Medical Tapes and Bandages Market Overview

The Global

Medical Tapes and Bandages Market size is expected to reach a

value of USD 8.9 billion in 2024, and it is further anticipated to reach a market

value of USD 12.8 billion by 2033 at a

CAGR of 4.2%.

The global clinical tape and bandages market grows on support from the growing incidences of chronic wounds, surgical strategies, and sports injuries. The rising prevalence of chronic diseases like diabetes and venous ulcers further boosts growth in demand for medical tapes and bandages. Product design and material innovations, such as that of advanced adhesive bandages and water-resistant medical tapes, further accelerate the growth of the market.

Again, it is this aging population and the growing number of surgical procedures undertaken worldwide that fuel growth in this marketplace. This is boasted by North America with the greatest share, aided by Europe and Asia-Pacific, both because of a well-established healthcare infrastructure and high expenditure on healthcare.

The marketplace is likely to witness a growth trend, driven by a CAGR impetus due to steady improvements in wound care technology and increased attention being paid to wound management. The growth prospects for the US medical tapes and bandages market look quite promising, mainly driving forces that include enhancements in the field of medical technology coupled with rising healthcare expenditures.

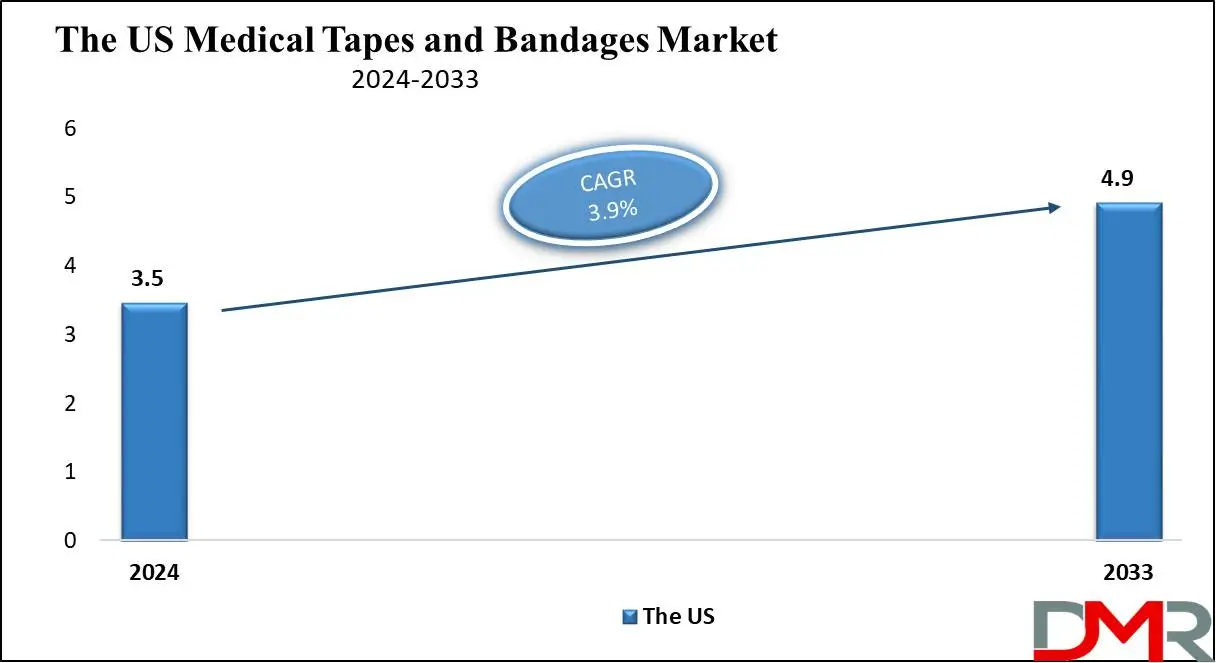

The US Medical Tapes and Bandages Market

The US medical tapes and bandages market is projected to be valued at USD 3.5 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.9 billion in 2033 at a CAGR of 3.9%.

A key trend in the US market includes the development of antimicrobial and hypoallergenic products, sensitive to patients' skin requirements. The marketplace is also witnessing upward trajectory growth for advanced wound care products, which have better curing capabilities and are more comfortable. Additionally, a higher frequency of chronic diseases like diabetes, compounded by complications like ulcers, acts as another demand driver. Other recent developments include the addition of additional eco-friendly products and furthering its distribution channels, hence increasing the accessibility of products in many healthcare settings.

