Market Overview

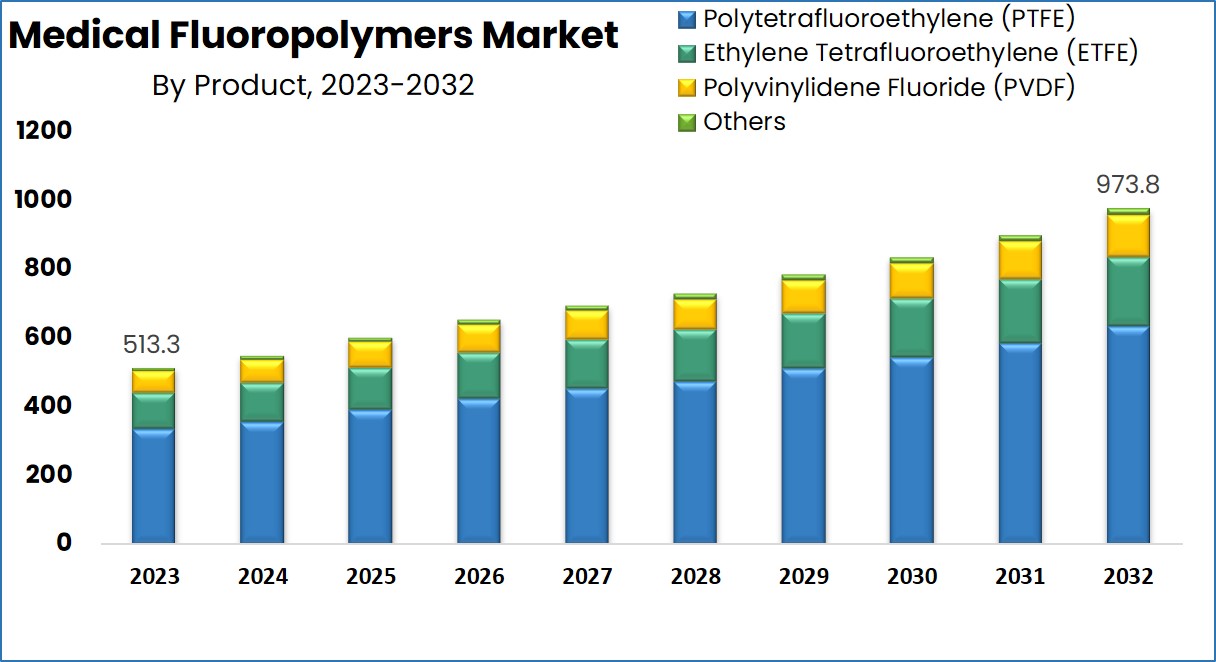

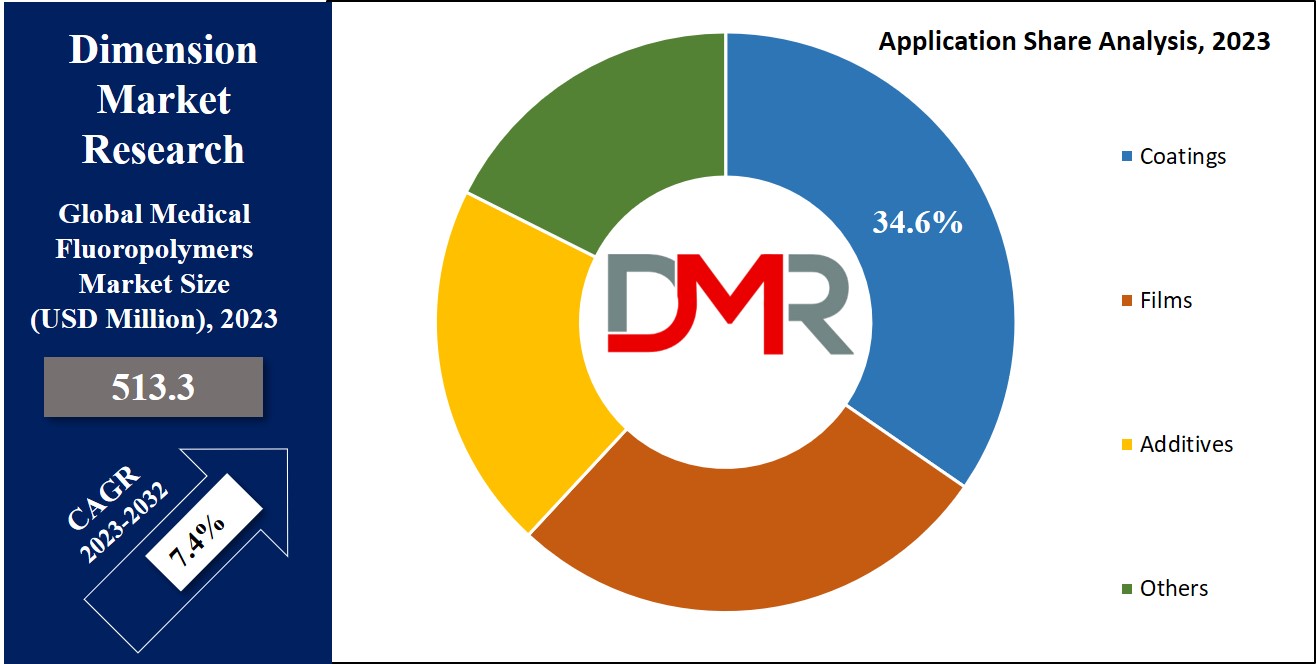

The Global Medical Fluoropolymers Market is expected to reach a value of USD 513.3 million in 2023 while experiencing a significant CAGR of 7.4% for the forecast period (2023-2032).

Medical fluoropolymers are high-performance polymers renowned for their exceptional resistance to solvents, acids, and bases; low friction coefficient; and superior thermal stability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These characteristics render them indispensable in medical applications that demand stringent non-reactivity and cleanliness, such as in the manufacturing of catheters, surgical instruments, and prosthetics. The market for medical fluoropolymers encompasses the global dynamics of supply and demand, focusing on the production, distribution, and application of these polymers within the healthcare sector.

The medical fluoropolymers market is poised for substantial growth, driven by the increasing demand for advanced medical devices. This growth stems from global health challenges and an aging population. Established players can capitalize on these opportunities by innovating polymer formulations and expanding production capabilities. Growing adoption of fluoropolymer-based medical devices for minimally invasive procedures further accelerates the market outlook.

Meanwhile, newcomers and entry-level businesses can find potential in niche medical applications, such as specialized fluoropolymer coatings for emerging medical technologies or enhancing material properties to support minimally invasive devices.

The

Medical Aesthetics also presents lucrative opportunities, particularly in advanced coatings for aesthetic devices like dermal fillers or laser equipment. Strategic partnerships with healthcare providers and focused investments in R&D for application-specific products—whether in medical implants or aesthetic technologies—could significantly facilitate market entry and competitive positioning.

