Market Overview

Global

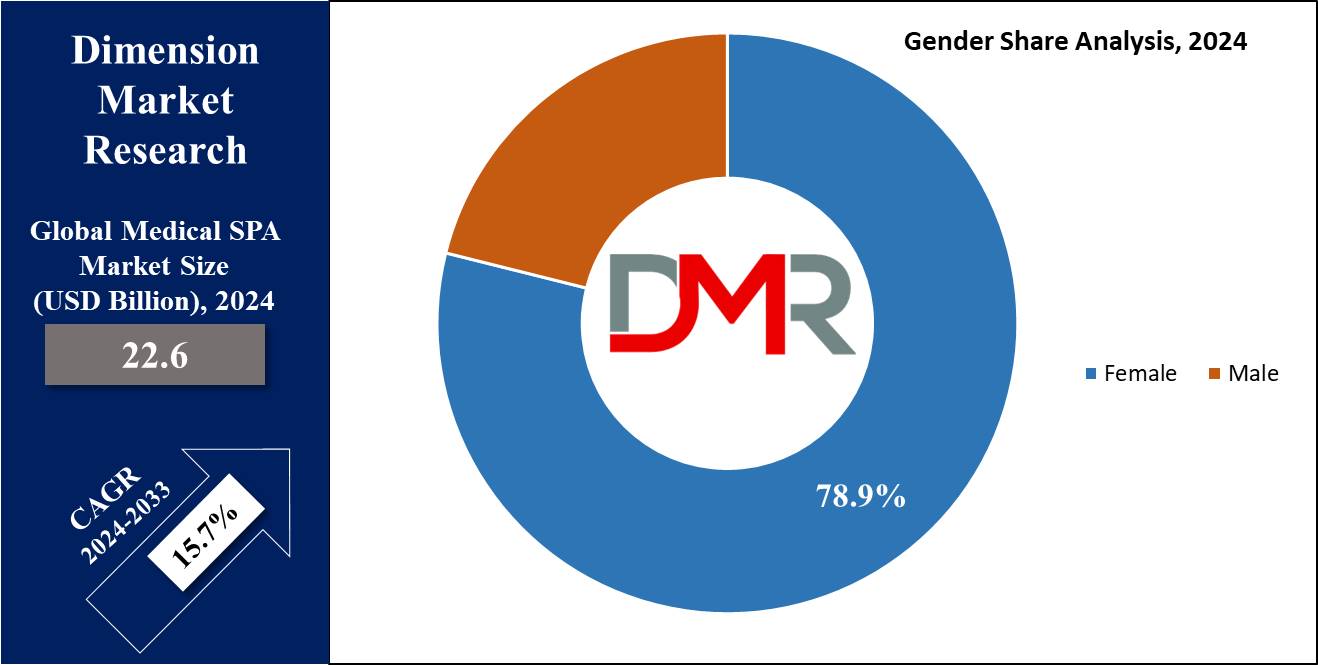

Medical SPA Market is forecasted to reach

USD 22.2 billion by the end of 2024 and grow to

USD 83.9 billion in 2033, with a

CAGR of 15.7%.

A medical spa, often referred to as a med spa, is a hybrid between a traditional day spa and a medical clinic. It offers a range of cosmetic and aesthetic treatments that are typically performed under the supervision of licensed healthcare professionals, such as doctors, nurse practitioners, or physician assistants. The growth of the market can be linked to increasing consumer awareness of self-care and anti-aging services, along with the rapid expansion of the wellness tourism industry.

According to the American Med Spa Association, there is a notable demand for minimally invasive treatments, which include options like chemical peels, non-surgical skin tightening, body sculpting, and tattoo removal. Furthermore, the rising popularity of wellness-themed vacations, often offered as part of wellness packages at hotels, plays a significant role in driving the demand for these services.

The US Medical SPA Market

The US Medical SPA Market is projected to reach USD 8.0 billion by the end of 2024 and grow substantially to an expected USD 27.7 billion market by 2033 at an anticipated CAGR of 14.7%.

The U.S. medical spa market is driven by increasing consumer demand for non-invasive cosmetic procedures and a growing focus on overall wellness. The rise in disposable income and the aging population seeking age-defying treatments contribute significantly to market growth.

