Further, the growing use of cell phones is driving the adoption of lone worker safety measures. For instance, AlertMedia Inc. provides iOS & Android apps for distress signals & quick aid requests. These smartphone app alarms enhance safety for lone workers by providing quick assistance. Due to such trends, the need for emergency notification systems has grown along with the popularity of such apps.

Real time warning and notification systems have become an indispensable resource in various industries due to an ever increasing need for accurate, timely information sharing across industries. Effective communication is crucial in today's highly competitive environment and maintaining operational agility; however, high implementation costs of mass notification systems present a considerable barrier for small and medium sized enterprises (SMEs), thus restricting their adoption.

U.S. military operations have also made use of mass notification systems, allocating USD 732 billion for improving emergency communication efficiency within their defense sector in 2020. As part of these efforts, the Department of Defense (DoD) launched the Enterprise Mass Warning and Notification System (EMWNS), to enhance safety and protection for personnel while significantly expanding mass notification system market size.

Key Takeaways

- Growing Demand for Emergency Communication: Increasing need for real-time alerts in military, healthcare, corporate, and public safety sectors is driving market growth.

- Technological Advancements: Integration of AI, cloud-based solutions, and IoT is enhancing the efficiency and scalability of MNS.

- Government & Defense Investments: Rising government funding and military adoption of MNS, such as the U.S. DoD’s EMWNS, is boosting market expansion.

- Healthcare & Education Sector Adoption: Increasing implementation in hospitals, universities, and public institutions for emergency preparedness and crisis response. The adoption is further supported by Healthcare IT Solutions and Healthcare Cloud Computing, which streamline communication and security in healthcare environments.

- North America Leading the Market: The U.S. dominates the market due to high investments in public safety and advanced communication infrastructure.

Use Cases

- Emergency & Disaster Alerts: Used by governments and public safety agencies to send real-time alerts during natural disasters, terrorist threats, and extreme weather conditions.

- Military & Defense Communication: Implemented by armed forces for secure and instant communication, ensuring the safety of personnel and operational efficiency.

- Corporate & Workplace Safety: Enables businesses and enterprises to communicate evacuation procedures, cybersecurity threats, and critical updates to employees.

- Healthcare & Hospital Notifications: Used in hospitals and medical facilities to coordinate emergency responses, manage crisis situations, and alert staff during critical incidents.

- Education & Campus Security: Deployed in schools, colleges, and universities to notify students and staff about safety threats, lockdowns, and emergency protocols.

Market Dynamic

The growing demand for crisis management solutions and mass notification systems is driven by the widespread integration of cutting-edge technologies like IoT,

cloud computing, and data analytics across different industries. These advancements not only improve user engagement but also significantly improve safety protocols, providing versatile functionalities that exceed conventional applications.

This empowerment equips businesses, local administrations, & governmental entities with the means to effectively engage individuals or groups, conveying crucial information regarding emergencies, upcoming events, & natural disasters.

For instance, in September 2022, AlertMedia, Inc., introduced its new emergency communication software for security teams. This innovative software accommodates a spectrum of communication modalities, real-time insights, centralized event management, threat monitoring, and orchestrated responses, thereby enhancing the overall safety paradigm.

Further, in the last decade, public security concerns have increased, spanning artificial and natural emergencies, each with the potential for significant harm to life and property. Hazardous Materials (HAZMAT) incidents & industrial accidents are governed by distinct regulations in many countries, with dedicated infrastructures for public safety & security. This scenario has made the way for the growth of mass notification systems, catering to these evolving demands.

Driving Factors

Effective communication during emergencies is one of the key drivers behind growth of the mass notification system (MNS) market. Organizations increasingly rely on MNS to quickly communicate critical information during natural disasters, security threats, or IT outages. Thanks to technological innovations like cloud deployment, these systems offer greater scalability and reliability.

Government mandates and regulations encouraging the adoption of emergency response solutions provide additional impetus for market expansion. Furthermore, integration between MNS and advanced technologies like IoT and AI enhance real time monitoring capabilities and automated alert capabilities resulting in widespread adoption across industries.

