Market Overview

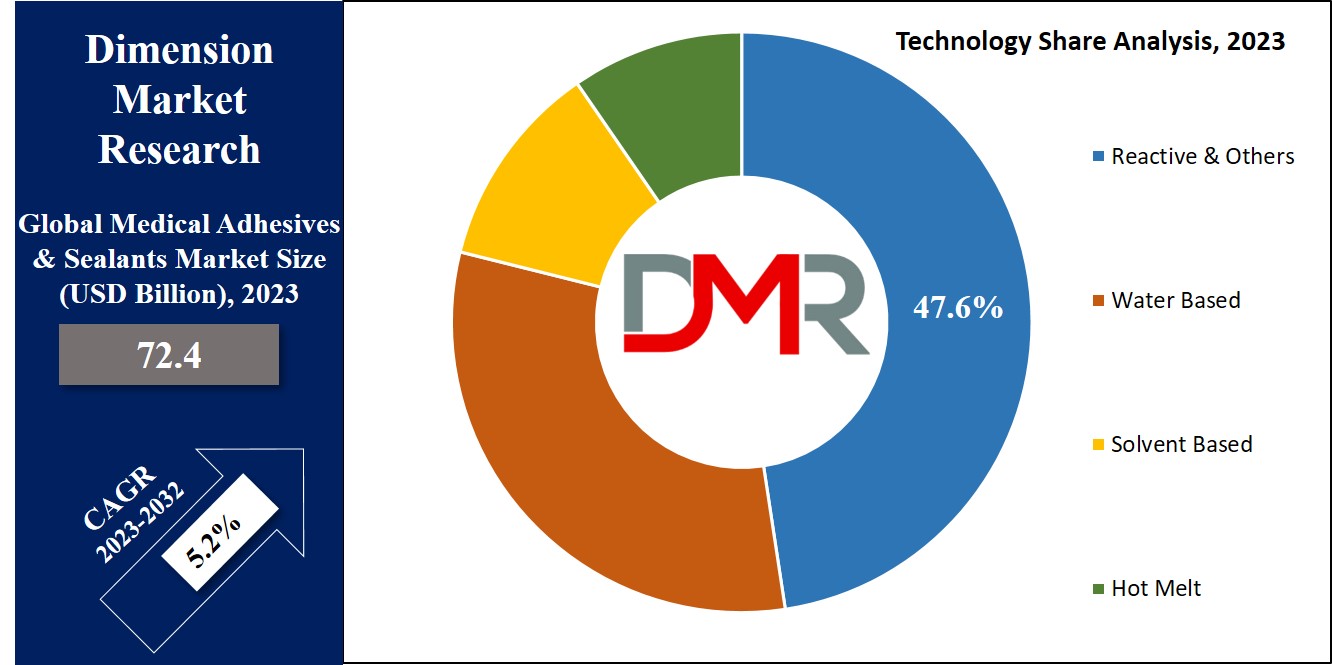

The Global Medical Adhesives and Sealants Market is expected to reach a value of

USD 72.4 billion in 2023, and it is further anticipated to reach a market value of

USD 114.2 billion by 2032 at a

CAGR of 5.2%.

Adhesives & Sealants are fundamental materials that can temporarily or permanently bind surfaces. In the medical field, fibrin stands out as a popular sealant, highly used in orthopedic procedures with a high penetration rate of 25-30%. However, their efficiency decreases by 10-15% in wet surgical conditions. These materials highly cut

healthcare costs, reduce surgery time, & are generally user-friendly.

Key Takeaways

- By Adhesives Resin, Acrylic lead in 2023 & is anticipated to dominate throughout the forecasted period.

- By Technology, Reactive & Others is a leading technology in the market in 2023.

- In addition, the Hot melt is expected to have significant growth over the forecasted period.

