Global Medical Imaging Outsourcing Market constitutes the medical services that are offered to the healthcare sector which includes magnetic resonance imaging (MRI), X-ray, Computed Tomography, ultrasound, and others by a third-party provider or individuals who are specialized in Medical Imaging.

Outsourcing in this area could apply to multiple scientific imaging services ranging from image acquisition to imaging interpretation, evaluation, reporting and even storing the imagery data.

Major players in the international Medical Imaging Outsourcing Market include imaging centers that are specialized, research corporations (CROs),

medical device manufacturers, and healthcare providers. Providing imaging services to healthcare agencies on an outsourcing basis can offer a variety of benefits for organizations such as lower costs, access to specialist knowledge, better efficiency, and expandability. Fundamental factors driving the growth of this market are the rising demand for Diagnostic Testing solutions, technical progress in the field of imaging, increasing healthcare expenditure, and higher accuracy of diagnoses.

Key Takeaways

- The Global Medical Imaging Outsourcing Market size is estimated to have a value of USD 9.4 billion in 2024.

- Computed tomography is expected to dominate the global medical imaging outsourcing device market in term of devices as it hold 58.2% of market share in 2024.

- The market is growing at a CAGR of 4.2 percent over the forecasted period.

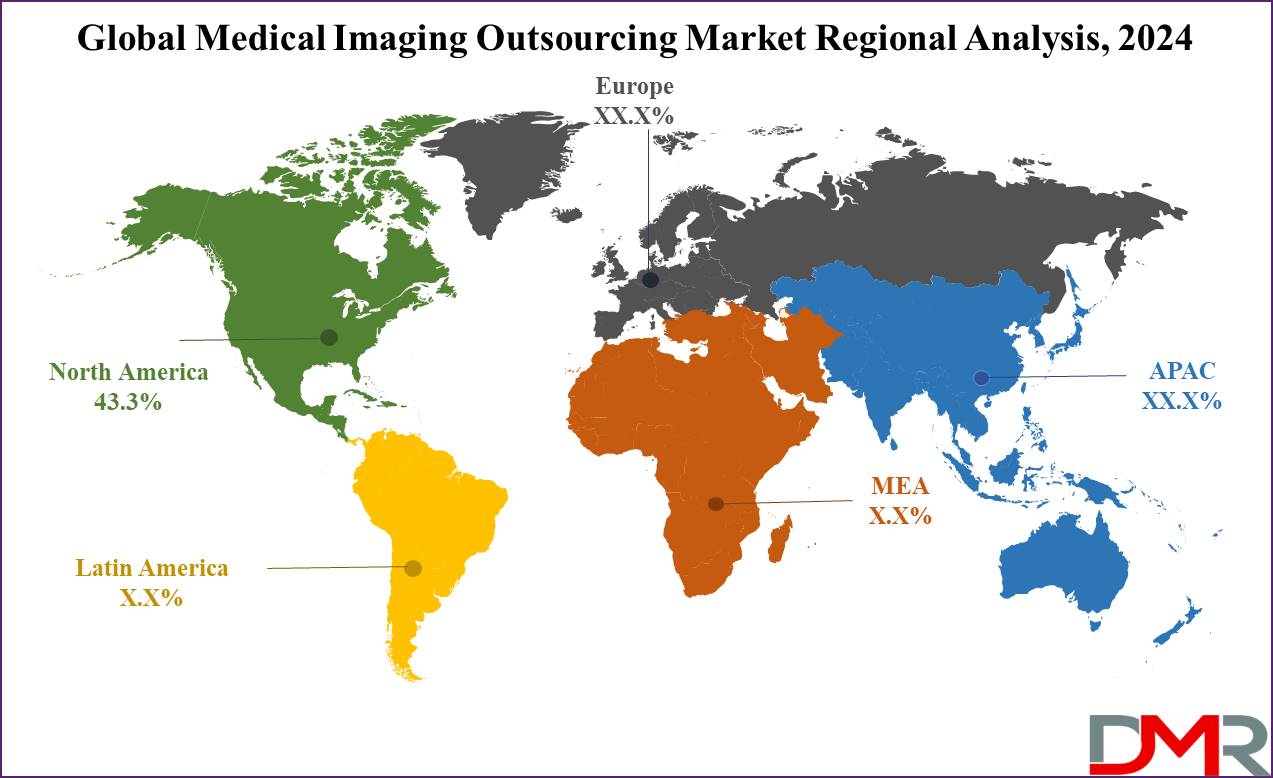

- North America has expected to hold the largest market share for the Global Medical Imaging Outsourcing Market with a share of about 43.3% in 2024.

Use Cases

- Outsourcing medical imaging reduces overhead charges, as companies avoid investments in equipment, preservation, and staffing.

- Specialized outsourcing companies offer access to skilled radiologists and modern imaging technology, enhancing diagnostic accuracy.

- Outsourcing allows healthcare providers to scale imaging offerings consistent with demand fluctuations, without capital investments or staffing constraints.

- By outsourcing imaging tasks, healthcare centers can allocate sources to center features like patient care and treatment.

