The global micro data center market is gaining significant traction owing to trends, such as the growing demand for localized data processing caused by

edge computing, IoT, and real-time data analytics. Micro data centers are compact, self-contained units that deliver core functionalities of traditional data including power, cooling, and storage in smaller, more flexible forms.

Because of their modular nature, they are rapidly deployable by enterprises and therefore represent an ideal solution for a wide range of vertical markets that require scalable, cost-effective infrastructures.

Applications driving demand for micro data centers now include edge computing, in which increasingly more organizations process information close to the end user from its derivation. This reduces latency, enhances response times, and allows data-intensive applications like

Artificial Intelligence,

Machine Learning, and autonomous vehicles to operate. The investment in Micro Data Centres hence becomes a priority in the telecommunication, retail, and healthcare sectors to manage volumes of data emanating from IoT devices and other connected systems. Furthermore, these centers are often supplemented by

Data Center Liquid Immersion Cooling systems to improve energy efficiency and thermal management in high-performance environments.

With businesses moving to decentralize their IT operations, the need for agile infrastructure has grown. Micro data centers offer the ability to deploy IT resources in various remote locations, branch offices, and urban areas, helping with the high-density computing need without requiring the complexity of large-scale facility building. Markets are likely to continue growth as industries move to prioritize data processing and storage near the generation point to enhance operational efficiency.

The global market is poised for stable growth, driven by continuous technological advancements, the emergence of 5G networking, and the ever-growing need for real-time data processing. The micro data center market is thus expected to witness an upward adoption rate throughout the forecast period.

Micro Data Center Market growth has been driven by an increasing need for edge computing and local data processing. Businesses relying on real-time data analytics have seen demand increase significantly for smaller, efficient, decentralized data centers; providing cost-effective solutions with reduced latency and greater flexibility. The Micro Data Center Market continues to experience tremendous expansion.

As more IoT devices and 5G networks emerge, so has demand for micro data centers. Businesses must process large volumes of data locally in order to reduce travel distance and enhance performance within industries like retail, healthcare and manufacturing. Countries in the Middle East, especially

The Kingdom of Saudi Arabia (KSA) Data Center segment, are witnessing accelerated development as part of national transformation strategies.

Micro data centers have become a significant driver in meeting remote and distributed IT infrastructure demands. Organizations using them can deploy computing resources closer to where data is produced, providing continuous operations even in remote locations. Their modular, scalable design enables businesses to adapt quickly to changing demands while optimizing power usage and cutting overall costs.

Sustainability being of prime concern, micro data centers offer more energy-efficient solutions compared to traditional data centers. Their smaller physical footprint and use of renewable energy sources help businesses lower their carbon footprint while adopting AI, machine learning and automation offers additional ways of increasing operational efficiency. The use of

Micro Turbines in some installations also supports green energy goals by enhancing local power generation capabilities.

