Market Overview

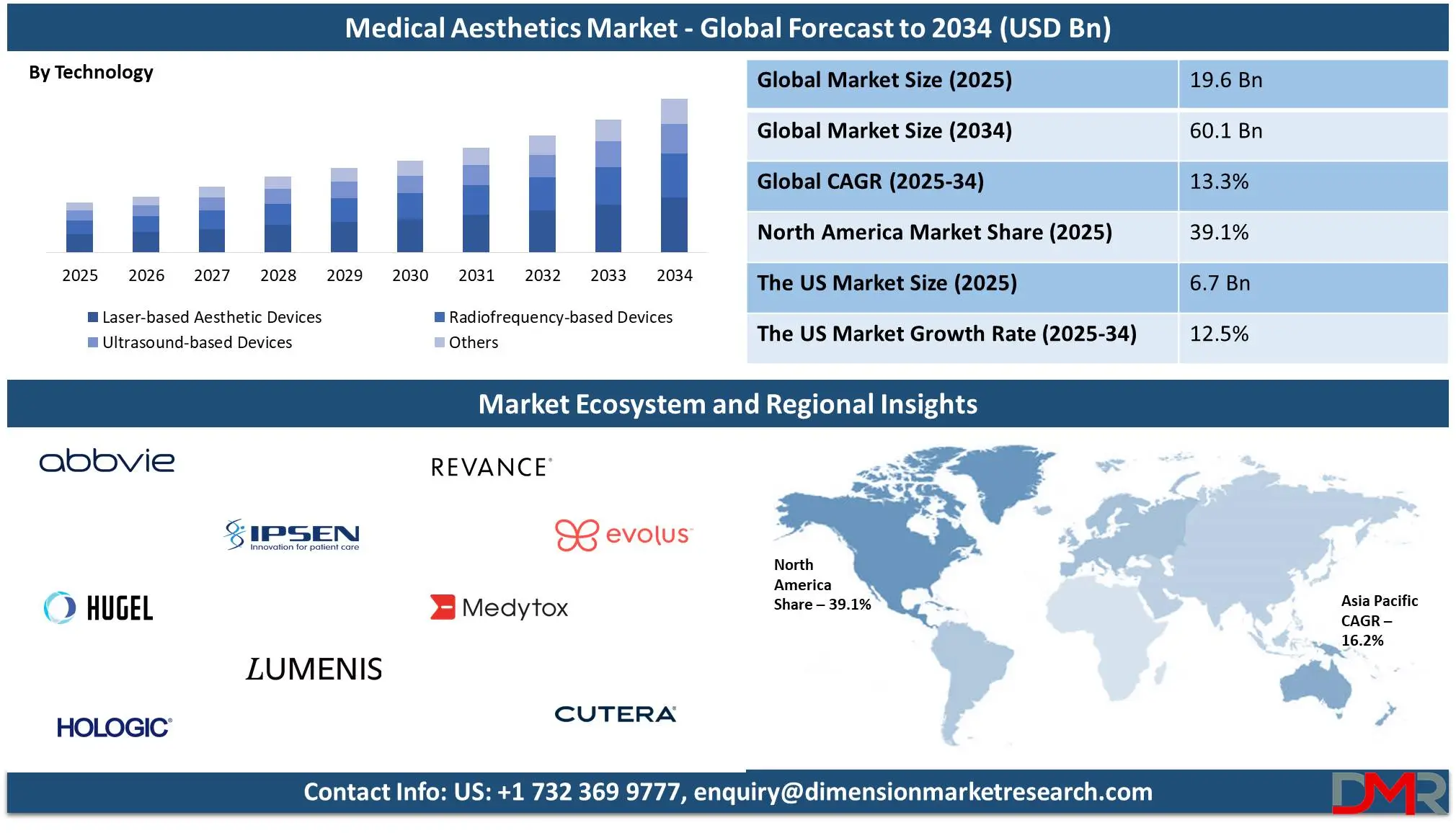

The Global Medical Aesthetics Market is projected to reach

USD 19.6 billion in 2025 and grow at a compound annual growth

rate of 13.3% from there until 2034 to reach a value of

USD 60.1 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Medical aesthetics is an emerging branch of medicine dedicated to improving an individual's appearance through non-invasive, minimally invasive procedures that improve skin quality, reduce signs of aging, and contour the body without major surgery. Common aesthetic procedures include Botox injections, dermal fillers, laser treatments, chemical peels, and non-surgical body contouring procedures like Botox.

As opposed to cosmetic surgery procedures such as facelifts or liposuction that include more invasive surgeries like facelifts and liposuction invasive surgeries require major downtime with lower risks whereas aesthetic procedures usually performed within clinics, med spas or dermatology offices where risks and downtimes are typically lower risks are reduce risks are involved compared with cosmetic surgeries invasive processes like facelifts or liposuction procedures performed more commonly among medical aesthetic practitioners and professionals with less risks involved than cosmetic surgery procedures like facelifts or liposuction involving procedures like facelifts or liposuction cosmetic surgery requires major surgical interventions lunlike cosmetic surgery where major procedures could involve extensive downtimes and risks are lower risks compared with medical aesthetic practices which typically performed within clinics, med spas, or dermatology offices with minimal downtime and risks involved; medical aesthetics typically performed within clinics/med spas/dermatology offices with lower downtimes than when performing cosmetic surgery procedures.

Over the last decade, the need for medical aesthetics has surged significantly due to technological advancements, increased attention paid to self-care practices, and social media. Many individuals seek quick yet effective treatments that fit into their busy lifestyles without lengthy recovery times, requiring lunchtime procedures. Furthermore, advances in treatment techniques have made these procedures safer and more natural-looking, drawing in younger individuals looking for preventive care and men seeking cosmetic enhancements.

