Market Overview

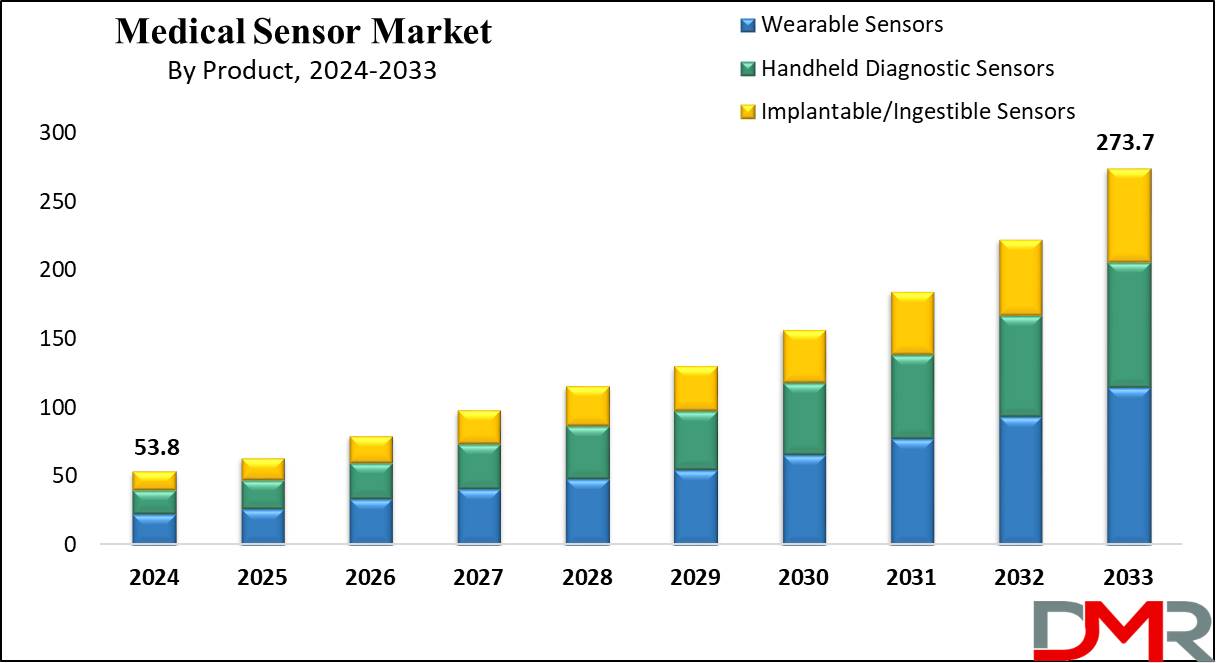

The Global Medical Sensor Market is expected to reach a value of USD 53.8 billion by the end of 2024, and it is further anticipated to reach a market value of USD 273.7 billion by 2033 at a CAGR of 19.8%.

Medical sensors play a major role in healthcare by supporting the collection of large data essential for therapy, diagnosis, and monitoring. They are widely integrated into

medical devices such as imaging systems, wearable gadgets, implants, and vital sign monitors.

Moreover, the rise in digital health adoption and remote health monitoring systems is driving market demand, especially for wearable medical devices like activity trackers and continuous glucose monitors.

Further, the rise in the adoption of medical sensors is driven by their ability to allow faster and more accurate detection, treatment, and management of health conditions.

Also, the rising demand for both simple and advanced monitoring & diagnostic devices—including blood pressure monitoring devices, pulse oximeters, and diabetes care devices—is expected to further support the usage of medical sensors in the healthcare sector.

Integrated into technologies like anesthesia delivery systems, infusion pumps, insulin delivery devices, laparoscopy tools, and cardiac pumps, medical sensors contribute significantly to improving patient care and outcomes.

Key Takeaways

- Market Growth: The Medical Sensor Market size is expected to grow by 210.3 billion, at a CAGR of 19.8% during the forecasted period of 2025 to 2033.