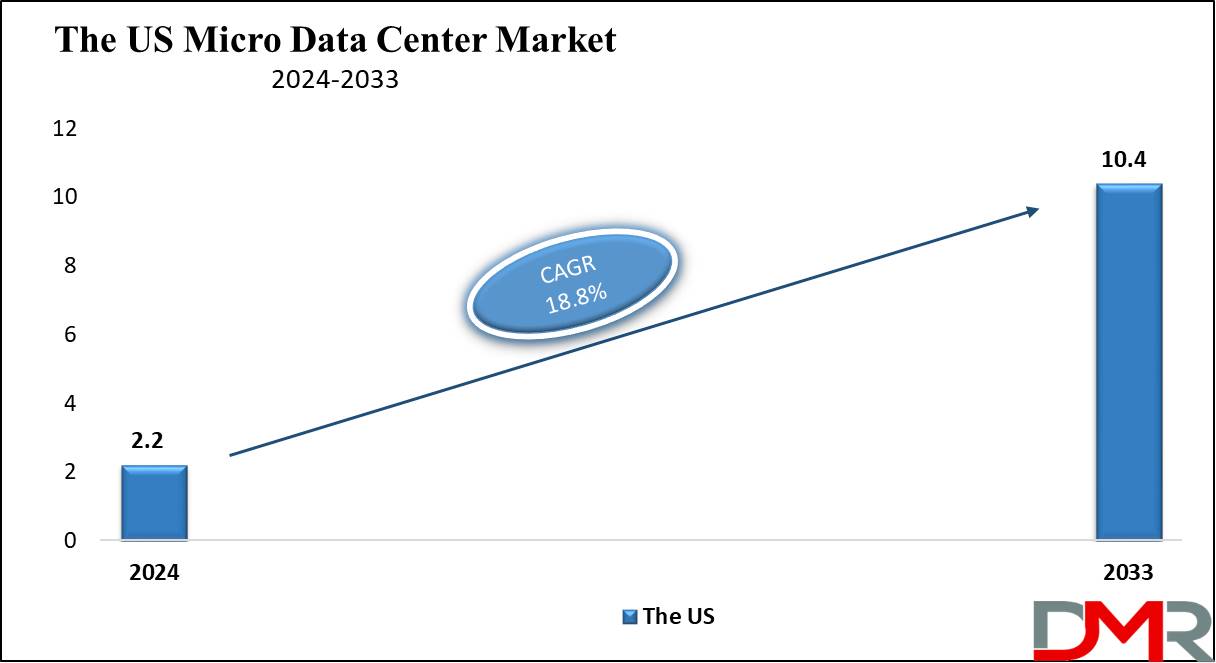

The US Micro Data Center Market

The US Micro Data Center Market is projected to be

valued at USD 2.2 billion in 2024 which is further expected to witness subsequent growth in the upcoming period as it holds

USD 10.4 billion in 2033 at a

CAGR of 18.8%. The rapid growth of edge computing, real-time processing of data, and localized data storage demand drive the growth of the micro data center market in the United States.

The sizeable CAGR may show up in the U.S. market size during the forecast period owing to the increasing adoption of micro

data center solutions within IT, telecommunications, retail industries, and healthcare organizations. The need for instant data processing near its source, together with real-time analytics and AI-driven systems, fuels the demand for micro data centers in the U.S.

One of the major market trends for the U.S. involves its movement toward edge micro data centers, assuring that increasing data generation via IoT devices and 5G networks is sufficiently supported. These facilities facilitate low latency and optimize bandwidth usage, making them highly important in sectors where high demands for data are involved.

Further, the increasing demand for robust and modular data centers prevailed in the deployment of micro data centers in remote and rural areas, ensuring seamless connectivity and continuity of business operations.

Recently, major players in the United States micro data center market have kept their eyes on product portfolio expansion to meet the ever-growing demands from hyperscalers, cloud service providers, and enterprises. This trend is expected to drive market growth and further boost demand for micro data centers in this region.

Key Takeaways

- Global Market Value: The global micro data center market size is estimated to have a value of USD 6.4 billion in 2024 and is expected to reach USD 33.0 billion by the end of 2033.

- The US Market Value: The US Micro Data Center Market is projected to be valued at USD 10.4 billion in 2033 from a base value of USD 2.2 billion in 2024 at a CAGR of 18.8%.