Further, trends in medical aesthetics have witnessed significant change. A main focus is now being placed on subtle and natural-looking results rather than dramatic ones; patients are mainly opting for "baby Botox," in smaller doses than usual to prevent wrinkles rather than correct deep lines. Non-surgical skin-tightening and fat-reduction treatments have become highly popular as people search for alternatives to surgery. Another key trend has been combination treatments, combining different procedures to maximize results - for instance, combining Botox with laser resurfacing could improve both wrinkles AND skin texture simultaneously.

Major events and developments have shaped the medical aesthetics industry over time. The recent pandemic caused a temporary decrease in procedures, but demand quickly rebounded as people became more focused on self-care due to remote work and video calls. Facial aesthetic treatments also increased with people becoming aware of facial lines and texture more during virtual meetings than before, alongside rapid technological developments, including better laser devices, improved dermal fillers, and AI-driven skincare solutions that custom-tailor treatments.

Medical aesthetics has evolved beyond traditional beauty treatments to include regenerative medicine techniques like platelet-rich plasma (PRP) therapy, which uses blood from patients' bodies to revitalize skin and hair. New injectable treatments like longer-lasting dermal fillers and next-generation neurotoxins are being developed for greater results and lasting improvement. Patient safety and education have also seen an increase, with more professionals receiving training to ensure high-quality care is provided to every individual patient.

In recent trends, medical aesthetics is expected to experience further development with innovative new technologies and treatment options offering better results with reduced risks. As social acceptance of aesthetic procedures grows, more individuals may explore non-surgical treatments as a means of maintaining their appearances. As more customized, minimally invasive treatments focus on natural-looking outcomes with long-lasting benefits, personalized medical aesthetics will remain an integral component of modern beauty and well-being.

The US Medical Aesthetics Market

The US Medical Aesthetics Market is projected to reach USD 6.7 billion in 2025 at a compound annual growth rate of 12.5% over its forecast period.

