Market Overview

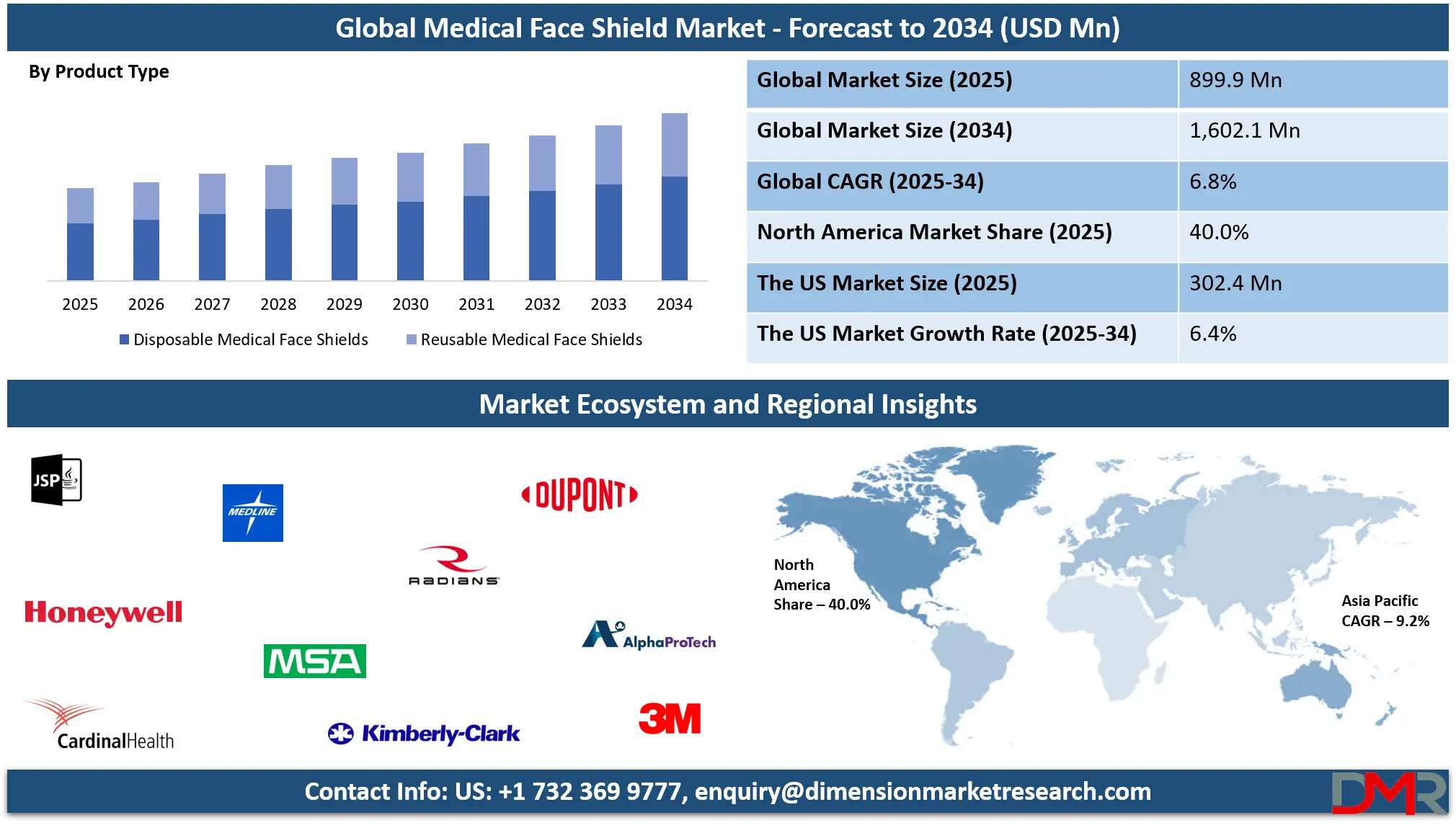

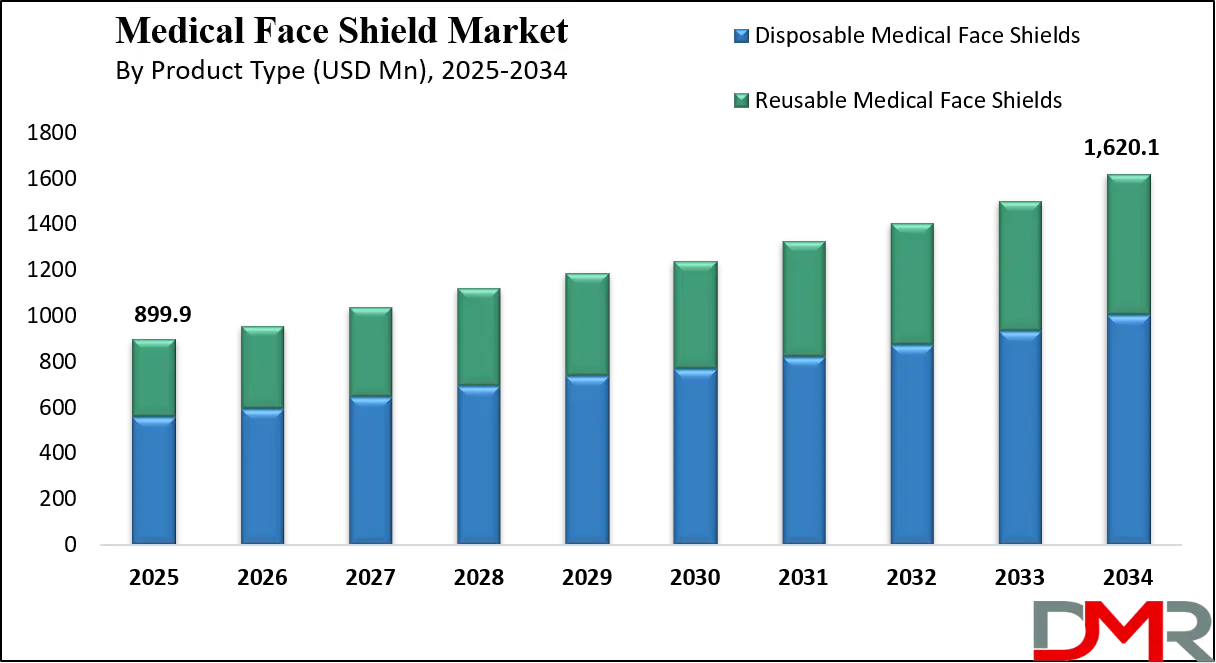

The Global Medical Face Shield Market size is projected to reach USD 899.9 million in 2025 and grow at a compound annual growth rate of 6.8% to reach a value of USD 1,620.1 million in 2034.

Medical face shields are transparent protective devices designed to cover the entire face, protecting healthcare professionals from splashes, droplets, and airborne contaminants. These shields are made using materials like polyethylene terephthalate (PET), polycarbonate (PC), and polyvinyl chloride (PVC), and are available in disposable and reusable formats. They are a vital component of personal protective equipment used across hospitals, laboratories, dental clinics, and emergency medical services, playing a critical role in infection prevention and occupational safety within the healthcare ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition, the growth in the market is supported by growing focus on infection control standards, rise in healthcare expenditure, and continuous improvements in product design. Lightweight structures, better optical clarity, anti-fog coatings, and adjustable headgear are improving usability and comfort. Regulatory enforcement of PPE usage and heightened preparedness for infectious disease outbreaks have strengthened procurement cycles, indicating a transition from emergency-driven demand to sustained institutional adoption across healthcare systems.

