Medical polymers are a class of specialized materials designed for use within the healthcare sector, offering essential properties such as biocompatibility, stabilizability, and flexibility. These polymers are utilized in a wide array of medical applications ranging from disposable syringes and intravenous bags to implants and prosthetics.

The Medical Polymer market comprises the production and distribution of these polymers specifically tailored for medical applications. This market is distinguished by its stringent regulatory requirements and ongoing demand driven by innovations in medical technologies and procedures.

Looking forward to 2024, the Medical Polymer market presents significant growth opportunities for both established players and new entrants. For large companies already active in the market, investing in advanced research and development to create more sophisticated biocompatible materials can offer a competitive edge.

Several key trends are shaping the Medical Polymer market. Firstly, the push towards more sustainable medical solutions is accelerating the development of biodegradable and bio-based polymers.

To provide a comprehensive perspective on the market, it is essential to integrate recent findings and statistics. According to research from Springer, approximately 25% of all plastic medical products are PVC-based, highlighting the dominance of this material in the current market. Furthermore, studies by Yildiz reveal that polymers hold a significant share across various applications within the health sector, including 41% in drug delivery systems and 31% in pioneering new medical approaches.

Additionally, the vast number of academic articles indexed by Google Scholar, exceeding 30,000 on the topic of biomedical polymers for disease management or clinical use in the past decade, underscores the extensive research and interest in this field. These insights not only illustrate the current state of the market but also underscore the potential for innovation and expansion within the sector.

By understanding these dynamics and incorporating the latest research, companies in the Medical Polymer market can better position themselves to lead in innovation and meet the evolving needs of the healthcare industry. Whether for large players or new entrants, the focus on advanced, sustainable, and tailored polymer solutions will be crucial in capturing growth and achieving success in this vital market.

