Market Overview

The Global

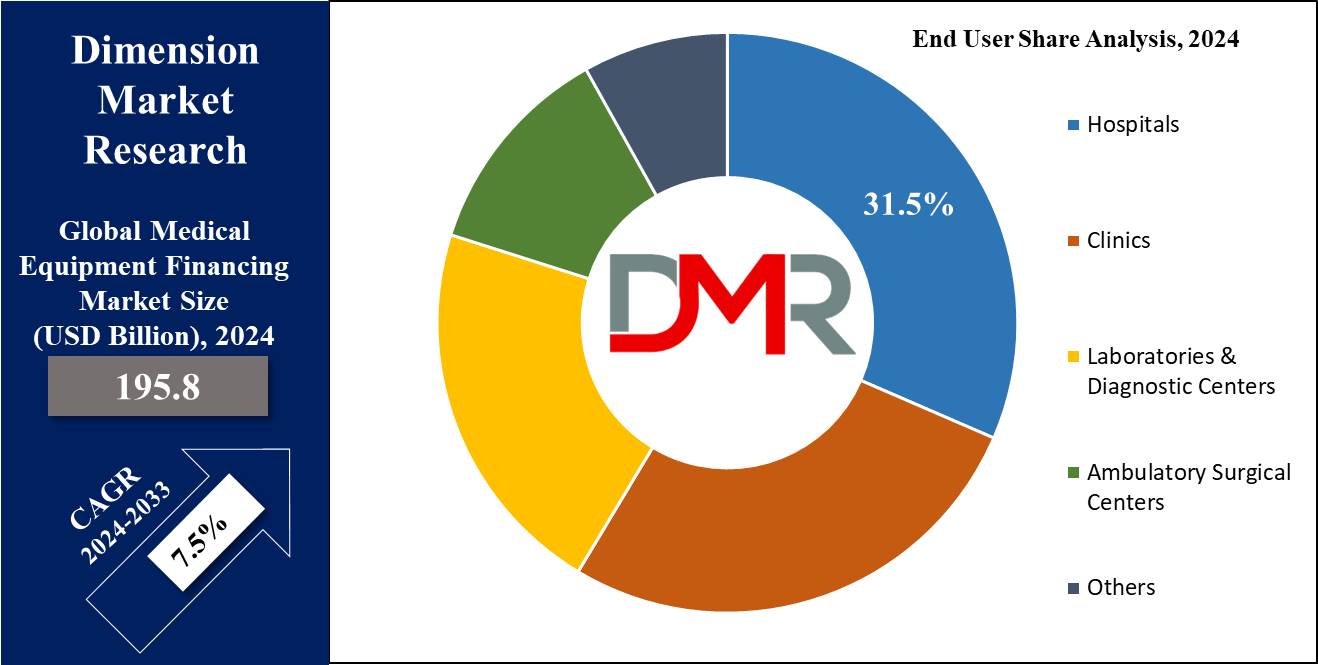

Medical Equipment Financing Market is anticipated to be valued at

USD 195.8 billion in 2024 and is further expected to reach

USD 374.7 billion by 2033, at a CAGR of 7.5% due to the constant evolution of medical technology and equipment.

Medical equipment financing is the process of getting funds or loans, mainly for the purchase of medical equipment that allows hospitals to get necessary tools, machinery, and technology without paying the entire cost of purchase.

The funds are provided by a variety of institutions and leasing companies, like banks, credit unions, and equipment suppliers.

Healthcare providers also partner to provide financing options to their patients. In addition, increasing cash reserves as a precaution against the most adverse reimbursement scenario will stimulate market growth.

The market dynamics of the Medical Equipment Financing Market are driven by several factors, including the high cost of healthcare equipment, increasing demand in developing countries, and the presence of advanced technology in developed nations.

Key Takeaways

- Market Size: At a CAGR of 7.5%, the Global Medical Equipment Financing market is expected to be valued at USD 195.8 billion in 2024 and is anticipated to reach USD 374.7 billion by 2033.

- Market Definition: Medical equipment financing is a provision of financial solutions specifically tailored for acquiring, upgrading, or leasing medical equipment.

- Equipment Analysis: The diagnostic equipment segment is anticipated to lead the global market in the equipment segment with a revenue share of 33.2% in 2024.

