Market Overview

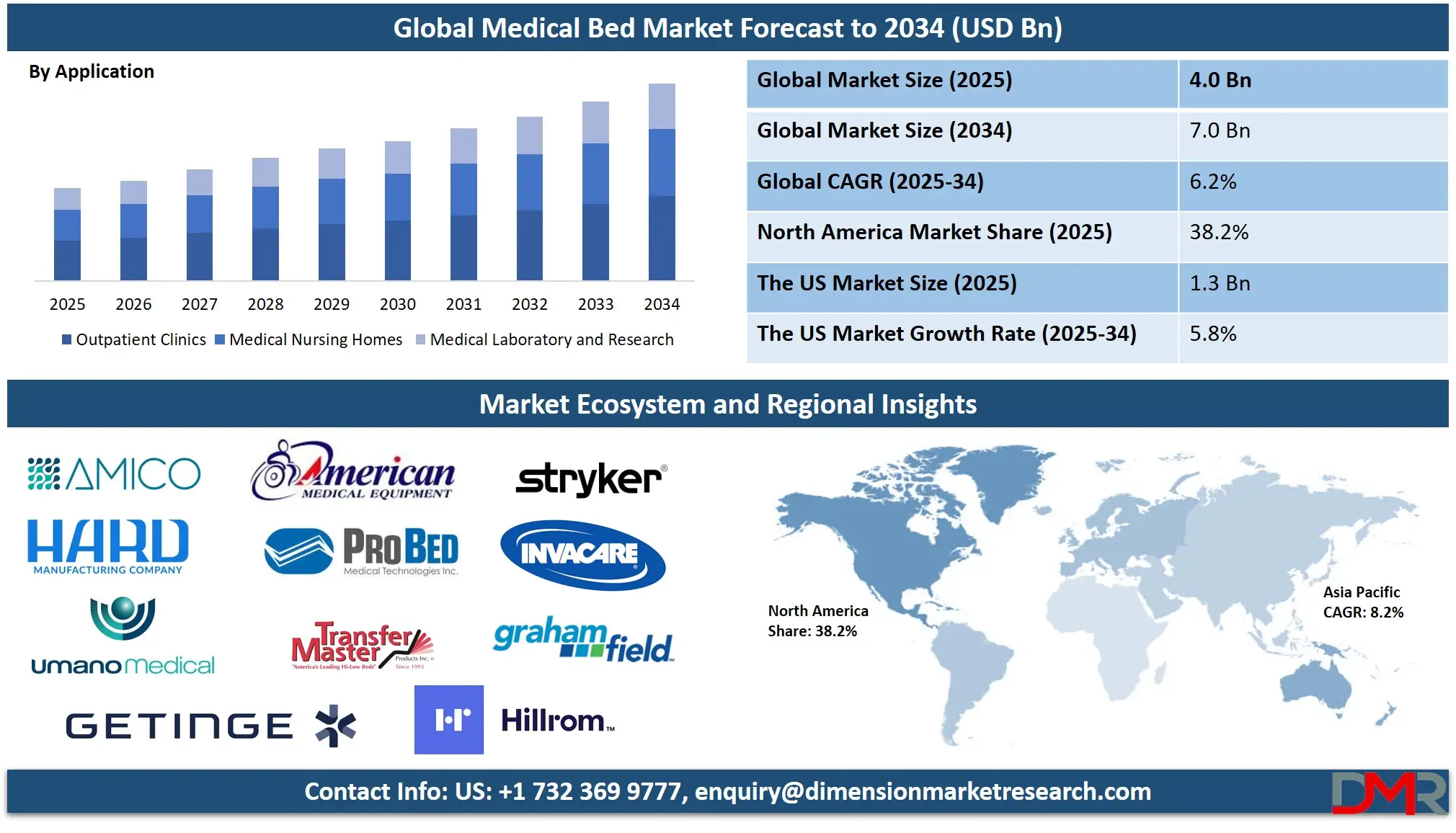

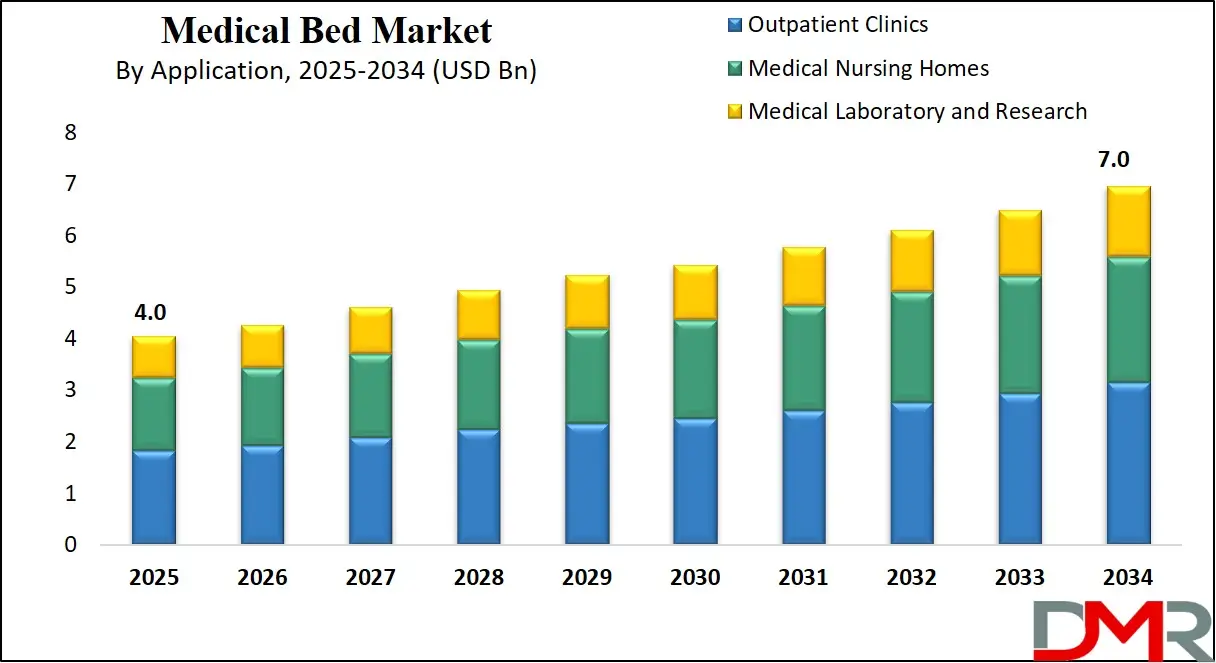

The global medical bed market is estimated to reach a market value of USD 4.0 billion in 2025, while it is further projected to grow to a market value of USD 7.0 billion in 2034 at a CAGR of 6.2%.

The global mammography systems market is expanding due to the increasing incidence of breast cancer, the rollout of national screening programs, and technological advancements such as digital breast tomosynthesis (DBT) and AI-assisted image interpretation. According to global cancer burden data from the World Health Organization and international cancer registries, breast cancer remains the most frequently diagnosed cancer in women, which drives healthcare systems to invest in advanced imaging devices to improve early detection rates.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One significant trend is the replacement of analog mammography units with full-field digital mammography systems and 3D tomosynthesis platforms. These technologies provide higher-resolution imaging, improved lesion detection, and integration with computer-aided detection (CAD) tools, enhancing diagnostic accuracy and workflow efficiency. Adoption is particularly strong in organized screening programs, where image quality and reading speed are critical.

Opportunities are emerging in regions with lower screening penetration, especially in middle-income countries implementing population-based screening. Mobile mammography units are being deployed to rural and underserved areas, enabling earlier detection and reducing mortality disparities. Integration with ultrasound and MRI for dense-breast screening offers additional growth potential, along with AI algorithms that support triage and prioritize high-risk cases.

However, the market faces restraints such as disparities in screening uptake, shortages of trained radiologists, and the high cost of advanced mammography systems, which can slow adoption in budget-constrained healthcare systems. Regulatory approval processes for AI-based diagnostic tools also add complexity.

Future growth prospects include broader adoption of DBT in national screening protocols, personalized screening schedules based on breast density, increased mobile screening capabilities, and global health initiatives targeting early breast cancer detection. These factors, combined with demographic aging and expanding awareness campaigns, position the mammography systems for sustained expansion over the next decade.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