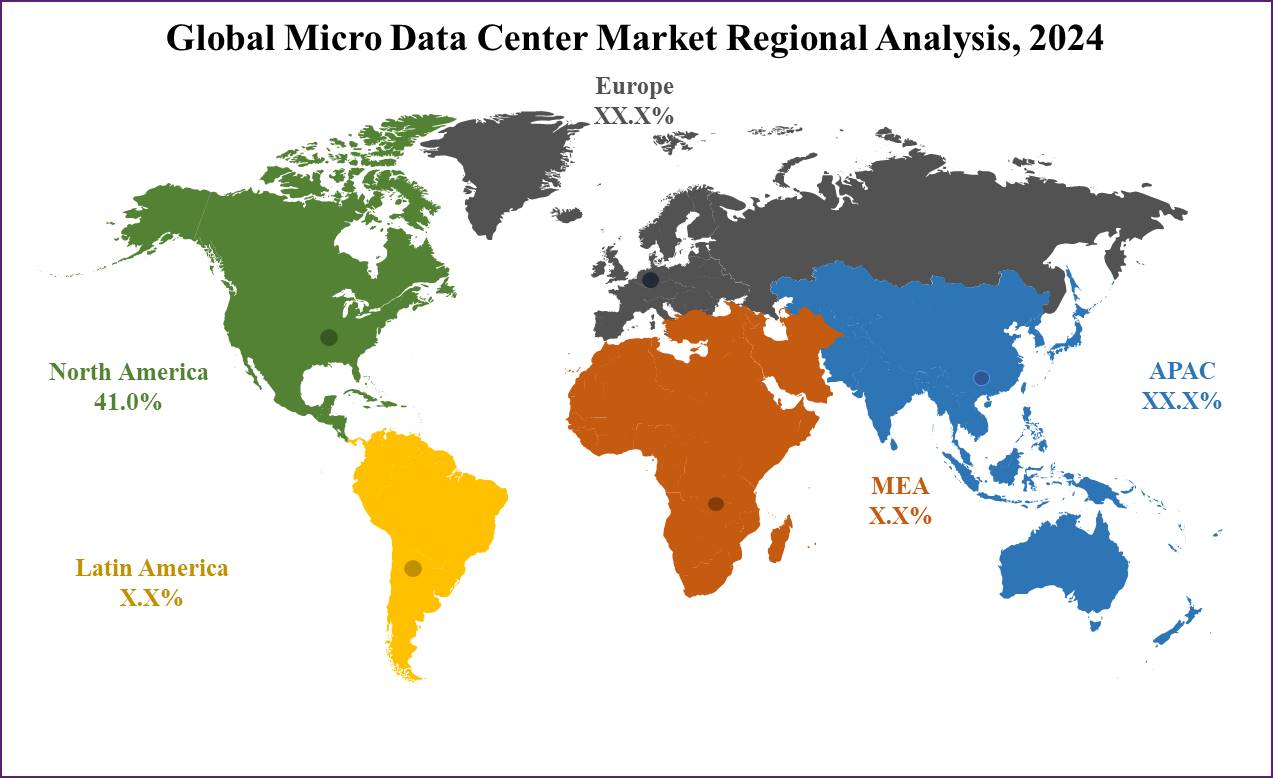

- Regional Analysis: North America is expected to have the largest market share in the global micro data center market with a share of about 41.0% in 2024.

- By Component Segment Analysis: Solutions are projected to dominate this market in terms of components as they hold 61.2% of the market share in 2024.

- By Application Segment Analysis: Remote office and branch office (ROBO) are projected to dominate this segment in the global micro data center market as they hold 44.9% of the market share in 2024.

- Key Players: Some of the major key players in the global micro data center market are Schneider Electric, Dell Inc., Vertiv Group Corp., Eaton, IBM, and many others.

- Global Growth Rate: The market is growing at a CAGR of 20.0 percent over the forecasted period.

Use Cases

- Edge Computing: Micro Data Centers are deployed at the edge of the network. In this case, data processing occurs closer to its source. Latency is hence reduced, and real-time data analytics is achieved. The automotive and telecommunication industries use micro data centers to support applications based on AI, IoT devices, and infrastructure for smart cities.

- Remote Office and Branch Office (ROBO): Each business that normally has more than one remote site leverages a micro data center for local data processing and storage. With this, they can provide high speed to access data, hence smooth operation without depending on a central data center.

- Disaster Recovery: Micro Data Centers have become so important in their utilization for purposes of disaster recovery due to their backup storage and processing capability. Industries with mission-critical operations, such as healthcare and finance operate micro data centers to continue the operational function in case of an outage or other emergency.