Medical Polymer Market Key Takeaways

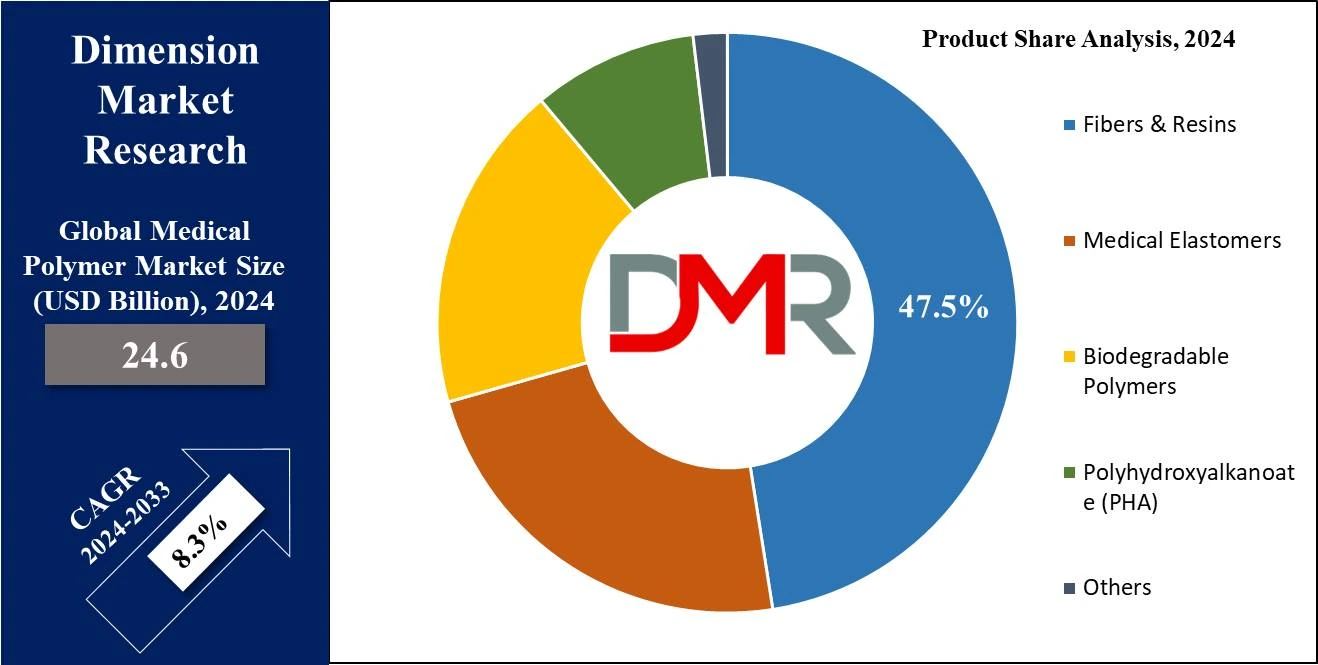

- The Global Medical Polymer Market size is estimated to have a value of USD 24.6 billion in 2024 and is expected to reach USD 50.5 billion by the end of 2033.

- The market is growing at a CAGR of 8.3 percent over the forecasted period.

- Fibers and resins are anticipated to dominate the product segment in the medical polymer market as it holds 47.5% of market share in 2024.

- Medical device packaging is projected to dominate the application segment with 36.4% of market share by the end of 2024.

- North America is projected to dominate this market with a total market share of about 44.1% in 2024.

Medical Polymer Market Use Cases

- Medical polymers are used for their durable and biocompatible nature in orthopedic implants, and cardiovascular stents.

- This material is play a vital role in drug delivery system as it controls the release of drug as well as can protection of pharmaceuticals for improved treatment efficacy.

- The medical polymer is utilized in surgical tool due to their durability, precision and fewer chances to be contaminated.

- Medical polymer is used in case of dressings, sutures, and tissue adhesives due to their biodegradable and antimicrobial properties.

- Diagnostic equipment utilizes polymers in imaging agents, lab-on-chip devices, and test kits to enhance accuracy in diagnostics and patient monitoring.

Medical Polymer Market Dynamic

The growing emphasis on research and development has significantly advanced technology in polymer science and manufacturing processes, particularly within the medical sector. Medical polymers play a crucial role in driving innovation by enhancing properties such as biocompatibility and durability.

Additionally, the market operates under a stringent regulatory framework, including FDA approvals, which often pose challenges for new entrants and extend product development timelines. Alongside these developments, the integration of Medical SPA solutions is also gaining attention, as they combine advanced polymer applications with specialized medical and aesthetic treatments, further expanding opportunities in the healthcare industry.

These healthcare trends, which involve minimally invasive procedures and personalized medicine, drive demand for medical polymers in applications such as drug delivery systems. Intense competition in the market results in pricing pressures and product differentiation strategies. This market also poses various challenges that affect the demand for medical polymers thus sparking innovation for protection against the spread of infectious diseases.

Research Scope and Analysis

By Product

Fibers and resins are anticipated to dominate the product segment in the medical polymer market as it holds 47.5% of market share in 2024. The ongoing research and development activities in this segment are directed toward improving medical fibers and resins for more biocompatibility and strength. The rising need for lightweight and durable medical devices has been pushing the growth of this market. It is necessary to comply with stringent regulations that include ISO 10993 for biocompatibility.

The progress of this market in polymer chemistry enhances the coating properties of the product as it provides tear-resistant, antimicrobial, and drug-eluting coatings, which expand the scope of medical polymers in the manufacturing sector. Intense competition among the manufacturers as well as suppliers creates an environment for innovation and cost optimization which in the long run leads to quality improvement. In general, technological advances, market growth, regulation, and the increasing competition in this market determine the way medical fibers and resins, fulfill the changing needs of medical applications while guaranteeing safety and performance standards.

By Application

Medical device packaging is projected to dominate the application segment with 36.4% of the market share by the end of 2024. The international medical polymer market is comprised of polymeric materials specifically designed for medical purposes, which need to fulfill several requirements of the manufacturers, such as biocompatibility and sterilization.