- Outsourcing facilitates get entry to clinical imaging services in remote or underserved areas, enhancing healthcare accessibility and patient consequences.

Market Dynamic

The Global Medical Imaging Outsourcing Market is formed with the aid of technological improvements, fee pressures in healthcare, demand for diagnostic services, regulatory compliance, and globalization of healthcare. Advancements in imaging technology attract outsourcing to get access to equipment and specialized services. However, the high cost of this market forces vendors to seek cost-effective solutions that promote outsourcing.

The growing demand for diagnostic services, pushed by the rise in aging populations and chronic illnesses, also fosters outsourcing opportunities. These elements collectively affect market dynamics, making outsourcing a strategic choice for scientific imaging offerings in a complex healthcare landscape where

Healthcare IT plays a critical role in improving efficiency and data security.

Research Scope and Analysis

By Device

Computed tomography is expected to dominate the global medical imaging outsourcing device market in term of devices as it hold 58.2% of market share in 2024.

Computed Tomography (CT) is the leading segment in scientific imaging outsourcing because of its versatile applications across diverse diagnostic need, like head, chest, abdomen, and extremity imaging. Its fast picture acquisition allows timely diagnoses, making it ideal for emergency instances. Additionally, CT scans are cost-efficent in comparison to different modalities like MRI and PET, making them attractive to healthcare carriers seeking to optimize budgets.

CT scanners' large availability enhances accessibility, mainly in smaller centers or underserved areas. Moreover, CT's excessive-decision pictures make sure diagnostic accuracy, important for detecting conditions starting from fractures to tumors. While CT dominates outsourcing because of its combination of versatility, performance, value-effectiveness, accessibility, and accuracy, its dominance may additionally vary relying on regional elements and precise clinical requirements.

The Medical Imaging Outsourcing Market Report is segmented on the basis of the following

By Device

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Positron Emission Tomography (PET)

Regional Analysis

North America dominate the global medical imaging outsourcing market as it is projected to commands

43.3% of market share by the end of 2024 and further anticipated to show subsequent

growth in the forthcoming period of 2024 to 2033.

North America, in particular United States and Canada, benefits from advanced healthcare infrastructure, fostering well developed clinical imaging centers which offer their service to various sectors. Technological innovations in imaging modalities like CT, MRI, and PET drive the demand for outsourcing offerings, leveraging contemporary technology. High healthcare spending in this region encourages providers to outsource imaging offerings to manage fees whilst ensuring quality and get access to advanced technologies.

The large and getting old population increases the demand for imaging services, prompting efficient control through outsourcing. Additionally, this region’s stringent regulatory environment guarantees compliance with healthcare requirements and patient statistics protection, presenting reassurance to each vendors and sufferers utilizing outsourcing services.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Medical Imaging Outsourcing Market features key players competing with each other as offer variours product through technology innovation, strategic partnerships, and international expansion. Leading companies in this market encompass RadNet, InHealth Group, ICON percent, BioClinica, Synarc (a subsidiary of BioClinica), Covance Inc. (LabCorp), Radiology Partners, Center for Diagnostic Imaging (CDI), Vital Images (Canon Medical Systems), and Agfa-Gevaert Group.

These groups provide a wide range of imaging offerings, together with MRI, CT, PET/CT, ultrasound, and X-ray, catering to the demand of this market need to medical research and diagnostic. These market players leverage their geographic reach, technological understanding, and strategic collaborations to satisfy the growing need for clinical imaging outsourcing globally, making sure complete solutions for healthcare providers and scientific researchers.

Some of the prominent players in the Global Medical Imaging Outsourcing Market are

- Flatworld Solutions Pvt. Ltd.

- Alliance Medical

- MetaMed

- Diagnostic Imaging Services

- NORTH AMERICAN SCIENCE ASSOCIATES INC.

- Ankarad Medical Imaging Systems

- Shields MRI

- KAYI Healthcare

- RadNet, Inc.

- PROSCAN IMAGING

- Other Key Players

Recent Development

- In November 2023, Aidoc invests $30M to develop a groundbreaking clinical AI foundation model for medical imaging, aiming to enhance diagnostic accuracy and integrate seamlessly into healthcare workflows.

- In Octoer 2023, Kaiser Permanente workers, after a strike over wages and staffing, ratified a new contract with a 21% wage increase over four years.

- In June 2023, Gradient Health secures $2.75M funding to build extensive annotated medical imaging library, fostering AI development, collaborations, and advancements in healthcare research.

- In May 2023, Siemens Healthineers plans to construct a semiconductor factory in Germany for producing crystals vital in advanced CT scanners, enhancing imaging quality.

- In February 2023, Radiology increasingly adopts cloud storage to solve IT, cybersecurity issues. Amy Thompson highlights cloud's benefits, addressing data security concerns and freeing up IT staff.

- In January 2023, Life Science Outsourcing has acquired J-Pac Medical, a company specializing in manufacturing, packaging, and sterilization outsourcing for medical devices and diagnostics.