In this market is primarily focus on, packaging materials that are particularly made for the packaging of medical devices, pharmaceutical products, and other healthcare-related things. These films are used for different needs and to ensure the safety of medical products throughout their life cycle including production and utilization.

The medical packaging films offer excellent barriers with air and moisture permeability which have proven to be vital in preventing moisture, light, and other possible contaminants from undermining product quality.

Medical devices and pharmaceutical products such as implants, dialysis equipment, prosthetics, and contraceptives among others must go through sterilization processes like gamma radiation, ethylene oxide, and autoclaving to ensure their quality. In a similar way that

Food Packaging aims to preserve freshness and prevent contamination, medical packaging films prioritize sterility and safety, reflecting a shared emphasis on high barrier performance.

Key Takeaways

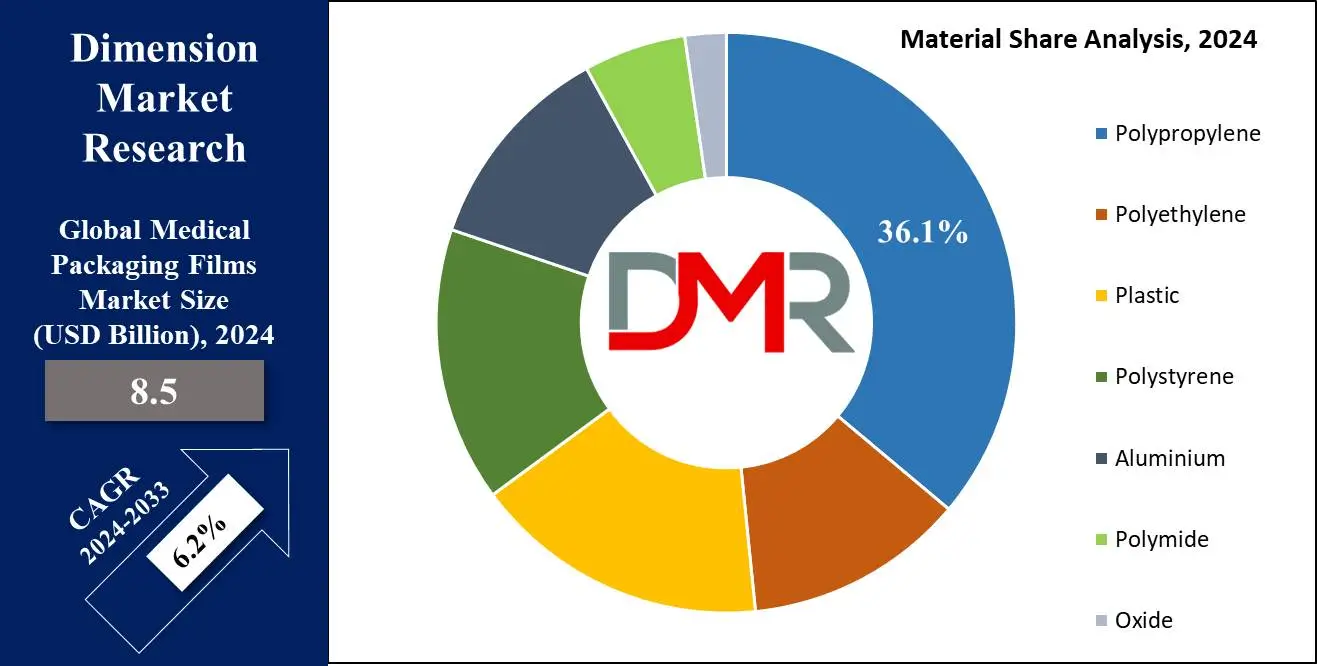

- Polypropylene is projected to dominate the material segment with 36.1% of the market share in 2024.

- Thermoformable films are anticipated to dominate this market in terms of type in 2024.