The main categories in this segment include medical-grade plastics, elastomers, biodegradable and bioresorbable polymers. Major factors driving the growth of this segment are the demand for minimally invasive surgeries, technological advancements, higher health spending, and a focus on infection control.

These polymers serve as an essential component of different medical devices, equipment, and packaging materials in the healthcare industry which eventually, results in a more safe and successful treatment. With time, changing medical needs, and increasing awareness, the demand for medical polymers of diverse nature is rising over time, the rise being a consequence of innovative technology and the demand for specific purposes in medical applications.

The Medical Polymer Market Report is segmented based on the following

By Product

- Fibers & Resins

- Polyvinyl Chloride

- Polypropylene

- Polyethylene

- Polystyrene

- Others

- Medical Elastomers

- Styrene Block Copolymer

- Rubber latex

- Others (TPU, TPO, TPV)

- Biodegradable Polymers

- Polyhydroxyalkanoate (PHA)

- Others

By Application

- Medical Device Packaging

- Medical Components

- Orthopedic Soft Goods

- Wound Care

- Cleanroom Supplies

- Bio-Pharm Devices

- Others

Medical Polymer Market Regional Analysis

North America is expected to dominate the global medical polymer market as it projected to command

44.1% of market share by the end of 2024. North America, especially the US, has the most demanding standards in medical device packaging which is monitored by the

FDA and

ASTM International.

Compliance with these standards is integral for market entry and the companies that will make it in this market should do this with a great deal of care. This region enjoys a sophisticated healthcare infrastructure that facilitates efficient work processes within the sphere of manufacturing, research, and distribution.

North America is undoubtedly the leading innovation center for the healthcare and packaging industries, driving the production of advanced technologies and materials. This region also fosters a large consumer base and significant healthcare spending driven by an aging population and the notable high rate of chronic diseases that will continue the demand for medical packaging and devices. The region's economically stable condition and disposable income levels also enhance the growth of these innovations as the manufacturer's demand for them increases.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key companies in the medical device packaging market are Amcor plc (as part of Amcor), DuPont de Nemours, Inc., Bemis Company, Inc., Berry Global, Inc., West Pharmaceutical Services, Inc., and Oliver Healthcare Packaging. The global leaders are providing these packaging solutions with their unique offers. Similarly, the market is fragmented by regional players and niche manufacturers, who can provide agility and product modularization for their local customers. Some businesses opt for vertical integration, exercising businesses of manufacturing, materials, and distribution.

The major driving force of innovation is the competition that works through new advanced materials and designs to meet expanding consumer requirements and regulations. Ongoing research and development considerably help in maintaining an edge in the highly dynamic medical device packaging industry by ensuring that the brand is in tune with various market trends.

Some of the prominent players in the Global Medical Polymer Market are

- BASF SE

- Bayer Material Science AG

- Celanese Corporation

- ubrizol Corporation

- DSM N.V.

- Huntsman Corporation

- E. I. du Pont de Nemours Company

- Eastman Chemical Company

- ExxonMobil Corporation

- Evonik Industries AG

- The Dow Chemical Company

- Other Key Players

Recent Development

- In September 2023, The Mitsubishi Chemical Group incorporates BioPBS™, a bio-based compostable polymer, into EN TEA teabag pouches, emphasizing sustainability and innovation in packaging.

- In September 2023, Researchers develop a new polymer for CAR T-cell therapy, enabling efficient gene delivery into floating T-cells, potentially enhancing cancer treatment effectiveness.

- In July 2023, Biocoat Incorporated acquires Chempilots, a European provider of specialty polymers for medical devices, to enhance its biomaterial platform and expand market access.

- In May 2023, DuPont plans to acquire Spectrum Plastics Group, enhancing its healthcare offerings with advanced manufacturing capabilities, expanded customer base, and increased revenue.

- In May 2023, Tissium, a tissue reconstruction company, secures €50m ($53.8m) in Series D funding to launch biomorphic programmable polymers for tissue repair, aiming for commercialization in 2024.