- Smart Manufacturing: Micro data centers have been used in manufacturing environments to process big data emanating from IoT devices and continuous automation systems in real-time. They help with production process optimization, equipment performance monitoring, and driving better decision-making at a local level with localized computing.

Market Dynamic

Trends

Increasing Adoption of Edge ComputingOne of the major trends acting as a driver in the global micro data center market is the increasing demand for edge computing. With the widespread adoption of IoT, AI, and

5G technologies, localized processing of data will be required to reduce latency and thus further enhance operational efficiency. Micro data centers positioned near the source of data generation enable enterprises to process and analyze streaming data in real time at the edge.

This is true for industries that rely on real-time processing, such as healthcare, manufacturing, and telecommunications. Since edge computing solutions bring businesses nearer to their goals of improving customer experiences, reducing bandwidth costs, and positively changing system performances, micro data centers are about to form part of the future IT infrastructure.

Modular and Scalable Solutions Gaining Traction

Due to flexibility and scalability, modular micro data centers are broadly attracting attention. These types of pre-configured systems let enterprises leverage the quick deployment of data center solutions and scale up or down their infrastructure based on their businesses.

Besides, unlike the traditional data center that requires so much time and resources to establish or expand, these modular micro-data centers can be committed and deployed even within days.

This trend goes hand in glove with the escalating demand for agile and cost-effective IT solutions, particularly in sectors like retail, finance, and logistics, which face variable demand for data processing capabilities. The modular micro data center will maintain its growth curve throughout the forecast period since it gives a way for companies to future-proof their infrastructure.

Growth Drivers

Rising Demand for Real-Time Data Processing

major growth driver for the micro data center market is the increasing need across verticals for finance, healthcare, and manufacturing regarding real-time data processing. Companies today generate a huge amount of data, which needs immediate processing for decision-making and operational efficiency.

Micro data centers facilitate organizations to process information closer to the source of the data and hence reduce latency for quicker response times. Real-time data processing has immense value in industries such as financial services, where fraud detection and high-frequency trading depend on it, and delays in processing result in financial losses. This ability of micro data centers to support real-time analytics inspires their wide adoption.

Proliferation of IoT and AI Applications

Intense development of both IoT devices and AI-driven applications significantly fuels demand for micro data centers. Given the number of IoT devices, the data they will generate, and the fact that much of this data will have to be processed and analyzed almost in real-time, it cannot be done with centralized data centers alone. Micro data centers process IoT data locally, thus improving response times and reducing loads on central data centers.

The trend will further justify the deployment of edge-based micro-data centers since AI-driven applications require reduced latency for data processing in autonomous vehicles and smart city infrastructure. This proliferation of IoT and

AI is expected to be one of the major drivers for market growth.

Growth Opportunities

Expansion into Emerging MarketsThis includes, in particular, the emerging markets of the Asia-Pacific and Latin America with vital growth opportunities for micro data centers. This geographic region is scoped for high-speed transformation in digital dealings and demand for localized data processing solutions. Furthermore, with the extension of 5G networks coupled with smart city initiatives, demand could also rise in industries such as telecommunications, government, and retail for micro data centers.

Moreover, growing small and medium-scale enterprises in these regions spur the demand for affordable and scalable IT infrastructure; hence, micro data centers have a wide opening in these markets. Therefore, emerging markets become very attractive for market participants to expand their global presence.

Growing Adoption in the Telecommunications Industry

The increased demand for edge computing solutions and the rollout of 5G networks drive this growth opportunity for

micro data centers within the telecommunications segment. Some of the major deployments of micro-data centers are being witnessed by telecom operators for handling massive traffic generated by 5G and IoT devices.

These centers also provide low-latency processing and improved network efficiency for critical applications such as autonomous vehicles and augmented reality. Due to increased 5G network expansion and edge computing services by telecoms, microdata centers are going to be in increasing need. Increased adoption in the telecom sector creates a big opportunity for market growth during the forecast period.