Further, recent progress includes innovation in reusable shield designs, investments in domestic manufacturing capacity, and stronger public-private procurement mechanisms. Strategic collaborations between manufacturers and healthcare distributors are improving supply resilience, while regulatory harmonization efforts are shaping quality benchmarks. These shifts are positioning medical face shields as a long-term safety solution rather than a temporary protective measure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

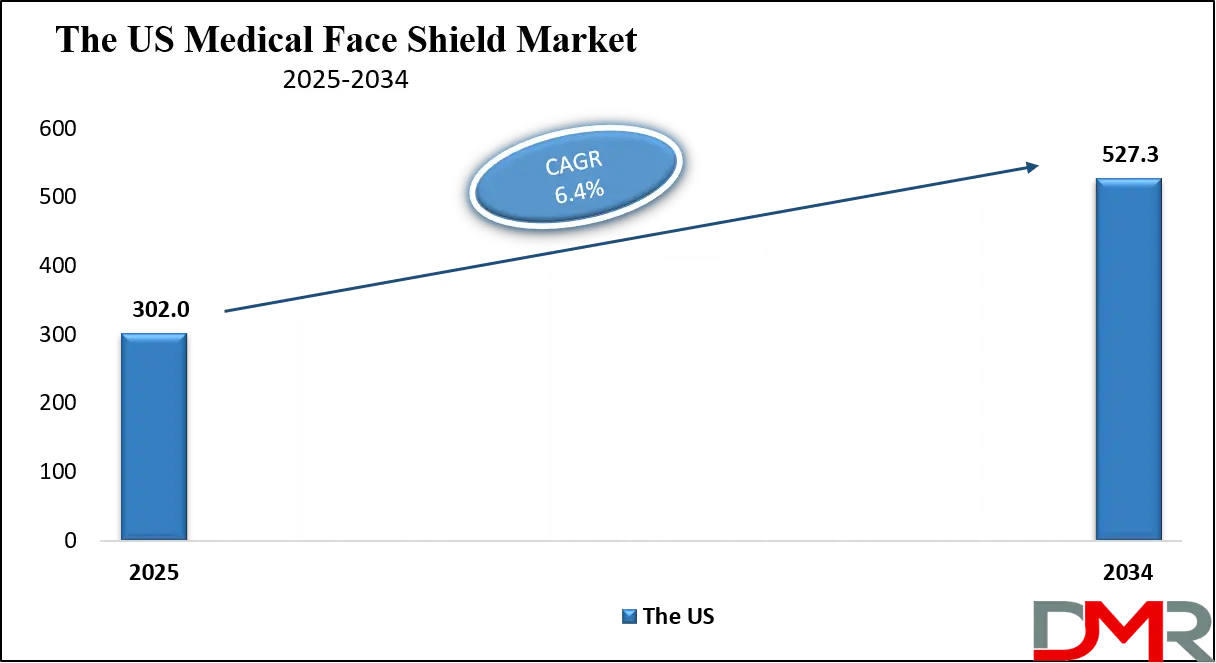

The US Medical Face Shield Market

The US Medical Face Shield Market size is projected to reach USD 302.0 million in 2025 at a compound annual growth rate of 6.4% over its forecast period.

Stringent occupational safety regulations and a well-established healthcare infrastructure drive the US medical face shield market. Hospitals, ambulatory surgical centers, and diagnostic laboratories account for a significant portion of demand due to mandatory PPE compliance enforced by federal and state authorities. Government stockpiling programs and institutional procurement contracts support consistent demand. The presence of advanced manufacturing capabilities and strong distribution networks enables rapid adoption of design innovations, reinforcing the country’s leadership position in both consumption and innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Medical Face Shield Market

Europe Medical Face Shield Market size is projected to reach USD 252.0 million in 2025 at a compound annual growth rate of 6.7% over its forecast period.