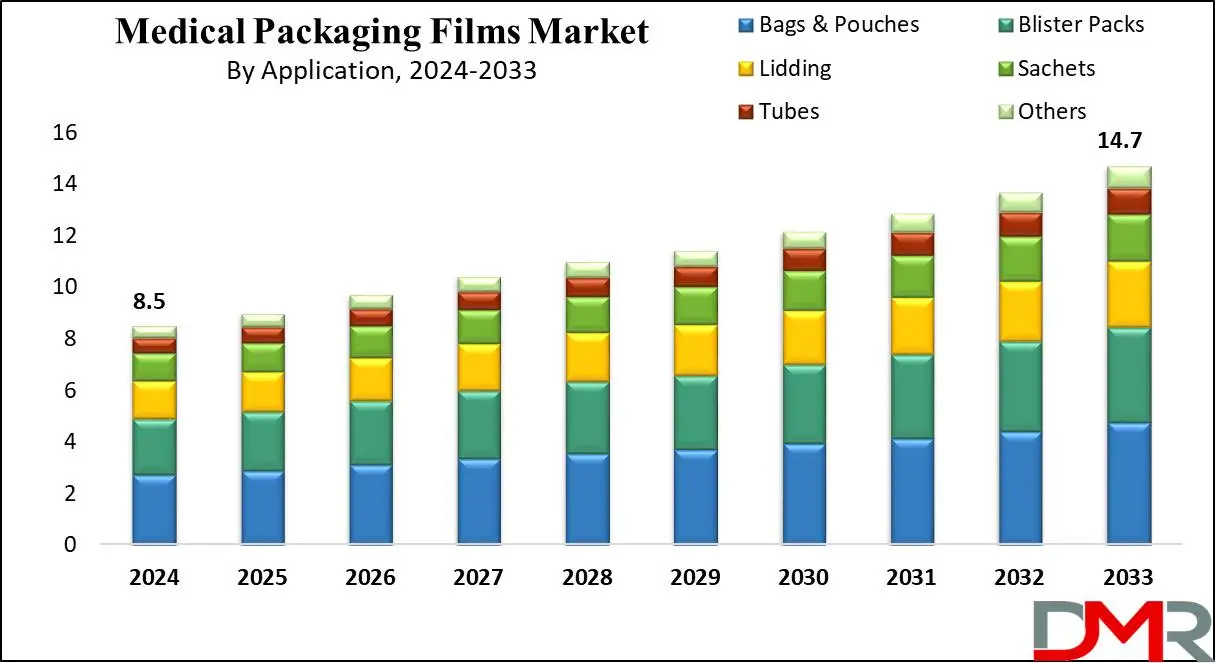

- Bags and pouches are projected to exert their dominance based on application as they hold 32.2% of the market share in 2024.

- Pharmaceuticals are anticipated to dominate the global medical packaging films market and dominate the end-user segment with the highest market share in 2024.