Key Takeaways

- Market Value: The Global Medical Tapes and Bandages Market size is estimated to have a value of USD 8.9 billion in 2024 and is expected to reach USD 12.8 billion by the end of 2033.

- Growth Rate: The market is growing at a CAGR of 3.9 percent over the forecasted period.

- The US Market Size: The US Medical Tapes and Bandages market is projected to be valued at USD 4.9 billion in 2033 from a base value of USD 3.5 billion in 2024 at a CAGR of 3.9%.

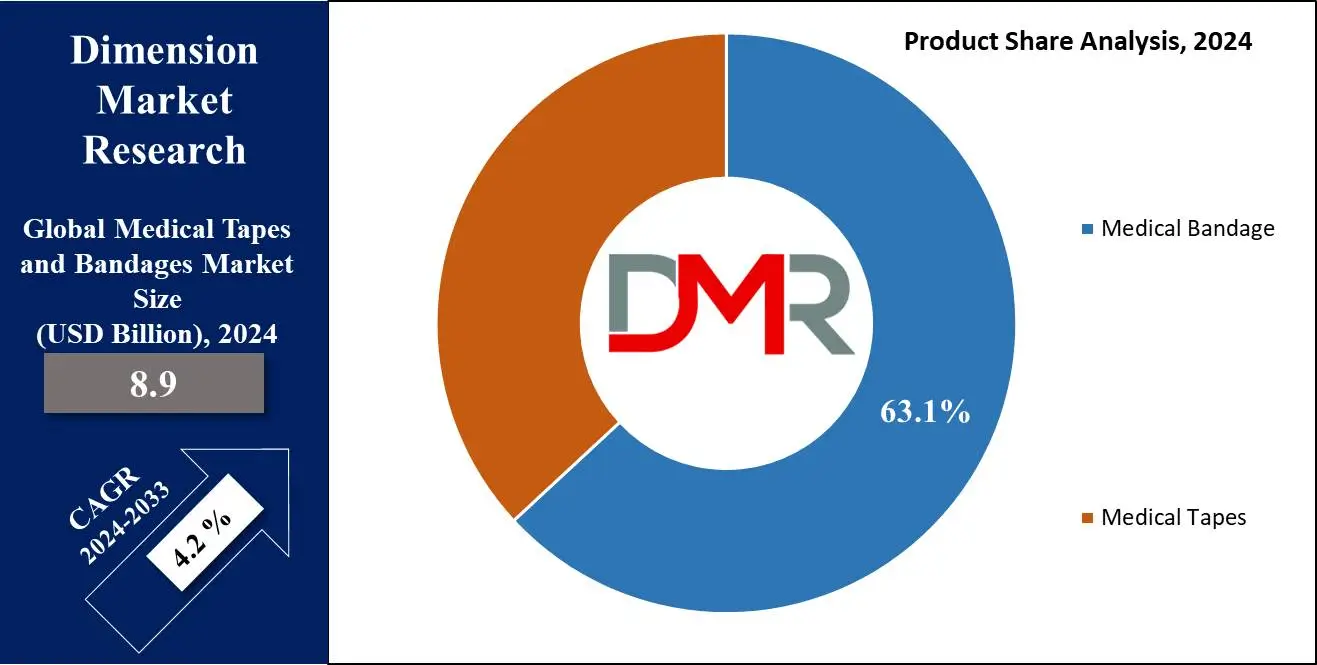

- By Product Segment Analysis: In the context of products medical bandages are projected to contain 63.1% of the market share in 2024.

- By Application Segment Analysis: In terms of application, surgical wound treatment is projected to emerge as the primary segment in this market as it will hold 28.0% of the market share by the end of 2024.

- By End User Segment Analysis: Hospitals are projected to dominate the end-user segment in the global medical tapes and bandages market as it holds the highest market share in 2024.

