Market Overview

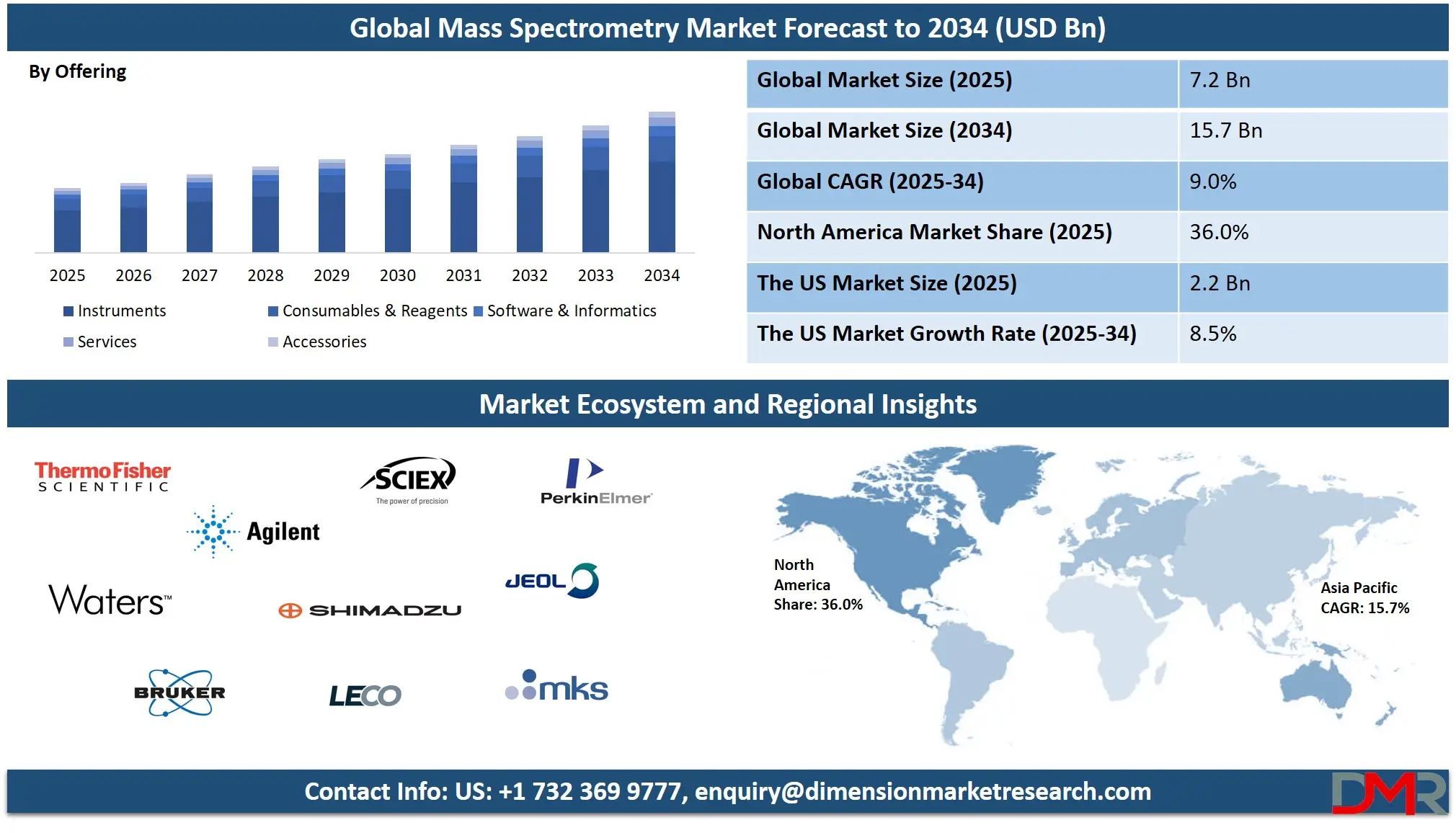

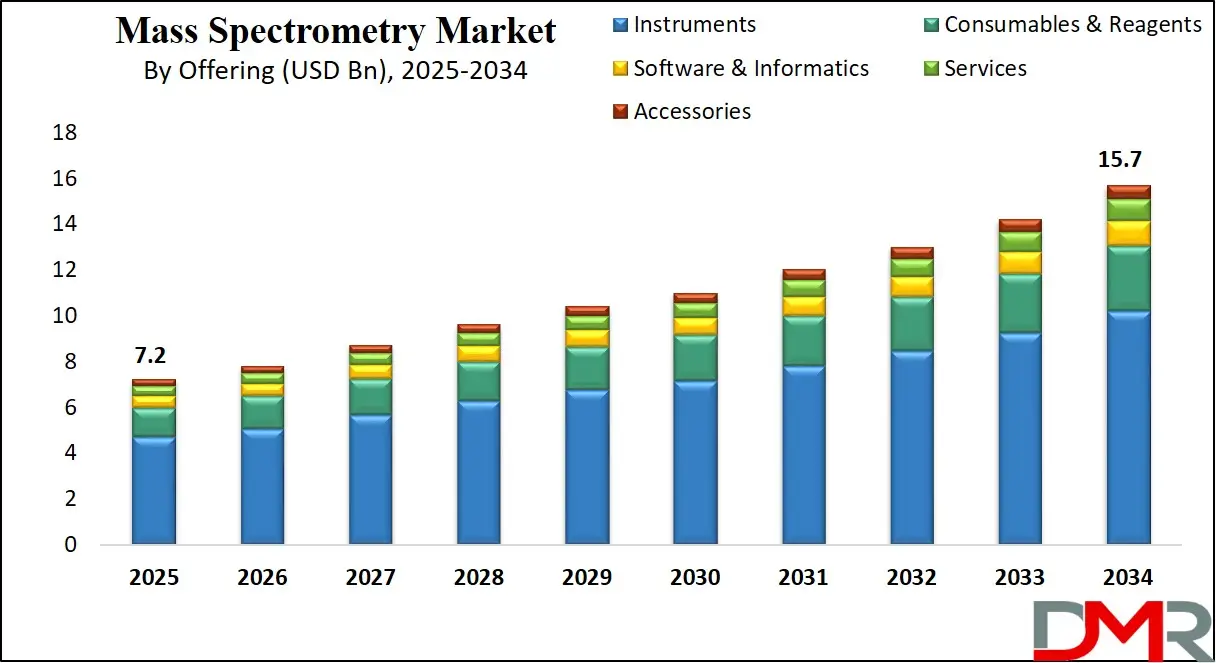

The global mass spectrometry market is projected to grow from USD 7.2 billion in 2025 to USD 15.7 billion by 2034, registering a CAGR of 9.0%. Rising demand for advanced analytical instruments in pharmaceutical research, clinical diagnostics, environmental monitoring, and food safety testing is driving market expansion.

Technological advancements, high-resolution mass analyzers, and the growing adoption of proteomics and metabolomics applications are expected to drive market growth across North America, Europe, and the Asia-Pacific region. Mass spectrometry is a highly sophisticated analytical technique used to measure the mass-to-charge ratio of ions.

It enables the precise identification, characterization, and quantification of chemical compounds in complex mixtures by ionizing chemical species and sorting the resulting ions based on their mass-to-charge ratios. The technique is widely applied across diverse fields such as proteomics, metabolomics, environmental analysis, pharmaceuticals, and food safety, making it a cornerstone of the broader In Vitro Diagnostics Market and Life Science Tools Market.

By providing detailed information on molecular structure, isotopic composition, and chemical properties, mass spectrometry serves as a cornerstone tool in research, quality control, and regulatory compliance. Modern mass spectrometers integrate advanced ionization methods, high-resolution detectors, and data processing software to deliver accurate, reproducible, and high-throughput analysis, making them indispensable in both academic and industrial laboratories, including those focused on Drug Discovery Market and Precision Medicine Market.