- By Product: The Wearable Sensors segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Application: The Chronic illness & at-risk monitoring application is expected to lead the Medical Sensor market in 2024

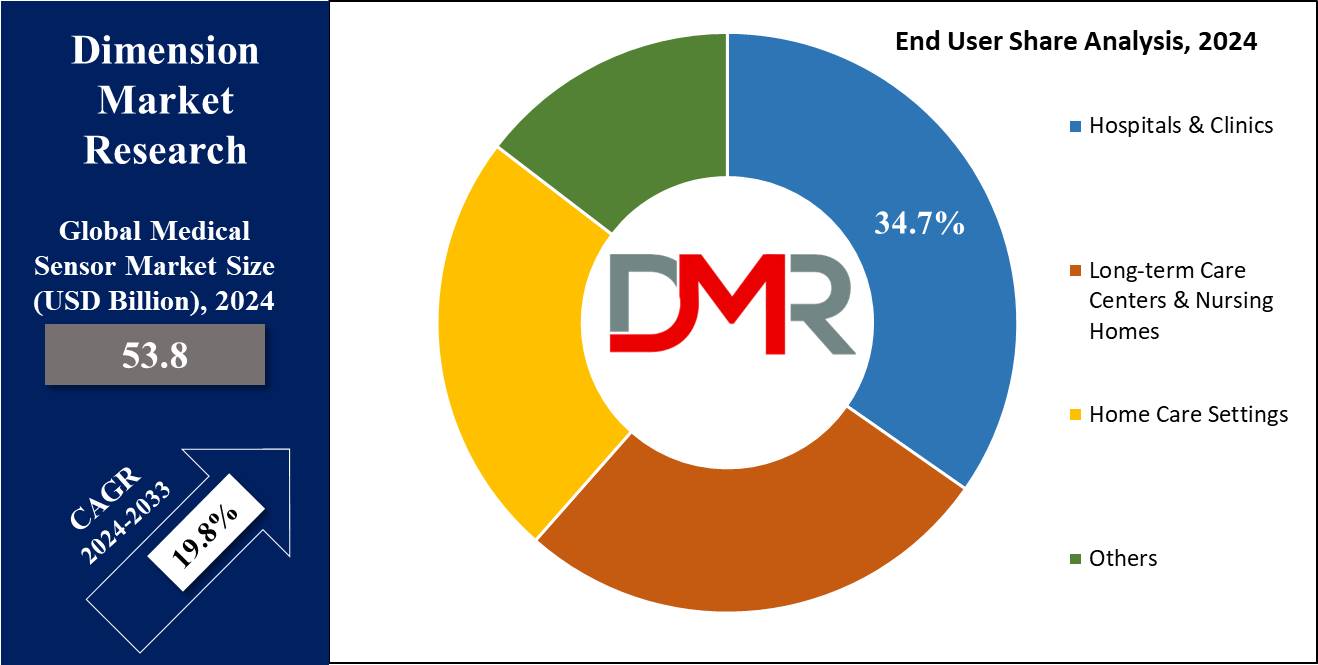

- By End User: The hospital & clinics segment is expected to get the largest revenue share in 2024 in the Medical Sensor market.