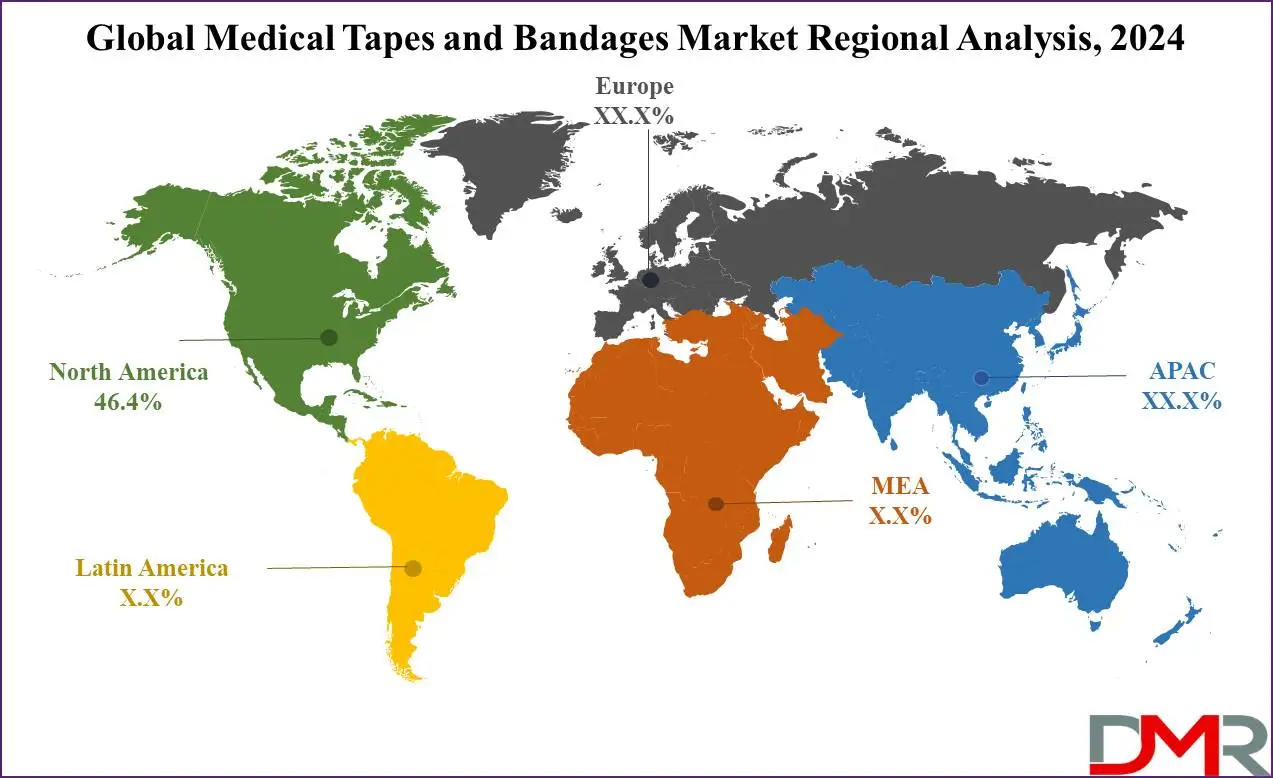

- Regional Analysis: North America is expected to have the largest market share in the Global Medical Tapes and Bandages Market with a share of about 46.4% in 2024.

Use Cases

- Surgical Wound Treatment: Medical tapes and bandages are important for post-operative wound care, ensuring safety, proper restoration, and minimizing infection risks.

- Traumatic Wound Treatment: Used in emergency care to stabilize and shield wounds like lacerations, abrasions, and punctures, facilitating faster healing.

- Ulcer Treatment: Effective in handling chronic ulcers, including diabetic and venous ulcers, with the aid of promoting a moist wound environment and stopping additional damage.

- Sports Injury Treatment: Essential for treating sprains, strains, and fractures, providing assistance, reducing swelling, and accelerating the restoration technique.

- Burn Injury Treatment: Used within the control of burn accidents by shielding the affected region, reducing pain, and preventing contamination.

Medical Tapes and Bandages Market Dynamic

Trends

Technological AdvancementsWith the launch of antibacterial and waterproof tapes, bandages have become a more premium offering in wound care management. This is in contrast to traditional materials and would otherwise reduce the elasticity of adhesives, making a more breathable adhesive conducive for patient comfort as well as having improved viscous capacity-reducing infection which can significantly accelerate healing. The healthcare sector is witnessing changes, to cater to the demand new products like biodegradable and hypoallergenic tapes are under research & development initiatives by market players.