Trending Factors

Multi channel communication has emerged as a prominent trend in the mass notification system market, as organizations adopt systems that utilize SMS, email, voice calls, push notifications and social media for emergency notification purposes. Cloud based MNS solutions offer increased flexibility, scalability and cost effectiveness.

Incorporating AI analytics is also becoming more prevalent as companies incorporate

artificial intelligence powered message targeting and delivery services. Mobile first solutions have gained in popularity with smartphones becoming ubiquitous; customized industry specific MNS solutions have also seen steady adoption to meet diverse communication needs.

Restraining Factors

High initial implementation costs and complex integration processes present mass notification system markets with significant challenges. Small and medium sized enterprises (SMEs) often find it hard to adopt advanced MNS due to budgetary limitations.

Compatibility issues between legacy systems and MNS further compound deployment difficulties, while concerns regarding data privacy risks associated with cloud based systems could hinder adoption in sectors handling sensitive information. Furthermore, lack of awareness about their capabilities within certain regions or industries impede market penetration these factors collectively act as restraints on mass notification system adoption overall.

Opportunity

With increased attention paid to workplace and public security comes increased opportunities in the mass notification system market. MNS usage among educational institutions, healthcare

facilities and industrial plants highlights their role as proactive risk management solutions. Emerging markets in Asia Pacific and Latin America hold unexploited potential, driven by digital transformation initiatives and government investments in smart city projects.

AI powered multilingual MNS has expanded accessibility and effectiveness globally; additionally, rising demand for MNS in remote/hybrid work environments provides opportunities for innovative solutions tailored specifically for decentralized communication challenges.

Research Scope and Analysis

By Component

The hardware sector has secured a significant market share, surpassing over 70% of the total market revenue in 2023, and is further anticipated to grow more over the forecasted period. This growth is attributed to the growing use of IP-based notification devices and managed systems, particularly in healthcare settings. This sector encompasses pivotal elements such as command centers, alarm strobes, and notification speakers, crucial for the deployment of software subscriptions.

Moreover, the software segment is also anticipated to project high growth throughout the forecast period. The convergence of cutting-edge technologies, mainly artificial intelligence and cloud computing, within the software component, is set to drive its growth. The strategic focus of key players on enriching the software with the latest market technologies is expected to not only fuel this segment but also present diverse opportunities for stakeholders in the coming future.

By Organization Size

In 2023, the large enterprise segment has secured a significant market share, exceeding 68% of the total revenue. With a widespread remote workforce & diverse customer base, large businesses rely on mass notification systems for scalable services. These systems provide a dependable disaster response method, providing fast emergency communication through an inbuilt interface. This trend is expected to continue in major organizations, ensuring employee safety and strong connectivity during emergencies.

Additionally, the Small and Medium Enterprises (SMEs) sector is expected to achieve high growth during the forecast period. SMEs benefit from user-friendly interfaces and simple setups, driving the need for mass notification systems among small businesses. These systems also create strong networks, enhancing employee connectivity.

Furthermore, the growing government support for SME digitalization will further boost the segment growth. These factors together contribute to the sector's promising growth during the forecasted period.

By Solution

In 2023, the in-building solution is driving the growth of the market by contributing to the market share of over 65%. This growth was due to the use of solutions like signs and speaking systems to guide people inside and outside buildings. These solutions work well with fire alarms and public systems, sending out alerts & messages effectively. Additionally, the need for smart building trends is expected to make this segment grow more in the future.

At the same time, the wide-area solutions part is set to grow significantly in the future. These solutions are great at sending clear voice messages & sound over big areas. They have strong speakers that make the alerts easy to hear as they're getting even more advanced. These things together will help to fuel the growth of the market in the coming future as well.

By Deployment

In 2023, the on-premise segment leads the global market share by deployment for controlling data, priorities, resources, and security on-site. Meanwhile, the cloud segment also notices significant growth, which further demonstrates the substantial growth potential over the forecasted period.

Cloud-based systems gained traction for their cost-effectiveness, ease of use, increased capacity, and enhanced security through Software-as-a-Service (SaaS) providers. Market players are concentrating on this by introducing cloud-based mass notification software. For instance, On Solve, a major player, launched an intuitive cloud platform for critical event management and mass notifications.

By Application

In 2023, the Business Continuity and Disaster Recovery (BCDR) segment surged ahead, securing a significant market share of over 65% for the global mass notification system market. This category is dedicated to assisting businesses of all sizes through challenging times, by lowering the impact of disruptions. It allows swift emergency responses, safeguards data, secures reputation, and allows smooth operations. This trend is set to continue, driving the segment's growth in the coming future.

Moreover, the Integrated Public Alert and Warning (IPAW) segment also contributed significantly in 2023. This sector utilizes the Emergency Alert System (EAS) to assist governments in effectively communicating crucial messages, urging awareness, safety, recovery, and damage limitation during disasters. It further ensures that the reach of these messages across various devices is anticipated to drive the segment's revenue in the coming future.

By End-User Industry

In 2023, the education sector leads the market by capturing a significant market share of over 21% across the globe. Further, the expansion of the sector is driven by the growing deployment of mass notification systems to improve safety for students and staff and ensure the smooth functioning of educational institutions. These systems activate during emergencies, making calls, sending voicemails, and alerting authorities like police, fire, or ambulance services.

The alerts are simple and conveyed through various customized communication channels, including phone, SMS, email, mobile app push, and even social media. With an effective emergency communication setup in place, timely delivery of crucial messages is ensured for everyone. All these trends are further anticipated to drive the future of the market over the forecasted period.

The Global Mass Notification System Market Report is segmented on the basis of the following

By Component

- Software

- Hardware

- Services

By Organization Size

By Solution

- In-building Solutions

- Distributed Recipient Solutions

- Wide-area Solutions

By Deployment

By Application

- Business Continuity and Disaster Recovery

- Integrated Public Alert and Warning

- Interoperable Emergency Communication

By End-user Industry

- Healthcare

- Government

- Education

- Energy & Utilities

- Commercial

- Others

How Does Artificial Intelligence Contribute To Improve Mass Notification System Market ?

- Intelligent & Automated Alerts: AI-powered MNS can analyze real-time data from multiple sources (weather sensors, social media, surveillance cameras, etc.) and automatically trigger alerts for emergencies such as natural disasters, cyber threats, or security breaches.

- Enhanced Predictive Analytics: AI algorithms analyze historical data and current trends to predict potential crises. This enables proactive risk management in sectors like healthcare, defense, corporate security, and public safety.

- Real-Time Multilingual Communication: AI-driven natural language processing (NLP) translates messages instantly, ensuring multi-language emergency alerts for diverse populations. This is essential for global organizations, government agencies, and multinational corporations.

- AI-Powered Voice & Chatbots: AI-enabled virtual assistants and chatbots provide automated responses during crises, guiding individuals through evacuation procedures, medical emergencies, or lockdown situations in real-time.

- Adaptive Learning & Continuous Improvement: Machine learning (ML) allows MNS to continuously learn from past incidents, refining alert mechanisms for better accuracy and faster response times.