- By Application, Paper & Packaging takes the lead & drives the market in 2023

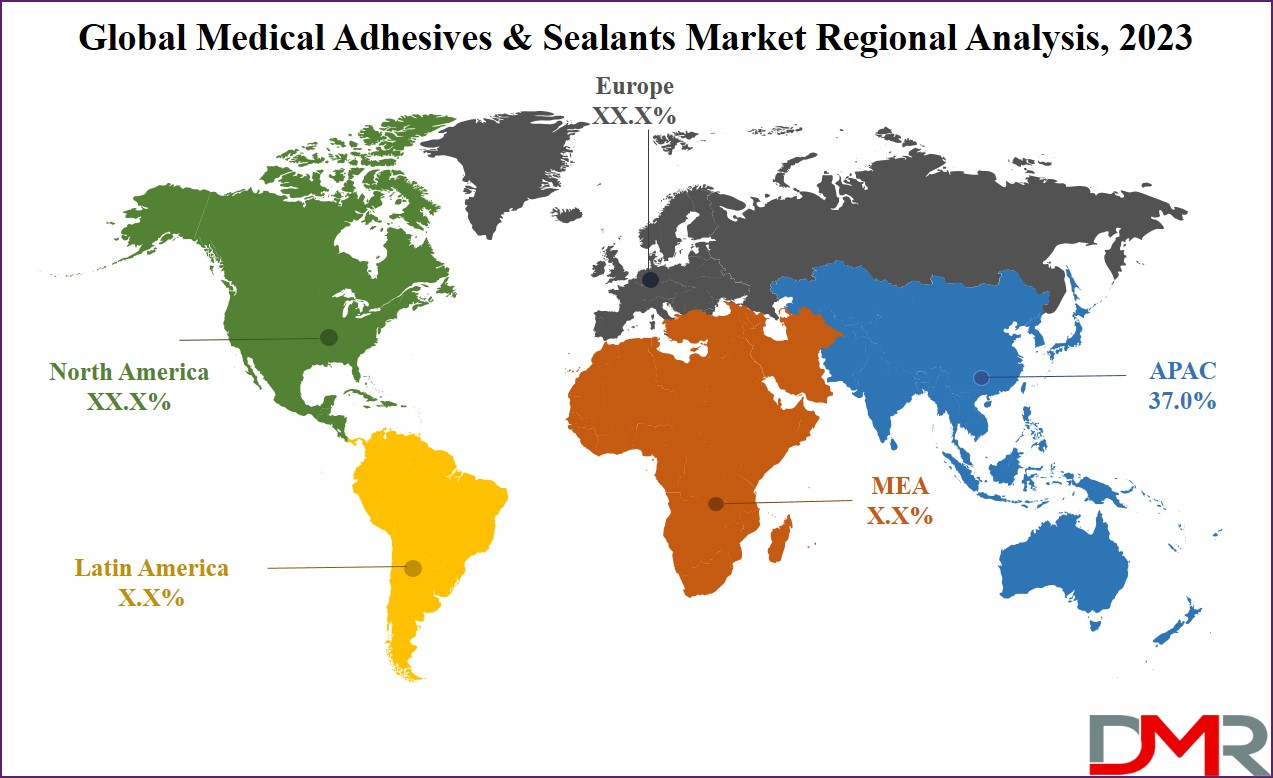

- Asia Pacific has a 37.0% share of revenue in the Global Medical Adhesives and Sealants Market in 2023

Market Dynamic

The switch from conventional mechanical fastening to adhesive bonding brings about several advantages, including improved aesthetics, reduced weight, greater design flexibility, & enhanced performance. Industries, mainly in aerospace, automotive, & electronics, are highly recognizing the efficiency, longevity, & affordable of adhesive bonding, driving the growing need for adhesives & sealants. The growing need for electronic devices like smartphones, tablets, & laptops, driven by technological developments, has highly increased the use of adhesives & sealants for component bonding, a key factor fueling industry growth.

In addition, factors like urbanization trends, population growth, & significant government spending have spurred notable expansion in the building & construction sector. Adhesives & sealants play a vital role in filling cracks, sealing openings, and securing joints in this sector, contributing to their rising popularity and overall market growth.

However, the industry experiences a potential challenge in the form of strict government regulations on volatile organic compounds, which could restrain the expansion of the market.

Research Scope and Analysis

By Adhesive Resin

Acrylic products took the lead in the market in 2023, securing a significant share of revenue, and are expected to expand further due to increased construction & infrastructure investments. Further, the growth is anticipated in projects like stadiums, chemical plants, bridges, concert halls, museums, research facilities, and

medical buildings.