Europe demonstrates steady growth due to strong regulatory oversight and regional health safety frameworks. Policies emphasizing worker protection and infection prevention promote consistent usage across healthcare and laboratory settings. Sustainability initiatives encourage reusable and recyclable face shield designs, while public healthcare systems ensure large-scale procurement through tenders. Innovation is supported by strict quality standards and harmonized certification processes, resulting in high adoption rates across hospitals and diagnostic centers.

Japan Medical Face Shield Market

Japan Medical Face Shield Market size is projected to reach USD 45.1 million in 2025 at a compound annual growth rate of 7.0% over its forecast period.

Japan’s market benefits from a technologically advanced healthcare system and an aging population requiring increased medical services. Hospitals and clinics prioritize high-quality PPE to support infection control in densely populated urban areas. Government initiatives to strengthen healthcare preparedness and domestic medical manufacturing contribute to stable growth. Challenges include high quality compliance costs, but opportunities arise from innovation in lightweight and ergonomically optimized shields suited for long clinical usage.

Medical Face Shield Market: Key Takeaways

- Market Growth: The Medical Face Shield Market size is expected to grow by USD 665.8 million, at a CAGR of 6.8%, during the forecasted period of 2026 to 2034.

- By Product Type: The disposable medical face shields segment is anticipated to get the majority share of the Medical Face Shield Market in 2025.

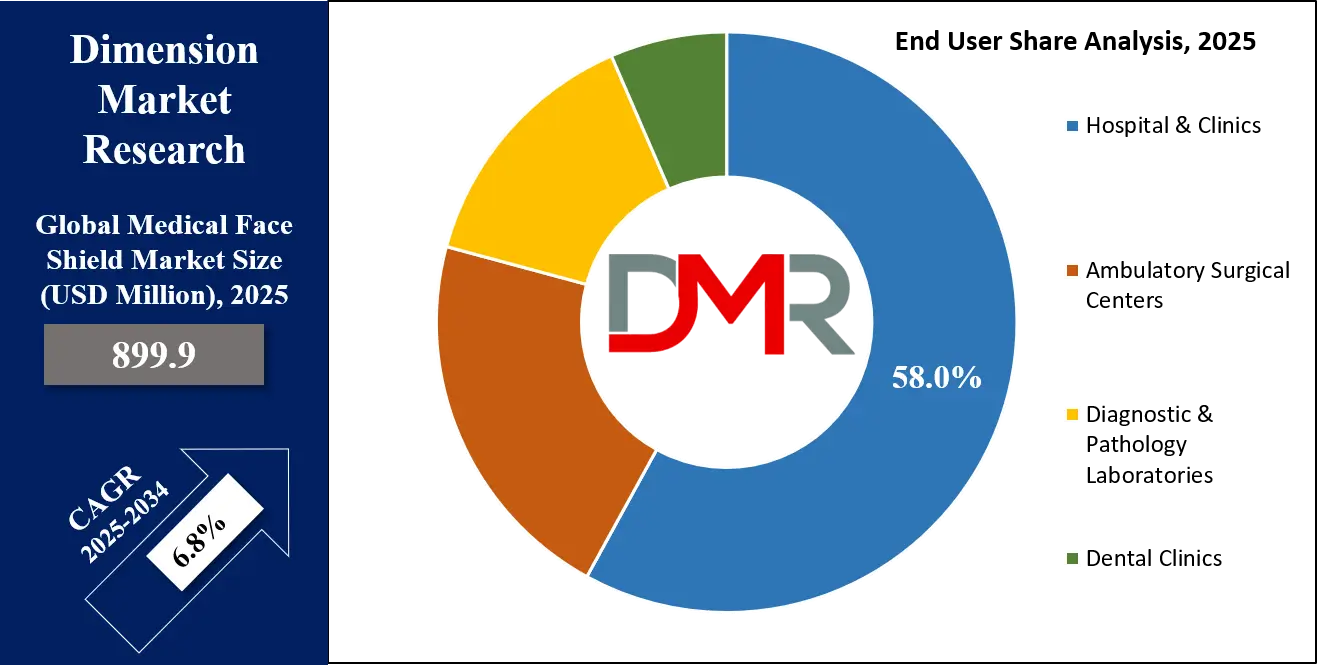

- By End User: The hospitals & clinics segment is expected to get the largest revenue share in 2025 in the Medical Face Shield Market.