The market is witnessing key trends such as a move towards sustainability in medical practices, which increases the demand for durable fluoropolymers that reduce medical waste by minimizing the need for frequent replacements. Additionally, the trend towards the miniaturization of medical devices necessitates materials that can perform reliably at smaller scales and tighter tolerances.

Fluoropolymers, known for their robustness and versatility, are well-suited to these applications. The rise of technologies such as 3D printing and laser manufacturing also enhances the use of fluoropolymers in the production of customized and precise medical components.

The robustness of fluoropolymers is demonstrated by their high tensile strengths, typically ranging from 4000 to 5000 psi, which ensures reliability under demanding medical conditions. Economically, the significance of fluoropolymers in the market is highlighted by their current price in the U.S., which is approximately USD 13,500 per metric ton. This indicates their premium positioning within the industry.

Furthermore, the versatility of fluoropolymers extends beyond healthcare, as evidenced by their increasing use in flexible plastic packaging within the food sector, accounting for over 28% of the total global packaging market. This widespread application underscores potential growth opportunities in adjacent markets where the unique properties of fluoropolymers can be effectively utilized.

Key Takeaways

-

The Global Medical Fluoropolymers Market is projected to reach USD 513.3 million by 2023, with a CAGR of 7.4% from 2023 to 2032.

- PTFE (Polytetrafluoroethylene) leads the market segments, dominating global shares in 2023 due to its chemical resistance and inert properties.

- Fluoropolymer coatings, known for their chemical and corrosion resistance, are dominant in 2023 and expected to maintain their market leadership.

- Industrial equipment, including pharmaceutical and chemical processing systems, is the leading application area, driving market demand.