Further, polyurethane adhesive product consists of exceptional qualities like quick curing, effective abrasion & chemical resistance, and strong bond strength across different materials like metal,

plastic, rubber, wood, & glass. These adhesives, typically use reactive technology with urethane linkages and provide solidity, low viscosity, & speedy curing. Further, epoxy-based products, also reactive, adhere to a diverse range of materials, providing high resistance to chemicals, environments, & high temperatures. Their superior properties hinge on the nature of cross-linking polymers, allowing strong bonding across different substrates.

By Sealants Resin

Silicones play a vital role as sealant resins in the Global Medical Adhesives & Sealants Market and contribute significantly in 2023, as it is known for their versatility, silicones are preferred in medical applications due to their biocompatibility and resistance to bacteria growth. As sealants, silicones create durable, flexible barriers, securing airtight & watertight seals. In the medical field, they find higher use in bonding & sealing medical devices, prosthetics, and equipment.

Silicones offer exceptional stability under different conditions, including exposure to bodily fluids & sterilization processes. Their non-toxic nature & ability to hold up to a wide range of substrates make them indispensable in the medical adhesives and sealants landscape, contributing to the industry's growth by providing reliable and safe solutions for medical applications.

By Technology

Reactive & other technologies took center stage in the global market in 2023, commanding a significant revenue share. The growth of the segment is driven by the myriad advantages provided by reactive technology-based products. These include rapid manufacturing speeds owing to short setting times, growth heat resistance, & strong adhesion properties to a broad spectrum of substrates. The hot-melt sector is expected to boom in the coming years. In the textiles & fabrics industry, the use of polyester hot melt adhesives has gained traction, particularly in cotton, wool, & fabric sub-sectors, which stems from the notable enhancement in the anti-pilling performance of cotton-woven fabrics & the enhanced elastic recovery rate of the fabric.

Furthermore, the adoption of hot melt adhesive products in automotive vehicle dashboards is gaining global popularity, which contributes to minimal vibrations & enhanced sound insulation in dashboards, aligning with the growing emphasis on providing soundproof rides in the automotive industry throughout the forecast period.

By Application

The paper & packaging segment took the lead in the market in 2023, holding a substantial revenue share. Also, the future presents promising opportunities for market players, mainly in flexible packaging. In addition, the growth in healthcare spending has highly impacted the need for packaging, driven by the growth in the need for PPE kits, surgical masks, & other healthcare products.

Moreover, the building & construction segment is expected to be a major player in the industry, marked by rapid technological & architectural innovations.

Particularly, mining facilities, airports, transportation routes, &residential projects are experiencing significant transformations to align with evolving standards & specifications. The global market is anticipated to benefit from increased demand in the assembly of electrical & electronic components, with China emerging as a leading global producer. Investments in emerging technologies like 5G & IoT are expected to drive the growth of China's electrical & electronics industry in the forecast period.

The Medical Adhesives and Sealants Market Report is segmented on the basis of the following:

By Adhesives Resin

- Acrylic

- PVA

- Polyurethanes

- Styrenic block

- Epoxy

- EVA

- Others

By Sealant Resin

- Silicones

- Polyurethanes

- Acrylic

- Polyvinyl acetate

- Others

By Technology

- Water-based

- Solvent-based

- Hot melt

- Reactive & others

By Application

- Paper & packaging

- Consumer & DIY

- Building & construction

- Furniture & woodworking

- Footwear & leather

- Automotive & Transportation

- Medical

- Others

Regional Analysis

Asia Pacific leads the industry, commanding a substantial 37.0% of the revenue share in 2023. Lately, the COVID-19 pandemic highly impacted various sectors, including textiles, construction, and automotive, with notable repercussions on export trade. For instance, China & India experienced a 12.4% year-on-year decline in textile trade, according to government data.