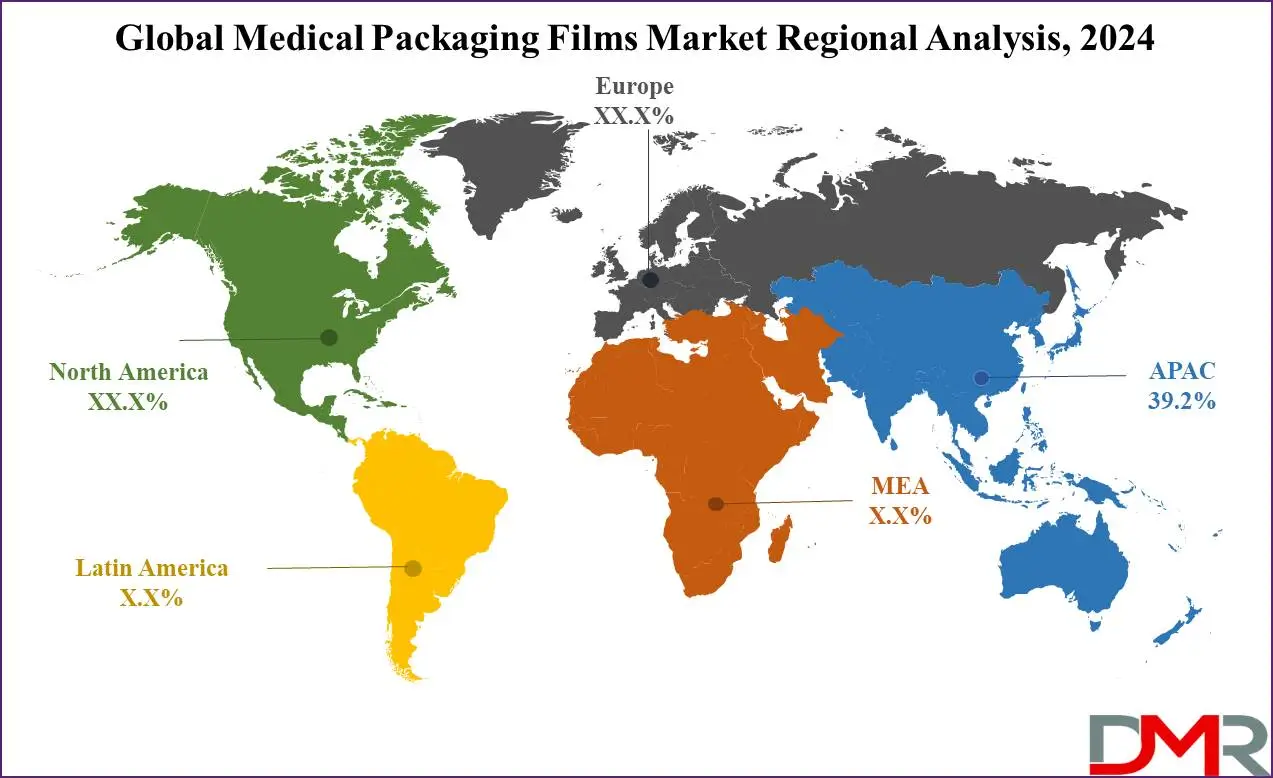

- North America is projected to dominate the global medical packaging film market with 39.2% of the market share in 2024.

Use Cases

- Extending the shelf-life of the products: - Medical packaging films are used in packaging pharmaceutical products like tablets, capsules, vials, and syringes where they protect the products against moisture, oxygen, light, and contaminants.

- Maintaining sterility: - Packaging films play a critical role in medical devices like surgical instruments, and diagnostic equipment which require sterile packaging to prevent contamination.

- Safety from environmental conditions: - Films used in wound care products, such as adhesive dressings, surgical tapes, and bandages, require specialized properties to facilitate breathability, & moisture management.

- Use in diagnostic kits: - Packaging films are utilized in diagnostic test kits for various medical conditions, including rapid tests, molecular diagnostics, and point-of-care testing.

Medical Packaging Films Market Dynamic

Healthcare sector expenses represent one of the most dynamically growing areas in many aspects particularly due to population growth or chronic diseases. These factors are one of the key forces that drive the demand for medical packaging films. The global medical packaging film market may ensure additional measures through several regulatory bodies like the FDA, EMA, and so forth that are focused on product safety and effectiveness which is accompanied by strict acts. The stringent laws and regulations affect the industry but at the same time, it can serve as an outlet where drug manufacturers can show how imaginative they can be.

The technological developments in film, especially in the barrier properties and sustainability of the packaging films, have led to a new era that imposes long shelf life and resistant packaging films. The demand for these products is emerging for various reasons like health and sterility as well as higher barrier properties required.

These advances in material science are echoed across sectors—technologies used in Optical Films and

Automotive Wrap Films are increasingly being adapted to improve the functional and aesthetic attributes of medical packaging. Besides this, we have also noted a radical shift in packaging sustainability, where manufacturers are using the most environmentally friendly materials to indicate the presence of the solution to the ever-growing environmental challenges and regulatory demands.