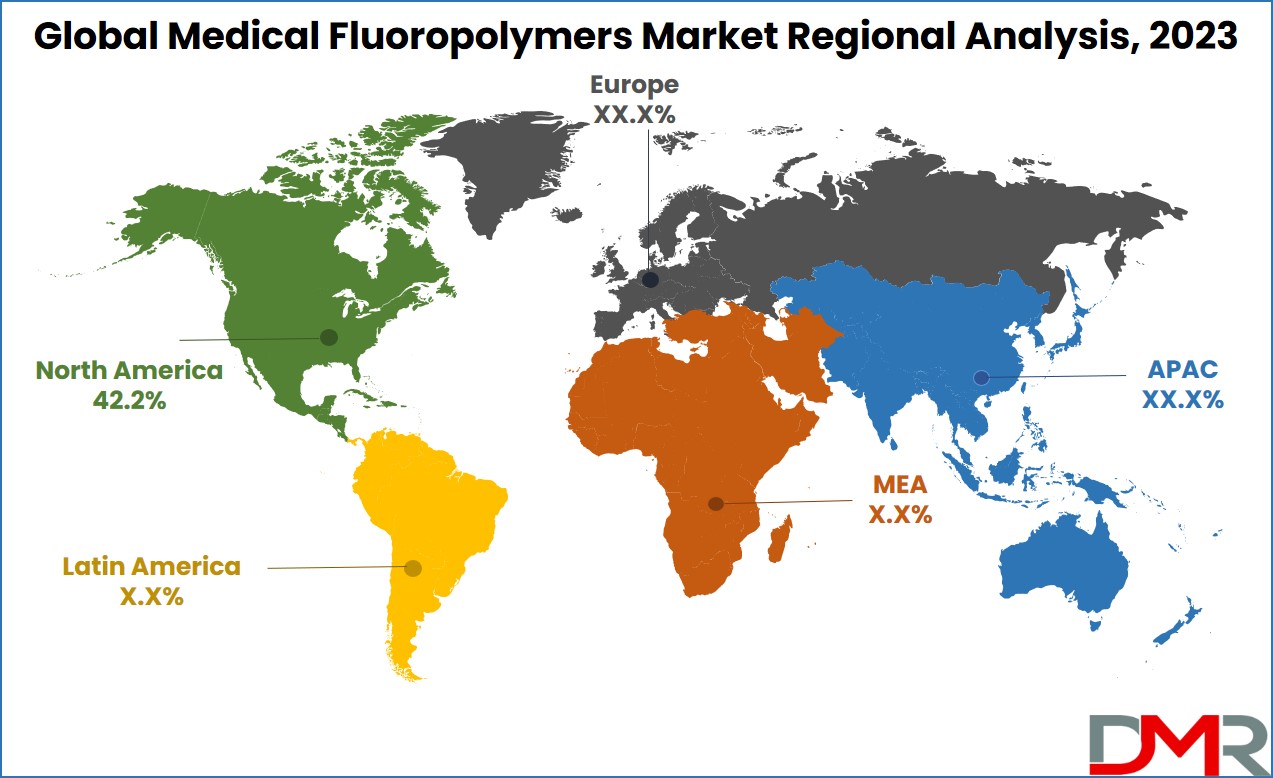

- North America holds the largest market share at 42.2% in 2023, with expected growth in medical applications like tubing and drug delivery devices.

Use Cases

- Medical Device Manufacturing: Medical fluoropolymers are utilized in the production of catheters, surgical instruments, stents, and prosthetics due to their chemical inertness, thermal stability, and low friction, ensuring safety and reliability in critical medical applications.

- Medical Coatings: Fluoropolymer coatings provide corrosion and chemical resistance for equipment surfaces, tubing, and medical implants, enhancing durability, sterilizability, and performance in harsh operational environments.

- Drug Delivery Systems: Fluoropolymers are applied in tubing, drug delivery devices, and medical bags, enabling precise and safe handling of pharmaceuticals, minimizing contamination, and extending shelf life of sensitive medications.

- Industrial & Laboratory Equipment: Fluoropolymers are integral in manufacturing chemical processing systems, filtration membranes, heat exchangers, and laboratory vessels due to their superior resistance to aggressive chemicals and extreme temperatures.