Some of the trends include a shift towards personalized treatment plans tailored to individual needs and preferences. There is also a growing emphasis on holistic wellness, integrating traditional spa treatments with medical procedures.

Key Takeaways

- Market Growth: The global Medical SPA market is anticipated to expand by USD 58.1 billion, achieving a CAGR of 15.7% from 2025 to 2033.

- Market Definition: Medical SPA combines traditional spa treatments with medical procedures supervised by licensed healthcare professionals.

- Service Analysis: Facial Treatment is anticipated to dominate the Medical SPA market with a high revenue share of 55.2% in 2024.

- Gender Analysis: The female segment is expected to lead the Medical SPA market with a revenue share of 78.9% in 2024.

- Age Analysis: The adult group is expected to lead the market with a revenue share of 73.2% in 2024.

- Service provider Analysis: Single ownership is predicted to lead the market with a revenue share of 40.1% in 2024.

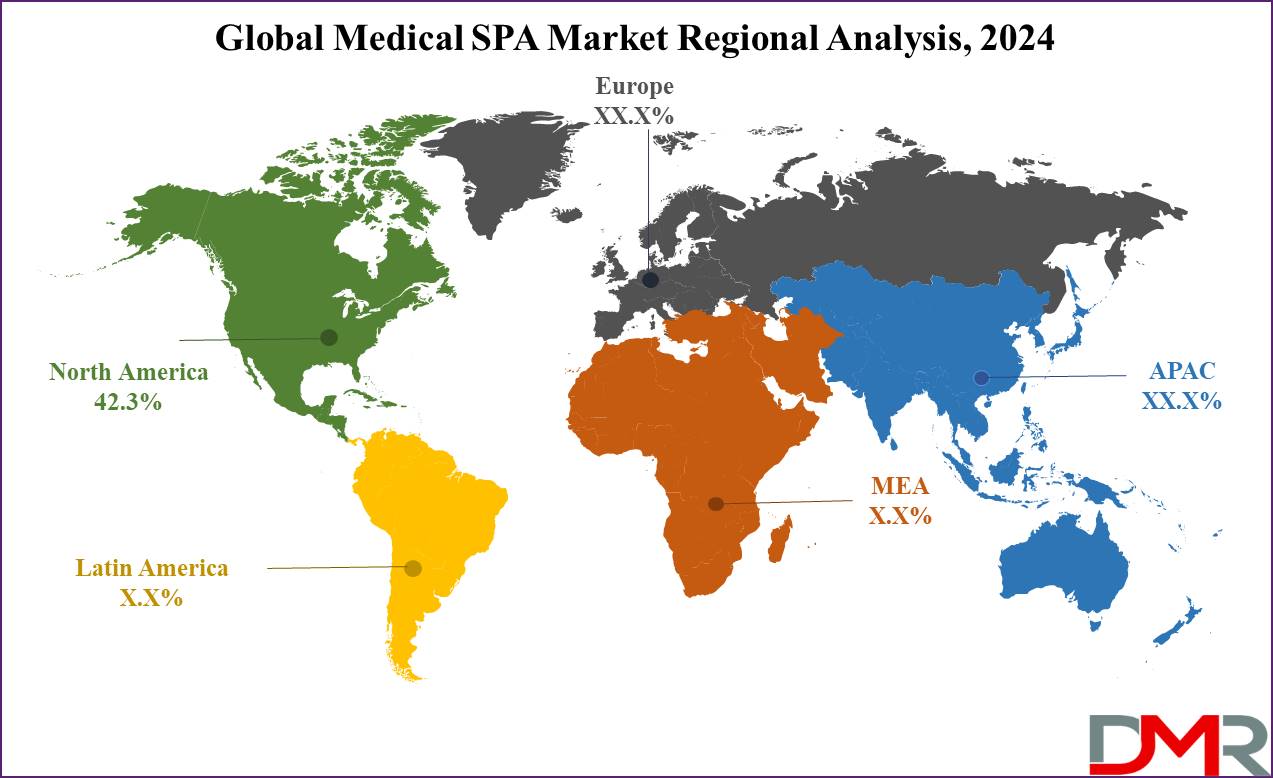

- Regional Analysis: North America is projected to dominate the global Medical SPA market, holding a market share of 42.3% by 2024.