The US offers strong growth opportunities in the medical aesthetics market due to growing demand for non-invasive procedures, as well as the growth in disposable income and advanced healthcare infrastructure. Rise in awareness of aesthetic treatments, technological innovations, and a high number of trained professionals further drive market expansion. In addition, an aging population and social media influence boost the adoption of aesthetic procedures.

Further, the medical aesthetics market is driven by high consumer demand for minimally invasive treatments, technological advancements, and a well-established healthcare system. Growing aesthetic awareness and social media influence further fuel market expansion. However, restraints like high procedure costs, regulatory challenges, and potential risks associated with aesthetic treatments. Additionally, limited insurance coverage for cosmetic procedures may hinder accessibility for some consumers.

Medical Aesthetics Market: Key Takeaways

- Market Growth: The Medical Aesthetics Market size is expected to grow by 38.2 billion, at a CAGR of 13.3%, during the forecasted period of 2026 to 2034.

- By Technology: The Laser-based Aesthetic Devices segment is anticipated to get the majority share of the Medical Aesthetics Market in 2025.

- By End User: The hospital & clinics segment is expected to get the largest revenue share in 2025 in the Medical Aesthetics Market.

- Regional Insight: North America is expected to hold a 39.1% share of revenue in the Global Medical Aesthetics Market in 2025.

- Use Cases: Some of the use cases of Medical Aesthetics include anti-aging treatments, skin rejuvenation, and more.

Medical Aesthetics Market: Use Cases:

- Anti-Aging Treatments: Minimizes wrinkles, fine lines, and skin sagging through Botox, dermal fillers, and laser therapies for a youthful appearance.

- Skin Rejuvenation: Improves skin texture, tone, and clarity with chemical peels, microneedling, and PRP therapy to treat acne scars, pigmentation, and sun damage.

- Non-Surgical Body Contouring: Improves body shape and reduces fat using treatments like cryolipolysis (CoolSculpting) and radiofrequency-based skin tightening.

- Hair Restoration: Treats hair loss and thinning with PRP therapy, laser treatments, and medical-grade topical solutions to stimulate hair growth.

Stats & Facts

- The Aesthetic Society highlights that Aesthetic One has provided over 23,000 patients with permanent access to implant and procedure data, ensuring long-term safety and record-keeping. With 24,230 procedures documented and 46,217 devices registered, this initiative has seen a remarkable 67% growth from last year.

- Breast augmentation dominates aesthetic procedures, accounting for 72.3% of recorded surgeries, followed by removal/replacement (23.18%), reconstruction (3.49%), and other specialized procedures. As per The Aesthetic Society, these statistics emphasize the ongoing popularity of breast-related enhancements.

- ISAPS reports that aesthetic procedures worldwide have surged by 5.5% this year, reaching over 15.8 million surgical procedures performed by plastic surgeons. The non-surgical sector has grown even faster, now at 19.1 million treatments, marking an extraordinary 40% increase in the last four years.

- Liposuction remains the world’s most performed surgical procedure, surpassing 2.2 million in 2023. Following closely behind are breast augmentation, eyelid surgery, abdominoplasty, and rhinoplasty. According to ISAPS, eyelid surgeries alone grew by 24%, making them one of the fastest-rising procedures globally.

- ISAPS findings reveal that the U.S. leads the world in aesthetic procedures with over 6.1 million performed, followed by Brazil at 3.3 million. However, Brazil takes the lead in surgical procedures, conducting 2.1 million in 2023.

- The demand for different procedures shifts with age—The Aesthetic Society reports that younger patients (18-34) favor breast augmentation, middle-aged adults (35-50) lean toward liposuction, and those over 51 frequently opt for eyelid surgery and facelifts.

- Non-surgical enhancements are skyrocketing, with ISAPS data showing that botulinum toxin remains the top choice at 8.8 million treatments worldwide. Hyaluronic acid procedures also experienced a major 29% increase, reaching 5.5 million.