- Type Analysis: New medical equipment is expected to dominate the medical equipment financing market with maximum revenue share in 2024.

- End User Analysis: The hospital segment is expected to dominate the medical equipment market with a revenue share of 31.5% in 2024.

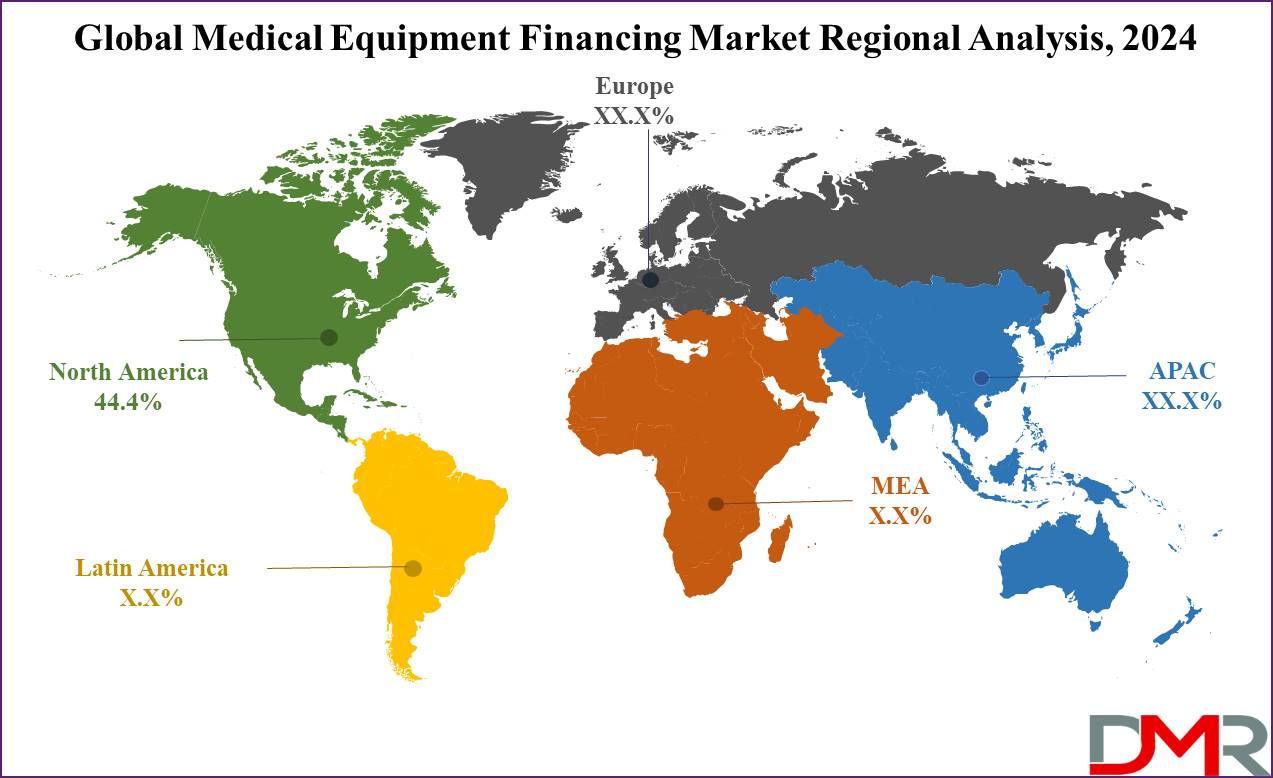

- Regional Analysis: The North American region is anticipated to dominate the medical Equipment Financing market with a revenue share of 44.4% in 2024.

Use Cases

- Hospital Facility Upgrades: Hospitals commonly require financing to upgrade or expand their facilities with the latest medical equipment to provide accurate diagnoses and effective treatments.

- Financing for Healthcare Practitioners: Healthcare practitioners need to invest in equipment for patient healthcare ranging from examination tables and diagnostic tools to specialized machinery during their initial career which needs financing.

- Veterinary Equipment Financing: Loan or financing options are aimed at providing diagnostic imaging machines, surgical equipment, and anesthesia systems to veterinary practitioners.

- Dental Equipment Investments: Dental equipment financing provides dentists with the means to acquire or upgrade their equipment to enhance patient care and improve operational efficiency.