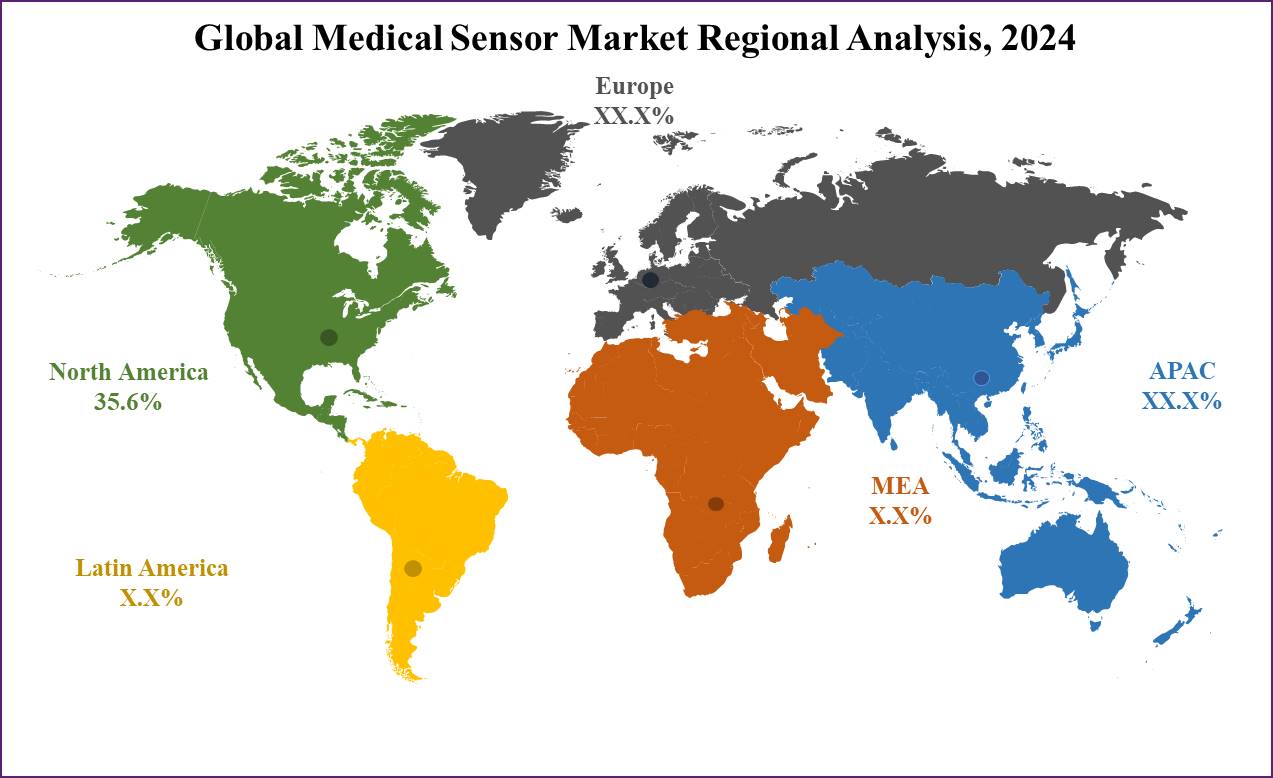

- Regional Insight: North America is expected to hold a 35.6% share of revenue in the Global Medical Sensor Market in 2024.

- Use Cases: Some of the use cases of Medical Sensor include product vital signs monitoring, diagnostic assistance, and more.

Use Cases

- Vital Signs Monitoring: Medical sensors are used to constantly monitor critical signs like heart rate, blood pressure, respiratory rate, and body temperature. This includes advanced blood sensors, pulse oximeters, and wearable cardiac monitoring and cardiac rhythm management devices that provide clinicians with live data for timely intervention.

- Remote Patient Monitoring: With the development of telemedicine and mHealth platforms, wearable and implantable sensors enable home healthcare and remote patient engagement solutions, reducing hospital visits and improving patient quality of life.

- Diagnostic Assistance: Medical sensors support digital health & healthcare analytics through accurate and objective data. Devices like insulin pumps, sleep apnea devices, and advanced medical robotic systems enhance diagnostic and therapeutic capabilities.

- Rehabilitation and Wellness: Motion sensors and wearable fitness technology—such as wearable activity trackers—are increasingly adopted in smart healthcare products for rehabilitation, chronic disease tracking, and wellness programs.

Market Dynamic

Driving Factors

Advancements in Healthcare Technology

Constant innovations in healthcare technology drive the need for more advanced medical sensors. These sensors allow better monitoring, diagnosis, and treatment, creating better patient outcomes and driving market growth.

Rising Healthcare Awareness and Aging Population

With the rise in awareness about health and wellness, along with a growing aging population globally, there's a high demand for medical sensors to monitor chronic conditions and age-related health issues, which fuels the expansion of the medical sensor market as healthcare becomes more customized and preventive.

Opportunities

Expansion of Telemedicine and Remote Monitoring

The rise in the adoption of telemedicine & remote patient monitoring provides a major opportunity for medical sensor manufacturers. As healthcare systems globally use digital health solutions, there's a high need for sensors that can precisely collect and transmit patient data remotely, improving accessibility and convenience for both patients & healthcare providers.

Emerging Markets and Untapped Potential

Emerging markets provide several growth opportunities for medical sensor companies. Factors like higher healthcare investments, growing disposable incomes, and higher access to healthcare services in regions like Asia-Pacific, Latin America, and Africa create a productive environment for the adoption of medical sensor technologies. Moreover, addressing unmet healthcare needs in these markets provides opportunities for innovation and market expansion.