The global mass spectrometry market encompasses the commercial sector involved in manufacturing, selling, and servicing mass spectrometers and their related consumables, reagents, software, and accessories. It includes a wide range of technologies such as liquid chromatography-mass spectrometry, gas chromatography-mass spectrometry, inductively coupled plasma-mass spectrometry, and matrix-assisted laser desorption/ionization time-of-flight systems.

Market growth is driven by the growing demand for precision analytical instruments in pharmaceutical research, clinical diagnostics, environmental monitoring, and food safety testing, a trend also seen in the Food Safety Testing Market. Expanding applications in proteomics and metabolomics research and the growing focus on drug discovery, biomarker identification, and quality assurance are key contributors to market expansion.

The market is characterized by continuous technological advancements, integration with bioinformatics platforms, and rising adoption of automated sample preparation and high-throughput analysis. Leading players are focusing on enhancing instrument sensitivity, resolution, and throughput while developing software solutions for data acquisition, processing, and regulatory compliance.

Geographically, North America and Europe dominate the market due to advanced research infrastructure, high R&D investments, and established regulatory frameworks. The Asia-Pacific region is witnessing significant growth fueled by growing pharmaceutical production, rising research activities, and growing awareness about environmental and food safety regulations. The mass spectrometry market continues to evolve with innovations in miniaturized instruments, portable devices, and hybrid techniques, further widening its application scope across scientific and industrial domains.