Market Dynamic

Drivers

Growing healthcare establishmentsThe medical equipment financing market is experiencing global expansion driven by the constantly rising number of healthcare establishments in developing regions. Also, the trade war between the U.S. and China increased the price of medical equipment forcing end users to finance the medical equipment.

To make things easier,

medical finance companies are willing to facilitate various financial schemes for their customers, thus boosting the growth of the market. In addition, the upgradation of certain equipment requires heavy costs which become unaffordable for middle-income physicians and developing countries, thus financing this equipment is a good option.

Restraints

Impact on healthcare financingIncreasing costs of medical equipment, such as X-ray machines, MRI scanners, and CT scanners, are prompting end users to reconsider their capital investment strategies. The high prices are causing potential buyers to be more hesitant about purchasing new equipment, which is expected to negatively impact the market throughout the forecast period.

Healthcare Facilities Prioritize Equipment Maintenance Over New Purchases

Equipment financing companies are facing major challenges despite economic growth. Banks are getting more resources and are interested in the medical equipment sector, but many businesses are being careful with their spending. Hospitals, clinics, and diagnostic centers are focusing on maintaining their current equipment instead of buying new ones, which obstructs the growth of this market.

Opportunities

Technological Advancement

The medical equipment financing market is showing great opportunities due to rapid technological advancements and AI innovations which fully realize the potential of the medical industry. This has been the primary factor driving demand and attracting medical professionals, such as doctors, to the equipment financing market.

Due to the high cost and sophistication of the equipment, hospitals, and diagnostic centers have opted for financing. Consequently, healthcare providers are increasingly focused on technologies that enhance operational efficiency and improve patient care.

Trend

Adoption of value-based care model

The transition from fee-for-service to value-based care models has significantly motivated healthcare providers to invest in advanced medical equipment which focused more on quality over quantity, prioritizing patient outcomes and efficient care delivery.

Investing in advanced medical equipment enables healthcare facilities to meet the stringent requirements of value-based care models, such as reducing readmission rates and minimizing medical errors. These technologies, including electronic health records (EHRs), telemedicine platforms, and sophisticated diagnostic tools, contribute to better patient monitoring, data management, and treatment planning.

Research Scope and Analysis

By Equipment

The medical equipment financing market is divided into diagnostic, therapeutic, patient monitoring, laboratory equipment, and others. Diagnostic equipment is expected to lead this market with a revenue share of 33.2% in 2024 due to the rising demand for medical equipment like computed tomography scans, magnetic resonance imaging, ultrasound, and others for the treatment and diagnosis of different medical conditions.

Also, the rising occurrence of many infectious diseases along with the increasing need for ventilators is predicted to boost the growth of the segment. Another factor that drives the growth of this market is the rise in requirement for superior, high-quality, need for cutting-edge equipment, and advanced healthcare facilities due to the booming healthcare industry in developing countries. The government is determined to set up more diagnostic centers as a result of the rising disease and advancement in diagnostic technology.

Surgical centers are investing frequently in equipment like dialysis machines, and ICU equipment to give the best possible medical treatment to their consumers. The therapeutic equipment segment is projected to raise its market value in 2024 due to its increase in facilities like electrocardiograph monitors, incubators, and EHR systems.

By Type

New medical equipment is expected to dominate the medical equipment financing market with maximum revenue share in 2024 due to its latest feature. This equipment is never been used before and is typically purchased directly from manufacturers or authorized distributors. It is equipped with the latest medical technology along with warranties and service agreements.

Also, financing this equipment involves traditional loans, equipment leasing, or vendor financing arrangements which is easier, driving the growth of this segment. Furthermore, the rental segment is anticipated to grow in the upcoming year due to maintenance and support services, allowing healthcare providers to access necessary equipment without the burden of ownership responsibilities.

Furthermore, the refurbished equipment is expected to lead the market due to financial constraints in emerging nations. These are pre-owned equipment that is restored to a like-new condition, often by certified technicians or manufacturers. Moreover, some e-commerce sites are predicted to offer simple ways to buy and re-sell reconditioned medical equipment.

By End User

The hospital segment is expected to dominate the medical equipment financing market with a revenue share of 31.5% in 2024 due to factors like increased investment in healthcare infrastructure, rising demand from patients at the clinical center, and surgical operations institutes.