- As noted by The Aesthetic Society, body type influences aesthetic choices significantly—patients with a BMI below 20 are far more likely to choose breast augmentation, whereas those with a BMI above 30 tend to undergo liposuction and tummy tucks for body contouring.

- Seasonal trends play a key role in procedure timing, with winter months seeing the highest number of cosmetic surgeries, while summer is noticeably slower. The Aesthetic Society suggests this could be due to recovery preferences aligning with cooler weather.

- While women dominate procedures like breast augmentation and liposuction, The Aesthetic Society finds that men are most likely to undergo gynecomastia treatment, liposuction, and nose surgery, reflecting growing male interest in aesthetics.

- ISAPS research shows that eyelid surgery has now surpassed liposuction as the most popular procedure for men, while liposuction has replaced breast augmentation as the top choice for women, seeing a 29% rise compared to 2021.

- The most commonly performed surgical procedures include liposuction, tummy tucks, and breast augmentations, with over 90% of surgeons offering these services. The Aesthetic Society notes that less than 5% specialize in niche treatments such as vaginal rejuvenation, penile enlargement, buttock implants, or hair transplants.

- According to ISAPS, hospitals continue to be the leading location for surgical procedures (46.9% worldwide), followed by office-based surgery centers (31.4%). Meanwhile, Colombia, Mexico, Turkiye, Syria, and Thailand attract the highest numbers of international cosmetic patients.

- Aesthetic One is proving to be a game-changer in the industry, offering free, permanent data access to patients and providers alike. The Aesthetic Society reports that this platform is growing rapidly, reflecting an increasing focus on patient safety and transparency.

Market Dynamic

Driving Factors in the Medical Aesthetics Market

Rise in Non-Invasive and Minimally Invasive ProceduresThe rise in preference for non-invasive and minimally invasive procedures is a major driver of the medical aesthetics market. Patients now look for treatments that provide effective results with minimal downtime, lesser risk, and lower costs compared to traditional surgery. Developments in laser technology, injectable fillers, and skin-tightening treatments have made it possible to achieve natural-looking enhancements without the need for major surgical interventions.

Procedures like Botox, dermal fillers, microneedling, and laser resurfacing are widely popular due to their quick recovery and noticeable improvements. In addition, body contouring technologies like cryolipolysis and radiofrequency-based fat reduction are gaining traction as safer alternatives to liposuction. With growth in awareness and acceptance, these procedures continue to attract a broad range of patients, from younger individuals seeking preventative care to older adults looking for subtle rejuvenation.

Expanding Consumer Demographics and Accessibility

The medical aesthetics market is expanding beyond its traditional demographic, with more men and younger individuals opting for cosmetic procedures. The stigma surrounding aesthetic enhancements has diminished, leading to a growth in demand across different age groups and genders. Male patients are increasingly looking for treatments like jawline contouring, hair restoration, and body sculpting, while younger consumers are opting for preventative Botox and skin-enhancing procedures.

In addition, medical aesthetics is becoming more accessible due to the growing number of specialized clinics, med spas, and trained professionals offering these treatments. The availability of financing options, installment plans, and lower-cost alternatives has also made aesthetic procedures affordable to a larger population. As accessibility increases, more people are considering and undergoing cosmetic treatments, further propelling market growth.

Restraints in the Medical Aesthetics Market

High Treatment Costs

One of the main restraints on the growth of the medical aesthetics market is the high cost of treatments, particularly for advanced procedures. While non-invasive treatments are generally more affordable than surgery, the cumulative costs for a series of treatments or high-end technologies like laser resurfacing or body contouring can be significant. For various potential patients, the expense of repeated sessions or multiple treatments may be a barrier, mainly in markets where disposable income is lower.

In addition, the lack of insurance coverage for aesthetic procedures means patients must pay out of pocket, which limits access for those who cannot afford these treatments. The perceived high cost compared to the results may deter some individuals, particularly in emerging economies where aesthetic treatments are still seen as luxury services.