The US Mass Spectrometry Market

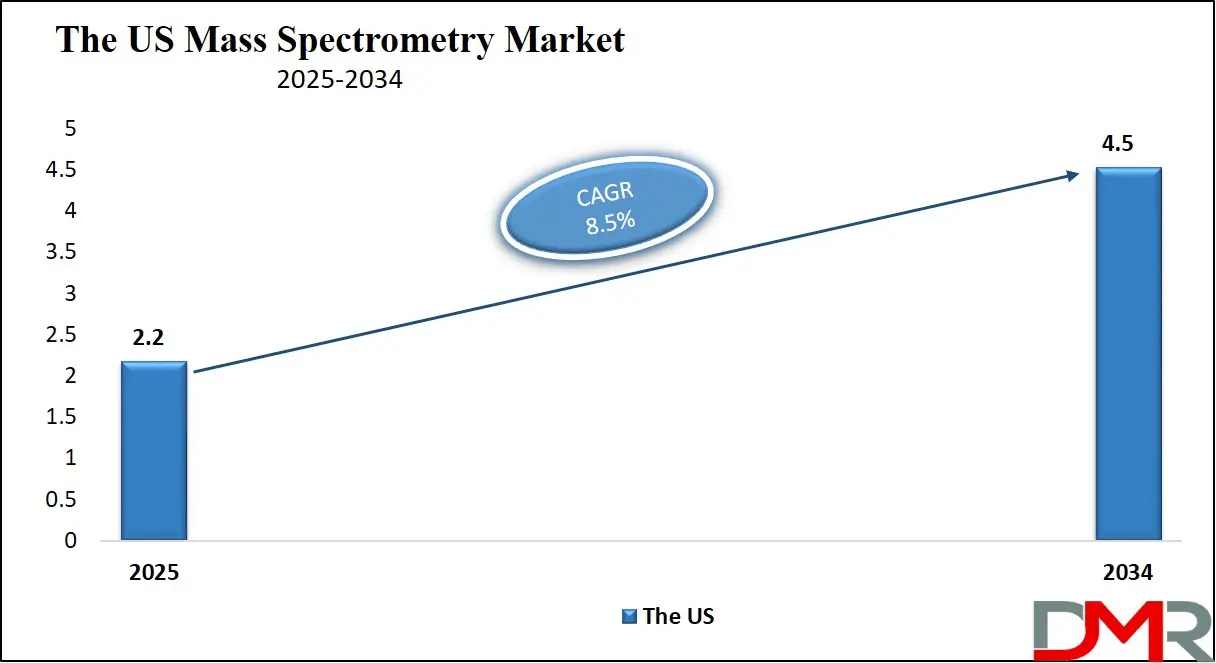

The US Mass Spectrometry Market is projected to be valued at USD 2.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.5 billion in 2034 at a CAGR of 8.5%.

The United States mass spectrometry market is one of the most advanced and mature globally, driven by the country’s strong research infrastructure, high investment in life sciences, and stringent regulatory requirements. The market benefits from widespread adoption of liquid chromatography-mass spectrometry, gas chromatography-mass spectrometry, and inductively coupled plasma-mass spectrometry across pharmaceutical, biotechnology, and clinical research laboratories.

Growing applications in drug discovery, biomarker identification, proteomics, and metabolomics are growing the demand for high-resolution, high-sensitivity mass spectrometers. Additionally, the U.S. market is supported by robust academic and government research institutions, contract research organizations, and environmental and food testing laboratories that rely on mass spectrometry for precise chemical and molecular analysis, reinforcing its role in the Clinical Trials Market.

Technological innovation is a key driver of the U.S. mass spectrometry market, with companies focusing on the development of hybrid instruments, automated sample preparation systems, and integrated data processing software. High-throughput analysis and enhanced instrument sensitivity are improving operational efficiency and enabling complex molecular characterization.

Furthermore, regulatory compliance in pharmaceutical and clinical testing is pushing adoption of validated and standardized mass spectrometry platforms. The market also sees growth from emerging applications such as forensic toxicology, metabolite profiling, and environmental contaminant detection. North America’s well-established distribution channels, presence of major industry players, and growing collaborations between instrument manufacturers and research institutions continue to strengthen the United States’ leadership in the global mass spectrometry landscape.

Europe Mass Spectrometry Market

The European mass spectrometry market is projected to reach approximately USD 1.2 billion in 2025, reflecting a steady growth trajectory driven by strong demand across pharmaceutical, clinical, and environmental research sectors. The region benefits from advanced research infrastructure, well-established regulatory frameworks, and high R&D investments in biotechnology and life sciences.

Adoption of high-resolution mass spectrometry, LC-MS, GC-MS, and MALDI-TOF technologies is widespread in European laboratories, supporting applications such as drug discovery, proteomics, metabolomics, and food safety testing. The focus on precision medicine, biomarker discovery, and quality control in pharmaceuticals further reinforces the market demand for sophisticated analytical instruments.

The market in Europe is expected to grow at a compound annual growth rate of 6.4%, supported by technological advancements, growing awareness of environmental and food safety regulations, and expansion of clinical and academic research activities. Manufacturers are focusing on developing hybrid instruments, improving sensitivity and throughput, and providing comprehensive service solutions to meet regional demands.

Additionally, collaborations between instrument providers and research institutions, along with government initiatives to enhance scientific infrastructure, are accelerating adoption. The growing trend toward miniaturized, automated, and high-throughput mass spectrometry systems is also expected to drive long-term growth in the European market.

Japan Mass Spectrometry Market

The mass spectrometry market in Japan is projected to reach approximately USD 400 million in 2025, reflecting steady adoption across pharmaceutical, clinical, and environmental research sectors. The country benefits from advanced technological infrastructure, a strong presence of leading instrument manufacturers, and substantial investment in life sciences and biotechnology research.