Restraints

High Initial Deployment Costs

One of the major constraints in the growth of the micro data center market is the high upfront cost of deployment. While the long-term benefits of micro data centers are pretty attractive in terms of efficiency and scalability, this makes it unaffordable for SMEs due to the initial investment required for advanced components such as cooling systems, servers, and power management.

Moreover, the cost of integrating micro data centers into existing IT infrastructure adds to the overall cost. These high costs may lead to a lower rate of adoption of micro data centers by budget-conscious organizations, especially in industries characterized by tight capital expenditure budgets.

Security and Compliance Challenges

Security remains much more of a concern and often becomes a block to the general adoption of micro data centers, mainly for industries that deal with sensitive data, like healthcare, financial services, and the government.

However, even while micro data centers afford local processing of data, their deployment in locations that are considered remote or decentralized may easily render them vulnerable to cyber-attacks, theft, or environmental hazards.

Meeting the different stringent regulatory requirements that pertain to micro data centers, such as data protection laws among other industry-specific security standards, can be quite complex and expensive. These security and compliance challenges are some of the deterrent factors to the adoption of micro data centers, especially in those industries requiring strict data governance.

Research Scope and Analysis

By Component

Solutions are projected to dominate the global micro data center market in terms of components as they hold 61.2% of the market share by the end of 2024. Solutions will continue to dominate the component segment in the global micro data center market, as they can offer integrated systems that can help address several operational needs.

Micro data center solutions usually include both hardware and software components and furnish a business with a complete infrastructure for localized data processing, storage, and network management.

These are pre-engineered solutions designed for rapid deployment. As such, this deployment process is easier and requires much less on-site customization. The demand for micro data center solutions is driven by increasing demand due to the increased adoption of cloud computing, IoT applications, and big data analytics, which are driving demand for efficient and scalable infrastructure.

These micro data center solutions enable enterprises to execute the workloads of data-intensive applications on their own without taking any aid from the traditionally large-scale data centers by providing all-in-one systems. Faster deployment, reduced operational costs, and better data security are the promising benefits assured by micro data centers, thereby making the solutions appealing in many industries these days.

Another key reason such solutions lead the market is that designs are incrementally moving toward modular and tailored ones. In addition, organizations can also opt for the exact configuration required to suit specific needs, such as edge computing, disaster recovery, or remote office deployment. This inflexibility in design is driving the micro data center market, wherein enterprises are moving toward turnkey solutions that integrally offer a package of hardware, software, and network management tools.

By Type

In the context of type-based micro data centers are anticipated to dominate this segment it holds the highest market share in 2024. The type segment includes rack-based micro-data centers, which have a higher share in the global micro-data center market, as they offer modularity, flexibility, and ease of deployment.

These micro-data centers are pre-configured and designed to be deployed within a standardized rack system, thus offering a compact and scalable solution for enterprises that require localized data processing and storage.

Because the rack-based systems can be expanded or contracted to meet demand, they should prove quite flexible for a variety of different workloads and operational imperatives. Increasing demand for edge computing and real-time data processing is likely to drive more interest in rack-based micro data centers.

The small footprint for rack-based micro data centers makes them well-suited for space-constrained environments, remote offices and branch locations, and certainly industrial settings. Besides, rack-based micro data centers are preferred due to their easy integration into the current IT infrastructure, thus minimizing deployment complexities and costs.

The other key reason for leading the market share by rack-based micro data centers is the fact that they are supportive of high-density computing environments within them. These are made to cope with demand growth in IoT applications, AI-driven systems, and

big data analytics.

Thus, these systems find increasing demand from industries like telecommunication, healthcare, and manufacturing. At the same time, their standardized design ensures compatibility across a wide array of components, further fueling market growth in the forecast period.