Medical Packaging Films Market Research Scope and Analysis

By Material

Polypropylene is projected to dominate the material segment in the

global medical packaging films market

with 36.1% of the market share in 2024. This strong material is water-resistant as well as gas- and chemical-proof, which guarantees that the medical products come with sterility and integrity when packaging. Its capability to pass different sterilization methods which is accompanied by its durability makes it the most suited for medical device packages.

Furthermore, polypropylene is a flexible, formable, and transparent material that enables a variety of package designs and transparent products to be shelved. Compared to counselors such as aluminum and polyamide, polypropylene is more economical and recyclable, which convinces consumers to use polypropylene on eco-conscious products. The property combination of polypropylene enables it to be a popular and valuable tool for assuring product safety, regulatory compliance, and cost-effectiveness in the process of medical packaging.

By Type

Thermoformable films are anticipated to dominate the global medical packaging films market in terms of type with the highest market share in 2024. In the segment of medical packaging films, thermoformable has been dominating because of its superior barrier properties, compatibility with sterilization, durability, and cost-effectiveness. This strong material is water-resistant as well as gas- and chemical-proof, which guarantees that the medical products come with sterility and integrity when packaging. Its capability to pass different sterilization methods which is accompanied by its durability makes it the most suited for medical device packages.

Furthermore, polypropylene is a flexible, formable, and transparent material that enables a variety of package designs and transparent products to be shelved. Compared to counselors such as aluminum and polyamide, polypropylene is more economical and recyclable, which convinces consumers to use polypropylene on eco-conscious products. The property combination of polypropylene enables it to be a popular and valuable tool for assuring product safety, regulatory compliance, and cost-effectiveness in the process of medical packaging.

By Application

Bags and pouches are projected to exert the dominance of the global medical packaging film market in terms of application as they hold 32.2% of the market share in 2024. In this segment, the dominance of bags and pouches may be accommodated by the availability of those products in specific sizes, shapes, and configurations. They defend the product against infection, moisture, and tampering even while preserving the integrity of the product at the same time. The bags and pouches are easy to deal with which makes them user-friendly for healthcare professionals and quit customers, with labeling options for clean identity.

Also, these bags and pouches can be customized according to rules and regulations set by various global healthcare organizations. So, overall this market is highly versatile which drives the growth of the global medical packaging films market.

By End User

Pharmaceuticals are anticipated to dominate the global medical packaging films market in end user segment with the highest market share in 2024. Compared to other kinds of packaging chemicals, foodstuff drugs have many packaging materials required to help in safe storage, transport, and dispensing, especially when patients have to consume different types of drugs simultaneously. The FDA and EMA rule-making agencies impose regulations that companies must comply with. Such conditions necessitate the use of verified packaging solutions to guarantee product stability.

The packaging is essential as it serves multiple functions such as protecting the pharmaceutical products from environmental factors and maintaining the strength of the active ingredients. In addition, it offers direct protection to patient health through alerts and preventative tampering, contamination, or misuse, in the forms of tamper-evident seals and accurate dosage placement labels. In sum, pharmaceutical packaging ensures proper protection during shipping to and from use and promotes patients' well-being through the packaging. The same precision and high-barrier properties found in Food Packaging,

Optical Films, and Automotive Wrap Films illustrate the growing intersection of technology and safety across diverse packaging industries.

The Medical Packaging Films Market Report is segmented based on the following

By Material

- Polypropylene

- Polyethylene

- Plastic

- Polystyrene

- Aluminum

- Polyamide

- Oxide

By Type

- Thermoformable Films

- High Barrier Films

- Coated Films

- Metallized Films

- Co-extruded Films

- Formable Films

- Formable Films

By Application

- Bags & Pouches

- Blister Packs

- Lidding

- Sachets

- Tubes

- Others

By End Use

- Pharmaceuticals

- Medical Devices Manufacturers

Medical Packaging Films Market Regional Analysis

The Asia Pacific region is expected to be the largest medical packaging film market

with 39.2% of the market share in 2024. Meanwhile, the region will be projected to grow quite substantially between the

years 2024 to 2033. This area is prosperous enough to sustain and boost a well-organized healthcare industry hence the increased need for medical packaging for this region. In addition, there are various regulatory bodies in this area which play a vital role in the growth of this sector while assuring the safety and compliance of the materials used in packaging for medical use which makes the investors confident hence they consider investing in the area.