- Aerospace & Transportation Equipment: In specialized transportation and aerospace applications, medical-grade fluoropolymers ensure high performance, durability, and reliability in seals, insulation, and components exposed to extreme conditions.

Market Dynamic

The surge in the need for cutting-edge medical technologies & devices, coupled with heightened investments in healthcare in emerging economies, is anticipated to be the key driving force behind the rising demand for medical fluoropolymers by 2032. In the United States, the medical fluoropolymers sector is being propelled by the growing need for fluoropolymers in medical sectors like the production of capsules, drainage bags, tablets, & more.

Qualities such as resistance to wear & tear, chemicals, as well as the ability to withstand extreme temperatures, play a crucial role in the shelf life of components including photovoltaics, fuel cells, & batteries. The increasing global population & rapid industrialization are anticipated to boost energy demand, subsequently driving growth in the

Chemical Logistics due to the need for safe and efficient transportation of raw materials like lithium, electrolytes, and specialty chemicals.

Consequently, there is a surge in technological advancements & innovations related to energy conservation, storage, efficient power transmission, & new business models in this sector. The growing demand for lithium-ion batteries & other energy storage technologies further amplifies the need for specialized chemical logistics solutions. Key factors driving this expansion include rising disposable income, substantial R&D investments in the automotive industry, and stringent government regulations aimed at curbing carbon emissions—all of which rely on robust chemical supply chains.

Research Scope and Analysis

By Product

The PTFE product segment dominates the market, with the maximum share globally in 2023. Polytetrafluoroethylene, a synthetic fluoropolymer, is widely used for manufacturing pump interiors, gaskets, seals & washers, due to its resistance to chemicals & inert properties. It's also gaining popularity in quartz and chip heater encapsulation’s versatility in blending with fillers like glass beads, carbon graphite, & molybdenum disulfide enhances its features.

In contrast, ETFE (Ethylene Tetrafluoroethylene) is a fluorine-dependent plastic having corrosion resistance properties & strength across various industries such as electronics, chemicals, automotive, healthcare architecture, & construction. PVDF (Polyvinylidene fluoride) finds its place in biomedical sciences as a synthetically produced membrane in membrane filtration devices & immunoblotting due to its properties of resistance to chemicals.

By Application

Fluoropolymer coatings show dominance in the market in 2023 and are expected to continue their dominance in the coming years. These coatings, with a blend of lubricants, & high-performance resins produce smooth, hard & slick surfaces with remarkable resistance to chemicals & corrosion. They offer reduced friction, electrical resistance, exhibit abrasion resistance, & resist wetting.

In architectural coatings, particularly for exterior sections, fluoropolymer coatings are favored for their protection against rough weather conditions. They also find usage in aviation, where they protect wiring insulation on aircraft, reducing the risk of onboard fires. Moreover, the food industry benefits from these coatings in molds & trays, enhancing the production of, bread, cheese, candy, & other products by avoiding sticking & providing ease to the cleaning process.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End-User

During the forecast period, industrial equipment is set to dominate the market, constituting a significant share. This is majorly due to its extensive utilization in various industrial settings such as pharmaceutical processing equipment, chemical processing, membrane and filtration systems, as well as heat exchangers. Fluorine-based polymers are the material of choice in these applications, providing resistance to thermal & corrosion challenges.

They are effectively used to coat a diverse range of industrial products like filter tanks, small vessels, flanges, reactors, valves, & piping in the chemical processing sector. These polymers, identified by high purity levels & controlled viscosity, prove to be excellent candidates for filtration & membrane sectors. The chemical processing sector depends largely on these materials for corrosion-resistant fluid-managing equipment & components.

Additionally, factors like rapid urbanization, increasing population, increased infrastructure investments, & supportive policies for encouraging development & construction work are expected to fuel the industry's growth.

The Global Medical Fluoropolymers Market Report is segmented on the basis of the following:

By Product

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene Fluoride (PVDF)

- Ethylene Tetrafluoroethylene (ETFE)

- Others

By Application

- Films

- Coatings

- Additives

- Others

By End-Use

- Industrial equipment

- Electrical & Electronics

- Transportation Equipment

- Automotive Vehicles

- Aerospace

- Others

- Construction

- Others

Regional Analysis

North America dominates the market with a 42.2% share globally in 2023. In North America, the Medical Fluoropolymers sector is expected to flourish well in the near future, due to rising demand for these materials in the manufacturing of medical tubing, drug delivery devices & medical bags. Moreover, increased investments in healthcare infrastructure are further propelling the expansion of this industry in North America.

In Europe, which includes key economies like France, Germany, the U.K., & Italy, the market is expected to experience substantial growth. The region is currently at the forefront of a technological revolution in the healthcare sector, particularly in the realm of

medical devices & products. The

Healthcare CRM is poised to benefit significantly from this transformation, as providers adopt advanced customer relationship management tools to streamline patient engagement, data analytics, and personalized care delivery.

Various European governments are actively focusing on modernizing their healthcare ecosystems through the adoption of effective & efficient technologies, further accelerating demand for integrated CRM solutions. This shift is anticipated to drive the growth of both the Medical Fluoropolymers industry and digital healthcare platforms in Europe in the coming years, solidifying the region’s position as a major contributor to the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Medical Fluoropolymers Market is witnessing a consolidation trend due to the presence of numerous global and regional players, with major companies boasting strong distribution networks and well-established product brands. Ongoing research and development efforts within the industry offer significant growth opportunities for market players, thereby positively impacting the overall market.

Manufacturers are actively engaged in R&D activities to enhance medical-grade fluoropolymer products. For example, in October 2021, researchers at the University of California, Los Angeles (UCLA) developed an innovative method for producing durable fluoropolymer films with excellent mechanical properties, suitable for various medical applications, such as implantable devices and protective coatings.

Some of the prominent players in the Global Medical Fluoropolymers Market are:

- The Chemours Company

- Solvay SA

- Arkema

- Daikin Industries, Ltd.

- AdTech Polymer Engineering Ltd.

- Dongyue Group Limited

- Saint-Gobain

- W.L. Gore & Associates, Inc.

- Hitachi, Ltd.

- Holscot Fluoropolymers Ltd.

- Honeywell International Inc.

- Other Key Players

Recent Developments

- August 2025: The U.S. FDA concluded that fluoropolymers like PTFE used in medical devices are safe, with no conclusive evidence of patient care issues.

- July 2025: Americhem launched EcoLube™ MD, PFAS-free internally lubricated compounds for medical devices, addressing environmental concerns.

- March 2025: The FTC sued to block GTCR's $627 million acquisition of Surmodics, citing anticompetitive concerns in the medical device coatings market.

- February 2025: The global fluoropolymer market is projected to grow from USD 513.3 million in 2023 to USD 973.8 Mn by 2033, with a CAGR of 7.4%.

- January 2025: Americhem launched EcoLube™ MD, PFAS-free internally lubricated compounds for medical devices, addressing environmental concerns.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 513.3 Mn |

| Forecast Value (2033) |

USD 973.8 Mn |

| CAGR (2024-2033) |

7.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solutions and Services), By Size (Small & Medium-sized Enterprises and Large Enterprises), By Industry Vertical (Public Sector, Pharmaceuticals, Media & Entertainment, IT & Telecommunication, BFSI, and Others Industry Verticals). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

TCS, Target, Salesforce, Nike, Nationwide, Klarna, J.P. Morgan, IBM, General Motors Co., Ford Motor Co., Flipkart, Citigroup, and Other Key Players. |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

How big is the Global Medical Fluoropolymers Market?

▾ In 2023, the Global Market for Medical Fluoropolymers is expected to reach a valuation of USD 513.3 million.

What is the anticipated growth rate for the Global Medical Fluoropolymers Market?

▾ The Global Medical Fluoropolymers Market is projected to experience a noteworthy compound annual growth rate (CAGR) of 7.4% from 2023 to 2032.

Which region has dominated the Global Medical Fluoropolymers Market?

▾ North America dominated the market in 2022 and is further expected to contribute 42.2% share globally in 2023.

Who are the prominent players in the Global Medical Fluoropolymers Market?

▾ Some of the prominent players in the Global Medical Fluoropolymers Market include The Chemours Company, Solvay SA, Arkema, Daikin Industries, Ltd., AdTech Polymer Engineering Ltd., Dongyue Group Limited, Saint-Gobain, W.L. Gore & Associates, Inc., Hitachi, Ltd., Holscot Fluoropolymers Ltd, etc.