A medical device is a device that includes a variety of items like tools, machines, implants, software, or materials that manufacturers design for medical use. These items can be utilized individually or together to serve a medical purpose, making them essential in healthcare for several diagnostic, therapeutic, & monitoring applications.

Key Takeaways

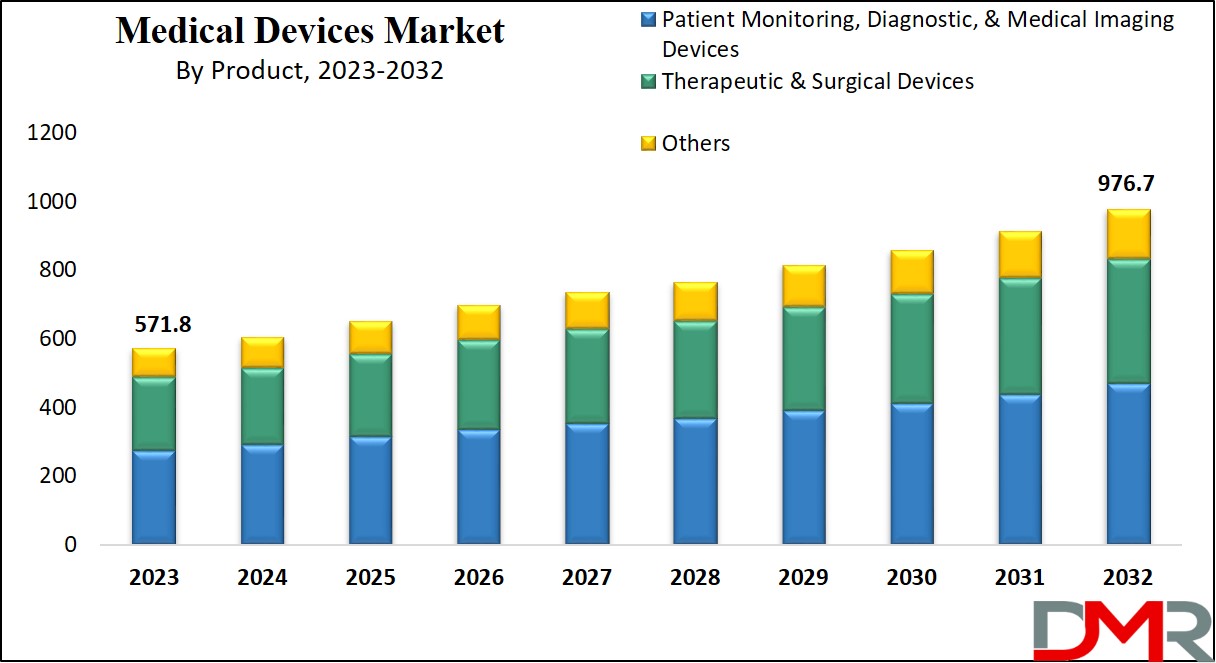

- Market Growth: The global medical devices market is projected to grow from USD 571.8 billion in 2023 to USD 976.7 billion by 2032, at a CAGR of 6.1%.

- Growth Drivers: Rising chronic illnesses, technological advancements, and an aging global population are primary drivers increasing demand for medical devices worldwide.

- Segment Leadership: Patient monitoring, diagnostic, and medical imaging devices hold the largest market share in 2023 and are expected to see the fastest growth due to increased adoption and technological improvements.