By Rack Unit

20-40 RU size is projected to dominate this segment as it holds the highest market share by the end of 2024. The 20-40 RU size is the factor that dominates the rack unit segment due to its optimal balance in both ways between capacity and compactness. These mid-tier applications of micro data centers provide enough space for major components, like servers, storage systems, and cooling solutions, while keeping it relatively compact for space-constrained environments.

The 20-40 RU configuration will best fit the needs of an enterprise looking to carry out localized data processing, consistent and comprising moderate to high workloads, without having to invest in a full-scale Data Centre. One of the major reasons for this kind of dominance by the 20-40 RU segment is its versatility.

Micro data centers in this segment find very broad applications in edge computing, where real-time processes of data and low-latency operations become crucial. Their medium size empowers enterprises to deploy adequate computing power capable of handling data-intensive workloads such as IoT, big data analytics, and AI without compromising cost and energy efficiency.

Additionally, scalability factors associated with 20-40 RU micro data centers enable enterprises to scale up their infrastructure along with business growth.

This makes them quite attractive for industries such as telecommunications, manufacturing, and retail sectors. With the increased traction of modular and scalable data center solutions, the 20-40 RU segment is likely to continue its dominance in the rack unit segment during the forecast period.

By Enterprise Size

Large enterprises are projected to dominate the enterprise size segment in the global micro data center market in 2024 owing to the need for massive data processing and complex IT infrastructures. Every day, large-sized enterprises generate massive data, arising from IoT devices, big data analytics, and AI-driven applications.

To access and manage the data efficiently, large-scale solutions are required-strengthening the reason why micro data centers prove to be ideal for large enterprises. Most of the key reasons behind the dominance of large enterprises revolve around higher financial and technical capability to invest in advanced micro data center solutions.

These organizations can afford high-performance, fully integrated system deployment catering to real-time data processing, edge computing, and hybrid cloud environments. Large enterprises are further assisted by micro data centers in providing localized data processing for latency reduction and overall operational efficiency improvement.

Also, large enterprises typically have numerous locations that include remote offices and branch offices. This necessitates the deployment of micro-data centers across these locations to ensure smooth data processing and connectivity.

The flexibility and scalability of micro data centers allow large enterprises to tailor their infrastructure to specific operational needs. In addition, it ensures that they will be able to meet increasing demands for modern applications. This can, in turn, be attributed to the rise in the adoption of micro data centers by large enterprises, hence the growth in market dominance in the enterprise size segment.

By Application

Remote office and branch office (ROBO) applications are anticipated to dominate the application segment of the global micro data center market as they hold 44.9% of the market share in 2024. Among application segments, remote office, and branch office applications represent the biggest market share in the global micro data center market, as localized data processing is gaining increasing demand in dispersed environments.

This enables organizations with more than one remote location to have the assurance of a very efficient and reliable way of data processing and storage. Because micro data centers can provide a feasible and cost-effective solution to ROBO environments, prospective applications can process data close to its source independently of the central data center.

Greater consumption of edge computing and real-time data processing is one of the main reasons that forces these dominating factors of ROBO applications.

Micro-modular data centers were also implemented in remote offices, allowing companies to process vital data locally and minimize latency, hence ensuring business continuity in the most disconnected areas. This is important because industries such as retail, banking, and telecommunications, whose remote locations generate immense volumes of data that have to be processed immediately.

Micro data centers are scalable and flexible for organizations to extend the infrastructure to meet the ever-increasing demands of remote offices.

Microdata centers' localized data storage and processing capabilities ensure that ROBO environments have enough autonomy, hence improved operational efficiency, to ensure business continuity. This increasing demand for a reliable and locally supported data processing solution is driving the adoption of micro data centers within the ROBO segment.

By Industry Vertical

The BFSI (Banking, Financial Services, and Insurance) sector is projected to dominate the industry vertical segment of the global micro data center market as it holds the highest market share in 2024. The BFSI sector, with heavy dependence on real-time data processing, security, and uninterrupted services, is expected to remain at the forefront in the industry vertical segment of the global micro data center market.