- Regional Insight: North America is expected to hold a 40.0% share of revenue in the Global Medical Face Shield Market in 2025.

- Use Cases: Some of the use cases of Medical Face Shield include dental care, clinical procedures, and more.

Medical Face Shield Market: Use Cases:

- Clinical Procedures: Used by doctors and nurses to prevent exposure to blood and bodily fluids during treatment.

- Dental Care: Protects dental professionals during aerosol-generating procedures.

- Laboratory Operations: Shields lab technicians from chemical splashes and biological hazards.

- Emergency Response: Provides frontline protection for paramedics and emergency responders.

Stats & Facts

- The World Health Organization reported in 2024 that over 65% of healthcare workers globally use face shields as part of standard PPE protocols.

- The US Centers for Disease Control and Prevention stated in 2025 that face shields reduce facial exposure risk by more than 90% in clinical environments.

- European Commission confirmed in 2024 that PPE compliance across public hospitals exceeded 95% in EU member states.

- The Japanese Ministry of Health reported in 2025 a 12% annual increase in hospital PPE procurement volumes.

- The US Department of Health and Human Services indicated in 2024 that federal healthcare facilities increased PPE inventory buffers by 18%.

Market Dynamic

Driving Factors in the Medical Face Shield Market

Infection Prevention Standards

The increase in awareness of hospital-acquired infections and occupational exposure risks is a major growth driver. Healthcare institutions are largely integrating face shields into routine clinical protocols to protect staff and patients. Mandatory infection control policies, combined with continuous training programs, are reinforcing consistent usage. Enhanced comfort and improved visibility have increased acceptance among healthcare professionals, making shields a standard requirement rather than an optional accessory.

Regulatory Enforcement and Procurement

Government regulations mandating PPE usage across healthcare facilities are sustaining long-term demand. Centralized procurement programs, institutional tenders, and emergency preparedness policies ensure continuous purchasing cycles. Compliance audits & safety inspections further reinforce adoption. These regulatory mechanisms reduce demand volatility and encourage manufacturers to invest in capacity expansion and quality improvements.

Restraints in the Medical Face Shield Market

Cost Sensitivity in Emerging Facilities

High-quality face shields using advanced materials involve higher production costs, which can limit adoption in smaller clinics and cost-constrained healthcare systems. Budget limitations often lead to preference for lower-priced alternatives, affecting margins and slowing premium product penetration. This restraint is particularly evident in regions with limited reimbursement structures.

Regulatory Fragmentation

Differences in certification and safety standards across regions increase compliance complexity for manufacturers. Product redesigns, multiple approval processes, and documentation requirements raise development costs and delay market entry. Smaller manufacturers face difficulties scaling internationally, which restricts competition and innovation in certain markets.

Opportunities in the Medical Face Shield Market

Growth of Reusable Solutions

Increasing focus on sustainability and cost efficiency is driving interest in reusable medical face shields. Hospitals are adopting serializable designs to reduce waste and long-term procurement costs. This trend creates opportunities for manufacturers to develop premium reusable products with longer life cycles and higher margins.

Expansion of Digital Distribution

Online medical supply platforms are transforming procurement practices by enabling faster access, price transparency, and broader product selection. This channel is especially beneficial for small clinics and diagnostic labs, opening new growth avenues and improving market penetration in underserved regions.

Trends in the Medical Face Shield Market

Ergonomic and Comfort-Driven Design

Manufacturers are prioritizing comfort through lightweight frames, adjustable headbands, and anti-fog technology. These features reduce fatigue and improve compliance during long clinical shifts. Comfort-centric innovation is becoming a key differentiator in purchasing decisions.