Mass spectrometry techniques such as LC-MS, GC-MS, and MALDI-TOF are widely utilized in drug discovery, clinical diagnostics, proteomics, and metabolomics studies. The focus on precision medicine, biomarker identification, and regulatory compliance in pharmaceuticals further drives the demand for high-performance analytical instruments in Japanese laboratories.

Japan’s mass spectrometry market is expected to grow at a CAGR of 5.5%, supported by growing government initiatives to promote scientific research, rising awareness of environmental monitoring, and expansion of industrial quality control applications. Manufacturers are introducing high-resolution and hybrid instruments with improved sensitivity, throughput, and automation to cater to the evolving needs of research and clinical laboratories.

Additionally, collaborations between domestic and international instrument providers, coupled with a growing emphasis on integrating mass spectrometry with bioinformatics and data analytics, are expected to enhance operational efficiency and drive market growth in Japan over the forecast period.

Global Mass Spectrometry Market: Key Takeaways

- Market Value: The global Mass Spectrometry market size is expected to reach a value of USD 15.7 billion by 2034 from a base value of USD 7.2 billion in 2025 at a CAGR of 9.0%.

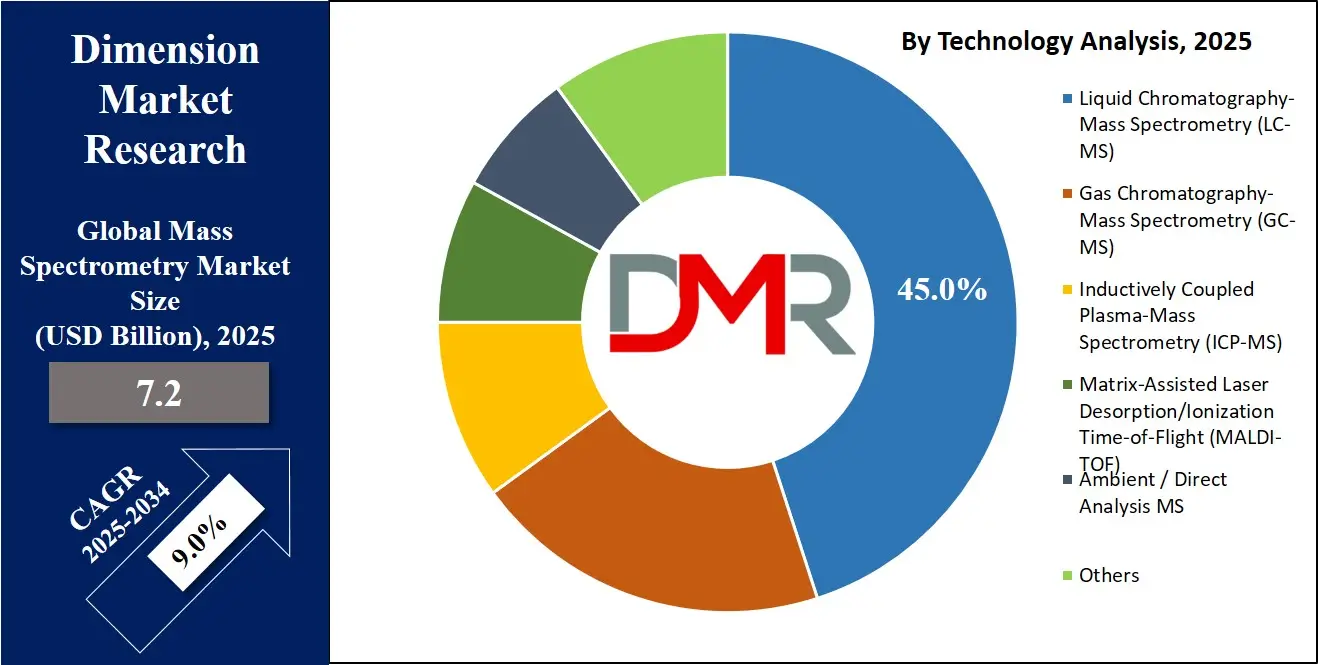

- By Technology Segment Analysis: Liquid Chromatography-Mass Spectrometry (LC-MS) will dominate the technology segment, capturing 45.0% of the market share in 2025.

- By Offering Segment Analysis: Instruments are anticipated to dominate the offering type segment, capturing 65.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Benchtop will dominate the deployment mode segment, capturing 78.0% of the market share in 2025.

- By Application Segment Analysis: Proteomics & Genomics applications will account for the maximum share in the application segment, capturing 22.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global Mass Spectrometry market landscape with 36.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Mass Spectrometry market include Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Bruker Corporation, Danaher Corporation (SCIEX), Shimadzu Corporation, PerkinElmer, JEOL Ltd., LECO Corporation, MKS Instruments, Ametek, Rigaku Corporation, Hitachi High-Tech Corporation, Teledyne Technologies, Analytik Jena AG, Jasco, and Others.

Global Mass Spectrometry Market: Use Cases

- Pharmaceutical Drug Discovery and Development: Mass spectrometry plays a critical role in pharmaceutical research by enabling precise identification, quantification, and structural analysis of small molecules, peptides, and proteins. It is extensively used in drug discovery, metabolite profiling, pharmacokinetics, and toxicology studies. Advanced LC-MS/MS and high-resolution mass analyzers help accelerate preclinical and clinical research, optimize lead compounds, and ensure regulatory compliance in drug development pipelines. Adoption of mass spectrometry ensures faster molecule characterization and reliable biomarker identification, improving the efficiency of therapeutic development.

- Clinical Diagnostics and Biomarker Analysis: In clinical laboratories, mass spectrometry is widely used for diagnostic testing and biomarker discovery. Techniques such as MALDI-TOF and LC-MS enable accurate detection of proteins, metabolites, and hormones at low concentrations. It is applied in disease diagnosis, therapeutic drug monitoring, newborn screening, and clinical proteomics. Integration with bioinformatics platforms and automated sample preparation allows high-throughput and reproducible analysis, supporting personalized medicine initiatives and precision healthcare strategies across hospitals and diagnostic centers.

- Environmental and Food Safety Monitoring: Mass spectrometry is crucial for monitoring environmental contaminants and ensuring food safety. GC-MS and ICP-MS techniques are used to detect pesticides, heavy metals, organic pollutants, and toxins in soil, water, and agricultural products. Food and beverage laboratories leverage mass spectrometry for adulteration testing, nutritional analysis, and quality assurance. These applications help regulatory agencies and research organizations maintain compliance with safety standards, mitigate environmental risks, and protect public health from chemical and biological hazards.

- Forensic and Toxicology Analysis: Forensic laboratories utilize mass spectrometry for crime scene investigation, toxicology screening, and drug identification. High-resolution MS and tandem mass spectrometry provide sensitive detection of controlled substances, metabolites, explosives, and chemical residues. Its application extends to postmortem analysis, doping control in sports, and environmental forensic studies. Mass spectrometry ensures accurate, reliable, and legally defensible results, making it a cornerstone analytical tool for law enforcement agencies, forensic experts, and public safety authorities.

Impact of Artificial Intelligence on the global Mass Spectrometry market

Artificial intelligence is increasingly transforming the global mass spectrometry market by enhancing data analysis, interpretation, and predictive capabilities. Machine learning algorithms and AI-powered software enable automated spectral deconvolution, pattern recognition, and real-time anomaly detection, significantly reducing manual intervention and analysis time. In pharmaceutical research, clinical diagnostics, and proteomics, AI helps identify biomarkers, optimize workflows, and improve reproducibility and accuracy of complex molecular characterization. Integration of AI with high-resolution mass spectrometers and bioinformatics platforms is driving smarter decision-making, accelerating drug discovery, improving diagnostic precision, and enabling high-throughput analysis across environmental, food safety, and forensic applications, thereby expanding the overall market potential.

Stats & Facts

- U.S. National Institutes of Health (NIH)

- In 2024, NIH allocated approximately USD 1.5 billion to mass spectrometry-related research projects.

- By 2025, NIH funding for mass spectrometry research is expected to increase by 5%, reaching an estimated USD 1.575 billion.

- U.S. Food and Drug Administration (FDA)

- The FDA approved 15 new mass spectrometry-based diagnostic devices in 2024.

- In 2025, the FDA anticipates approving 18 new mass spectrometry-based diagnostic devices, marking a 20% increase from 2024.

- U.S. Environmental Protection Agency (EPA)

- The EPA reported a 10% increase in the use of mass spectrometry for environmental testing between 2023 and 2024.

- In 2025, the EPA plans to expand its mass spectrometry capabilities by 15% to enhance environmental monitoring.

- The European Union funded 25 mass spectrometry research projects under Horizon 2020 in 2024.

- In 2025, the European Commission plans to fund 30 mass spectrometry research projects under Horizon Europe.

- Japan Ministry of Health, Labour and Welfare

- The Japanese government allocated USD 50 million for mass spectrometry research in 2024.

- In 2025, Japan plans to increase its mass spectrometry research funding to USD 55 million.

- National Institutes of Health (NIH) - U.S.

- NIH-supported mass spectrometry research projects grew by 8% in 2024 compared to 2023.

- In 2025, NIH expects a 10% growth in mass spectrometry research projects.

- U.S. Department of Energy (DOE)

- The DOE reported a 12% increase in mass spectrometry usage for energy research in 2024.

- In 2025, the DOE plans to expand its mass spectrometry applications in energy research by 15%.

- U.S. Department of Agriculture (USDA)

- The USDA utilized mass spectrometry in 30% of its food safety testing programs in 2024.

- In 2025, the USDA aims to increase mass spectrometry usage in food safety testing to 35%.

- National Aeronautics and Space Administration (NASA)

- NASA employed mass spectrometry in 5 space missions in 2024.

- In 2025, NASA plans to use mass spectrometry in 7 space missions.

- National Science Foundation (NSF)

- The NSF funded 50 mass spectrometry research projects in 2024.

- In 2025, the NSF plans to fund 55 mass spectrometry research projects.

- World Health Organization (WHO)

- The WHO reported a 15% increase in mass spectrometry applications for global health monitoring between 2023 and 2024.

- In 2025, the WHO plans to expand mass spectrometry applications in global health monitoring by 18%.