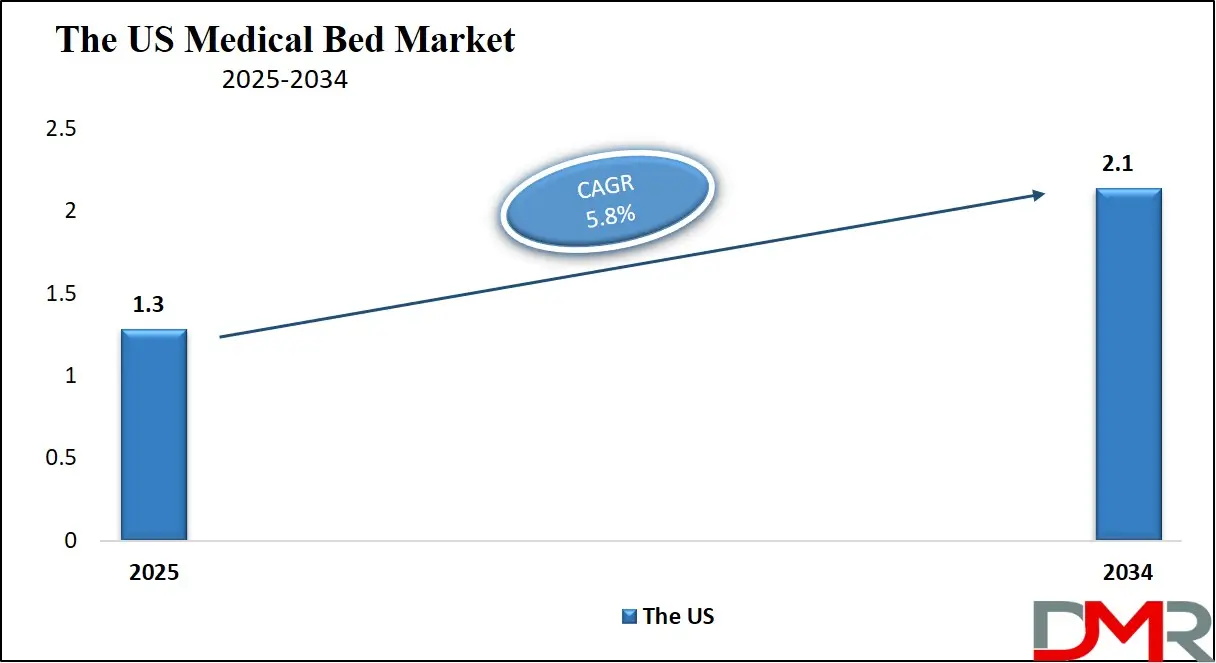

The US Medical Bed Market

The US Medical Bed Market is projected to reach USD 1.3 billion in 2025 at a compound annual growth rate of 5.8% over its forecast period.

The U.S. medical bed market is being shaped by a clear demographic tailwind: a growing senior population and rising prevalence of chronic conditions drive demand across acute, post-acute, long-term, and home-care settings. Official population and health-service reports indicate steady growth in the 65-and-older cohort, prompting hospitals and long-term care providers to plan capacity and invest in specialty beds bariatric, pressure-relief, ICU, and rehabilitation models.

Public payer frameworks and regulatory quality metrics (focused on pressure ulcer prevention, fall reduction, and infection control) influence hospital procurement specifications, pushing buyers toward beds with integrated clinical features such as pressure-management compatibility, low-height positions, side-rail and fall-detection options, and nurse-assist interfaces. Occupational safety guidance and labor reports also motivate facilities to choose electrically powered positioning and patient-handling options to reduce caregiver injuries and improve workflow efficiency.

Meanwhile, the home-health and aging-in-place trend supported by government aging-services programs and community-care initiatives fuels demand for adaptable beds that can move from institutional to home environments, and for rental and leasing models that reduce upfront capital strain on families and community providers. Technology integration is increasingly important: interoperability with patient-monitoring systems, cable management, and modular accessories align with hospital digital roadmaps.

Cost pressures in the U.S. health system drive interest in total-cost-of-ownership decisions, replacement cycles, and preventative-maintenance contracts. Taken together, demographic, regulatory, workforce, and care-delivery trends create a multi-segment market where clinical need and policy both push toward safer, more versatile, and more connected medical beds.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Medical Bed Market

The Europe Medical Bed Market is estimated to be valued at USD 600.0 billion in 2025 and is further anticipated to reach USD 930.8 billion by 2034 at a CAGR of 5.0%.

Europe’s medical bed market reflects aging populations, diverse national procurement systems, and public health planning that collectively determine bed types and volumes. Continental demographic profiles and official statistics demonstrate rising median ages and a growing share of older adults, which drives demand for beds suited to geriatric care, Medical Rehabilitation Services, and long-term residential settings. Many European countries use centralized or regional public procurement with standardized tender specifications emphasizing pressure-area management, hygienic design for infection prevention, and energy-efficient electrical components requirements that shape product design and vendor selection.

National health ministries and social-care authorities factor demographic projections and hospital-capacity planning into multi-year purchasing cycles, encouraging adoption of multi-functional beds that are serviceable across acute wards, step-down units, and nursing homes. Workforce planning and nurse-to-patient ratios reported in public health documents also affect bed feature preferences: devices that reduce manual handling and support safe patient transfers become more highly valued where staffing constraints persist.

Additionally, policy drives toward community-based and home-care models are shifting some purchasing toward hybrid beds that are transportable and adaptable to home environments, supporting reablement and early discharge programs. Regional differences Nordic countries’ emphasis on ergonomic design, southern Europe’s focus on cost-efficiency, and central Europe’s mixed approaches mean suppliers must offer configurable platforms. Overall, public-sector planning, demographic aging, quality standards, and an emphasis on integrated care pathways combine to create a market where versatility, safety, and lifecycle support are primary procurement drivers.

The Japan Medical Bed Market

The Japan Medical Bed Market is projected to be valued at USD 240.0 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 385.2 billion in 2034 at a CAGR of 5.4%.

Japan’s medical bed market is strongly influenced by one of the world’s most aged societies, robust public healthcare planning, and government-led long-term care policies. National demographic statistics indicate a very high and growing share of citizens aged 65 and over, which translates into a sustained need for beds tailored to geriatric medicine, rehabilitation, long-term care, and community-based services. Policy instruments such as long-term care insurance frameworks and official capacity-planning guidance encourage investment in beds that address mobility impairment, pressure-injury prevention, fall risk mitigation, and compact design that fits smaller residential and hospital room footprints.

Consequently, demand is high for low-profile beds, multi-positional frames, and integrated surface-compatibility with pressure-relief mattresses. Japan’s health system's emphasis on rehabilitation and “community-care” transition programs also creates niche demand for convertible beds that support early mobility and discharge to home-based settings.