Safety Concerns and Regulation Issues

Safety concerns and a lack of strict regulatory standards are major restraints in the medical aesthetics market. As the industry grows rapidly, so does the presence of unqualified practitioners offering low-cost treatments in non-accredited facilities, potentially leading to subpar results and increased risk of complications. Patients may experience side effects such as bruising, swelling, or even more severe reactions, particularly when procedures are not administered properly.

The lack of standardized regulations across different regions further complicates the issue, with varying guidelines for training, certification, and treatment protocols, which creates uncertainty among consumers and can damage the reputation of the industry, leading to a lack of trust and reluctance to invest in aesthetic treatments. Enhanced regulations and greater patient education are needed to address these concerns.

Opportunities in the Medical Aesthetics Market

Technological Advancements and Innovations

The rapid pace of technological development provides a significant opportunity for the medical aesthetics market. Innovations like AI-driven diagnostic tools, more effective laser treatments, and regenerative medicine techniques like platelet-rich plasma (PRP) therapy are transforming the way aesthetic treatments are performed. These advancements not only enhance treatment outcomes but also make procedures safer, faster, and more personalized.

The development of more effective non-invasive body contouring options and skin rejuvenation treatments is attracting a broader customer base, like younger individuals seeking preventative measures. As technology constantly evolves, medical aesthetics can expand its offerings, reaching untapped markets and providing consumers with even more effective, affordable, and accessible options for enhancing their appearance.

Rising Demand for Men’s Aesthetic Treatments

The growth in demand for aesthetic treatments among men presents a notable opportunity in the medical aesthetics market. Traditionally, cosmetic procedures were mainly targeted at women, but over recent years, more men are looking at treatments like Botox, dermal fillers, hair restoration, and body sculpting, which is being driven by growing societal acceptance, the influence of social media, and an increased focus on self-care.

Men are now more likely to address aging concerns, improve their appearance, and maintain a youthful look with non-invasive treatments. This opens up a new market segment for businesses and professionals in the industry. By catering to male consumers with tailored services and marketing strategies, the medical aesthetics market can capitalize on this expanding demand and further boost growth.

Trends in the Medical Aesthetics Market

Rise of Personalized and Customized Treatments

One of the most notable recent trends in the medical aesthetics market is the growth in the demand for personalized and customized treatments. Consumers are moving away from one-size-fits-all procedures and are looking for tailored solutions that address their distinctive needs and aesthetic goals.

Developments in technology, like AI and 3D imaging, allow for precise assessments of individual facial structures, skin types, and body contours, allowing practitioners to create more effective treatment plans. Whether it’s a combination of Botox, dermal fillers, or laser treatments, these personalized approaches help achieve more natural, long-lasting results. As consumers become more informed and selective, personalized treatments have become a key differentiator in the competitive aesthetics market, providing a more individualized experience that fosters customer loyalty.

Growth in Non-Surgical Body Contouring

Non-surgical body contouring has emerged as a major trend in the medical aesthetics market. Procedures like CoolSculpting, cryolipolysis, and radiofrequency treatments are gaining popularity due to their ability to reshape and reduce fat without the need for invasive surgery. These treatments appeal to individuals looking to improve their body shape with minimal recovery time and risk. The trend is also being driven by a growing awareness of the benefits of non-invasive alternatives to traditional body sculpting methods, such as liposuction. As technology improves, non-surgical body contouring procedures are becoming more effective, offering consumers an appealing option for achieving their desired body aesthetics without the expense or recovery time associated with surgery.