Restraint Factors

Stringent Regulatory Compliance

Compliance with strict regulatory standards, like FDA approvals in the United States and CE marking in Europe, constructs a major restraint. Meeting these standards adds time and costs to product development, potentially slowing down market entry and enhancing operational expenses for medical sensor manufacturers.

Data Privacy and Security Concerns

As medical sensors collect sensitive patient data, concerns about data privacy and security provide a restraint to market growth. Ensuring strong data encryption, compliance with privacy regulations, and protection against cyber threats are important challenges that must be looked into to maintain patient trust and regulatory compliance.

Trends

Integration with Artificial Intelligence (AI)

There's an increase in the trend of integrating medical sensors with AI algorithms, which enhances sensor capabilities in analyzing complex data patterns, improving diagnostic accuracy, and allowing predictive healthcare analytics, ultimately causing more personalized and efficient patient care.

Wearable Health Technology

The adoption of wearable health technology constantly rises, driving the need for medical sensors embedded in devices like smartwatches, fitness trackers, and health monitoring wearables. These sensors allow constant health monitoring outside clinical settings, empowering individuals to easily manage their well-being and supporting remote patient monitoring initiatives.

Research Scope and Analysis

By Type

Heart rate sensors are expected to dominate the global medical sensor market in 2024, mainly attributed to their major role in patient health monitoring. These sensors are important in calculating heart rates and identifying irregular heart rhythms, critical for patients, mainly those struggling with cardiovascular diseases (CVD).

Given that CVD remains the major cause of death across the world, with about half of adults afflicted in the US, the demand for continual heart rate monitoring is soaring. Further, as per the American Heart Association, by 2035, it's anticipated that over 130 million adults in the U.S. will suffer from CVD, supporting the strong growth trajectory of this segment.

Further, the temperature sensors segment is anticipated to show the highest growth during the forecast period, which can be said due to the increase in the adoption of health monitoring practices.

Temperature sensors play a major role in measuring and tracking body temperature, enabling early detection of fever, cold, and other temperature-related anomalies. With the growth in hospitalization rates driven by the rise in chronic diseases and the broad consumption of advanced medical technologies, the need for temperature sensors is expected to witness a major growth in the coming years.

By Product

The wearable sensors segment is expected to seize the largest market share of the medical sensor market in 2024, driven by its major role in allowing devices to monitor patients' physiological and motion activities.

These sensors are smoothly integrated into clothing, shoes, and wristbands, or directly attached to the body, supporting the tracking and recording of many healthcare indicators like pulse, blood pressure, and calorie intake.

With the ongoing application of big data analytics, wearable sensors are highly used in long-term monitoring to predict and prevent medical emergencies and boost their demand. Moreover, higher R&D investments and collaborative ventures among industry players are expected to further support the adoption of wearable sensor devices, driving market growth.

Further, the implantable/ingestible sensor segment is anticipated to show major growth throughout the forecast period, as known for their high accuracy, miniaturization, and safety, these sensors meet various medical applications, like localized drug delivery, deep brain stimulation, and cochlear implants.

However, strict regulatory mandates regarding biocompatibility create a significant challenge, potentially impacting the industry's expansion. Yet, the inherent advantages of implantable/ingestible sensors in providing accurate healthcare solutions are expected to sustain their growth momentum in the coming future.

By Technology

Among the various technologies, the medical sensor market is categorized as wearable, implantable, ingestible, non-invasive, invasive, and minimally invasive, whereas the minimally invasive segment comes out with the fastest growth prospects in the forecast period, which is driven by a collective emphasis on enhancing patient outcomes, evident through lower recovery times, shorter hospital stays, and lower incisions facilitated by less invasive medical procedures.

The segment's transformative impact extends across the entire medical sensor market, driving the growth in adoption rates as healthcare providers highly recognize the benefits and efficiencies offered by minimally invasive techniques.

By Application

Chronic illness & at-risk monitoring emerged as the major applications driving the medical sensor market in 2024, claiming the largest revenue share, which comes from the growth in the number of chronic diseases and the growing demand for point-of-care testing solutions.

Diseases like diabetes require meticulous monitoring to gauge progression or regression, driving the availability of diverse devices developed to monitor patient activities and assess associated health risks.