Occupational-safety considerations and caregiver shortage metrics drive preference for electrically operated, caregiver-assist features, and patient-transfer compatibility to reduce physical strain on staff. Manufacturers serving Japan often prioritize compact engineering, easy-clean surfaces to meet infection-control protocols, and durable construction with high uptime for frequently used hospital fleets.

In addition, the cultural preference for dignity and independence in eldercare makes patient-centric features quiet motors, intuitive controls, and discreet aesthetics important. Overall, demographic realities combined with government-led eldercare frameworks and health-service planning create a market focused on specialized geriatric functionality, space-efficient designs, and beds that enable seamless transitions across acute, subacute, and home-care environments.

Global Medical Bed Market: Key Takeaways

- Global Market Size Insights: The Global Medical Bed Market size is estimated to have a value of USD 4.0 billion in 2025 and is expected to reach USD 7.0 billion by the end of 2034.

- Regional Insights: North America has the largest market share for the Global Medical Bed Market, with a share of about 38.2% in 2025.

- The US Market Size Insights: The US Medical Bed Market is projected to be valued at USD 1.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.1 billion in 2034 at a CAGR of 5.8%.

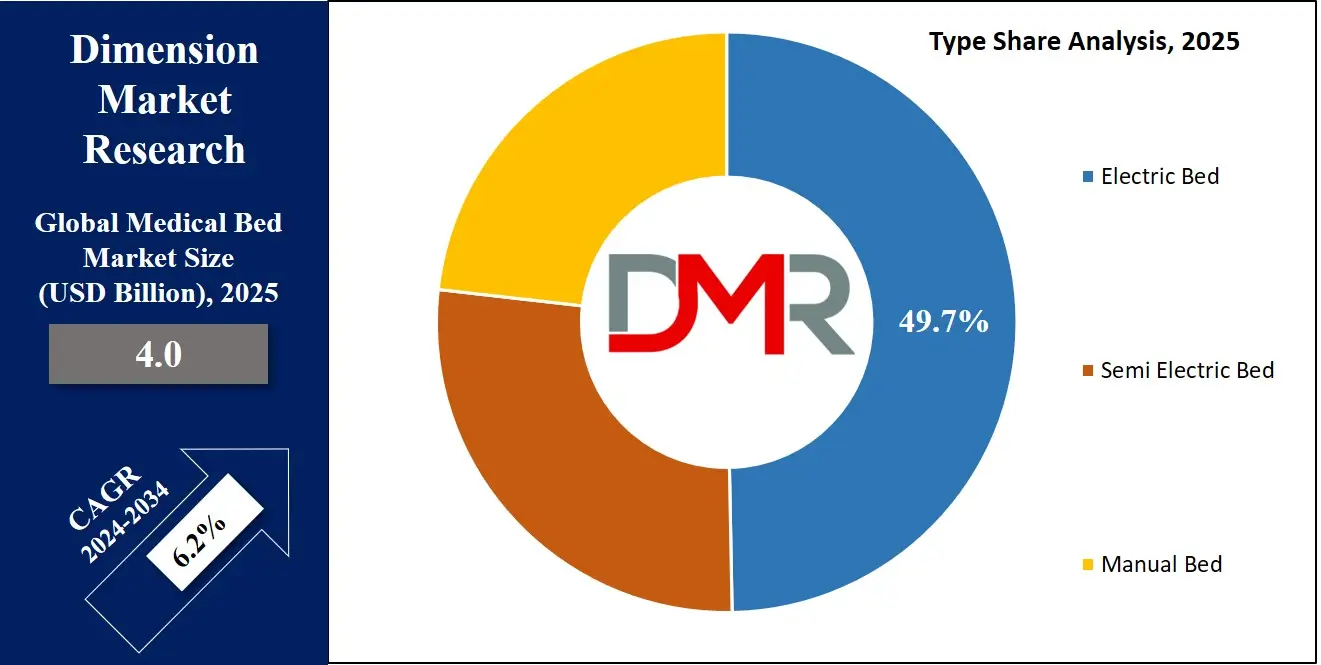

- Type Segment Analysis: Electronic beds are anticipated to dominate the global medical bed market in the context of type, as they hold 49.7% of the market share in 2025.

- Usage Segment Analysis: Long-term care patients are the primary users of medical beds in the global medical bed market as they are projected to acquire the highest market share in 2025.

- Application Segment Analysis: Outpatient clinic is projected to dominate the global medical bed market in the context of application, as they hold 74.9% of the market share in 2025.

- Key Players: Some of the major key players in the Global Medical Bed Market are Invacare Corporation, Hill-Rom Services Inc., Stryker Corporation, Transfer Master Products, Inc., Umano Medical Inc., and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 6.2% percent over the forecasted period.

Global Medical Bed Market: Use Cases

- Acute care ICU and step-down units: Critical-care environments require ICU-grade beds with advanced positioning, integrated monitoring mounts, pressure-redistribution compatibility, and rapid convertibility for procedures. These beds support ventilated patients, facilitate prone positioning, and include caregiver-assist features to reduce manual handling, making them essential for intensive workflows, sepsis management, and rapid-response scenarios in tertiary hospitals.