Research Scope and Analysis

By Product Type Analysis

Facial aesthetic products are set to lead the medical aesthetics market in 2025, holding a 37.4% share due to the growing demand for non-surgical treatments like dermal fillers, Botox, and skin boosters. These products provide quick, minimally invasive solutions for enhancing facial features, reducing wrinkles, and restoring volume, making them highly popular among consumers. With the rise in awareness of aesthetic treatments and a growing focus on youthful appearances, more people are opting for facial injectables and skincare solutions. The expansion of aesthetic clinics, dermatology centers, and med spas is further driving market growth. Developments in formulation and longer-lasting results are making these products more effective and desirable. As social media and beauty trends continue to influence consumer preferences, facial aesthetic products will remain a dominant segment in the medical aesthetics market.

Further, skin aesthetic devices are experiencing significant growth in the medical aesthetics market due to the growing demand for advanced skin care treatments like laser therapy, radiofrequency, and microneedling. These devices provide effective solutions for skin tightening, acne scars, pigmentation, and overall skin rejuvenation. With a rising number of consumers looking for professional-grade treatments with minimal downtime, aesthetic clinics and dermatology centers are rapidly adopting these devices. Constant technological advancements have improved precision, safety, and treatment outcomes, boosting their popularity. The market is also expanding due to the growing awareness of skin health and beauty enhancement, making skin aesthetic devices a key driver of industry growth.

By Technology Analysis

Laser-based aesthetic devices will lead the medical aesthetics market in 2025, holding a 36.0% share due to their numerous applications in skin rejuvenation, hair removal, scar reduction, and body contouring. These devices are highly effective, providing non-invasive solutions with less downtime, making them highly popular among consumers. The demand for laser treatments is growing as more people look for painless and quick aesthetic enhancements with long-lasting results. Developments in laser technology, including precision targeting and improved safety, are further driving adoption. With growing awareness and affordability, laser-based devices will continue shaping the market by providing innovative solutions for various cosmetic concerns.

Further, ultrasound-based devices are experiencing significant growth in the medical aesthetics market due to their effectiveness in skin tightening, fat reduction, and collagen stimulation. These non-invasive treatments provide a safer alternative to surgery, appealing to consumers looking for little recovery time. The growing demand for anti-aging and body-contouring solutions is fueling the adoption of ultrasound technology. Improved imaging and precision in treatment delivery are making these devices even more reliable. As more aesthetic clinics integrate ultrasound-based services, their market presence continues to expand. This growth is further supported by increasing consumer awareness and advancements in ultrasound technology, ensuring better treatment outcomes.

By Application Analysis

Facial and skin rejuvenation will lead the medical aesthetics market in 2025, holding a 41.9% share, driven by the rise in the demand for treatments that improve skin texture, tone, and elasticity. With people looking for non-invasive or minimally invasive solutions to combat aging signs like wrinkles, fine lines, and sagging skin, procedures like laser resurfacing, chemical peels, microneedling, and radiofrequency treatments are gaining popularity. The growth of social media beauty trends and the desire for youthful, glowing skin have fueled consumer interest in rejuvenation treatments.

Advancements in skincare technology, including AI-driven diagnostics and personalized treatments, are also boosting market growth. Dermatology clinics, med spas, and aesthetic centers are expanding their service offerings, making these treatments more accessible. With a major preference for natural-looking enhancements, facial and skin rejuvenation remains a dominant and evolving segment in the medical aesthetics industry.

Further, breast augmentation is witnessing significant growth over the forecast period, driven by the rising number of individuals looking for body enhancement procedures, as it benefits from the growth in the availability of advanced implants, fat grafting techniques, and improved surgical methods that ensure safer and more natural results. The influence of beauty standards, personal confidence, and post-pregnancy body restoration are key factors pushing demand for breast augmentation.

More medical facilities, like specialized aesthetic surgery centers, are offering customized solutions to cater to diverse patient needs. Technological advancements in implant materials and 3D imaging for surgical planning are further improving patient outcomes. As awareness and acceptance of aesthetic procedures grow, breast augmentation remains one of the most sought-after treatments in the medical aesthetics industry.