Increased Chronic Wound IncidenceWith an increasing elderly population and prevalence of chronic diseases (such as diabetes, and obesity) in the world today there is a global increase in the incidence of chronic wounds such as diabetic ulcers, venous ulcers, and pressure sores. This trend fuels the requirement for

wound care products - including medical tapes and bandages in high amounts. In response, the market has created specialized products for effective management and treatment of these chronic wounds with successful patient outcomes improving their overall quality of life.

Growth Drivers

Aging PopulationMoreover, the rise in the geriatric population across the globe further increases the demand for medical tapes and bandages. Chronic wounds, surgical interventions, and skin conditions affecting older adults call for solutions that will provide effective wound management. Expanding the aging population bolsters demand for premium wound care products, propelling market expansion.

Rising Surgical Procedures

Thanks to the advances in medical technology and growing concern for patient health outcomes, that number has been gradually increasing worldwide. To prevent infection surgical wound infection and better healing post-operative care necessitates a large amount of medical tapes and bandages, which help expand the market. Growth in the number of procedures from small outpatient cases to big surgeries makes wound care products important.

Growth Opportunities

Emerging Markets

The medical tapes and bandages industry may face some major growth opportunities To fixate the dressing waterproof adhesive products are used, which take a long time to dry this is a restraint for future growth. Revenue-wise, these are the fastest-growing regions due to improvements in healthcare infrastructure, increasing health expenditure, and better awareness related to advanced wound care solutions. Firms are seeking to improve their reach in these markets by fostering local partnerships and developing region-specific product offerings.

Product InnovationThe introduction of innovative skin-friendly and biodegradable wound care products is further encouraging the growth of this market. Smart bandages with sensor elements for wound healing, as appreciated eco-friendly patches. Overall, patient-focused solutions are evolving rapidly. A global expansion broader than had been established before alongside promoting patient comfort and the efficacy of treatment with some of these innovations.

Restraints

High Costs Advanced medical tape and dressing are costly, limiting their usage by groups in places with a low-income level. These products have greater performance and yield positive patient outcomes; however, for these very features, they bear a higher price point and can be a barrier to widespread use in cost-sensitive markets. This cost factor can drive the market well in countries with small

healthcare budgets and few resources.

Regulatory Challenges

One of the hurdles to entering and expanding in this market is the strict regulatory regime and quality standards required for product approval. Products such as medical adhesive tapes and bandages are strictly regulated for their safety and efficacy, which significantly slows down time-to-market and raises compliance costs. At the same time, material investment in quality assurance and regulatory affairs capabilities is required to navigate through this complex and constantly shifting regulatory environment.

Medical Tapes and Bandages Market Research Scope and Analysis

By Product

In the context of products medical bandages are projected to contain 63.1% of the market share in 2024. Medical bandages account for the largest proportion within the medical tape and bandages market as they find extensive usage in any kind of wound care. The categories of bandages range from muslin, elastic, triangular, orthopedic, to specialty, depending on whether support, compression, or protection is required. Muslin bandage rolls, standard, and antibacterial are mostly used mainly due to their breathable and cost-effective nature. Elastic roll bandages have also become quite popular since they provide adjustable compression, which is sometimes key in the treatment of conditions like sprains and strains. Without orthopedic bandages, one would not have the possibility of immobilizing the injury for a healing process.

Crepe, gauze, and knitted bandages fall under the specialty category with specialized tailoring for a host of different types. Their versatility and wide applicability in medical applications make bandages indispensable in wound care management, hence driving their market. The corporate strategy, new product development in materials and design continuously, all for advancement towards improving patient comfort and outcomes in healing, ensure their leadership globally within the medical tape and bandages market.

By Application

In terms of application, surgical wound treatment is projected to emerge as the primary segment in this market as it will hold 28.0% of the market share by the end of 2024. Surgical wound treatment dominates the medical tape and bandages market because of the critical nature of effective post-operative care. Although most surgical procedures require meticulous post-operative wound care, quite a few significantly improve the ability of the patient to heal with minimal infections and scarring. Protection of surgical incisions, support, and maintenance of sterility in that area are some of the major functions performed by both medical tapes and bandages.

The rising number of surgical interventions, due to increasing aging and chronic diseases, increases the demand for quality wound care products. New developments in surgical wound care, like antimicrobial and waterproof bandages, add more to their efficiency and patient comfort. Emphasis on reducing hospital-acquired infections and improving

surgical outcomes has made surgical wound treatment a major application segment driving the medical tapes and bandages market forward. This segment will continue to dominate as the sector of advanced wound care products grows in surgical settings, impelled by the continued precedence that healthcare providers lay on patient safety and recovery.