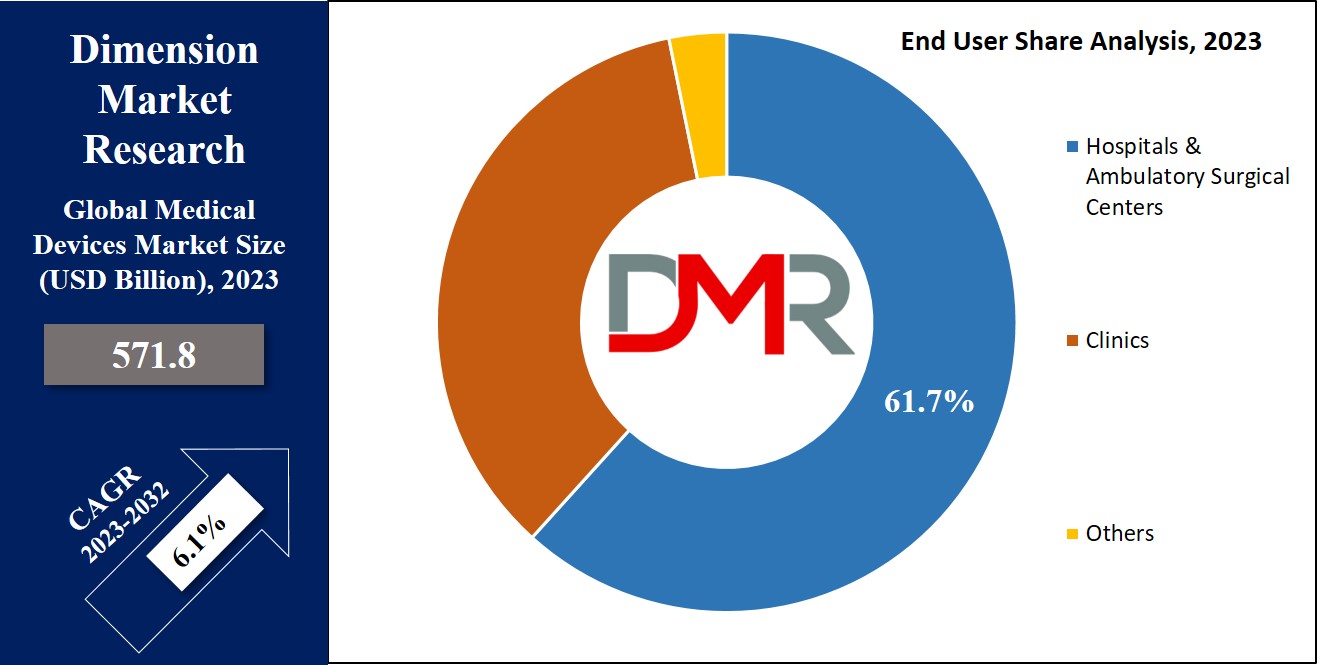

- End-User Dominance: Hospitals and ambulatory surgical centers are the leading end-users, driven by greater infrastructure, skilled workforce, and higher use of advanced medical technologies in these settings.