By End User Analysis

Hospitals & clinics will dominate the medical aesthetics market in 2025, holding a 43.7% share due to their advanced infrastructure, skilled professionals, and ability to provide safe and effective treatments. These facilities provide various aesthetic procedures, from minimally invasive treatments like Botox and fillers to complex surgeries such as facelifts and body contouring. Patients prefer hospitals and clinics because of the high level of expertise, hygiene, and post-treatment care available. The growing awareness of aesthetic procedures, increasing medical tourism, and the rising demand for anti-aging treatments are boosting patient visits. In addition, hospitals and clinics constantly invest in advanced technologies, ensuring better treatment outcomes and patient satisfaction. As more people look for professional and reliable aesthetic solutions, these healthcare facilities will continue to play a crucial role in market expansion.

Moreover, homecare settings are experiencing significant growth in the medical aesthetics market due to the rising popularity of at-home beauty devices and skincare treatments. Consumers are mainly opting for convenient and affordable aesthetic solutions that can be used without visiting a clinic. Devices for skin rejuvenation, hair removal, and anti-aging treatments are becoming more advanced and accessible, making homecare treatments a preferred choice for many. The demand is further driven by busy lifestyles and the ease of self-administered treatments. As technology improves, home-use aesthetic devices offer better results, encouraging more people to invest in them. This trend is expected to drive steady market expansion in the coming years.

The Medical Aesthetics Market Report is segmented on the basis of the following

By Product Type

- Facial Aesthetic Products

- Body Contouring Devices

- Cosmetic Implants

- Skin Aesthetic Devices

- Hair Removal Devices

- Others

By Technology

- Laser-based Aesthetic Devices

- Radiofrequency-based Devices

- Ultrasound-based Devices

- Others

By Application

- Facial & Skin Rejuvenation

- Fat Reduction & Body Contouring

- Hair Removal

- Breast Augmentation

- Others

By End User

- Hospitals & Clinics

- Medical Spas & Beauty Centers

- Homecare Settings

Regional Analysis

Leading Region in the Medical Aesthetics Market

North America will lead the medical aesthetics market in 2025, holding a

39.1% share, driven by high consumer demand, advanced healthcare infrastructure, and the presence of leading aesthetic companies. The region has a strong culture of aesthetic enhancement, with people increasingly looking for treatments like Botox, dermal fillers, laser procedures, and body contouring. The availability of skilled professionals, advanced technology, and a well-regulated medical environment further boost market growth. Social media influence, rising disposable income, and a growing aging population looking for anti-aging solutions are fueling demand.

Additionally, the popularity of minimally invasive procedures with quick recovery times is increasing. The US and Canada have a large network of aesthetic clinics and medical spas, making treatments easily accessible. Constant innovations in non-surgical aesthetic procedures and a high level of awareness about cosmetic treatments contribute to North America’s dominant position in the global medical aesthetics market.

Fastest Growing Region in the Medical Aesthetics Market

Asia Pacific is set for significant growth in the medical aesthetics market over the forecast period, driven by growing disposable income, growing beauty consciousness, and expanding access to aesthetic treatments. Countries like China, Japan, South Korea, and India are experiencing a growth in demand for cosmetic procedures, both surgical and non-surgical. The influence of social media, a strong beauty industry, and medical tourism are key factors fueling this growth. Advancements in technology, along with a growing number of trained professionals, are making aesthetic treatments more accessible. Additionally, affordability, compared to Western countries, is attracting international patients, further boosting the region’s market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The medical aesthetics market is highly competitive, with numerous players offering various advanced treatments and devices. Innovation plays a key role as companies continuously develop new technologies like laser systems, injectables, and skin rejuvenation solutions to meet growing consumer demand. The market is also shaped by the increasing number of trained professionals and clinics specializing in aesthetic procedures.

Strategic partnerships, product launches, and research-driven advancements help companies stay ahead in this fast-evolving industry. Additionally, factors like affordability, regulatory approvals, and patient safety influence competition. With rising awareness and demand, both established and emerging players are expanding their global presence, making the market dynamic and full of opportunities.