Market Dynamics

Global Mass Spectrometry Market: Driving Factors

Increasing Demand in Pharmaceutical and Biotech Research

The growing adoption of mass spectrometry in pharmaceutical and biotechnology research is a major driver of market growth. Advanced techniques such as LC-MS/MS and high-resolution mass spectrometry are increasingly used for drug discovery, metabolite profiling, proteomics, and biomarker identification. The need for precise molecular characterization, high-throughput analysis, and regulatory compliance in clinical trials and drug development is accelerating the deployment of mass spectrometers in laboratories globally.

Expansion of Clinical Diagnostics and Personalized Medicine

Mass spectrometry is critical in clinical diagnostics for the accurate detection of proteins, metabolites, and therapeutic drugs. Rising prevalence of chronic diseases, growing focus on early diagnosis, and the shift toward personalized medicine are driving demand for high-sensitivity instruments. Integration with bioinformatics platforms and automated workflows enhances reproducibility and throughput, supporting precision healthcare initiatives and fostering growth in diagnostic laboratories.

Global Mass Spectrometry Market: Restraints

High Cost of Instruments and Maintenance

The capital-intensive nature of mass spectrometry systems, including high-resolution and hybrid analyzers, limits adoption, particularly among small laboratories and emerging markets. In addition to instrument costs, maintenance, calibration, and consumables add to operational expenses. Budget constraints in academic institutions and smaller diagnostic labs can restrain market expansion despite the growing demand for advanced analytical solutions.

Complexity and Need for Skilled Personnel

Mass spectrometry requires highly trained operators for accurate analysis and interpretation of complex spectra. Limited availability of skilled professionals and the need for specialized training in sample preparation, instrument handling, and data processing pose challenges for laboratories. This technical complexity can slow adoption in regions with insufficient expertise and infrastructure, acting as a barrier to market growth.

Global Mass Spectrometry Market: Opportunities

Integration with Artificial Intelligence and Machine Learning

AI-powered mass spectrometry solutions present opportunities to improve data analysis, automate spectral interpretation, and enable predictive analytics. Machine learning algorithms can accelerate biomarker discovery, optimize workflows, and improve reproducibility, making instruments more accessible to laboratories with limited personnel. The combination of AI with high-resolution instruments opens new applications in drug discovery, clinical diagnostics, environmental testing, and food safety analysis.

Emerging Applications in Environmental and Industrial Testing

Growing concerns about environmental pollution, food safety, and industrial quality control are driving demand for mass spectrometry beyond traditional research applications. Detection of contaminants, heavy metals, and toxins in water, soil, and food products offers significant growth potential. Industrial sectors are increasingly adopting mass spectrometry for process optimization, quality assurance, and regulatory compliance, expanding the scope of market applications globally.

Global Mass Spectrometry Market: Trends

Miniaturization and Portable Mass Spectrometers

The development of compact, portable, and field-deployable mass spectrometers is a key market trend. These instruments enable on-site environmental monitoring, rapid food testing, and forensic analysis, reducing the need for centralized laboratory facilities. Portability combined with high sensitivity and real-time data acquisition is growing accessibility and adoption across diverse industries.

Adoption of Hybrid and High-Resolution Instruments

There is a rising trend toward hybrid and high-resolution mass spectrometers that combine multiple analytical techniques, such as Q-TOF and Orbitrap platforms. These systems provide higher accuracy, enhanced resolution, and broader application coverage in proteomics, metabolomics, and complex molecular analysis. The focus on high-throughput, automated workflows and integration with advanced software solutions is shaping the evolution of the market toward more efficient and versatile analytical platforms.

Research Scope and Analysis

By Technology Analysis

In the global mass spectrometry market, Liquid Chromatography-Mass Spectrometry (LC-MS) is expected to dominate the technology segment, capturing 45.0% of the market share in 2025. LC-MS is highly favored due to its high sensitivity, accuracy, and versatility in analyzing complex biological and chemical samples.

It allows precise identification, quantification, and structural elucidation of small molecules, peptides, proteins, and metabolites, making it a preferred choice in pharmaceutical research, clinical diagnostics, and proteomics. Its compatibility with high-resolution mass analyzers and automated workflows enables high-throughput analysis, improved reproducibility, and regulatory compliance, further driving its widespread adoption across research and industrial laboratories.

Gas Chromatography-Mass Spectrometry (GC-MS) also plays a significant role in the technology segment, particularly for analyzing volatile and semi-volatile compounds in environmental, food, and forensic applications. GC-MS combines the separation capabilities of gas chromatography with the detection and identification power of mass spectrometry, providing reliable and sensitive analysis of pesticides, organic pollutants, and chemical residues.

Its ability to deliver trace-level detection and accurate compound identification makes it indispensable in laboratories focused on food safety, environmental monitoring, and forensic toxicology. Although it does not capture the same market dominance as LC-MS, GC-MS remains a critical technology for specific analytical applications where compound volatility and thermal stability are key considerations.

By Offering Analysis

In the global mass spectrometry market, instruments are anticipated to dominate the offering type segment, capturing 65.0% of the total market share in 2025. This dominance is driven by the growing demand for advanced analytical equipment across pharmaceutical, biotechnology, clinical, environmental, and food testing laboratories.

High-resolution mass spectrometers, hybrid analyzers, and automated systems are preferred for their precision, sensitivity, and ability to perform complex molecular characterization. Investments in research and development, technological advancements, and the growing need for high-throughput and reproducible analysis further fuel the adoption of instruments, making them the primary revenue contributor in the offering segment.

Consumables and reagents also play a vital role in the mass spectrometry market, providing essential support for accurate and efficient analyses. This category includes chromatography columns, solvents, calibration standards, sample preparation kits, and specialized matrices required for techniques such as LC-MS, GC-MS, and MALDI-TOF.

These products ensure consistent performance, reliability, and compliance with analytical standards across various laboratory applications. Growing demand for quality control in pharmaceuticals, food safety testing, environmental monitoring, and clinical diagnostics is driving the consumption of consumables and reagents, making them a significant segment in supporting the overall functionality and efficiency of mass spectrometry systems.

By Deployment Mode Analysis

In the global mass spectrometry market, benchtop systems are expected to dominate the deployment mode segment, capturing 78.0% of the market share in 2025. Benchtop mass spectrometers are highly preferred in laboratories due to their compact design, ease of installation, and ability to perform high-precision analyses without requiring extensive infrastructure.

These systems are widely used across pharmaceutical research, clinical diagnostics, environmental testing, and food safety laboratories because they offer reliable performance, high sensitivity, and compatibility with automated workflows. Their growing adoption is further supported by advancements in miniaturized instruments, enhanced resolution, and integrated software for efficient data acquisition and processing, making benchtop systems the most deployed mode in the market.

OEM mass spectrometry solutions also contribute significantly to the market by providing customized, embedded systems integrated into larger analytical platforms. Original equipment manufacturer solutions are commonly utilized in industrial, research, and process monitoring applications where specialized instrument configurations are required.

These systems allow companies to incorporate mass spectrometry capabilities directly into analytical workflows, enhancing process efficiency and enabling real-time monitoring. While the overall adoption is lower compared to benchtop systems, OEM solutions cater to niche applications and industries requiring tailored analytical setups, thereby playing an important role in the deployment segment of the market.

By Application Analysis

In the global mass spectrometry market, proteomics and genomics applications are expected to account for the maximum share in the application segment, capturing 22.0% of the market share in 2025. Mass spectrometry plays a critical role in protein and gene analysis by enabling precise identification, quantification, and characterization of complex biomolecules.

Techniques such as LC-MS/MS and high-resolution mass analyzers are extensively used in protein profiling, peptide mapping, and genomic studies, supporting drug discovery, biomarker identification, and personalized medicine research. The growing focus on understanding molecular mechanisms, disease pathways, and therapeutic targets drives the adoption of mass spectrometry in proteomics and genomics laboratories, making it the leading application segment globally.

Clinical diagnostics and biomarker testing also represent a significant application area for mass spectrometry. In this segment, the technology is utilized for accurate detection of proteins, metabolites, hormones, and other molecular markers critical for disease diagnosis, therapeutic drug monitoring, and patient-specific treatment planning.

Techniques like MALDI-TOF and LC-MS are employed for high-throughput screening and quantitative analysis, ensuring reproducible and reliable results in clinical laboratories. The rising prevalence of chronic and complex diseases, growing emphasis on early diagnosis, and the shift toward precision medicine are driving the adoption of mass spectrometry for clinical and biomarker applications across hospitals, diagnostic centers, and research institutes.

The Mass Spectrometry Market Report is segmented on the basis of the following:

By Technology

- Liquid Chromatography-Mass Spectrometry (LC-MS)

- Gas Chromatography-Mass Spectrometry (GC-MS)

- Inductively Coupled Plasma-Mass Spectrometry (IP-MS)

- Matrix-Assisted Laser Desorption/Ionization Time-of-Flight (MALDI-TOF)

- Ambient/Direct Analysis MS

- Others

By Offering

- Instruments

- Consumables & Reagents

- Software & Informatics

- Instrument control & acquisition

- Data processing/interpretation

- Quantitation & workflows

- Spectral libraries/databases

- LIMS integration & compliance

- Installation & training

- Maintenance & upgrades

- Validation & compliance

- Contract testing / CRO services

- Autosamplers

- Ion sources

- Detectors

- Vacuum components

By Deployment Mode

- Benchtop

- OEM

- Portable

- Cloud-based

By Application

- Proteomics & Genomics

- Clinical Diagnostics & Biomarker Testing

- Metabolomics & Lipidomics

- Pharmaceutical R&D & Quality Control

- Environmental Analysis

- Food & Beverage Testing

- Forensics & Toxicology

- Petrochemical & Energy

- Other Applications

Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global mass spectrometry market landscape, accounting for 36.0% of the total market revenue in 2025. The region’s dominance is driven by the presence of advanced research infrastructure, high investment in pharmaceutical and biotechnology R&D, and stringent regulatory standards that demand precise analytical testing.