Use Cases

- Anti-Aging Treatments: Medical spas offer a range of anti-aging services such as Botox, dermal fillers, and chemical peels which help reduce wrinkles, fine lines, and age spots, allowing clients to achieve a youthful appearance.

- Skin Rejuvenation and Resurfacing: Many med spas specialize in skin rejuvenation techniques like laser therapy, microdermabrasion, and photo facials which can address skin concerns such as acne scars, pigmentation issues, and uneven skin tone.

- Wellness and Relaxation Therapies: Medical spas frequently offer wellness therapies, including massage, aromatherapy, and hydrotherapy which promote relaxation, stress relief, and overall well-being.

- Hair Restoration Treatments: Medical treatments are designed to stimulate hair growth and improve hair density for individuals experiencing hair thinning or loss, providing a non-surgical solution to a common concern.

Market Dynamic

Drivers

Increasing Demand for Beauty TreatmentsA major driving force behind the growth of the medical spa market is growing consumer interest in non-invasive & minimally invasive aesthetic treatments. Several treatments, such as Botox, dermal fillers, laser hair removal, & chemical peels, are very popular today since people have started to abandon surgical treatments due to their fast recovery speed. In addition, social networking and an aging population contribute to increasing the desire for these treatments, and demand for such treatments in a pharmacy has risen significantly.

Cosmetic Technology

The other major driving force for the medical spa market is the rapid development of cosmetic technology. Achievements with regard to the developments in laser therapy, radio frequency devices, and skin rejuvenation extend services provided by medical spas. Such technologies lying at the heart of the treatments increase their efficiency while providing greater safety and comfort to the patients. Thanks to modern equipment, services offered by medical spas allow one to provide individual procedures according to skin type and aesthetic goals.

Restraints

High Cost of Advanced Equipment and Technology

A significant challenge faced by medical spas is the substantial expense associated with acquiring and maintaining advanced medical and aesthetic equipment. Devices used for procedures like laser therapy, body contouring, and skin tightening entail a considerable upfront investment as well as ongoing maintenance costs. This financial burden can hinder smaller, innovative spas from competing with larger, established facilities.

Risks Associated with Non-Surgical Procedures

The medical spa market faces significant restraints due to the inherent risks linked to non-surgical procedures. While treatments like Botox and laser therapies are generally safe, potential side effects such as allergic reactions, infections, or undesirable results can deter consumers.

Opportunities

Growth of Medical Tourism

Medical tourism is experiencing rapid growth and gaining global attention, driven by active government involvement and strategic business initiatives aimed at defining, organizing, and promoting this sector. Medical spas and aesthetic treatments are essential components of the medical tourism industry.

Countries with established public-private partnerships, including associations and medical tourism cluster networks, are enhancing their capabilities in this field. Additionally, the increasing number of healthcare facilities obtaining international accreditation to ensure patient safety and quality care is expected to create significant opportunities throughout the forecast period.

Targeted Marketing Strategies for Medical Spas

Targeted marketing strategies are essential for medical spas to attract and engage potential clients. Social media platforms like Instagram and TikTok are particularly effective for reaching younger demographics, allowing spas to showcase treatments through visually appealing content. Sharing before-and-after photos and client testimonials can enhance engagement and foster community.

Trends

Integrating Wellness and Holistic Services

Medical spas are fast embracing wellness and holistic services due to the increasing demand for integrated mental and physical healthcare. Most spas these days complement beauty treatments with wellness interventions such as nutrition counseling, detoxification therapies, and stress management programs. It is this broadening of offerings from mutual products of beauty and wellness that keeps distinguishing medical spas from other traditional spas. Their attendant clientele is broadly based, both physically and mentally.

Personalized Treatment Planning

A Medical spa will be able to provide more beneficial solutions for specific skin types and conditions, as well as aesthetic aspirations, supported by AI-powered skin analysis and prediction algorithms. Equally, data analytics helps to track the outcomes of treatments and ensures patient satisfaction. As customers look for more personalized experiences, AI diagnosis and treatment planning become a competitive advantage to medical spas by improving customer satisfaction and retention.

Research Scope and Analysis

By Service

It is expected that the facial treatment segment will continue to dominate the medical SPA market with 55.2% market share of the total revenue in 2024, due to rising demand for Botox and other anti-aging treatments like dermal fillers. Facial treatments will further remain the largest segment, pushed forward by increasing awareness about skincare and a growing trend toward anti-aging with a preference for non-invasive procedures.