Some of the prominent players in the Global Medical Aesthetics are

- AbbVIe

- Ipsen

- Revance Therapeutics

- Hugel

- MediTox

- Evolus

- Daewoong Pharmaceutical Co., Ltd.

- Cutera Inc

- Lumeins

- Syneron Candela

- Fotona

- InMode

- Sientra

- Merz Pharma GmbH & Co. KGaA

- Galderma

- Alma Lasers

- Hologic

- InMode

- Bison Medical

- Classys Inc

- Other Key Players

Recent Developments

- In March 2025, Alma Lasers has launched the latest edition of its award-winning aesthetics platform, Alma Harmony. Built on a distinguished 20-year legacy, Alma's new platform features a stunning modern design and substantial upgrades to offer more treatment possibilities and a simply intelligent experience.

- In February 2025, Empower Aesthetics announced its partnership with SeaMist MedSpa, a premier provider of advanced skincare and wellness treatments with locations in Newport and Wakefield, RI. Further, this announcement marks the latest in a series of new partnerships Empower has solidified with leading medical aesthetics practices across the U.S.

- In December 2024, Crown Aesthetics launched SkinPen Precision Elite, a revolutionary FDA-cleared device (Elite Cartridge Unit) that sets a new benchmark in microneedling, as it's an advanced device designed to enhance the user experience for aesthetic practitioners. It features significant upgrades, including an innovative, one-time use, easy-to-install cartridge, minimizing risk for accidental lockouts with active retraction technology powered by the all-new ActiSine technology.

- In September 2024, Merz Aesthetics launched Ultherapy PRIME—a noninvasive, FDA-cleared medical aesthetics treatment that provides a truly customized and long-lasting lift of the skin in one session with zero downtime. The platform is the evolution of Ultherapy®, which has been recognized as the Gold Standard for nonsurgical lifting due to its large body of clinical evidence, well-established mechanism of action (MOA) and high patient satisfaction.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.6 Bn |

| Forecast Value (2034) |

USD 60.1 Bn |

| CAGR (2025-2034) |

13.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 6.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Facial Aesthetic Products, Body Contouring Devices, Cosmetic Implants, Skin Aesthetic Devices, Hair Removal Devices, and Others), By Technology (Laser-based Aesthetic Devices, Radiofrequency-based Devices, Ultrasound-based Devices, and Others), By Application (Facial & Skin Rejuvenation, Fat Reduction & Body Contouring, Hair Removal, Breast Augmentation, and Others), By End User (Hospitals & Clinics, Medical Spas & Beauty Centers, and Homecare Settings) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AbbVIe, Ipsen, Revance Therapeutics, Hugel, MediTox, Evolus, Daewoong Pharmaceutical Co., Ltd, Cutera Inc, Lumeins, Syneron Candela, Fotona, InMode, Sientra, Merz Pharma GmbH & Co. KGaA, Galderma, Alma Lasers, Hologic, InMode, Bison Medical, Classys Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Medical Aesthetics Market?

▾ The Global Medical Aesthetics Market size is expected to reach a value of USD 19.6 billion in 2025 and is expected to reach USD 60.1 billion by the end of 2034.

Which region accounted for the largest Global Medical Aesthetics Market?

▾ North America is expected to have the largest market share in the Global Medical Aesthetics Market, with a share of about 39.1% in 2025.

Who are the key players in the Global Medical Aesthetics Market?

▾ Some of the major key players in the Global Medical Aesthetics Market are AbbVie, Ipsen, Revance Therapeutics, and others

What is the growth rate in the Global Medical Aesthetics Market?

▾ The market is growing at a CAGR of 13.3 percent over the forecasted period.

How big is the Medical Aesthetics Market in the US?

▾ The Medical Aesthetics Market in the US is expected to reach USD 6.7 billion in 2025.