Product Customization

Face shields tailored for dental, surgical, and laboratory applications are gaining traction. Custom dimensions, enhanced coverage, and compatibility with other PPE improve functionality. This trend reflects a shift toward application-specific protective solutions rather than generic designs.

Impact of Artificial Intelligence in Medical Face Shield Market

- Demand Forecasting: AI predicts procurement needs to prevent shortages.

- Manufacturing Quality Control: Vision systems detect defects in real time.

- Design Optimization: AI simulations improve ergonomic fit and visibility.

- Supply Chain Optimization: AI improves inventory planning and logistics efficiency.

- Predictive Maintenance: Artificial Intelligence minimizes downtime in manufacturing facilities.

Research Scope and Analysis

By Product Type Analysis

Disposable medical face shields dominate the product type segmentation due to their ease of use, hygiene reliability, and suitability for high-turnover clinical environments. In 2025, this segment accounts for 62% of the overall market share, largely driven by strict infection control protocols and emergency preparedness requirements across healthcare facilities.

Hospitals, outpatient departments, and emergency rooms prefer disposable shields to eliminate the risk of cross-contamination and avoid the operational burden of cleaning and sterilization. Government stockpiling initiatives, public health emergency reserves, and bulk procurement contracts further reinforce demand. Despite growing sustainability concerns, the need for rapid replacement, consistent protection, and regulatory compliance ensures continued dominance in acute care settings.

Reusable medical face shields represent the fastest-growing product segment, supported by sustainability goals and long-term cost-efficiency strategies adopted by healthcare providers. Hospitals and large clinical networks are majorly investing in reusable designs that can withstand repeated sterilization without compromising clarity or structural integrity.

Advances in material engineering, including scratch-resistant coatings and enhanced anti-fog technologies, have significantly enhanced product lifespan and user comfort. These improvements make reusable shields suitable for controlled environments such as operating rooms and specialty clinics. Developed healthcare systems, in particular, are driving adoption as part of waste reduction initiatives and environmental compliance programs, positioning reusable shields as a strategic alternative to disposable products.

By Material Type Analysis

Polycarbonate leads the material segmentation with a 45% market share in 2025, owing to its exceptional impact resistance, superior optical clarity, and high durability. PC-based face shields are widely preferred in surgical suites, emergency departments, and intensive care units where maximum facial protection is required. The material’s compatibility with advanced anti-fog and anti-scratch coatings further enhances its appeal, especially for prolonged clinical use.

Polycarbonate shields also maintain structural integrity under repeated cleaning and sterilization, making them suitable for reusable applications. Although relatively higher in cost, their performance advantages justify adoption in high-risk medical environments, ensuring continued dominance within the material category.

Further, Polyethylene terephthalate is the fastest-growing material segment due to its cost-effectiveness, lightweight nature, and ease of mass production. PET is commonly used in disposable medical face shields designed for general clinical applications, including outpatient care, diagnostics, and non-invasive procedures. Its affordability makes it particularly attractive in cost-sensitive healthcare systems and emerging markets where budget constraints influence purchasing decisions.

PET shields offer adequate transparency and flexibility, supporting short-term usage requirements. Growing demand from ambulatory surgical centers and diagnostic laboratories further supports expansion. While PET lacks the durability of polycarbonate, its low cost and scalability drive rapid adoption across large-volume procurement programs.

By End User Analysis

Hospitals and clinics account for 58% of total demand in 2025, making them the dominant end-user segment in the medical face shield market. High patient footfall, frequent exposure to infectious agents, and strict compliance with occupational safety regulations drive sustained consumption. Both public and private hospitals rely heavily on face shields across departments such as emergency care, surgery, intensive care, and outpatient services.

Institutional procurement policies, government funding, and mandatory PPE guidelines ensure consistent replenishment cycles. Clinics also contribute significantly due to routine procedures requiring close patient interaction. The continuous need for staff protection and infection prevention solidifies this segment’s leadership position.