By End User

Hospitals are projected to dominate the end-user segment in the global medical tapes and bandages market as it hold the highest market share in 2024. Hospitals dominate the market for medical tapes and bandages, driven by their full-fledged requirements for wound care and large patient numbers. Acting as the primary health provider, hospitals undertake a large number of surgeries, treat cases of trauma, and have chronic wounds that need to be treated, for which medical tapes and bandages are used continuously. It is in hospitals that advanced medical facilities and qualified healthcare experts ensure good management of wounds; this creates demand for quality products for wound care.

Besides, owing to proper infection control measures exercised in hospitals, sterile and more specialized solutions for wound care are called for. Increasing attention to safety and recovery convincingly explains the requirement for dependable wound care products within a hospital setting. Hospitals have formed and will continue to be the biggest end-use application in the medical tape and bandages market on account of the rising incidents of surgeries, trauma cases, and chronic wounds, thereby acting as drivers of growth and innovation in the area of wound care products.

The Global Medical Tapes and Bandages Market Report is segmented based on the following

By Product

- Medical Bandage

- Muslin Bandage Rolls

- Standard Muslin Bandage Rolls

- Antibacterial Muslin Bandage Rolls

- Elastic Bandage Rolls

- Triangular Bandage Rolls

- Cotton Triangular Bandages

- Non-Woven Triangular Bandages

- Orthopedic Bandage Rolls

- Elastic Plaster Bandages

- Specialty Bandages

- Crepe Bandages

- Gauze Bandages

- Knitted Bandages

- Other Bandages

- Medical Tapes

- Fabric Tapes

- Acetate

- Viscose

- Cotton

- Silk

- Polyester

- Other Fabric Tape

- Paper Tapes

- Standard Paper Tapes

- Hypoallergenic Paper Tapes

- Plastic Tapes

- Propylene

- Polyethylene

- Polyvinyl Chloride (PVC)

- Other Plastic Tapes

- Other Tapes

By Application

- Surgical Wound Treatment

- Traumatic Wound Treatment

- Lacerations

- Abrasions

- Puncture Wounds

- Contusions

- Ulcer Treatment

- Diabetic Ulcers

- Venous Ulcers

- Pressure Ulcers

- Arterial Ulcers

- Sports Injury Treatment

- Sprains and Strains

- Fractures

- Muscle Injuries

- Burn Injury Treatment

- First-Degree Burns

- Second-Degree Burns

- Third-Degree Burns

- Chronic Wound Treatment

- Non-Healing Wounds

- Infected Wounds

- Others Application

By End User

- Hospitals

- Ambulatory Surgery Center

- Clinics

- Retail

- Home Healthcare

- Others

Medical Tapes and Bandages Market Regional Analysis

North America is projected to lead the regional segment of the global medical tape and bandages market as it is anticipated to

hold 46.4% of the total market revenue by the end of 2024 and is further projected to show subsequent growth in the upcoming period of 2024 to 2033. Outfitted healthcare infrastructures and high healthcare spending in the region help maintain the use of advanced

wound care products.

Additionally, a high prevalence of chronic diseases such as diabetes and obesity that cause chronic types of wounds has been recorded. North America has managed to incorporate a significant number of surgical procedures, which also contribute to the demand for tapes and bandages in this region. The major players and the current research and development activities that take place in this region are significant for any product innovations and the growth of markets.

Moreover, rising awareness and advanced wound care products have considerably helped the market in gaining acceleration. North America's effort to improve healthcare outcomes and cut costs while doing so through proper wound care positions it at the top of the medical tape and bandage arena.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Medical Tapes and Bandages Market Competitive Landscape

3M, Johnson & Johnson, and Smith & Nephew are leading market players, offering diversified, innovative wound care products. These leaders continuously focus on research and development for the introduction of advanced wound care solutions to enhance the patient's comfort and outcome of healing, such as antibacterial and waterproof bandages. Strategic mergers and acquisitions to strengthen the product portfolio and geographical reach remain core elements of competition.

The dynamics of these smaller players and encouraging new entrants are adding to the market new niche products that specifically target certain niche wound care needs. This increasing demand for effective wound management solutions is consequently leading companies to invest in product innovations and marketing strategies that are sure to possess a larger chunk of the market share. With the current increased interest in more advanced wound care and patient-centric solutions, there is destined to be competition within the global market for medical tape and bandages, therefore resulting in new developments and possibly market growth.

Some of the prominent players in the Global Medical Tapes and Bandages Market are:

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- 3M

- McKesson Corporation

- Ethicon Inc. (JOHNSON & JOHNSON)

- B. Braun Melsungen AG

- Paul Hartmann AG

- Coloplast

- Integra Lifesciences

- Medtronic Industries

- Other Key Players

Recent Developments

2024

- June: 3M introduced a new line of eco-friendly medical tapes, focusing on sustainability and patient comfort. This development highlights 3M's commitment to environmental responsibility and innovation in wound care products, addressing the growing demand for sustainable healthcare solutions.

- May: Johnson & Johnson announced the launch of an advanced antibacterial bandage designed for faster healing of chronic wounds. This product aims to reduce infection rates and improve healing times for patients with chronic wounds, showcasing Johnson & Johnson's focus on advanced wound care technology.

- March: Smith & Nephew expanded its product portfolio with innovative waterproof bandages catering to active patients. These bandages are designed to stay securely in place even during activities like swimming and exercise, offering enhanced convenience and protection for patients.

- January: Mölnlycke Health Care invested in a new production facility to enhance the manufacturing capacity of advanced wound care products. This investment aims to meet the increasing global demand for high-quality wound care solutions and support Mölnlycke's growth strategy in the medical tapes and bandages market.

2023

- December: Medline Industries launched a new range of hypoallergenic medical tapes targeting sensitive skin patients. These tapes are designed to minimize skin irritation and provide gentle yet effective adhesion, addressing the needs of patients with sensitive or compromised skin.

- October: B. Braun Melsungen AG introduced a line of orthopedic bandages with enhanced support and comfort features. These bandages are specifically designed to provide optimal support and compression for orthopedic injuries, improving patient outcomes and comfort.

- August: Cardinal Health collaborated with healthcare providers to develop customized wound care solutions, improving patient outcomes. This partnership aims to create tailored wound care products and protocols that address specific patient needs, demonstrating Cardinal Health's commitment to personalized healthcare.

- July: ConvaTec Group announced the development of next-generation adhesive bandages with superior sticking properties and breathability. These bandages are designed to offer better adhesion and comfort, particularly in challenging environments, enhancing the overall patient experience.

- May: Coloplast launched a series of elastic bandages designed for improved compression and support in sports injuries. These bandages provide effective support and compression for athletes and active individuals, helping to manage and recover from sports-related injuries.

- March: Hartmann Group unveiled new gauze bandages with antimicrobial properties. These bandages are infused with antimicrobial agents to reduce the risk of infection and promote faster healing, offering an advanced solution for wound care management.

Medical Tapes and Bandages Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 8.9 Bn |

| Forecast Value (2033) |

USD 12.8 Bn |

| CAGR (2024-2033) |

4.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 3.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Medical Bandage, and Medical Tapes), By Application (Surgical Wound Treatment, Traumatic Wound Treatment, Ulcer Treatment, Sports Injury Treatment, Burn Injury Treatment, Chronic Wound Treatment, and Others Application), By End User (Hospitals, Ambulatory Surgery Center, Clinics, Retail, Home Healthcare, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Smith & Nephew PLC, Mölnlycke Health Care AB, 3M, McKesson Corporation, Ethicon Inc. (JOHNSON & JOHNSON), B. Braun Melsungen AG, Paul Hartmann AG, Coloplast, Integra Lifesciences, Medtronic Industries , and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Medical Tapes and Bandages Market size is estimated to have a value of USD 8.9 billion in 2024 and is expected to reach USD 12.8 billion by the end of 2033.

The US Medical Tapes and Bandages market is projected to be valued at USD 3.5 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.9 billion in 2033 at a CAGR of 3.9%.

North America is expected to have the largest market share in the Global Medical Tapes and Bandages Market with a share of about 46.4% in 2024.

Some of the major key players in the Global Medical Tapes and Bandages Market are Smith & Nephew PLC, Mölnlycke Health Care AB, 3M, McKesson Corporation, Ethicon Inc. (JOHNSON & JOHNSON), B. Braun Melsungen AG, Paul Hartmann AG, Coloplast, and many others.

The market is growing at a CAGR of 3.9 percent over the forecasted period.