Financial institutions handle a high volume of sensitive data concerning transactions, customer information, and regulatory compliance requirements. Therefore, for such data processing securely and efficiently, micro data centers, over time, have become integral to IT infrastructure in the BFSI sector.

Among the main factors responsible for the contribution of micro data centers in recent times to the BFSI sector, the proliferation in demand for edge computing to handle real-time data processing is a key factor. Micro data centers thus enable a financial organization to process information closer to the source, thereby reducing latency and transaction speeds. This is very important in high-frequency trading, and fraud detection, among other financial services dependent on real-time data analysis.

Besides, micro data centers will provide advanced data security along with adherence to regulatory requirements that are very stringent in the BFSI industry. Several stringent regulations govern issues concerning data privacy and financial transactions.

The localized and secured environments provided by micro data centers will accord with national and international standards. Modularity and scalability help financial institutions build more infrastructure when needed, further pushing the use of micro data centers in the BFSI sector.

The Micro Data Center Market Report is segmented on the basis of the following

By Component

- Solution

- Power Systems

- UPS (Uninterruptible Power Supply)

- Power Distribution Units (PDU)

- Backup Generators

- Cooling Systems

- Monitoring and Management

- DCIM (Data Center Infrastructure Management) Solutions

- Remote Monitoring and Control

- Security and Access Control Systems

- Storage and Servers

- Compute Modules

- Data Storage Solutions

- Services

- Consulting Services

- Installation and Deployment

- Maintenance and Support

- Integration Services

- Managed Services

By Type

- Rack-based Micro Data Centers

- Cabinet-based Micro Data Centers

- Container-based Micro Data Centers

- Modular Micro Data Centers

By Rack Unit

- Up to 20 RU

- 20–40 RU

- Above 40 RU

By Enterprise Size

By Application

- • Remote Office and Branch Office

- • Instant Data Center

- • Edge Computing

By Industry Vertical

- Banking, Financial Services, and Insurance

- IT and Telecommunications

- Government and Defense

- Media and Entertainment

- Healthcare

- Retail

- Manufacturing

- Others

Regional Analysis

North America is projected to dominate the global micro data center market as it

holds 41.0% of the market share by the end of 2024. North America holds a major share in the global market of micro data centers due to its well-established technological infrastructure, considerable usage of edge computing, and the significant presence of key market players.

Indeed, the U.S. is the home of numerous leading technology companies in the world, including cloud service providers and data center operators. This acts as a conducive factor in attracting demand for newer concepts in data processing solutions referred to as micro data centers. This is also coupled with the increasing use of IoT, AI, and big data analytics as more digitization takes place around the region.

Since it is difficult to transmit IoT-generated data to centers for processing, which often requires near real-time processing, there has been a growing need for localized and low latency in data processing. One of the main reasons for this is because early adoption of edge computing technologies that have taken place in North America.

Micro-data centers are increasingly being used in businesses across all industries to process data closer to their source, including in telecommunications, finance, and healthcare. This reduces latency and enhances efficiency in operations, hence making the systems ideal for real-time processing applications.

It also provides the proper regulatory structure needed, which accelerates safe and secure data center deployment. The investment in R&D with lenient government policies has worked in the right direction to provide a perfect ecosystem wherein the Micro Data Centres can develop themselves. North America maintains the majority of the market share in the global micro-data center market. And this is likely and believed to prevail in the forecast period.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global micro data center market is characterized by intense competition, with key players operating in the micro data center space continuously innovating to meet the evolving needs of businesses. Major players such as Schneider Electric, Vertiv, HPE, and Dell Technologies dominate the market with a wide range of micro data center solutions, offering modular and scalable systems that cater to various industry verticals.

These companies are focused on expanding their product portfolios by introducing advanced solutions that support edge computing, AI, and IoT applications. For example, Schneider Electric has been actively promoting its EcoStruxure™ Micro Data Center, which offers integrated, pre-engineered systems for quick deployment. Vertiv, another key player, provides micro data centers that are tailored to support high-density computing environments, particularly in the telecommunications and IT sectors.

