A microturbine works as a small-scale power generation device, operating on principles similar to traditional gas turbines but on a smaller scale, typically ranging between 25 to 500 kilowatts, as these are known for their compactness & high efficiency.

Further microturbines operate as distributed energy solutions in residential, commercial, industrial, & remote power generation applications. By combusting fuels like natural gas,

biofuel, or diesel, microturbines drive turbines to generate electricity.

Coal-driven power plants are widely recognized for their harmful environmental impact due to the substantial release of hazardous gases, significantly contributing to global warming and its adverse effects on human life. Similarly, nuclear-powered turbines generate toxic emissions with long-term detrimental effects on ecosystems.

In response, governments are intensifying efforts to mitigate greenhouse gas emissions by transitioning from coal and nuclear turbines to gas turbines. These gas-powered alternatives emit considerably fewer harmful gases, offering a cleaner energy solution aligned with

E-fuels development and sustainability initiatives.

By the end of 2019, approximately 2,045 GW of coal-based power plants were operational globally. However, many nations are actively phasing out coal. For instance, China had 1,042.9 GW of operational coal-based plants as of January 2021, contributing to elevated air pollution levels. The country has committed to reducing reliance on coal and nuclear energy, targeting significant phase-outs by 2025 to meet environmental and sustainability goals.

Micro Turbines Market Key Takeaways

- By End User, Industrial sector lead in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, the Commercial sector is expected to have significant growth over the forecasted period.

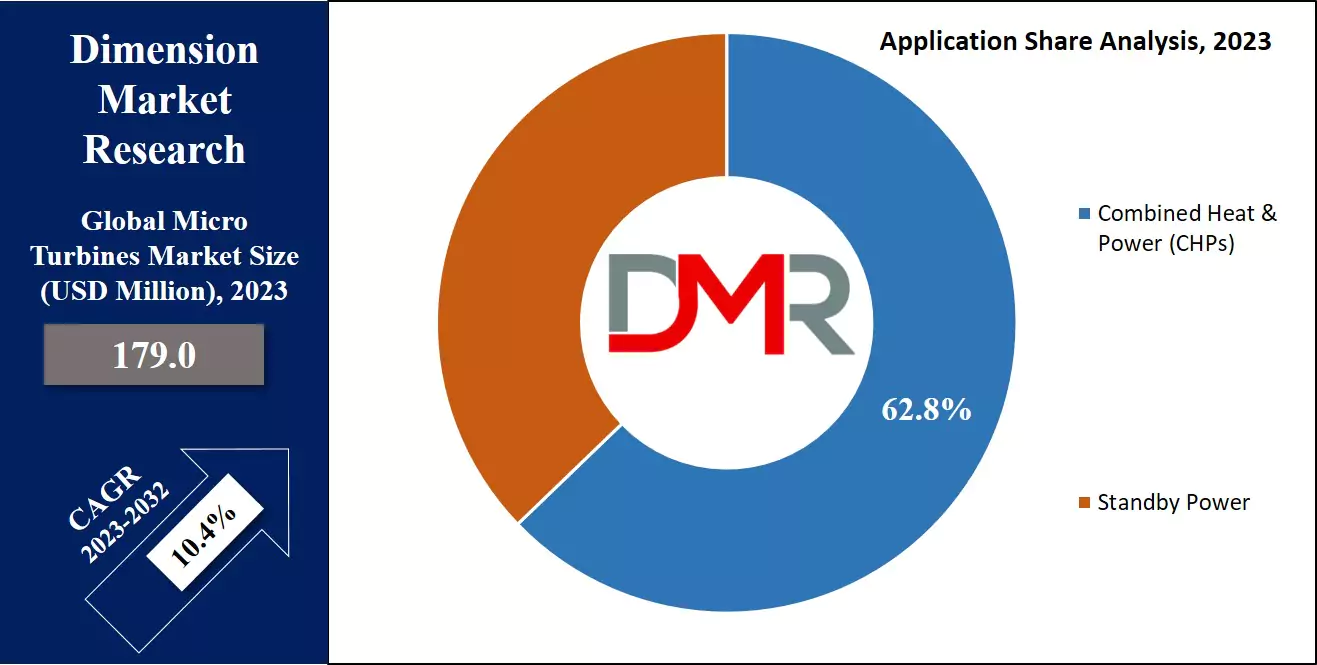

- By Application, the Combined Heat & Power (CHP) takes the lead & drive the market in 2023.

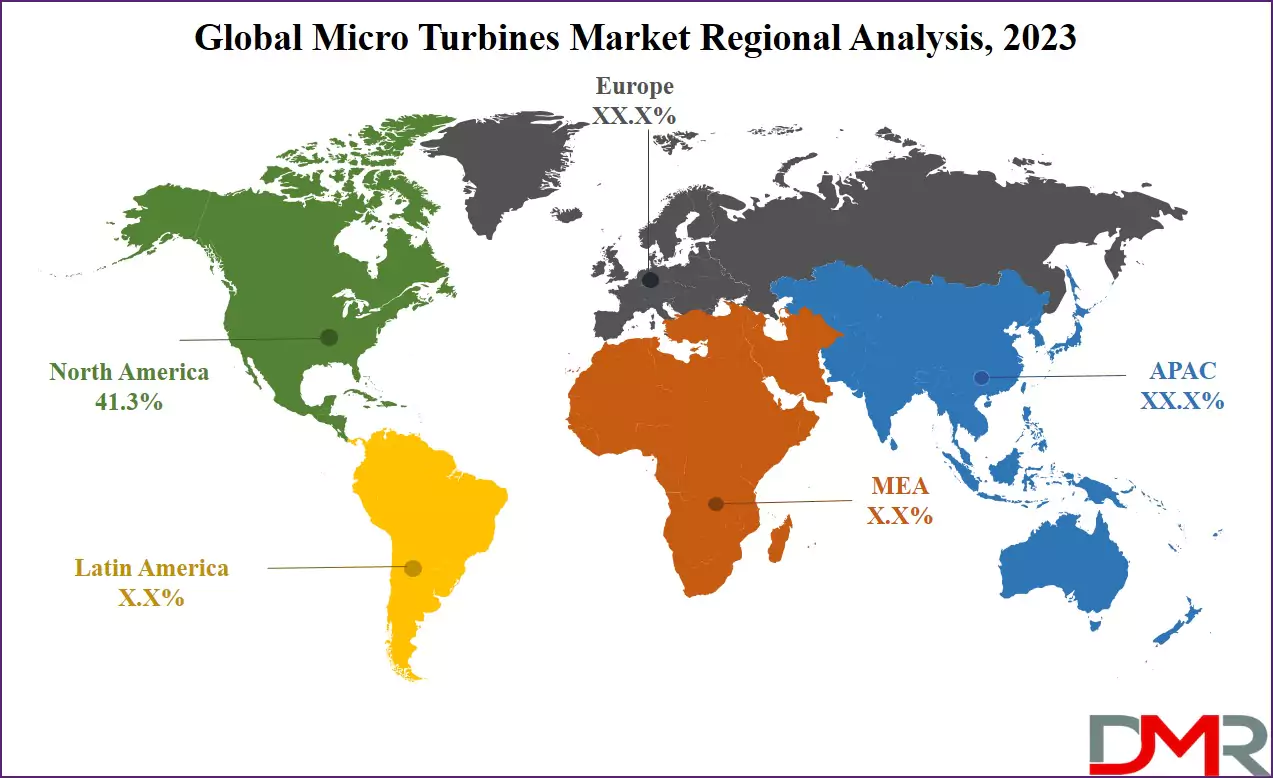

- North America has a 41.3% share of revenue in the Global Micro Turbines Market in 2023.

Micro Turbines Market Use Cases

- Distributed Power Generation: Micro turbines provide on-site power for businesses, reducing dependence on the central grid and enhancing energy reliability.

- Combined Heat and Power (CHP) Systems: These turbines generate both electricity and usable heat, improving energy efficiency in industrial and commercial applications.

- Remote and Off-Grid Power Supply: Used in isolated locations such as oil rigs, mines, and rural communities where grid access is limited or unavailable.

- Waste-to-Energy Solutions: Micro turbines convert biogas from landfills, wastewater treatment plants, and agricultural waste into usable energy.

- Backup and Emergency Power: Hospitals, data centers, and critical infrastructure use micro turbines as reliable backup power sources during outages.

- Low-Emission Power for Urban Areas: Their compact size and low emissions make them ideal for distributed energy generation in cities, reducing pollution and grid strain, and even integrating with Virtual Power Plant models for smarter grid management.

Micro Turbines Market Dynamic

The global microturbine systems market is set for growth in the forecast period, driven by favorable government regulations that act as drivers for the industry. Further, the market's expansion is fueled by the inherent advantage of having few movable parts, which not only limits overhaul costs but also expands its applicability across various sectors, enhancing its overall appeal.

However, the market faces challenges in the form of volatile fuel prices, which are anticipated to restrain growth during the forecast period. In addition, the high level of competition from both emerging entrants & established players is expected to create hindrances to the global microturbine systems market. Even after these challenges, the industry's positive trajectory is highlighted by regulatory support & the efficiency of microturbine systems in diverse applications.

Drive

Micro turbines market growth is being propelled by rising demand for decentralized energy systems, as industries and commercial establishments increasingly turn towards them for their ability to provide efficient, low emission, reliable power solutions. These turbines are well suited to remote or off-grid locations, providing uninterrupted energy supply while decreasing reliance on centralized grids.

Furthermore, government incentives promoting renewable energies as well as stringent emission regulations drive adoption. Micro turbines boast significant operational advantages, including lower maintenance requirements and compatibility with renewable energy sources, making them an attractive solution for various power generation and cogeneration systems.

Trend

Integration of Micro Turbines Into Hybrid Systems: Micro turbine integration is an emerging trend in the market, providing consistent power generation by mitigating fluctuations from renewable energy sources like solar panels

or wind turbines. Furthermore, recent advancements in control technologies and energy storage systems, like batteries, are further streamlining hybrid system operations.

As there has been increasing emphasis on sustainable energy solutions that reduce carbon footprints while simultaneously optimizing micro turbine designs specifically optimized for hybrid applications across industrial, residential and commercial sectors. This aligns with the rising focus on

Solar Panel Recycling and cleaner fuels to ensure holistic renewable energy adoption.

Restraints

The high initial costs associated with micro turbines pose an undue barrier to market expansion. Acquiring and installing these systems while also integrating infrastructure can present substantial financial hurdles for small and medium enterprises (SME). Though micro turbines offer long-term operational benefits, initial investment often discourages potential buyers in cost-sensitive markets.

Competitors such as reciprocating engines and fuel cells add pressure. Furthermore, special skills may be required to operate and maintain micro turbines, creating additional adoption barriers. Addressing cost challenges through technological innovation and economies of scale is vital to expanding market penetration.

Opportunity

Remote locations present immense growth prospects for the micro turbines market. Regions without access to centralized energy grids increasingly rely on micro turbines as reliable power supplies in industries like mining, oil & gas production, telecom and emerging economies such as Brazil.

Furthermore, due to disaster resilience measures and emergency power solutions becoming an increasing focus of future energy strategies; micro turbines become essential components. The rising adoption of E-fuels and advanced grid integration technologies such as Virtual Power Plant systems further expands the scope for micro turbines in both developed and emerging markets.

Micro Turbines Market Research Scope and Analysis

By Power Rating

Micro-turbines having 50 kW-250 kW power rating lead the segment in 2023, contributing the highest revenue share, and are projected to have significant growth in the forecast period.

In addition, the 50 kW-250 kW micro-turbines are expected to show growth in demand, driven by the growing use of hybrid electric vehicles in developed regions, mainly in North America. These micro turbines cater mainly to domestic utilities & find applications in small commercial establishments for heating & boiling purposes. The key driver for their growth depends on their energy-efficient properties, leading to lesser energy expenses for households and improving their appeal to consumers.

By Application

The micro turbines market is led by the

Micro Combined Heat and Power (CHP) segment in 2023. CHP, known for its energy efficiency, generates electricity while simultaneously using waste heat for practical thermal energy in space heating & cooling applications. Whether as a standalone system or integrated into a utility structure, Micro Combined Heat and Power is included in establishments needing both electrical & thermal energy, driven by a growing concern for environmental sustainability.

Further, the Standby Power segment plays a crucial role during power outages in commercial settings growing at a significant rate during the forecasted period. As the electricity demand continues to rise, standby power solutions experience growing adoption, meeting the need for an uninterrupted power supply, such an increasing dependency on standby power sources is a key factor driving the growth of this segment within the micro turbines market.

By End User

In 2023, the industrial sector comes out as the dominant end-user for micro turbines, finding broad applications in diverse industries like oil & gas, construction & manufacturing, pharmaceuticals, wastewater treatment, and mining. Further, the industrial segment is expected for substantial growth, mainly in construction and oil & gas, driving its leading position with continuous development in these sectors.

