Market Overview

The Global Meat Substitute Market is expected to reach a value of USD 28.5 billion by the end of 2024, and it is further anticipated to reach a market value of USD 751.4 billion by 2033 at a CAGR of 43.9%.

Meat Substitute is used to replicate the taste, texture, & nutritional benefits of animal-based meat which are often plant-made or lab-grown products. These alternatives aim to imitate the flavor of meat at the same time it provides a more ethical and sustainable option. They are made with the help of many resources and technological advancements.

Plant-based meat ingredients are soy, wheat gluten, pea protein, & other proteins which can be included in meatballs, sausages, burgers, and more. On the other hand, lab-based meat substitutes are grown in the lab by cultivating animal cells, which avoids the need to raise and slaughter animals.

Also, the increasing number of animal husbandries is facing backlash among different sections of society due to its detrimental effect on the environment. There is a growing trend to limit dietary choices and reduce the production of animal-based meat, which increases the demand for meat substitutes.

Based on the research,

Plant-based meat is increasingly popular for reducing reliance on livestock for meat. These are clean meats that are famous due to the growing adoption of vegan diets. Moreover, conditions like cervical spondylosis are increasing among corporate workers, which drives the growth of this market.

Key Takeaways

- Market size: The Global Meat Pizza Market is expected to grow by 711.7 billion, at a CAGR of 43.9% during the forecasted period of 2025 to 2033.

- Market Definition: Meat substitutes are food products made from vegan ingredients and eaten as alternatives to meat.

- Source segment: In terms of source, plant-based proteins are expected to dominate with the largest revenue share of 62.3% in 2024.

- Product segment: Based on the product type, tofu is anticipated to dominate the meat substitutes market in 2024.

- Functionality segment: Weight management is predicted to lead the market with a high CAGR in 2024

- Distribution Channel: In the context of distribution, retail is expected to dominate the meat substitutes market with the largest revenue share of 63.1% in 2024.

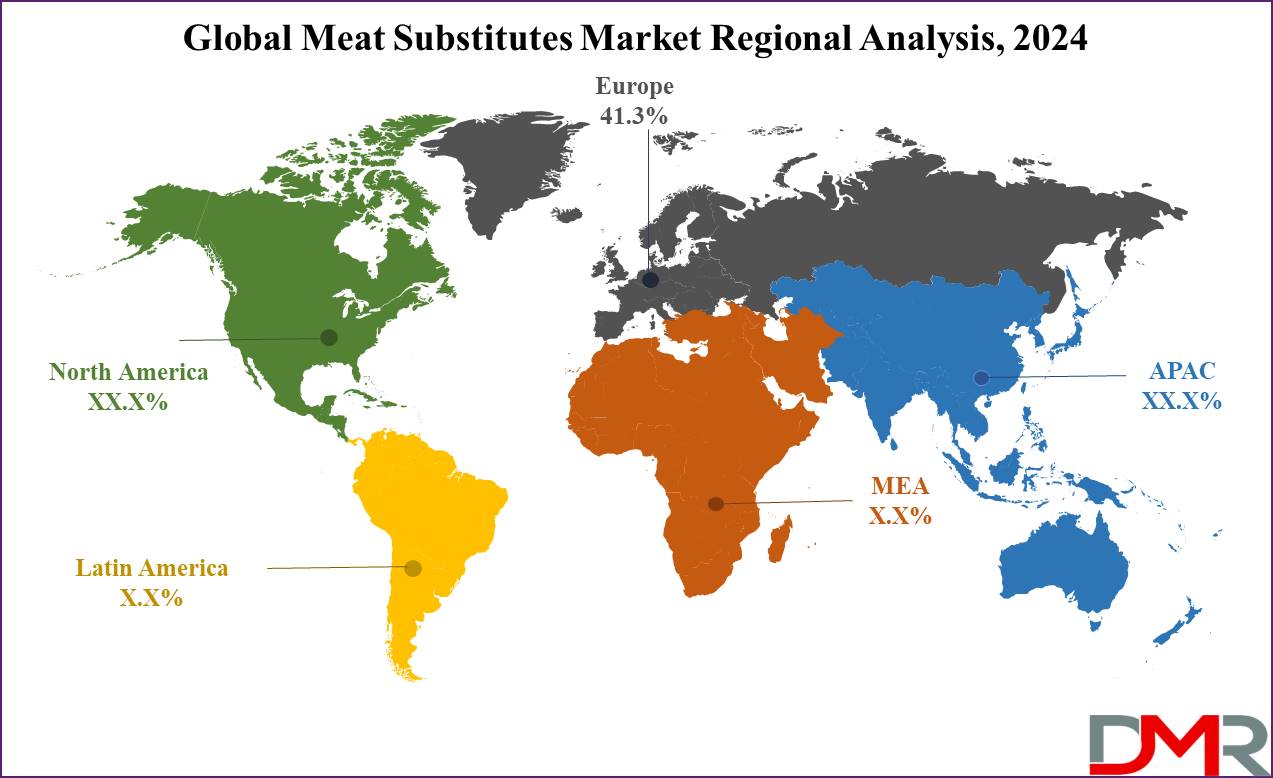

- Regional Analysis: Europe is expected to dominate the meat substitutes market with a revenue share of 41.3% in 2024.