- Rehabilitation and post-acute recovery: Rehab units use modular beds enabling precise tilt, height, and lateral positioning to support physiotherapy, wound care, and progressive mobility training. Features like detachable side-rails, posture-support accessories, and mattress-system compatibility help clinicians implement graduated rehabilitation protocols, shorten length of stay, and improve functional outcomes after orthopedic or neurological events.

- Long-term care and nursing homes: Residential eldercare settings demand beds focused on fall prevention, pressure-injury management, and user comfort. Low-height designs, integrated bed-exit alarms, and surfaces compatible with static or alternating-pressure mattresses address chronic-care needs while supporting staff with ergonomic adjustments that minimize caregiver injury risk and assist in daily activities of living.

- Home health and aging-in-place support: Homecare beds enable safe discharge and aging-in-place by providing adjustable heights, simple user controls, and compatibility with caregiver-assist equipment. Rental or purchase options facilitate transitional care after hospitalization, support family caregivers, and reduce readmission risk by enabling safe transfers, pressure management, and nighttime monitoring in a domestic setting.

- Bariatric and specialty support for high-acuity needs: Bariatric-capacity beds and specialty frames address higher weight capacities, reinforced structures, and wider platforms for safe handling and dignity. Used in acute, long-term, and community settings, these beds pair with heavy-duty surfaces and lifting accessories to ensure safe transfers, reduce staff injury, and support complex-care patients with mobility and pressure-management requirements.

Market Dynamic

Driving Factors in the Global Medical Bed Market

Aging Population and Rising Chronic Disease Burden

One of the most powerful growth drivers in the medical beds market is the global demographic shift toward an aging population, combined with a higher prevalence of chronic illnesses requiring prolonged or specialized care. Elderly individuals are more likely to require hospitalization, long-term care, and rehabilitation services, all of which depend heavily on appropriately designed medical beds.

Government population statistics in regions such as Europe, North America, and Japan indicate a sustained rise in the proportion of people aged 65 and over. These patients frequently need beds with features such as adjustable height, pressure redistribution, and caregiver-assist functions to ensure safety and comfort.

In addition, the rising incidence of chronic conditions like cardiovascular disease, diabetes, obesity, and mobility-limiting musculoskeletal disorders increases hospital admissions and long-term care facility occupancy rates. This sustained demand cycle drives consistent procurement by healthcare providers. Policy frameworks that encourage improved patient safety and fall prevention further incentivize investment in advanced bed designs.

Expanding Healthcare Infrastructure and Government Investments

Healthcare infrastructure expansion is a significant driver of demand for medical beds, particularly in developing economies. Many countries are building new hospitals, expanding ICU capacity, and modernizing long-term care facilities to meet population health needs.

Government-led investments often part of broader public health strategies include the procurement of advanced medical equipment, with beds being a critical component of inpatient care. For instance, national health authorities in emerging Asian and African economies are working to increase hospital-bed-to-population ratios in line with World Health Organization recommendations.

These initiatives are frequently supported by international funding agencies, public-private partnerships, and targeted stimulus programs for healthcare infrastructure. In developed economies, infrastructure renewal includes replacing aging hospital bed fleets with modern, ergonomically designed units that reduce staff injury risk and improve patient comfort.

Restraints in the Global Medical Bed Market

High Capital Costs and Budget Constraints in Public Healthcare

A major restraint for the medical beds market is the high capital cost associated with advanced bed systems, especially in budget-constrained public healthcare settings. Fully featured electric beds with integrated technology, ergonomic design, and compatibility with specialized mattresses can cost several times more than basic manual beds. For hospitals operating under tight budgetary allocations, especially in low- and middle-income countries, such investment is difficult to justify.

Procurement processes in public hospitals often prioritize the lowest initial cost over long-term value, leading to slower adoption of premium beds. Even in developed markets, capital spending freezes during economic downturns can delay replacement cycles. Leasing and rental programs partially address this barrier, but in many cases, the initial outlay for upgrading entire bed fleets remains prohibitive. This cost sensitivity also affects long-term care facilities and home care providers, particularly when reimbursement systems do not directly cover equipment expenses.

Regulatory Complexity and Lengthy Approval Processes

Medical beds, particularly those with integrated electronics or patient-monitoring capabilities, must comply with stringent safety, electrical, and medical device regulations. In many countries, beds with advanced features are classified as medical devices requiring certification before market entry. These processes can be time-consuming and costly, especially when navigating multiple regulatory regimes for international distribution.

Compliance with standards such as IEC 60601 for electrical safety, infection control guidelines, and ergonomic design requirements can slow product launches. Furthermore, updates to regulatory frameworks, such as the EU Medical Device Regulation (MDR), increase documentation and testing demands. For manufacturers, this means longer lead times and higher R&D costs. Smaller players may struggle to meet these requirements, limiting competition and slowing innovation in certain markets.

Opportunities in the Global Medical Bed Market

Penetration into Emerging Markets with Low Bed-to-Population Ratios

The medical beds market has significant growth potential in countries where the bed-to-population ratio remains below global averages. Many low- and middle-income countries face critical shortages of hospital and long-term care capacity, creating opportunities for manufacturers to supply both basic and advanced bed models. By aligning offerings with the budget constraints of these healthcare systems through cost-optimized designs, durable materials, and local assembly suppliers can capture underserved segments.