Diagnostic and pathology laboratories represent a rapidly growing end-user segment, fueled by increased testing volumes and heightened laboratory safety regulations. Personnel handling biological samples, chemicals, and infectious specimens require reliable facial protection to mitigate occupational exposure risks. Rising diagnostic activity, driven by preventive healthcare trends and expanded screening programs, has amplified the need for protective equipment.

Laboratories increasingly integrate face shields into standard safety protocols, complementing gloves and masks. Awareness of workplace safety and compliance with biosafety guidelines further accelerate adoption. As diagnostic services expand across hospitals and independent facilities, demand from this segment is expected to rise steadily.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Distribution Channel Analysis

Medical device distributors hold a 48% market share in 2025, supported by long-standing relationships with hospitals, clinics, and government healthcare institutions. National distributors dominate large-scale supply contracts, including public hospital tenders and emergency preparedness programs, while regional distributors efficiently serve localized healthcare networks. Their established logistics infrastructure ensures timely delivery, inventory management, and regulatory compliance.

Distributors also play a key role in educating buyers on product standards and certifications. The ability to supply in bulk, offer bundled PPE solutions, and provide after-sales support makes this channel the preferred choice for institutional procurement.

Online medical supply platforms are the fastest-growing distribution channel, driven by convenience, competitive pricing, and expanded product accessibility. Digital platforms enable healthcare providers, especially small clinics and diagnostic centers, to compare products, manage procurement efficiently, and receive faster deliveries.

The growth of e-commerce in healthcare procurement has reduced dependence on traditional distribution networks, particularly in remote and underserved regions. Transparent pricing, flexible order quantities, and direct manufacturer access further enhance appeal. As digital adoption increases across healthcare systems, online platforms are expected to play an increasingly important role in shaping future distribution dynamics.

The Medical Face Shield Market Report is segmented on the basis of the following:

By Product Type

- Disposable Medical Face Shields

- Reusable Medical Face Shields

By Material Type

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Polyvinyl Chloride (PVC)

By End User

- Hospitals & Clinics

- Public Hospitals

- Private Hospitals

- Ambulatory Surgical Centers

- Diagnostic & Pathology Laboratories

- Dental Clinics

By Distribution Channel

- Medical Device Distributors

- National Distributors

- Regional Distributors

- Institutional / Tender-Based Procurement

- Government Tenders

- Private Healthcare Contracts

- Pharmacies & Drug Stores

- Online Medical Supply Platforms

Regional Analysis

Leading Region in the Medical Face Shield Market

North America leads the medical face shield market with a 40% share in 2025, supported by its advanced healthcare infrastructure, stringent occupational safety regulations, and well-established procurement systems. Hospitals, ambulatory surgical centers, and diagnostic laboratories in the region strictly adhere to infection prevention guidelines, ensuring sustained demand for protective equipment.

Consistent government procurement through public health agencies and emergency preparedness programs further reinforces market stability. High awareness among healthcare professionals regarding workplace safety and infection control contributes to regular usage across medical settings. Additionally, rapid adoption of innovative face shield designs, including reusable and ergonomically enhanced products, strengthens regional dominance and supports long-term market leadership.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Medical Face Shield Market

Asia-Pacific is the fastest-growing region in the medical face shield market, driven by expanding healthcare infrastructure, rising medical expenditure, and proactive government initiatives to strengthen infection control systems. Rapid urbanization and population growth are increasing patient volumes, leading to higher demand for protective equipment across hospitals and clinics.

Governments in the region are investing heavily in healthcare capacity expansion, public hospital modernization, and domestic medical manufacturing. Growing awareness of occupational safety and stricter healthcare regulations are further accelerating adoption. The presence of cost-sensitive markets also encourages large-scale procurement of disposable face shields, positioning Asia-Pacific as a key growth engine for the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The medical face shield market is shaped by innovation, cost efficiency, and supply reliability. Also the players in the market focus on product differentiation through ergonomic design, material quality, and sustainability. Further, strategic partnerships with distributors, investments in R&D, and expansion of manufacturing capacity are common strategies. Entry barriers include regulatory compliance and certification requirements, while long-term contracts and brand trust provide competitive advantages.