Further, the Gulf Cooperation Council (GCC) stands out as a major growth driver for the Middle East and Africa. Despite a recent downturn in the housing sector due to falling oil prices & economic slowdown, increased investments in energy, residential construction, & transportation infrastructure are anticipated to revive the construction industry in the GCC region. Further, Central & South America anticipate infrastructural development boosted by government initiatives for economic recovery, as the construction industries in countries like Colombia, Argentina, & Peru are expected for steady growth, mainly contributing to growing product demand. Moreover, Peru's economic growth is largely attributed to heightened construction & related activities in the country.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global market for adhesives & sealants in the medical sector experiences a fragmented structure, which implies that various diverse players & competitors are contributing to the market, each with their unique products & strategies. Further, the presence of a variety of companies highlights the diverse nature of the industry.

In September 2022, Henkel AG & Co. KGaA expanded its Brandon, South Dakota production facility to produce thermal interface material adhesives, which are, marketed under Loctite & Bergquist, and find applications in the electronics & automotive sectors, which reflects Henkel's commitment to meeting the need for these materials in key industries.

Some of the prominent players in the global Medical Adhesives and Sealants Market are:

- Sika AG

- H B Fuller

- 3M Company

- Henkel AG

- Huntsman

- RPM International

- Ashland Inc

- Dow

- MAPEI

- Pidilite Industries

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Medical Adhesives and Sealants Market:

The COVID-19 pandemic & subsequent recession highly influenced the Global Medical Adhesives & Sealants Market, as the healthcare sector experienced unprecedented challenges owing to disruptions in the supply chain, delayed elective procedures, & a switch in priorities toward pandemic-related necessities. While the need for medical adhesives & sealants surged with growth in use in manufacturing essential medical supplies like PPE kits & ventilators, the overall market experienced a degree of volatility.

Further, the economic downturn along with cost-cutting measures, affects capital investments and R&D activities. However, the long-term impact highlighted a resilient market as the healthcare industry adapted to the new normal, showing the crucial role of adhesives & sealants in medical applications, as the recovery & vaccine distribution efforts are gradually stabilizing the market, with a new focus on innovation & sustainability.

Recent Development

- In June 2023, H.B. Fuller unveiled its acquisition of Beardow Adams, a UK-based family-owned company specializing in multifunctional industrial adhesives, to highlight its commitment to expanding its adhesive manufacturing capabilities, marking a major step in strengthening its position in the industrial adhesive market.

- In January 2022, Bostik unveiled its partnership with DGE Group, a specialty chemicals distributor, which entails the distribution of Bostik's products across Europe, the Middle East, & Africa, which includes Born2Bond engineering adhesives for automotive, electronics, luxury packaging, &various other applications, particularly those requiring accurate by-the-dot application methods.

- In January 2023, H.B. Fuller, introduced Swift melt 1515-I, its first bio-compatible product compliant in IMEA (India, Middle East, and Africa), mainly designed for medical tape applications in challenging climates, like the high temperatures & humidity of the Indian sub-continent, the product allows secure & quick bonding with ISO 10993-5 certification for cytotoxicity, making it safe for use in stick-to-skin medical scenarios.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 72.4 Bn |

| Forecast Value (2032) |

USD 114.2 Bn |

| CAGR (2023-2032) |

5.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Adhesives Resin (Acrylic, PVA, Polyurethanes,

Styrenic block, Epoxy, EVA, and Others), By Sealant

Resin (Silicones, Polyurethanes, Acrylic, Polyvinyl

acetate, and Others), By Technology (Water-based,

Solvent-based, Hot melt, and Reactive & others), By

Application (Paper & Packaging, Consumer & DIY,

Building & construction, Furniture & woodworking,

Footwear & leather, Automotive & Transportation,

Medical, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Sika AG, H B Fuller, 3M Company, Henkel AG,

Huntsman, RPM International, Ashland Inc, Dow,

MAPEI, Pidilite Industries, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Medical Adhesives and Sealants Market size is estimated to have a value of USD 72.4 billion

in 2023 and is expected to reach USD 114.2 billion by the end of 2032.

Asia Pacific has the largest market share for the Global Medical Adhesives and Sealants Market with a

share of about 37.0% in 2023.

Some of the major key players in the Global Medical Adhesives and Sealants Market are Sika AG, H B

Fuller, 3M Company, and many others.

The market is growing at a CAGR of 5.2 percent over the forecasted period.