In addition to these established players, the market has seen the entry of new competitors offering niche and specialized solutions. Partnerships and collaborations between micro data center providers and cloud service companies are becoming increasingly common, as businesses seek to deliver localized data processing solutions to their clients. Overall, the competitive landscape is marked by continuous innovation, with companies striving to offer customizable and energy-efficient micro data center solutions to drive market growth.

Some of the prominent players in the Global Micro Data Center Market are

- Schneider Electric

- Dell, Inc.

- Vertiv Group Corp.

- Eaton

- IBM

- Huawei Technologies Co., Ltd.

- Rittal GmbH & Co.

- Panduit Corp.

- Zella DC

- Other Key Players

Recent Developments

- June 2024: Schneider Electric Expands Ruggedized Micro Data Center Solutions

- Schneider Electric announced an expansion of its ruggedized micro data center portfolio, introducing new models specifically designed to withstand harsh environments. These solutions are geared toward industrial settings, outdoor deployments, and remote areas with extreme temperatures and unpredictable environmental conditions.

- April 2024: Vertiv Launches Next-Generation Rack-Based Micro Data Centers

- Vertiv introduced a new line of rack-based micro data centers, designed specifically for edge computing and industries such as telecommunications and retail. These systems are optimized for high-density computing, offering enhanced energy efficiency and simplified deployment.

- February 2024: Dell Technologies Integrates AI in Modular Micro Data Centers

- Dell Technologies announced a significant upgrade to its modular micro data center solutions by incorporating AI-driven management and monitoring systems. These advanced systems enable real-time data analytics, allowing businesses to optimize their IT operations and improve efficiency.

- December 2023: HPE Expands GreenLake Edge Computing with New Micro Data Centers

- Hewlett Packard Enterprise (HPE) expanded its GreenLake edge computing portfolio by introducing micro data centers designed to operate in hybrid cloud environments. These new micro data centers provide seamless integration between on-premise infrastructure and cloud services, offering businesses the flexibility to manage workloads across multiple platforms.

- November 2023: Huawei Introduces Micro Data Centers for IoT and 5G Applications

- Huawei launched a new series of micro data centers targeting IoT and 5G-driven applications. These solutions are specifically designed to support the growing demands of smart cities, connected vehicles, and telecommunications infrastructure.

- August 2023: Eaton Collaborates with Cisco to Develop Energy-Efficient Micro Data Centers

- Eaton Corporation announced a strategic collaboration with Cisco to co-develop micro data centers for edge locations, focusing on energy efficiency and ease of deployment. The partnership aims to deliver scalable solutions for remote offices, branch offices, and small-to-medium businesses (SMBs) seeking localized data processing capabilities.

- May 2023: Rittal Launches HPC-Optimized Micro Data Centers for BFSI and Healthcare

- Rittal introduced a new line of micro data centers optimized for high-performance computing (HPC) environments, particularly targeting the BFSI and healthcare sectors. These micro data centers are designed to handle data-intensive applications, such as fraud detection in finance and patient data management in healthcare.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 6.4 Bn |

| Forecast Value (2033) |

USD 33.0 Bn |

| CAGR (2024-2033) |

20.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solution, and Services), By Type (Rack, Cabinet, and Container), By Rack Unit (Up to 20 RU, 20–40 RU, and Above 40 RU), By Enterprise Size (Large Enterprises, and SMEs), By Application

(Remote Office and Branch Office, Instant Data Center, and Edge Computing), By Industry Vertical (Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Media and Entertainment, Healthcare, Retail, Manufacturing, and Others)

|

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Schneider Electric, Dell Inc., Vertiv Group Corp., Eaton, IBM, Huawei Technologies Co. Ltd., Rittal GmbH & Co., Panduit Corp., Zella DC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |