diversifying traditional long haul trade lanes and creating new opportunities for ports and carriers to serve faster and more flexible supply chains.

Global Maritime Freight Transport Market: Research Scope and Analysis

By Cargo Type Analysis

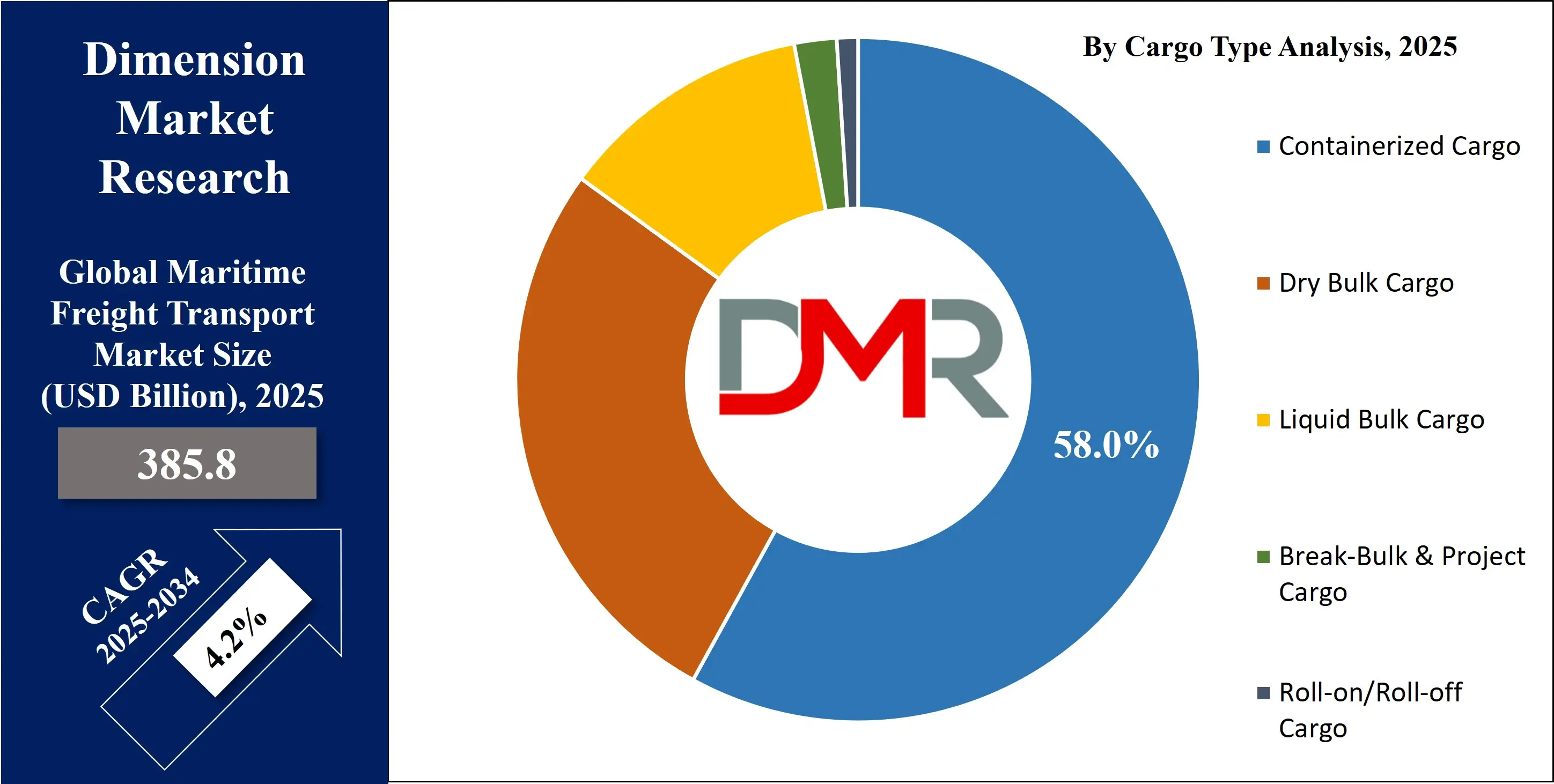

Containerized cargo is anticipated to dominate the cargo type segment of the global maritime freight transport market with a 58.0% share in 2025, largely because of its unmatched efficiency, standardization, and ability to support globalized manufacturing and consumer trade. Containers enable seamless handling across ships, ports, rail, and trucking networks, making them ideal for transporting electronics, retail goods, machinery, and e commerce shipments. The rapid growth of international trade, especially between Asia, North America, and Europe, continues to drive high container volumes, while port automation and larger container vessels further strengthen the dominance of this segment by improving cost efficiency and cargo throughput.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Dry bulk cargo also plays a crucial role in the maritime freight transport market by supporting the global movement of essential raw materials such as iron ore, coal, grains, and fertilizers. Although it represents a smaller share than containerized cargo, dry bulk shipping remains vital for industries such as steel production, power generation, and agriculture. Bulk carriers are specifically designed to transport large volumes of unpackaged commodities over long distances, making this segment highly sensitive to global industrial activity and infrastructure development. Rising demand for food security, energy, and construction materials continues to sustain strong dry bulk trade flows across major exporting and importing regions.

By Vessel Type Analysis

Container ships are expected to lead the vessel type segment in the maritime freight transport market, capturing approximately 56.0% of the total share in 2025, due to their critical role in handling high volumes of containerized goods efficiently across international trade routes. These vessels are designed to transport standardized containers that simplify loading, unloading, and intermodal transfers between ships, trucks, and rail, making them ideal for global supply chains. The increasing demand for consumer goods, electronics, and e-commerce shipments, integrated with port automation and the deployment of ultra-large container vessels, continues to reinforce the dominance of container ships in global maritime logistics.

Bulk carriers also hold a significant position in the vessel type segment by transporting large quantities of unpackaged raw materials such as coal, iron ore, grains, and other industrial commodities. These ships are essential for supporting energy, manufacturing, and agricultural industries worldwide, providing cost-efficient long-distance transport for bulk cargo. The demand for bulk carriers is closely linked to global industrial production, commodity prices, and infrastructure development in both exporting and importing regions. Despite having a smaller share compared to container ships, bulk carriers remain a backbone of seaborne trade for raw materials.

By Service Model Analysis

Liner shipping services are expected to dominate the service model segment of the maritime freight transport market, capturing around 74.0% of the total market share in 2025, due to their scheduled operations and predictable service routes. These services provide regular, fixed-schedule shipping between major ports, enabling exporters and importers to plan cargo movements with reliability and efficiency. Liner shipping is particularly important for containerized cargo, consumer goods, and industrial products, as it ensures timely delivery and consistent transit times. Investments in larger vessels, port automation, and integrated logistics networks further enhance the efficiency and appeal of liner services in global trade.

Tramp shipping services, while holding a smaller share compared to liner services, play a vital role in the maritime freight transport market by offering flexible, non-scheduled shipping for bulk and specialized cargo. These services operate on demand, chartering vessels for specific cargo or trade routes without fixed schedules, which makes them suitable for commodities like coal, grains, or industrial raw materials. Tramp shipping allows shipping companies and traders to respond to variable cargo volumes and seasonal demand, providing adaptability in supply chains where flexibility is more critical than fixed scheduling.

By Shipping Route Type Analysis

Intercontinental trade routes are expected to dominate the shipping route type segment of the maritime freight transport market, capturing approximately 52.0% of the total share in 2025, as they facilitate the movement of goods between major global economies across continents. These routes connect key manufacturing hubs in Asia with consumer markets in North America and Europe, supporting high volumes of containerized cargo, bulk commodities, and energy shipments. The scale and reliability of intercontinental shipping enable global supply chains to operate efficiently, while advances in vessel capacity, port infrastructure, and navigational technology continue to strengthen these long-distance trade corridors.

Intra-regional trade routes, while accounting for a smaller portion of the market, are critical for connecting neighboring countries and supporting regional economic integration. Coastal shipping and short-sea routes within Asia, Europe, and North America allow for faster, more frequent movement of goods such as agricultural products, manufactured items, and industrial inputs. These routes reduce transit times, provide flexible scheduling, and help decongest larger intercontinental corridors. The growth of regional trade agreements and nearshoring strategies is further increasing the demand for intra-regional maritime transport services, particularly for smaller ports and secondary markets.

By Port & Logistics Integration Analysis

Port-to-port transport is expected to dominate the port and logistics integration segment of the maritime freight transport market, capturing around 41.0% of the total share in 2025, as it represents the most traditional and widely used mode of sea-based cargo movement. This approach focuses on the transportation of goods directly between shipping ports without extending the service to inland destinations, making it cost-efficient for large-volume shipments such as bulk commodities, containers, and liquid cargo. Port-to-port transport remains the backbone of international trade by enabling standardized handling and efficient scheduling across major global shipping lanes.

Port-to-door integrated logistics, while holding a smaller share compared to port-to-port transport, plays a growing role in providing end-to-end supply chain solutions. This service combines maritime transport with inland distribution through trucks or rail to deliver cargo directly to the consignee’s warehouse or production facility. It is particularly valuable for high-value goods, perishable products, and e-commerce shipments, as it ensures faster delivery, improved cargo visibility, and streamlined coordination between shipping lines, freight forwarders, and logistics providers. The increasing demand for seamless logistics and time-sensitive deliveries is driving growth in port-to-door integrated services.

By Industry Vertical Analysis

Manufacturing and industrial trade are expected to dominate the industry vertical segment of the maritime freight transport market, capturing around 29.0% of the total share in 2025, as these sectors rely heavily on the movement of raw materials, components, and finished goods across global supply chains. Maritime transport enables cost-efficient, large-volume shipping for machinery, automotive parts, electronics, and other industrial products, connecting manufacturing hubs in Asia, Europe, and North America with global markets. The efficiency, reliability, and scalability of ocean freight make it a preferred choice for industrial trade, supporting timely production cycles and global distribution networks.

Energy and resources also represent a significant portion of the market, driven by the long-distance transportation of crude oil, coal, natural gas, and other raw materials. Bulk carriers and tankers facilitate the movement of these commodities from producing regions to industrial and energy-consuming markets worldwide. Demand for energy resources and industrial minerals directly impacts cargo volumes, making maritime transport critical for sustaining energy supply chains. The growth of global industrial activity and the need for reliable resource distribution continue to reinforce the importance of maritime shipping for the energy and resources sector.

The Maritime Freight Transport Market Report is segmented on the basis of the following

By Cargo Type

- Containerized Cargo

- Consumer & Retail Goods

- Electronics & Appliances

- Industrial & Manufacturing Goods

- E-commerce Parcels

- Dry Bulk Cargo

- Iron Ore & Minerals

- Coal & Coke

- Grains & Agricultural Commodities

- Cement, Fertilizers & Other Bulks

- Liquid Bulk Cargo

- Crude Oil

- Refined Petroleum Products

- LNG & LPG

- Liquid Chemicals

- Break-Bulk & Project Cargo

- Machinery & Equipment

- Steel & Industrial Structures

- Roll-on/Roll-off Cargo

- Passenger Vehicles

- Commercial & Heavy Vehicles

By Vessel Type

- Container Ships

- Ultra-Large Container Vessels

- Post-Panamax & Panamax Vessels

- Feeder Container Vessels

- Bulk Carriers

- Capesize

- Panamax

- Handymax & Supramax

- Tankers

- Crude Oil Tankers

- Product Tankers

- LNG & Chemical Tankers

- General Cargo & Multipurpose Vessels

- Ro-Ro & Car Carrier Vessels

By Service Model

- Liner Shipping Services

- Fixed-Schedule Container Services

- Regional & Short-Sea Liner Services

- Specialized Reefer & Fast Liner Services

- Tramp Shipping Services

- Spot Market Bulk Charters

- Time-Charter Operations

- Contract of Affreightment

- Project & Heavy-Lift Shipping

By Shipping Route Type

- Intercontinental Trade Routes

- Intra-Regional Trade Routes

- Domestic Coastal Shipping

By Port & Logistics Integration

- Port-to-Port Transport

- Port-to-Door Integrated Logistics

- Door-to-Door End-to-End Freight

By Industry Vertical

- Manufacturing & Industrial Trade

- Energy & Resources

- Retail, Consumer Goods & E-commerce

- Agriculture & Food Trade

- Automotive & Mobility

- Chemicals & Pharmaceuticals

Global Maritime Freight Transport Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global maritime freight transport market, capturing approximately 39.0% of total market revenue in 2025, driven by the region’s strong manufacturing base, high export volumes, and expanding consumer demand. Key countries such as China, Japan, South Korea, and India serve as major production hubs, exporting electronics, machinery, textiles, and consumer goods to North America, Europe, and other regions. The presence of well-developed ports, growing container throughput, and increasing investments in shipping infrastructure further strengthen Asia Pacific’s dominance, making it the largest contributor to global maritime trade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East & Africa region is expected to witness significant growth in the maritime freight transport market, driven by rising energy exports, infrastructure development, and expanding trade links with Asia, Europe, and North America. Investments in modern port facilities, free trade zones, and logistics hubs are enhancing cargo handling capacity and efficiency, while growing demand for crude oil, LNG, and industrial commodities supports increased bulk and container shipping volumes. Strategic location along key shipping lanes such as the Suez Canal further positions the region as a vital growth corridor in global maritime trade.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Maritime Freight Transport Market: Competitive Landscape

The global maritime freight transport market is highly competitive, characterized by a mix of large-scale shipping lines, regional carriers, and specialized logistics providers. Companies compete on factors such as fleet capacity, route coverage, service reliability, cost efficiency, and technological capabilities, including digital tracking, automated terminals, and predictive maintenance systems. Strategic partnerships, mergers, and alliances are common to expand global reach and optimize operational efficiency. Innovation in green shipping, smart ports, and integrated supply chain solutions also plays a crucial role in differentiating service offerings and maintaining a competitive edge in this dynamic market.

Some of the prominent players in the global Maritime Freight Transport market are:

- Mediterranean Shipping Company (MSC)

- A.P. Moller–Maersk

- CMA CGM Group

- COSCO Shipping Lines

- Hapag-Lloyd

- Ocean Network Express (ONE)

- Evergreen Marine Corporation

- HMM Co., Ltd.

- ZIM Integrated Shipping Services

- Yang Ming Marine Transport

- Wan Hai Lines

- Pacific International Lines (PIL)

- SITC Container Lines

- UniFeeder

- Korea Marine Transport Co. (KMTC)

- IRISL Group

- Sinokor Merchant Marine

- BBC Chartering

- Pan Ocean Co., Ltd.

- VARAMAR

- Other Key Players

Global Maritime Freight Transport Market: Recent Developments

- January 2026: Ocean Network Express and MTI officially launched the AI‑driven joint venture QUAVEO in Ho Chi Minh City to accelerate digital transformation and scalable operational solutions in container shipping, integrating advanced analytics and vessel optimization tools across global freight operations.

- June 2025: FTV Capital completed the acquisition of a maritime artificial intelligence leader to accelerate product development and market expansion within autonomous shipping and predictive analytics applications.

- May 2025: Orca AI secured USD 72.5 million in Series B funding led by Brighton Park Capital to scale its autonomous shipping platform and expand AI‑powered navigational and operational technologies for the maritime industry, driving efficiency and safety across fleets.

- May 2025: Orca AI raised USD 72.5 million in funding to support growth in autonomous maritime technologies and enhance situational awareness systems across commercial shipping operations.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 385.8 Bn |

| Forecast Value (2034) |

USD 556.6 Bn |

| CAGR (2025–2034) |

4.2% |

| The US Market Size (2025) |

USD 64.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Support & Maintenance Services, Deployment & Integration Services, Consulting & Advisory Services, Training & Enablement Services, Customization & Advanced Development), By Deployment Model (Cloud-Based Managed GeoServer, Hybrid Deployment, On-Premises Managed Deployment), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Application (Transportation & Logistics, Urban Planning & Smart Cities, Environmental & Climate Monitoring, Disaster Management & Emergency Response, Agriculture & Precision Farming, Other Spatial Applications), By End-User Industry (Government & Public Sector, Utilities & Energy, Transportation Authorities & Operators, Environmental & Urban Service Providers, Agriculture & Agri-Tech, Other Industries) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Boundless Spatial Inc., Camptocamp SA, SatSure Private Limited, Astun Technology Limited, Gaia3D Inc., Kartoza Proprietary Limited, GeoSolutions, BHSoft, RedPlanet Group Pty Ltd, AcuGIS, Geomatys SAS, GIS4Business Limited, GeoCat BV, Georepublic UG, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Maritime Freight Transport market?

▾ The global Maritime Freight Transport market size was valued at USD 385.8 billion in 2025 and is expected to reach USD 556.6 billion by the end of 2034.

What is the size of the US Maritime Freight Transport market?

▾ The US Maritime Freight Transport market was valued at USD 64.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 91.9 billion in 2034 at a CAGR of 3.9%.

Which region accounted for the largest global Maritime Freight Transport market?

▾ Asia Pacific is expected to have the largest market share in the global Maritime Freight Transport market, with a share of about 39.0% in 2025.

Who are the key players in the global Maritime Freight Transport market?

▾ Some of the major key players in the global Maritime Freight Transport market are Mediterranean Shipping Company (MSC), A.P. Moller–Maersk, CMA CGM Group, COSCO Shipping Lines, Hapag-Lloyd, Ocean Network Express (ONE), Evergreen Marine Corporation, HMM Co., Ltd., ZIM Integrated Shipping Services, Yang Ming Marine Transport, Wan Hai Lines, Pacific International Lines (PIL), SITC Container Lines, UniFeeder, Korea Marine Transport Co., and Others.