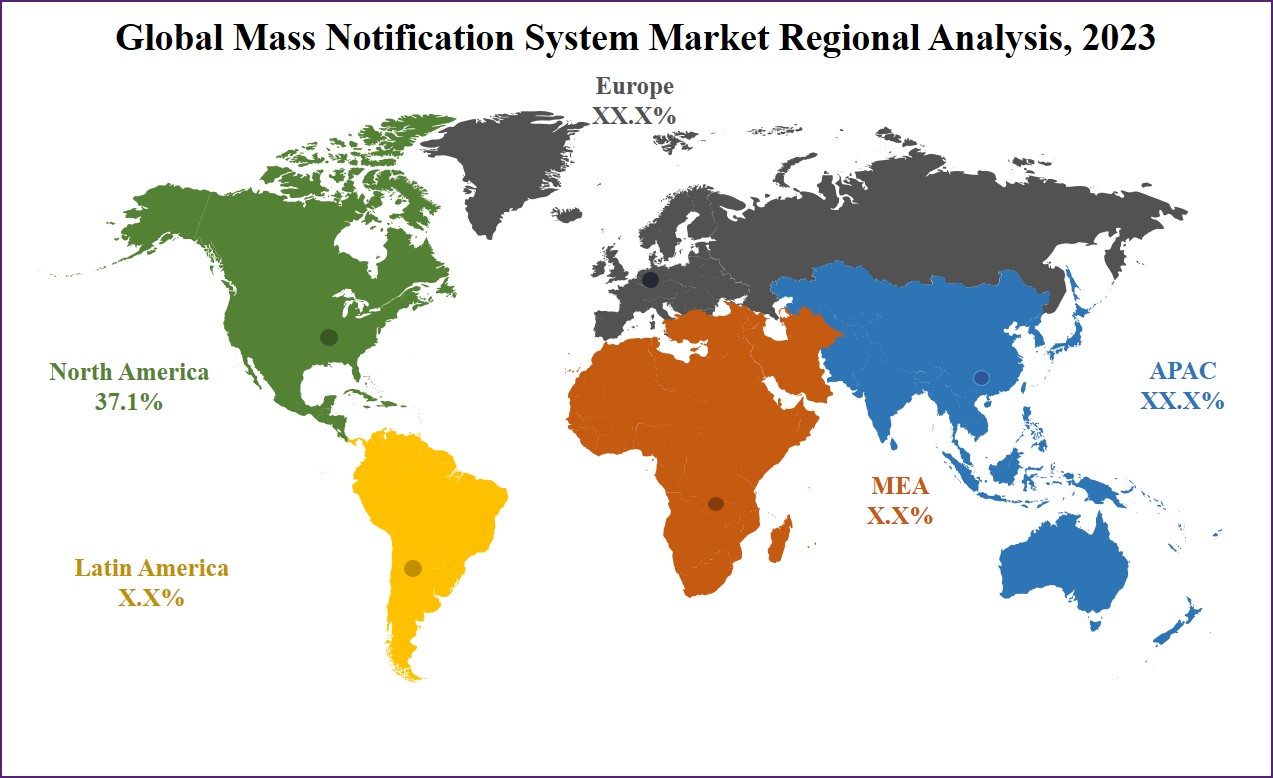

Regional Analysis

In 2023, North America secures a considerable market share, accounting for over

37.0% of global revenue. The region's adoption of mass notification systems is shaped by factors such as increased awareness following the 9/11 terrorist attack in 2001 and instances of campus shootings.

These incidents fueled public safety and security initiatives, fostering the development of vigilant monitoring, security, and emergency alert systems. This concerted effort creates significant growth opportunities for mass notification systems in the region during the forecasted period.

Moreover, the Asia Pacific region is set to become the fastest-growing market, projected to achieve a high growth rate during the forecast period. The increasing number of criminal activities and natural disasters in the region has spurred the implementation of mass notification systems to improve safety measures.

Furthermore, the market's expansion is fueled by growing aerospace and defense activities, driving the installation of vital emergency alert components like Earthquake Tsunami Warning Systems, EU-Alert, and National Messages across diverse geographical areas.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The key market players invest in research and development to improve their processes and grow. Partnerships, mergers, and acquisitions are also used to enhance products and gain a competitive edge. Innovating new and existing items helps attract customers and increase market share.

For instance, in August 2022, Acoustic Technology, Inc. introduced the latest version of its complete MNS Product line. This upgraded generation integrates proven features with essential enhancements, presenting the most advanced solution in the current market landscape.

Some of the prominent players in the Global Mass Notification System Market are

Recent Developments