Moreover, the global commercial microturbine installation is expected to experience significant expansion, with residential applications holding a significant share in 2023, as residential usage heavily depends on the convenient availability of natural gas, which highlights the growing importance of micro turbines not only in industrial applications but also in commercial & residential settings, highlighting the versatile & expanding role of micro turbines across different sectors.

The Micro Turbines Market Report is segmented on the basis of the following:

By Power Rating

- 12 kW – 50 kW

- 50 kW – 250 kW

- 250 kW – 500 kW

By Application

- Combined Heat & Power (CHP)

- Standby Power

By End User

- Residential

- Commercial

- Industrial

How Does Artificial Intelligence Contribute To Improve Micro Turbines Market ?

- Predictive Maintenance – AI analyzes turbine performance data to detect potential failures before they occur, reducing downtime and maintenance costs.

- Real-Time Performance Optimization – AI continuously adjusts fuel consumption, temperature, and power output to maximize efficiency and lower emissions.

- Grid Integration & Smart Energy Management – AI enables micro turbines to integrate seamlessly with smart grids, balancing power supply and demand in real time.

- Autonomous Operation & Remote Monitoring – AI-powered systems allow real-time remote monitoring and autonomous operation, reducing the need for human intervention.

- Fuel Efficiency Enhancement – AI optimizes fuel combustion and turbine operations to minimize waste and maximize energy output.

- Emissions Control & Regulatory Compliance – AI tracks and analyzes emissions data, helping companies meet environmental regulations and reduce their carbon footprint.

Micro Turbines Market Regional Analysis

North America emerged as the primary revenue contributor to the micro turbines market, capturing a

substantial 41.3% share in 2023, with the US leading the region. Further, the growth in the adoption of micro turbines in sectors like construction, pharmaceuticals, and mining is driving market growth. In addition, government initiatives allowing infrastructure development further fuel the expansion of the micro turbines market in North America.

Further, Europe is anticipated to experience the fastest growth in the forecast period, with the UK taking the lead in the micro turbines market, as strict government regulations focused on industrial development & rising the need for clean energy are significant drivers.

Moreover, the European governments' significant investments in clean fuel technology further support the micro turbines market's growth across the region, making it a major market in the global micro turbines landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Micro Turbines Market Competitive Landscape

The global microturbine systems market experiences intense competition, driven by the consistent introduction of advanced technologies via ongoing R&D initiatives by participants across the value chain. Key players are constantly using diverse business growth strategies to advance their footprint both regionally & globally, contributing to the dynamic and competitive nature of the market.

In May 2023, Capstone Green Energy Corporation announced that Supernova Energy Services SAS, its authorized distributor in Colombia, has successfully secured an order for a C1000 Signature Series microturbine, which will operate in tandem with an Alfa Laval steam boiler evaporator at an industrial dairy, generating 6,200 lbs. of steam per hour.

Some of the prominent players in the global Micro Turbines Market are

- FlexEnergy Inc

- Ansaldo Energia

- Calentix Technologies

- Capstone Turbine Corp

- Bladon Jets

- Brayton Energy

- Micro Turbine Technology

- Eneftech Innovation

- Wilson Solarpower Corp

- ICR Turbine Engine Corp

- Other Key Players

Micro Turbines Market Recent Development

- In February 2023, Capstone Green Energy Corporation announced that the California Air Resources Board (CARB) had recertified the Capstone C65 microturbine as a distributed generation resource excepted from CARB's emission standards. Earlier, certified in 2007, C65 has constantly met CARB's testing standards, by retaining its certification for the past 15 years.

- In April 2023, Andhra University started the development of a micro wind turbine generator capable of generating power even at low wind speeds of 5–6 kmph, which is designed without a gearbox and can be easily installed on streetlights, terraces, agricultural pumps, & traffic signals. Further, creating a substantial boost to both the economy & India's carbon credits, the MWTG, unlike solar panels, eliminates the need for energy storage batteries by connecting directly to domestic inverters or UPS. Further, it proves especially advantageous in coastal towns of India, where consistent & accessible wind speeds make it an ideal solution for diverse weather conditions.

- In March 2023, Avila Energy Corporation revealed the transfer of a EURO 2.5 million equity stake in Micro Turbine Technology B.V. from AVEX Energy, along with updated filings for continuous disclosure, where Avila Energy holds a 17.2% equity interest in MTT, which includes all contracts & preferred licenses previously held by AVEX, solidifying Avila Energy's position as a significant shareholder in MTT.

Micro Turbines Market Report Details