Use Cases

- Healthier Alternative: Meat substitutes are rich in low-fat calories and cholesterol compared to traditional meat, which makes it suitable for individuals to adopt healthier options.

- Environment Concerns: Meat substitutes require land, water, and energy as compared to raising livestock forms, which are a more environmentally friendly option.

- Dietary restriction: These substitutes are valuable options for consumers with allergies to certain types of meat and also it is rich in protein, a mineral that helps in muscle building.

- Innovative Cuisine: Chefs and cooks often experiment with meat substitutes to create new and exciting dishes, expanding culinary horizons and offering unique cuisine.

Market Dynamic

The meat substitute market is expanding due to the growing number of diseases transmitted through animals, which is increasing concern among consumers and leading to low consumption of animal products.

Consumer are continuously changing their dietary habits and adopting sustainable food due to increasing cases of obesity and diseases like heart disease and diabetes, which drives demand for meat substitutes. Also, an increasing number of vegan consumers due to its healthier options is a significant driver for plant-based meat substitutes, which increases the growth of the market.

Further, these products contain cholesterol-free proteins, which are an important factor in driving the growth of this market among diabetic consumers. These substitutes are known for their health benefits, which can prevent diseases, digestive issues, and obesity.

There is an emerging trend to include vegetables and grains in meat-based substitutes, which appeals to consumers and supports the growth of this market. Also, manufacturers are investing heavily in developing new products and continue to provide opportunities for market expansion. However, the production of meat substitutes is difficult as the color and flavor of meat can change with time, which obstructs the growth of this market.

Research Scope and Analysis

By Source

Plant-based proteins are expected to dominate the meat substitute market with the largest revenue share of 62.3% in 2024. This dominance is due to the limited availability of meat in certain regions, increasing environmental concerns, & demand for healthier food. Plant-based proteins like patties, tofu & humus provide a good source of protein which is popular among young, affluent consumers, with health-conscious individuals contributing to the expansion of the market.

These plant proteins go through hydrolysis to improve their functionality and are combined with ingredients like flour, binders, and oils to replicate meat texture. Also, the presence of raw materials and cheaply available protein sources contributes to the growth of meat substitutes made from plants, thus driving the dominance of this segment.

Mycoproteins are expected to experience rapid growth due to their rich nutrient content and high fiber, which helps to control blood cholesterol and sugar levels. These can make you fuller for a longer time compared to proteins from chicken or other non-vegetarian food ,and also help to avoid weight gain and unnecessary eating. It also contains rarely found proteins like amino acids, which help for the growth, repair, and maintenance of tissues, muscles, organs, and cells, driving the growth of this segment.

By Product Type

Tofu as a product type is expected to dominate the meat substitute market in 2024 due to its mild flavor and adjustable texture, which is suitable for many food applications. It is rich in protein and can be used in foods like salad, dessert, and fries, which serve as blocks or any shape to replicate meat products like chicken or beef. Tempeh is anticipated to grow with a high CAGR as it is made from soybeans, which are nutty, firm, and chewies in texture.

These are famous for their high protein, probiotic properties, nutritional benefits, and fiber content and are often used in dishes like sandwiches, fries, & burgers. Seitan is predicted to grow rapidly as it is a gluten-free wheat protein which commonly used in sandwiches. Moreover, ready-to-cook / ready-to-eat foods are gaining popularity due to changing lifestyles which often include veggie burgers, meatless meatballs, and plant-based sausages.

By Functionality

Weight management is expected to dominate the meat substitute market based on functionality in 2024, as everyone wants to look slim and healthy. Consumers are focusing on meat substitutes as they contain fewer calories and less saturated fats compared to animal-based products, which helps in weight management.

Immunity-boosting meat substitutes are anticipated to show growth due to their rich ingredients like vitamins, minerals, and antioxidants known to support the immune system. Plant-based meat alternatives are becoming famous as they include ingredients like mushrooms, which possess immune-boosting properties. Demand for meat substitutes with these properties is rising due to increasing interest in products that support overall health and wellness.

By Category

Refrigerated substitutes are anticipated to lead the meat substitutes market based on the category in 2024 due to the need to maintain their freshness. Products like tofu, tempeh, seitan, and plant-based burgers or sausages that are decaying in nature are included in this category.

They often possess shorter shelf life and contain ingredients like soy protein, wheat gluten, or pea protein are normally found in the refrigerated sections of grocery stores or supermarkets. These are famous for their freshness, texture, & ability to replicate the taste and feel of real meat.

Frozen substitutes are growing due to the increasing demand for products like veggie burgers, meatless meatballs, chicken strips, and many more plant-based alternatives. They have a longer shelf life and are often found in the freezer section of grocery stores, and are kept for an extended period before eating

By Distribution Channel

Retail is expected to dominate the meat substitutes market with the largest revenue share of 63.1% in 2024 as it includes hypermarkets, supermarkets, convenience stores, mini markets, & department stores.