Further, the sensor therapeutics segment is expected to exhibit the fastest growth throughout the forecast period. Development in sensor technologies has revolutionized live monitoring of many health parameters, supporting their increase in adoption in medical applications.

Moreover, the higher emphasis on preventive healthcare practices, along with the increasing incidence of chronic diseases, drives the demand for health sensors, positioning the sensor therapeutics segment for higher expansion.

By End User

The hospitals & clinics segment is expected to emerge as the leading end-user in the medical sensor market in 2024 by capturing the largest revenue share. These healthcare facilities act as a diverse patient population, providing a wide array of medical services with the help of a strong technical staff.

The segment's growth is mainly due to the rise in the adoption of advanced medical technologies and the higher patient inflow. Within hospitals, health sensors play a major role in both general wards and intensive care units, supporting constant monitoring of patients' vital signs like oxygen saturation, respiration rate, blood pressure, and heart rate, thus improving patient care and management.

Further, the long-term care centers & nursing homes segment is expected to witness the fastest growth during the forecast period, which is attributed to the growth in the geriatric population and the rise in the number of chronic diseases like heart problems, Alzheimer’s disease, and cancer. Health sensors provide many benefits in these settings, allowing continuous monitoring of patients and contributing to better health outcomes in long-term care settings.

The Medical Sensor Market Report is segmented based on the following

By Type

- Temperature Sensors

- Pressure Sensors

- Blood Glucose Sensors

- Blood Oxygen Sensors

- Electrocardiogram (ECG) Sensors

- Motion Sensors

- Image Sensors

- Flow Sensors

- Heart Rate Sensors

- Others

By Product

- Handheld Diagnostic Sensors

- Chronic illness & at-risk monitoring

- Patient admission triage

- Logistical tracking

- In-hospital clinical monitoring

- Post-acute care monitoring

- Wearable Sensors

- Disposable wearable sensors

- Non-disposable wearable sensors

- Wellness monitoring

- Chronic illness & at-risk monitoring

- Patient admission triage

- Logistical tracking

- In-hospital clinical monitoring

- Sensor therapeutics

- Post-acute care monitoring

- Implantable/Ingestible Sensors

- Wellness monitoring

- Chronic illness & at-risk monitoring

- Patient admission triage

- In-hospital clinical monitoring

- Sensor therapeutics

- Post-acute care monitoring

By Technology

- Wearable

- Implantable

- Invasive

- Non-Invasive

- Minimally Invasive

- Ingestible

By Application

- Handheld Diagnostic Sensors

- Chronic Illness & At Risk-Monitoring

- Wellness Monitoring

- Patient Admission Triage

- Logistical Tracking

- In Hospital Clinical Monitoring

- Sensor Therapeutics

- Post-Acute Care Monitoring

By End User

- Hospitals & Clinics

- Long-term care centers & Nursing homes

- Home Care Settings

- Others

Regional Analysis

North America emerged as the dominant force in the medical sensor market, claiming over 35% of the revenue share, which is due to the region's advanced healthcare infrastructure, increase in healthcare expenditure, and the presence of key industry players.

In addition, North America's higher adoption of advanced technologies further enhances its position as the most developed health sensor sector globally. The United States, mainly, leads this growth, promoting a thriving healthcare industry characterized by major investments in R&D.

Also, the nation acts as a hub for major companies & startups in the health sensor sector, benefiting from a favorable ecosystem comprising advanced technology, specialized healthcare infrastructure, and a skilled workforce.

Also, the country's steady commitment to technological development in healthcare, along with a favorable regulatory landscape, drives the constant development and adoption of health sensor solutions.

Further, Europe secured the second-largest market share in 2024, driven by higher demand for healthcare sensors and supportive central data management systems. Factors like the higher geriatric population and the increase in the number of diseases further contribute to market growth in the region.

Meanwhile, the Asia Pacific region is expected to witness the fastest growth during the forecast period. The rise in the number of cardiac diseases, mainly in countries like India and China, has boosted the demand for health sensor equipment.

Also, the region holds significant diabetes rates, with projections indicating a substantial increase in affected individuals by 2045, which, along with the presence of major companies in the region, drives its share in the global medical sensor market

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global medical sensor market features a competitive landscape characterized by many players competing for market share. Leading competitors use higher R&D capabilities to introduce innovative sensor technologies meeting various healthcare applications.

In addition, strategic collaborations, partnerships, and mergers allow companies to expand their product portfolios and enhance their market presence. Market essential prioritizes customer-centric approaches, focusing on product quality, reliability, and regulatory compliance to maintain competitive advantages.

With the constant evolution of healthcare technology and the rising need for advanced sensor solutions, competition in the global medical sensor market is expected to intensify, driving further innovation and market growth.

Some of the prominent players in the Global Medical Sensor Market are

- Honeywell International Inc

- GE Healthcare

- Stryker Corporation

- Hologic Inc

- Medtronic Plc

- Smith Medical Inc

- Siemens AG

- STMicroelectronics NV

- Omron Corporation

- NXP Semiconductors

- Other Key Players

Recent Developments

- In March 2024, Stryker announced to expansion of its prototype and testing facility in India, as it marks a major growth of its R&D footprint in the country, with an advanced 55,600-square-foot facility that integrates advanced infrastructure, improves microbiology capabilities, and a talented team to drive innovation and ensure product quality across its medical technology portfolio.

- In February 2024, Researchers from the Indian Institute of Technology, Guwahati successfully developed an affordable, gel-based wearable device that is capable of recording motion signals. The Organohydrogel sensor, placed on the bodies of patients in comatose states or experiencing similar conditions, through a wireless device and a smartphone can monitor subtle movements over an extended period, which provides healthcare professionals with invaluable insights into patient conditions and appropriate interventions can be taken.

- In January 2024, Medtronic plc announced CE (Conformité Européenne) Mark approval for the MiniMed 780G system with Simplera Sync, a disposable, all-in-one constant glucose monitor (CGM) needing no fingersticks or overtape. Simplera Sync features an enhanced user experience with a simple, two-step insertion process and is half the size of previous Medtronic sensors.

- In December 2023, Neuranics announced the introduction of a new magnetic sensor development kit, which is developed to record the heart’s magnetic activity and transmit it wirelessly through Bluetooth for round-the-clock recording and analysis on a smartphone, tablet, or laptop. Having a single point of contact on the body or through thin clothing, the company’s magnetocardiography (MCG) sensor can replace current three-lead electrocardiography (ECG) sensors for usage in medical monitoring devices and sports fitness devices.

- In March 2023, Medtronic and NVIDIA announced a partnership to expand the development of AI in the healthcare system & bring new AI-based solutions into patient care. An integration with NVIDIA Holoscan a live AI computing software platform processing on-spot data at the edge developed for building medical devices and NVIDIA IGX an industrial-grade edge AI hardware platform.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 53.8 Bn |

| Forecast Value (2033) |

USD 273.7 Bn |

| CAGR (2024-2033) |

19.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Temperature Sensors, Pressure Sensors, Blood Glucose Sensors, Blood Oxygen Sensors, Electrocardiogram (ECG) Sensors, Motion Sensors, Image Sensors, Flow Sensors, Heart Rate Sensors, and Others), By Product (Handheld Diagnostic Sensors, Wearable Sensors, and Implantable/Ingestible Sensors), By Technology (Wearable, Implantable, Invasive, Non-Invasive, Minimally Invasive, Ingestible), By Application (Handheld Diagnostic Sensors, Chronic Illness & At Risk-Monitoring, Wellness Monitoring, Patient Admission Triage, Logistical Tracking, In Hospital Clinical Monitoring, Sensor Therapeutics, Post-Acute Care Monitoring), By End User (Hospitals & Clinics, Long-term care centers & Nursing homes, and Home Care Settings, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Honeywell International Inc, GE Healthcare, Stryker Corporation, Hologic Inc, Medtronic Plc, Smith Medical Inc, Siemens AG, STMicroelectronics NV, Omron Corporation, NXP Semiconductors, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The Global Medical Sensor Market size is estimated to have a value of USD 53.8 billion in 2024 and is expected to reach USD 273.7 billion by the end of 2033.

North America is expected to have the largest market share in the Global Medical Sensor Market with a share of about 35.6% in 2024.

Some of the major key players in the Global Medical Sensor Market are Honeywell International Inc, GE Healthcare, Stryker Corporation, and many others.

The market is growing at a CAGR of 19.8 percent over the forecasted period.