These procedures are in great demand because people want to appear young. Medical-grade procedures that are famous among people include chemical peels, microdermabrasion, & laser therapies. The usual skin problems targeted in these treatments are wrinkles, acne, & hyperpigmentation. Also, advancements in technology allow for more effective & customized facial treatments, making the procedures accessible to a wide demographic, ranging from younger patients seeking prevention to older clients who seek rejuvenation.

The body shaping and contouring segment is the second most dominating in the medical spa market after facial treatment. This segment is enhanced due to the rising demand for non-invasive fat reduction and body sculpting procedures, such as CoolSculpting, SculpSure, and ultrasound-based therapies.

By Gender

Females are expected to account for 78.9% of revenue in the medical spa market by 2024, due to being primary customers and thus driving additional services targeted specifically towards them. Botox and dermal injection treatments have become incredibly popular among women looking to enhance their appearance and build up their self-confidence, with many opting for facial enhancement treatments such as Botox.

These noninvasive liposuction alternatives allow clients to reduce stubborn fat without surgery, scarring, or long recovery periods. Rising fitness and wellness cultures combined with increasing interest in improving body aesthetics following weight loss or pregnancy have fueled increased interest in these services. Male consumers are projected to see significant compound annual compound annual growth from 2024-2033.

Men have taken to these treatments more and more as they recognize their numerous wellness and relaxation benefits, prompting more industry players to offer tailored skincare products and services designed specifically for them. In turn, more male customers and targeted marketing strategies should drive this segment's expansion further.

By Age

Adults are expected to dominate the medical SPA market with a revenue share of 73.2 percent by 2024, driven in large part by social media influences that drive increasing facial treatment demands among adolescents. Adults typically prioritize maintaining their appearance, managing early signs of aging, and treating skin conditions seen during adulthood - fine lines, wrinkles, sun damage, or acne scarring being among them.

Teenagers have increasingly adopted anti-aging products into their beauty regimen and non-surgical scar revision treatments to achieve a more even and non-pigmented skin tone. Adults tend to be more aware of the advantages offered by medical-grade aesthetic treatments like Botox, fillers, laser therapies, and chemical peels; all popularly offered at medical spas.

Adults typically lead busy lifestyles and prefer noninvasive, quick recovery treatments with limited downtime to return to daily tasks quickly and comfortably. The geriatric age group dominates the medical spa market due to an increasing interest in anti-aging treatments, and as people live longer many seek ways to maintain a youthful appearance by improving skin texture, elasticity, and overall health.

By Service Provider

Single-ownership facilities are projected to account for 40.1% of revenue by 2033 and experience the greatest compound annual growth from 2024 to 2033. They comprise small medical spa facilities equipped with modern technologies. Single-owner medical spas often provide more personalized and customer-centric experiences, with owners becoming heavily engaged with day-to-day operations to ensure excellent service quality and personalized treatments designed to address specific client needs.

Customers seeking personalized aesthetic treatments such as Botox and dermal fillers benefit from a more hands-on approach, especially those seeking individualized attention such as Botox. Furthermore, due to increasing burnout rates and declining reimbursement rates for physicians' services, increasing numbers have taken on roles of medical spa directors or sole owners for greater flexibility and quicker decision-making capabilities. This type of ownership offers greater freedom while simultaneously expediting decision-making processes.

Owners can easily adapt their services, introduce new treatments, and respond to customer feedback without dealing with corporate bureaucracy, making their businesses more agile in a competitive market. Group ownership is the second most dominant segment in the medical spa market. Group-owned medical spas benefit from shared resources, including marketing, administrative support, and pooled financial investments.

The Medical SPA Market Report is segmented on the basis of the following

By Service

- Facial Treatment

- Body Shaping & Contouring

- Hair Removal

- Scar Revision

- Tattoo Removal

- Others

By Gender

By Age

- Adolescent

- Adult

- Geriatric

By Service Provider

- Single Ownership

- Group Ownership

- Free-standing

- Medical Practice Associated Spas

Regional Analysis

North America is predicted to dominate the Medical SPA market with a revenue share of

42.3% in 2024, due to demand for wellness and luxury beauty treatments. Such services, required and yearned for improved health and appearance, including BOTOX and dermal fillers, are hence in demand and are willing to be paid for by people in this region.

Advanced technologies, skilled professionals comprising licensed dermatologists and estheticians, and a strong healthcare infrastructure are some of the strengths of North America. This thus enables various medical centers to offer a wide range of cosmetic procedures, both non-invasive and minimally invasive. Besides skincare and aesthetic device manufacturing companies, many leading global medical SPA chains and companies are headquartered in North America.

This strong corporate presence aids in the development and dissemination of new treatments and technologies. The market in the Asia Pacific region is growing at the fastest rate due to its rapidly expanding middle class in South Asian countries. With strong cultural focuses on beauty, many consumers in the region opt for non-invasive procedures to improve their appearance.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The medical SPA market is highly competitive, with a mix of established players and emerging companies offering a wide range of services. Several leading companies are acquiring smaller or niche players to broaden their service portfolio and geographic presence. For instance, luxury spas often integrate medical services like injectables and laser treatments to cater to the growing demand for non-invasive procedures.

Some medical spas are partnering with cosmetic companies, wellness brands, or healthcare providers to enhance the range and quality of services. Collaborations help brands offer comprehensive beauty and wellness packages, strengthening customer retention.

Some of the prominent players in the global medical SPA market are

- Chic La Vie Med Spa

- Clinique La Prairie

- Kurotel-Longevity Medical Center and Spa

- Lanserhof

- The Orchard Wellness Resort

- Biovital Medspa LLC

- Allure Medspa

- Longevity Wellness Worldwide

- Serenity Medspa

- Vichy Celestins Spa Hotel

- Brenners Park-Hotel & Spa

- SHA Wellness Clinic

- Other Key Players

Recent Development

- In April 2024, JEUNESSE unveiled a cutting-edge HydraFacial treatment at its Jeunesse Medical Spa locations in Holmdel and Old Bridge, United States.

- In January 2024, Empower Aesthetics, a national platform for medical aesthetics, announced a partnership with DermaTouch RN, a prominent medical aesthetic practice with locations in Houston and San Antonio, Texas, as well as AW Skin Co., a well-respected medical spa and wellness center with three sites in Cool Springs, Franklin, and Murfreesboro, Tennessee.

- In November 2023, MD Esthetics completed the acquisition of Medical Aesthetics of New England (MANE), a well-established medical spa operating two locations in Acton and Fitchburg, Massachusetts.

- In November 2023, SHA Wellness Clinic revealed plans to open its first international location in Mexico in January 2024, marking the initial phase of its global expansion strategy, which will include an Abu Dhabi site in 2025.

- In January 2023, Chiva Som launched an online program for naturopathic and nutritional consultations aimed at children, reflecting its commitment to holistic health by providing tailored wellness guidance for younger individuals.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 22.2 Bn |

| Forecast Value (2033) |

USD 83.9 Bn |

| CAGR (2024-2033) |

15.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 8.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Service (Facial Treatment, Body Shaping & Contouring, Hair Removal, Scar Revision, Tattoo Removal, and Others), By Gender (Male, and Female), By Age (Adolescent, Adult, and Geriatric), By Service Provider (Single Ownership, Group Ownership, Free-standing, Medical Practice Associated Spas) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Chic La Vie Med Spa, Clinique La Prairie, Kurotel-Longevity Medical Center and Spa, Lanserhof, The Orchard Wellness Resort, Biovital Medspa LLC, Allure Medspa, Longevity Wellness Worldwide, Serenity Medspa, Vichy Celestins Spa Hotel, Brenners Park-Hotel & Spa, SHA Wellness Clinic, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Medical SPA Market size is estimated to have a value of USD 22.6 billion in 2024 and is expected to reach USD 83.9 billion by the end of 2033.

North America is expected to be the largest market share for the Global Medical SPA Market with a share of about 42.3% in 2024.

Some of the major key players in the Global Medical SPA Market are Chic La Vie Med Spa, Clinique La Prairie, and Lanserhof, and many others.

The market is growing at a CAGR of 15.7 percent over the forecasted period.

The US Medical SPA Market size is estimated to have a value of USD 8.0 billion in 2024 and is expected to reach USD 27.7 billion by the end of 2033.