They normally give discounts and promotions that are favored by consumers, driving the growth of this segment. Also, many known brands introduce their product with the help of supermarkets like Walmart, Target, and others to increase their customer base.

The food service segment is anticipated to grow rapidly, capturing the largest revenue share in 2024 as it includes establishments like restaurants, lounges, and hotels. Personalized and innovative food options are increasingly becoming popular through these services, which drives the growth of this segment. Consumers are searching for a lot of options to adjust their meals due to dietary and budget limitations that are provided by these food services.

Retailers and restaurants continuously introduce new plant-based proteins with some innovation due to their huge demand. New Products like meat plant protein lattes, burgers, and

meal kits are increasing the customer base across the globe, including vegetarian and non-vegetarian consumers. Many plant-based products are launched by these retailers and food servicing stores due to availability and affordability.

The Global Meat Substitute Market Report is segmented based on the following

By Source

- Plant-based Protein

- Mycoprotein

- Soy-based

- Others

By Product type

- Tofu

- Tempeh

- Seitan

- RTC/RTE

- Natto

- Others

By Category

By Functionality

- Weight Management

- Immunity Boosting Products

- Gut Health/Digestive Health

- Clinical Nutrition

- Others

By Distribution Channel

Regional Analysis

Europe is expected to dominate the meat substitutes market with the largest revenue share of 41.3% in 2024, driven by increasing demand for these substitutes from both young and old consumers. The rise in demand is particularly attributed to a large number of consumers turning vegan, along with rising awareness among the global population regarding animal welfare.

Earlier, there was no concept regarding meat alternatives now it’s getting popular in regions like Germany, which contributes a significant portion of revenue. This region is also growing due to the introduction of known processed food companies that provide a variety of plant-based meat options.

North America is expected to be the second-largest meat substitute market in 2024 as consumer in this region heavily depend on these products to fulfill their daily protein needs. Many consumers in this region are increasingly adopting a vegan lifestyle due to the desire to be healthy and environmentally friendly. Moreover, the increasing middle-class population and higher disposable income associated with this demographic are also driving the growth of the market in this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major market participants commonly employ strategies such as introducing new products and expanding through investments. Manufacturers and suppliers are focusing on logistical improvements and strengthening distribution channels as part of their business growth strategies. These initiatives are improving the product adoption rates among global consumers. The meat substitute market is fragmented due to many participants, and it is anticipated that there will be moderate to intense competition among the companies. The market is dominated by companies specializing in plant-based meat products, which is still in its developmental stages with continual new experiments. The major players included in the market are Beyond Meat, AMY's Kitchen Inc., Garden Protein International Inc., and Quorn Foods Inc. These companies are working to expand their market by investing in research and development activities.

Some of the prominent players in the global meat substitutes market are:

- Amy’s Kitchen, Inc.

- Beyond Meat

- Impossible Foods Inc.

- Quorn Foods

- Kellogg Co.

- Unilever

- Meatless B.V.

- Bites Foods Ltd.

- SunFed

- Tyson Foods, Inc.

- Others

Recent Development

- In March 2024, the Bezos Earth Fund, is investing USD 60.0 million to improve and scale meat alternatives, to help slow down the rate of climate change, deforestation, and biodiversity loss.

- In March 2024, Schouten Europe, a leading producer of plant-based protein products, announced the addition of mycoprotein products to its range with its vision to develop tasty, minimally processed, and nutritionally complete products based on plant-based proteins with a low footprint.

- In August 2023, Nestlé broadened its selection of plant-based offerings, providing consumers with a greater variety of meat substitute options and revealing products such as plant-based minced meat and lentil and vegetable soup.

- In January 2022, KFC launched Beyond Fried Chicken made up of plant-based meats at different locations globally.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 28.5 Bn |

| Forecast Value (2033) |

USD 751.4 Bn |

| CAGR (2024-2033) |

43.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Source (Plant-based Protein, Mycoprotein, Soy-based, and Others), By Product Type (Tofu, Tempeh, Seitan, RTC/RTE, Natto, and Others), By Category (Refrigerated, and Frozen), By Functionality (Weight Management, Immunity Boosting Products, Gut Health/Digestive Health, Clinical Nutrition, and Others), By Distribution Channel (Food Services, and Retail) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Amy’s Kitchen, Inc., Beyond Meat, Impossible Foods Inc., Quorn Foods, Kellogg Co., Unilever, Meatless B.V., VBites Foods Ltd., SunFed, Tyson Foods, Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Meat Substitutes Market size is estimated to have a value of USD 28.5 billion in 2024 and is expected to reach USD 751.4 billion by the end of 2033.

Europe has the largest market share in the Global Meat Substitutes Market with a share of about 41.3% in 2024.

Some of the major key players in the Global Meat Substitutes Market are Beyond Meat, AMY's Kitchen Inc., Garden Protein International Inc., & Quorn Foods Inc., and many others.

The market is growing at a CAGR of 43.9 percent over the forecasted period.