Partnerships with governments and NGOs to deploy beds in rural and underserved areas can expand market reach while contributing to public health outcomes. Mobile and modular bed systems are particularly appealing in these regions, allowing flexible deployment in clinics, field hospitals, and disaster relief settings. Companies that combine affordability, durability, and after-sales service will be well-positioned to capitalize on this untapped demand.

Integration of AI and Predictive Analytics into Bed Platforms

There is a growing opportunity to integrate AI and predictive analytics directly into medical bed systems to enhance patient monitoring, clinical decision-making, and workflow efficiency. Beds equipped with sensors can track movement patterns, detect early signs of pressure ulcer risk, and monitor respiratory function. AI algorithms can analyze these data streams to provide actionable insights for caregivers, such as adjusting patient positioning schedules or alerting staff to potential falls. By reducing manual checks and enabling preventive interventions, AI-enhanced beds can lower care costs while improving patient outcomes.

Hospitals seeking to optimize staffing efficiency will see strong ROI in beds that provide continuous monitoring and automated reporting. Moreover, integrating these capabilities into telemedicine and remote patient-monitoring systems can expand the market into home care and post-discharge settings.

Trends in the Global Medical Bed Market

Integration of Smart Technologies and IoT in Medical Beds

A major trend in the medical beds market is the adoption of smart beds equipped with IoT connectivity, sensor-based monitoring, and digital integration with hospital information systems. These beds track patient movement, vital signs, and pressure patterns in real time, enabling early detection of complications such as pressure ulcers or respiratory distress. They also provide alerts to caregivers through nurse-call integration or mobile devices, improving response times and reducing manual monitoring requirements.

Additionally, the interoperability of smart beds with electronic health records supports streamlined documentation, reducing administrative burden. As healthcare shifts toward value-based care, technology-enabled beds that enhance patient outcomes while optimizing staffing efficiency are becoming standard in new hospital builds and during major facility upgrades, especially in North America, Europe, and advanced Asia-Pacific healthcare systems.

Shift Toward Homecare and Community-Based Medical Bed Solutions

Another key trend is the rising demand for medical beds in homecare and community settings, driven by the aging population, post-acute care demand, and cost-containment strategies in healthcare systems. Governments and insurers increasingly promote home-based care to reduce hospital admissions and length of stay. This has increased demand for lightweight, portable, height-adjustable beds that can be safely operated in residential environments while providing features comparable to hospital beds.

Beds for homecare now often include electric adjustment, collapsible side rails, low-height safety designs, and compatibility with mobility aids or lifting equipment. Rental and leasing models have gained traction, particularly for temporary post-surgery or rehabilitation needs. Manufacturers are also producing modular beds that can transition between hospital and home settings without extensive reconfiguration.

Research Scope and Analysis

By Type Analysis

Electronic beds are anticipated to dominate the global medical bed market in 2025, holding 49.7% of the market share. Their popularity stems from their adaptability, enabling precise positioning to enhance patient comfort and facilitate diverse medical interventions. Electronic adjustment systems allow for smooth transitions between positions, reducing strain on both patients and caregivers.

Care teams benefit from improved ergonomics and workflow efficiency, as these beds require less physical effort to operate, minimizing injury risks for healthcare staff. Safety features such as integrated side rails, bed-exit alarms, and locking mechanisms provide an additional layer of patient protection, especially for elderly or mobility-impaired individuals.

Their versatility extends across hospitals, rehabilitation centers, long-term care facilities, and home-care environments, supporting treatments ranging from surgical recovery to chronic illness management. These beds often integrate with patient-monitoring devices and hospital information systems, enhancing clinical oversight. In long-term care, they reduce repositioning-related discomfort, while in acute care, they streamline procedures by offering rapid patient repositioning.

Furthermore, their compatibility with pressure-relief mattresses and assistive accessories makes them an essential component of modern patient care infrastructure. The rising focus on patient-centric care, coupled with advances in automation and smart-bed technologies, ensures electronic beds remain a cornerstone investment for healthcare facilities seeking to balance operational efficiency with enhanced patient outcomes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Usage Analysis

Long-term care patients are projected to lead the global medical bed market in 2025, driven by the aging population and the growing prevalence of chronic conditions requiring extended hospitalization or residential care. Nursing homes, assisted-living facilities, and rehabilitation centers form the primary demand hubs for these beds. Long-term care settings often cater to patients with disabilities, mobility impairments, or advanced illnesses, necessitating specialized beds with adjustable positioning, ergonomic controls, and pressure-redistribution surfaces to prevent complications such as pressure ulcers. These beds also facilitate safe patient transfers, reducing physical strain on caregivers and improving operational workflows.

Regulatory frameworks in regions like North America, Europe, and Japan mandate equipment safety, durability, and infection-control compliance, pushing facilities to invest in high-quality, low-maintenance solutions. Long-term care providers prioritize resident comfort, incorporating beds with quiet motors, easy-to-use controls, and compatibility with therapeutic mattresses. Additionally, these beds support integrated care approaches, enabling seamless delivery of physical therapy, wound care, and palliative services within the same unit.

Cost-efficiency is achieved through beds designed for multi-year durability, reducing replacement frequency and maintenance costs. As governments worldwide expand funding for eldercare and community health programs, the demand for long-term care beds will remain robust, making them a critical procurement priority for aging societies.

By Application Analysis

Outpatient clinics are expected to dominate the global medical bed market in 2025, holding 74.9% of the market share, largely due to the rapid expansion of ambulatory care models. The shift toward outpatient treatment is fueled by cost-containment strategies, technological advancements, and the rising preference for patient convenience. Clinics increasingly handle preventive care, diagnostic procedures, and minimally invasive treatments that once required hospital admission.

Beds in outpatient settings are used for diverse purposes, including endoscopy, infusion therapy, minor surgical interventions, and observation. Modern outpatient facilities require medical beds with adjustable height, backrest controls, and integrated monitoring systems to accommodate varied patient needs. Compact, multifunctional bed designs help optimize space utilization, critical for clinics handling high patient volumes within limited square footage. Additionally, beds with easy maneuverability enhance patient flow between treatment areas, improving operational efficiency.

Technological integration allows outpatient beds to support specialized equipment for procedures traditionally performed in hospital settings, expanding service offerings and revenue streams. Investment in advanced medical beds enables clinics to ensure safety, comfort, and clinical precision without incurring the costs of inpatient care. As healthcare systems globally encourage a shift from inpatient to outpatient services, the demand for versatile, procedure-ready beds in community-based facilities will continue to grow, solidifying their dominance in this segment.

The Medical Bed Market Report is segmented based on the following:

By Type

- Electric Bed

- Semi Electric Bed

- Manual Bed

By Usage

- Long Term Care

- Acute Care

- Maternity

- Psychiatric Care

By Application

- Outpatient Clinics

- Medical Nursing Homes

- Medical Laboratory and Research

Impact of Artificial Intelligence in the Global Medical Bed Market

- Enhanced Patient Monitoring: Artificial intelligence enables smart medical beds to monitor patient vitals, movement, and posture in real time, reducing the risk of bedsores, falls, and medical emergencies while improving overall patient safety and comfort.

- Predictive Healthcare Alerts: AI-powered beds integrate predictive analytics to detect early signs of patient deterioration, allowing timely medical interventions, enhancing critical care efficiency, and reducing hospital readmission rates through proactive health monitoring and alerts.

- Personalized Patient Comfort: Machine learning algorithms in medical beds personalize pressure adjustments, positioning, and support based on patient-specific data, ensuring optimized recovery conditions, improved sleep quality, and reduced physical strain for both patients and caregivers.

- Optimized Resource Management: AI enhances bed fleet management by tracking utilization, maintenance needs, and patient allocation in healthcare facilities, optimizing resource usage, reducing operational costs, and ensuring the timely availability of critical care equipment.

- Seamless Data Integration: AI-enabled integration with hospital information systems allows seamless data sharing from beds to electronic health records, improving workflow automation, clinical decision-making, and coordination between multidisciplinary healthcare teams for better patient outcomes.

Global Medical Bed Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to have substantial growth in the global medical bed market as it will hold 38.2% of the market share in 2025. This region, specifically the United States and Canada, fosters a well-developed healthcare infrastructure that offers long-term care and service facilities that push the growth of this market. This region is seeing a rise in the ageing population, which subsequently boosts the need for healthcare facilities for individuals with mobility impairment.

Major companies in this region heavily invest in research and development to offer products with more features and services to the patients, making them more popular and easier to use. In this region, few companies offer beds that are equipped with advanced features like electronic controls, pressure ulcer prevention systems, and integrated patient monitoring.

Additionally, North America has very strict regulatory standards for this market, which help in ensuring the safety and quality of the beds. Major manufacturers in this region follow these rules and regulations to enhance consumer confidence in their product portfolio, which pushes the growth of this market.

Region with the Highest CAGR

Asia Pacific is projected to witness the highest CAGR in the global medical beds market due to rapid healthcare infrastructure expansion, increasing healthcare expenditure, and government initiatives to improve patient care. Countries like China, India, and Japan are experiencing a surge in hospital construction, modernization of healthcare facilities, and adoption of advanced medical technologies to meet rising patient demands. The growing elderly population, particularly in Japan and China, is driving the need for specialized long-term care and home care beds.

Additionally, the rising incidence of chronic illnesses and the increasing number of surgical procedures are fueling demand for technologically advanced hospital beds with features like automated positioning, integrated monitoring, and mobility support. Cost-effective manufacturing capabilities and availability of skilled labor make the region attractive for international medical bed manufacturers, leading to joint ventures and local production facilities.

Governments are also implementing healthcare reforms and increasing public health investments, which are improving access to advanced medical equipment in rural and urban areas. Rapid urbanization and increasing awareness of patient safety and comfort further support market adoption. The integration of AI and IoT into medical beds is also accelerating in Asia Pacific, especially in high-growth economies, making it a hotspot for future innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global medical beds market is highly competitive, with major players focusing on technological innovation, strategic partnerships, and global expansion to strengthen their market positions. Key companies include Hill-Rom Holdings Inc., Stryker Corporation, Invacare Corporation, LINET Group SE, Arjo AB, and Gendron Inc., each offering a diverse portfolio of beds catering to hospitals, long-term care, and homecare settings. These players invest heavily in research and development to integrate advanced features such as automated height adjustments, AI-powered patient monitoring, fall detection sensors, Remote Patient Monitoring, and IoT connectivity for hospital information systems.

Mergers and acquisitions are common strategies to expand product offerings and enter emerging markets, especially in the Asia Pacific region. Many companies collaborate with healthcare providers to develop customized bed solutions tailored to specific patient needs. Additionally, there is an increasing focus on sustainability, with manufacturers exploring eco-friendly materials and energy-efficient designs.

Price competitiveness remains critical, particularly in cost-sensitive markets, prompting global leaders to establish local manufacturing units. The combination of innovation, strategic alliances, and market diversification is enabling these companies to maintain a strong foothold in the rapidly evolving medical beds industry.

Some of the prominent players in the Global Medical Bed Market are

- Invacare Corporation.

- Hill-Rom Services Inc.

- Stryker Corporation

- Transfer Master Products, Inc.

- Umano Medical Inc.

- ProBed Medical Technologies

- American Medical Equipment.

- Getinge AB.

- HARD Manufacturing Company, Inc.

- GF Health Products, Inc.

- Amico Group of Companies.

- Other Key Players

Recent Developments in the Global Medical Bed Market

- July 2025: Hillrom introduced a smart medical bed series with built-in patient monitoring systems, designed to improve hospital workflow efficiency, enable real-time health tracking, enhance patient comfort, and reduce staff workload through advanced automation features.

- May 2025: Stryker Corporation invested significantly in expanding its hospital bed manufacturing capacity to meet rising global demand, particularly in critical care facilities, ensuring improved supply chain resilience and faster delivery to healthcare institutions worldwide.

- March 2025: LINET Group launched an advanced ICU bed model with AI-driven posture adjustment, automated fall detection, and integrated patient sensors, aiming to improve intensive care efficiency and optimize safety for critically ill patients.

- January 2025: Invacare Corporation formed a strategic partnership with a healthcare technology provider to embed IoT capabilities into its homecare bed range, enabling remote monitoring, real-time adjustments, and enhanced caregiver support for patients in domestic settings.

- October 2024: Paramount Bed Holdings released its next-generation hospital bed featuring mobility assistance functions, designed to facilitate early patient mobilization post-surgery, reduce recovery time, and lower complications associated with prolonged bed rest.

- September 2024: Stiegelmeyer GmbH & Co. KG presented its latest bariatric care bed at a global healthcare expo, highlighting its reinforced frame, enhanced patient safety features, and ergonomic design to accommodate higher weight capacities comfortably.

- June 2024: Arjo introduced an upgraded long-term care bed specifically for dementia patients, incorporating sensory stimulation elements, pressure-relieving surfaces, and movement sensors to improve comfort, reduce agitation, and enhance quality of life in care environments.

- April 2024: Favero Health Projects entered a distribution partnership in the GCC region to expand hospital bed supply, targeting growing healthcare infrastructure needs with durable, cost-effective, and patient-focused bed designs for diverse clinical environments.

- February 2024: Gendron Inc. unveiled a heavy-duty bariatric medical bed with an exceptionally reinforced structure, wider sleeping surface, and advanced patient positioning controls, aiming to improve safety, comfort, and ease of care for larger patients.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.0 Bn |

| Forecast Value (2034) |

USD 7.0 Bn |

| CAGR (2025–2034) |

6.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Electric Bed, Semi Electric Bed, Manual Bed), By Usage(Long Term Care, Acute Care, Maternity, Psychiatric Care), By Application (Outpatient Clinics, Medical Nursing Homes, Medical Laboratory and Research |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Invacare Corporation., Hill-Rom Services Inc., Stryker Corporation, Transfer Master Products, Inc., Umano Medical Inc., ProBed Medical Technologies, American Medical Equipment., Getinge AB., HARD Manufacturing Company Inc., GF Health Products, Inc., Amico Group of Companies., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Medical Bed Market?

▾ The Global Medical Bed Market size is estimated to have a value of USD 4.0 billion in 2025 and is expected to reach USD 7.0 billion by the end of 2034.

Which region accounted for the largest Global Medical Bed Market?

▾ North America has the largest market share for the Global Medical Bed Market, with a share of about 38.2% in 2025.

What is the size of the US Medical Bed Market?

▾ The US Medical Bed Market is projected to be valued at USD 1.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.1 billion in 2034 at a CAGR of 5.8%.

Who are the key players in the Global Medical Bed Market?

▾ Some of the major key players in the Global Medical Bed Market are Invacare Corporation, Hill-Rom Services Inc., Stryker Corporation, Transfer Master Products, Inc., and Umano Medical Inc., among others.

What is the growth rate in the Global Medical Bed Market?

▾ The market is growing at a CAGR of 6.2% percent over the forecasted period.