Some of the prominent players in the global Medical Face Shield are:

- 3M Company

- Honeywell International Inc.

- Medline Industries, Inc.

- Cardinal Health, Inc.

- Kimberly-Clark Corporation

- Alpha Pro Tech, Ltd.

- MSA Safety Incorporated

- DuPont de Nemours, Inc.

- Prestige Ameritech

- Pyramex Safety Products LLC

- Moldex-Metric, Inc.

- Lakeland Industries, Inc.

- Gateway Safety, Inc.

- Radians, Inc.

- Bullard Company

- JSP Ltd.

- Delta Plus Group

- Sanax Protective Products, Inc.

- TIDI Products, LLC

- Ansell Limited

- Other Key Players

Recent Developments

- In January 2026, the Vision Council unveiled the revision of the ANSI/ISEA z87.1 American national standard for occupational and educational personal eye and face protection devices, which sets criteria related to the general requirements, testing, permanent marking, selection, care, and use of eye and face protectors to minimize the occurrence and severity or prevention of injuries from such hazards as impact, non-ionizing radiation, and liquid splash exposures in occupational and educational environments including, but not limited to, machinery operations, material welding and cutting, chemical handling, and assembly operations.

- In May 2025, U.S. Medical Glove Company (USMGC) launched its face mask manufacturing unit, a major step in restoring the nation's health and safety supply chain to American soil. The advance unit features six high-speed lines dedicated to producing 3-ply disposable face masks, furthering USMGC's commitment to providing critical medical products that are manufactured in the USA.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 899.9 Mn |

| Forecast Value (2034) |

USD 1,620.1 Mn |

| CAGR (2025–2034) |

6.8% |

| The US Market Size (2025) |

USD 302.0 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Disposable Medical Face Shields, and Reusable Medical Face Shields), By Material Type (Polyethylene Terephthalate (PET), Polycarbonate (PC), and Polyvinyl Chloride (PVC)), By End User (Hospitals & Clinics, Ambulatory Surgical Centers, Diagnostic & Pathology Laboratories, and Dental Clinics), By Distribution Channel (Medical Device Distributors, Institutional / Tender-Based Procurement, Pharmacies & Drug Stores, and Online Medical Supply Platforms) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

3M Company, Honeywell International Inc., Medline Industries, Inc., Cardinal Health, Inc., Kimberly-Clark Corporation, Alpha Pro Tech, Ltd., MSA Safety Incorporated, DuPont de Nemours, Inc., Prestige Ameritech, Pyramex Safety Products LLC, Moldex-Metric, Inc., Lakeland Industries, Inc., Gateway Safety, Inc., Radians, Inc., Bullard Company, JSP Ltd., Delta Plus Group, Sanax Protective Products, Inc., TIDI Products, LLC, Ansell Limited, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Medical Face Shield Market?

▾ The Global Medical Face Shield Market size is expected to reach USD 899.9 million by 2025 and is projected to reach USD 1,620.1 million by the end of 2034.

Which region accounted for the largest Global Medical Face Shield Market?

▾ North America is expected to have the largest market share in the Global Medical Face Shield Market, with a share of about 40.0% in 2025.

How big is the Medical Face Shield Market in the US?

▾ The US Medical Face Shield market is expected to reach USD 302.0 million by 2025.

Who are the key players in the Medical Face Shield Market?

▾ Some of the major key players in the Global Medical Face Shield Market include 3M, Honeywell, DuPont and others

What is the growth rate in the Global Medical Face Shield Market?

▾ The market is growing at a CAGR of 6.8 percent over the forecasted period.