Widespread adoption of technologies such as LC-MS, GC-MS, and high-resolution mass spectrometry in clinical diagnostics, proteomics, environmental monitoring, and food safety testing further reinforces market growth. Additionally, the presence of major industry players, well-established distribution channels, and strong collaborations between instrument manufacturers and research institutions contribute to North America’s leadership position in the mass spectrometry market.

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the global mass spectrometry market over the coming years. Rapid expansion of pharmaceutical manufacturing, growing investment in biotechnology and clinical research, and rising awareness about food safety and environmental monitoring are key factors driving market adoption.

Countries such as China, India, and Japan are witnessing growing demand for advanced analytical instruments like LC-MS, GC-MS, and MALDI-TOF due to their applications in drug discovery, proteomics, metabolomics, and regulatory compliance testing. Additionally, improving research infrastructure, government initiatives supporting life sciences, and the establishment of modern diagnostic and testing laboratories are accelerating market growth in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global mass spectrometry market is highly competitive, dominated by key players such as Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Bruker Corporation, Danaher Corporation (SCIEX), Shimadzu Corporation, and PerkinElmer. These companies focus on continuous technological innovation, development of high-resolution and hybrid mass spectrometers, and expansion of software and consumable offerings to strengthen their market position. Strategic collaborations, mergers and acquisitions, and investment in research and development are common strategies to enhance product portfolios and address emerging applications in pharmaceuticals, clinical diagnostics, environmental testing, and food safety. The competitive landscape is further shaped by regional players and OEM solution providers, creating a dynamic market environment driven by innovation, quality, and service.

Some of the prominent players in the global Mass Spectrometry market are:

- Thermo Fisher Scientific

- Agilent Technologies

- Waters Corporation

- Bruker Corporation

- Danaher Corporation (SCIEX)

- Shimadzu Corporation

- PerkinElmer, Inc.

- JEOL Ltd.

- LECO Corporation

- MKS Instruments

- Ametek, Inc.

- Rigaku Corporation

- Hitachi High-Tech Corporation

- Teledyne Technologies Incorporated

- Analytik Jena AG

- Jasco

- Hiden Analytical

- Advion Interchim Scientific

- Spectroswiss

- Nu Instruments

- Other Key Players

Recent Developments

- July 2025: PerkinElmer's QSight® 500 LC/MS/MS System was recognized as Innovation of the Year at the Labmate Awards for Excellence, highlighting its impact on food and environmental testing.

- July 2025: Agilent Technologies opened a new biopharma experience center in Hyderabad, India, to accelerate life-saving medicine development with advanced mass spectrometry and chromatography technologies.

- July 2024: Thermo Fisher Scientific completed its acquisition of Olink Holding AB, a provider of next-generation proteomics solutions, for approximately USD 3.1 billion.

- July 2024: Agilent Technologies acquired Biovectra, a contract development and manufacturing organization, for USD 925 million to enhance its biopharma services.

- June 2024: Thermo Fisher Scientific launched the Stellar™ mass spectrometer, offering high speed and sensitivity for precision medicine and translational research.

- June 2024: Agilent Technologies unveiled the 7010D Triple Quadrupole GC/MS System, providing enhanced sensitivity and robustness for food safety and environmental applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.2 Bn |

| Forecast Value (2034) |

USD 15.7 Bn |

| CAGR (2025–2034) |

9.0% |

| The US Market Size (2025) |

USD 2.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (Liquid Chromatography-Mass Spectrometry, Gas Chromatography-Mass Spectrometry, Inductively Coupled Plasma-Mass Spectrometry, Matrix-Assisted Laser Desorption/Ionization Time-of-Flight, Ambient/Direct Analysis MS, Others), By Offering (Instruments, Consumables & Reagents, Software & Informatics, Services, Accessories), By Deployment Mode (Benchtop, OEM, Portable, Cloud-based), and By Application (Proteomics & Genomics, Clinical Diagnostics & Biomarker Testing, Metabolomics & Lipidomics, Pharmaceutical R&D & Quality Control, Environmental Analysis, Food & Beverage Testing, Forensics & Toxicology, Petrochemical & Energy, Other Applications)) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Bruker Corporation, Danaher Corporation (SCIEX), Shimadzu Corporation, PerkinElmer, JEOL Ltd., LECO Corporation, MKS Instruments, Ametek, Rigaku Corporation, Hitachi High-Tech Corporation, Teledyne Technologies, Analytik Jena AG, Jasco, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Mass Spectrometry Market size is estimated to have a value of USD 5.7 billion in 2023 and is

expected to reach USD 12.3 billion by the end of 2032.

North America has the largest market share for the Global Mass Spectrometry Market with a share of

about 43.2% in 2023.

Some of the major key players in the Global Mass Spectrometry Market are Thermo Fisher Scientific Inc.,

Agilent Technologies Inc., Danaher Corporation, Waters Corporation, BrU.K.er Corporation, Shimadzu

Corporation, PerkinElmer Inc., Rigaku Corporation, LECO Corporation, JEOL Ltd., and many others.

The market is growing at a CAGR of 8.8 percent over the forecasted period.