Medical packaging industry leaders in the region have also impelled high-end technology innovation and industrial advances in medical packaging film on the international level. The healthcare industry with the necessary infrastructure including hospitals and research institutions will always need to use quality packaging materials which, in turn, will certainly enhance Asia Pacific’s position in this market. This region has emerged as the top region in the global medical packing film market due to the strict regulatory laws and well-developed infrastructure.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The intensely competitive environment of the global medical packaging film market is shaped by the presence of such players as large multinational corporations, local manufacturers, and specialized suppliers. It is often through this competition that they distinguish themselves on such criteria as product quality or innovation, price, distribution channels, or customer experience. These production companies offer a broad range of medical films with other products like pharmaceuticals, medical technologies another diagnostic tools that can be used all through the production process.

They make a lot of investment in their research and development stages where they develop several packaging solutions that currently and are emerging as a challenge in the healthcare sector. Such solutions include enhanced barrier properties, compatibility with sterilization treatments, sustainable designs, and user-friendly packaging.

Some of the prominent players in the Global Medical Packaging Films Market are

- Amcor plc

- Berry Global, Inc.

- DuPont de Nemours, Inc.

- 3M Company

- Tekni-Plex, Inc.

- Constantia Flexibles Group GmbH

- Mitsubishi Chemical Holdings Corporation

- Klöckner Pentaplast Group

- Bemis Company, Inc.

- Winpak Ltd.

- Schur Flexibles Group

- Glenroy, Inc.

- Sealed Air Corporation

- Other Key Players

Recent Development

- In November 2023, Coveris is introducing a recyclable thermoforming film called Formpeel P that's designed for clinical packaging programs as it offers flexibility and recyclability.

- In October 2023, Sumitomo Bakelite obtained 90% of Asahi Kasei Pax's film commercial enterprise, forming SB Pax, to enhance its pharmaceutical packaging marketplace presence.

- In August 2023, Amcor received Phoenix Flexibles in Gujarat, India, to make bigger clinical packaging generation, aiming to offer sustainable answers and enhance its presence in high-increase markets.

- In June 2023, Oliver Healthcare Packaging received EK-Pack Folien GmbH, enhancing its delivery chain manipulation and capacity for innovation in flexible packaging answers for the healthcare area.

- In June 2022, Huhtamaki introduced the Push Tab blister lid, an aluminum-free, mono-material PET blister pack cover, enhancing sustainability in pharmaceutical packaging without compromising functionality or existing production lines.

Medical Packaging Films Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 8.5 Bn |

| Forecast Value (2033) |

USD 14.7 Bn |

| CAGR (2023-2032) |

6.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material (Polypropylene, Polyethylene, Plastic, Polystyrene, Aluminum, Polyamide, and Oxide By Type (Thermoformable Films, High Barrier Films, Coated Films, Metallized Films, Co-extruded Films, Formable Films, and Formable Films), By Application (Bags & Pouches, Blister Packs, Lidding, Sachets, Tubes, and Others), By End Use (Pharmaceuticals, and Medical Devices Manufacturers) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Amcor plc, Berry Global Inc., DuPont de Nemours Inc., 3M Company, Tekni-Plex Inc., Constantia Flexibles Group GmbH, Mitsubishi Chemical Holdings Corporation, Klöckner Pentaplast Group, Bemis Company Inc., Winpak Ltd., Schur Flexibles Group, Glenroy Inc., Sealed Air Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |