Market Overview

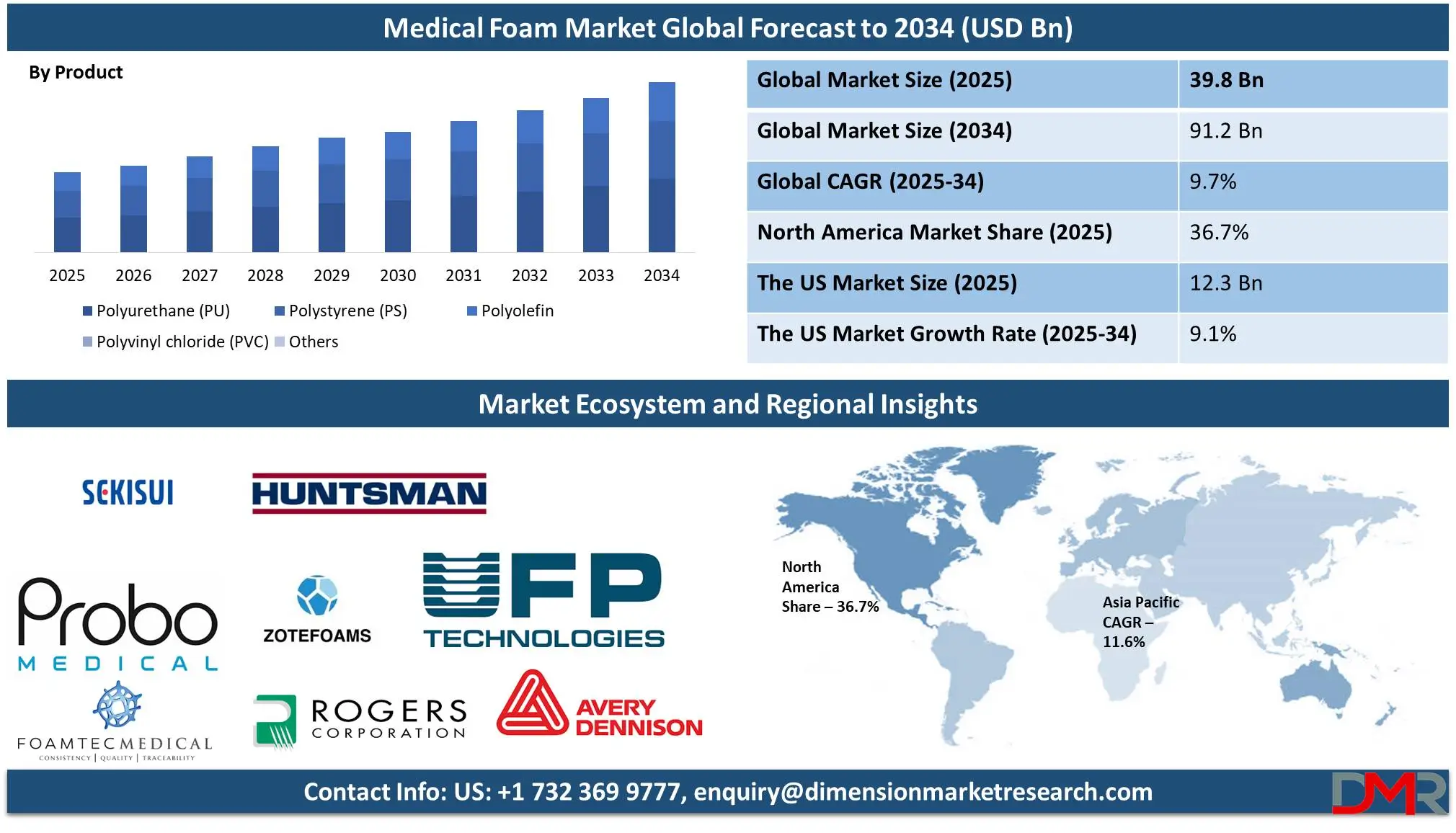

The global medical foam market was valued at USD 39.8 billion in 2025 and is expected to grow to USD 91.2 billion by 2034, registering a compound annual growth rate (CAGR) of 9.7% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Medical foam refers to specialized foam materials designed for use in healthcare and medical applications. These foams are often made from polyurethane, silicone, or other materials with properties tailored for hygiene, comfort, and functionality. Medical foams are commonly used in wound care (e.g., foam dressings that absorb exudates and promote healing), orthopedic supports (like cushions and braces), prosthetics, and surgical equipment. They are engineered to be biocompatible, durable, and sometimes antimicrobial. Their flexibility and customizable nature make them ideal for patient care, providing support, protection, and comfort in a variety of medical settings.

The medical foam industry has experienced significant growth, driven by an aging global population and increased healthcare expenditures. Medical foams are essential in applications such as wound care, prosthetics, and surgical dressings, offering properties like softness, lightweight structure, and biocompatibility. This growth is further supported by technological advancements that enhance the quality and cost-effectiveness of medical foams.

The US Medical Foam Market

The US Medical Foam market is projected to be valued at USD 12.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 26.9 billion in 2034 at a CAGR of 9.1%.

The U.S. medical foam market is driven by high per capita healthcare spending and the presence of a robust healthcare infrastructure. Growing demand for advanced medical devices and components, spurred by technological innovations, also boosts market growth. Additionally, the increasing geriatric population necessitates greater use of medical foam in applications like wound care and cushioning.

Due to sustainability concerns, eco-friendly and biodegradable medical foam products are gaining traction. Customized foam solutions tailored to specific medical devices and patient needs are also on the rise. Furthermore, the integration of antimicrobial and hypoallergenic properties into medical foam reflects the growing emphasis on infection control and patient comfort within healthcare settings.

Key Takeaways

- Market Growth: The global Medical Foam market is anticipated to expand by USD 48.0 billion, achieving a CAGR of 9.7% from 2026 to 2034.

- Product Analysis: Polyurethane (PU) foam is predicted to dominate the global market with a revenue share of 51.4% based on product by the end of 2025.

- Form Analysis: Flexible Foam is likely to dominate the medical foam market with a revenue share of 56.3% in 2025.

- Application Analysis: Bedding and cushioning are projected to dominate the global market with the highest revenue share of 38.4% by 2025 in terms of application.

- Regional Analysis: North America is projected to dominate the global medical foam market, holding a market share of 36.7% by 2025.

Use Cases

- Wound Care Products: Medical foam is commonly used in wound dressings, especially for absorbing exudates from wounds. The foam's porous structure provides an optimal moist environment for healing while protecting the wound from contamination and pressure. Examples include foam dressings for burns, ulcers, and post-surgical wounds.

- Orthopedic Support and Cushioning: Medical foam is utilized in orthopedic supports, braces, and padding. Its flexibility and cushioning properties make it ideal for providing comfort, reducing pressure points, and immobilizing injured areas. It’s widely used in custom-molded insoles, back supports, and splints.

- Surgical and Diagnostic Applications: In surgical environments, medical foam is used for patient positioning pads and surgical drapes. The foam provides stability, comfort, and support during lengthy procedures. In diagnostic tools like ultrasound, foam aids in maintaining patient comfort and proper positioning.

- Prosthetics and Mobility Aids: Medical foam is an integral component in prosthetic devices and mobility aids, such as wheelchairs and crutches. It helps improve comfort and usability by providing a lightweight, durable, and shock-absorbent material for padding and seating surfaces.

Market Dynamic

Driving Factors

Increasing Aging Population and Demand for Comfort

The increasing global aging population is driving increased demand for medical foam, as older individuals tend to experience pressure ulcers caused by prolonged time spent sitting or lying still on rigid surfaces and uncontrollable muscle movements. Soft bedding, cushioning, and padding made with medical-grade foam offer essential comfort in elder care settings - further cementing its role. Furthermore, seniors constitute a substantial consumer base for various devices like arthritis aids, hot and cold pads as well as powered wheelchairs - driving even greater demand for this particular grade of material in healthcare applications.

Expanding Applications of Medical-Grade Foams

Medical-grade foams have become an indispensable resource in wound dressings, medical supports, and prosthetic padding due to their softness, durability, and flexibility. Their water resistance makes them suitable for protective packaging as well as lightweight medical equipment like protective packaging for protective packaging or protective medical equipment requiring air flow exchange or wound healing; breather devices use breathing foams too! Breathing devices also utilize breathing devices as means for exchange heat and moisture exchange as well as wound healing prevention while breathing devices use them too for improved patient comfort and recovery - the global medical foam market's growth due to materials like polyethylene polyurethane or Metallocene foams being utilized across medical applications is driving its global expansion!

Restraints

Stringent Manufacturing Regulations

The global medical foam market faces significant difficulties adhering to stringent manufacturing regulations. These rules set high quality standards to safeguard patient safety and product reliability, necessitating significant investments in advanced technology, quality control systems and comprehensive testing - which increases production costs significantly while creating barriers for smaller companies competing within this marketplace.

Volatility of Raw Material Prices

Fluctuations in raw material prices, specifically petroleum-based components such as benzene and toluene, represent another key challenge to medical foam product production costs. Rising oil prices as well as production problems increase production expenses significantly and raise product pricing considerably.

Opportunities

Growing Adoption in Advanced Wound Care

With increasing rates of chronic wounds such as diabetic ulcers and pressure sores combined with an aging global population, the medical foam market holds great promise. Due to their superior moisture management properties, cushioning properties, and antibacterial capabilities, medical foam products have become indispensable solutions in wound care, healing, and infection prevention applications - thus expanding the growth potential of foam-based wound care solutions further and expanding demand in this market.

Increasing Use in Medical Devices

Medical foam materials have increasingly found use in orthopedic implants, prostheses, and surgical equipment production. Their lightweight yet biocompatible nature helps enhance functionality and performance for medical devices while opening new markets in healthcare applications across industries.

Trends

Medical Foam's Rising Use in Spinal Implants

The global medical foam market is experiencing remarkable expansion as more healthcare organizations utilize medical foam's exceptional biocompatibility, strength, and performance qualities in spinal implants. Medical foam's exceptional qualities of mimicking cancellous bone with interconnected pores through implants improve patient outcomes as well as meet rising healthcare solutions demand and contribute significantly to market expansion.

Shifting Focus toward Sustainable Packaging Solutions

Sustainability is changing the medical foam market as manufacturers innovate to comply with strict FDA regulations while meeting environmental concerns. A move toward eco-friendly and resource-efficient foam packaging with extended shelf life has opened new opportunities in healthcare; not only can such solutions reduce production and transportation costs but they are in keeping with healthcare providers' efforts at mitigating environmental impact.

Research Scope and Analysis

By Form

Flexible Foam is the market leader in the medical foam market with a revenue share of 56.3% in 2025, due to its versatility and desirable properties that make it indispensable across numerous applications. Softness, moisture resistance, and excellent mechanical properties all combine outstanding cushioning properties with impact resistance for patient safety, making flexible foam an indispensable material in medical settings such as bedding, wound care dressings, and medical device packaging. Flexible foam can conform easily to shapes while protecting delicate equipment during transportation; increasing attention on patient well-being has only further propelled its adoption by patients themselves and medical practitioners alike.

Rigid foam is another key material in medical applications, providing insulation and structural applications within this sector. Thanks to its superior thermal insulation properties and lightweight properties, rigid foam makes an excellent material choice for medical imaging equipment, temperature-controlled pharmaceutical packaging applications, and hospital infrastructure management applications as well as for maintaining consistent environments where patient health care and product effectiveness are crucial.

By Product

Polyurethane (PU) foam is likely to dominate the medical foam market with a revenue share of 51.4% in 2025, due to its exceptional biocompatibility, versatility, and vast applications in healthcare. These versatile foams find use as wound dressings, prosthetics, and cushioning material - offering comfort while supporting healing processes. PU foams' ability to accommodate varied medical needs while protecting patient safety has made them an indispensable material in healthcare settings.

Furthermore, investments in this sector and an increase in demand for advanced devices have only further pushed up adoption rates of this material. These materials meet the evolving demands of healthcare providers aiming to enhance patient care, reinforcing polyolefin foams' position as market leaders. Polyolefin foams represent another growing segment due to their lightweight nature and excellent chemical resistance - ideal for packaging medical devices and protective cushioning; easy sterilization/disposal makes these foams essential in healthcare applications.

By Application

Bedding and cushioning represent the largest revenue share of 38.4% by the end of 2025 in the medical foam market due to their significant role in improving patient comfort and care. Foam solutions are widely utilized across hospitals, clinics, and home healthcare environments for products like mattresses, pillows, and wheelchair cushions. These special products feature unique abilities to evenly dissipate pressure and offer solid support, essential in avoiding pressure ulcers and hastening patient recovery.

Their popularity ensures this segment's dominance in the market. As medical devices and components represent one of the fastest-growing categories within the medical foam market, their demand has driven rapid expansion. The demand is highest for cost-effective materials that comply with biocompatibility specifications in the production of devices used to treat diseases like Alzheimer's. Medical foam made by blending plastics such as polystyrene and polyethylene offers exceptional adaptability to meet the stringent demands of medical applications, making it indispensable for manufacturing various medical devices and components. Its versatile properties also make medical foam an invaluable choice.

The Medical Foam Market Report is segmented based on the following

By Form

- Flexible Foam

- Rigid Foam

- Spray Foam

By Product

- Polyurethane (PU)

- Polystyrene (PS)

- Polyolefin

- Polyvinyl chloride (PVC)

- Others

By Application

- Bedding & Cushioning

- Medical Packaging

- Medical Devices & Components

- Prosthetics & Wound Care

- Others

Regional Analysis

North America is likely to lead the global medical foam market

with a 36.7% revenue share by the end of 2025. The rising healthcare expenditures across the region have had a vital role in driving significant advances in medical technology and creating ground-breaking products. These innovations not only advance patient care but also spur the adoption of medical foam solutions in various healthcare applications such as wound care and patient support systems. North America benefits from substantial investments in healthcare infrastructure, which further increases demand for superior medical materials.

As healthcare systems and initiatives to enhance patient outcomes provide a supportive environment, medical foam market growth becomes even more expeditious. North America's rapidly aging population is another key driver, leading to more people experiencing chronic illnesses and age-related health concerns requiring specialty medical products like wound care foams and orthopedic supports. All these factors come together to position north america as an innovative hub dedicated to meeting healthcare demands as they arise.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key players in the global medical foam sector, such as Sekisui Chemical Co., Ltd., UFP Technologies, Inc., and Zotefoams plc, are employing a variety of strategies to boost their competitive positions. These strategies include prioritizing product innovation and development, increasing production capacities, and forging strategic partnerships or collaborations.

Additionally, these companies are dedicating resources to research and development to produce advanced medical foam solutions that address the changing demands of healthcare, while also exploring sustainable practices to comply with environmental regulations and cater to consumer preferences. These efforts are aimed at enhancing their market presence and ensuring sustained growth in the industry.

Some of the prominent players in the global Medical Foam are

- 3M

- General Plastics Manufacturing Company, Inc.

- Huntsman International LLC.

- Sekisui Chemical Co., Ltd.

- UFP Technologies, Inc.

- Zotefoams plc.

- Probo Medical

- Avery Dennison Corp.

- Rogers Corp.

- Foamtec Medical

- Other Key Players

Recent Developments

- In February 2024, Sekisui Chemical Co., Ltd. introduced a new range of biodegradable medical foams designed to address environmental concerns and meet stringent regulatory standards. This innovation reinforces Sekisui’s commitment to sustainable medical solutions and positions the company as a leader in the sector.

- In May 2024, Huntsman Corporation merged with a European medical foam producer to enhance its product portfolio and market reach. The merger is expected to result in a more comprehensive range of medical foam products and improved customer service capabilities, enabling Huntsman to better serve its clients in the medical industry.

- In April 2024, Trelleborg AB launched an innovative line of high-performance medical foams intended for use in prosthetics and orthotics. These foams offer superior cushioning and durability, catering to the specific needs of patients requiring long-term support in their medical devices.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 39.8 Bn |

| Forecast Value (2033) |

USD 91.2 Bn |

| CAGR (2024-2033) |

9.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 12.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Form (Flexible Foam, Rigid Foam, and Spray Foam), By Product (Polyurethane (PU), Polystyrene (PS), Polyolefin, Polyvinyl chloride (PVC), and Others), By Application (Bedding & Cushioning, Medical Packaging, Medical Devices & Components, Prosthetics & Wound Care, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

3M, General Plastics Manufacturing Company, Inc., Huntsman International LLC., Sekisui Chemical Co., Ltd., UFP Technologies, Inc., Zotefoams plc., Probo Medical, Avery Dennison Corp., Rogers Corp., and Foamtec Medical and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Medical Foam Market?

▾ The Global Medical Foam Market size is estimated to have a value of USD 39.8 billion in 2024 and is expected to reach USD 91.2 billion by the end of 2033.

Which region accounted for the largest Global Medical Foam Market?

▾ North America is expected to be the largest market share for the Global Medical Foam Market with a share of about 36.7% in 2024.

Who are the key players in the Global Medical Foam Market?

▾ Some of the major key players in the Global Medical Foam Market are Probo Medical, Avery Dennison Corp., Rogers Corp., and many others.

What is the growth rate in the Global Medical Foam Market?

▾ The market is growing at a CAGR of 9.7 percent over the forecasted period.

How big is the US Medical Foam Market?

▾ The US Medical Foam Market size is estimated to have a value of USD 12.3 billion in 2024 and is expected to reach USD 26.9 billion by the end of 2033.