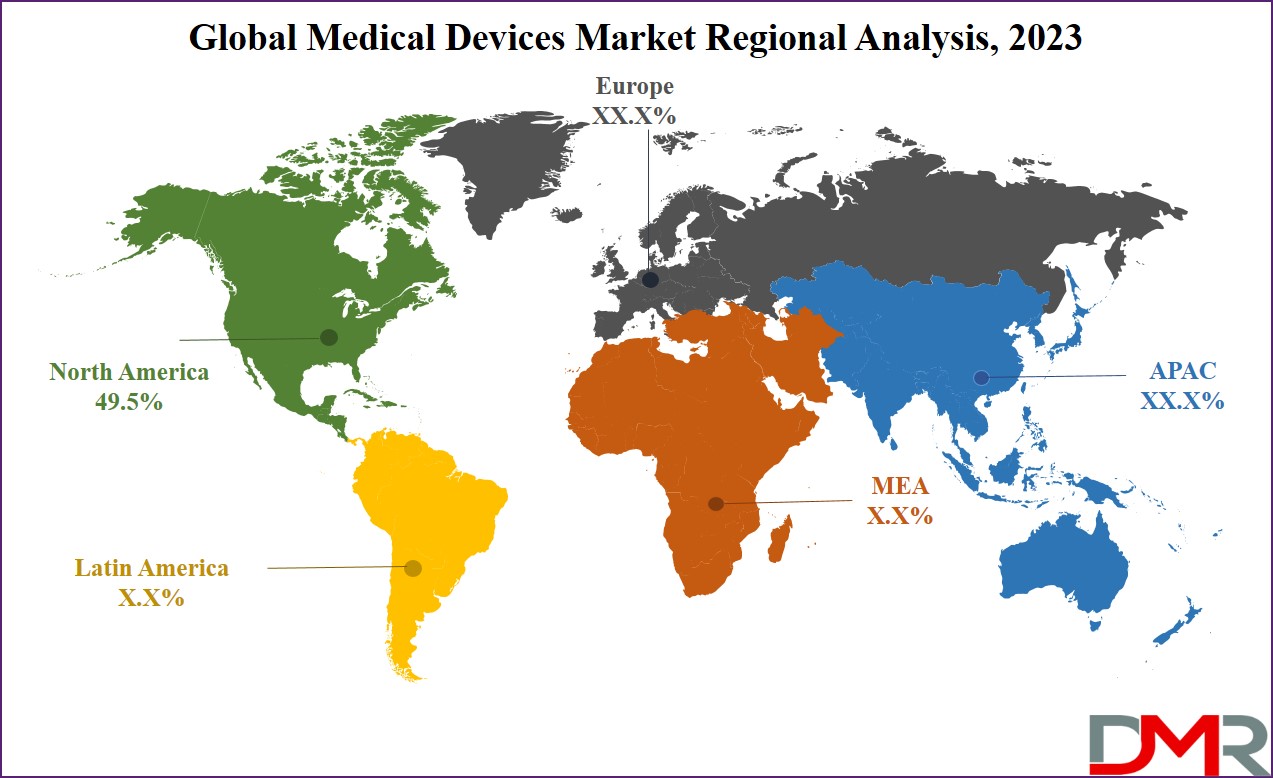

- Regional Leader: North America contributes 49.5% of market revenue in 2023, with sustained dominance expected due to chronic disease burden, high healthcare spending, and presence of major industry players.

- Competitive Landscape: The market is highly competitive, with key players focusing on innovation, cost efficiency, and strategic collaborations. Notable launches, such as Stryker’s EasyFuse System, highlight ongoing advancements.

Use Cases

- Remote Patient Monitoring: Enables healthcare providers to track and manage patient health data using connected devices, improving outcomes and reducing hospital readmissions.

- Diagnostic Imaging Solutions: Facilitates quicker and more accurate diagnoses in hospitals and clinics through advanced imaging devices, accelerating treatment decisions and improving patient care.

- Surgical Device Advancements: Supports minimally invasive procedures using innovative therapeutic and surgical equipment, leading to faster patient recovery and reduced healthcare costs.

- Elderly Care Support: Addresses the needs of the aging population with devices designed for chronic disease management, home monitoring, and improved elderly care services.

- Digital Health Integration: Promotes the use of digital health platforms and telemedicine, supporting remote consultations and expanding healthcare access in underserved regions.

- Hospital Infrastructure Enhancement: Optimizes resource allocation in hospitals and ambulatory surgical centers by implementing comprehensive device fleets, improving operational efficiency and patient throughput.

Market Dynamic

Several key factors are driving the growth of the medical devices market, among which one factor is the increasing prevalence of chronic illnesses, leading to more years of healthy life lost due to disability. In addition, technological developments in medical devices are another crucial driver, as they improve the effectiveness of treatment & diagnosis. Furthermore, the global aging population is steadily growing, increasing the need for

healthcare services & medical devices. The rising burden of chronic diseases globally is also contributing to this demand, as it necessitates advanced diagnostic & surgical procedures.

However, there are challenges that could hinder market growth, like strict regulations & uncertainties surrounding reimbursement policies are among the major obstacles. These factors can create barriers for medical device manufacturers & may delay the pace of innovation & market expansion in the coming future.

Research Scope and Analysis

By Product

The global medical device market in terms of products is divided into patient monitoring, diagnostic, &

medical imaging devices, therapeutic & surgical devices, and other devices. Among these, the patient monitoring, diagnostic, & medical imaging devices segment stands out, having the largest market share in 2023, and is anticipated for the most significant growth during the forecast period, which is largely owing to its growth in adoption in healthcare facilities. Factors driving this growth include ongoing technological developments, the approval of the latest products, & the benefits of more compact, portable designs. All of these factors together contribute to a growing demand for patient monitoring devices due to their important role in modern healthcare, thereby driving this segment's market expansion.