Hospitals and clinics are active in adopting and installing newly introduced medical technologies due to the availability of sufficient finances from finance businesses, which boosts the growth of this segment.

The laboratories and diagnostic centers are predicted to lead this segment over the upcoming year due to the rise in the requirement for diagnostic kits for medical care to patients.

The Global Medical Equipment Financing Market Report is segmented based on the following

By Equipment

- Diagnostics Equipment

- Therapeutic Equipment

- Patient Monitoring Equipment

- Laboratory Equipment

- Others

By Type

- New Medical Equipment

- Rental Equipment

- Refurbished Equipment

By End User

- Hospitals

- Clinics

- Laboratories & Diagnostic Centers

- Ambulatory Surgical Centers

- Others

Regional Analysis

North American region is expected to have a

revenue share of 44.4% in 2024 for the medical equipment financing market in the year 2024 due to the highest financing rate for medical equipment. The dominance of this market is further increased by continuous advancement in medical devices and spending on infrastructure.

This region is rapidly growing as governments are extensively showing support to this market by providing investment for research and development of medical equipment equipped with the latest technologies to enhance accuracy and improve patient outcomes. The rising healthcare requirement is also increasing the demand for advanced medical equipment solutions.

Following North America, Europe is the second region that is projected to show significant growth in this market due to the increasing adoption of

artificial intelligence technology-based medical equipment finance and expanding expenditures in healthcare infrastructure.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Medical equipment financing market is facing intense competition between established companies with a strong brand image that offers advanced products and good quality products, that drive revenue growth. Major players in the market include FinCorp, National Funding, Blue Bridge Financial, LLC, and more.

Medical equipment financing vendors like to implement such strategies as partnerships, new product launches, and acquisitions to strengthen their market positions and broaden their market presence. Further, they built a well-known portfolio for medical practitioners having varied loan options and low monthly installments.

Some of the prominent players in the global medical equipment financing market are

- Hero FinCorp

- National Funding

- Blue Bridge Financial, LLC

- First American Equipment Finance

- SMC Finance

- Siemens Financial Services, Inc.

- SLR Healthcare ABL

- TIAA Bank

- JPMorgan Chase & Co.

- Macquarie Group Limited

- Truist Bank

- HDFC Bank

- Others

Recent Development

- In January 2024, Swift Medical, a digital health technology company serving wound care providers, announced the successful financing of USD 8M by investors BDC Capital’s Women in Technology Venture Fund and funds managed by Virgo Investment Group.

- In May 2023, the Japanese medical equipment maker Omron Healthcare set to make a significant investment in the state of Tamil Nadu, ready to open its first medical device factory to produce low-frequency pain therapy equipment and body composition monitors.

- In April 2023, the Union Cabinet approved the National Medical Devices Policy to facilitate an orderly growth of the medical device sector to meet the public health objectives of access, affordability, quality, and innovation.

- In March 2023, the U.S. Food and Drug Administration announced it is requesting $7.2 billion in funding which allows the agency to continue to leverage new and emerging technologies, recruit and support a highly skilled workforce, and adapt oversight to new production and business models.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 195.8 Bn |

| Forecast Value (2033) |

USD 374.7 Bn |

| CAGR (2024-2033) |

7.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Equipment (Diagnostics Equipment, Therapeutic Equipment, Patient Monitoring Equipment, Laboratory Equipment, Others), By Type (New Medical Equipment, Rental Equipment, Refurbished Equipment), By End User (Hospitals, Clinics, Laboratories & Diagnostic Centers, Ambulatory Surgical Centers, Others |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Hero FinCorp, National Funding, Blue Bridge Financial, LLC, First American Equipment Finance, SMC Finance, Siemens Financial Services, Inc., SLR Healthcare ABL, TIAA Bank, JPMorgan Chase & Co., Macquarie Group Limited, Truist Bank, HDFC Bank, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Medical Equipment Financing Market is estimated to have a value of USD 195.8 billion in 2024 and is expected to reach USD 374.7 billion by the end of 2033.

North America is expected to be the largest market share for the Global Medical Equipment Financing Market with a share of about 44.4 % in 2024.

Some of the major key players in the Global Medical Equipment Financing Market are FinCorp, National Funding, Blue Bridge Financial LLC, and many others.

The market is growing at a CAGR of 7.5 percent over the forecasted period.