By End User

In terms of the end-users, the global medical device market is divided into hospitals & ambulatory surgical centers, clinics, and others., of which hospitals & ambulatory surgical centers are expected to take the lead in terms of market share during the forecast period, which is mainly owing to hospitals, that typically have the necessary infrastructure & a skilled workforce, making them readily equipped to provide medical services. Moreover, the higher use of many medical technologies like CT scanners, x-ray machines, handheld ultrasound devices, & endoscopes is driving the demand for healthcare services within hospital settings, as these factors all together contribute to the dominance of hospitals as the primary end-users in the market, given their accessibility & the presence of proficient healthcare professionals.

The Medical Devices Market Report is segmented on the basis of the following:

By Product

- Patient Monitoring, Diagnostic, & Medical Imaging Devices

- Therapeutic & Surgical Devices

- Others

By End User

- Hospitals & Ambulatory Surgical Centers

- Clinics

- Others

Regional Analysis

In the global medical device market, North America is a major driving force to the market by contributing

49.5% of the total revenue in 2023 and is anticipated to sustain the same in the coming years, due to several key factors, which include the growth in burden of chronic illnesses, higher healthcare spending, & the presence of major industry players. Further, the rise in the elderly population is expected to contribute to market growth.

Like, according to a report by the United Nations Population Fund, in Canada, a large portion of the population falls within the 15-64 age group, making up 65% of the total population, while 19% are 65 years or older as of 2022, which means more people are at higher risk for chronic conditions like respiratory issues, heart disease, & orthopedic problems, which shows greater demand for diagnostic & surgical medical devices, fueling the market growth. The rise in the incidence of chronic diseases like cardiovascular issues & respiratory conditions will also drive the demand for medical devices, mainly for procedures like cardiopulmonary bypass, driving the market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Medical Devices Market is highly competitive, featuring a mix of established & specialized companies. They are players across segments like diagnostic equipment & patient monitoring devices. The key factors driving competition include technological innovation, regulatory compliance, and cost efficiency. Further, collaboration with healthcare providers & an aim for sustainability & digital solutions are crucial for gaining a competitive edge.

For instance, in May 2022, Stryker introduced the EasyFuse Dynamic Compression System, a foot & ankle staple solution. which aims to simplify surgeries, offer robust dynamic-compression implants, & reduce unnecessary waste in the operating room.

Some of the prominent players in the global Medical Devices Market are:

- Johnson & Johnson

- GE Healthcare

- Siemens Healthineers

- Baxter

- Abbott

- Medtronic

- 3M Company

- Stryker Corp

- Cardinal Health Inc

- Zimmer Biomet

- Other Key Players

Recent Developments

- In January 2025, Zimmer Biomet announced plans to acquire Paragon 28 for approximately $1.1 billion, aiming to strengthen its portfolio in foot and ankle orthopedics.

- In January 2025, Stryker signed a $4.9 billion agreement to acquire Inari Medical, expanding its vascular disease solutions, and divested its U.S. spine business to VB Spine.

- In February 2025, Medtronic acquired Nanovis’ nanotechnology for improved spine implants, targeting enhanced implant fixation and spine solutions.

- In February 2025, Thermo Fisher Scientific agreed to purchase Solventum’s filtration and purification division for $4.1 billion, reinforcing its bioprocessing product line.

- In March 2025, 4C Medical Technologies secured $175 million in Series D funding to accelerate clinical trials and commercialization of its AltaValve TMVR system.

- In March 2025, Supira Medical raised $120 million in Series E funding to advance its next-generation percutaneous ventricular assist device for cardiac support.

- In January 2025, FIRE1 raised $120 million for its Norm™ heart failure self-management system, aimed at empowering remote patient care in heart failure management.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 571.8 Bn |

| Forecast Value (2032) |

USD 976.7 Bn |

| CAGR (2023–2032) |

6.1% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Patient Monitoring, Diagnostic, & Medical Imaging Devices, Therapeutic & Surgical Devices, and Others), By End User (Hospitals & Ambulatory Surgical Centers, Clinics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Johnson & Johnson, GE Healthcare, Siemens Healthineers, Baxter, Abbott, Medtronic, 3M Company, Stryker Corp, Cardinal Health Inc, Zimmer Biomet, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |